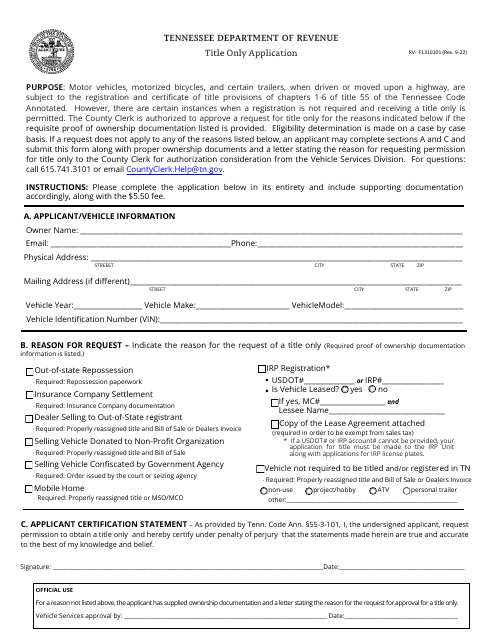

Tennessee Department of Revenue Forms

Documents:

418

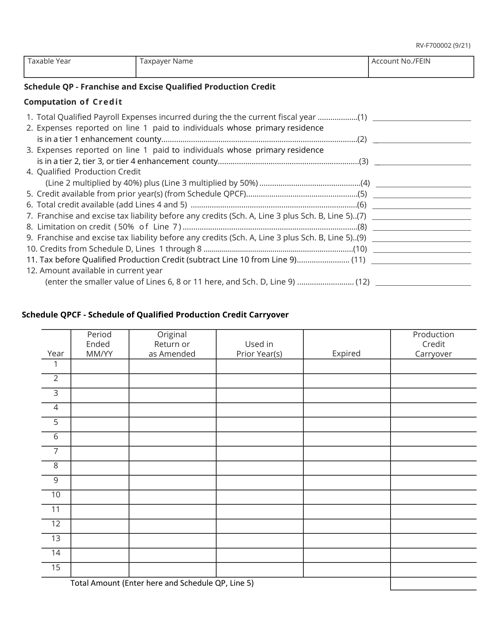

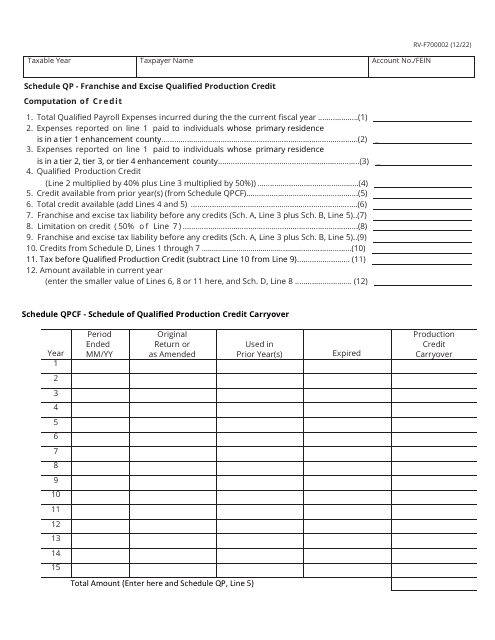

This form is used for reporting and claiming the Franchise and Excise Qualified Production Credit and Qualified Production Credit Carryover in the state of Tennessee.

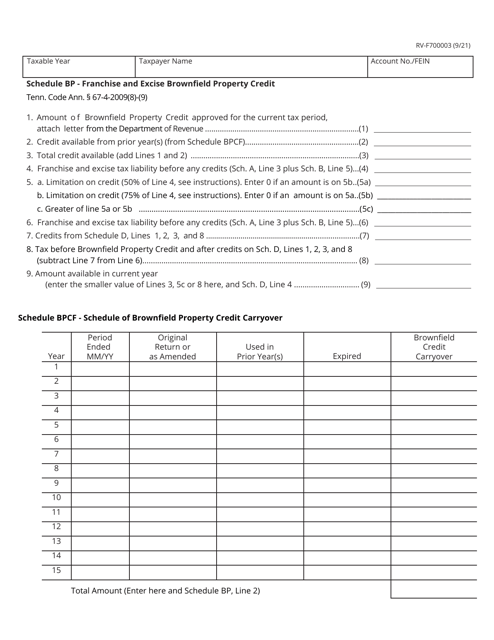

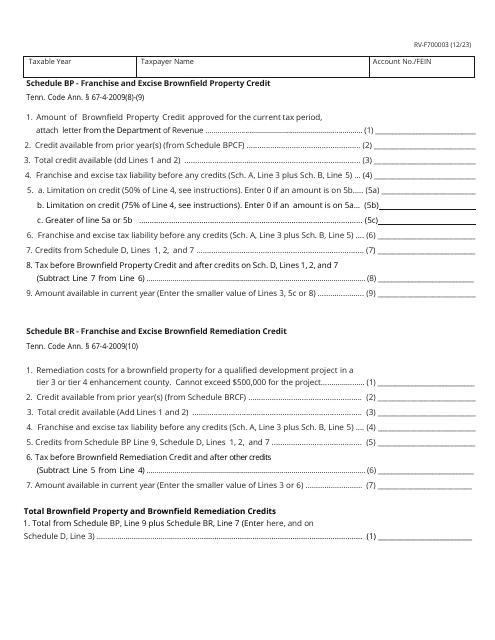

This form is used for claiming the Tennessee Franchise and Excise Brownfield Property Credit and reporting the carryover of unused credits from previous years.

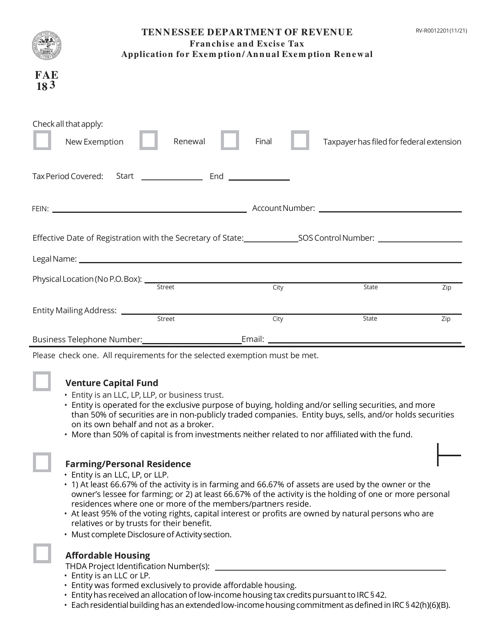

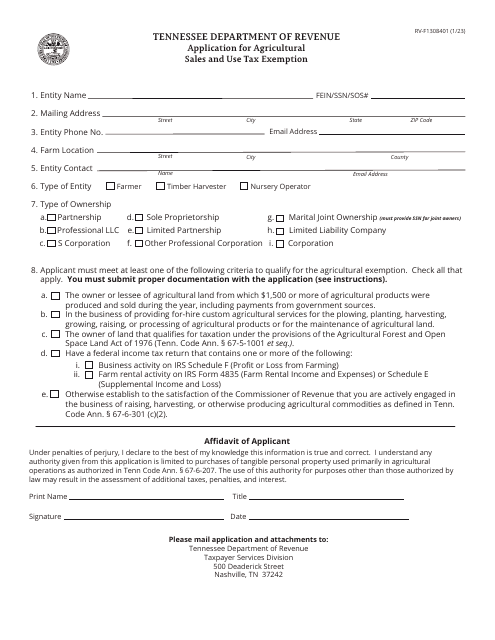

This form is used for applying for exemption or annual exemption renewal in Tennessee.

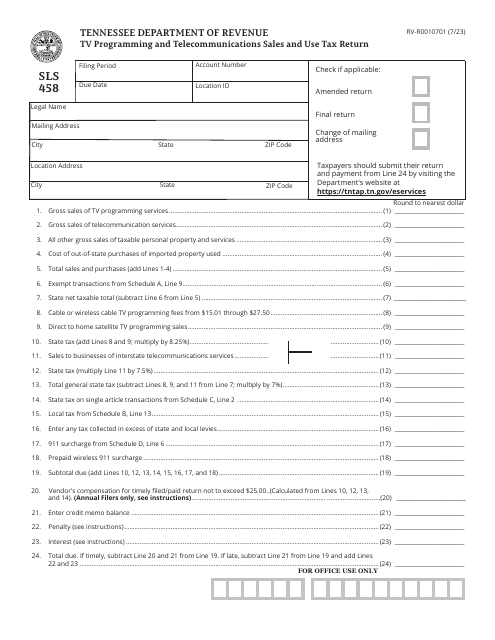

Form SLS458 (RV-R0010701) Tv Programming and Telecommunications Sales and Use Tax Return - Tennessee

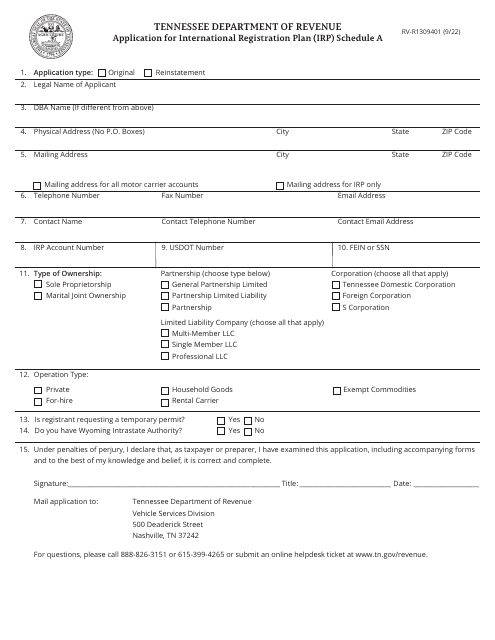

This form is used for applying for the International Registration Plan (IRP) in Tennessee.

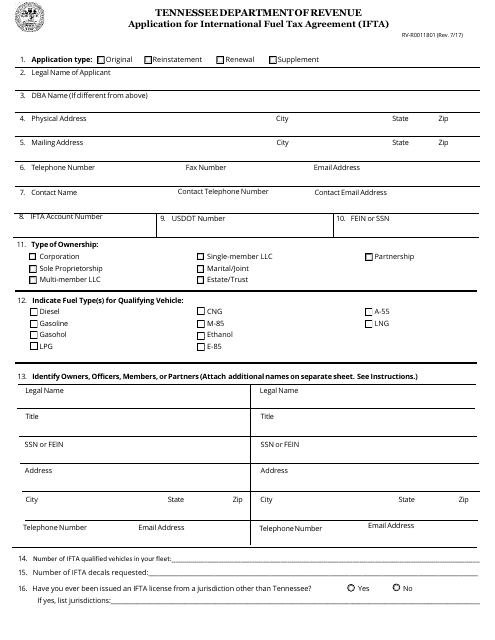

This form is used for applying for the International Fuel Tax Agreement (IFTA) in the state of Tennessee. IFTA is an agreement among the 48 contiguous United States and 10 Canadian provinces that simplifies the reporting and payment of fuel taxes by motor carriers operating in multiple jurisdictions.

This form is used for reporting the Qualified Production Credit for franchise and excise taxes in Tennessee.

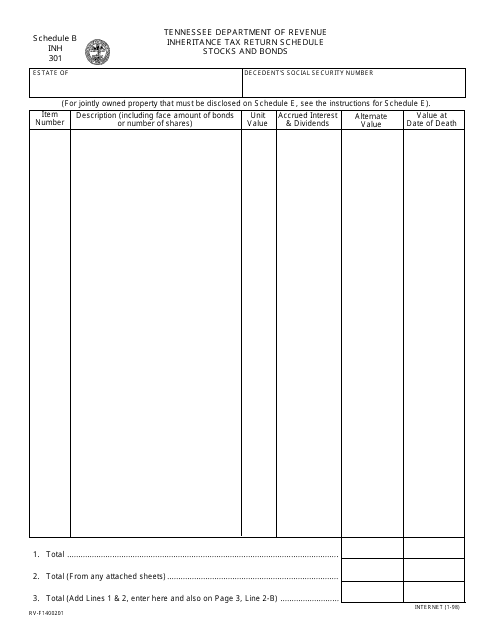

This form is used for reporting stocks and bonds on the Tennessee Inheritance Tax Return.