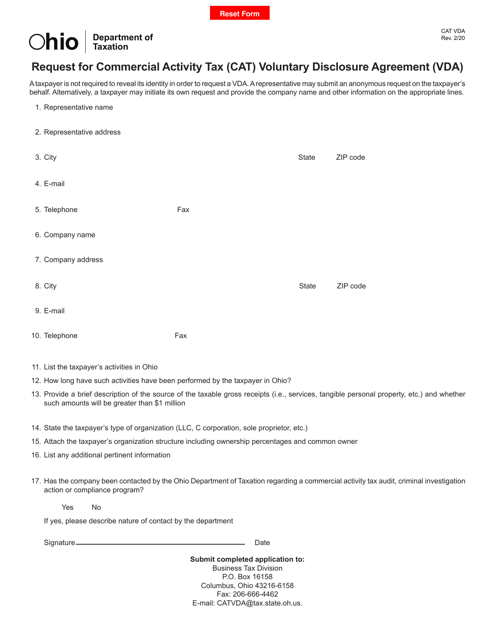

Ohio Department of Taxation Forms

Documents:

402

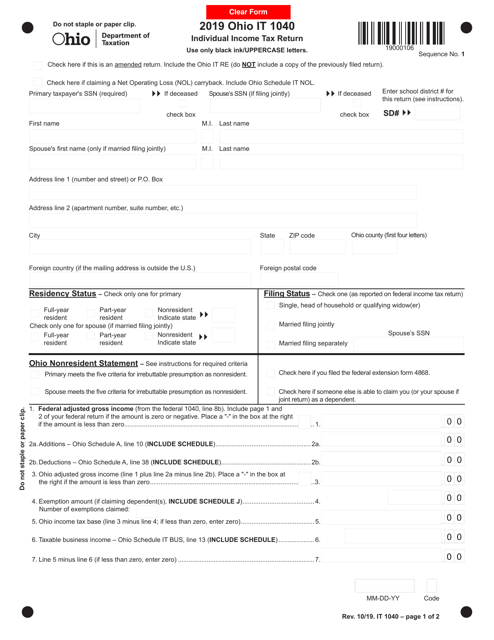

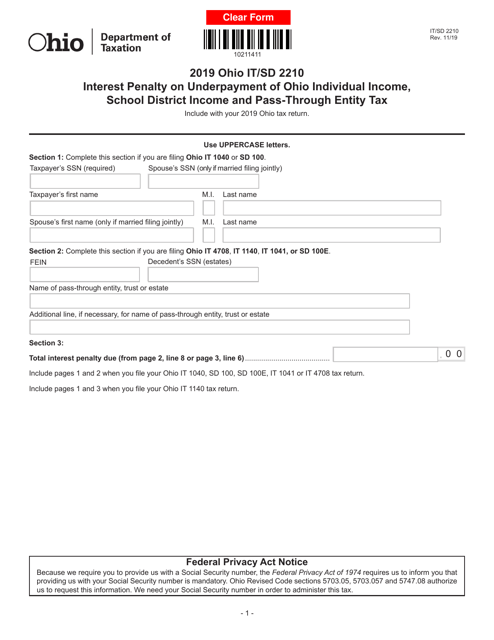

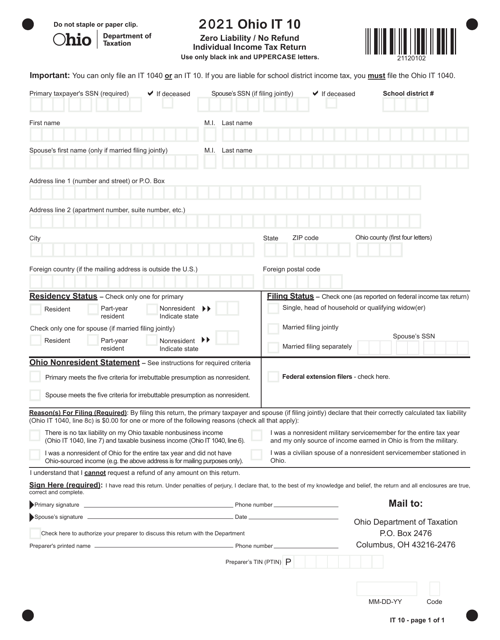

This Form is used for filing the Individual Income Tax Return in the state of Ohio. It is used to report and pay the taxes owed on your income for the tax year.

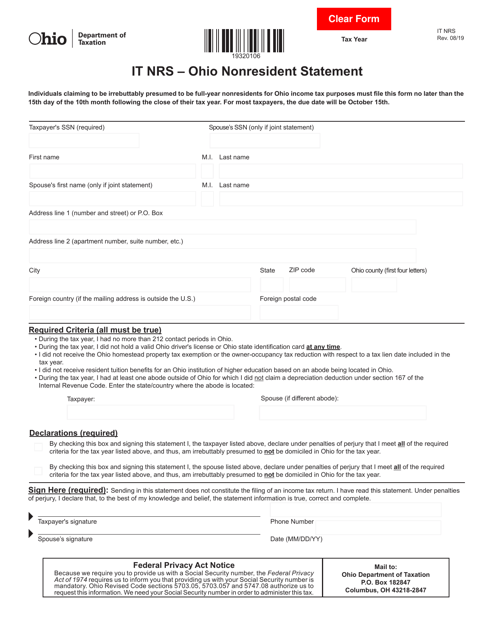

This Form is used for nonresidents of Ohio to report their income and deductions from the state. It helps determine their tax liability in Ohio.

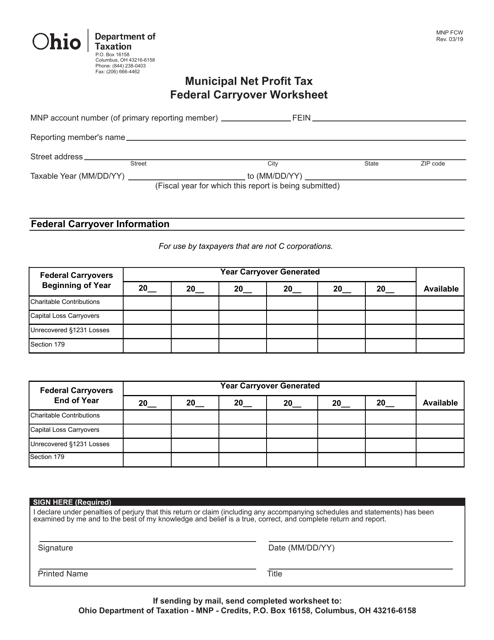

This form is used for calculating the municipal net profit tax federal carryover in the state of Ohio. It helps individuals and businesses keep track of any unused federal net operating losses that can be carried over for deductions on their municipal taxes.

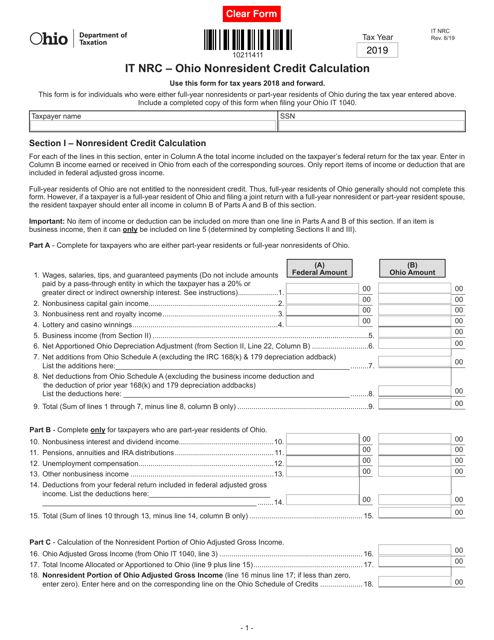

This form is used for calculating nonresident tax credit in Ohio.

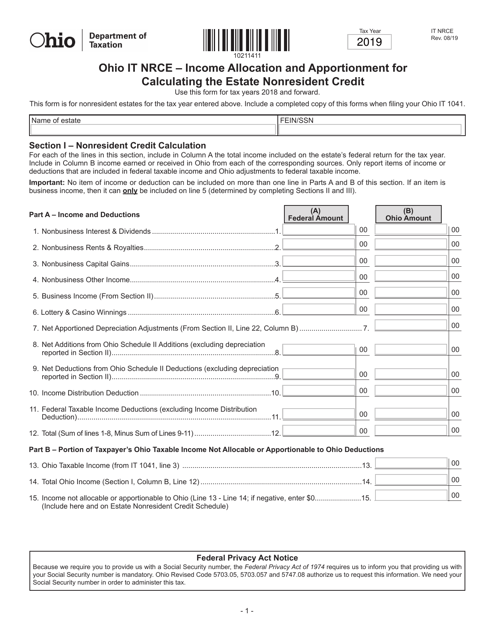

This form is used for calculating the estate nonresident credit in Ohio by allocating and apportioning income.

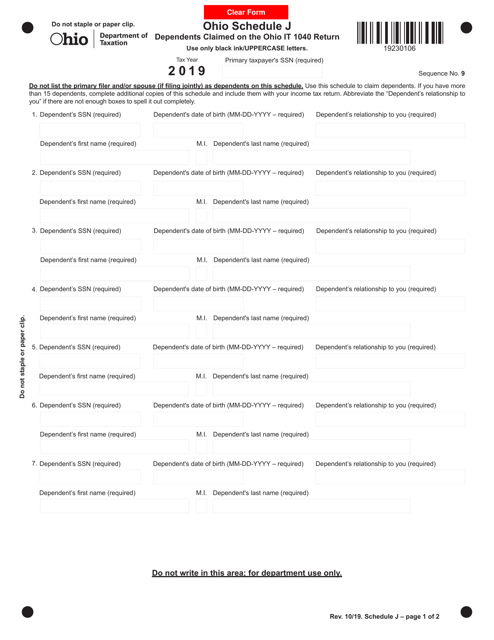

This Form is used for claiming dependents on the Ohio It 1040 tax return.

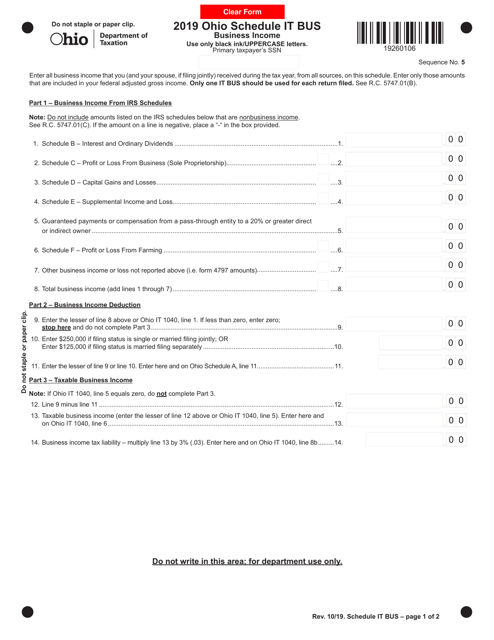

This document is used for reporting the business income of an IT company in the state of Ohio. It is necessary for tax purposes and helps the company accurately calculate their taxable income.

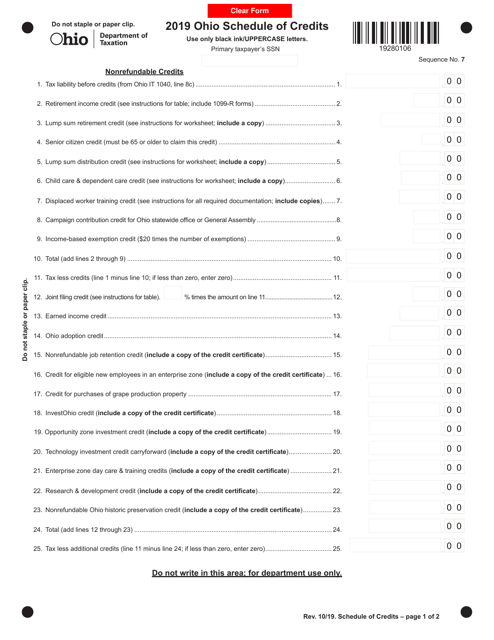

This document is used for calculating and determining the various tax credits available in the state of Ohio. It provides a schedule of credits that taxpayers can claim to reduce their overall tax liability.

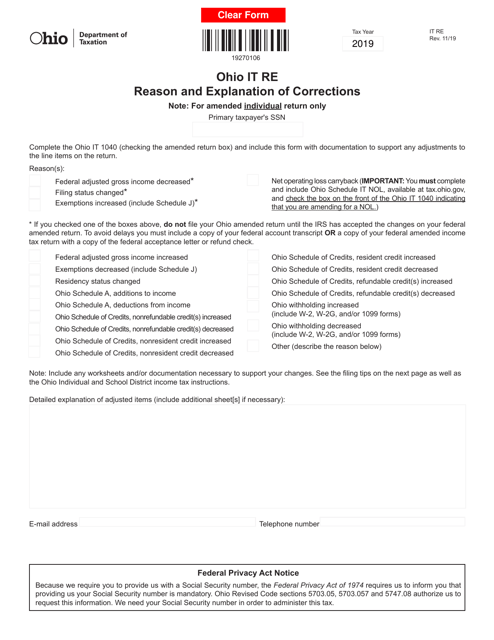

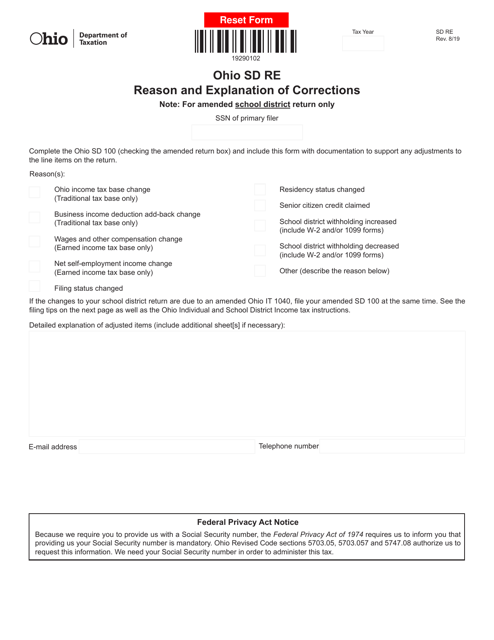

This form is used for providing a reason and explanation of corrections made for a Security Deposit Return (SD RE) in the state of Ohio.

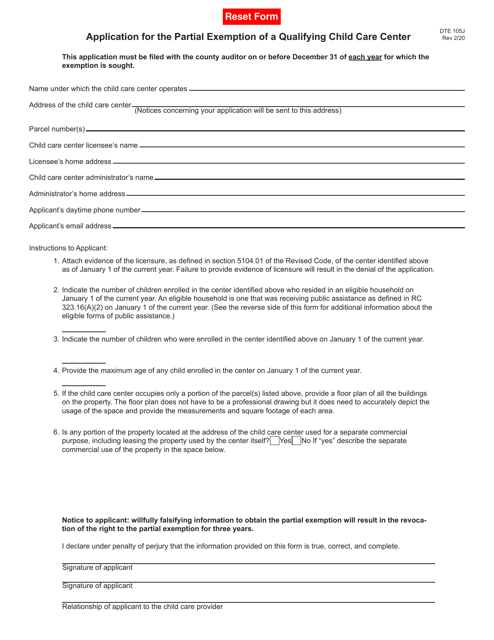

This form is used to apply for a partial exemption for a qualifying child care center in Ohio.

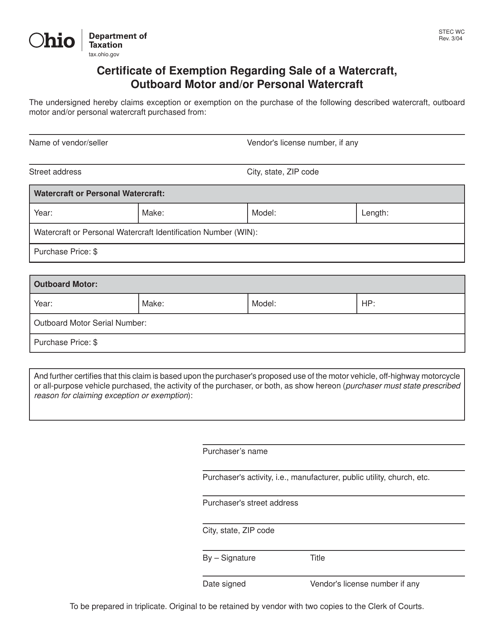

This form is used for obtaining a Certificate of Exemption regarding the sale of a watercraft, outboard motor, and/or personal watercraft in Ohio. It is required when a transaction meets certain criteria that exempt it from sales and use tax.

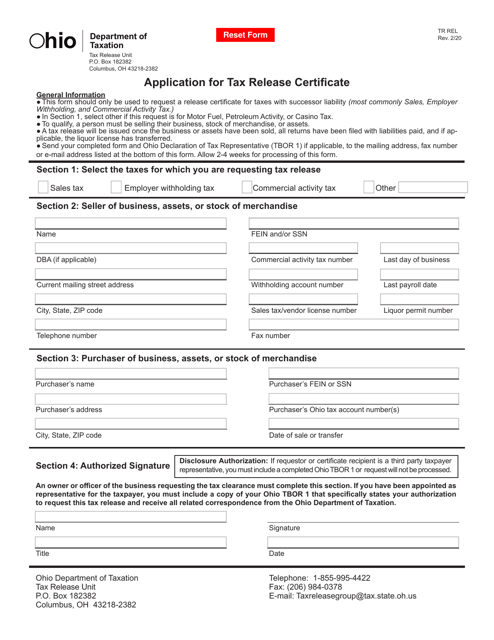

This form is used for acquiring a tax release certificate in Ohio. It helps individuals to request the release of their tax liabilities.

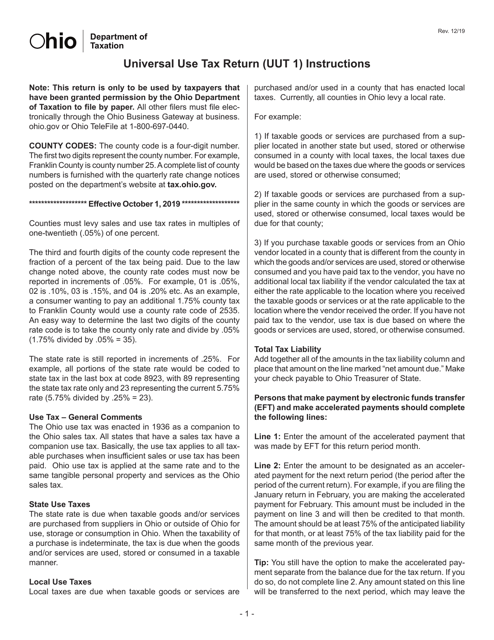

This Form is used for filing the Universal Use Tax Return in the state of Ohio. It provides instructions on how to report and pay use taxes for out-of-state purchases made by individuals or businesses.

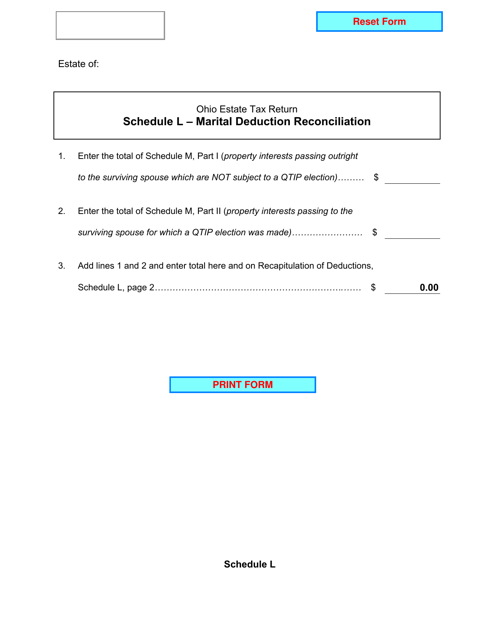

This document is used for reconciling the marital deduction in Ohio for tax purposes.

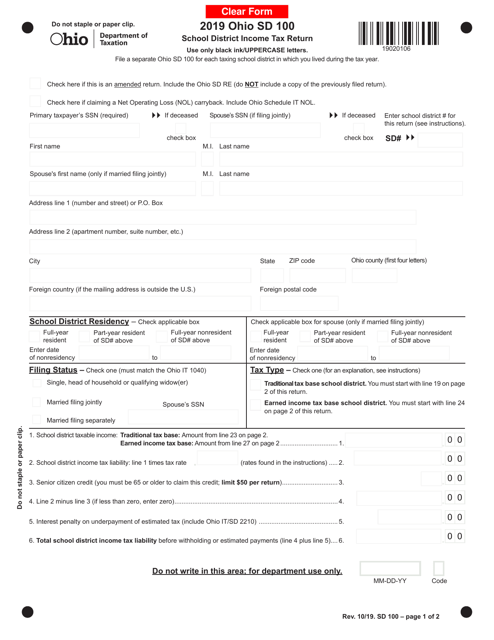

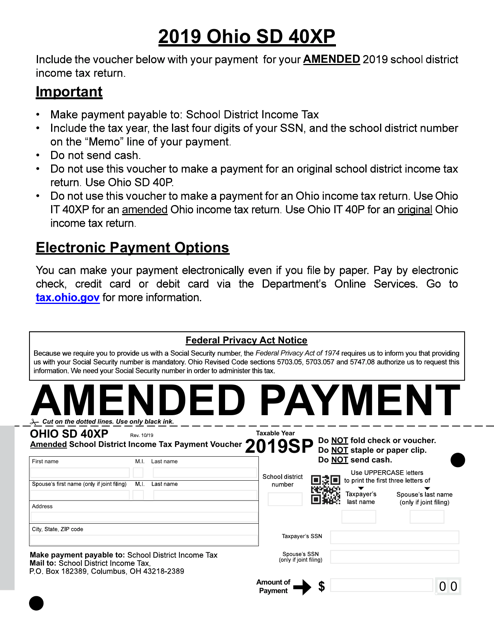

This form is used for making amended school district income tax payments in Ohio.

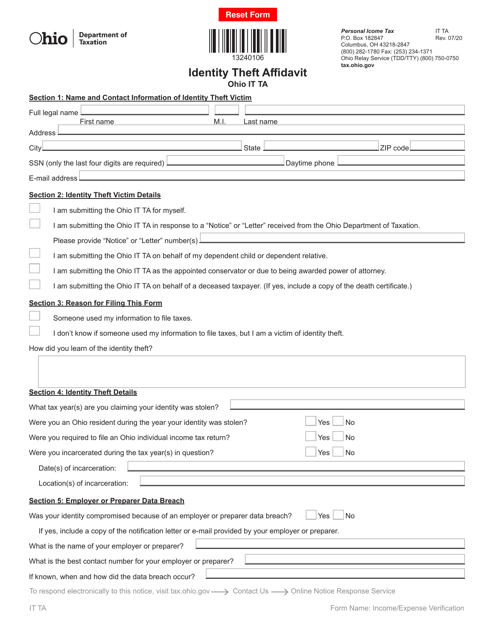

This document is used for reporting identity theft incidents in the state of Ohio. It helps victims provide necessary information to law enforcement and financial institutions.

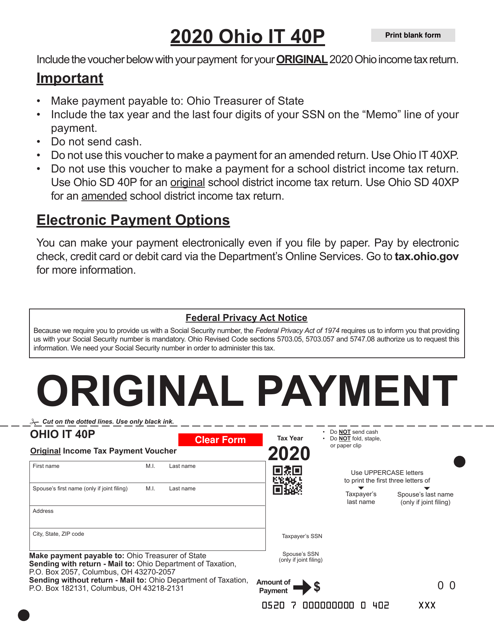

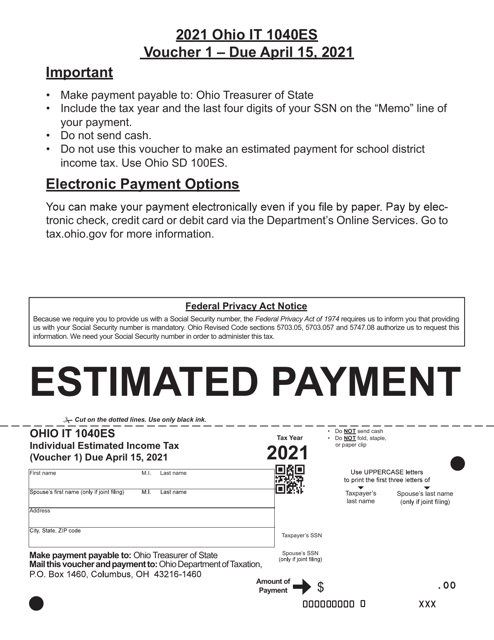

This document is used for making estimated income tax payments for individuals in the state of Ohio.

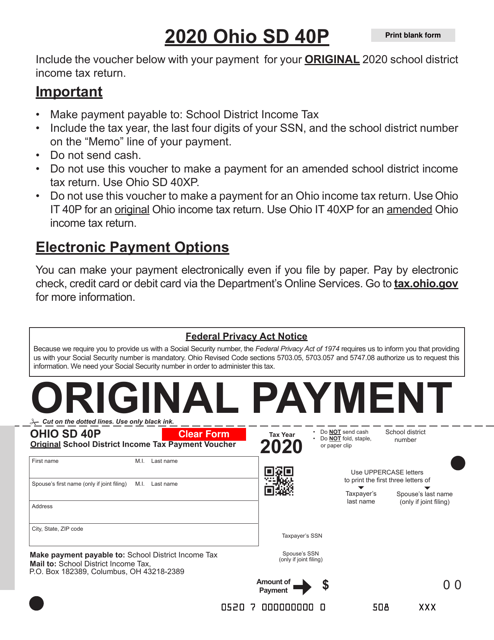

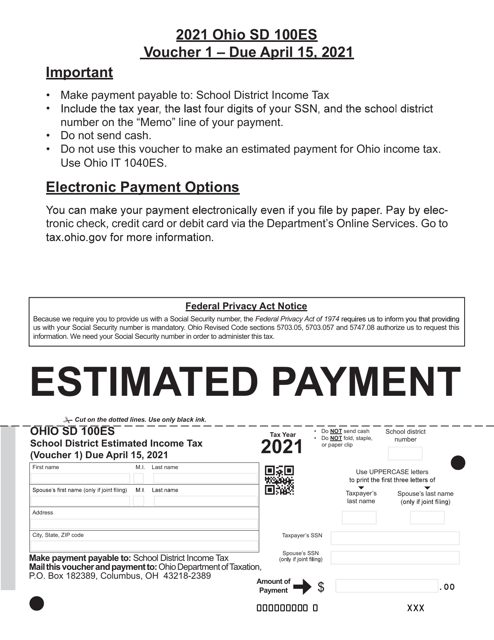

This Form is used for Ohio school district residents to submit their estimated income tax payments.

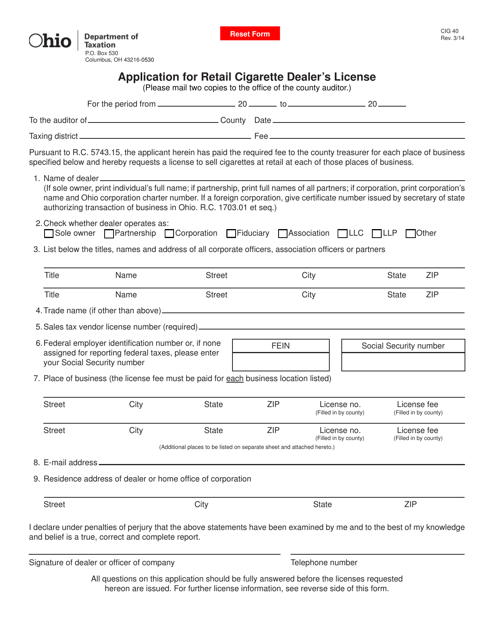

This Form is used for applying for a retail cigarette dealer's license in Ohio. It is required for businesses that sell cigarettes to the public.

This form is used for electing pass-through entity income tax return in the state of Ohio.