Tennessee Department of Revenue Forms

Documents:

418

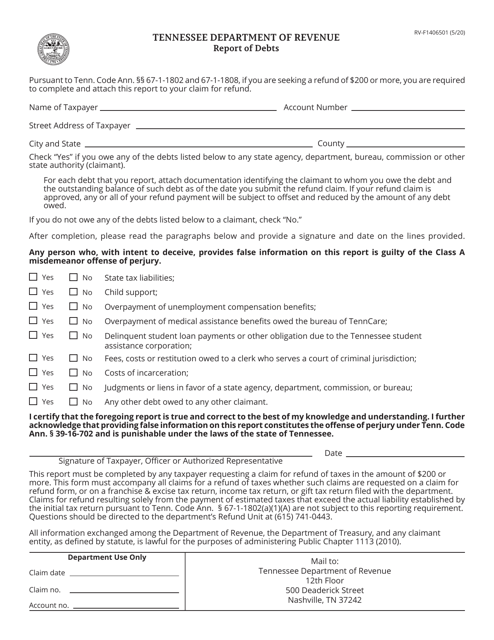

This form is used for reporting debts in the state of Tennessee. It is used to provide detailed information about any outstanding debts a person or entity may have.

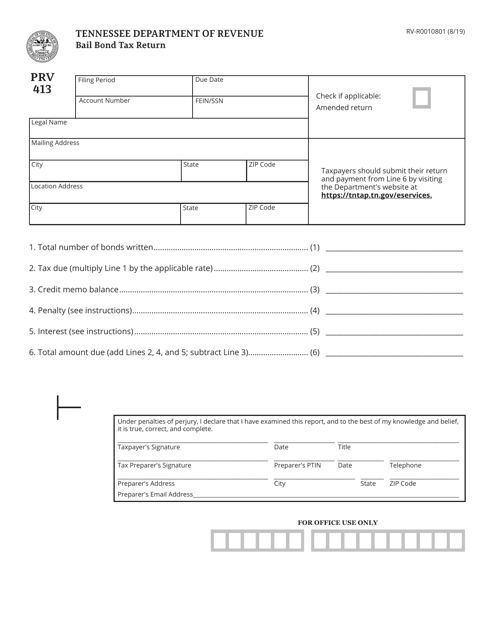

This document is used to file the Bail Bond Tax Return in Tennessee.

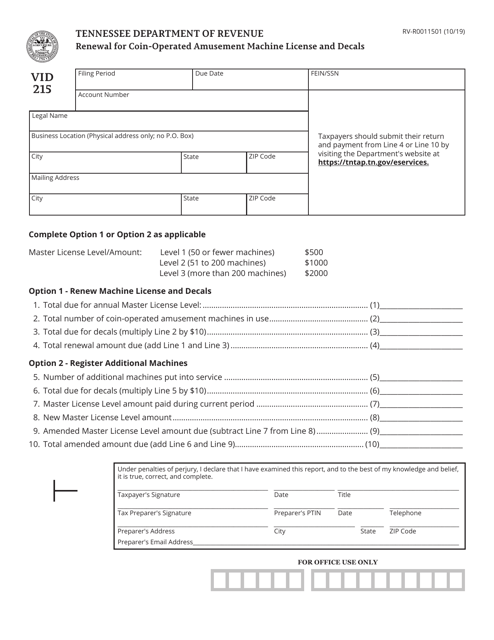

Form RV-R0011501 (VID215) Renewal for Coin-Operated Amusement Machine License and Decals - Tennessee

This form is used for renewing the license and decals for coin-operated amusement machines in Tennessee.

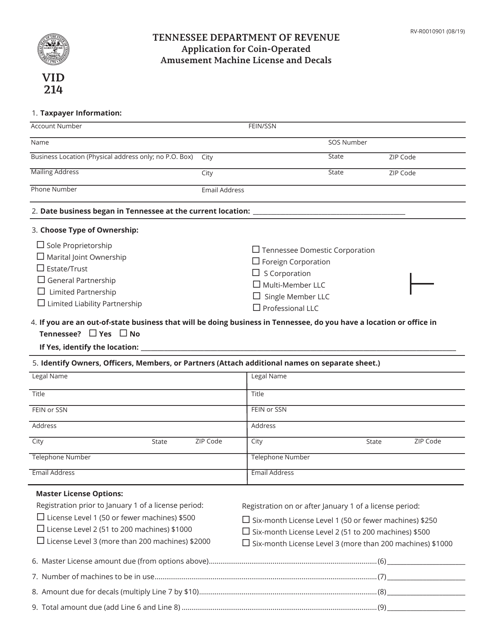

This form is used for applying for a coin-operated amusement machine license and decals in the state of Tennessee.

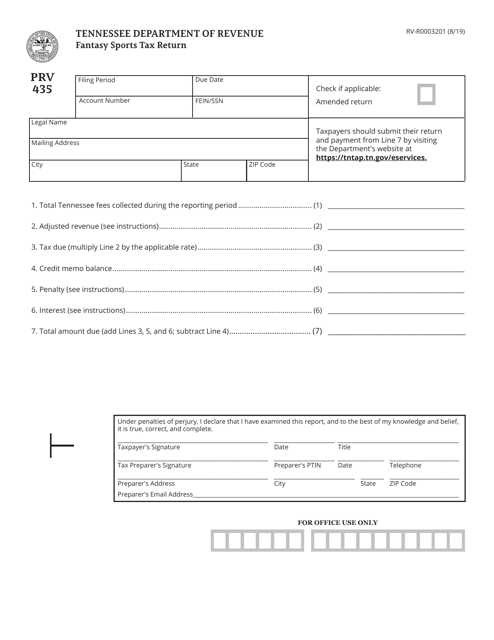

This form is used for filing a Fantasy Sports Tax Return in the state of Tennessee.

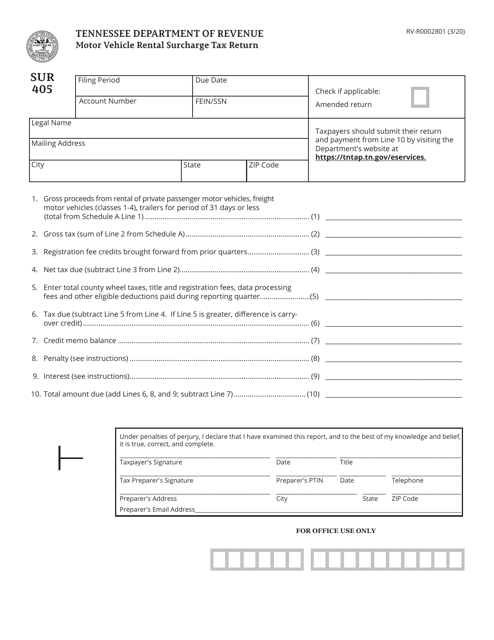

This Form is used for reporting and remitting the motor vehicle rental surcharge tax in the state of Tennessee.

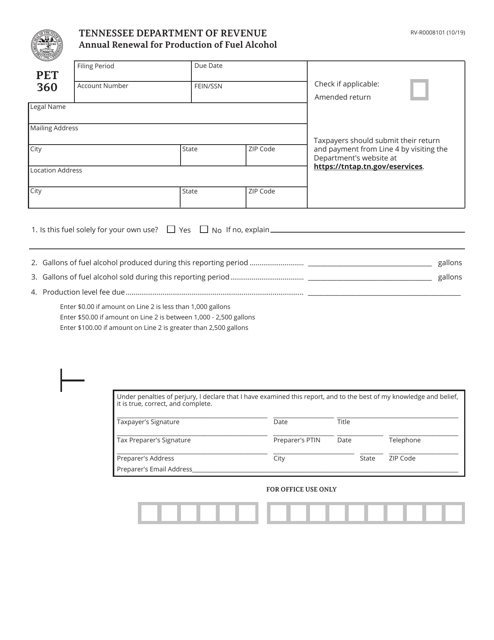

This Form is used for the annual renewal of production of fuel alcohol in Tennessee.

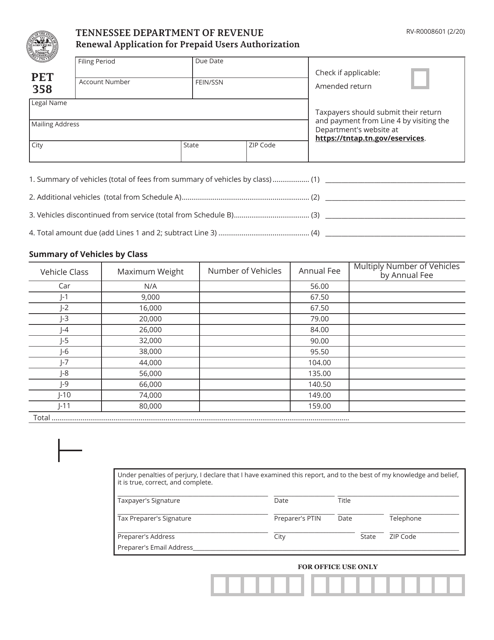

This form is used for renewing the authorization of prepaid users in Tennessee.

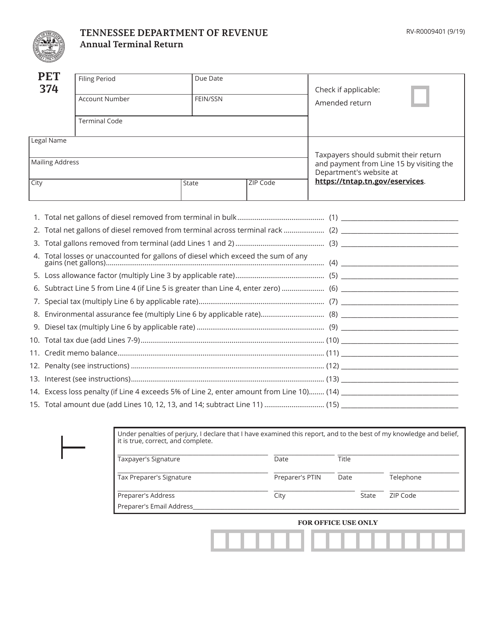

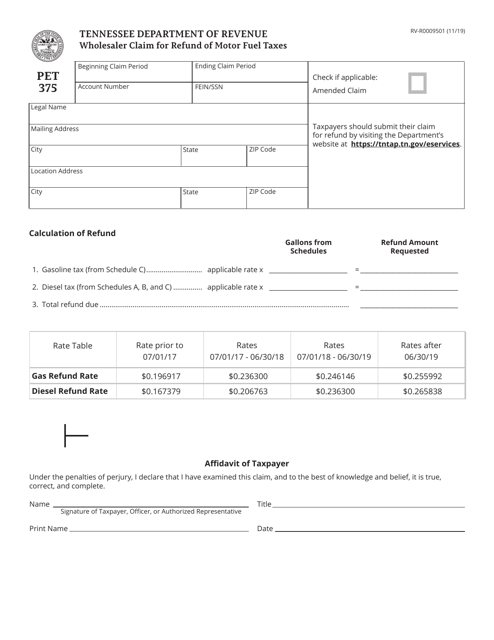

This form is used for filing the Annual Terminal Return in the state of Tennessee. It is used by terminal operators to report their activities and transactions for the year.

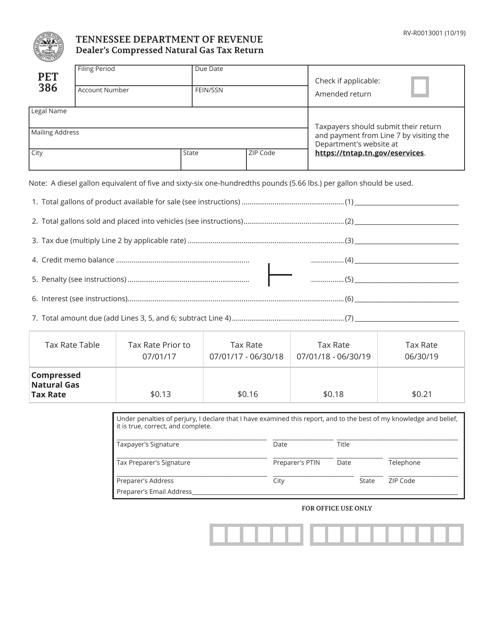

This Form is used for dealer's to report and pay compressed natural gas tax in Tennessee.

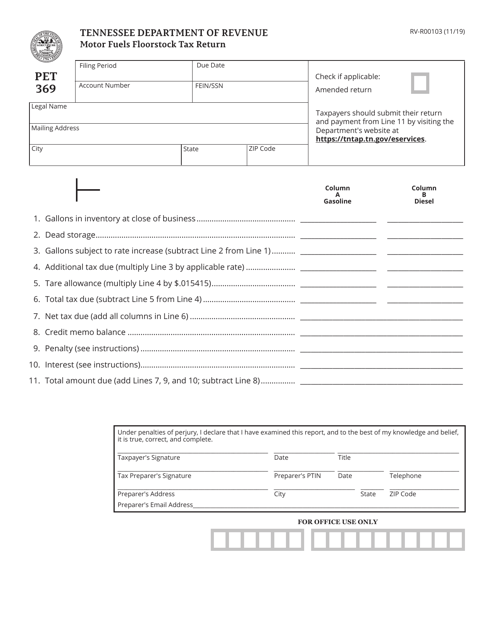

This Form is used for filing the Motor Fuels Floorstock Tax Return in Tennessee.

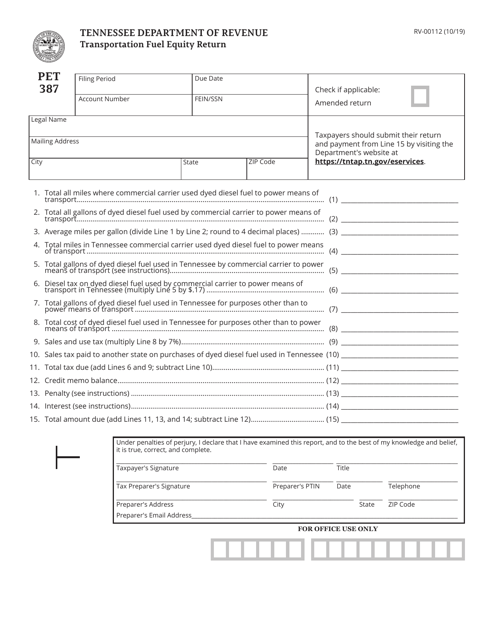

This form is used for filing a Transportation Fuel Equity Return in the state of Tennessee.

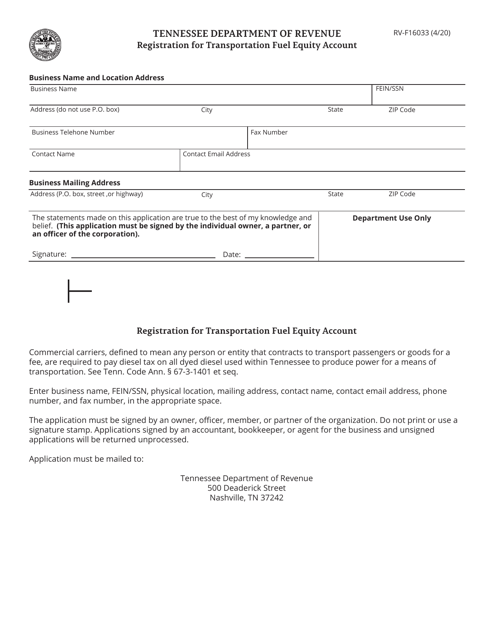

This form is used for registering for a Transportation Fuel Equity Account in Tennessee.

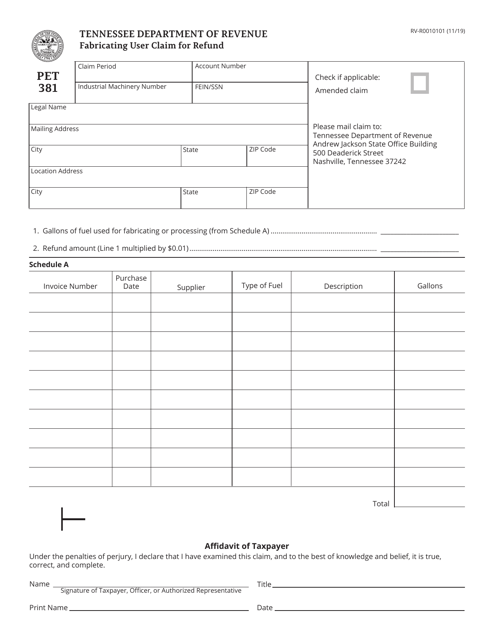

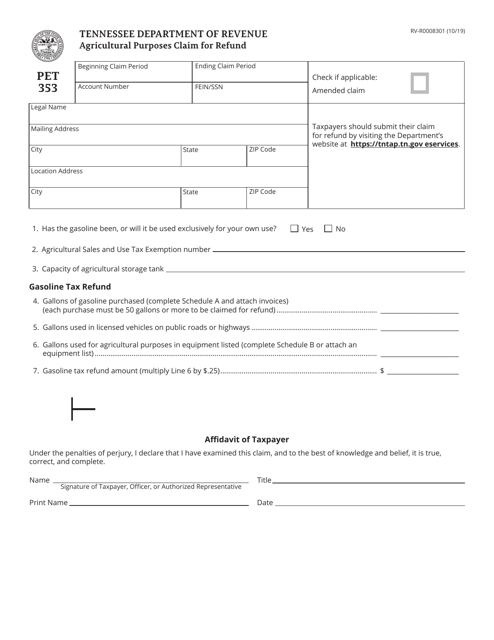

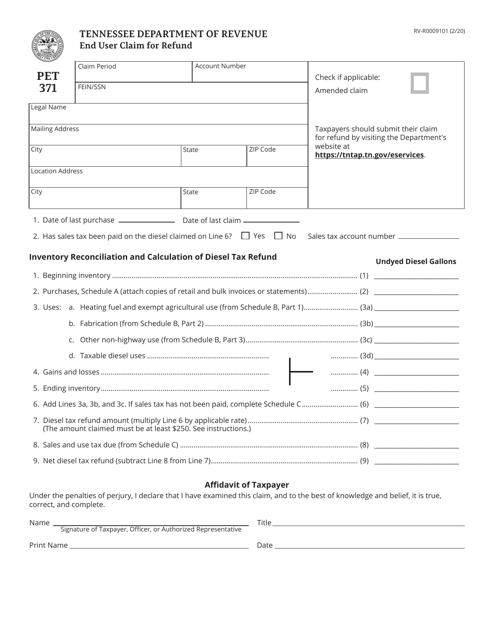

This Form is used for fabricating a user claim for refund in the state of Tennessee.

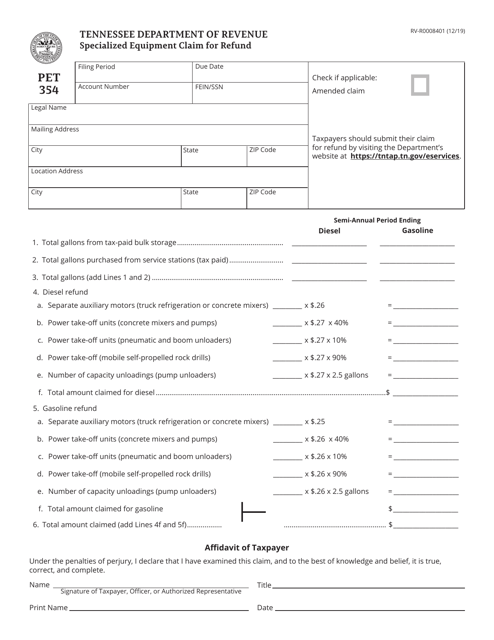

This form is used for filing a claim for refund for specialized equipment in Tennessee.

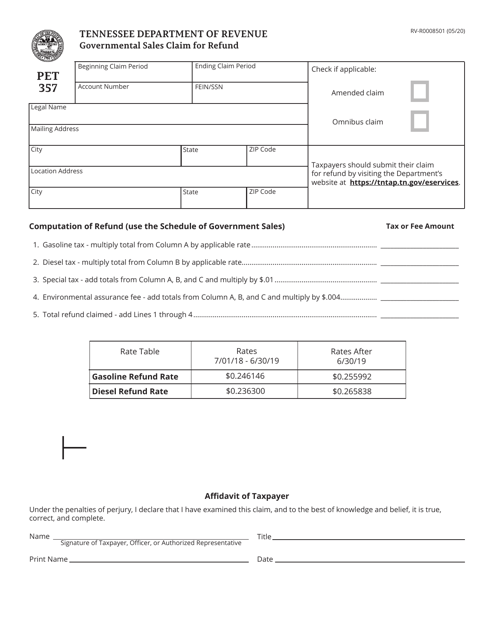

This document is used for filing a claim for refund of sales tax on government purchases in the state of Tennessee.

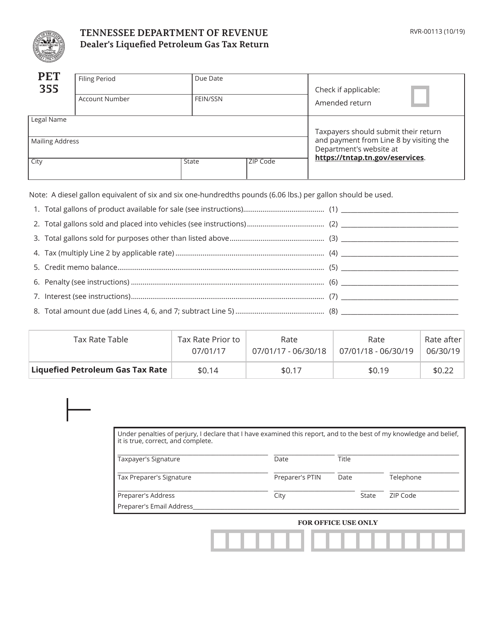

This form is used for dealers to report and pay their liquefied petroleum gas tax in the state of Tennessee.

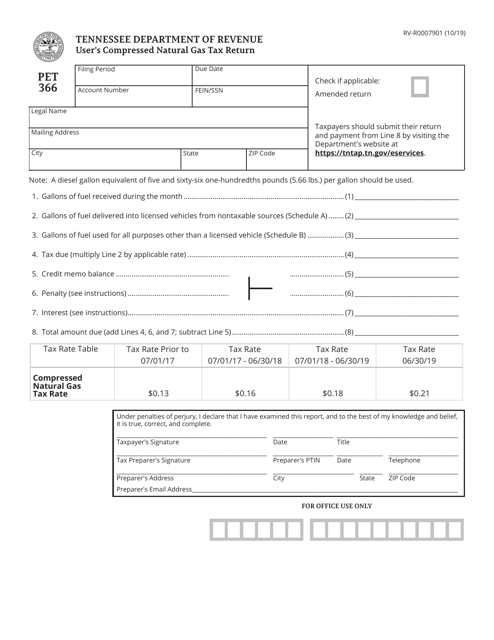

This form is used for filing a compressed natural gas tax return in the state of Tennessee.

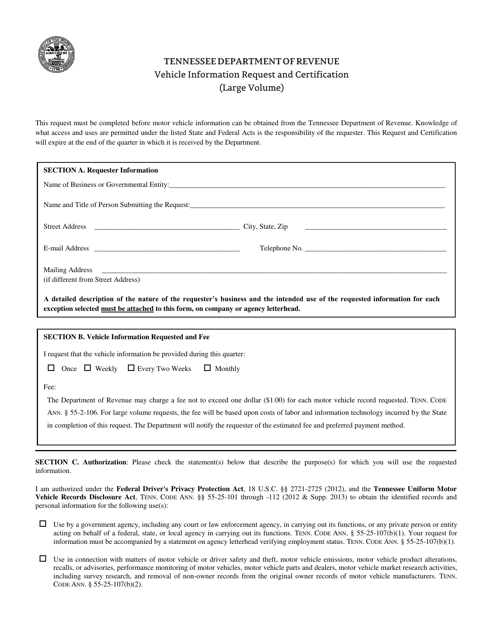

This document is used for requesting vehicle information and certification for large volume transactions in the state of Tennessee.

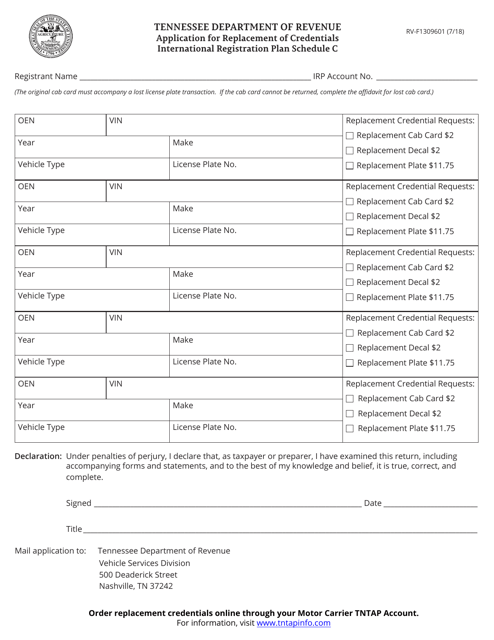

This form is used for applying for the replacement of credentials under the International Registration Plan in Tennessee. It is specific to recreational vehicles (RVs) and schedule C.

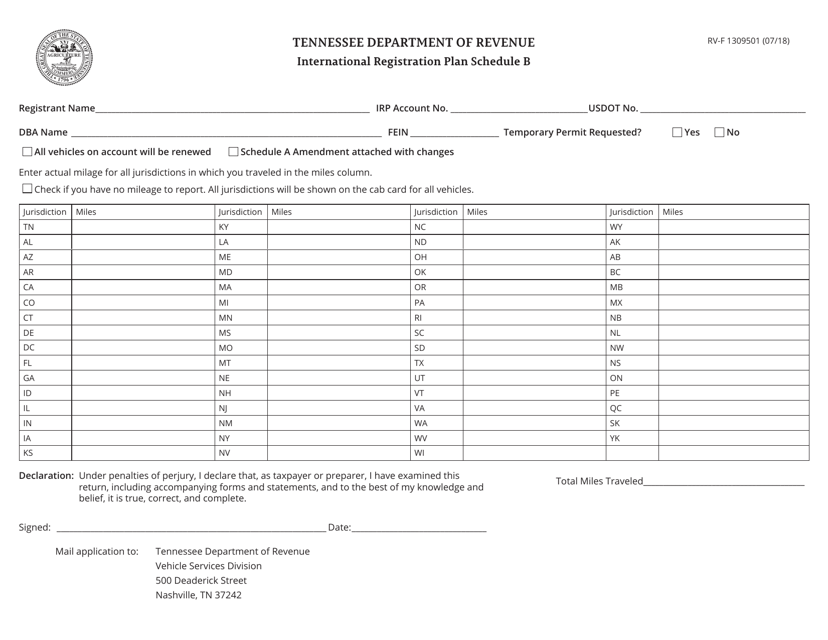

This form is used for completing Schedule B International Registration Plan for vehicles registered in Tennessee.