Tennessee Department of Revenue Forms

Documents:

418

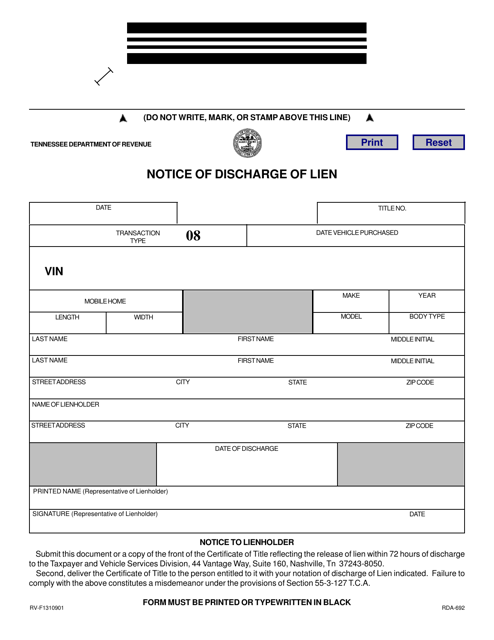

This form is used for notifying the discharge of a lien in the state of Tennessee. It is used to officially document the release of a lien on a property or asset.

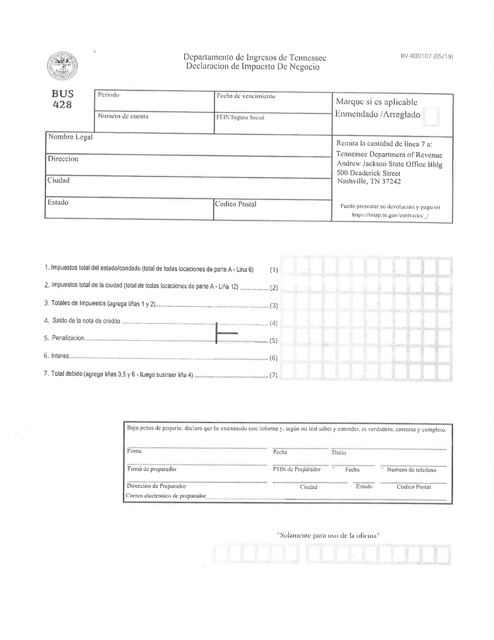

This Form is used for filing a business tax declaration in Tennessee. It is written in Spanish.

This document provides a checklist for motor carriers in Tennessee to ensure compliance with Tntap requirements. It outlines the necessary steps and information needed for motor carriers to successfully file their reports and fulfill their obligations.

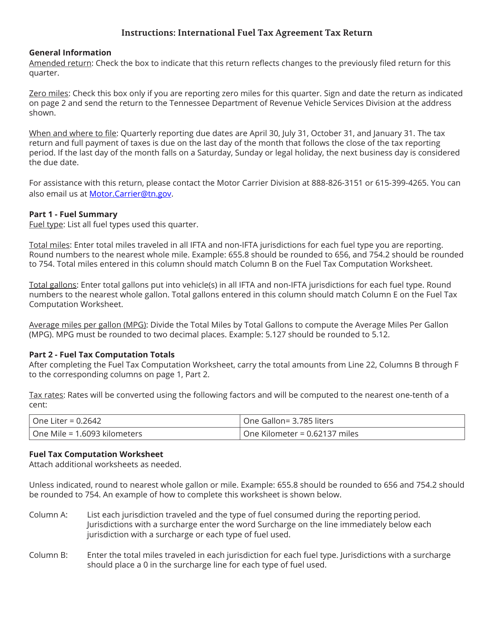

This document is used for filing the International Fuel Tax Agreement Tax Return specifically for the state of Tennessee. It provides instructions on how to properly complete and submit the form.

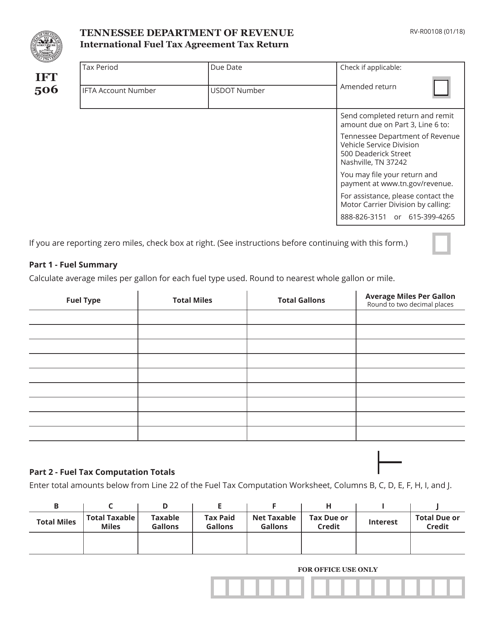

This Form is used for filing the International Fuel Tax Agreement Tax Return specifically for the state of Tennessee.

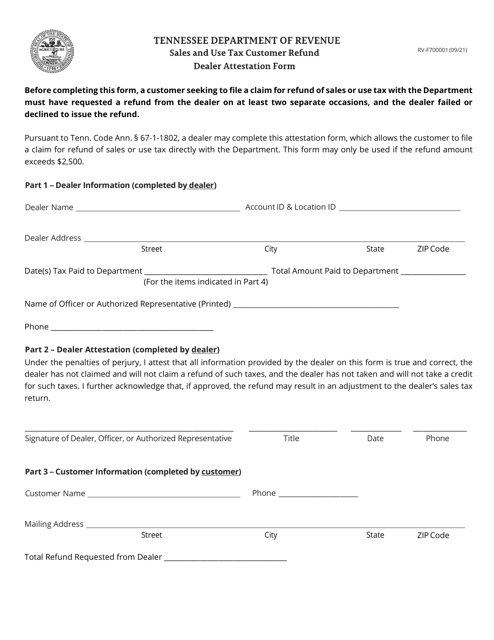

This form is used for dealers in Tennessee to attest to the accuracy of a sales and use tax customer refund.

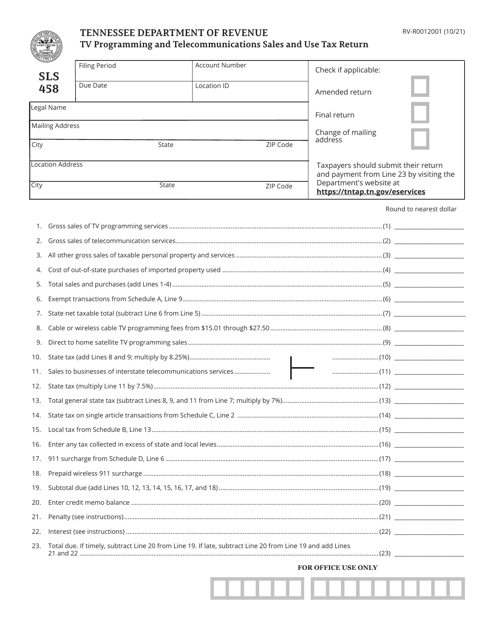

Form SLS458 (RV-R0012001) Tv Programming and Telecommunications Sales and Use Tax Return - Tennessee

This form is used for reporting and paying sales and use tax on television programming and telecommunications services in the state of Tennessee.

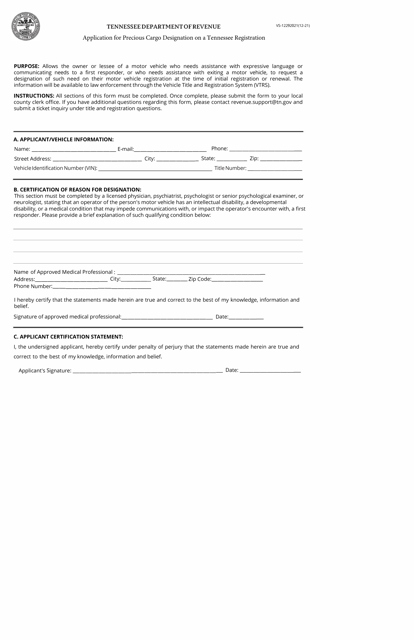

This form is used to apply for the precious cargo designation on a Tennessee registration.

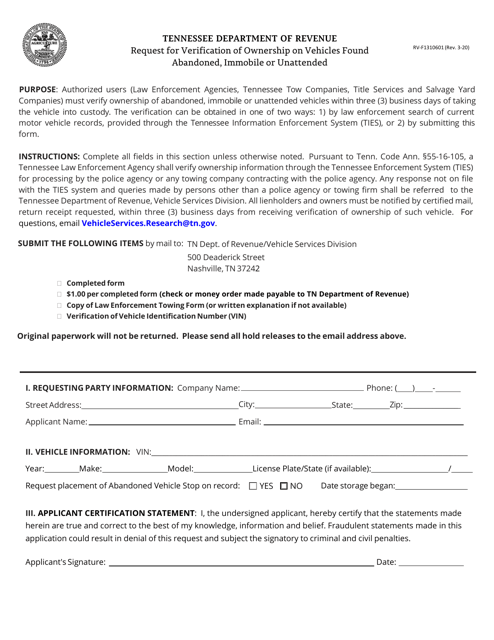

This form is used for requesting verification of ownership on vehicles that are found abandoned, immobile, or unattended in the state of Tennessee.

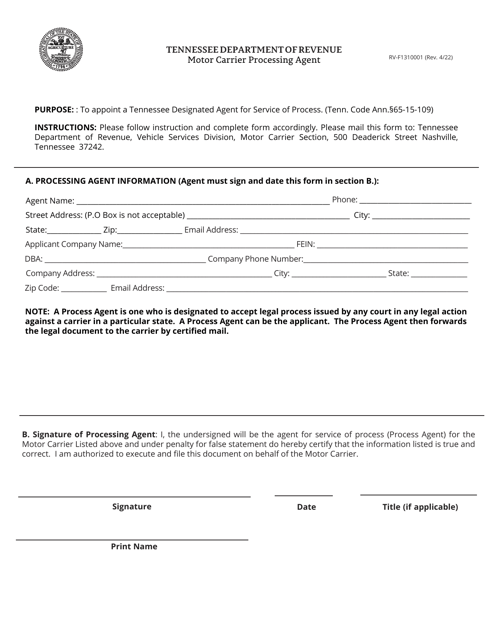

This Form is used for motor carriers operating in Tennessee to designate a processing agent.

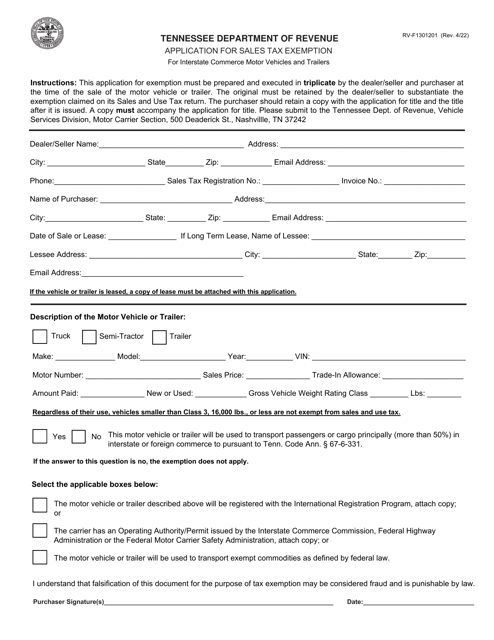

This Form is used for applying for a sales tax exemption on motor vehicles and trailers used for interstate commerce in Tennessee.

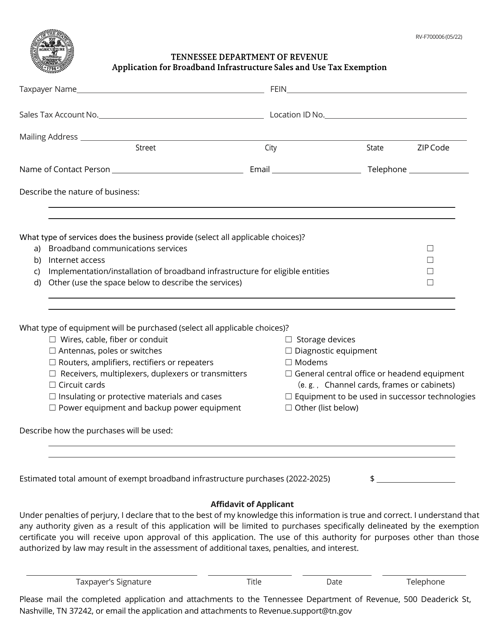

This Form is used for applying for a sales and use tax exemption for broadband infrastructure projects in Tennessee.

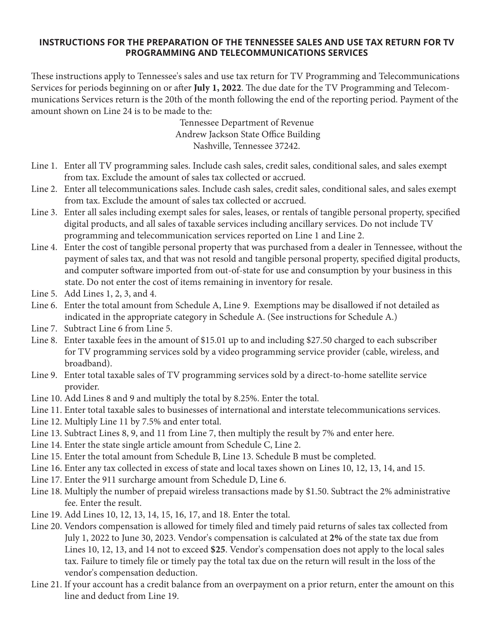

This Form is used for reporting and paying sales and use tax related to TV programming and telecommunications in the state of Tennessee. It provides instructions on how to fill out and submit the form.

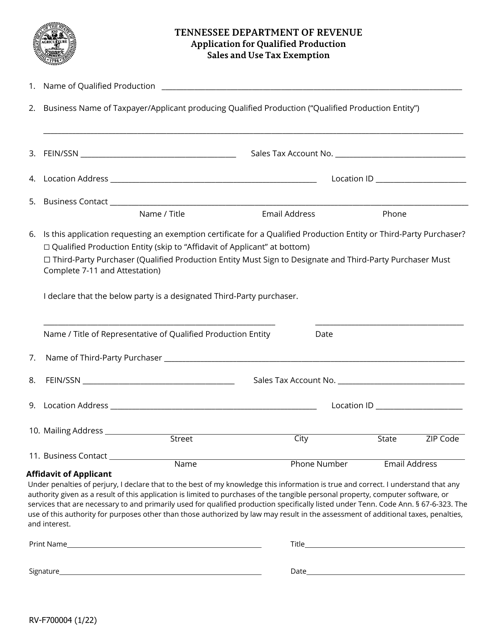

This form is used for applying for a qualified production sales and use tax exemption in Tennessee. It helps businesses in the production industry to claim exemptions on the sales and use tax for certain goods and services.

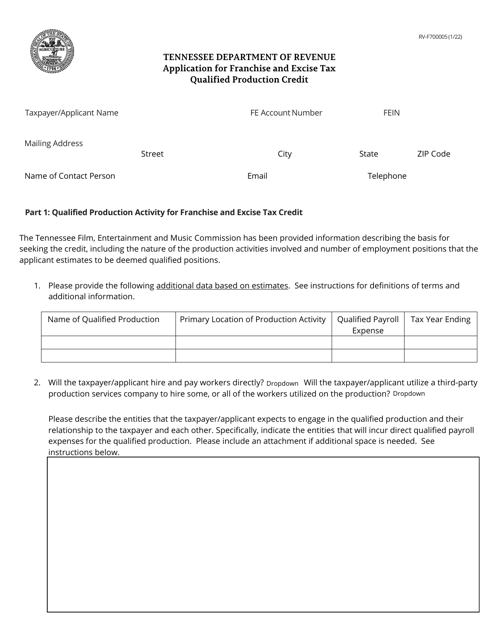

This form is used for applying for the Franchise and Excise Tax Qualified Production Credit in the state of Tennessee.

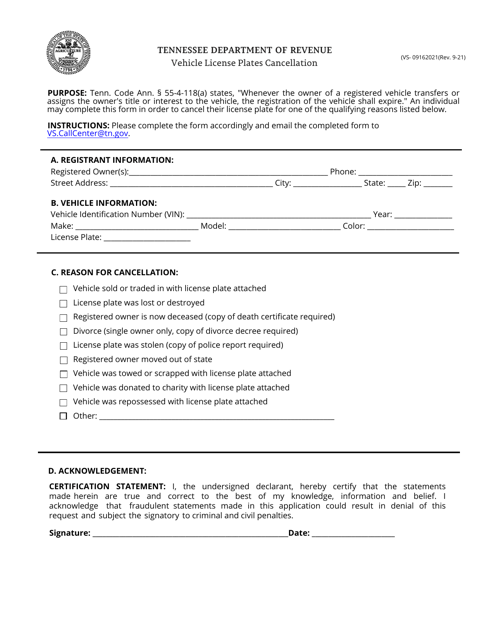

This form is used for canceling vehicle license plates in the state of Tennessee.