Tennessee Department of Revenue Forms

Documents:

418

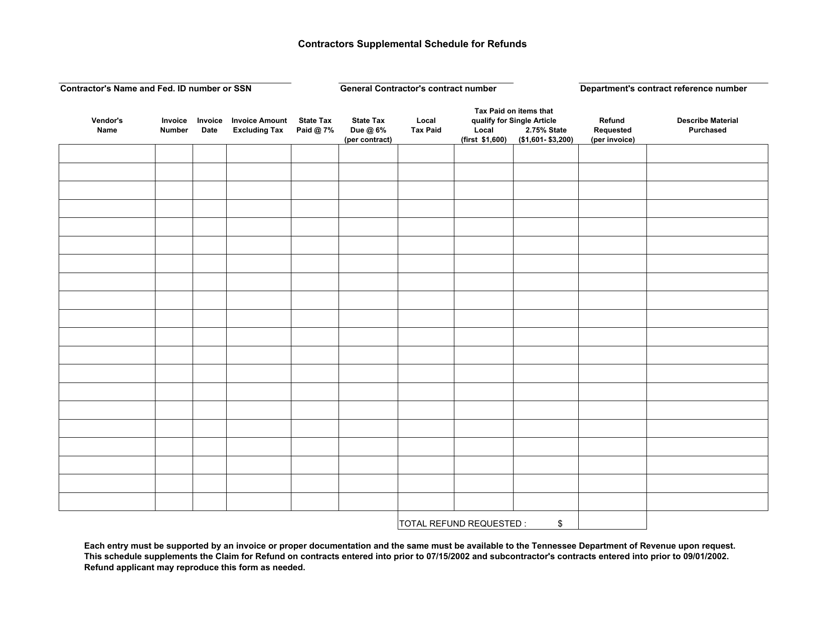

This document is used for contractors in Tennessee to request a refund for supplemental schedule payments.

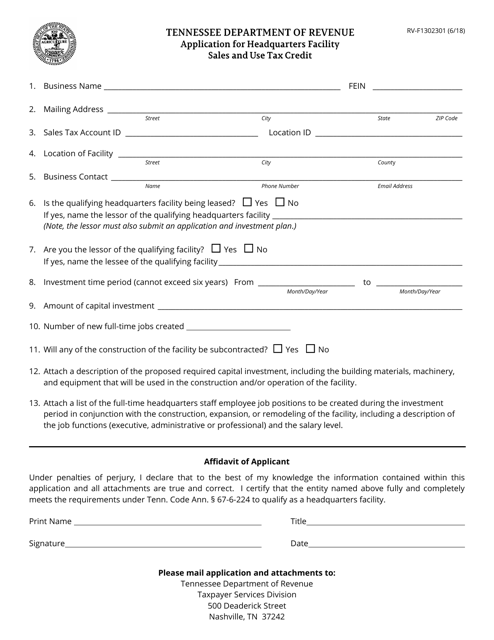

This Form is used for applying for the Headquarters Facility Sales and Use Tax Credit in Tennessee.

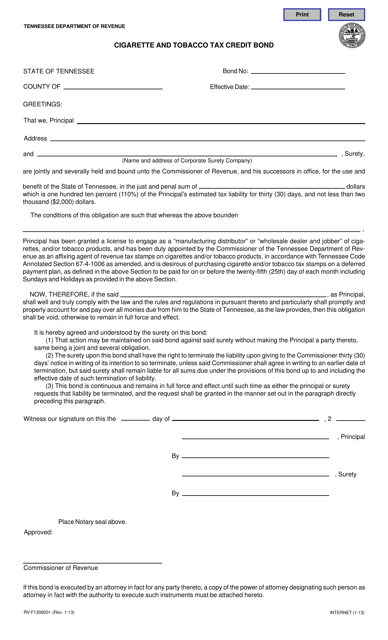

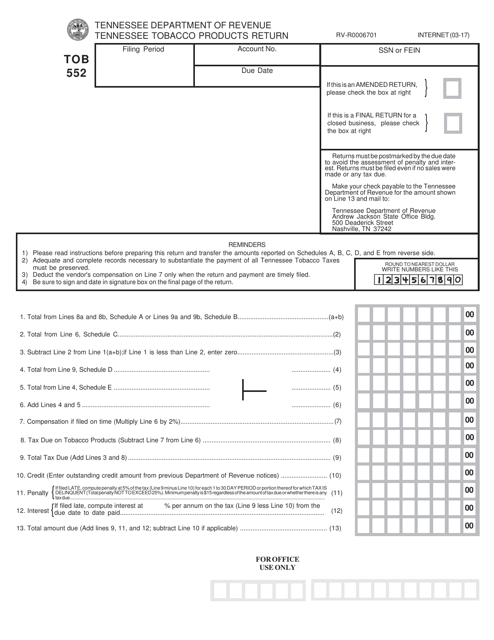

This document is a Cigarette and Tobacco Tax Credit Bond specific to the state of Tennessee. It is used to claim tax credits related to cigarettes and tobacco.

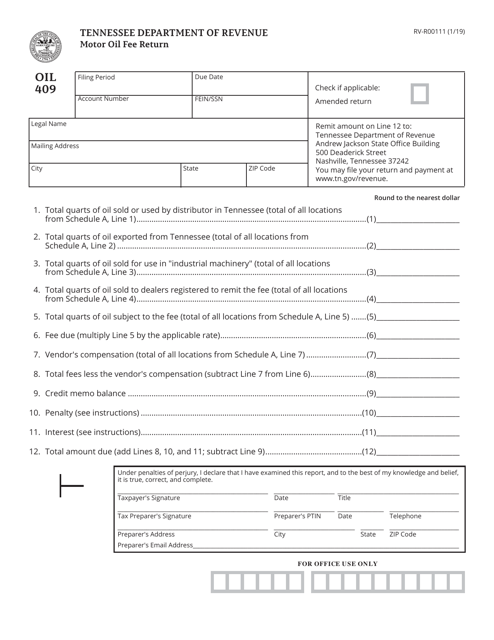

This form is used for motor oil distributors in Tennessee to report and pay the motor oil fee.

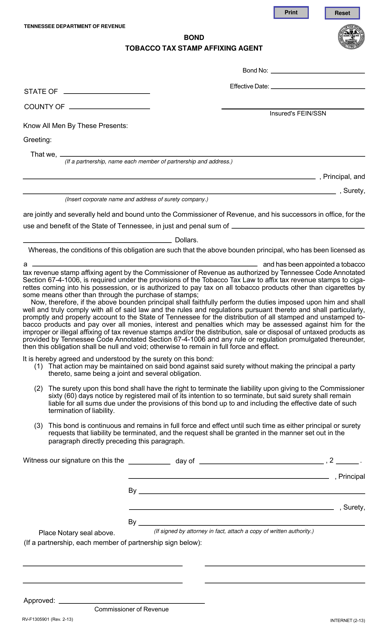

This form is used for obtaining a bond as a tobacco tax stamp affixing agent in the state of Tennessee.

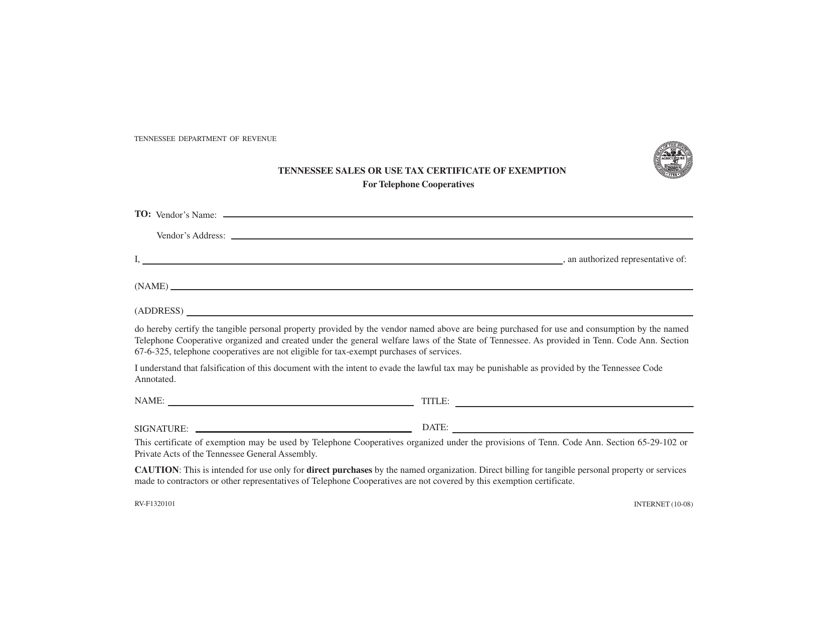

This form is used for Tennessee telephone cooperatives to obtain a sales or use tax exemption certificate.

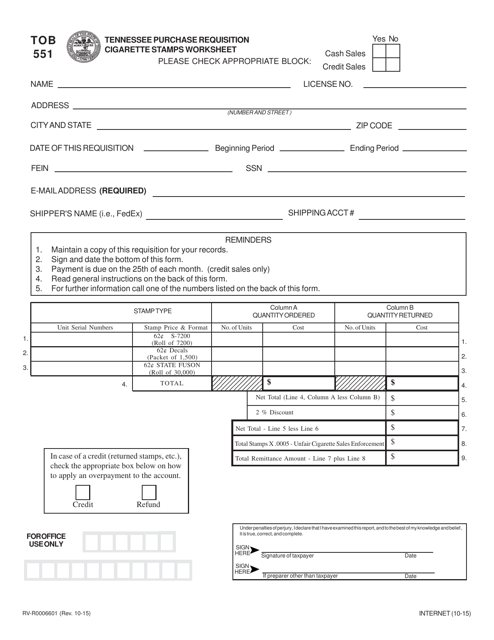

This form is used for submitting a purchase requisition for cigarette stamps in Tennessee. It serves as a worksheet to facilitate the process.

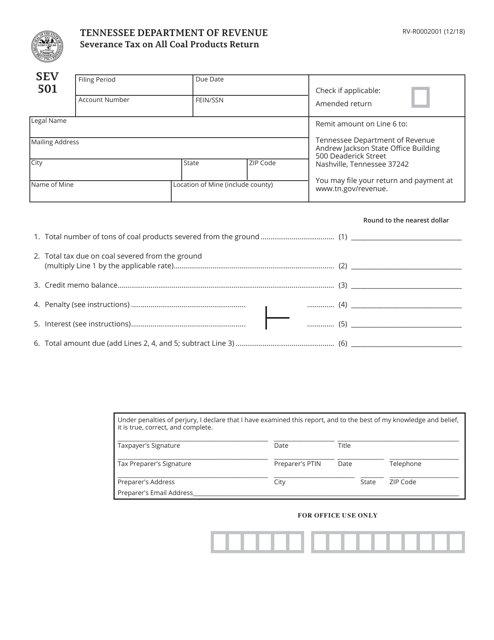

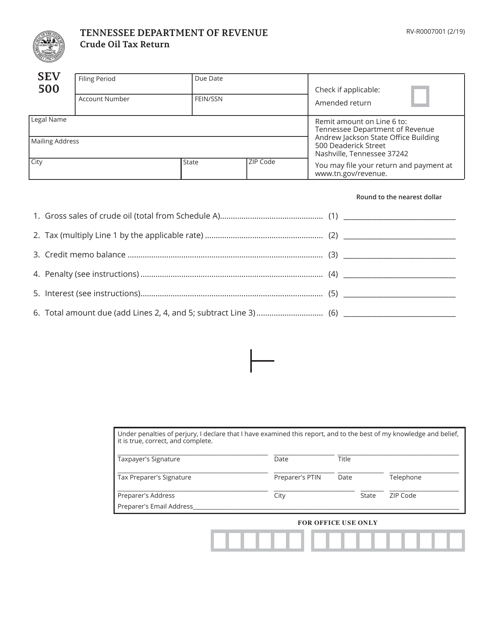

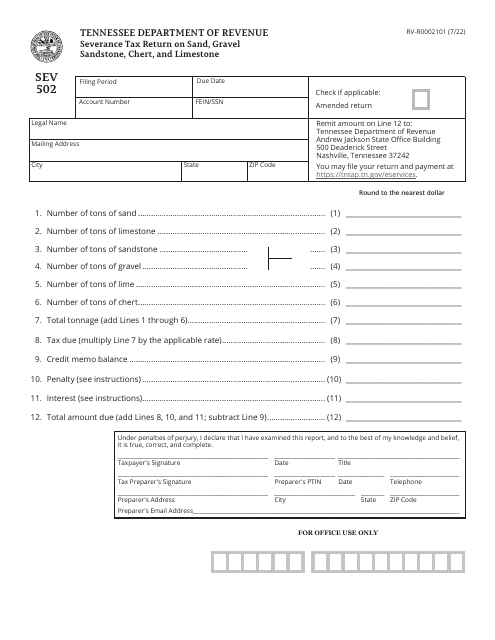

This form is used for reporting and paying taxes on crude oil in the state of Tennessee.

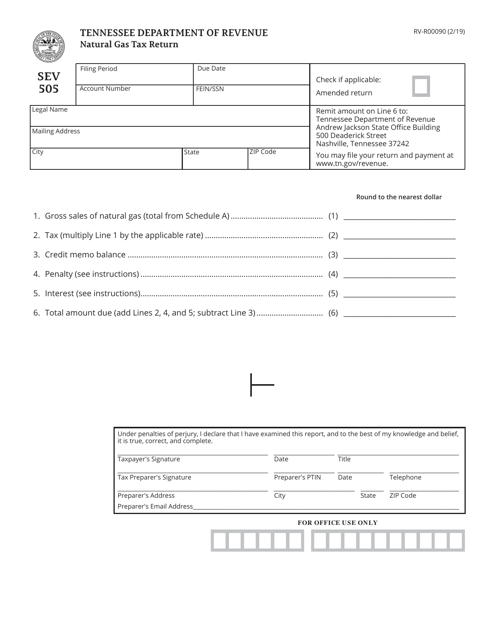

This form is used for filing the Natural Gas Tax Return in Tennessee.

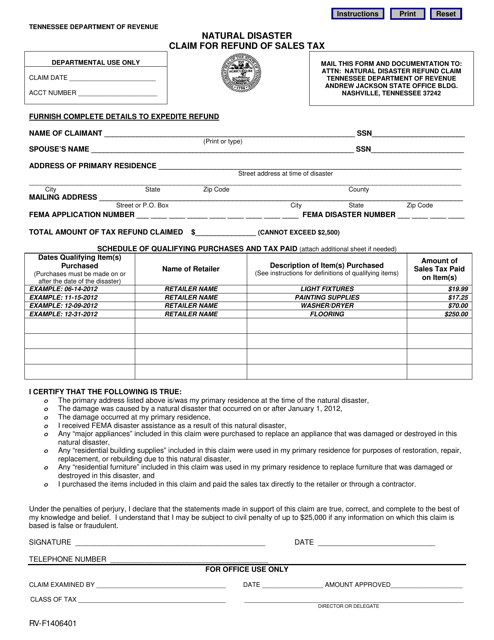

This form is used for filing a claim for refund of sales tax in the state of Tennessee due to a natural disaster.

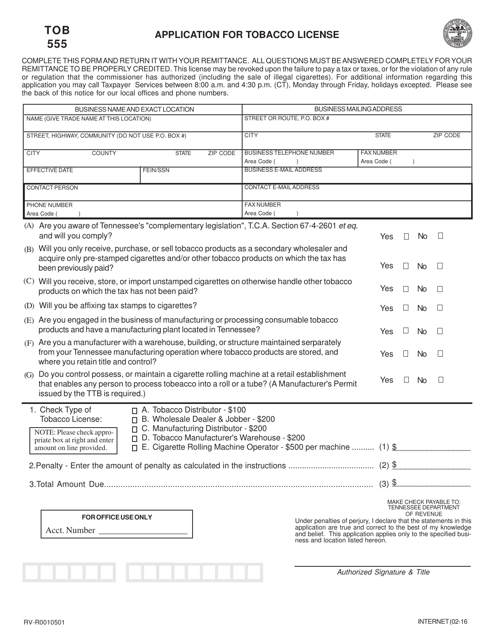

This form is used for applying for a tobacco license in Tennessee. It is required for individuals or businesses that want to sell tobacco products in the state.

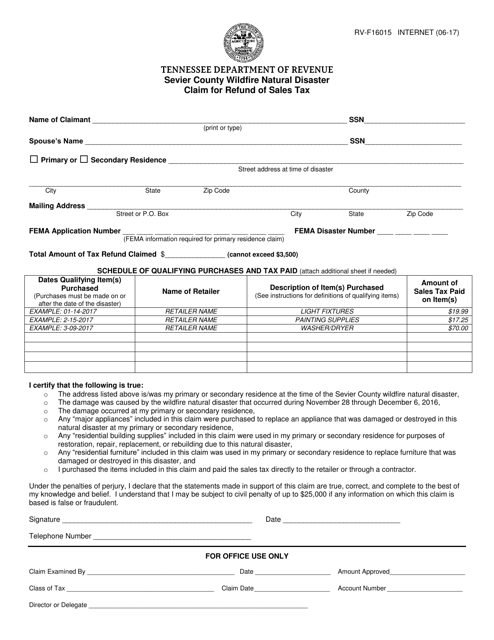

This form is used for residents of Sevier County, Tennessee, who were affected by the wildfire natural disaster and want to claim a refund of sales tax paid during the disaster.

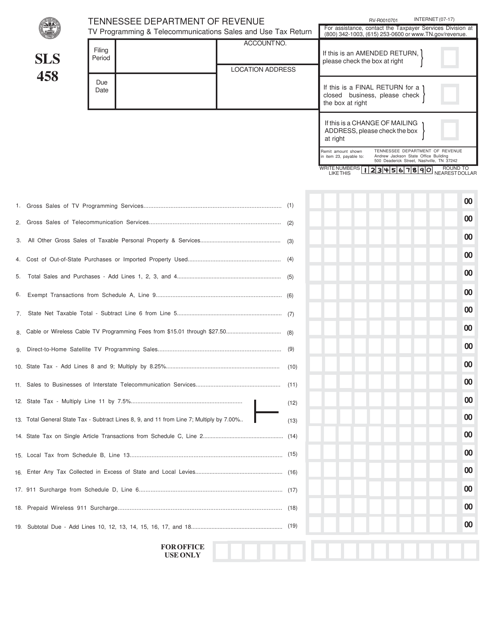

This Form is used for reporting and paying sales and use tax for TV programming and telecommunications services in Tennessee.

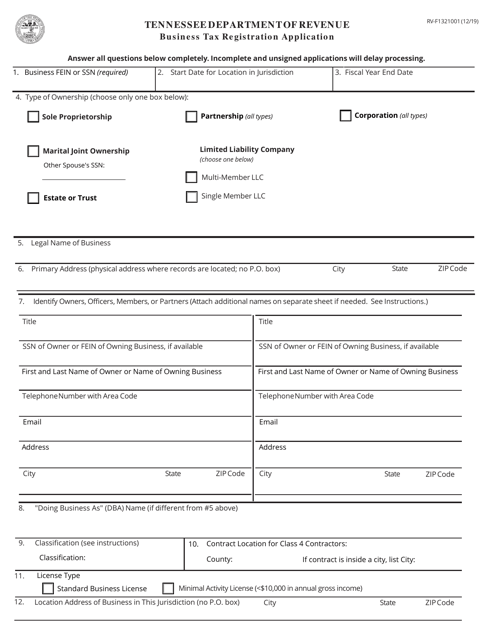

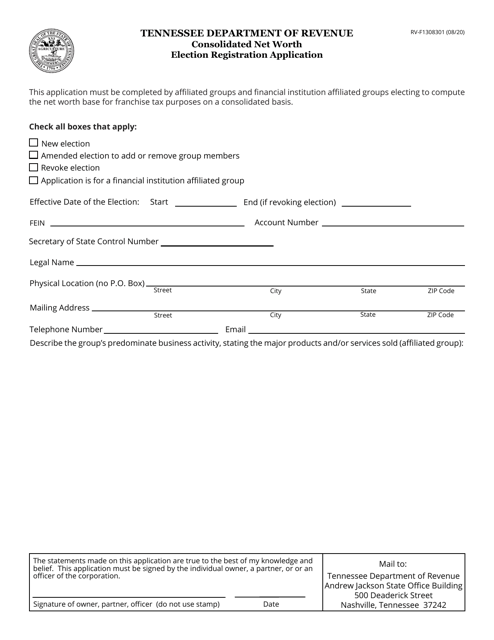

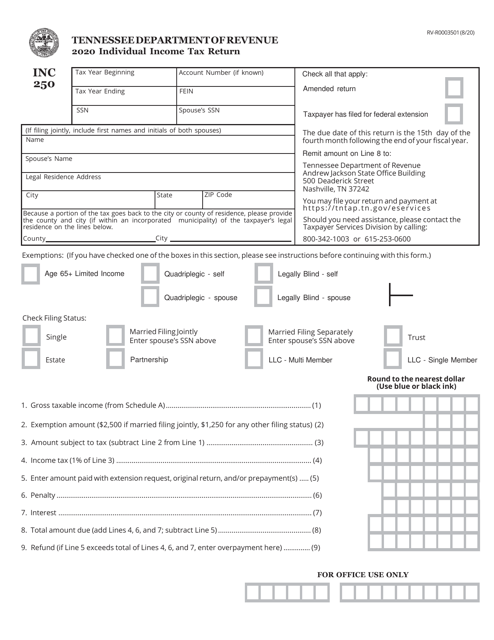

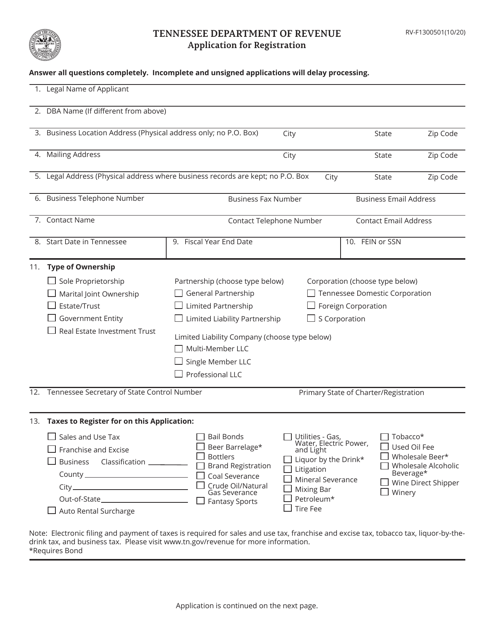

This form is used for registering a business for tax purposes in the state of Tennessee.

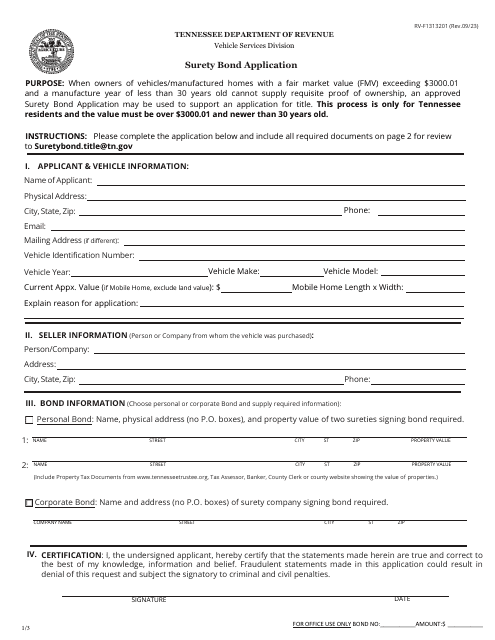

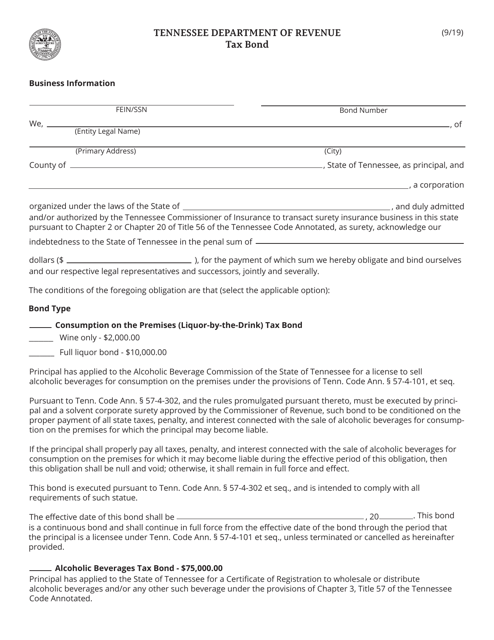

This document is a Tax Bond specific to the state of Tennessee. It is used to provide a guarantee of payment for any tax liabilities owed by an individual or business in Tennessee.

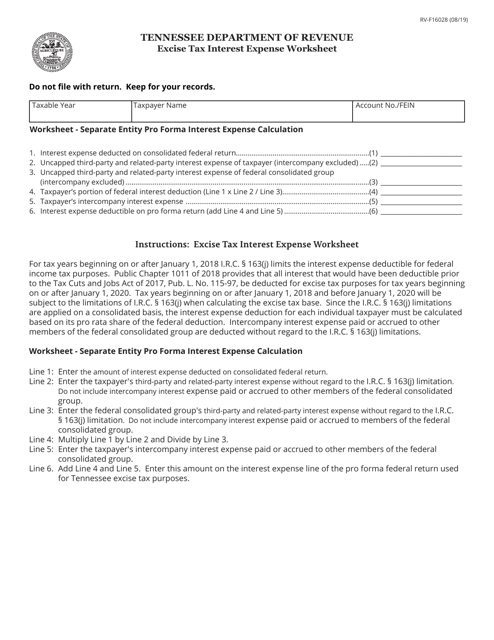

This Form is used for calculating the interest expense related to excise tax in the state of Tennessee. It helps businesses track and report their tax liabilities accurately.

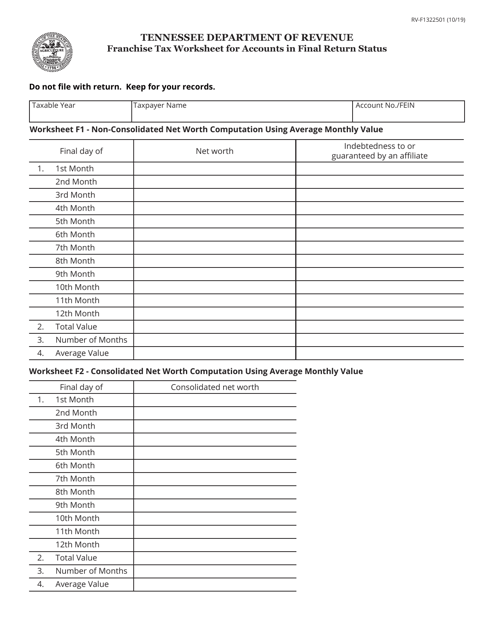

This document is used for calculating franchise tax for accounts in final return status in the state of Tennessee. It provides a worksheet to help businesses determine their franchise tax liability.

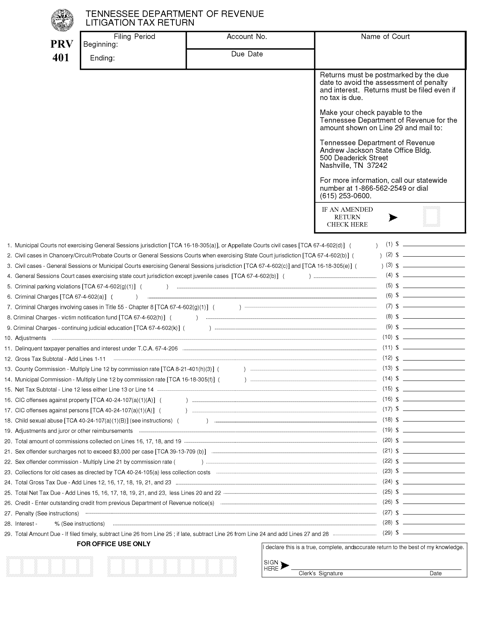

This form is used for filing a litigation tax return in the state of Tennessee. It is required for individuals and businesses involved in any legal proceedings or court cases.

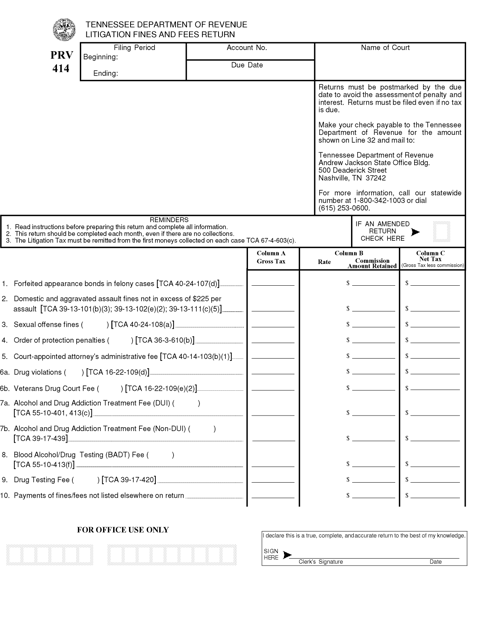

This form is used for reporting and paying litigation fines and fees in the state of Tennessee.

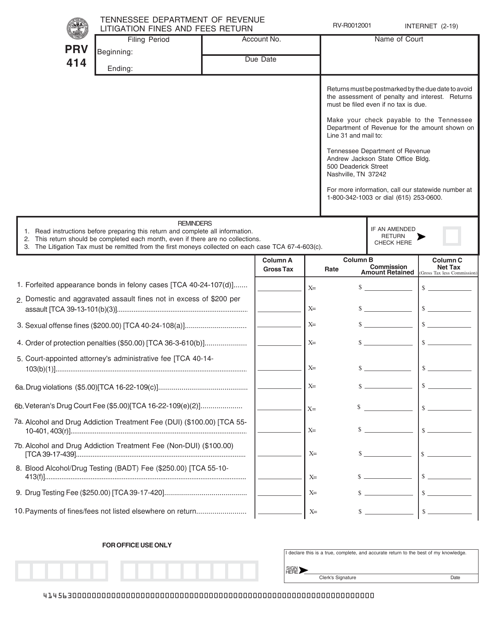

This form is used for reporting litigation fines and fees in the state of Tennessee. It is necessary for individuals or businesses who have been subjected to litigation and need to fulfill their obligations.

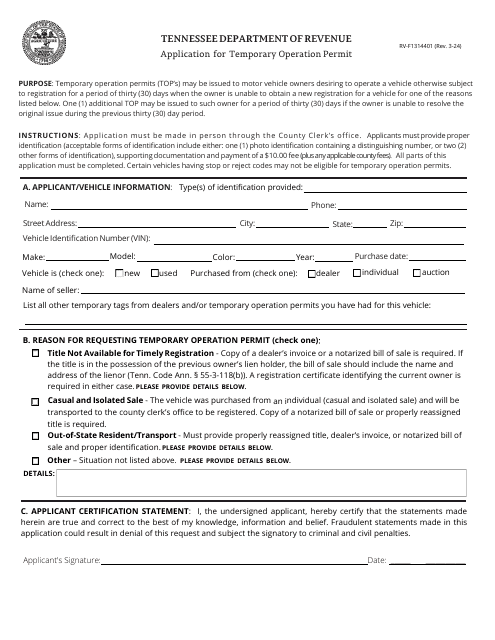

This form is used for applying for a personalized license plate in the state of Tennessee.

This form is used for filing an affidavit related to low or medium-speed vehicles in the state of Tennessee.