Virginia Department of Taxation Forms

Documents:

852

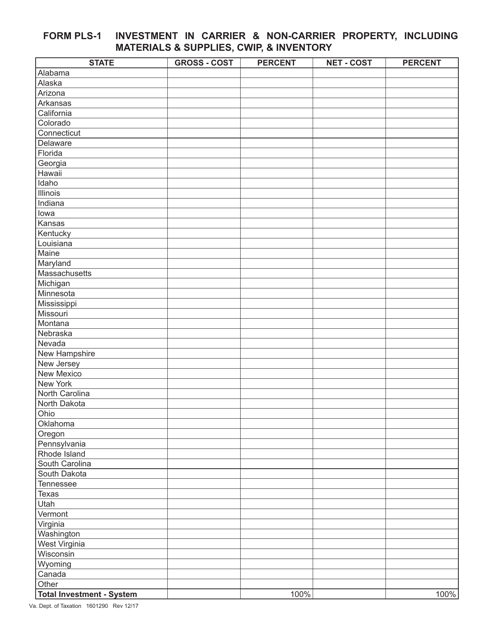

This Form is used for reporting investment in carrier and non-carrier property, including materials and supplies, construction work in progress (CWIP), and inventory in the state of Virginia.

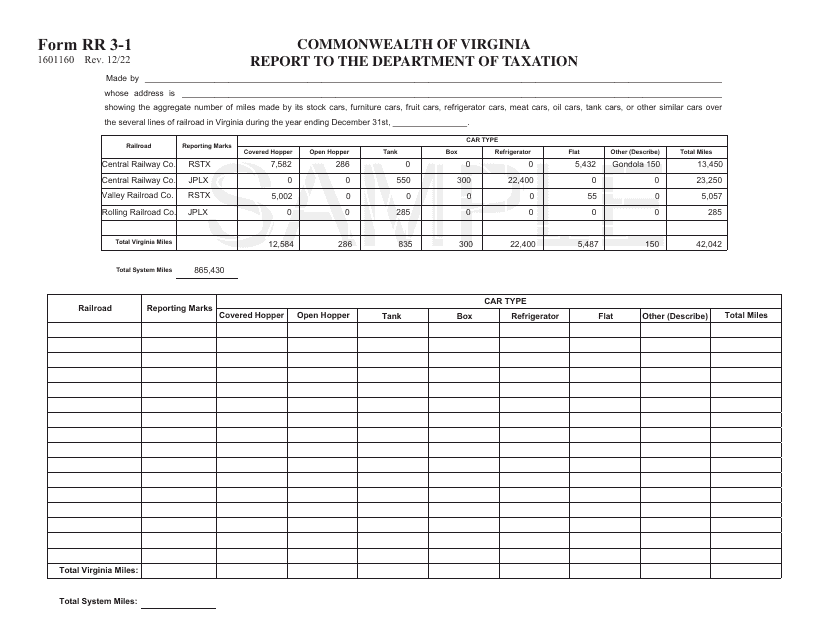

This Form is used for filing the Annual Tax Report of Railroad Companies in the state of Virginia.

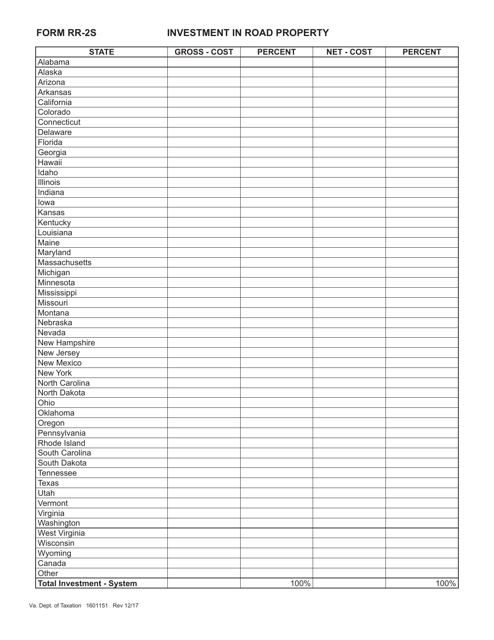

This Form is used for reporting investments in road property in the state of Virginia.

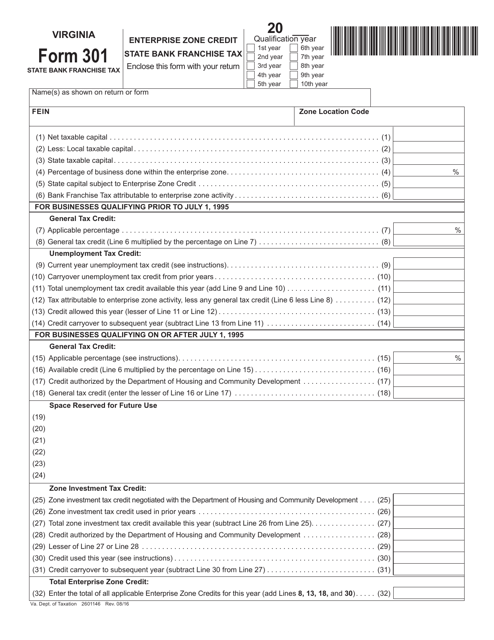

This form is used for claiming the Enterprise Zone Credit for Bank Franchise Tax in Virginia.

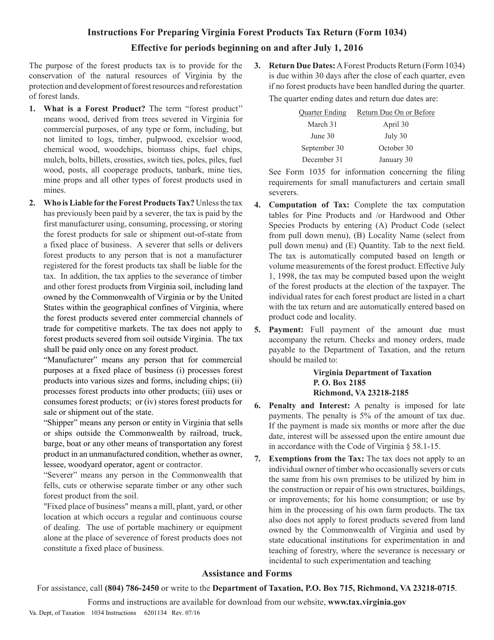

This Form is used for filing the Virginia Forest Products Tax Return in the state of Virginia. It provides instructions on how to report and pay taxes on forest products.

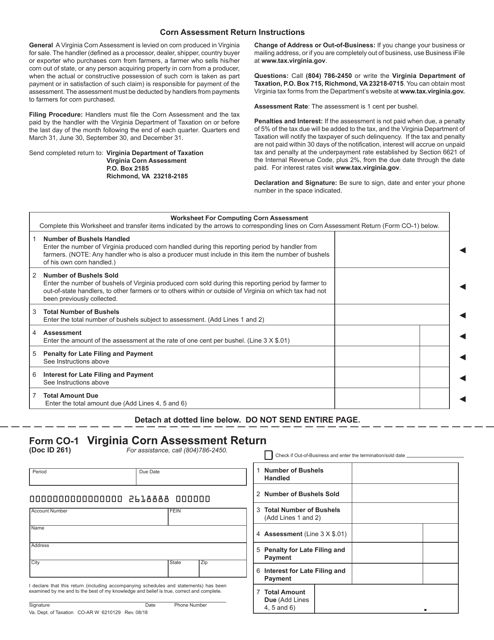

This Form is used for submitting the Virginia Corn Assessment Return in the state of Virginia.

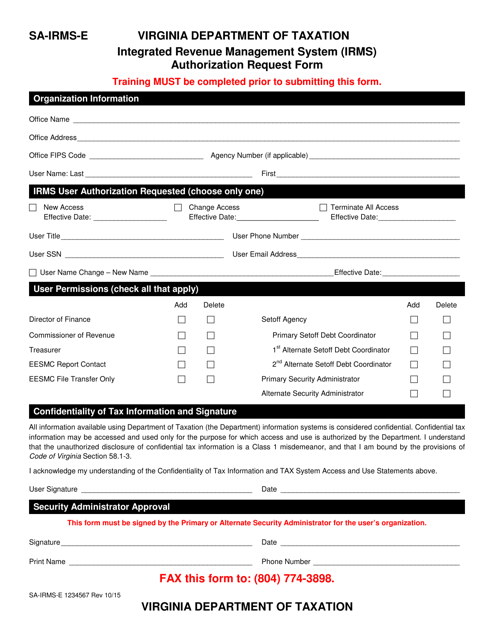

This form is used for requesting authorization for the Integrated Revenue Management System (Irms) in the state of Virginia.

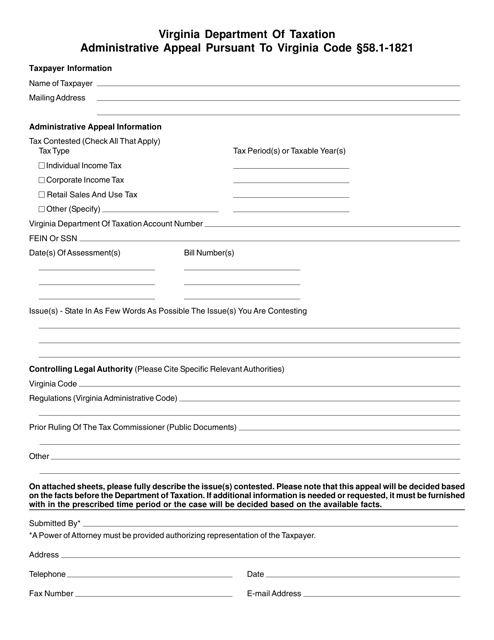

This document is used for filing an administrative appeal in the state of Virginia, specifically under Virginia Code 58.1-1821. The appeal process allows individuals to contest decisions made by the administrative authorities regarding tax matters.

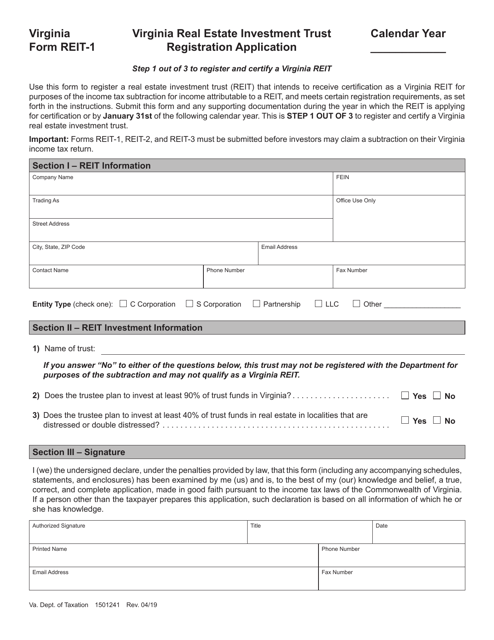

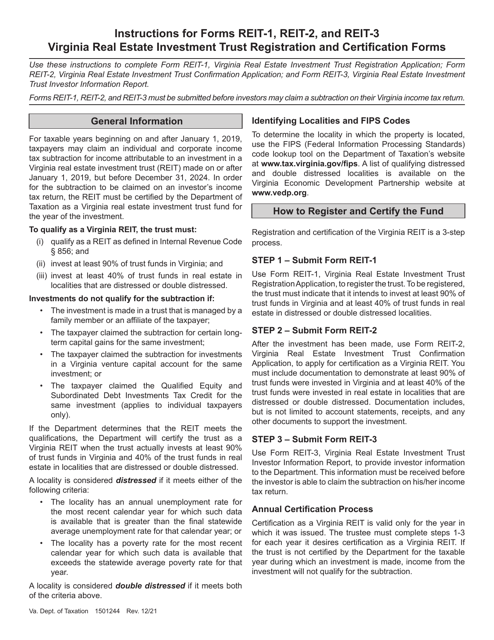

This Form REIT-1 is used for registering a Virginia Real Estate Investment Trust in the state of Virginia.

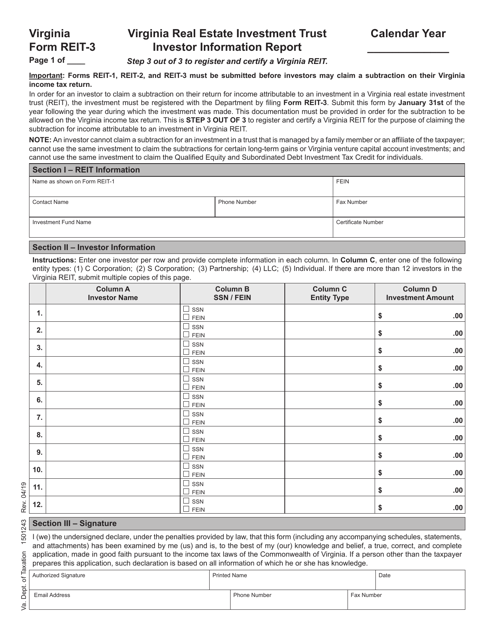

This Form is used for reporting investor information for the Virginia Real Estate Investment Trust (REIT-3) in Virginia.

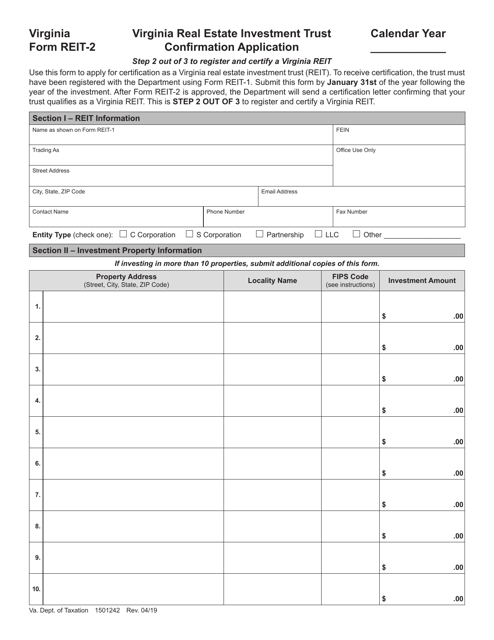

This document is used for applying for a confirmation of a Virginia Real Estate Investment Trust.

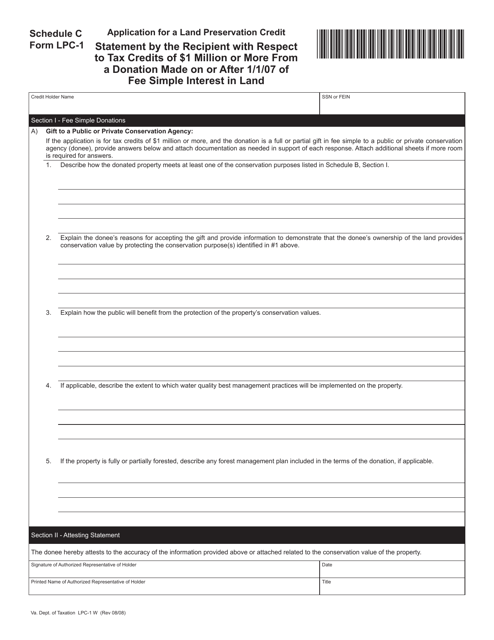

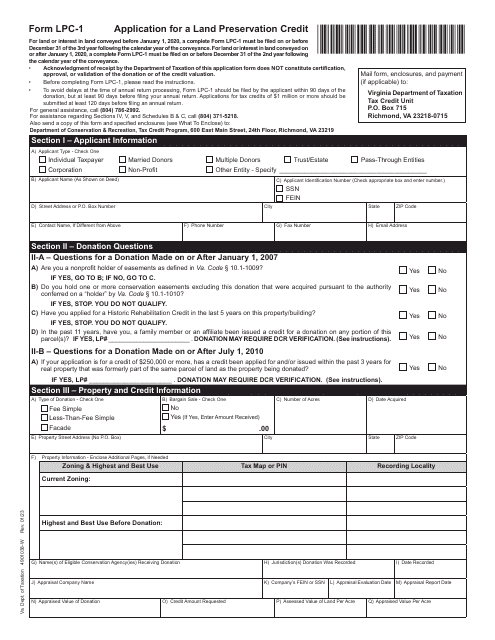

This Form is used for submitting a Schedule C statement in Virginia to report tax credits of $1 million or more received from a donation made on or after January 1, 2007, of fee simple interest in land.

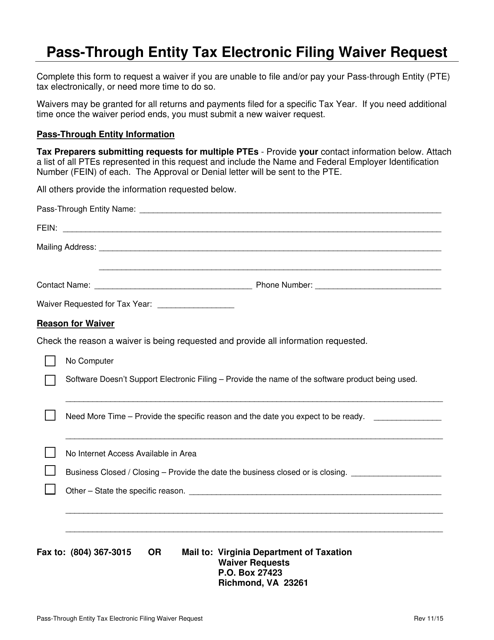

This Form is used for requesting a waiver to electronically file pass-through entity tax returns in the state of Virginia.

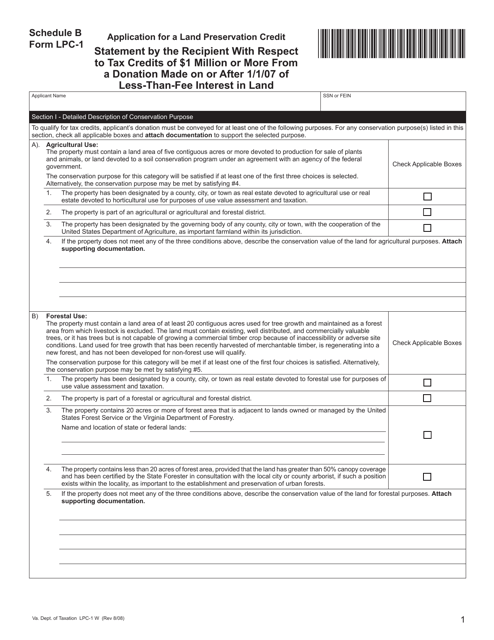

This document is for the recipient to provide a statement about tax credits of $1 million or more received from a donation of less-than-fee interest in land made in Virginia on or after 1/1/07.

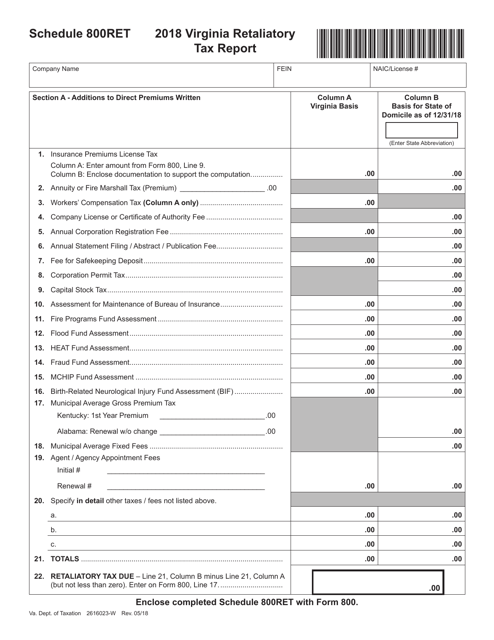

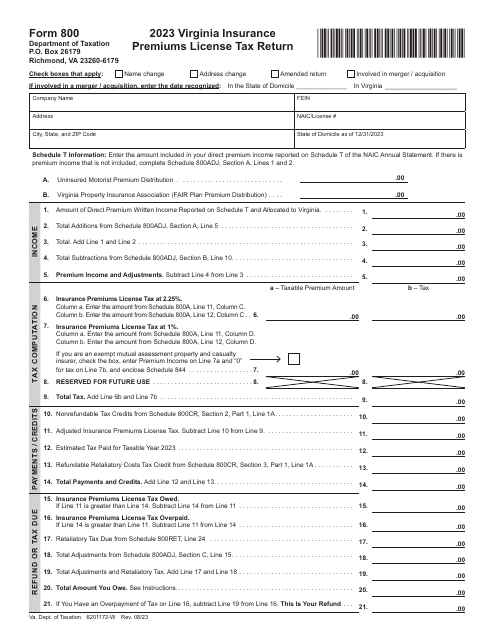

This document is used for filing the Virginia Retaliatory Tax Report - Virginia. Retaliatory tax is a tax imposed by Virginia on foreign insurance companies that is based on the taxes and fees charged to Virginia companies by the foreign insurance company's home state.

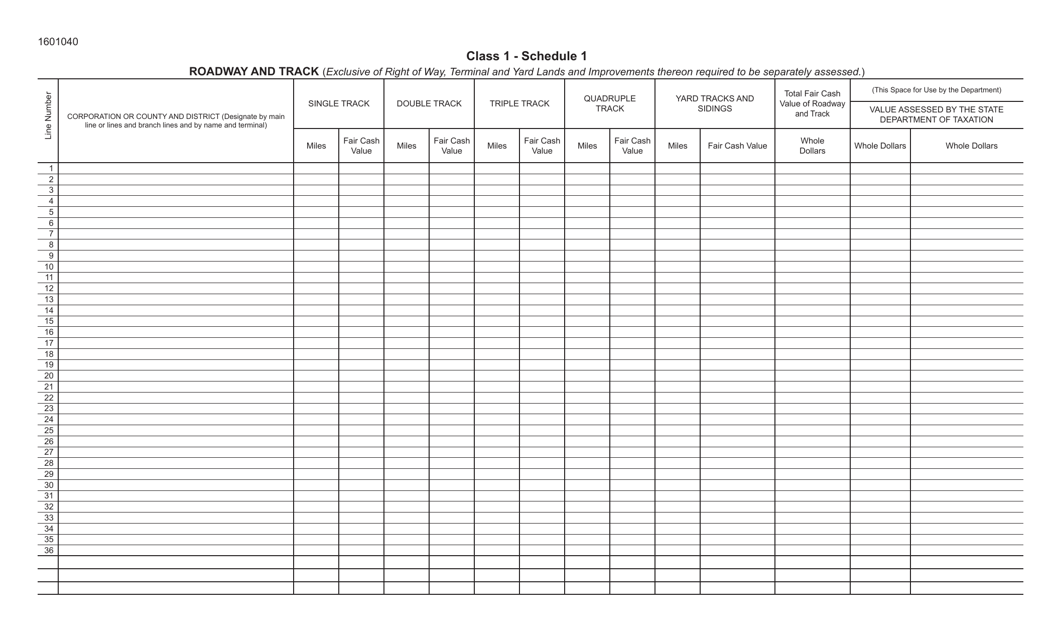

This form is used for reporting and tracking roadway and track information in the state of Virginia.

This form is used for the annual tax report of oil companies in Virginia.

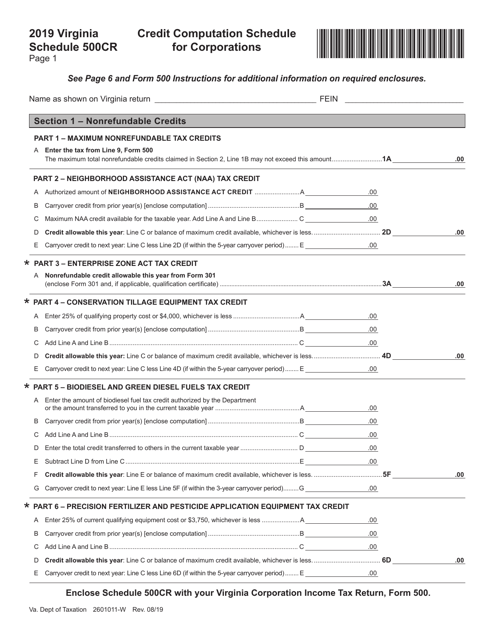

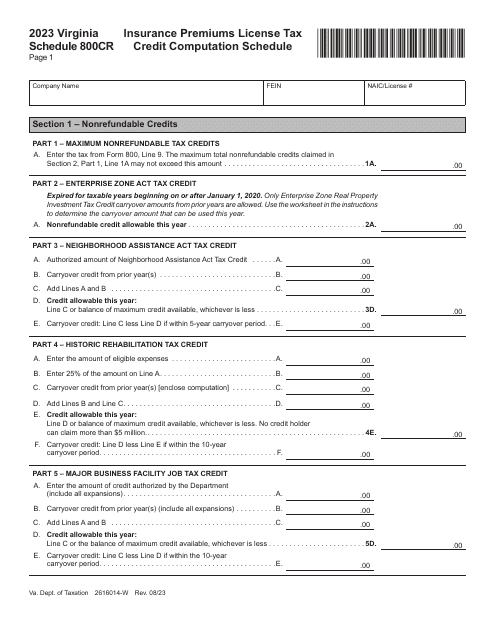

This Form is used for calculating credit computations for corporations in Virginia.

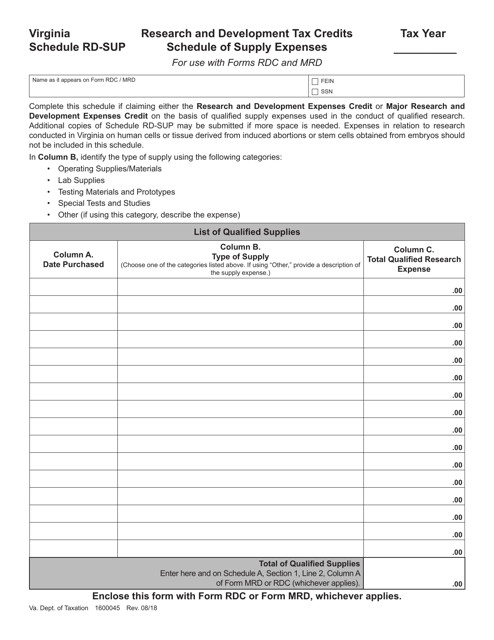

This document is the Schedule RD-SUP for claiming Research and Development Tax Credits for supply expenses incurred in the state of Virginia.

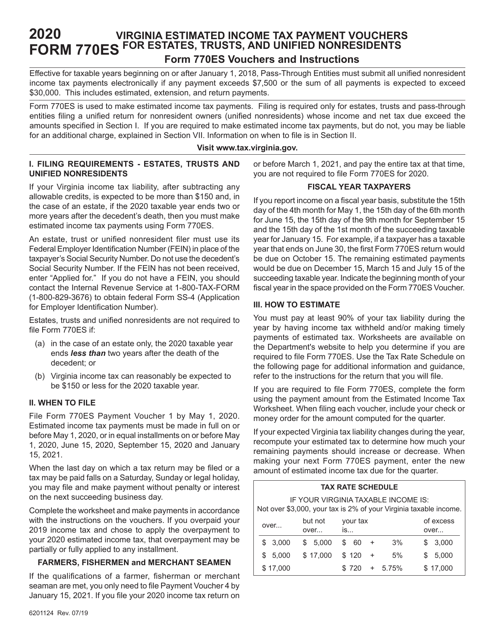

This form is used for making estimated tax payments for estates, trusts, and unified nonresidents in Virginia.