Ohio Department of Taxation Forms

Documents:

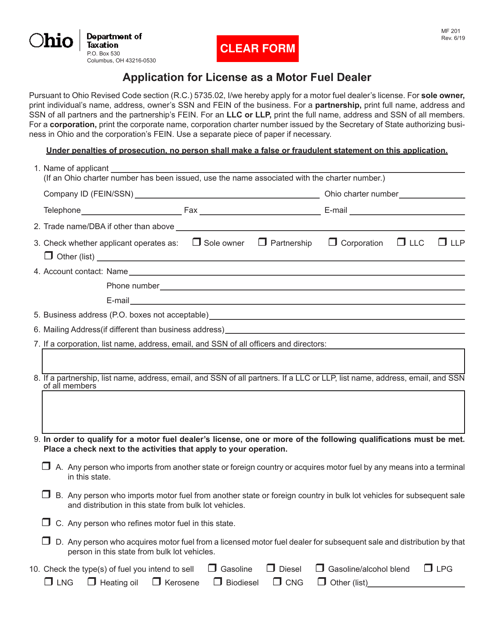

402

Form OTP10 Other Tobacco Products Schedule D - Tobacco Products Destroyed With Prior Approval - Ohio

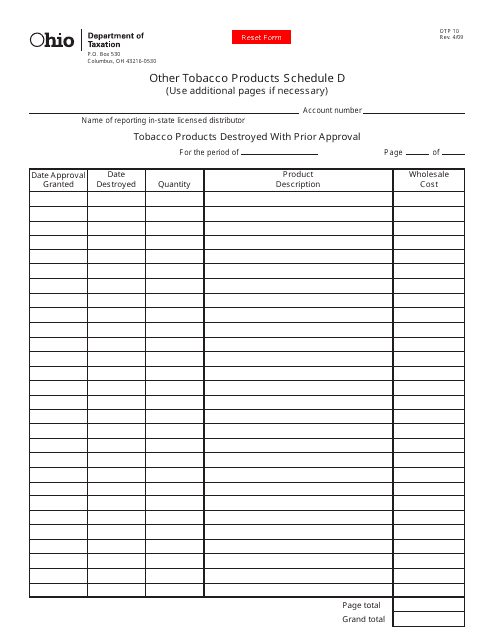

This Form is used for reporting tobacco products that have been destroyed with prior approval in the state of Ohio.

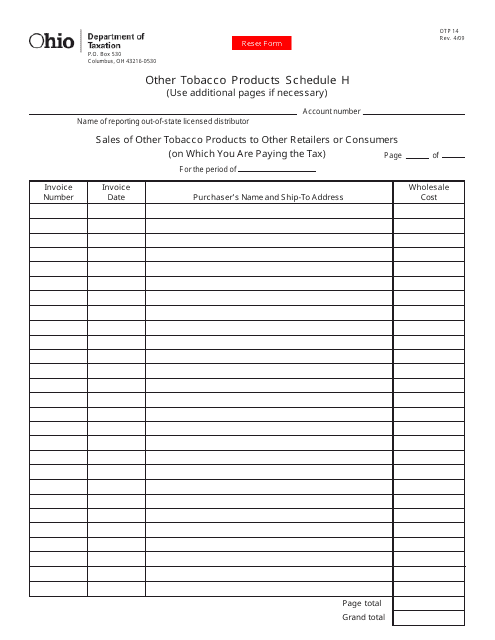

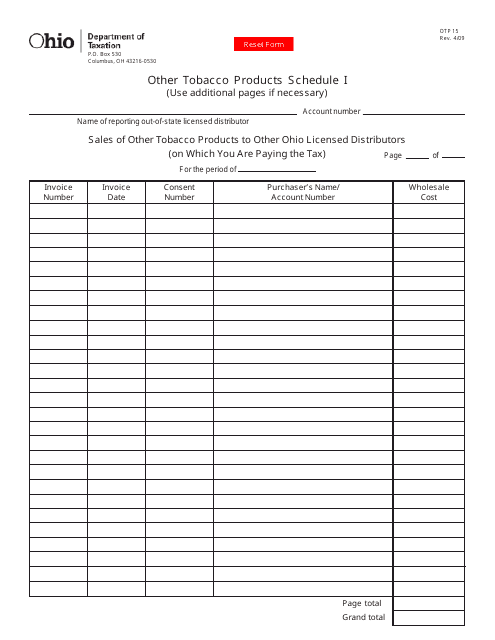

This document form is used for reporting sales of other tobacco products to other retailers or consumers in Ohio, on which you are paying the tax.

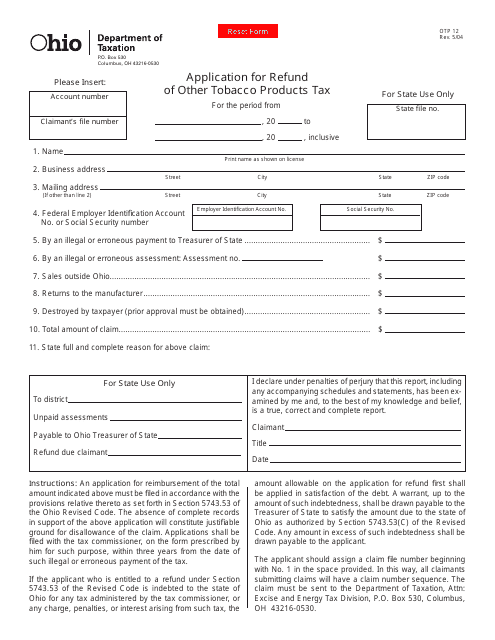

This form is used for applying for a refund of Other Tobacco Products Tax in the state of Ohio.

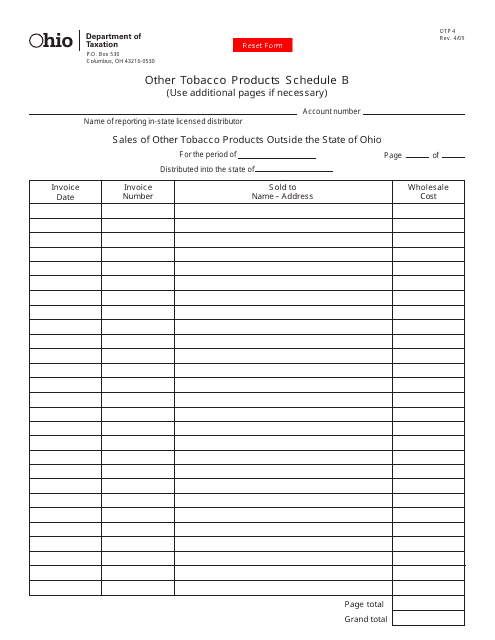

This form is used for reporting the sales of other tobacco products outside the state of Ohio. It is specifically designed for businesses located in Ohio.

This form is used for reporting and scheduling other tobacco products in Ohio, as required by law. It is part of the state's efforts to regulate the sale and distribution of tobacco products.

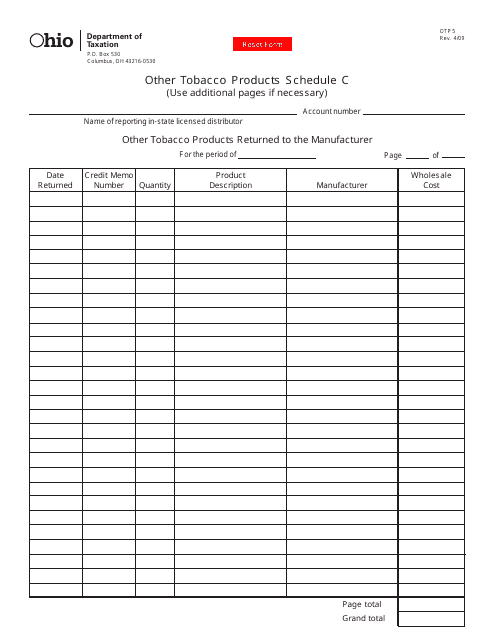

This form is used for reporting other tobacco products sales in Ohio. It is specifically for Schedule C of the OTP5 form.

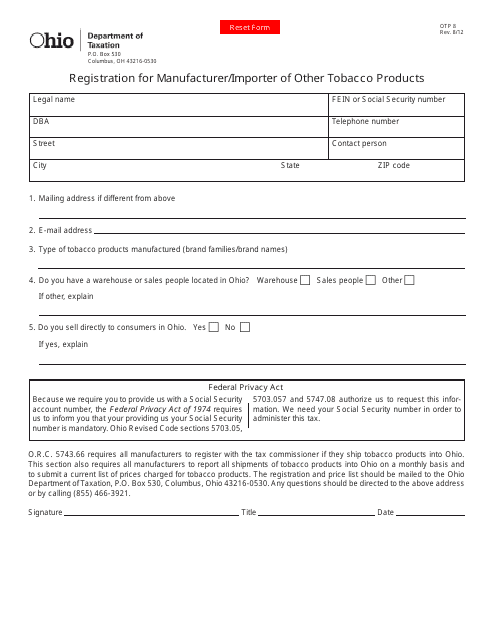

This form is used for registering as a manufacturer or importer of other tobacco products in Ohio.

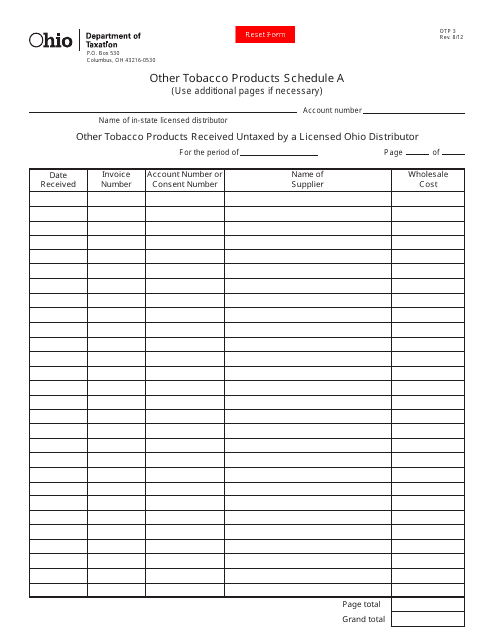

This form is used for reporting other tobacco products received untaxed by a licensed Ohio distributor in Ohio.

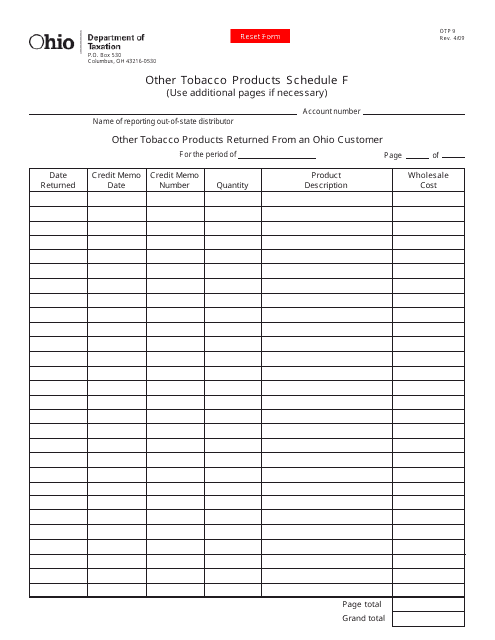

This form is used for reporting other tobacco products that have been returned by an Ohio customer in the state of Ohio.

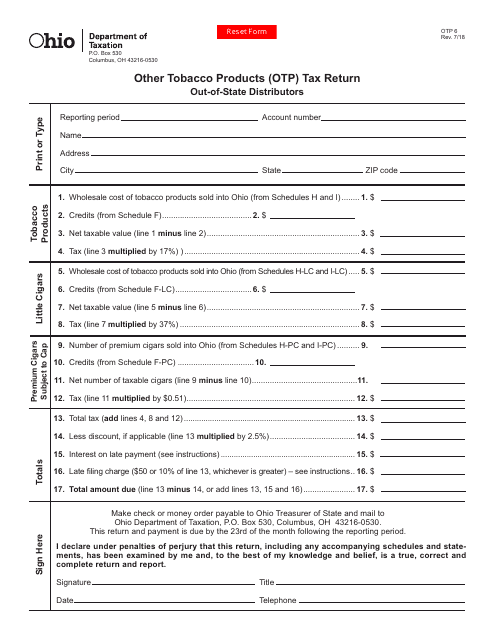

This form is used for reporting and paying taxes on other tobacco products in the state of Ohio.

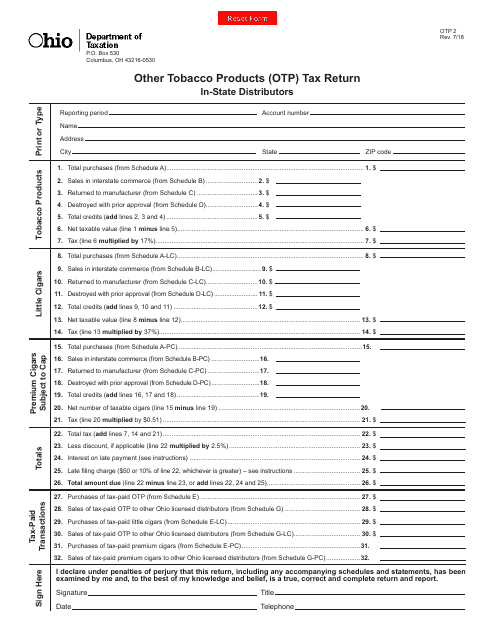

This Form is used for in-state distributors in Ohio to file their Other Tobacco Products (OTP) Tax Return.

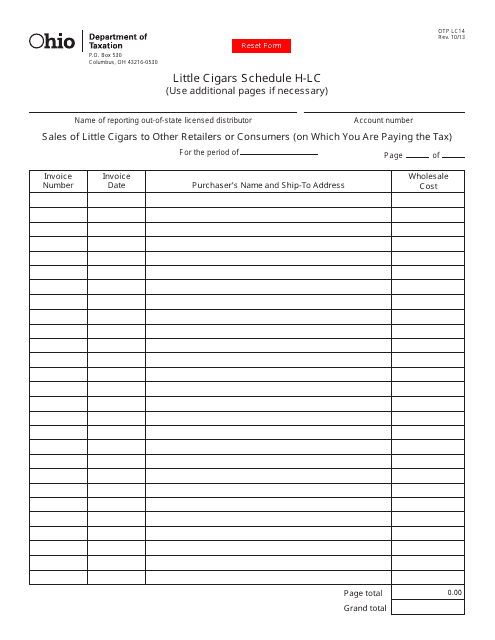

This Form is used for reporting sales of little cigars to other retailers or consumers in Ohio on which you are paying the tax.

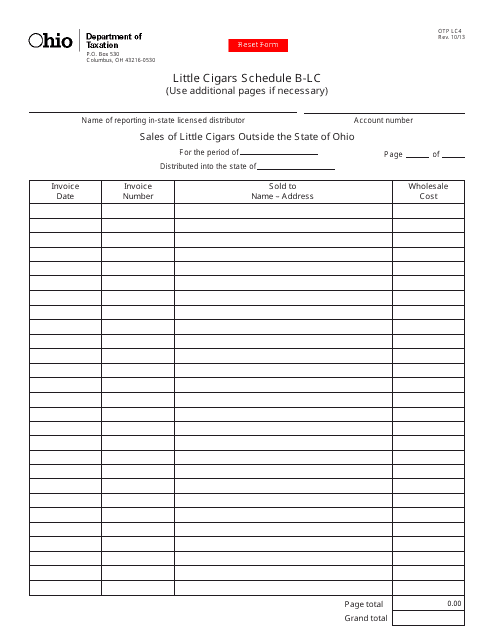

This Form is used for reporting the sales of little cigars outside the state of Ohio in Ohio.

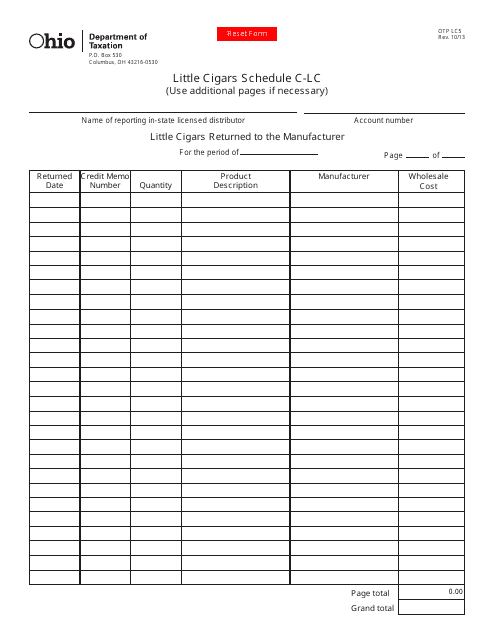

This Form is used for reporting the return of Little Cigars to the manufacturer in Ohio.

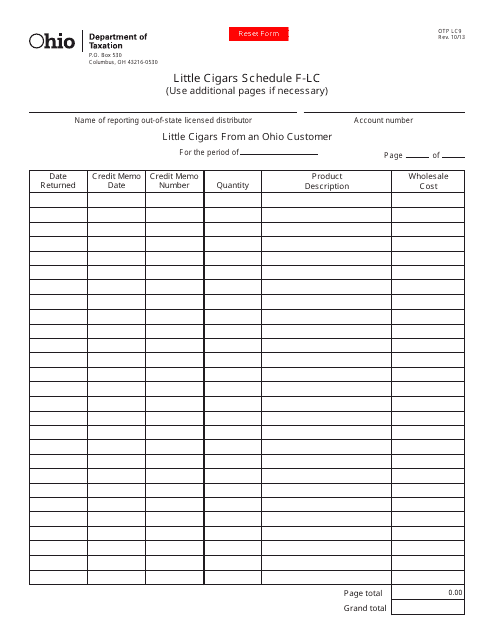

This Form is used for reporting little cigars purchased by an Ohio customer in Ohio.

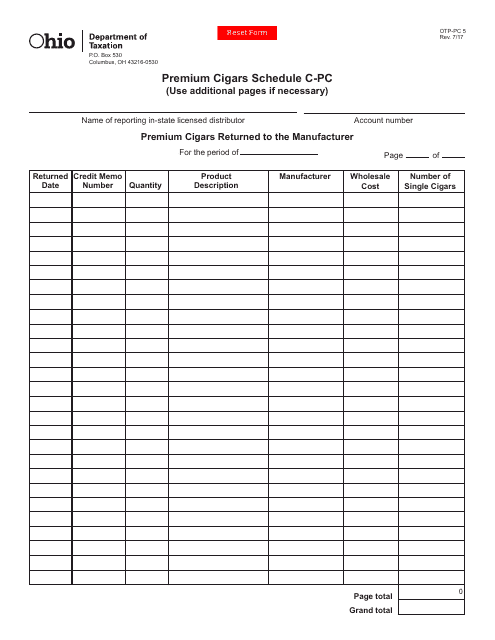

This form is used for reporting the return of premium cigars to the manufacturer in Ohio.

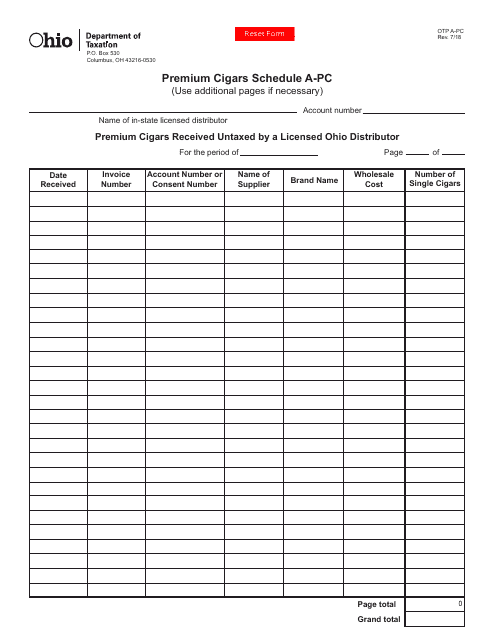

This form is used for reporting premium cigars received untaxed by a licensed Ohio distributor in Ohio.

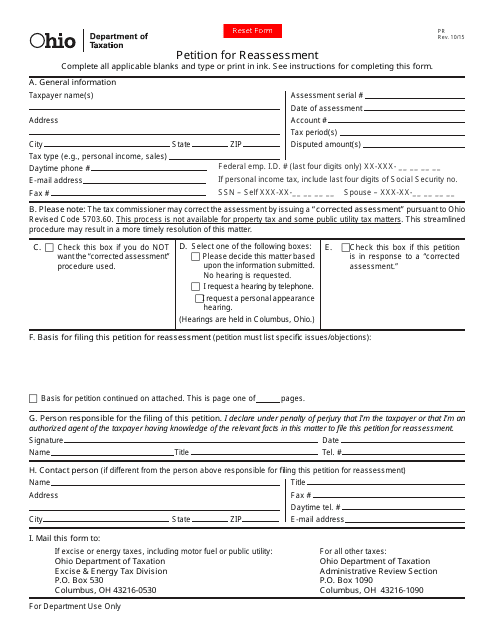

This document is a form used for petitioning for reassessment of property taxes in the state of Ohio.

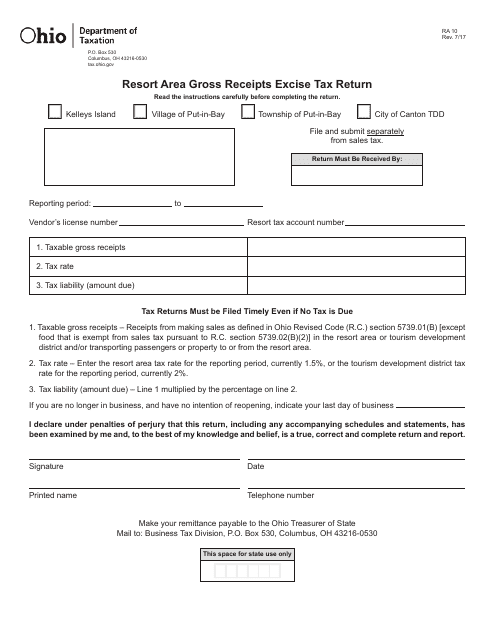

This form is used for reporting and paying the Resort Area Gross Receipts Excise Tax in Ohio.

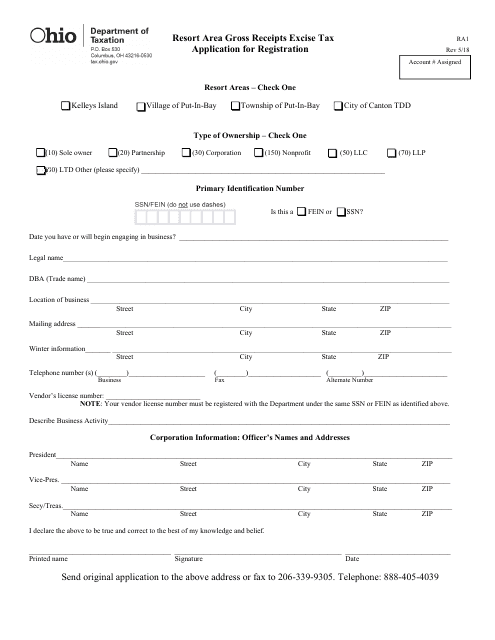

This Form is used for applying for registration and reporting gross receipts excise tax in the resort areas of Ohio.

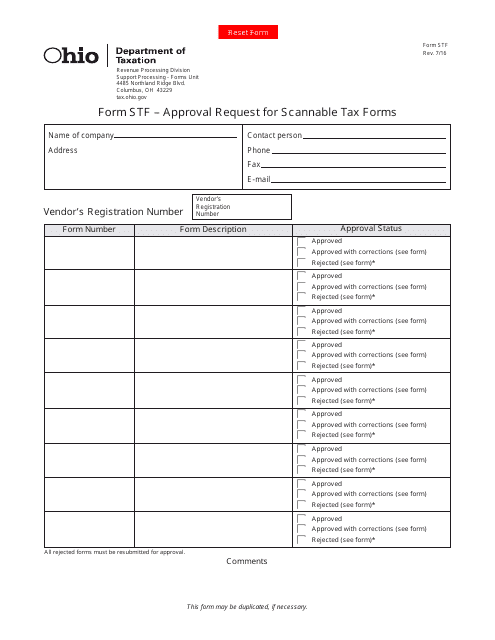

This Form is used for requesting approval to use scannable tax forms in Ohio.

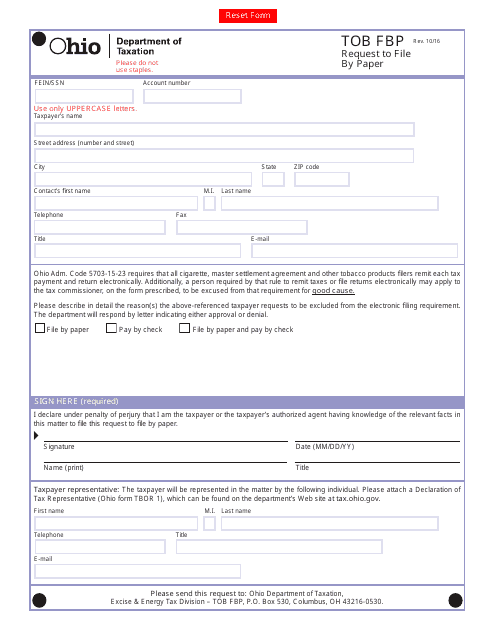

This Form is used for requesting to file the Ohio TOB FBP by paper instead of electronically.

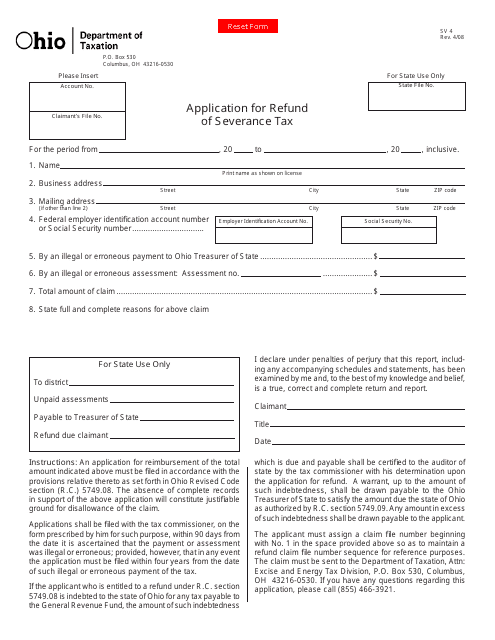

This Form is used for applying for a refund of severance tax in the state of Ohio.

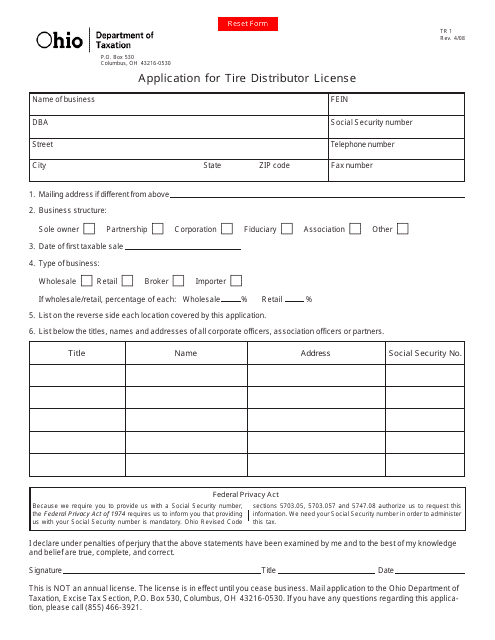

This form is used for applying for a Tire Distributor License in Ohio.

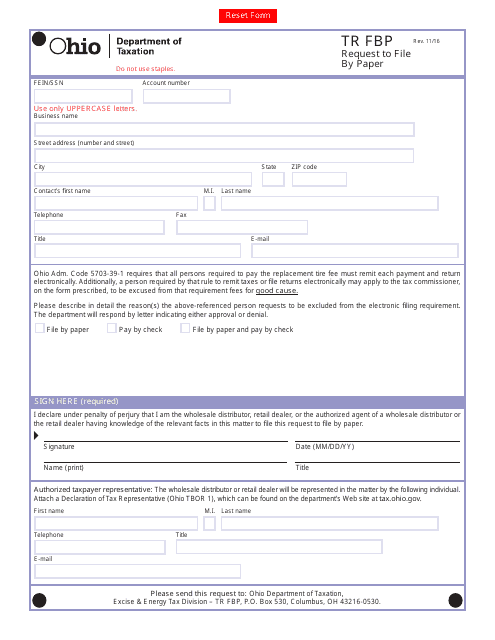

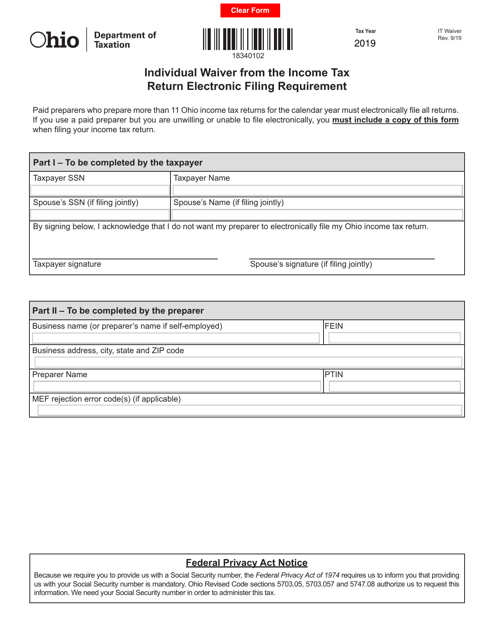

This Form is used for requesting to file Ohio taxes by paper instead of electronically.

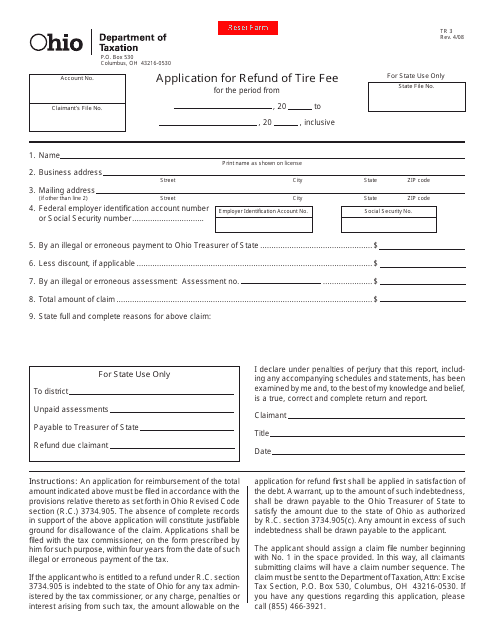

This form is used for applying for a refund of the tire fee in Ohio.

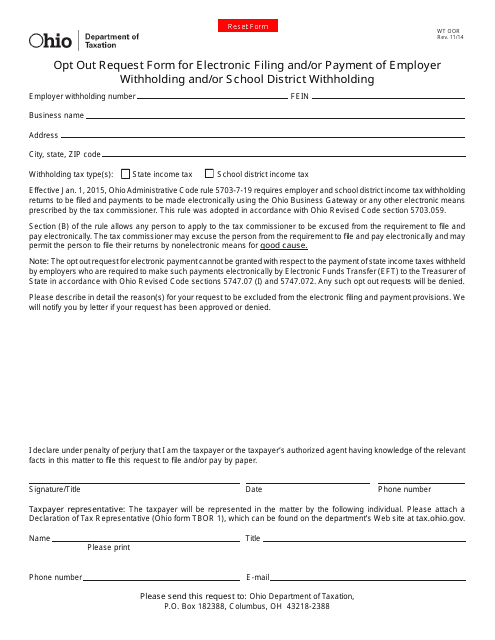

This form is used for requesting to opt out of electronic filing and/or payment of employer withholding and/or school district withholding in Ohio.

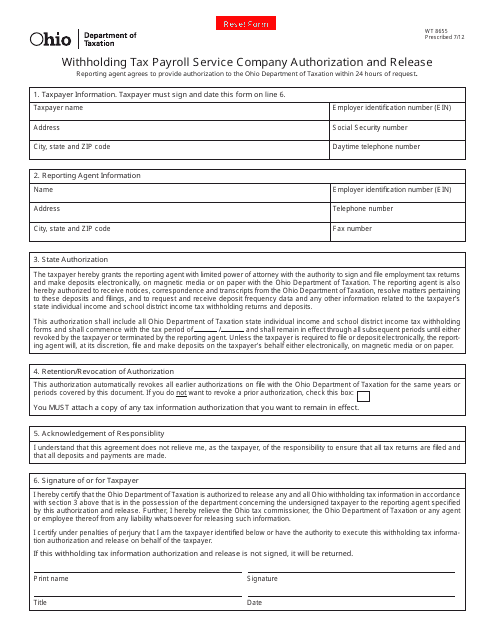

This form is used for authorizing a payroll service company to withhold tax payments on behalf of an employer in Ohio.

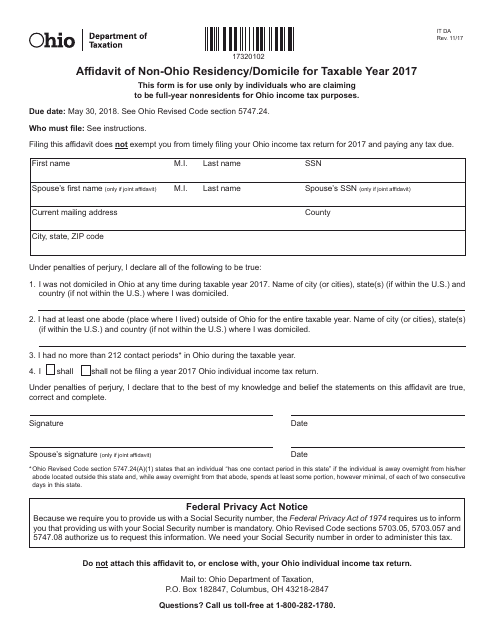

This form is used for declaring non-Ohio residency or domicile. It is meant for individuals who are not residents of Ohio for tax purposes.

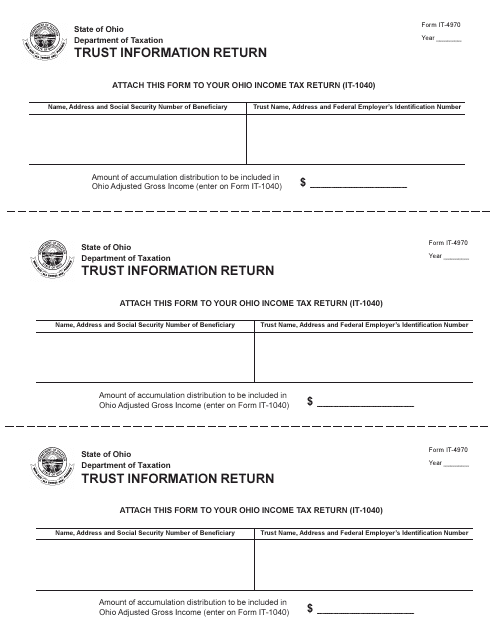

This Form is used for filing the Trust Information Return in the state of Ohio. It is required to report the income, deductions, and credits of a trust for tax purposes.

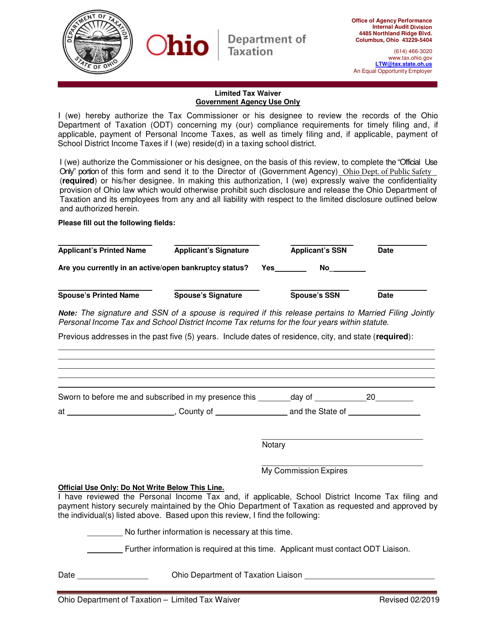

This Form is used for applying for a limited tax waiver in the state of Ohio. It allows individuals to request an exemption or reduction in their taxes for a specific period or situation.