Virginia Department of Taxation Forms

Documents:

852

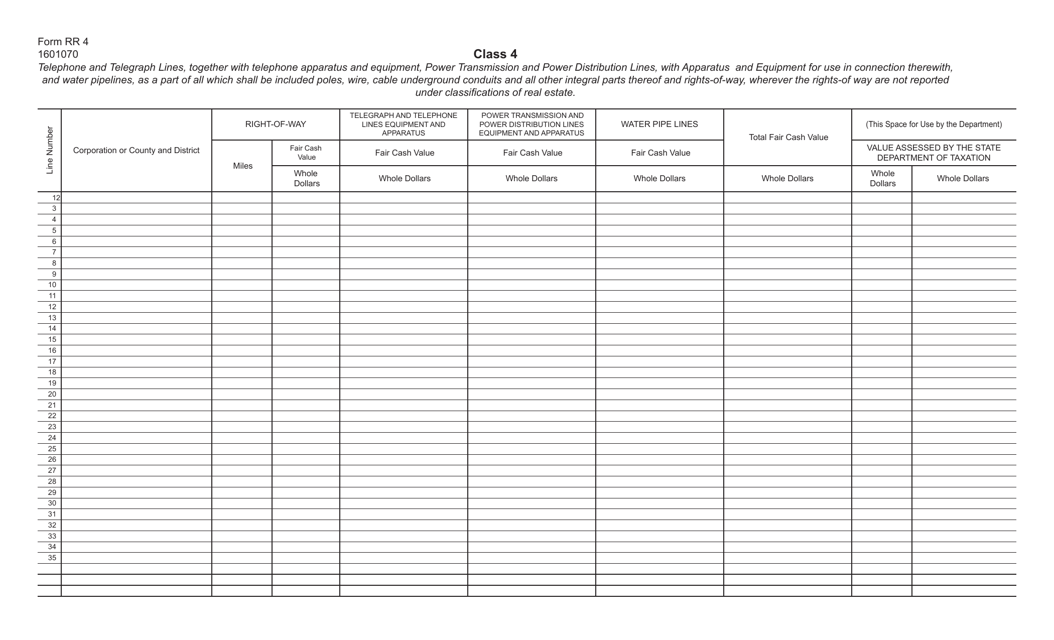

This form is used for reporting telephone and telegraph lines in Virginia that are not classified as real estate.

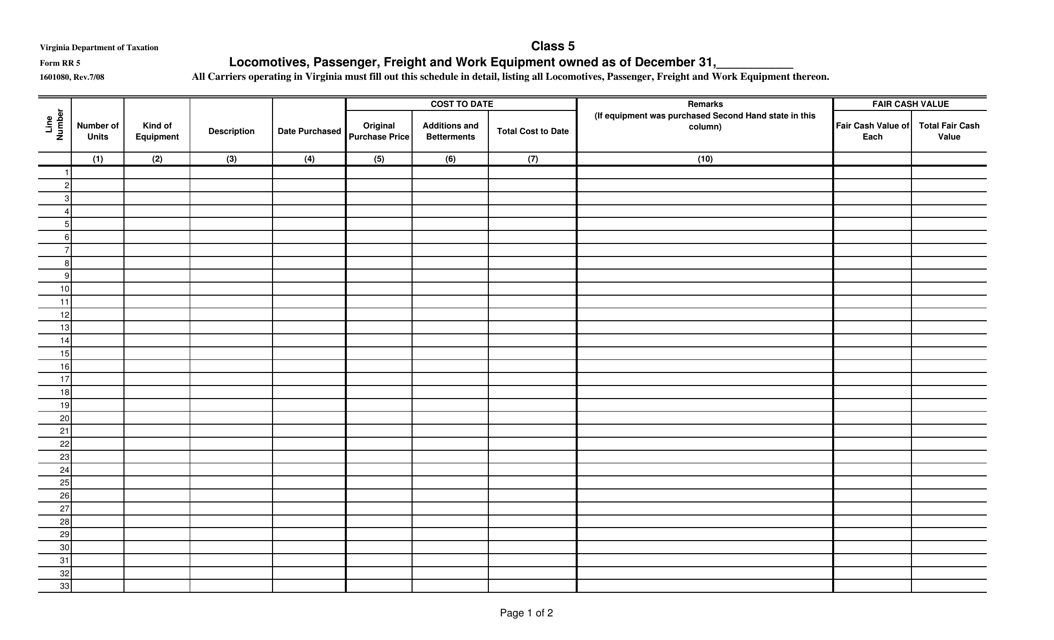

This form is used for reporting locomotives, passenger, freight, and work equipment owned by individuals or companies in Virginia as of December 31st.

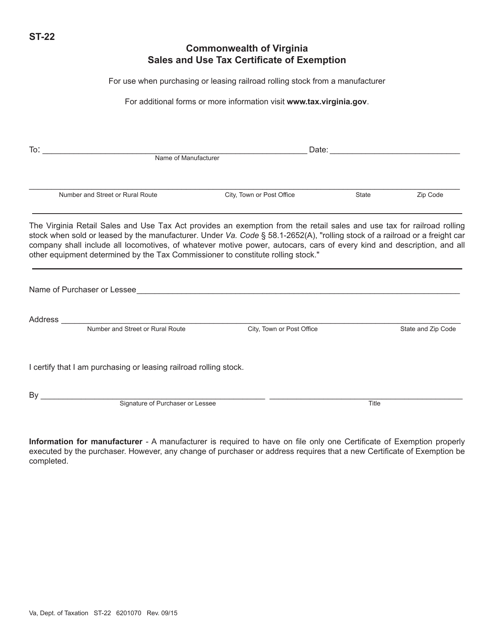

This form is used for claiming an exemption from sales tax for railroad rolling stock in the state of Virginia.

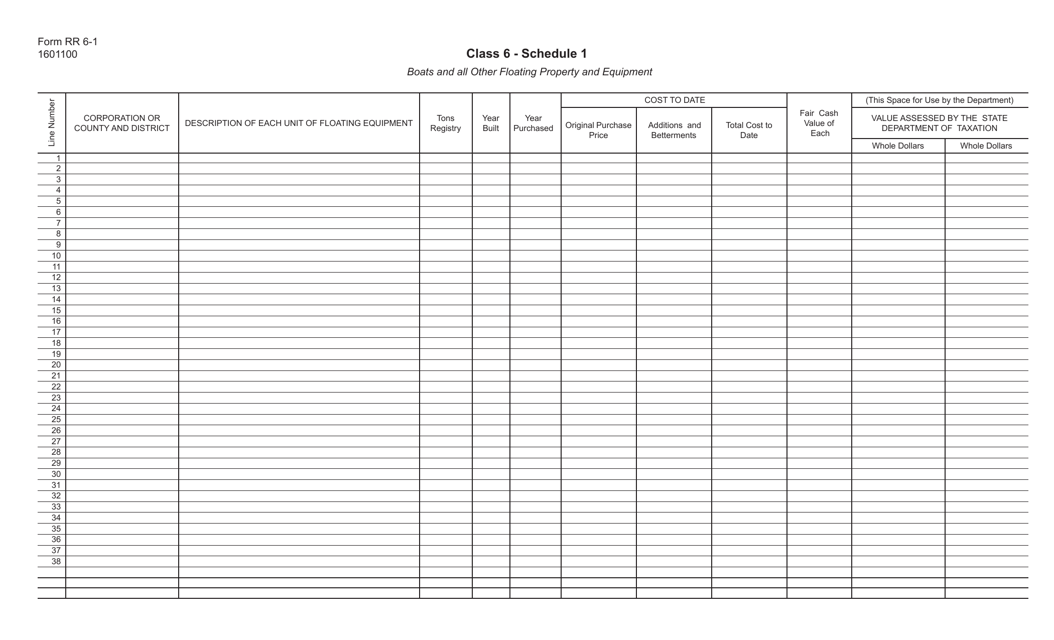

This form is used for reporting boats and all other floating property and equipment in the state of Virginia.

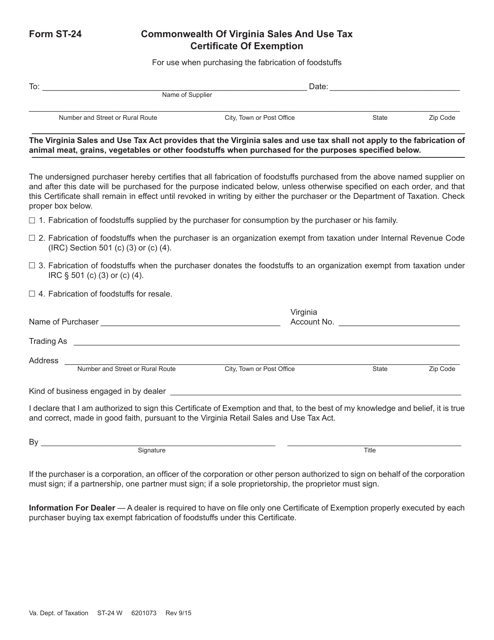

This form is used for requesting an exemption certificate for foodstuffs fabrication in Virginia.

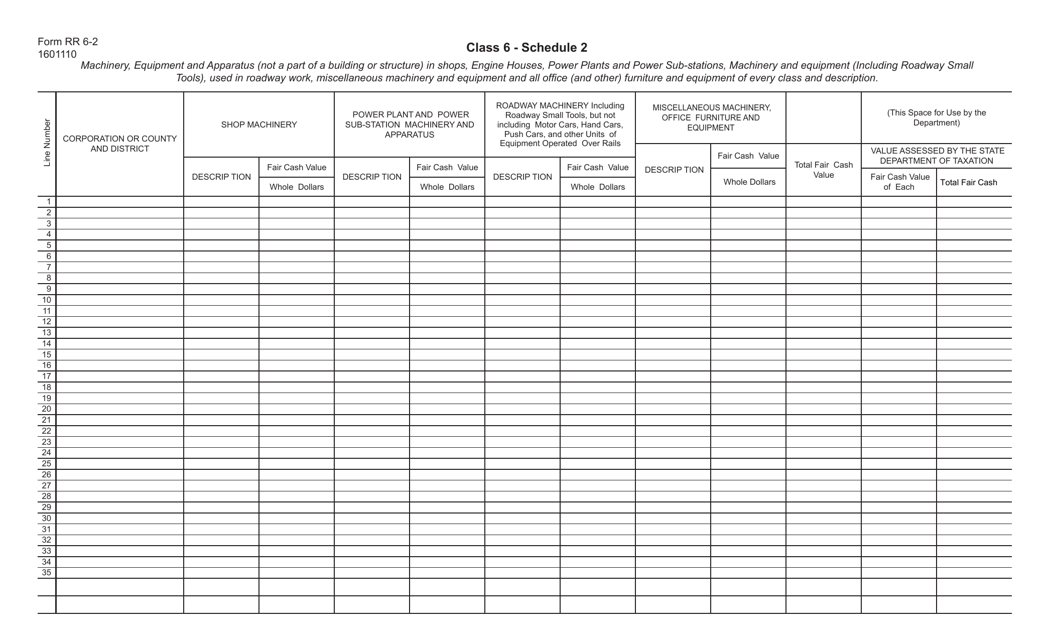

This Form is used for reporting and categorizing machinery, equipment, and apparatus in the state of Virginia under Class 6 for taxation purposes.

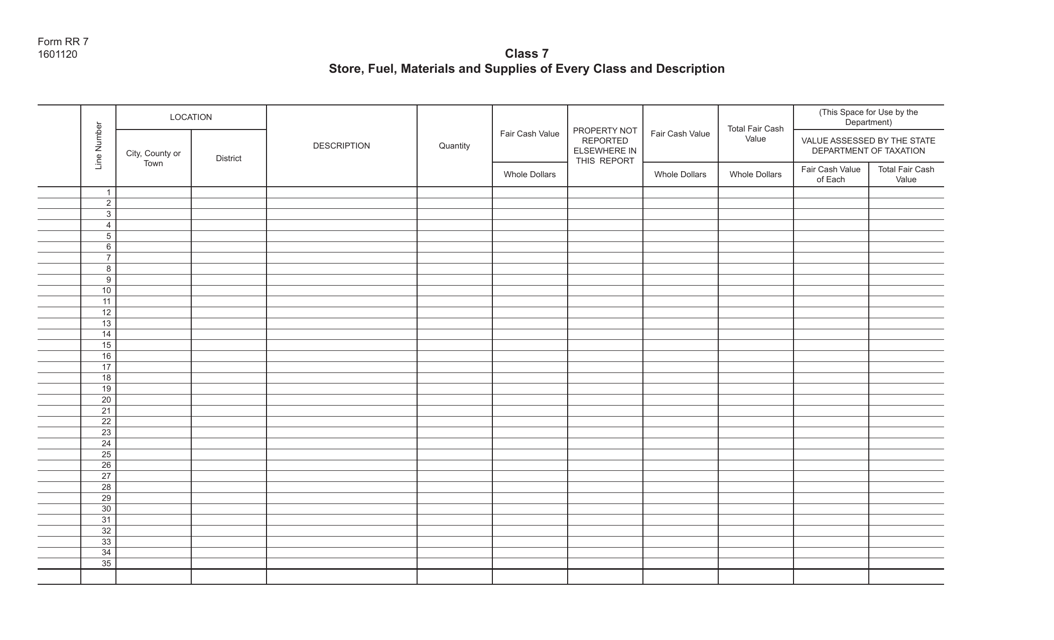

This Form is used for reporting store, fuel, materials, and supplies of every class and description for Class 7 in Virginia.

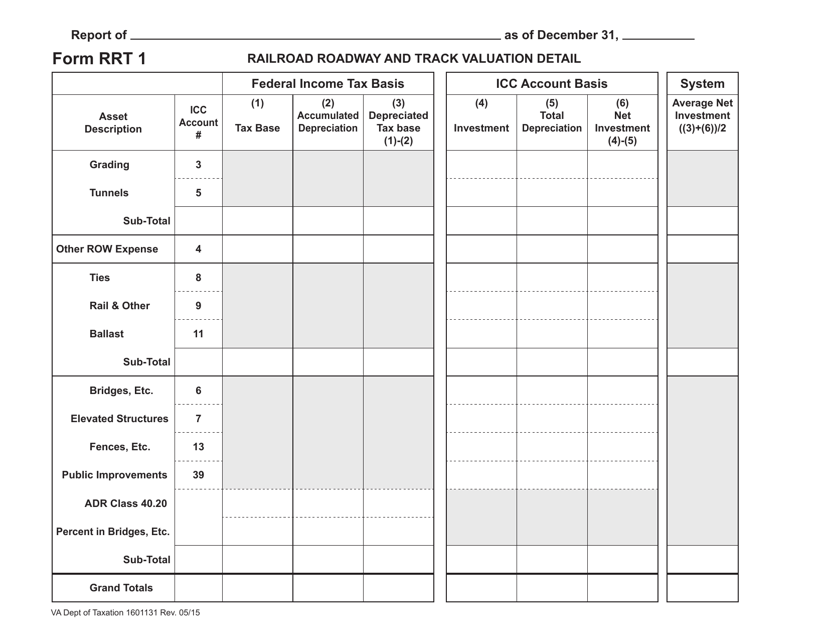

This form is used for providing detailed information on the valuation of railroad roadway and track in Virginia.

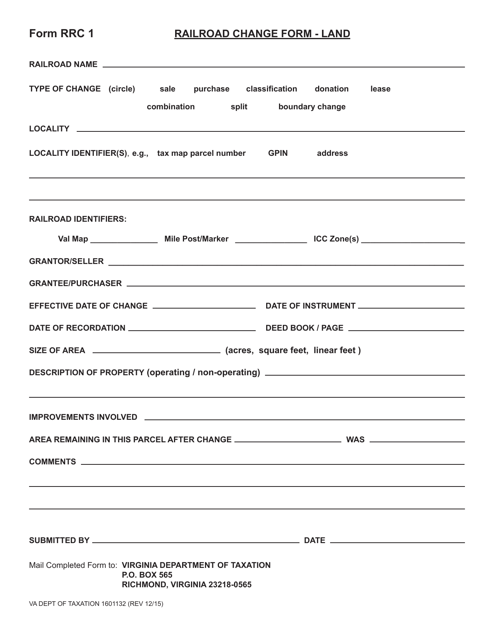

This form is used for making changes to railroad land in Virginia.

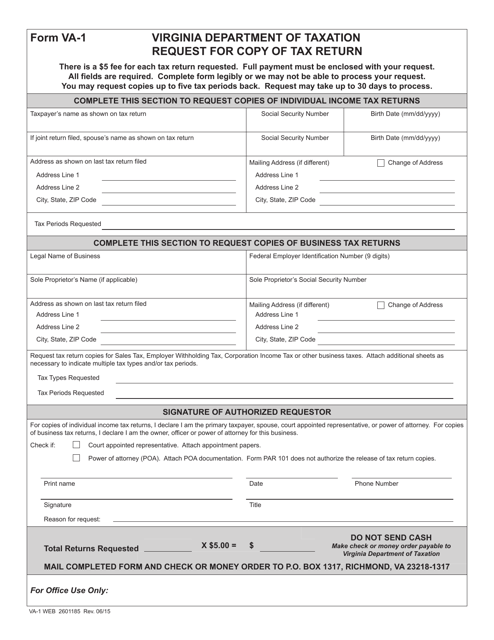

This form is used for requesting a copy of a tax return filed in Virginia. It is necessary if you need to obtain a copy of your previously filed tax return for various reasons.

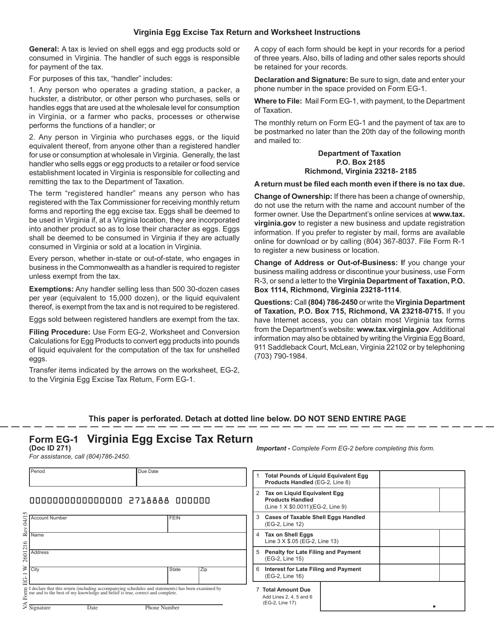

This Form is used for filing the Virginia Egg Excise Tax Return in Virginia. It is the official document to report and pay the state excise tax on eggs sold or used in Virginia.

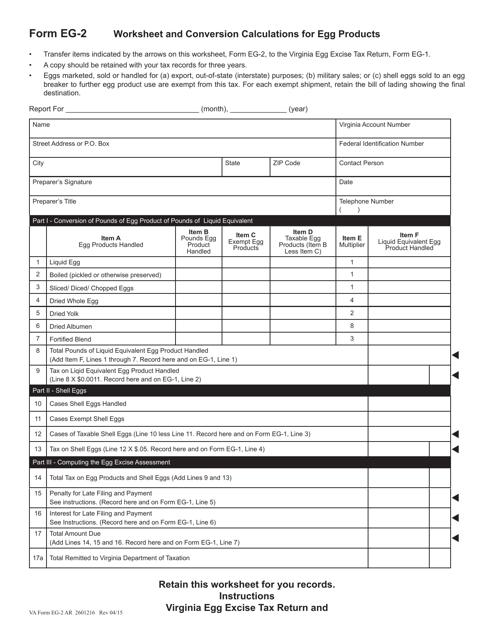

This type of document is a worksheet and conversion calculations for egg products in Virginia. It helps in determining the quantity and measurement conversions for various egg products.

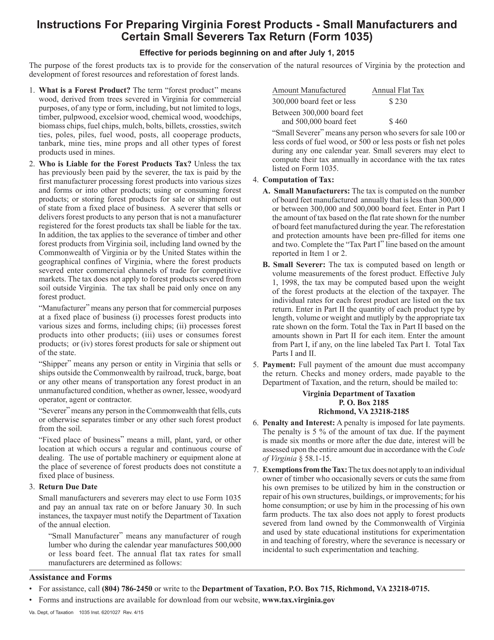

This Form is used for small manufacturers in Virginia to file their forest product tax return. It provides instructions on how to accurately report and pay taxes on forest products.

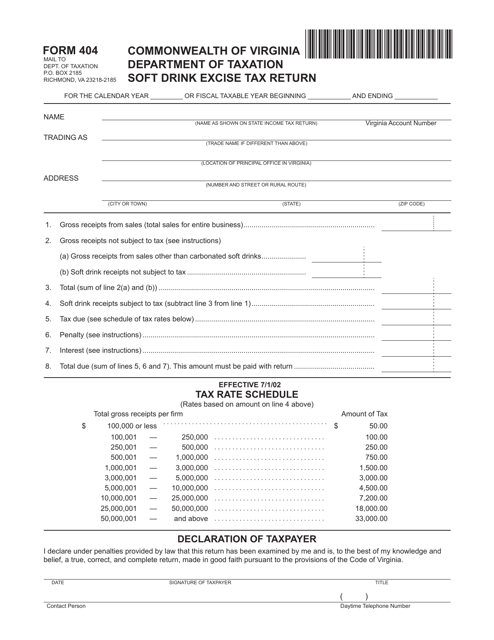

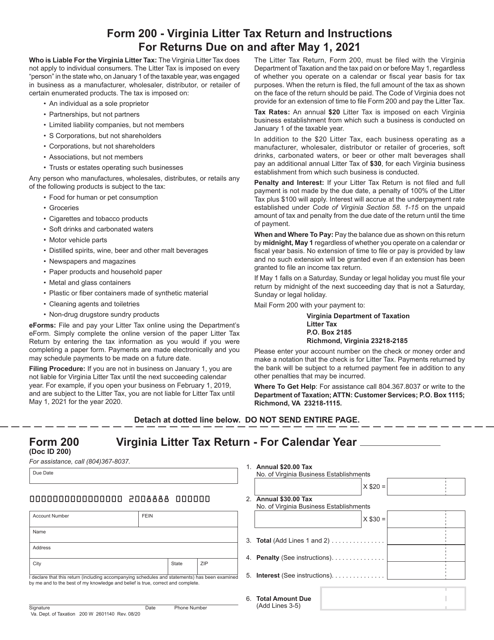

This form is used for reporting and paying the excise tax on soft drinks in the state of Virginia. It is necessary for businesses that manufacture or sell soft drinks to comply with the tax regulations.

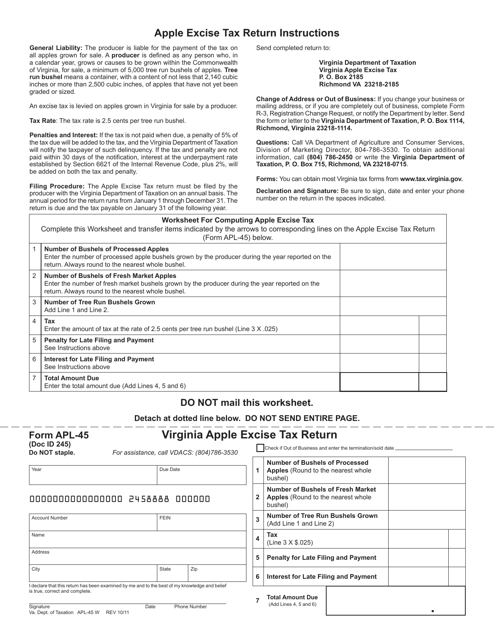

This document is for filing the Virginia Apple Excise Tax Return in the state of Virginia.

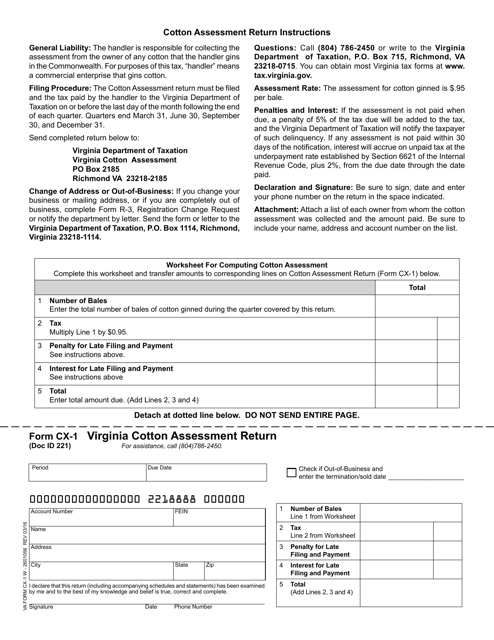

This form is used for reporting cotton assessments in Virginia.

This document is used for the annual tax reporting of gas companies in Virginia. It provides relevant information on the title page.

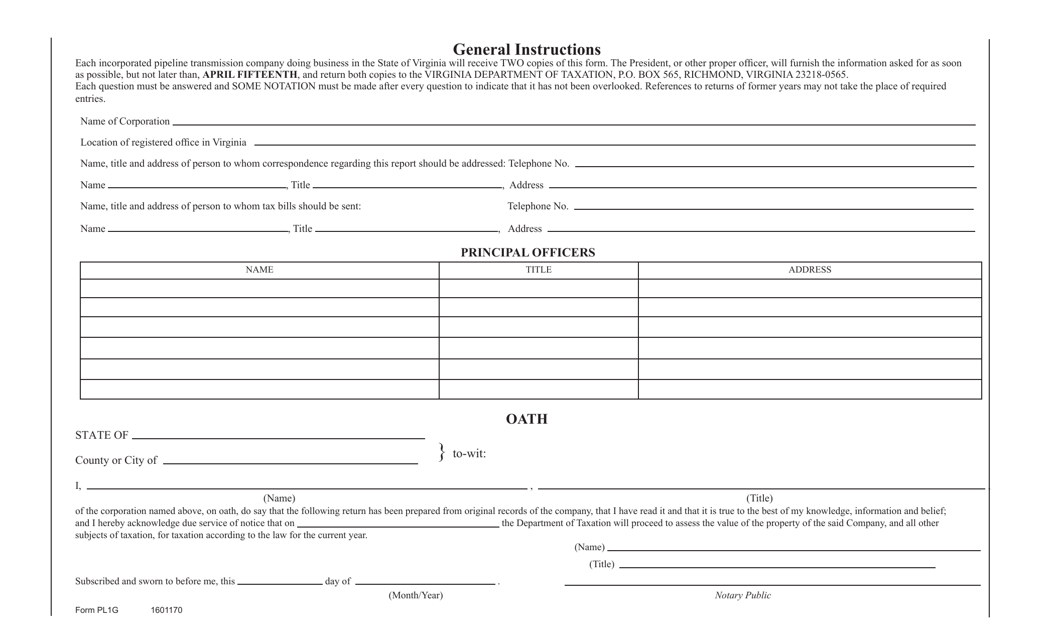

This document provides general instructions and an oath page for Form PL1G in the state of Virginia. It is used for completing the form and swearing under oath.

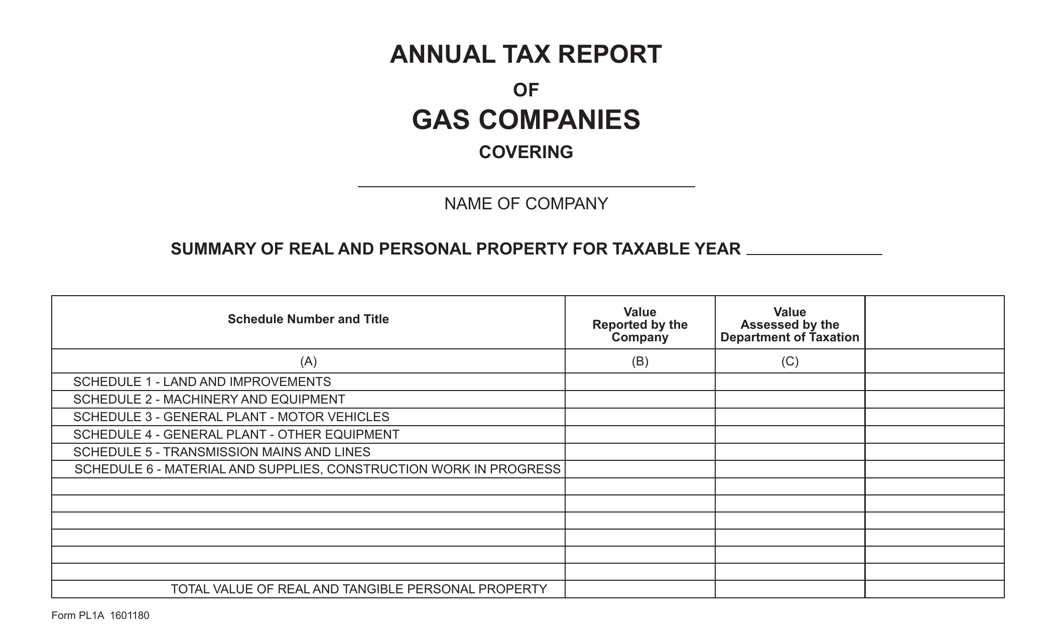

This Form is used for gas companies in Virginia to report their annual tax information. It is necessary for gas companies to submit this report to comply with tax regulations in Virginia.

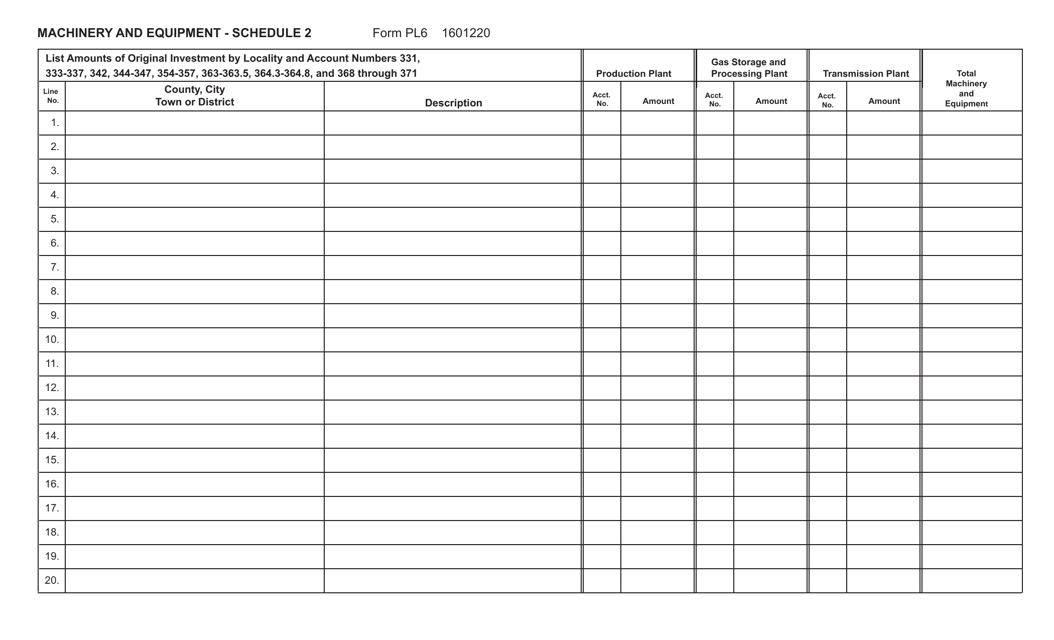

This Form is used for reporting machinery and equipment for tax purposes in Virginia.

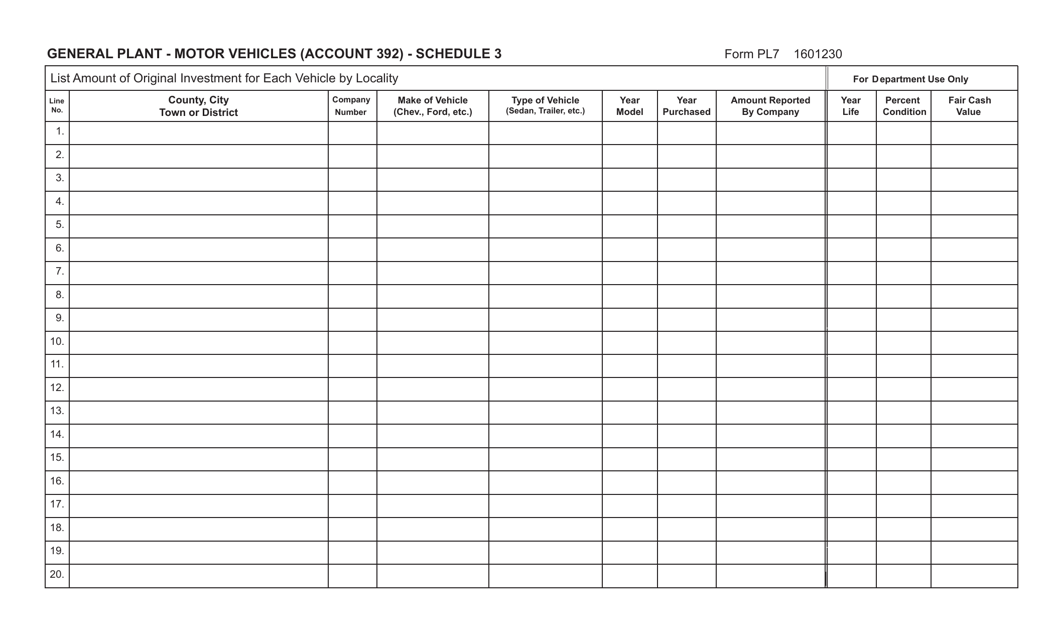

This Form is used for reporting general plant motor vehicles for account 392 in the state of Virginia.

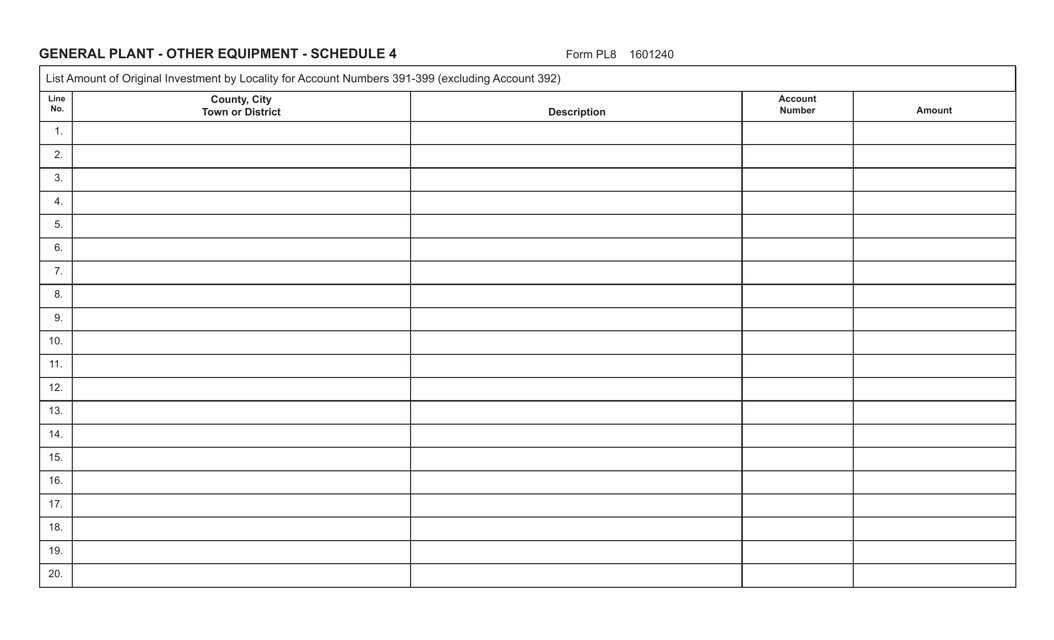

This form is used for reporting general plant and other equipment in the state of Virginia.

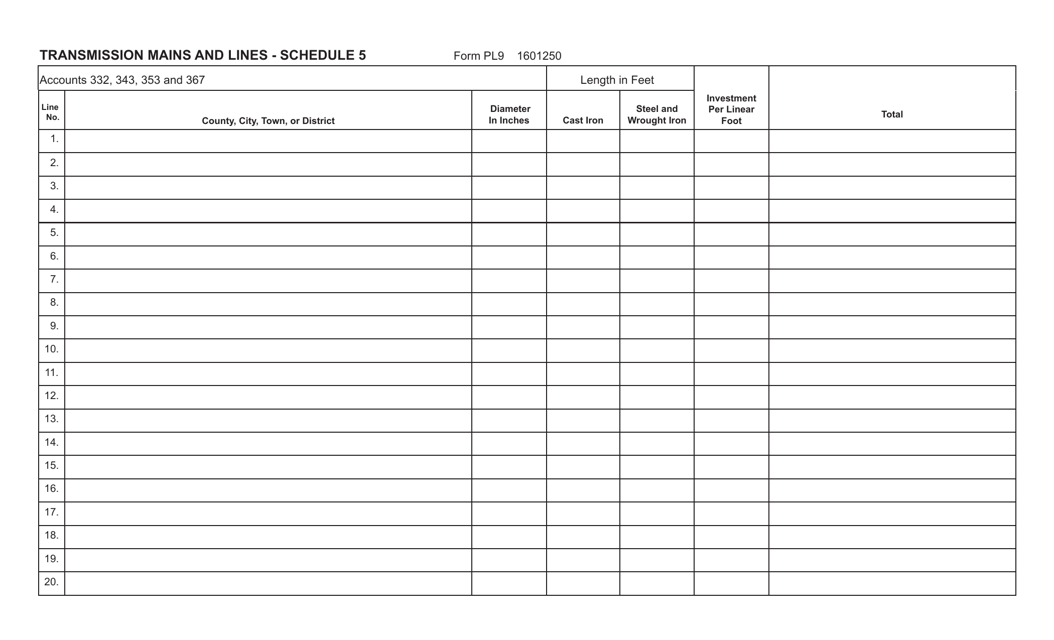

This Form is used for reporting and documenting the transmission mains and lines in the state of Virginia.

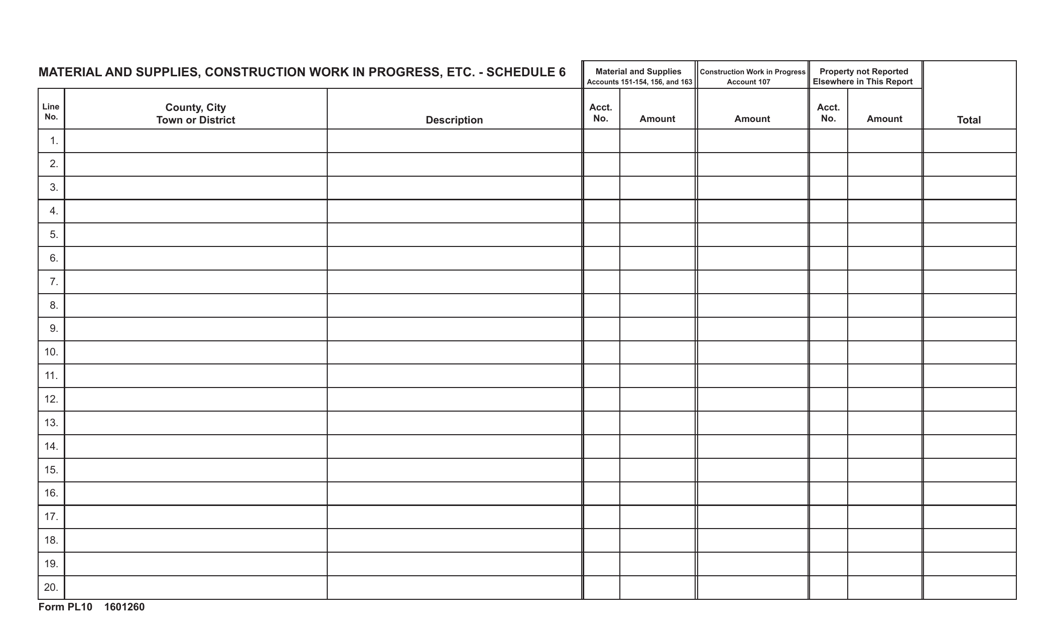

This Form is used for reporting material and supplies, construction work in progress, and other related information for tax purposes in the state of Virginia.

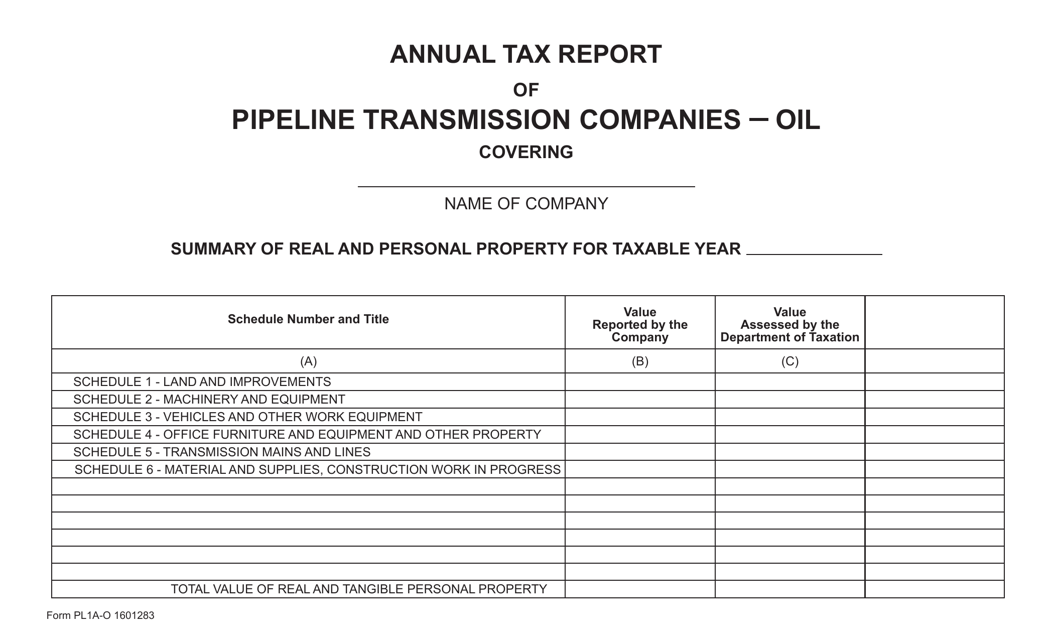

This form is used for pipeline transmission companies in Virginia to report their annual tax information related to the oil industry.

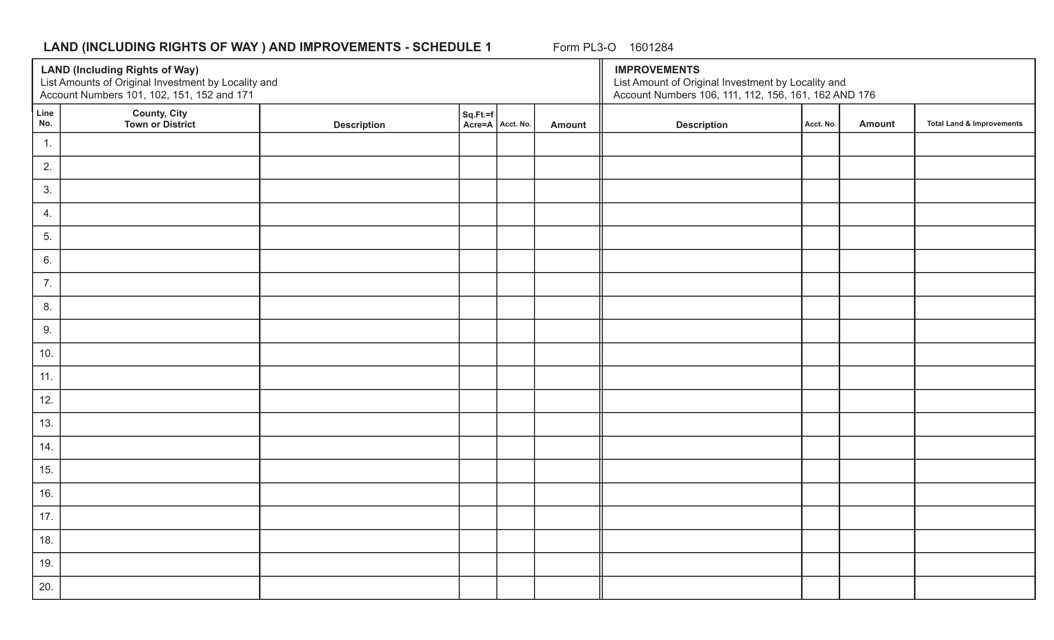

This form is used for reporting land, including rights of way, and improvements in the state of Virginia. It provides a detailed schedule for documenting these properties.

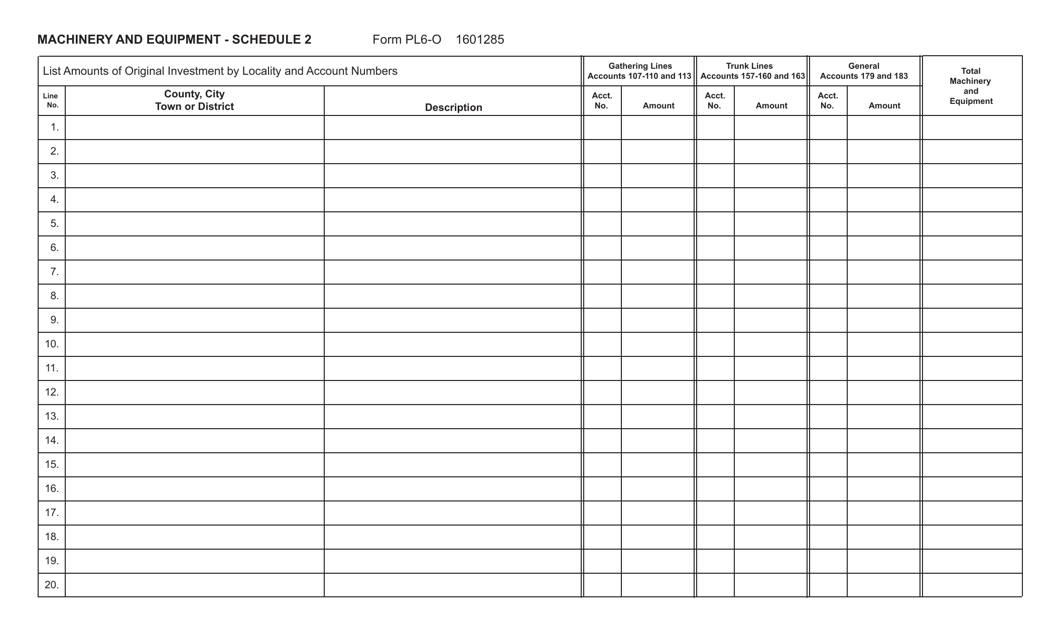

This form is used for reporting machinery and equipment in Virginia for tax purposes. It is part of Schedule 2 of Form PL6-O.

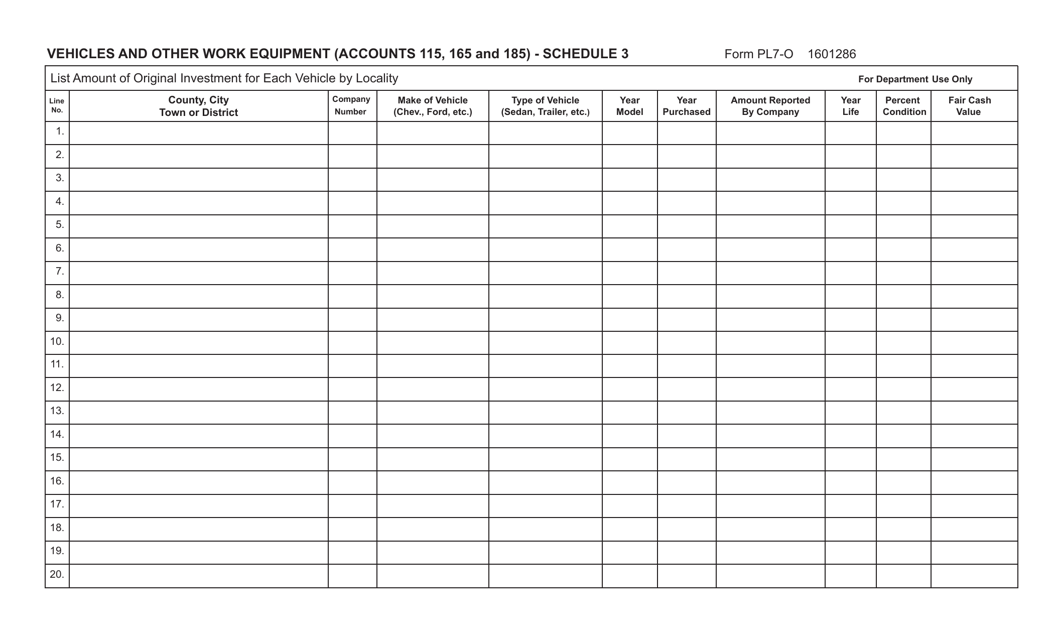

This Form is used for reporting vehicles and other work equipment for accounts 115,165 and 185 in Virginia.

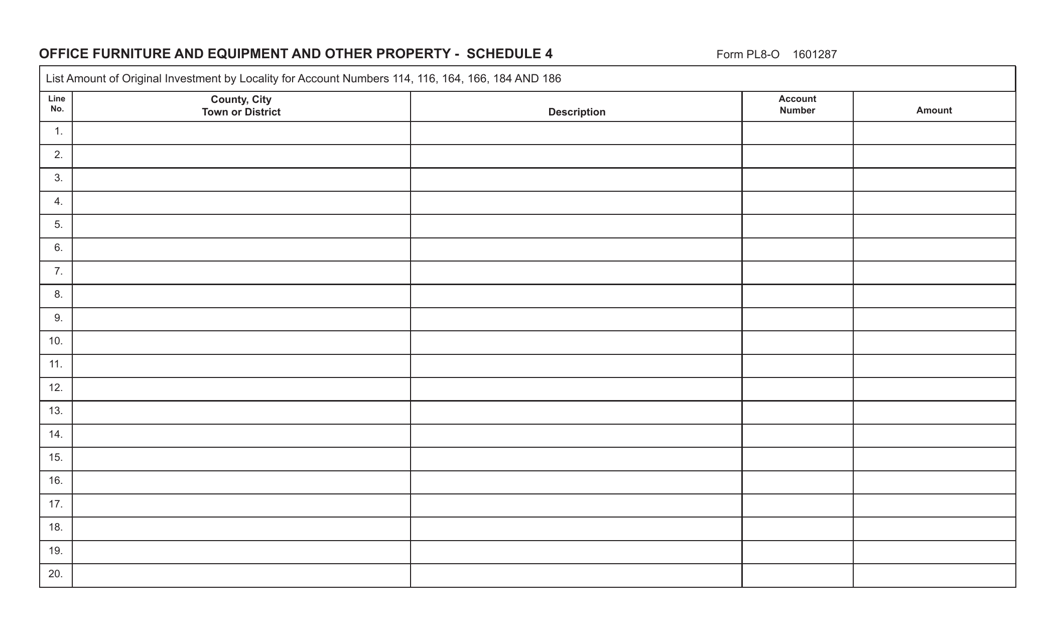

This form is used for reporting office furniture, equipment, and other property in the state of Virginia.

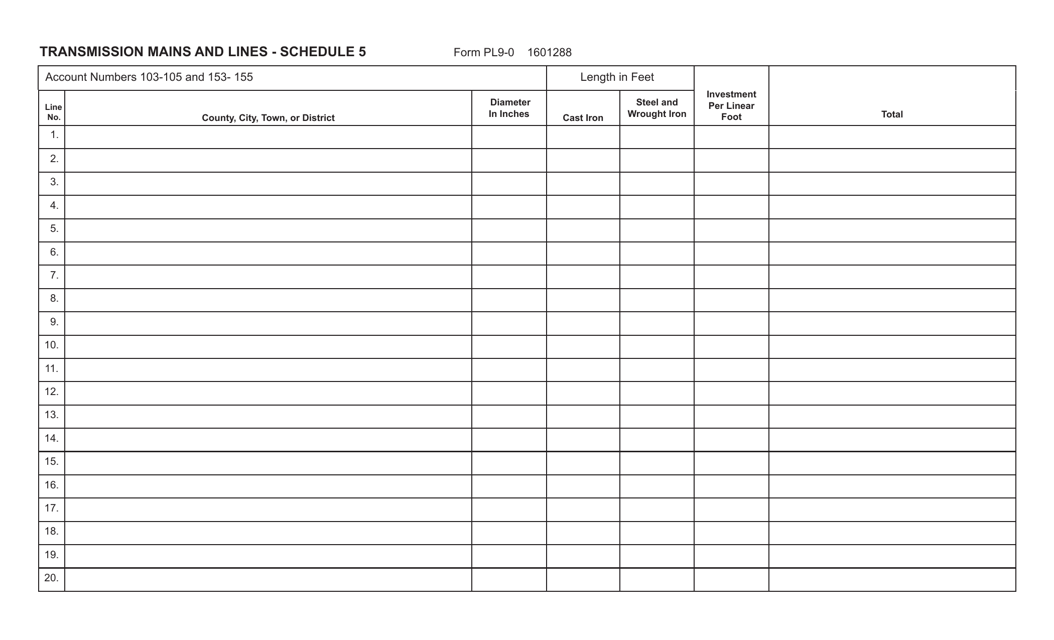

This Form is used for reporting and monitoring transmission mains and lines in the state of Virginia.

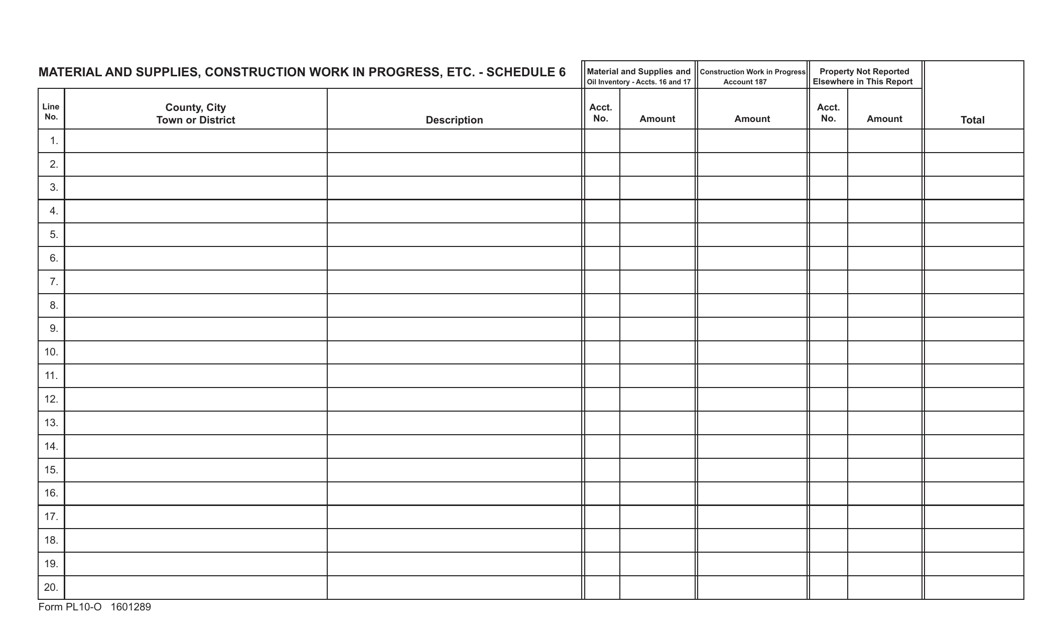

This document is used for reporting materials and supplies, construction work in progress, and other relevant details for construction projects in the state of Virginia.

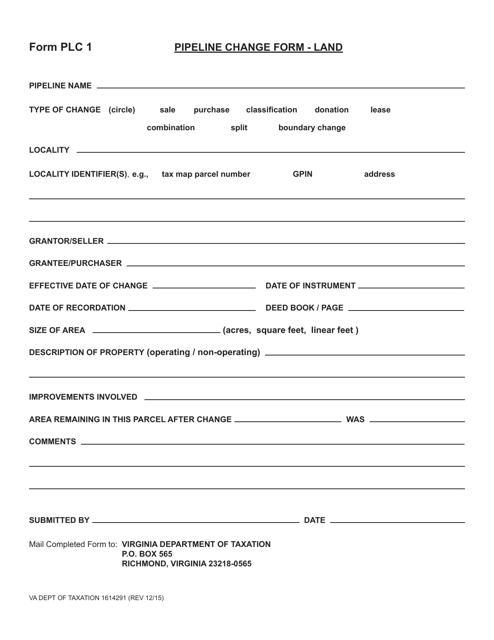

This Form is used for requesting a change to a pipeline on land in the state of Virginia.

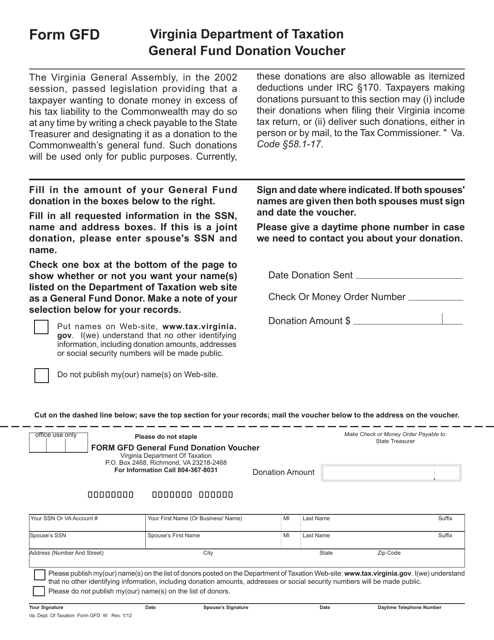

This Form is used for making a general fund donation in Virginia. It serves as a voucher to track the donation made to the general fund.

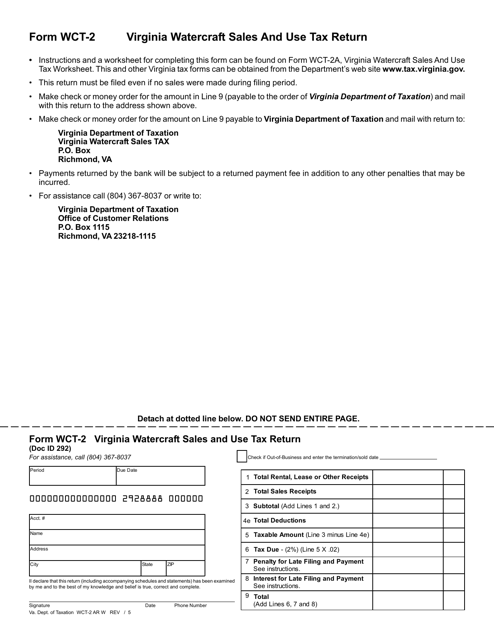

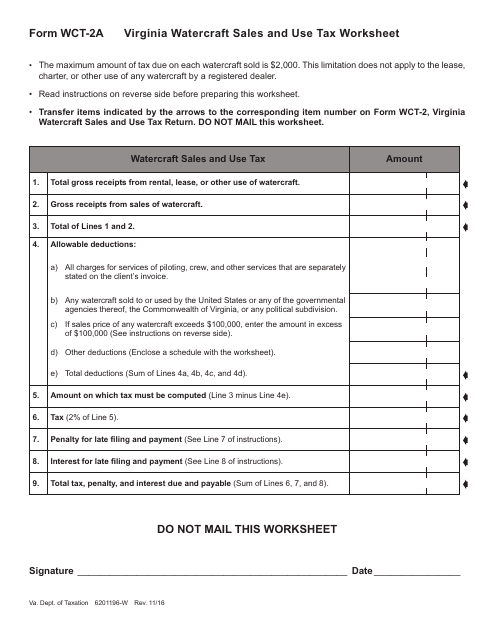

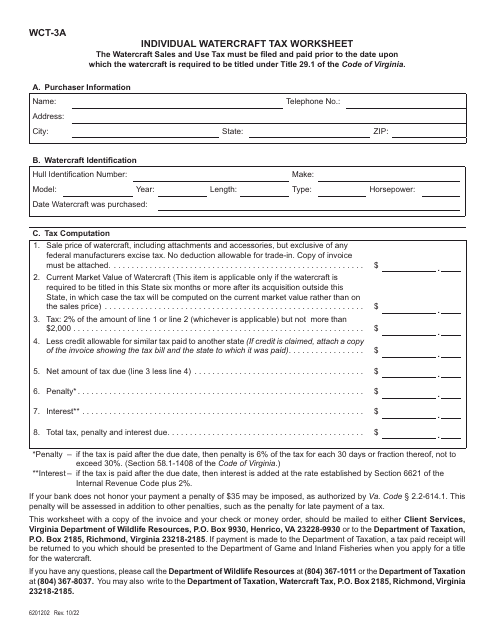

This form is used for reporting and paying sales and use tax on watercraft purchases in Virginia.

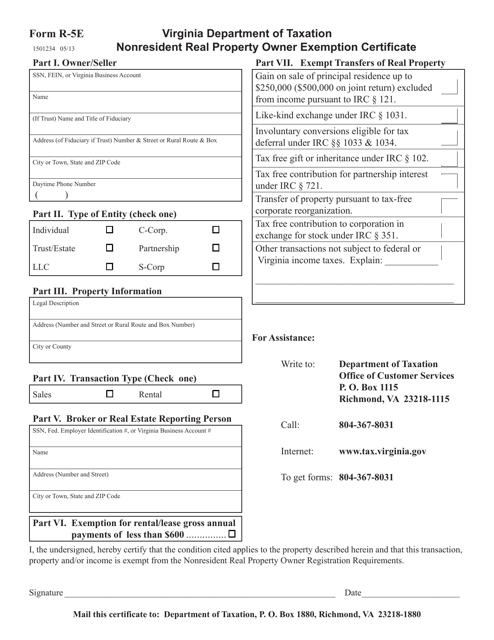

This form is used for nonresident property owners in Virginia to claim an exemption from real property taxes.

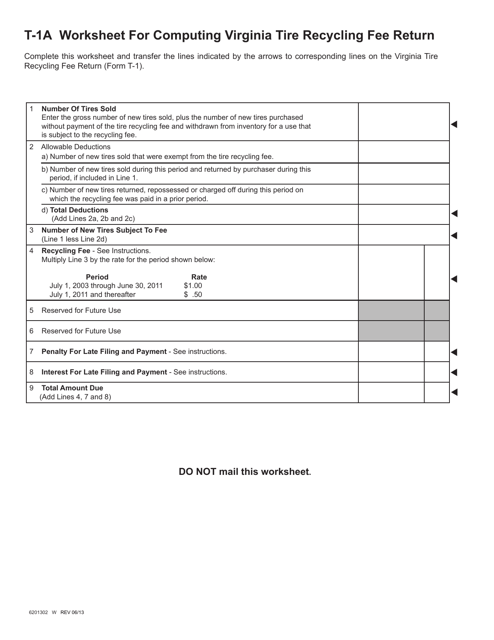

This Form is used for calculating the Virginia Tire Recycling Fee Return.

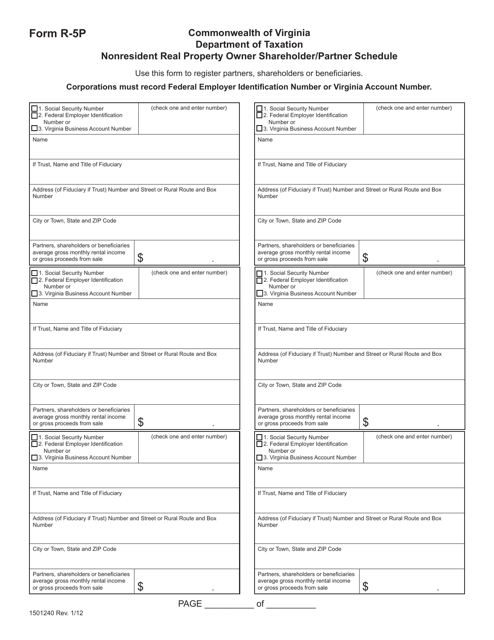

This form is used for nonresident real property owners in Virginia who are also shareholders or partners. It is used to report their ownership share in the property.