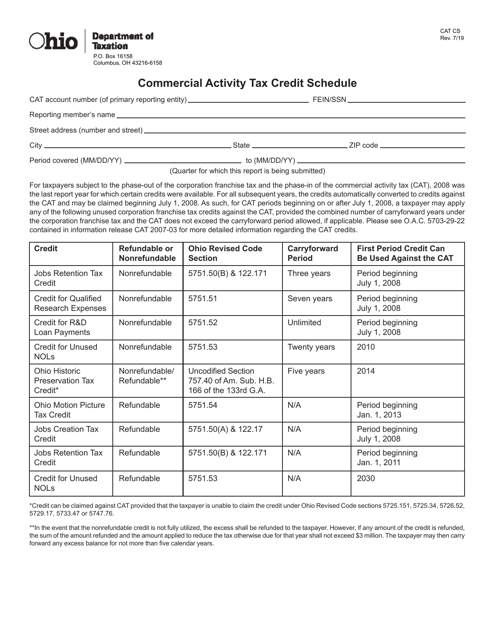

Ohio Department of Taxation Forms

Documents:

402

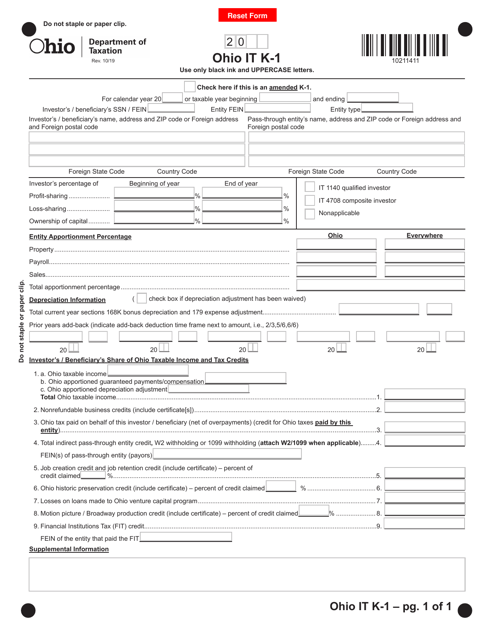

This form is used for reporting income from partnerships in the state of Ohio. It is used by individuals who are partners in a partnership and need to report their share of income, deductions, and credits on their personal tax return.

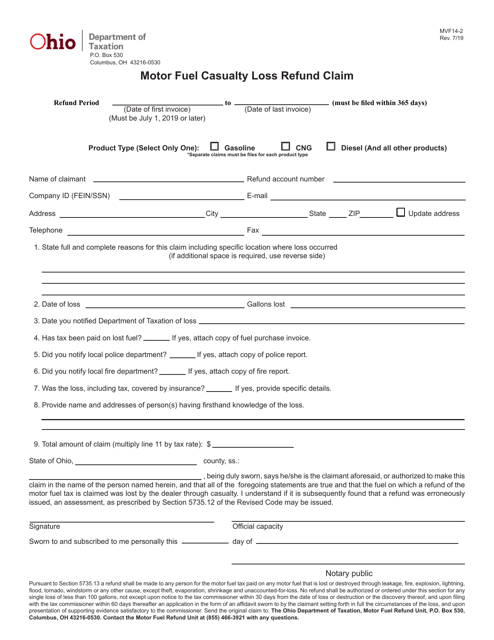

This form is used for filing a motor fuel casualty loss refund claim in the state of Ohio.

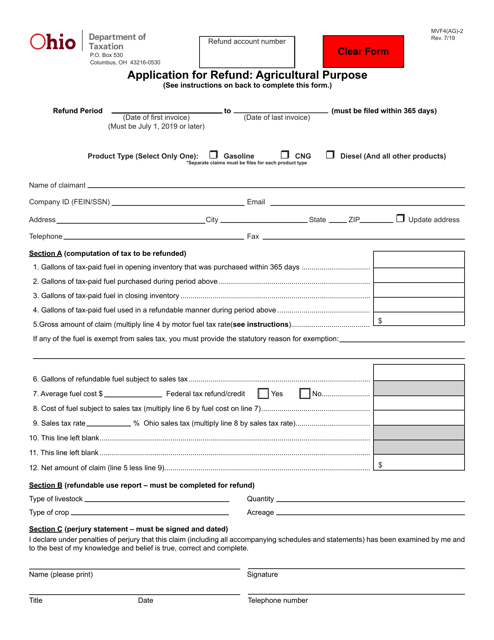

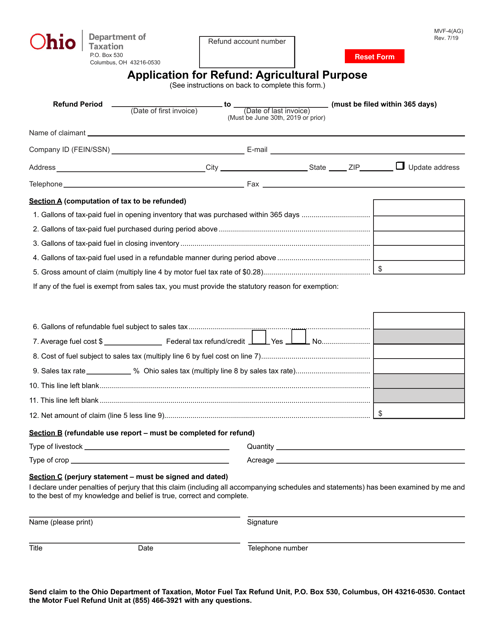

This document is used for applying for a refund for agricultural purposes in Ohio.

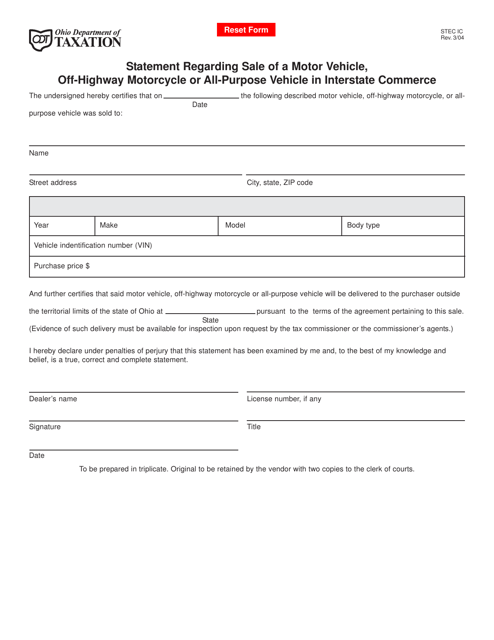

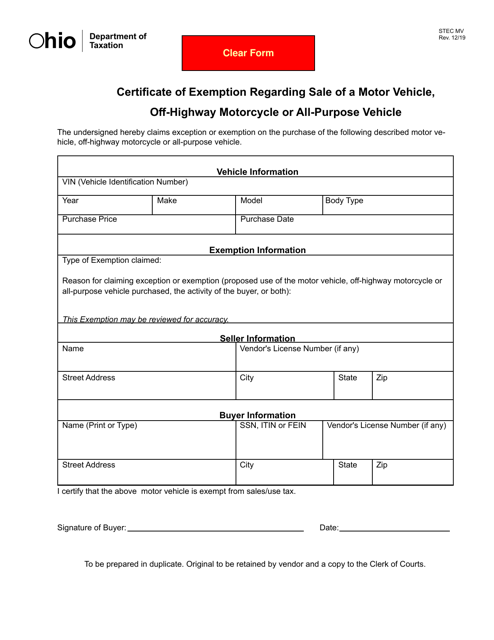

This form is used for providing a statement regarding the sale of a motor vehicle, off-highway motorcycle, or all-purpose vehicle in interstate commerce in the state of Ohio. It is necessary when buying or selling vehicles across state lines. The form helps ensure compliance with Ohio state regulations.

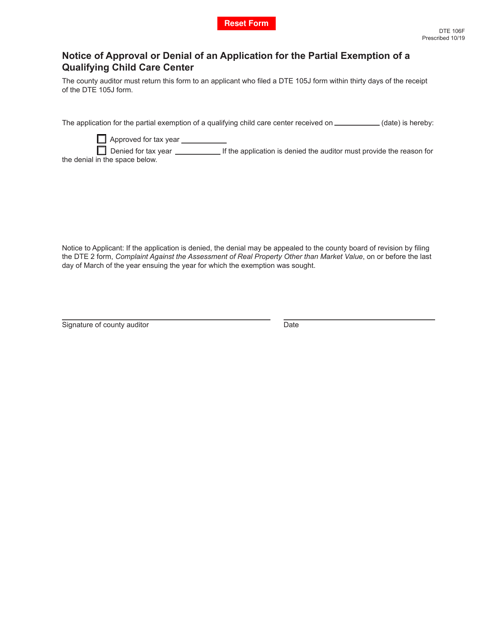

This form is used for notifying the applicant of the approval or denial of their application for the partial exemption of a qualifying child care center in Ohio.

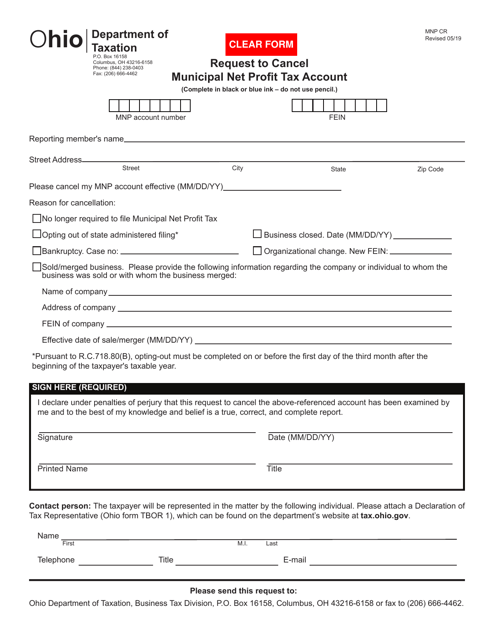

This form is used for requesting the cancellation of a Municipal Net Profit Tax Account in Ohio.

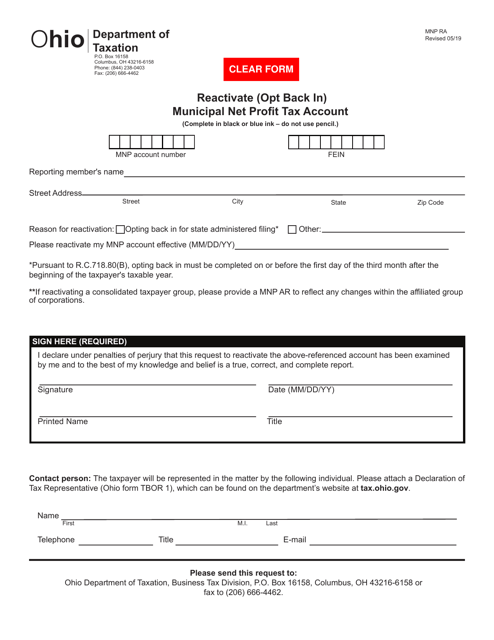

This form is used to reactivate a municipal net profit tax account in Ohio for those who have opted out and now wish to opt back in.

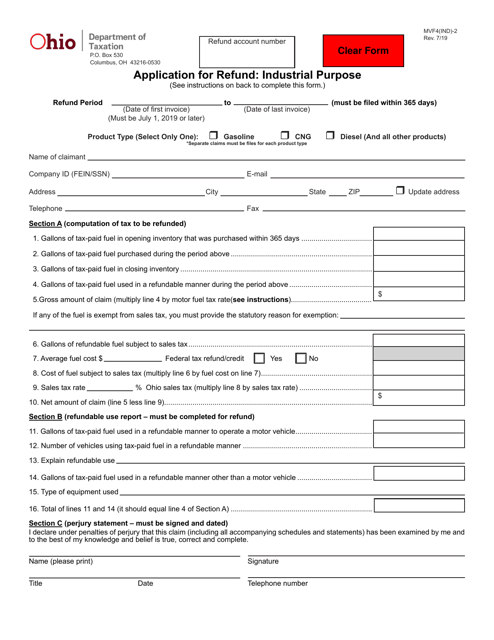

This form is used for applying for a refund for industrial purposes in the state of Ohio.

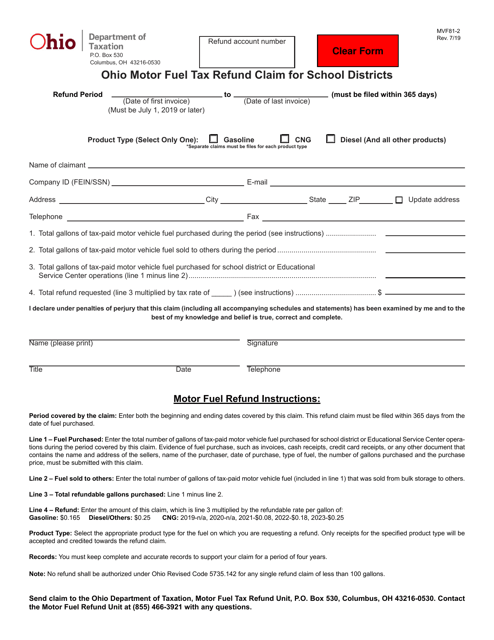

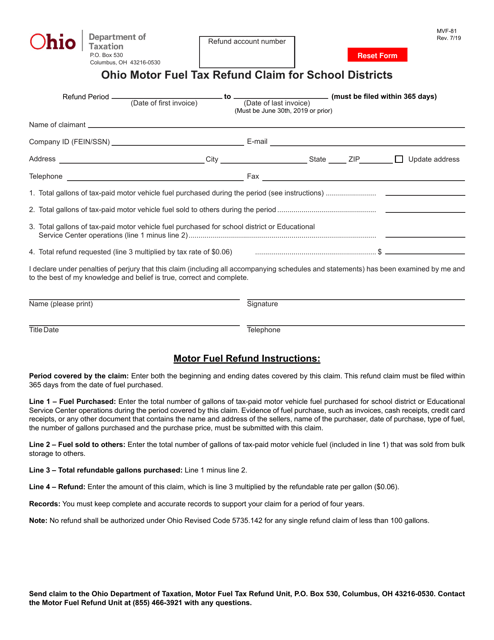

This Form is used for Ohio school districts to claim a refund for motor fuel taxes.

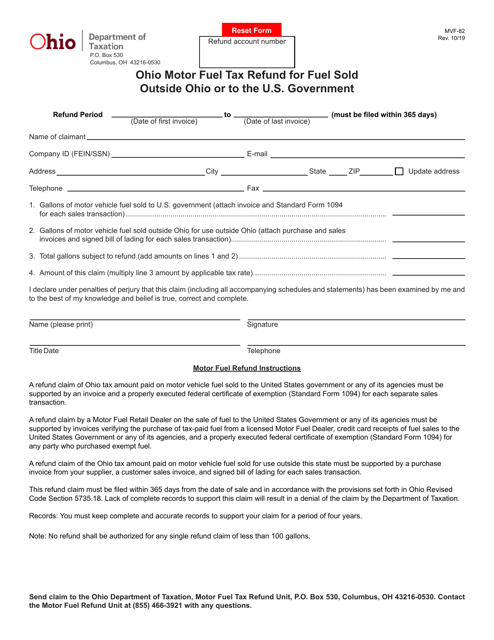

This form is used for requesting a refund of motor fuel tax paid in Ohio for fuel sold outside of Ohio or to the U.S. Government.

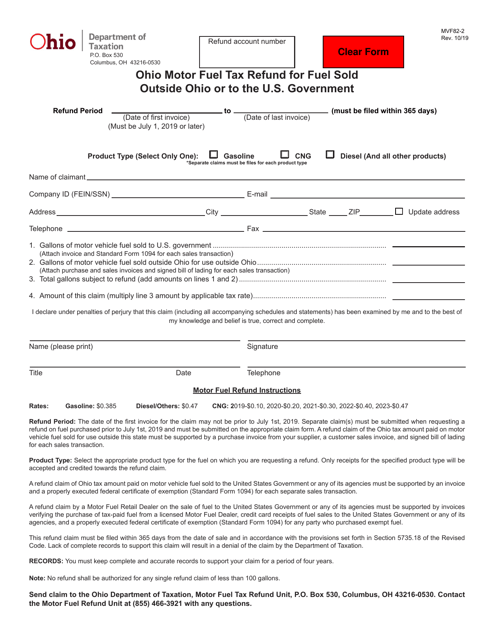

This Form is used for requesting a motor fuel tax refund in Ohio for fuel sold outside of Ohio or to the U.S. Government. It allows individuals or businesses to recoup tax paid on fuel that was not used within the state.

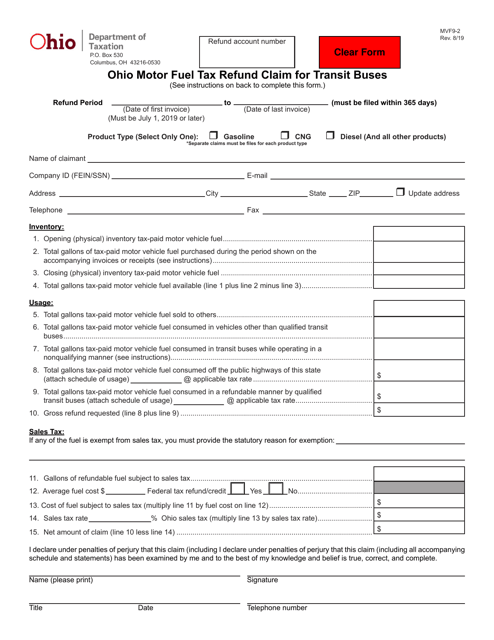

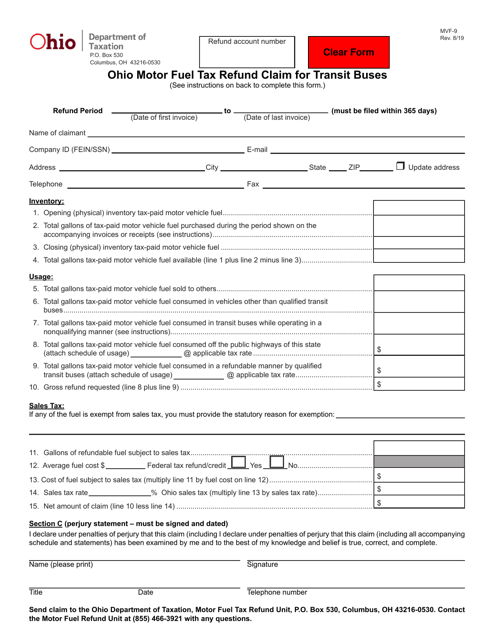

This form is used for Ohio residents to claim a refund on motor fuel tax for transit buses.

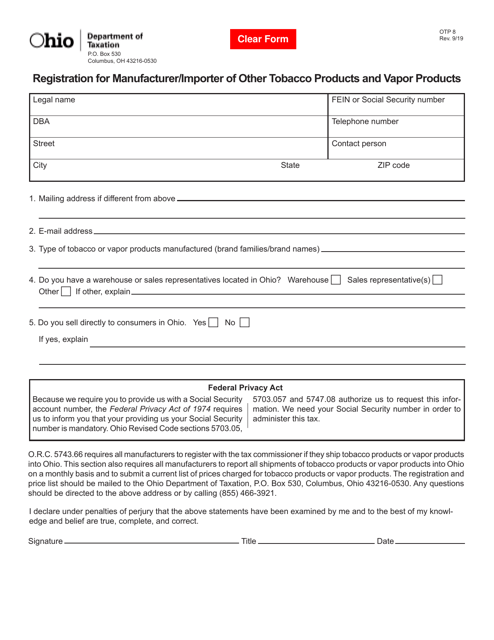

Form OTP8 Registration for Manufacturer/Importer of Other Tobacco Products and Vapor Products - Ohio

This Form is used for registering manufacturers and importers of other tobacco products and vapor products in Ohio.

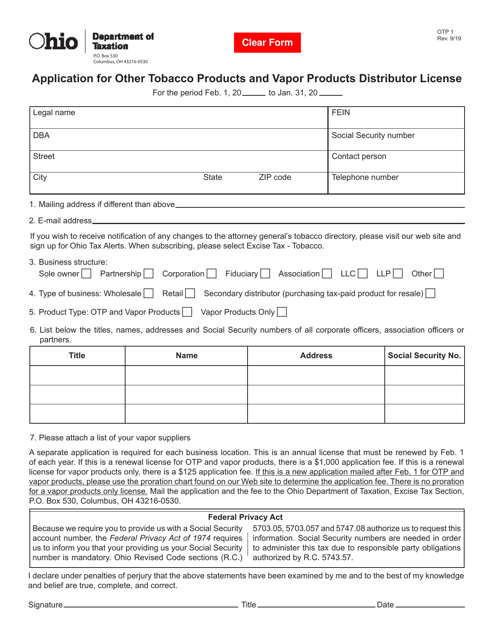

This form is used for applying for a distributor license for other tobacco products and vapor products in the state of Ohio.

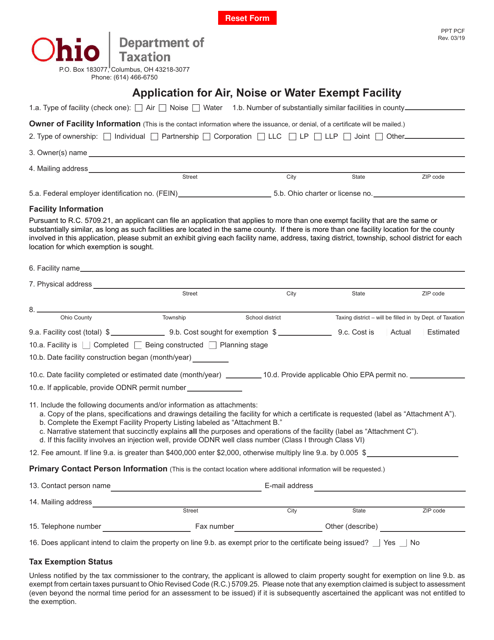

This form is used for applying for exemption from air, noise or water regulations for facilities in Ohio. It allows businesses to seek a waiver from certain environmental requirements.

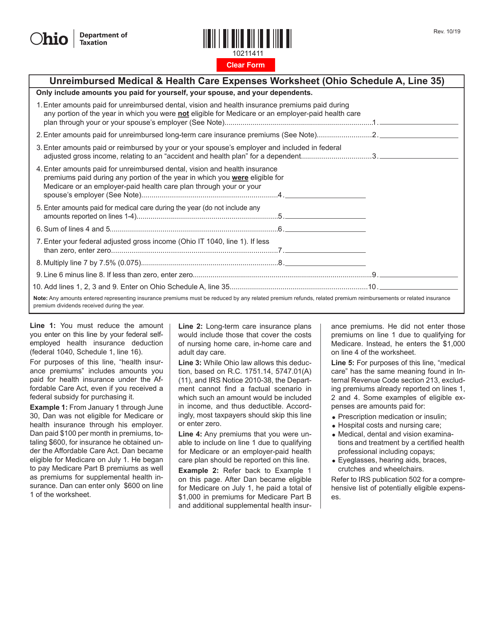

This document is a worksheet used for reporting unreimbursed medical and health care expenses on Ohio Schedule A, Line 35. It helps individuals in Ohio track and calculate their out-of-pocket medical costs for tax purposes.

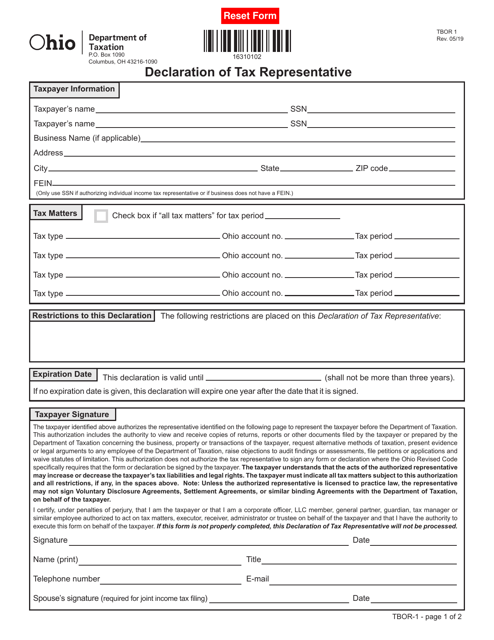

This Form is used for declaring a tax representative in the state of Ohio. It allows individuals to authorize someone else to act on their behalf for tax-related matters.

This form is used for reporting financial institution taxes in the state of Ohio. It provides instructions on how to accurately complete the form FIT10.