Tennessee Department of Revenue Forms

Documents:

418

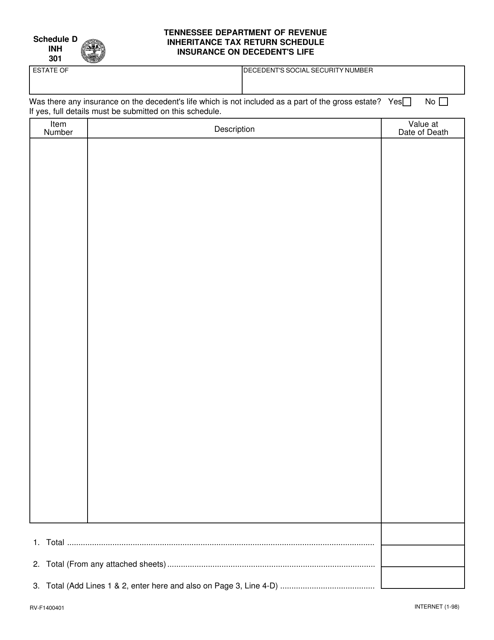

This form is used for reporting and calculating inheritance tax on insurance policies held by a deceased individual in Tennessee.

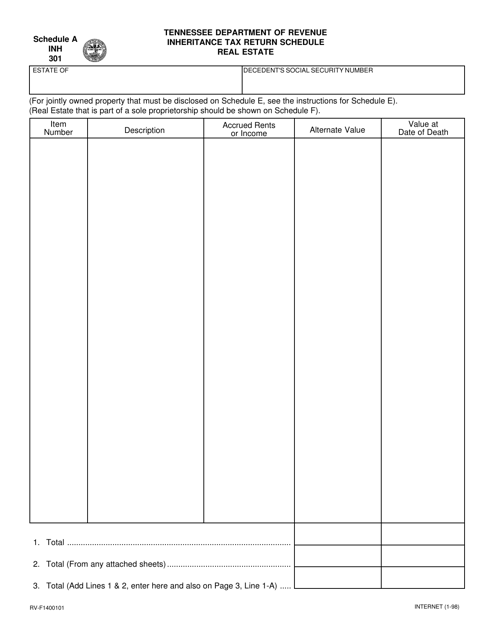

This form is used for reporting real estate assets for inheritance tax purposes in Tennessee.

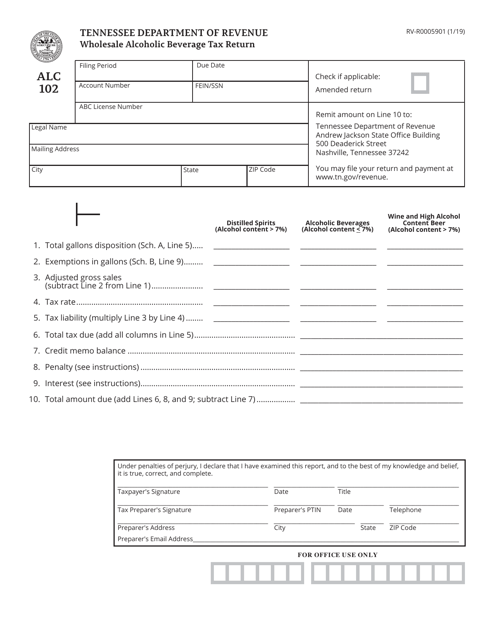

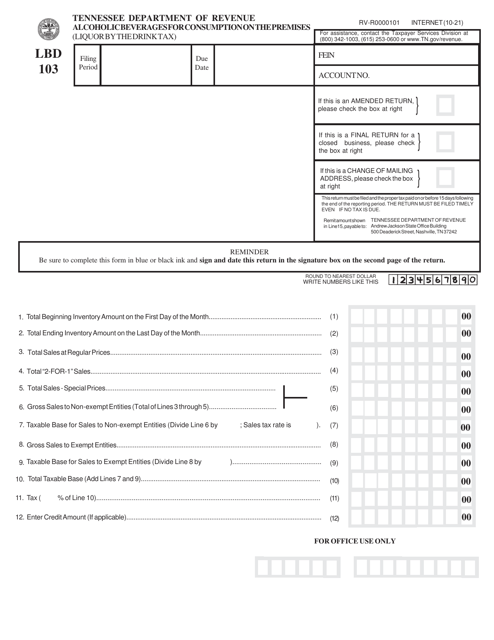

This form is used for filing the Wholesale Alcoholic Beverage Tax Return in the state of Tennessee.

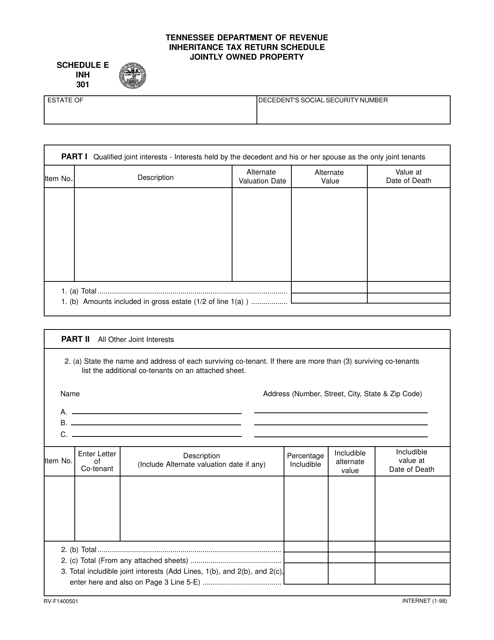

This document is used for reporting inheritance tax on jointly owned property in Tennessee.

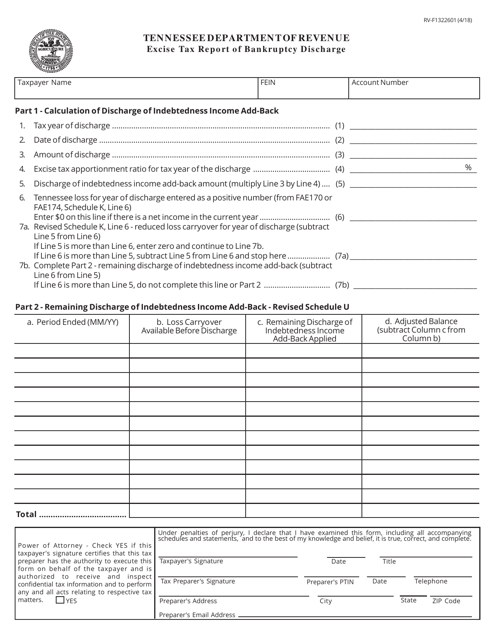

This form is used for reporting excise tax information related to a bankruptcy discharge in Tennessee.

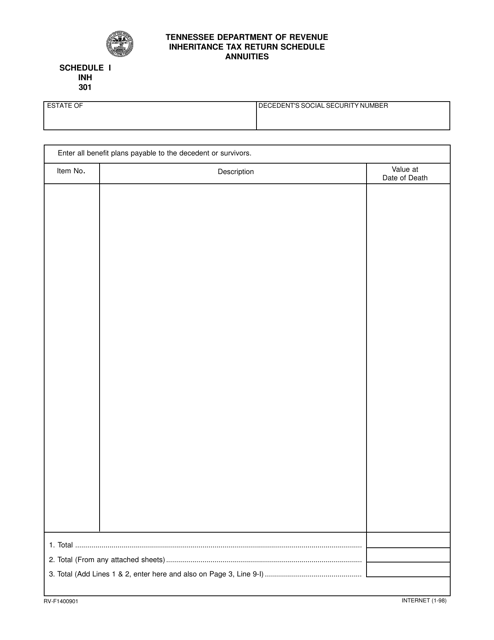

This Form is used for reporting annuities on the Schedule I Inheritance Tax Return in Tennessee.

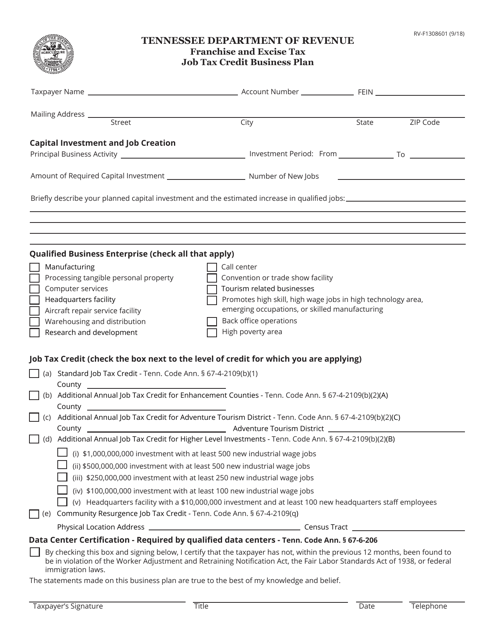

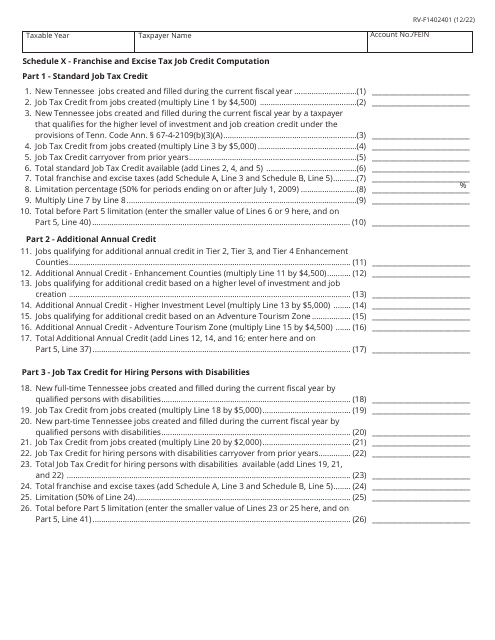

This form is used for submitting a business plan to apply for a job tax credit in Tennessee.

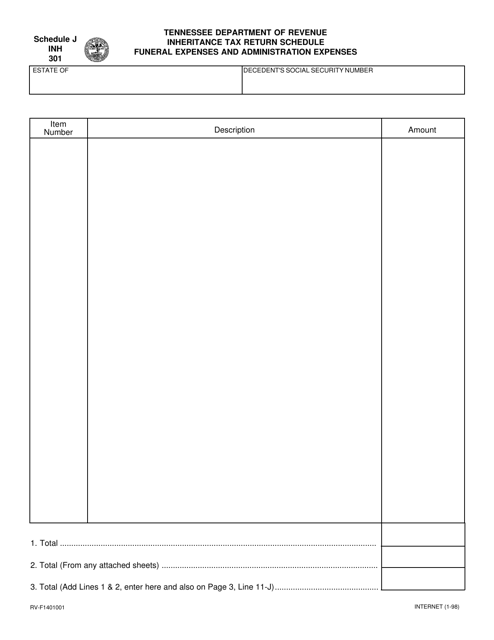

This form is used for reporting funeral expenses and administration expenses for the inheritance tax return in the state of Tennessee.

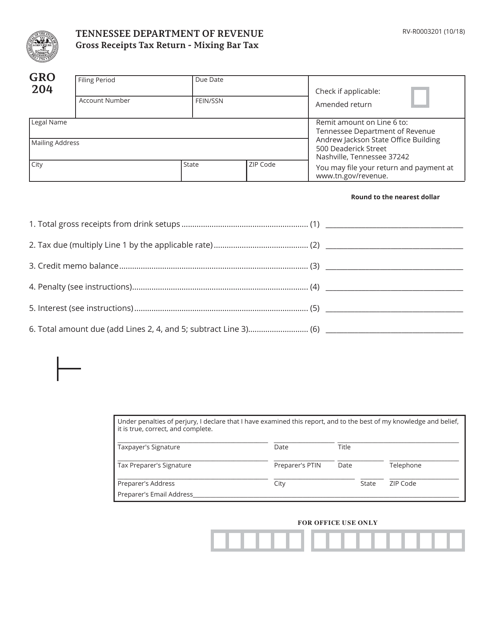

This Form is used for reporting and paying the Gross Receipts Tax on mixing bars in Tennessee.

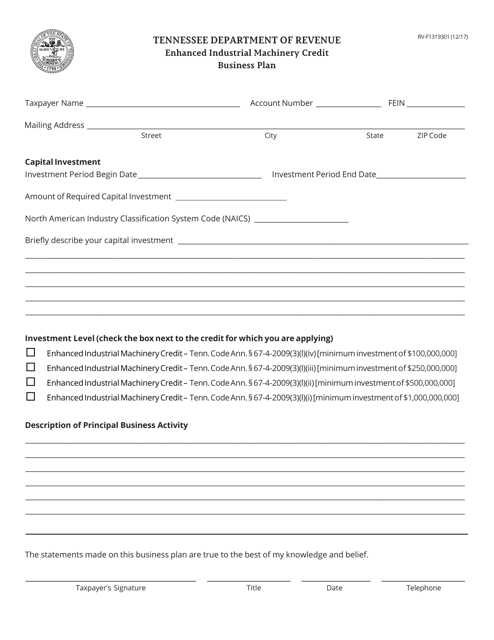

This Form is used for submitting an Enhanced Industrial Machinery Credit Business Plan in the state of Tennessee.

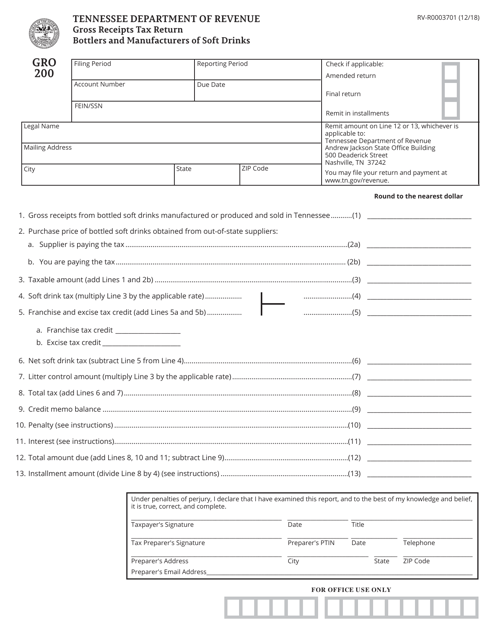

This Form is used for filing the Gross Receipts Tax Return by bottlers and manufacturers of soft drinks in the state of Tennessee.

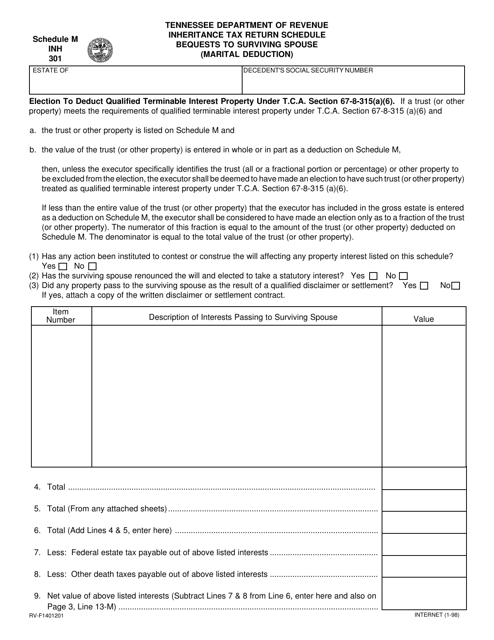

This form is used for reporting inheritance tax in Tennessee for bequests to a surviving spouse, specifically for the marital deduction.

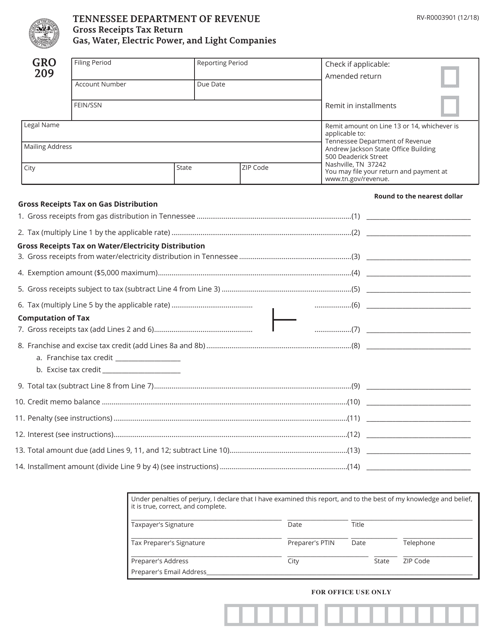

This Form is used for filing Gross Receipts Tax Return for Gas, Water, Electric Power, and Light Companies in Tennessee.

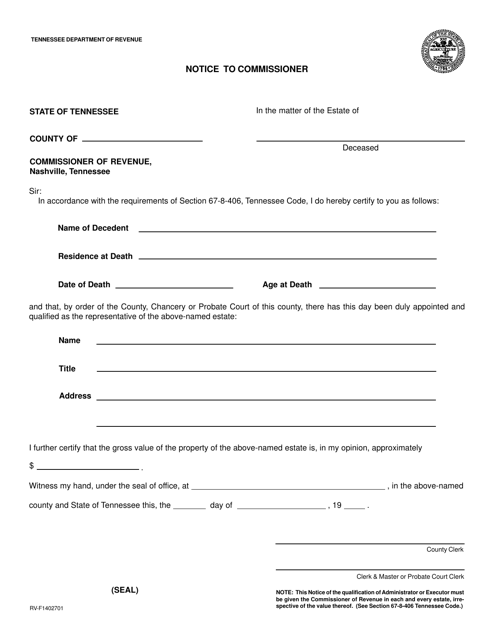

This Form is used for sending a notice to the Commissioner in Tennessee. It is a form that needs to be filled out to communicate important information or request action from the Commissioner.

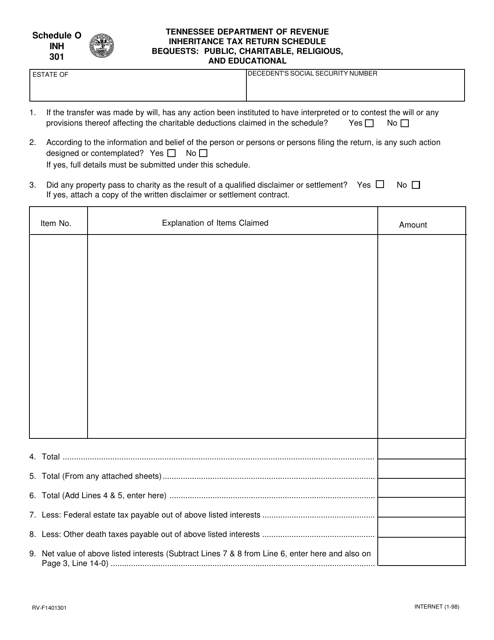

This Form is used for reporting bequests to public, charitable, religious, and educational organizations for inheritance tax purposes in Tennessee.

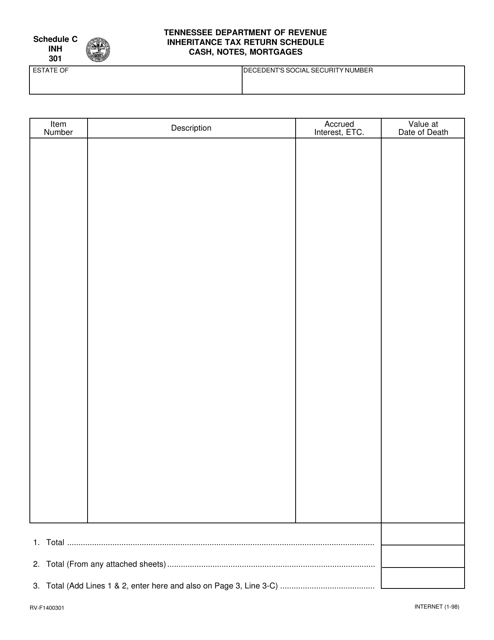

This form is used for reporting and calculating inheritance tax in Tennessee. It specifically focuses on cash, notes, and mortgages that are part of the inheritance.

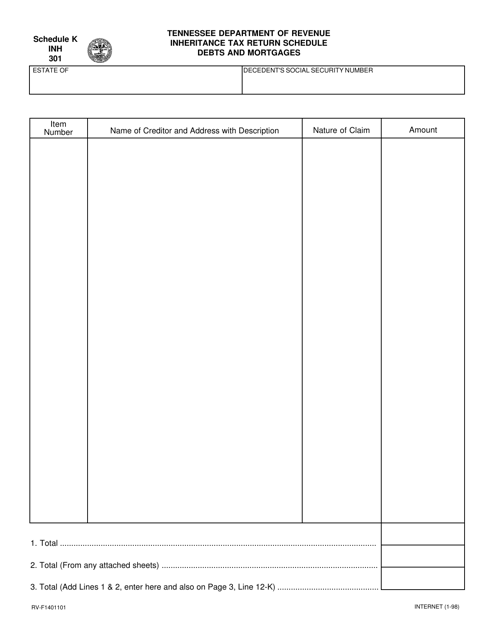

Form RV-F1401101 (INH301) Schedule K Inheritance Tax Return Schedule Debts and Mortgages - Tennessee

This form is used for reporting debts and mortgages related to inheritance on the Tennessee Inheritance Tax Return Schedule K.

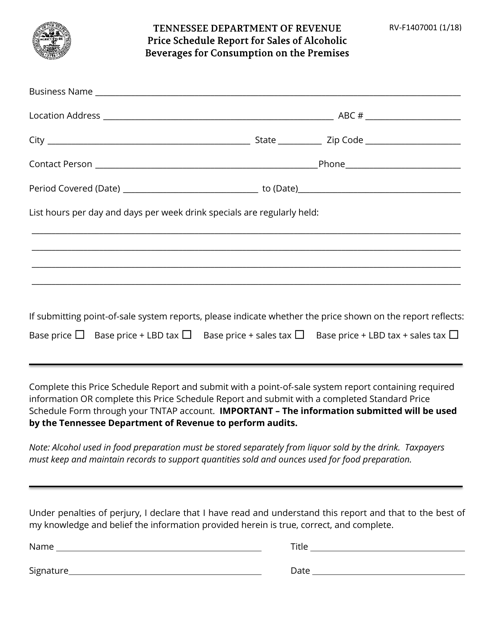

This form is used for reporting the price schedule of alcoholic beverages sold for consumption on the premises in Tennessee. It helps track the prices and ensure compliance with regulations.

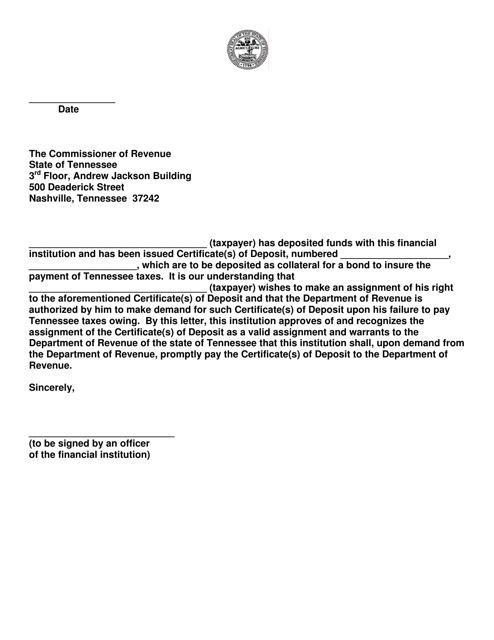

This form is used for pledging collateral to the Department of Revenue in the state of Tennessee. It allows individuals or businesses to offer collateral for certain tax obligations or other liabilities to the state.

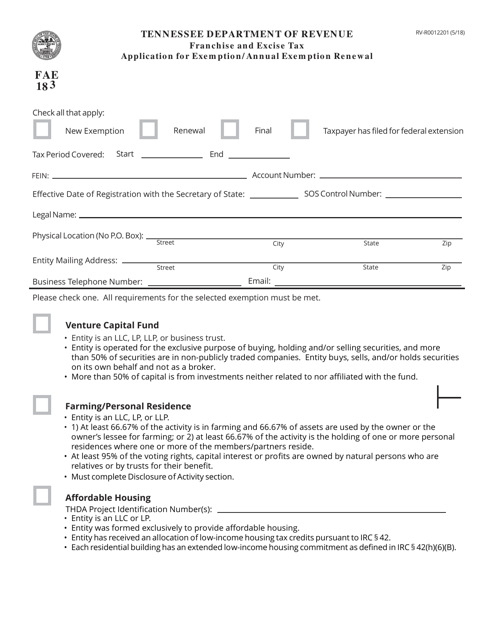

This form is used for applying for exemption or renewing an annual exemption in Tennessee.

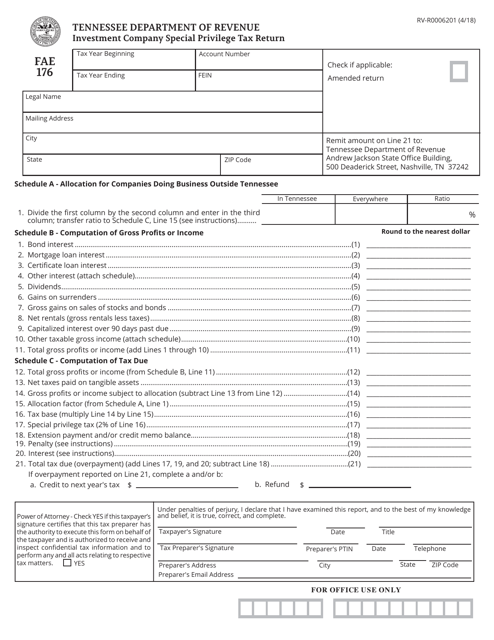

This form is used for filing the Investment Company Special Privilege Tax Return in Tennessee. It is used by investment companies to report and pay special privilege taxes.

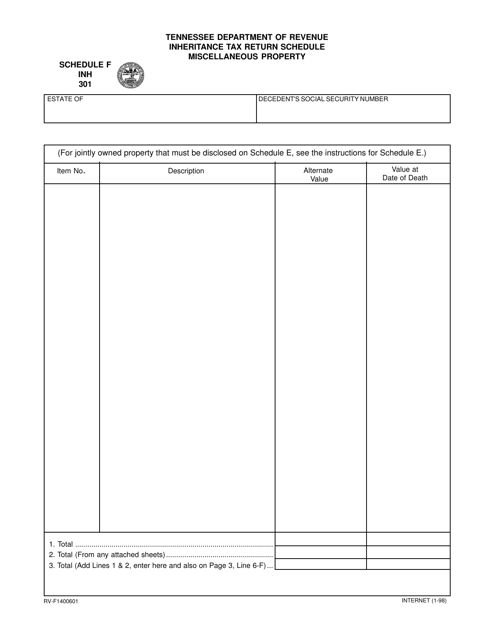

This Form is used for reporting miscellaneous inheritance properties on the Tennessee Inheritance Tax Return Schedule F.

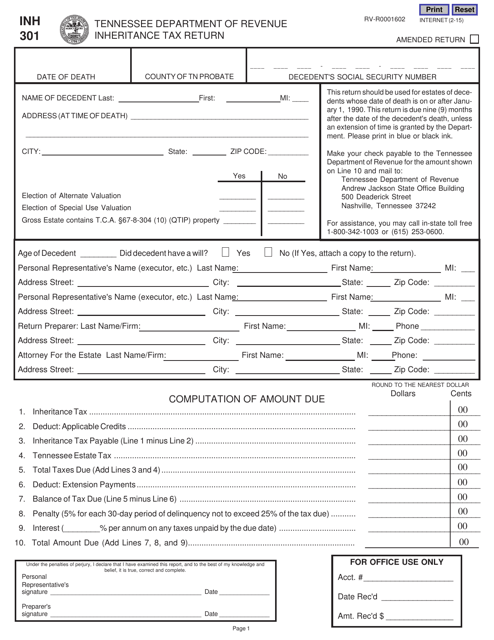

This form is used for filing an Inheritance Tax Return in Tennessee.

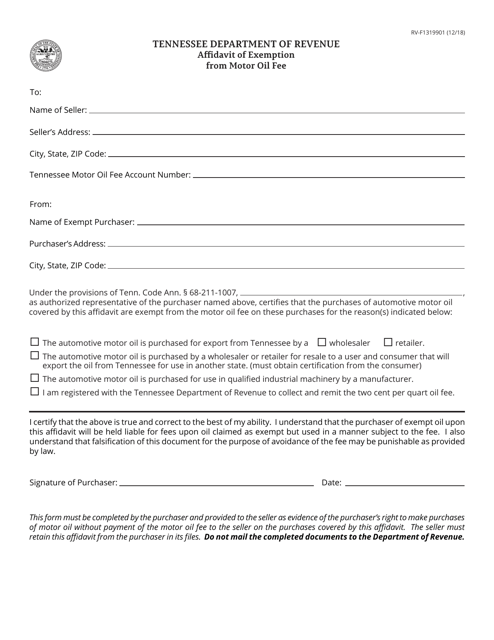

This form is used for claiming an exemption from the motor oil fee in Tennessee. The affidavit is filled out to provide proof of exemption.

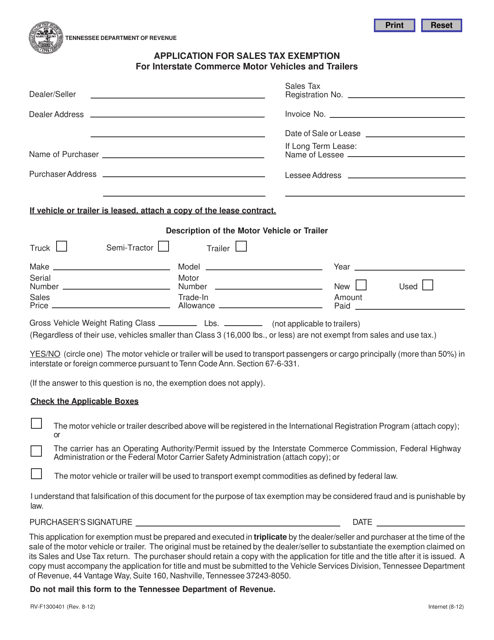

This form is used for applying for a sales tax exemption in Tennessee for motor vehicles and trailers used in interstate commerce.

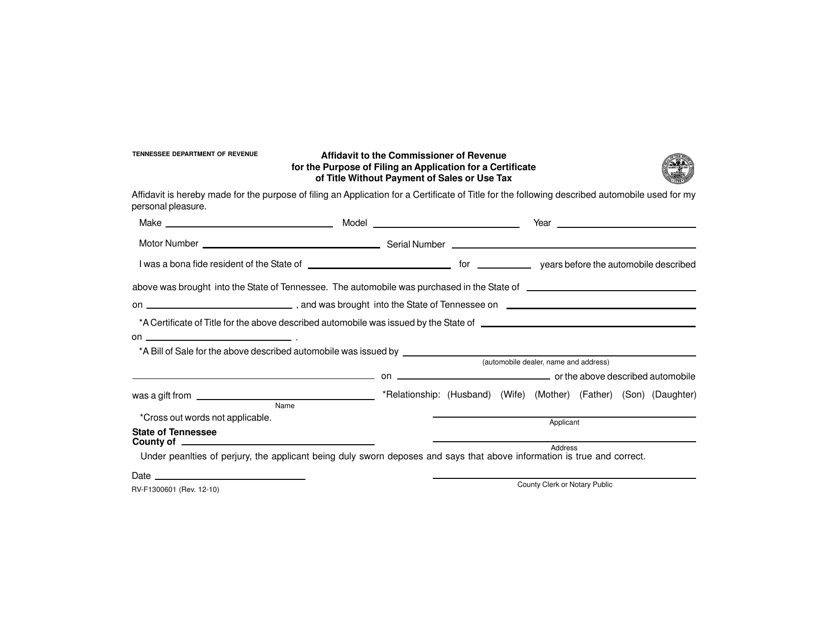

This form is used for filing an affidavit to the Commissioner of Revenue in Tennessee in order to apply for a certificate of title without payment of sales or use tax.

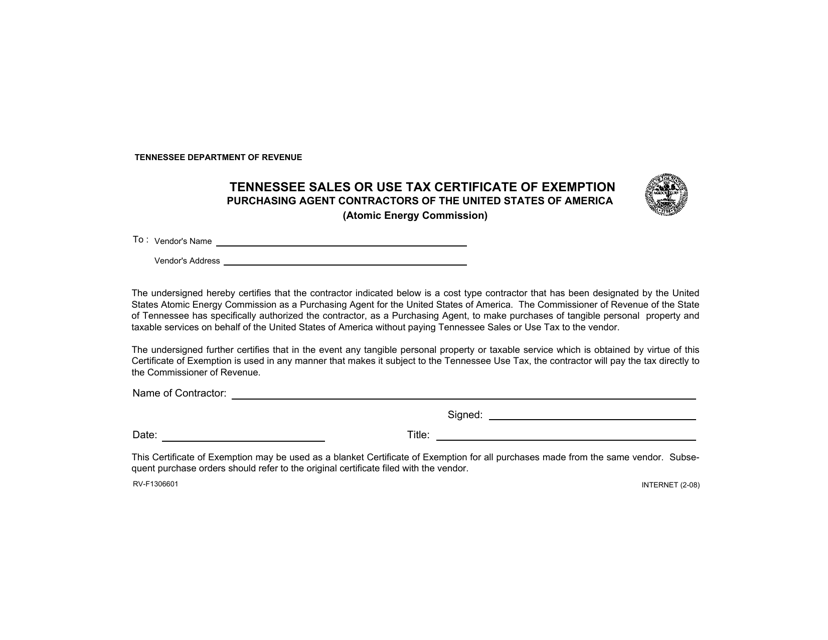

This Form is used for obtaining a Sales or Use Tax Certificate of Exemption for Purchasing Agent Contractors of the United States of America (Atomic Energy Commission) in Tennessee.

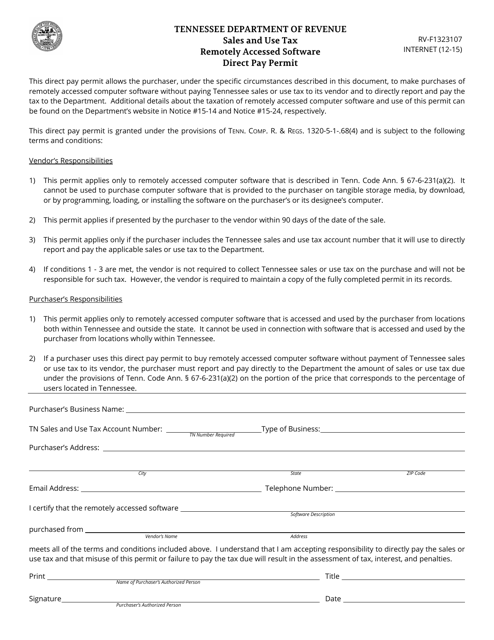

This Form is used for obtaining a Remotely Accessed Software Direct Pay Permit in the state of Tennessee.

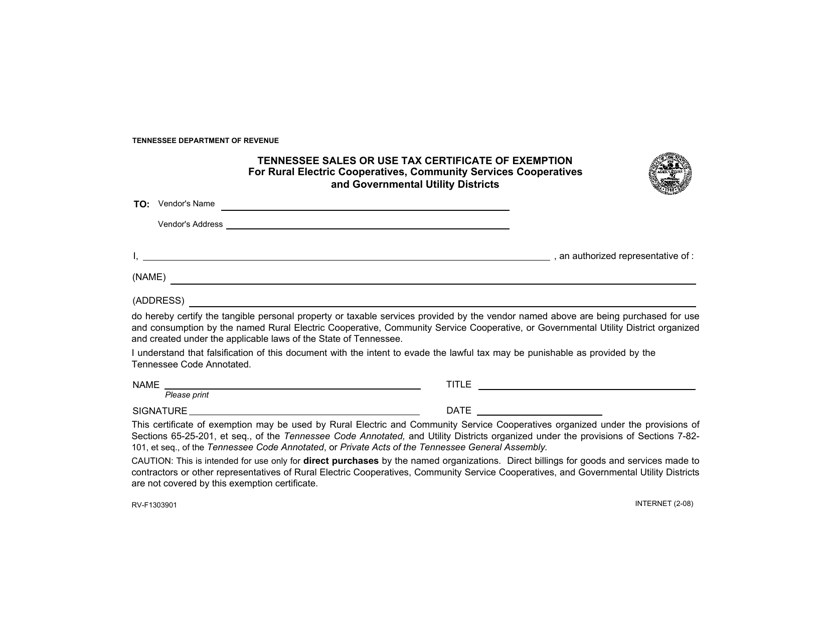

This form is used for rural electric cooperatives, community services cooperatives, and governmental utility districts in Tennessee to apply for a sales or use tax exemption certificate for certain items.

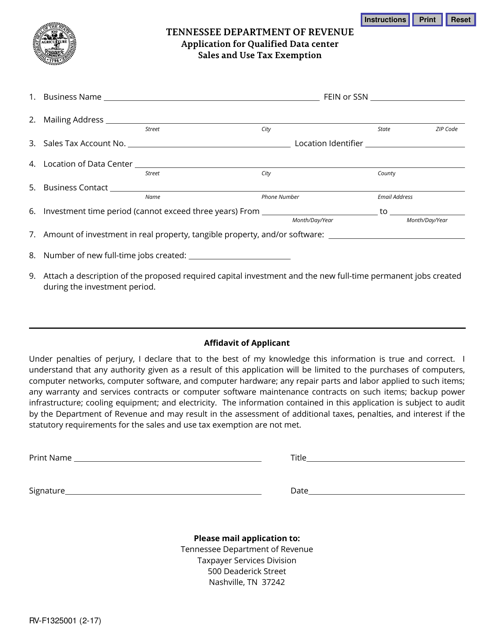

This form is used for applying for a sales and use tax exemption for qualified data centers in the state of Tennessee.

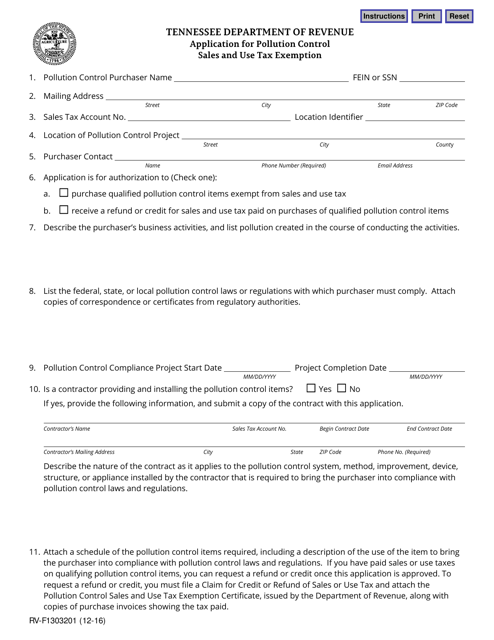

This form is used for applying for a sales and use tax exemption specifically for pollution control in the state of Tennessee.

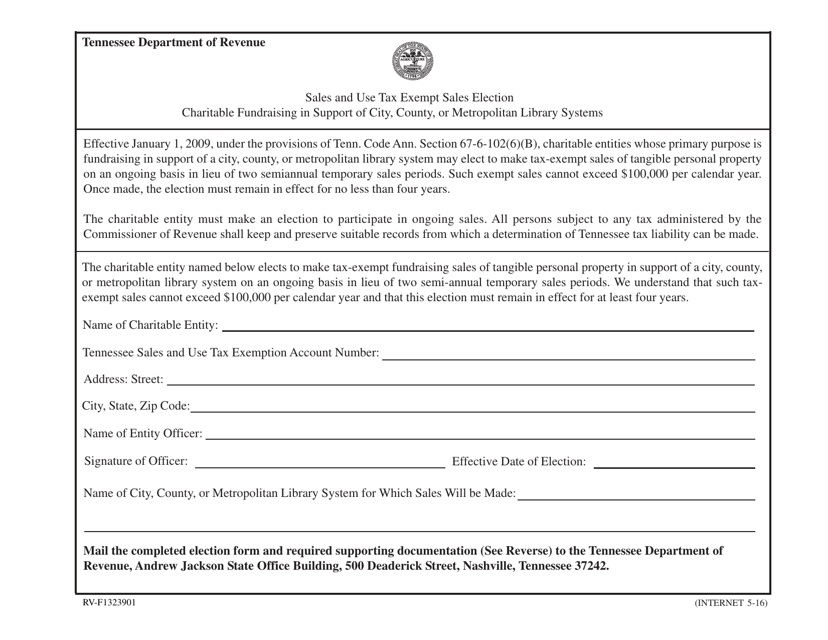

This form is used for making a sales tax exempt sales election for charitable fundraising to support library systems in Tennessee.

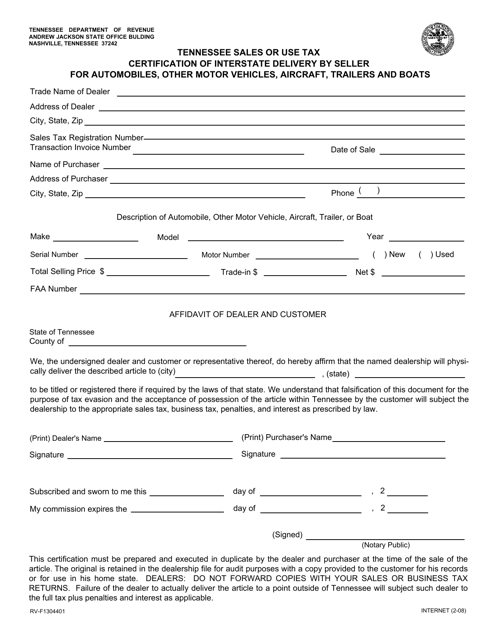

This form is used for sellers in Tennessee to certify the interstate delivery of automobiles, motor vehicles, aircraft, trailers, and boats for sales or use tax purposes. It ensures that the seller is exempt from collecting or remitting sales tax on these types of transactions.