Wisconsin Department of Revenue Forms

Documents:

1007

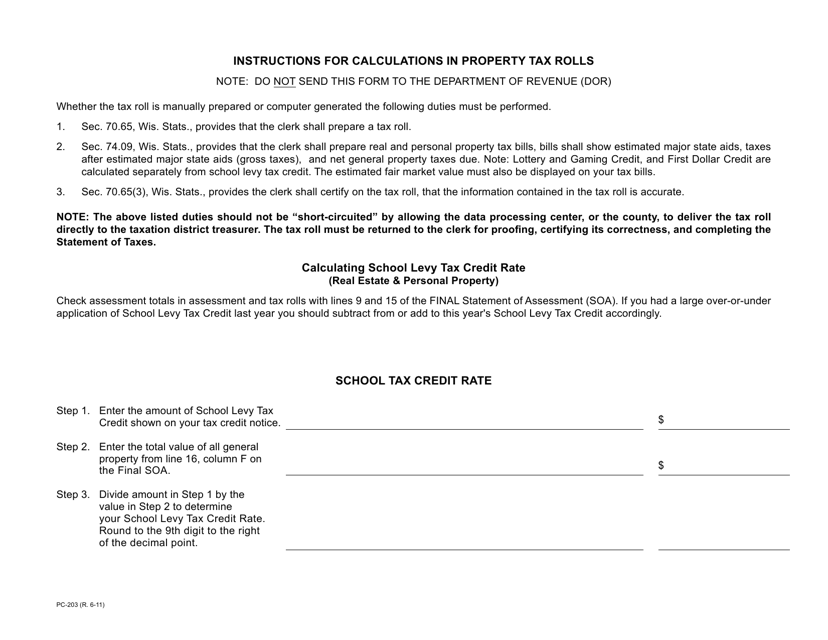

This document provides instructions for calculating property tax rolls in Wisconsin using Form PC-203. It guides individuals in understanding the calculations involved in determining property taxes.

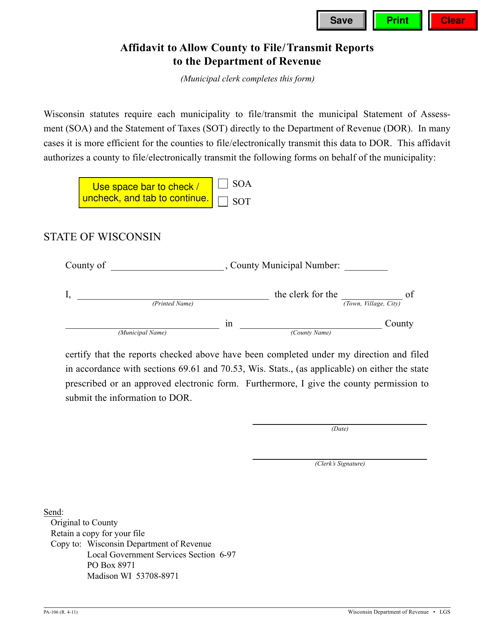

This form is used for the Affidavit to Allow County to File/Transmit Reports to the Department of Revenue in the state of Wisconsin. It allows the county to submit reports on behalf of its residents to the Department of Revenue.

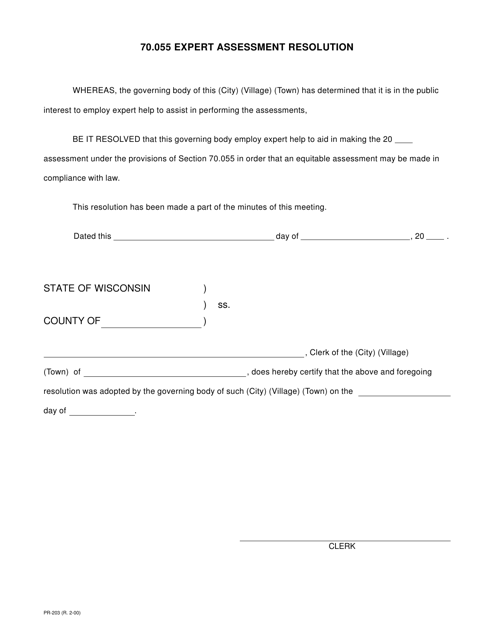

This document is a form used in Wisconsin for expert assessment resolution. It is used to facilitate the evaluation and resolution of disputes involving expert assessments.

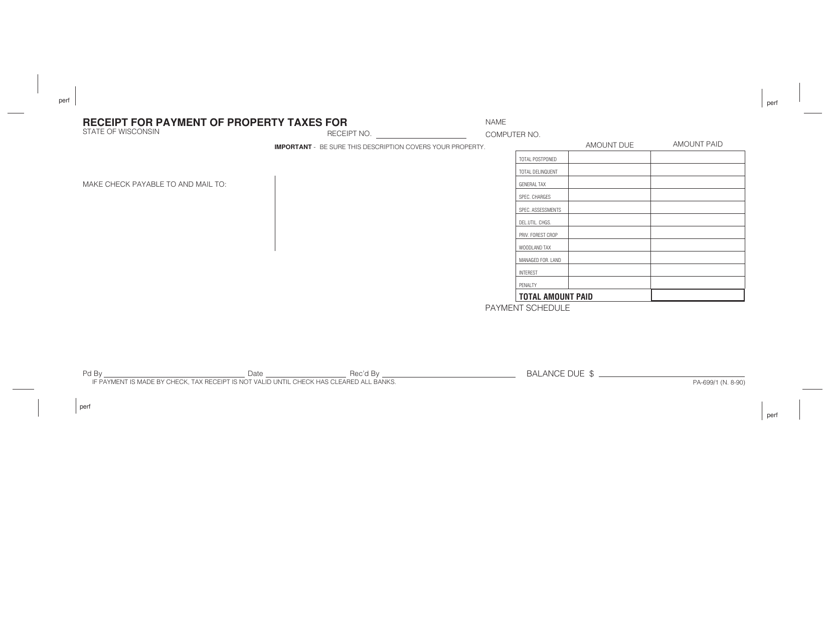

This form is used for providing a receipt for payment of property taxes in Wisconsin.

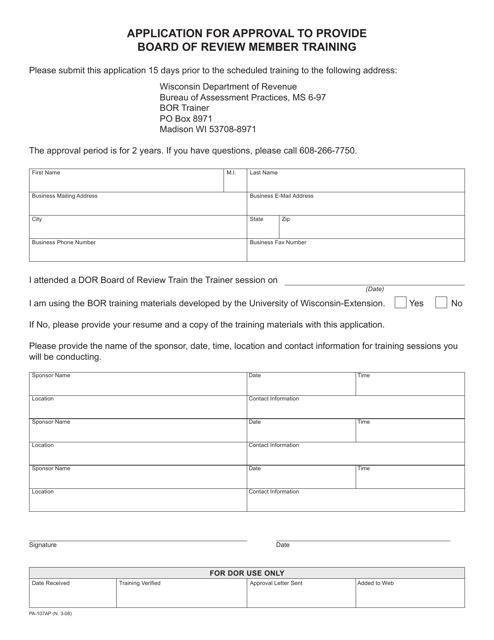

This form is used for applying to provide training to Board of Review members in Wisconsin.

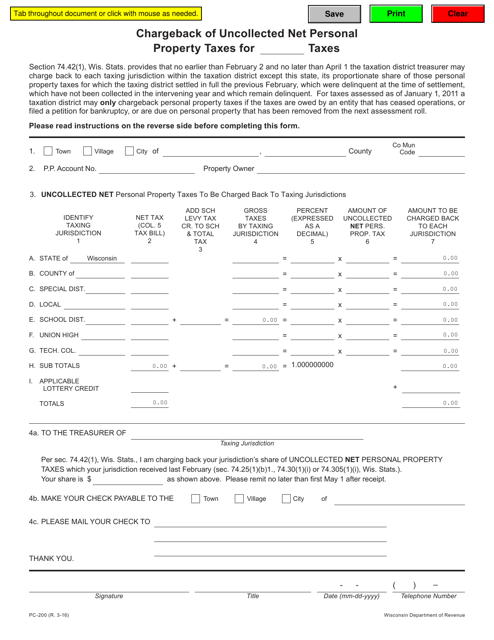

This Form is used for requesting a chargeback of uncollected net personal property taxes in the state of Wisconsin.

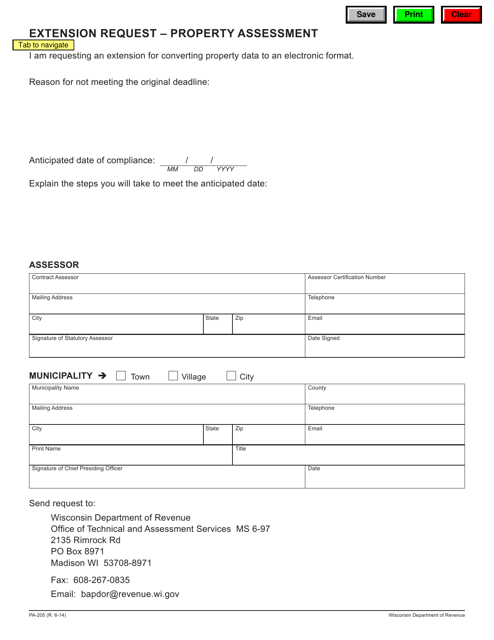

This Form is used for requesting an extension for property assessment in Wisconsin.

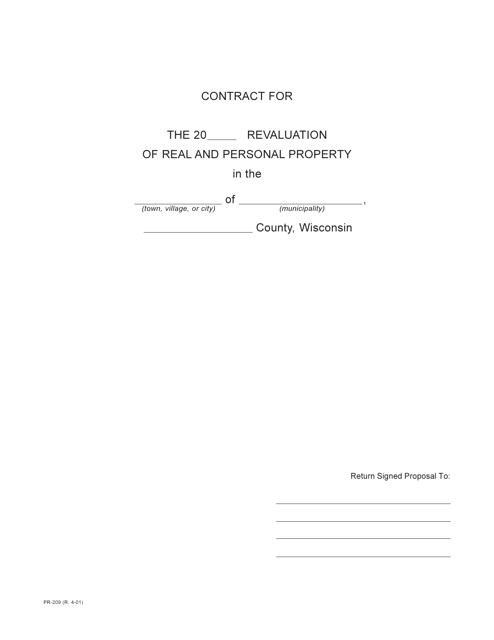

This Form is used for creating a contract for revaluation in the state of Wisconsin.

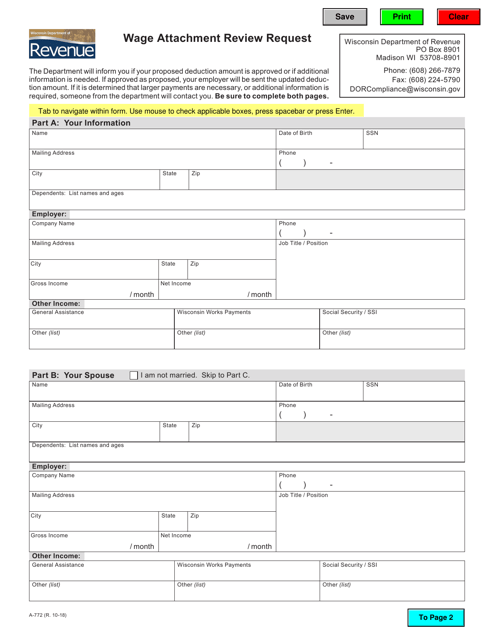

This Form is used for requesting a review of a wage attachment in Wisconsin.

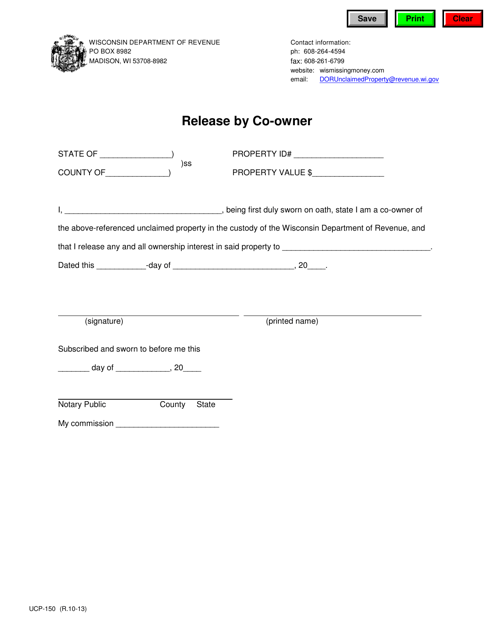

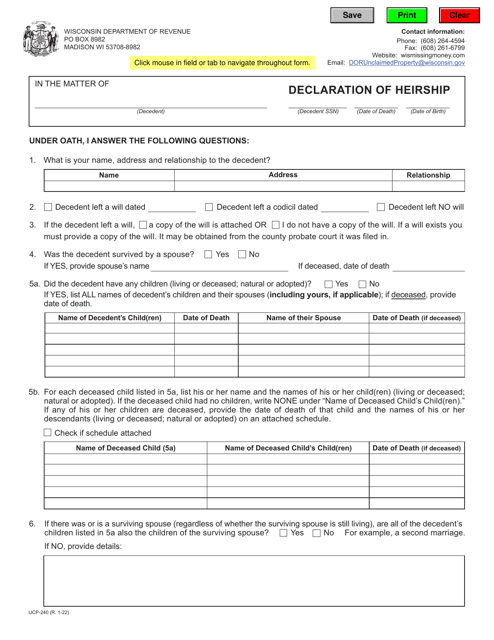

This form is used for releasing ownership rights by a co-owner in the state of Wisconsin.

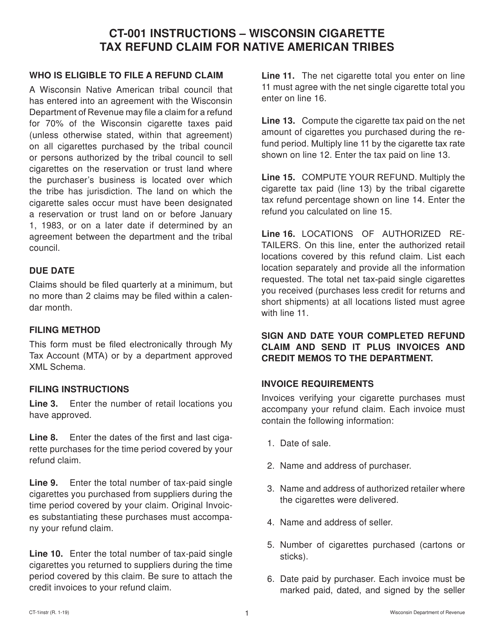

This form is used for Native American tribes to claim a refund on Wisconsin cigarette tax.

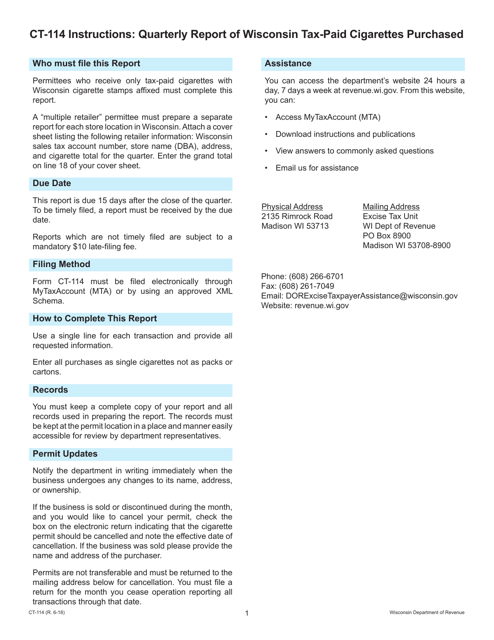

This form is used for reporting the quarterly purchases of tax-paid cigarettes in Wisconsin. It is required for businesses and individuals who purchase these cigarettes in the state.

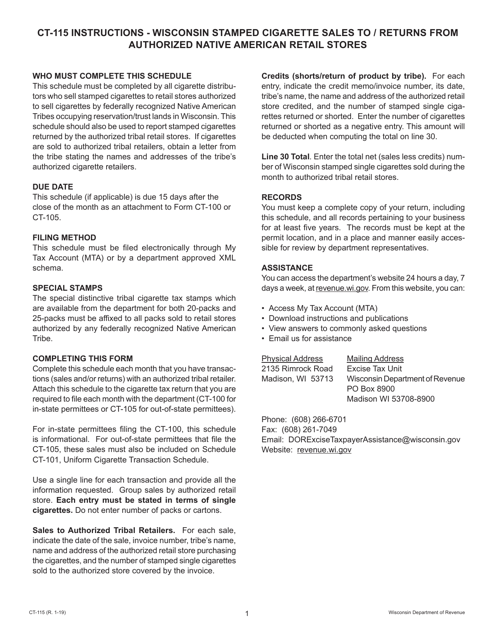

This form is used for recording and reporting cigarette sales to and returns from authorized Native American retail stores in Wisconsin.

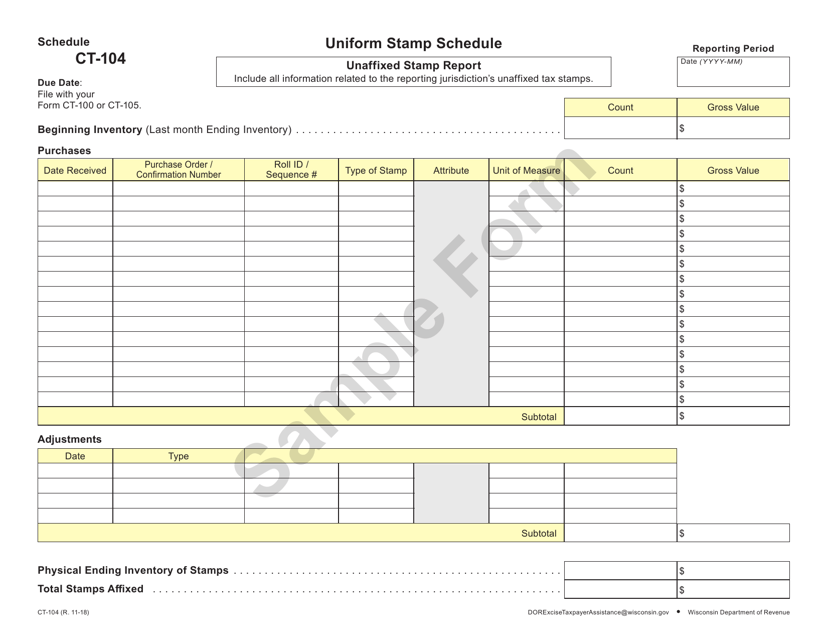

This document provides the uniform stamp schedule for the state of Wisconsin. It outlines the fees and requirements for various types of transactions, such as leases, mortgages, and land contracts.

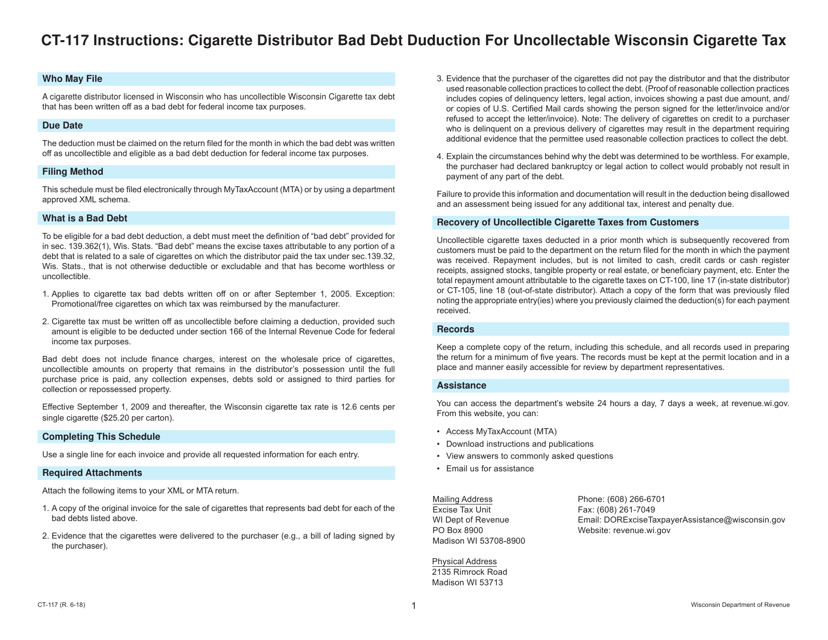

This form is used to claim a bad debt deduction for uncollectible Wisconsin cigarette tax if you are a cigarette distributor in Wisconsin.

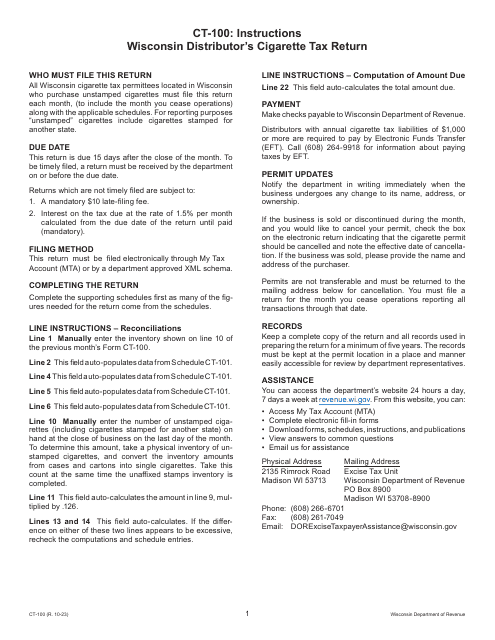

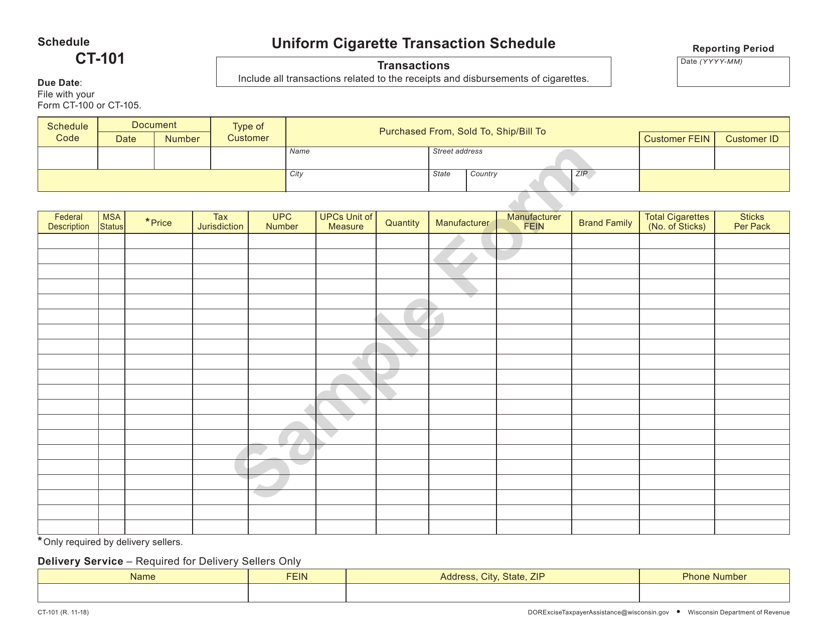

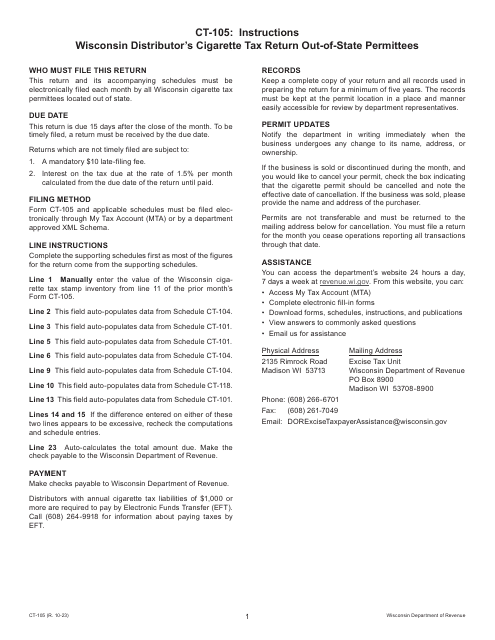

This Form is used for reporting cigarette transactions in Wisconsin.

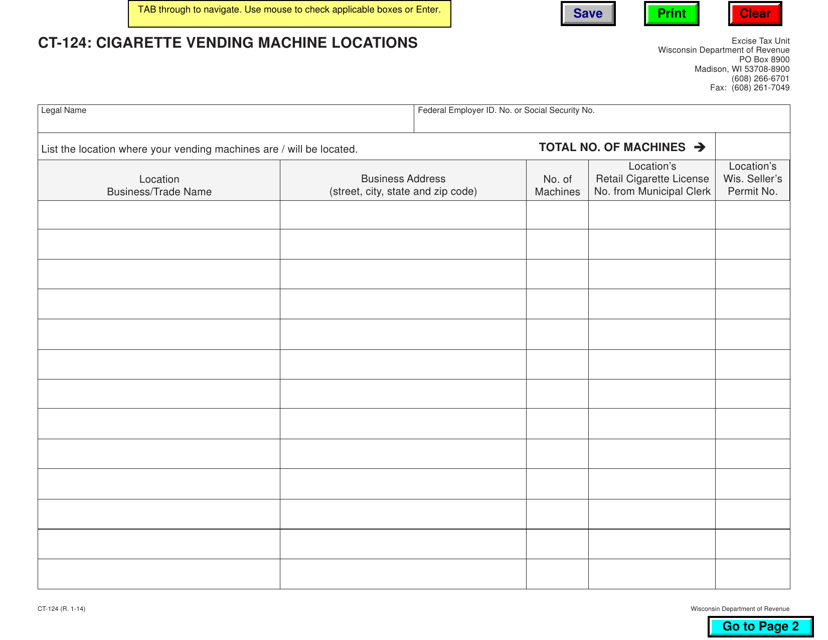

This form is used for reporting the locations of cigarette vending machines in Wisconsin.

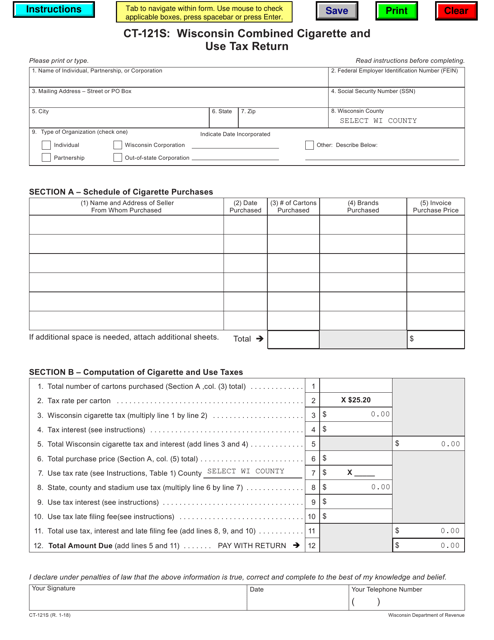

This document is a form used in Wisconsin for reporting and paying combined cigarette and use tax. It is used by businesses that sell cigarettes and other tobacco products.

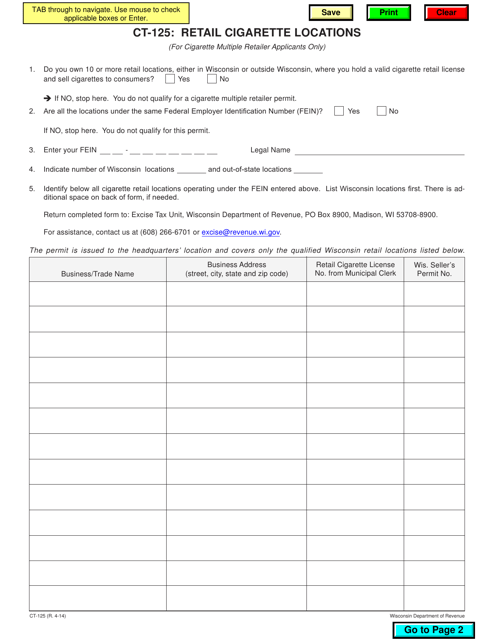

This form is used for registering retail cigarette locations in the state of Wisconsin.

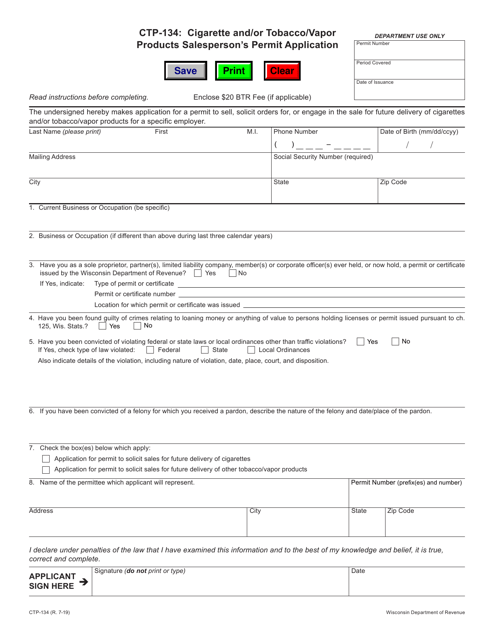

This Form is used for applying for a Cigarette and/or Tobacco/Vapor Products Salesperson's Permit in Wisconsin.

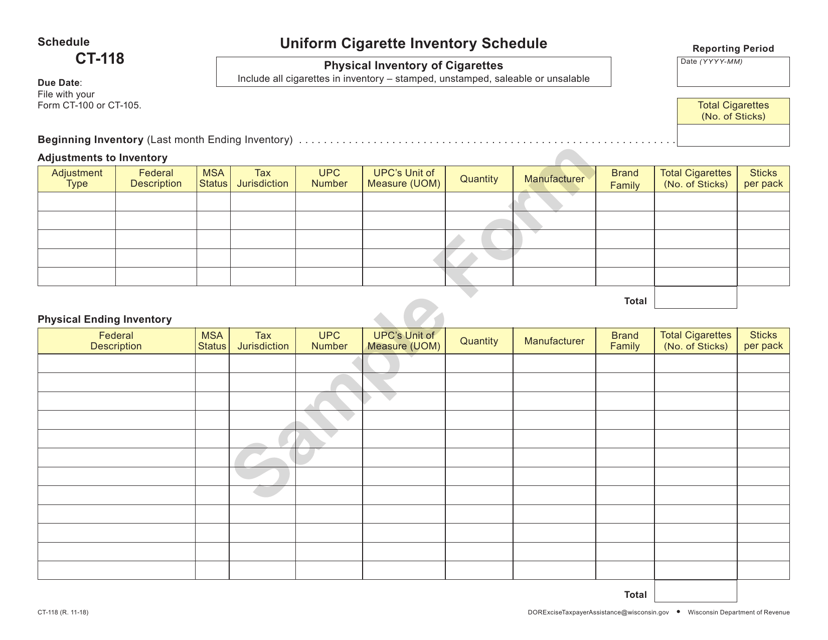

This document is a schedule for reporting the inventory of cigarettes in Wisconsin. It is used for keeping track of cigarette stock for regulatory purposes.

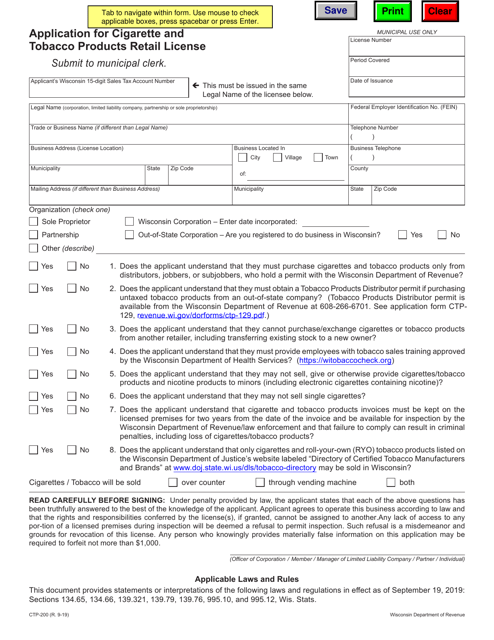

This form is used for applying for a retail license to sell cigarettes and tobacco products in the state of Wisconsin.

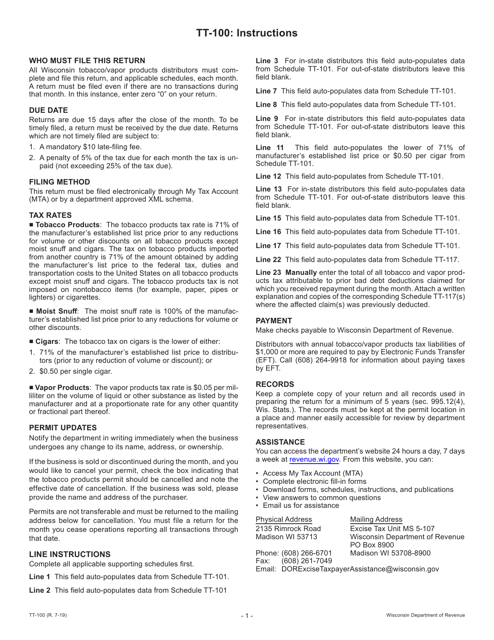

This Form is used for reporting and paying tobacco and vapor products tax by distributors in the state of Wisconsin.

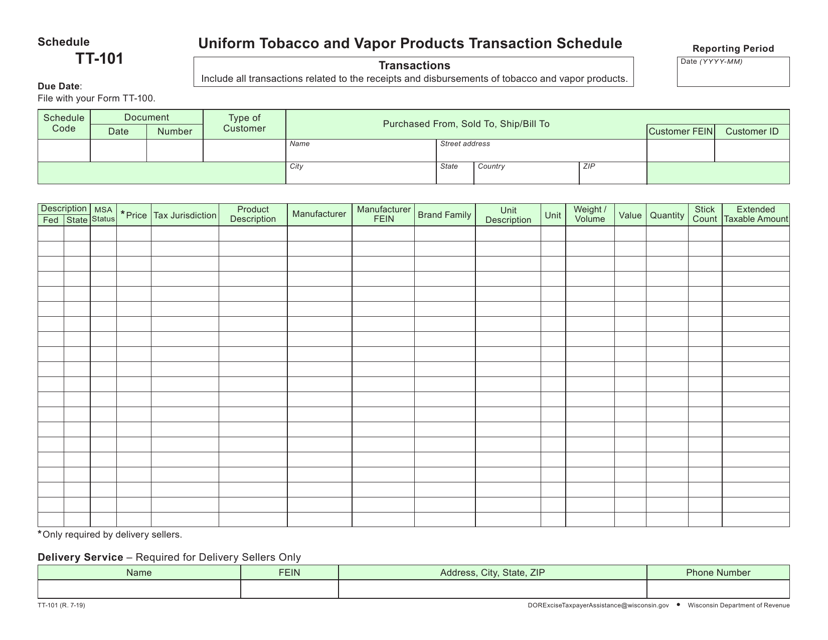

This document is used for reporting and recording tobacco and vapor products sales transactions in the state of Wisconsin. It helps businesses stay compliant with regulations and allows for accurate reporting of sales data.

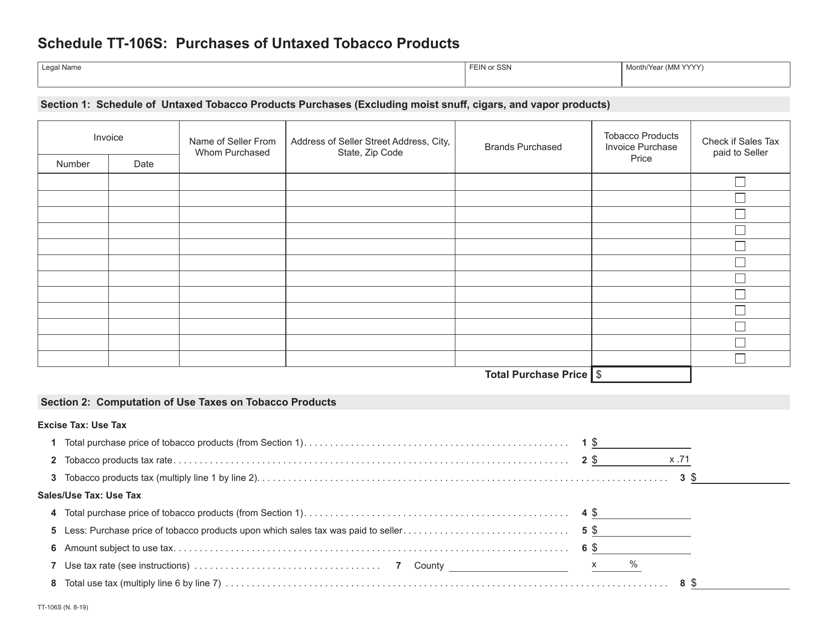

This document is used for reporting the purchases of untaxed tobacco products in Wisconsin.

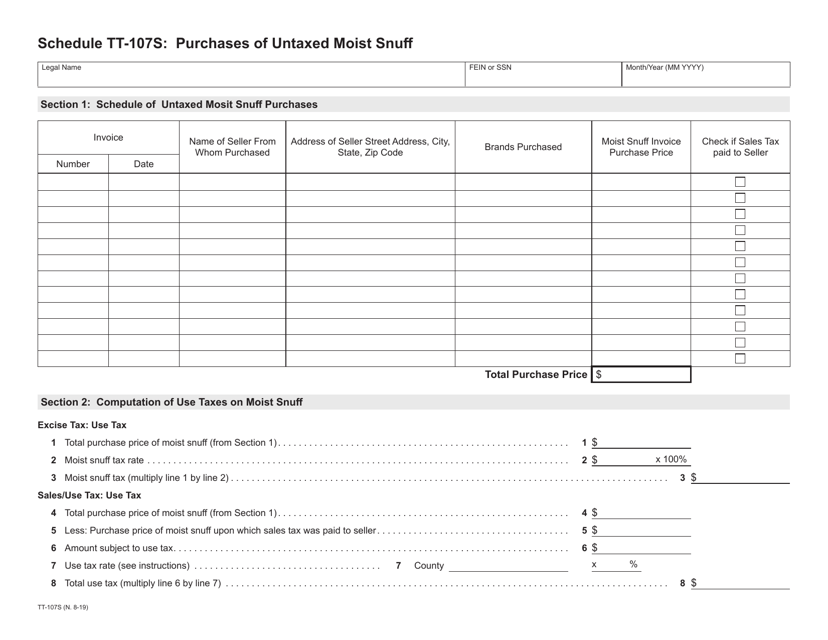

This document is used for reporting purchases of untaxed moist snuff in Wisconsin.

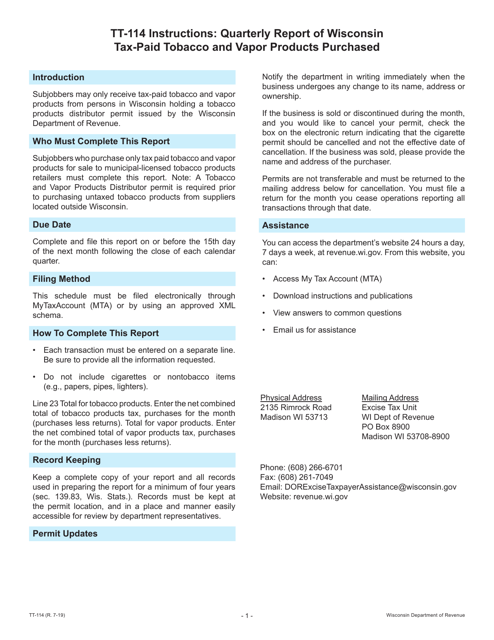

This form is used for reporting the quarterly purchase of tax-paid tobacco and vapor products in the state of Wisconsin.

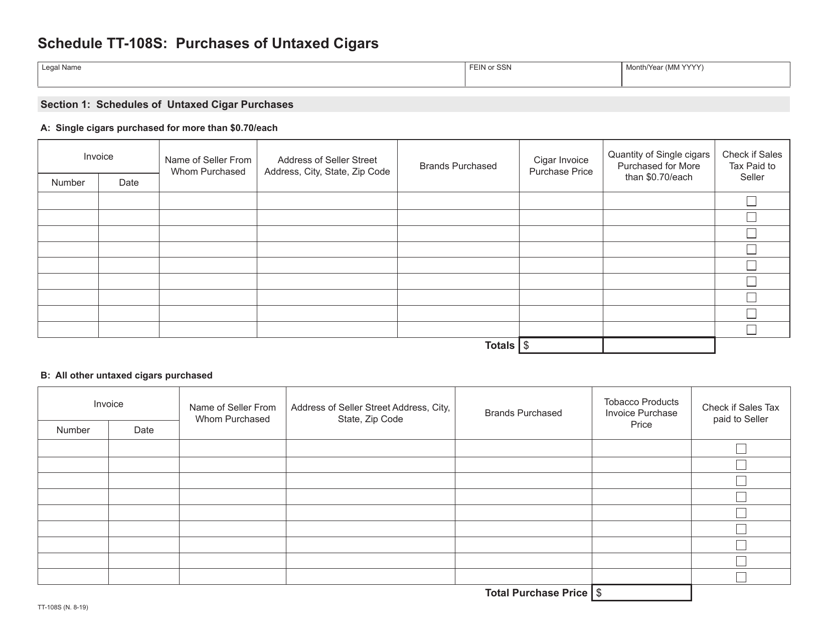

This document is used for reporting the purchases of untaxed cigars in Wisconsin.

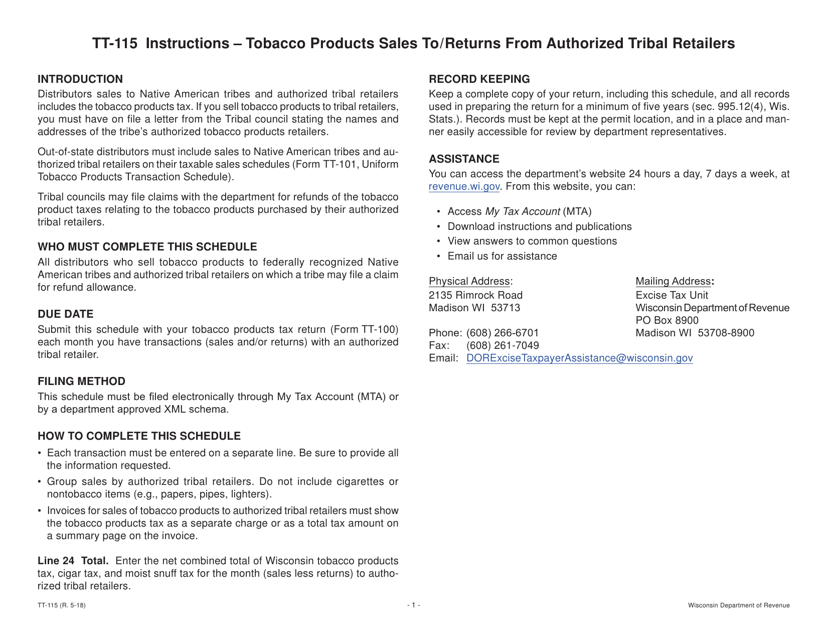

This form is used for reporting sales of tobacco products to and returns from authorized tribal retailers in Wisconsin. It is required for compliance with state regulations regarding the sale of tobacco products.

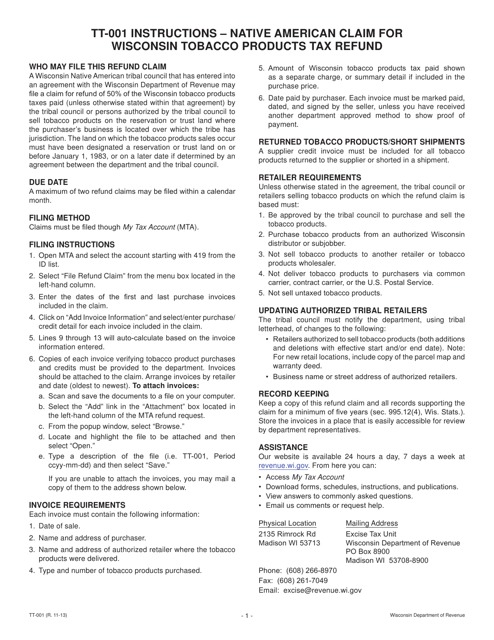

This form is used for Native Americans in Wisconsin to claim a refund on tobacco products tax.

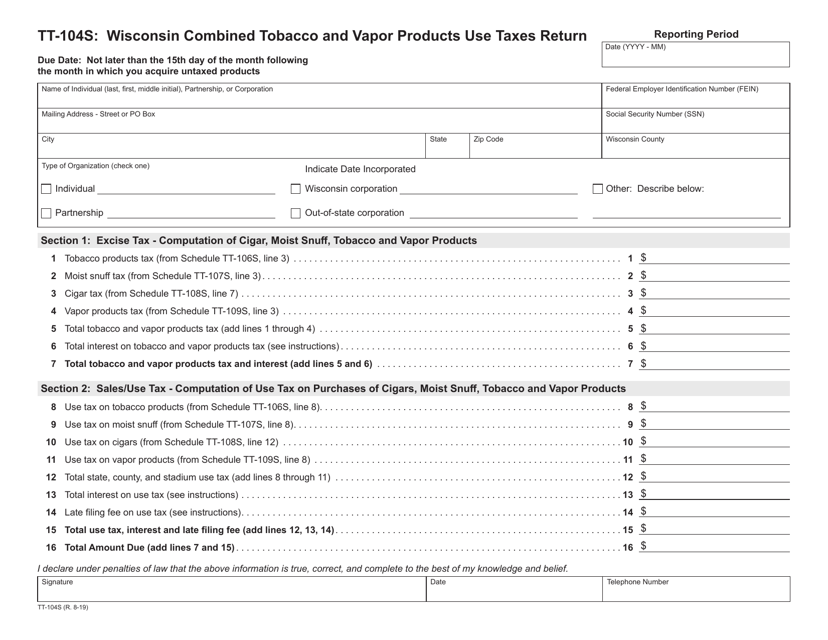

This Form is used for reporting and paying combined tobacco and vapor products use taxes in the state of Wisconsin.