Virginia Department of Taxation Forms

Documents:

852

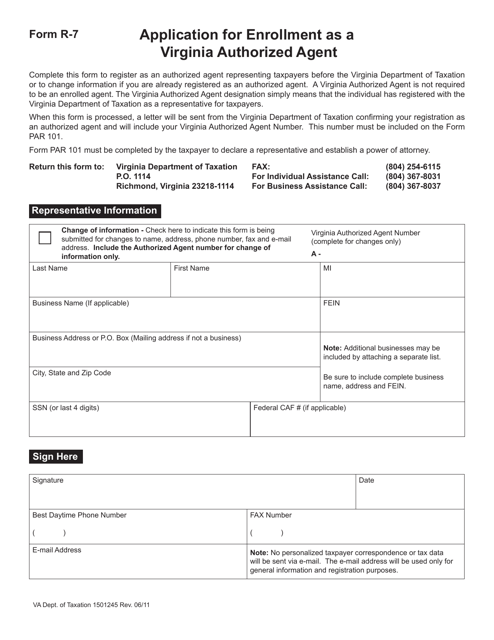

This Form is used for applying to become a Virginia Authorized Agent in the state of Virginia.

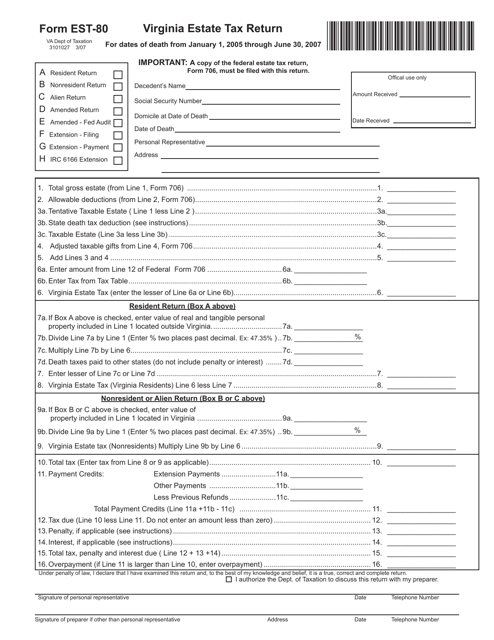

This form is used for filing the Virginia Estate Tax Return for individuals who have passed away between January 1, 2005, and June 30, 2007 in the state of Virginia.

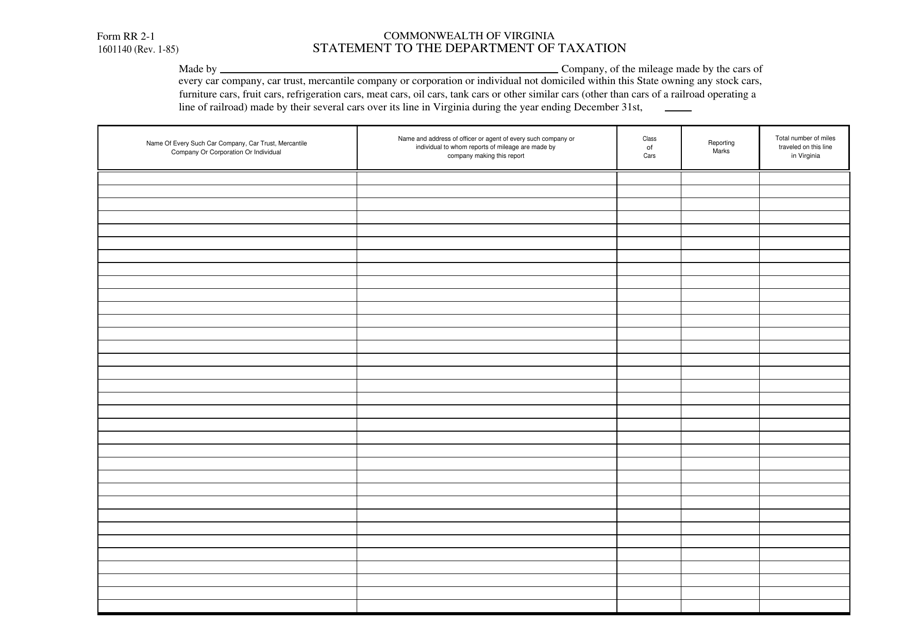

This form is used for submitting a statement to the Department of Taxation in Virginia.

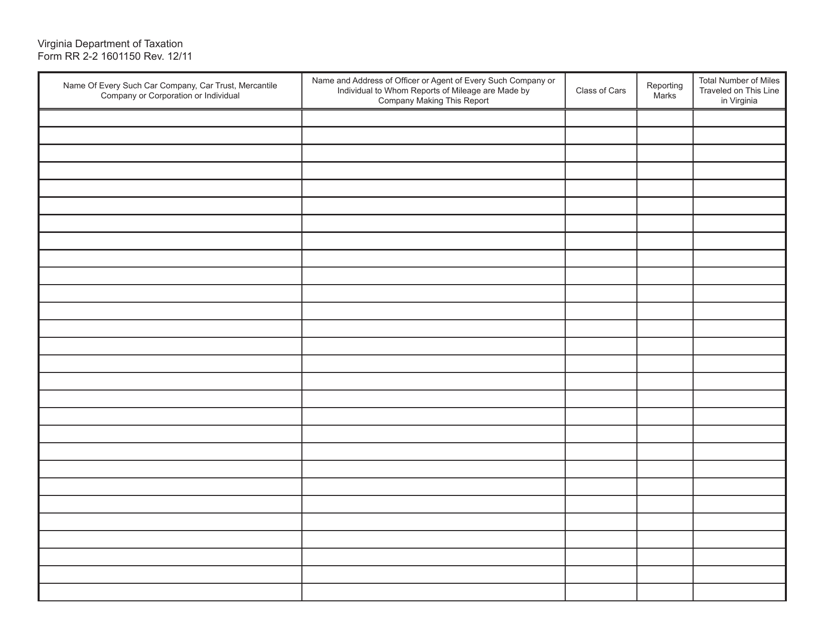

This document is a continuation of the Form RR2-2 Railroad Private Carline Mileage Return specifically for Virginia. It is used to report mileage information for private carlines in the state.

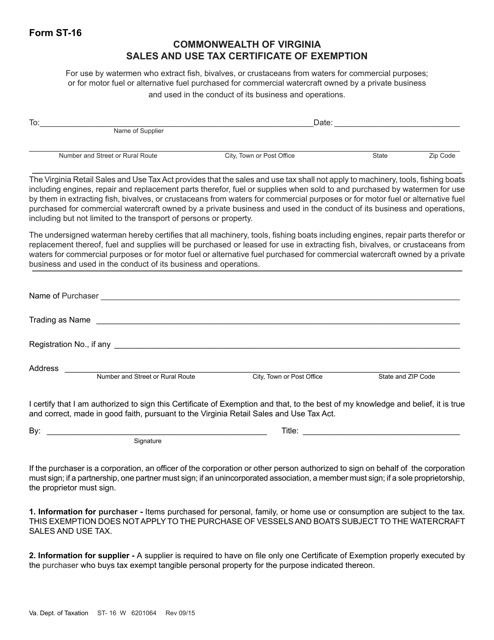

This form is used for the Sales and Use Tax Certificate of Exemption in Virginia.

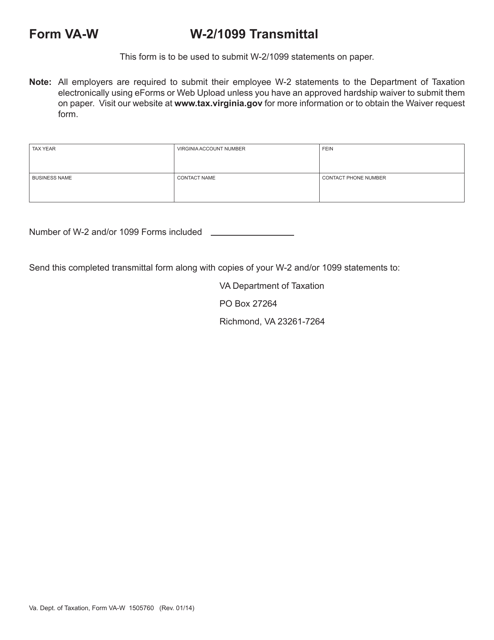

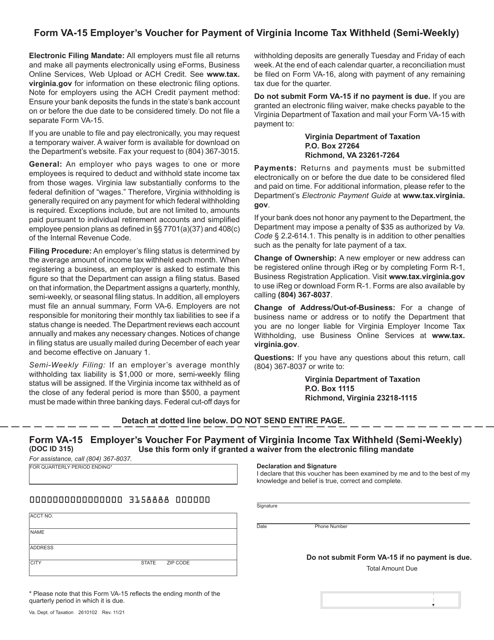

This form is used for submitting paper W-2 and 1099 forms to the state of Virginia. It is called the VA-W Withholding Transmittal form.

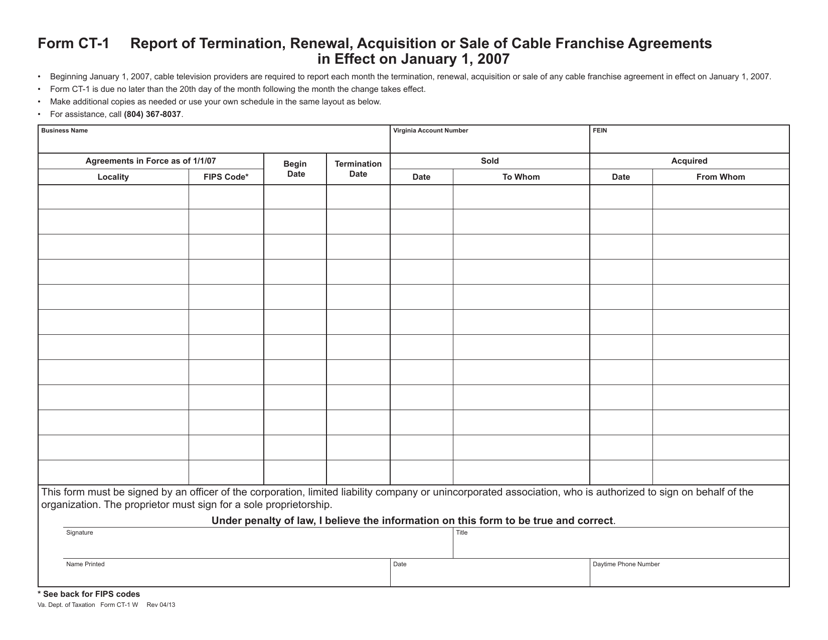

This form is used for reporting the termination, renewal, acquisition, or sale of cable franchise agreements in Virginia.

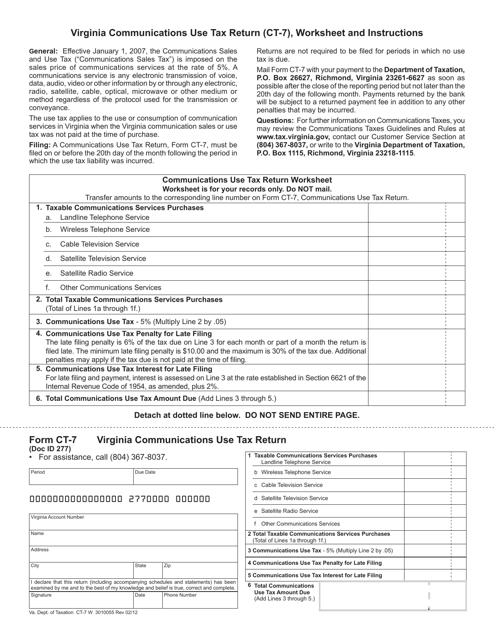

This form is used for reporting and paying the Virginia Communications Use Tax. It is applicable to businesses that provide certain taxable services in Virginia.

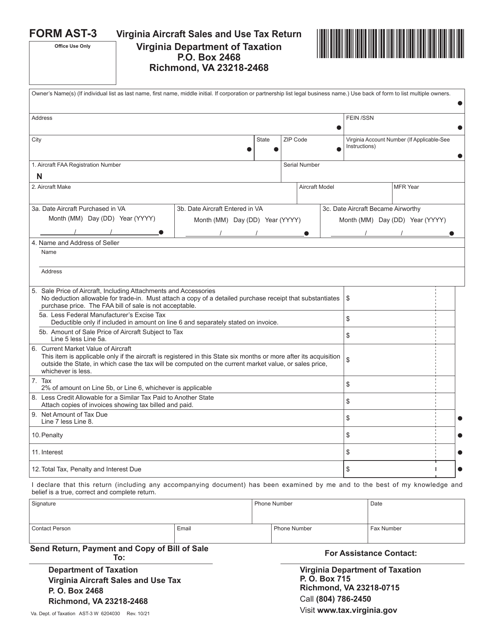

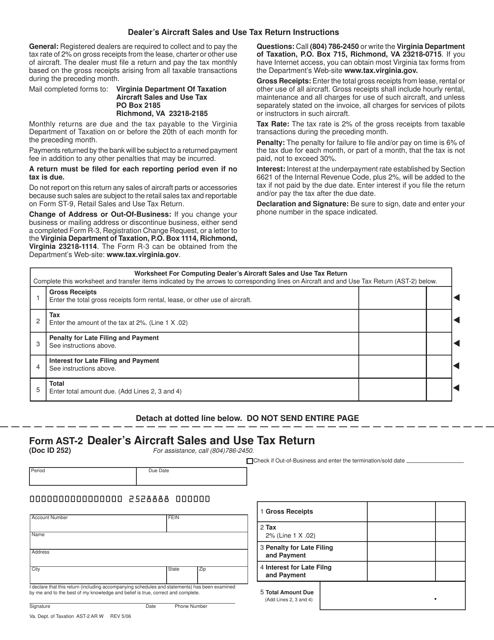

This form is used for reporting aircraft sales and use tax by dealers in Virginia.

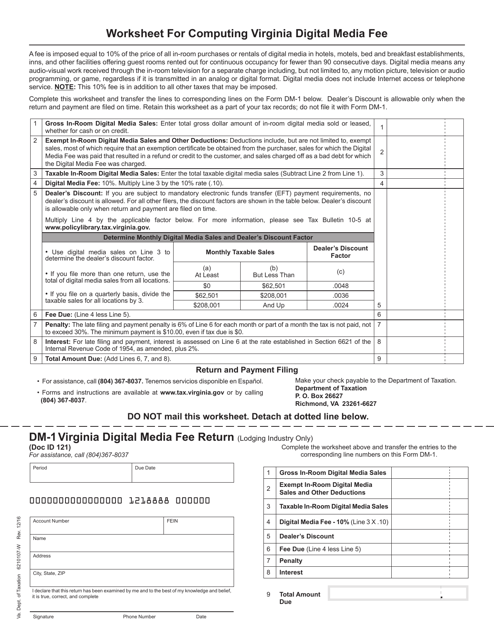

This Form is used for submitting the Virginia Digital Media Fee Return in Virginia.

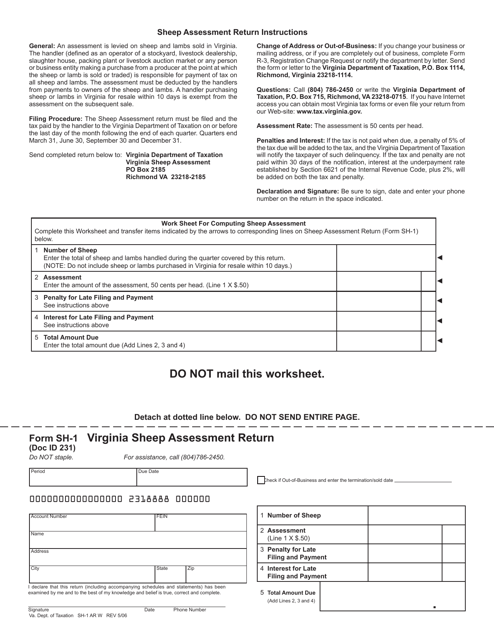

This Form is used for reporting sheep assessments in Virginia.

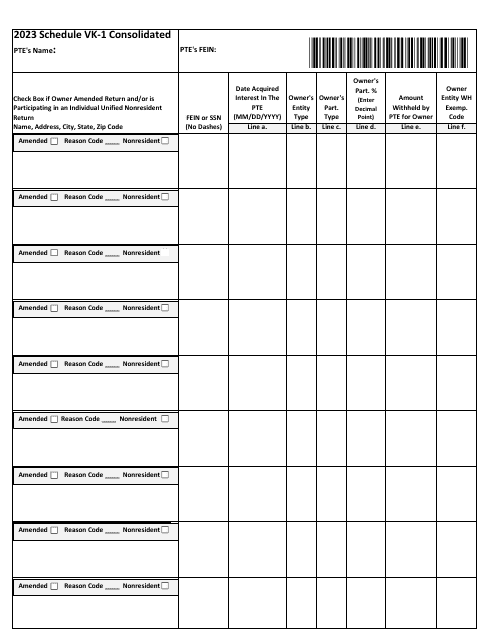

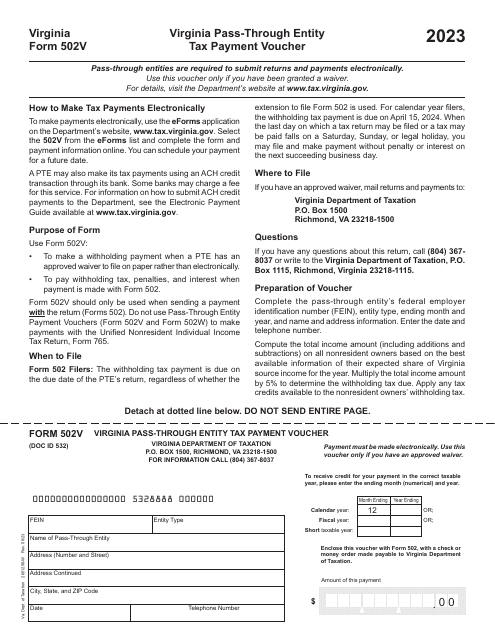

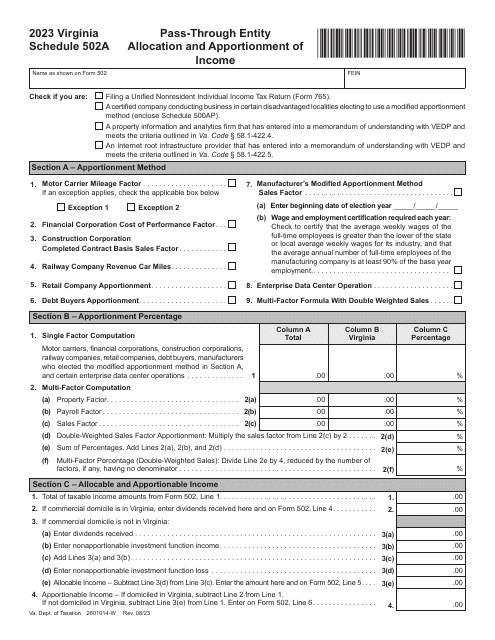

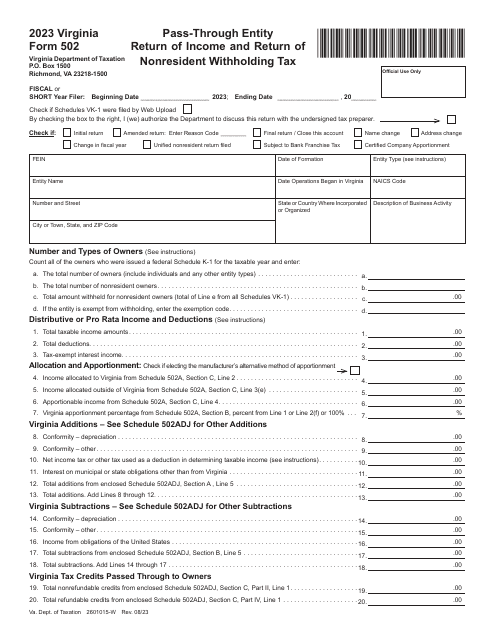

This Form is used for pass-through entities in Virginia to report their income and nonresident withholding tax. Instructions for filling out Form 502EZ.

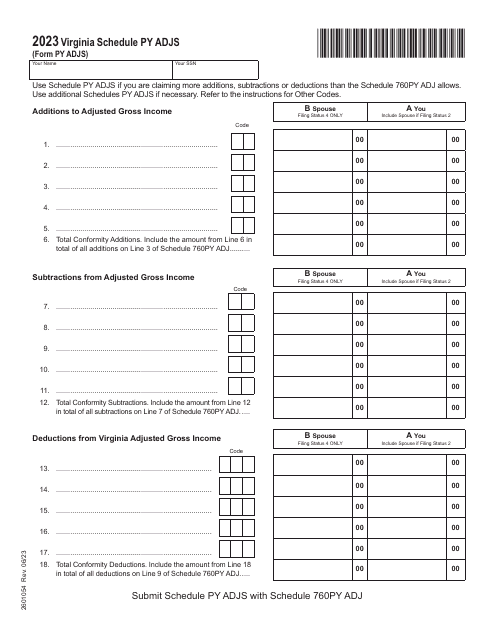

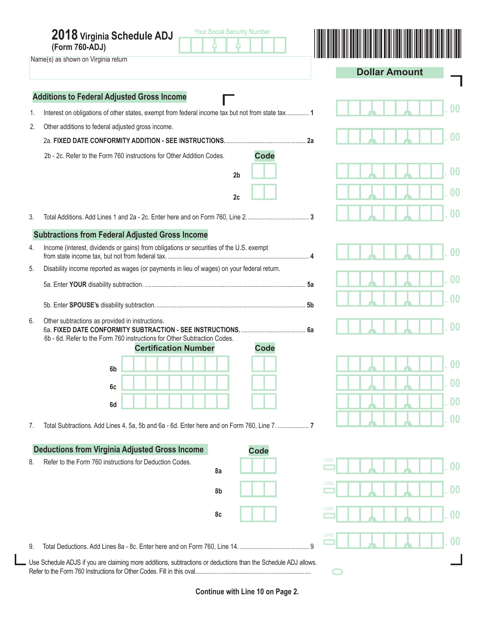

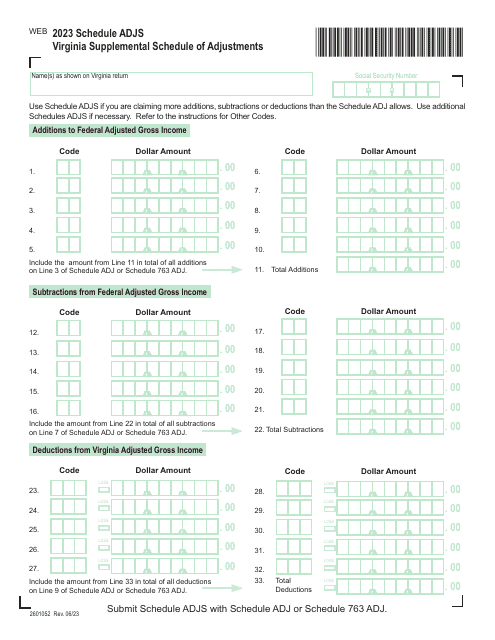

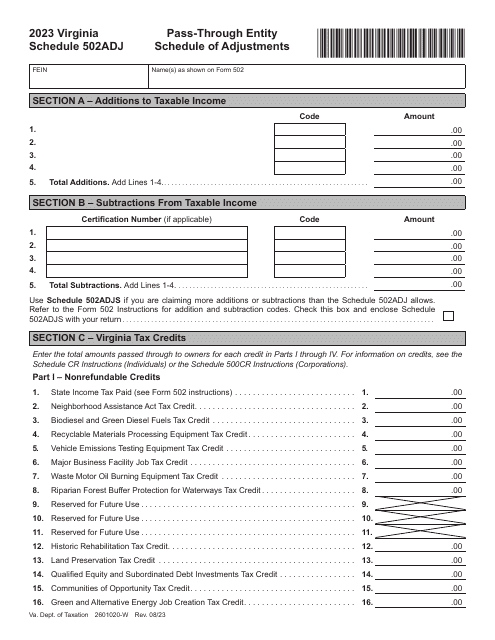

This type of document, the Schedule ADJ Virginia Schedule of Adjustments, is used in the state of Virginia to list and document any necessary adjustments to be made to a schedule or plan. It helps in organizing and tracking adjustments made to ensure accuracy and compliance with regulations.

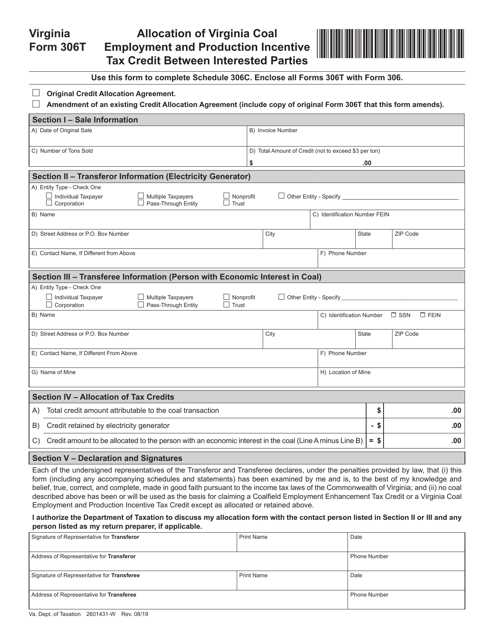

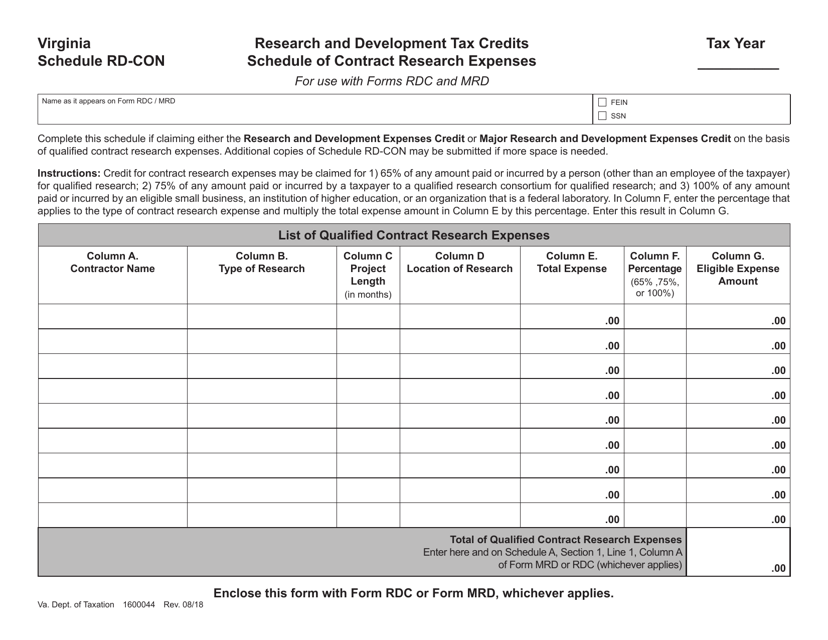

This type of document is used for reporting contract research expenses related to research and development tax credits in the state of Virginia.

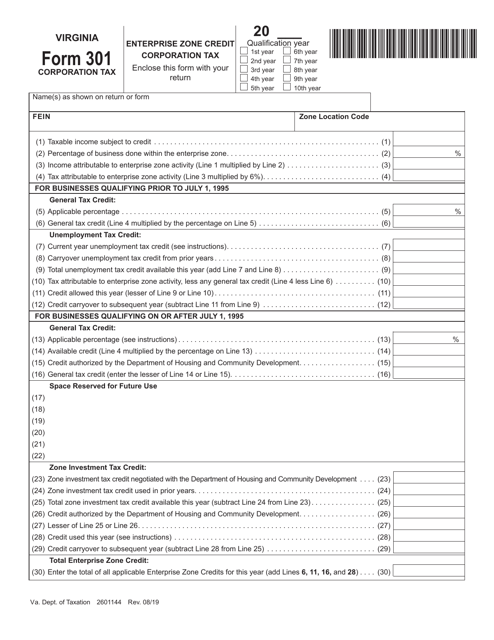

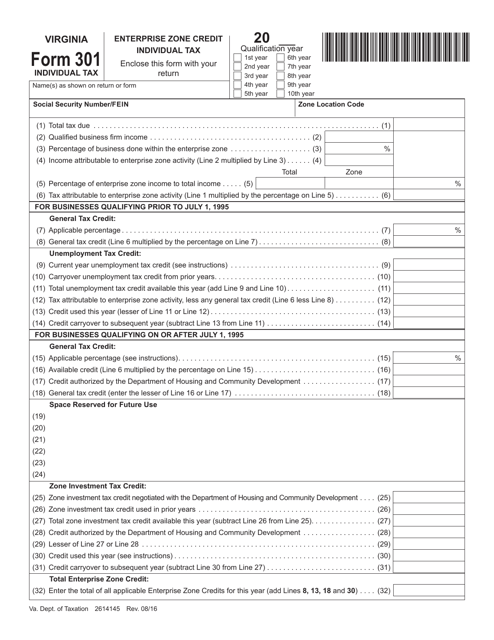

This form is used for claiming the Enterprise Zone Credit on individual taxes in the state of Virginia.

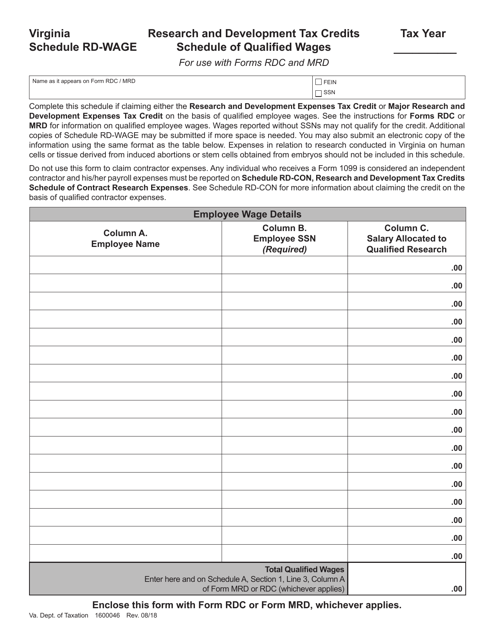

This document is the Schedule RD-WAGE for claiming Research and Development Tax Credits in Virginia. It is used to report qualified wages related to research and development activities.