New York State Department of Taxation and Finance Forms

Documents:

2566

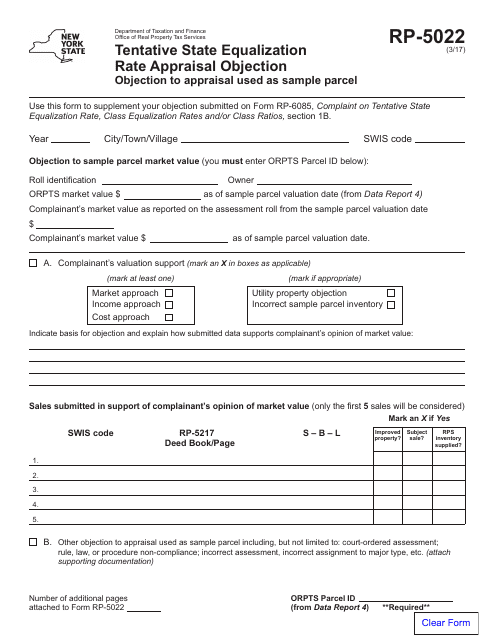

This form is used for filing an objection to the tentative state equalization rate in New York. It allows property owners to challenge the assessed value of their property for tax purposes.

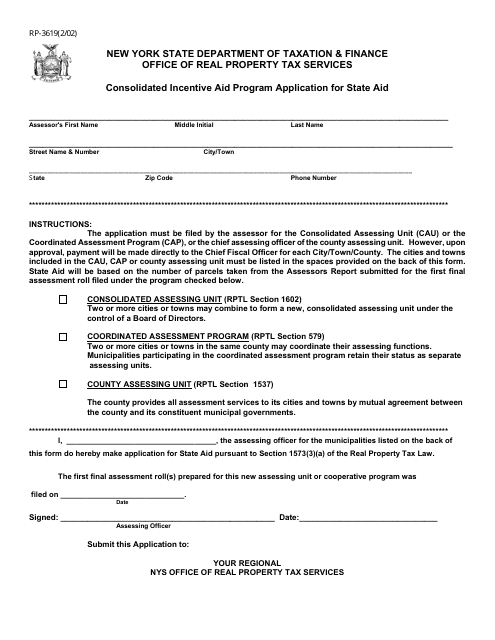

This form is used for applying for the Consolidated Incentive Aid Program in the state of New York. It is a program that provides financial assistance to eligible individuals or organizations for various purposes.

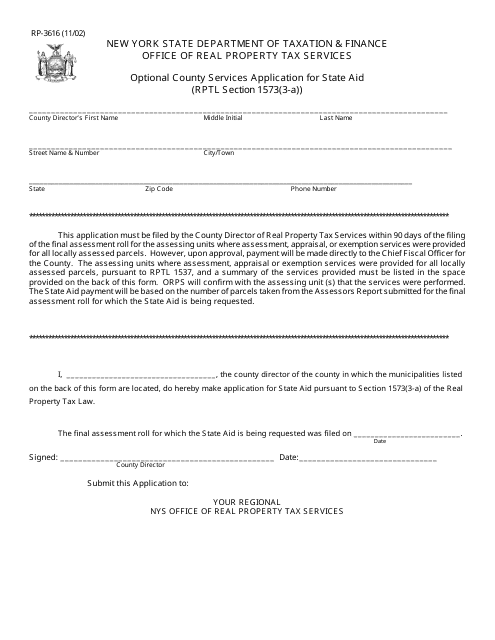

This Form is used for applying for optional county services state aid in New York.

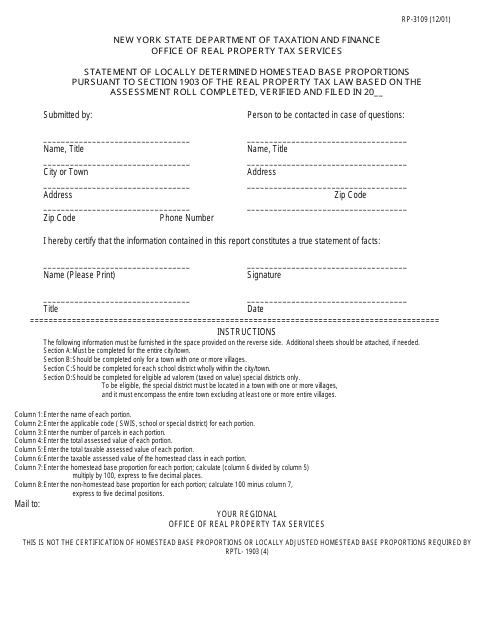

This form is used for reporting the locally determined homestead base proportions in New York. It is used to calculate property taxes based on the assessed value of a home.

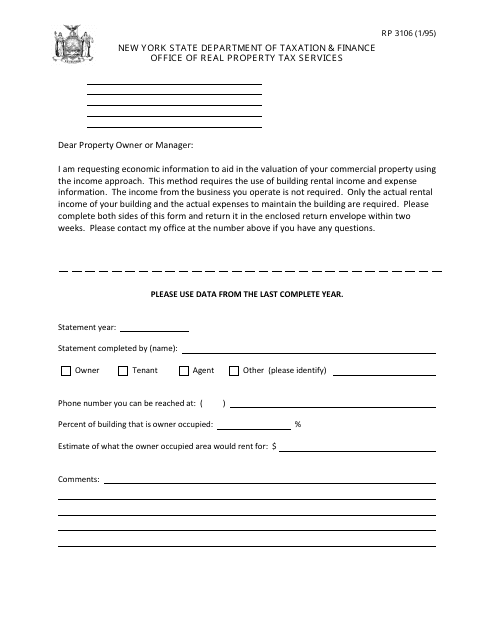

This form is used for collecting economic information to help assess the value of commercial property in New York.

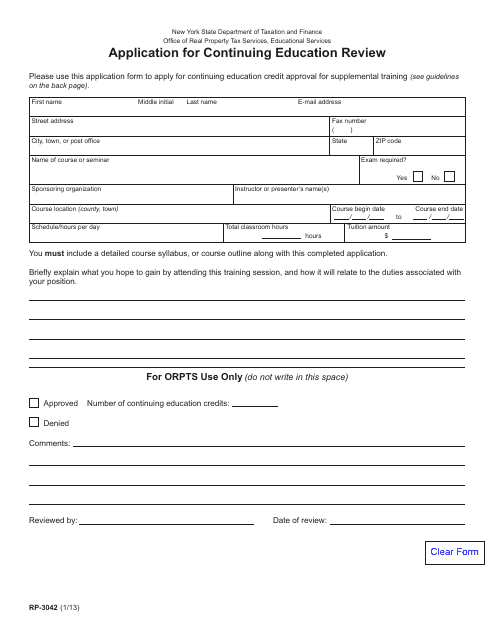

This form is used for New York residents who want to apply for a review of their continuing education credits.

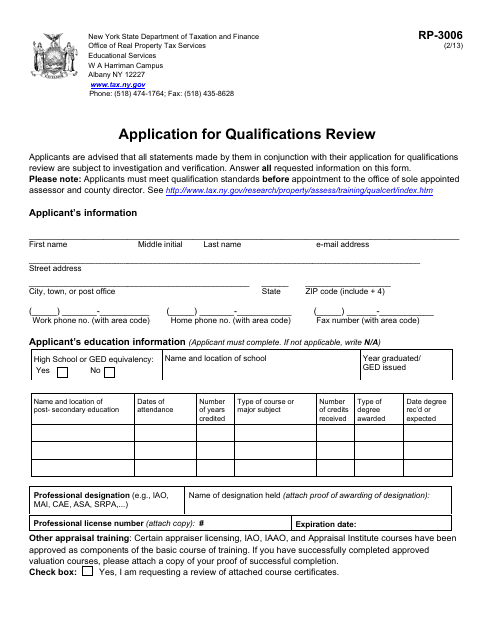

This Form is used for applying for a qualifications review in the state of New York.

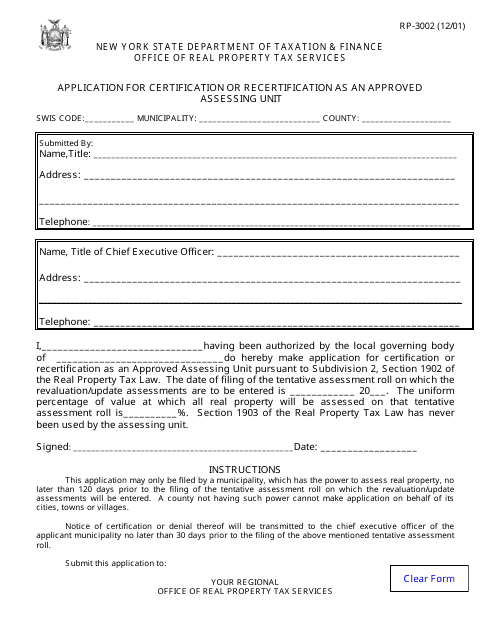

This form is used for applying or renewing certification as an approved assessing unit in New York.

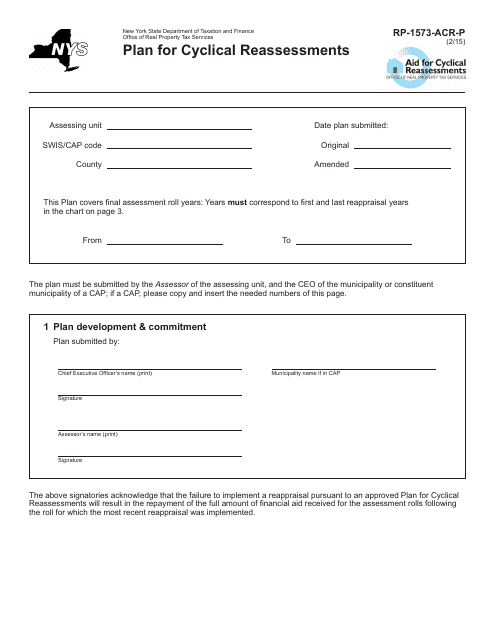

This form is used for creating a plan for cyclical reassessments in the state of New York.

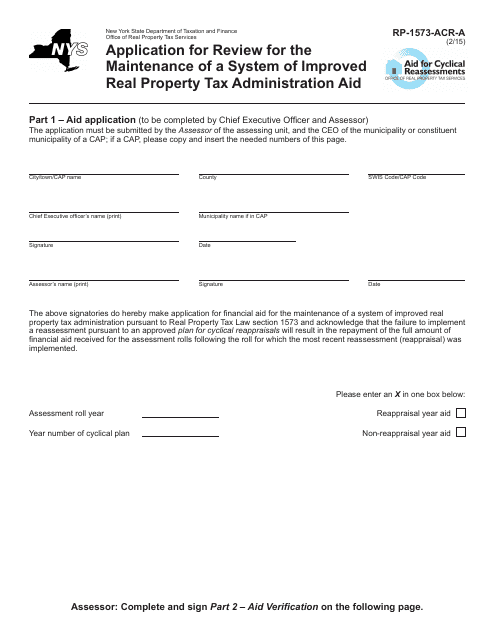

This form is used for applying for a review of the maintenance of a system of improved real property tax administration aid in New York.

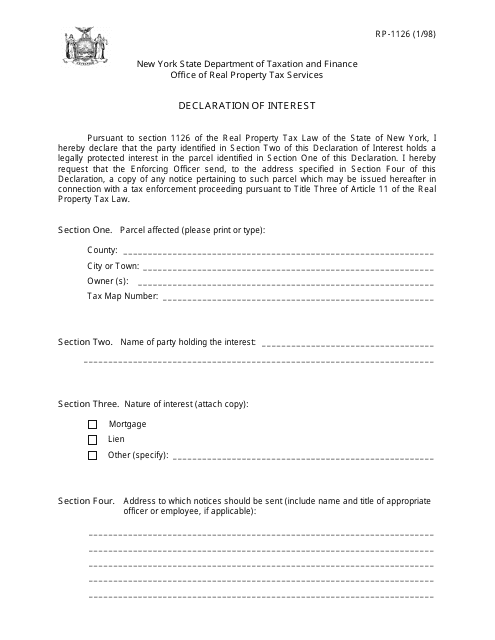

This form is used for declaring your financial interest in a property or business in the state of New York.

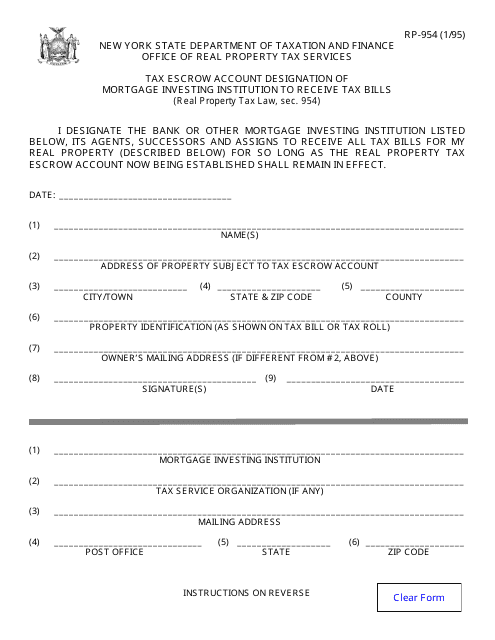

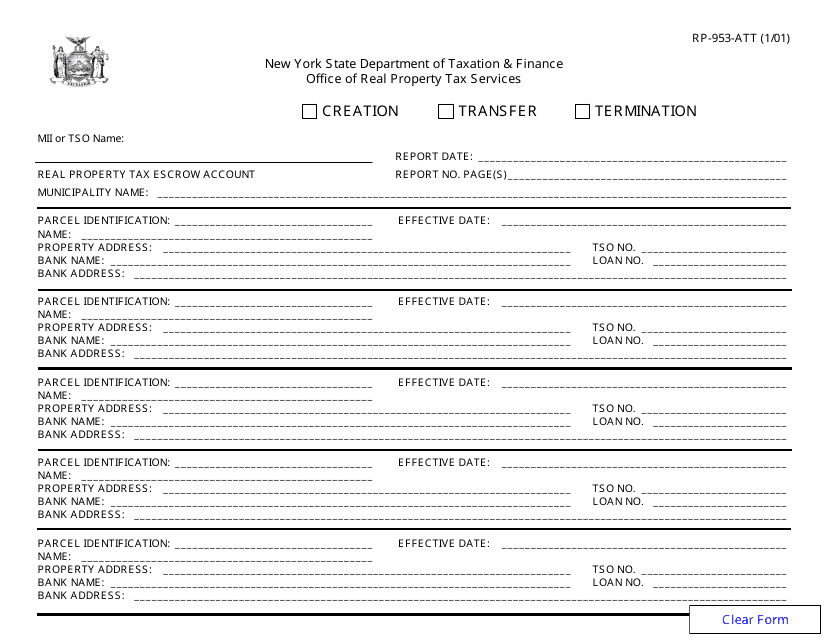

This document is used for designating a specific mortgage institution to receive tax bills for a tax escrow account in New York.

This form is used for creating a list of properties that are affected by a specific event or regulation in the state of New York. It helps to keep track of the properties that may be impacted and gather important information about them.

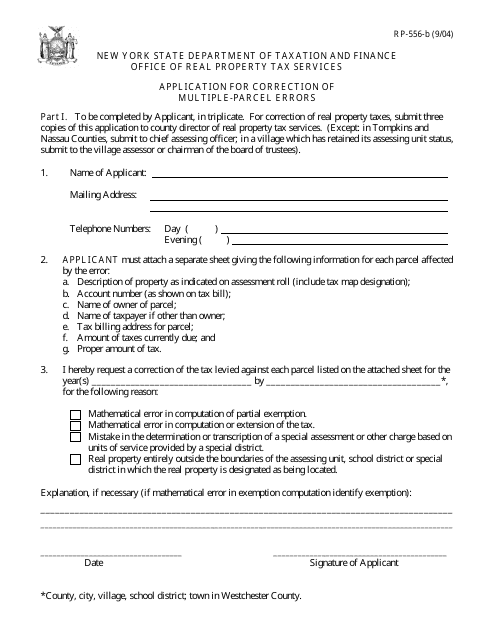

This form is used for requesting a correction of errors that involve multiple parcels of land in New York. It is necessary when there are inaccuracies or mistakes in the records related to multiple parcels of land.

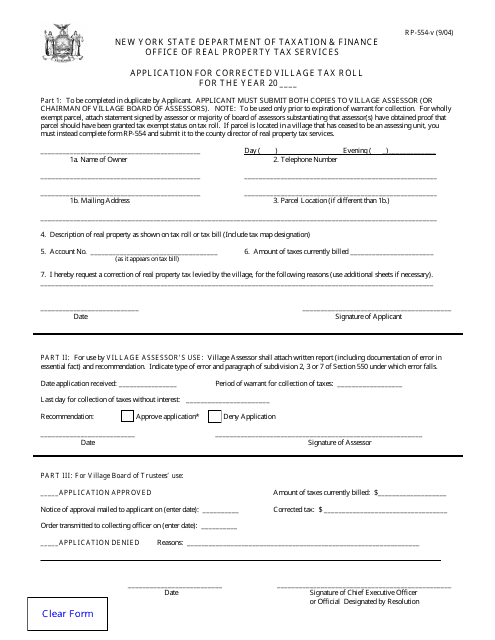

This form is used for submitting an application to correct the village tax roll in the state of New York.

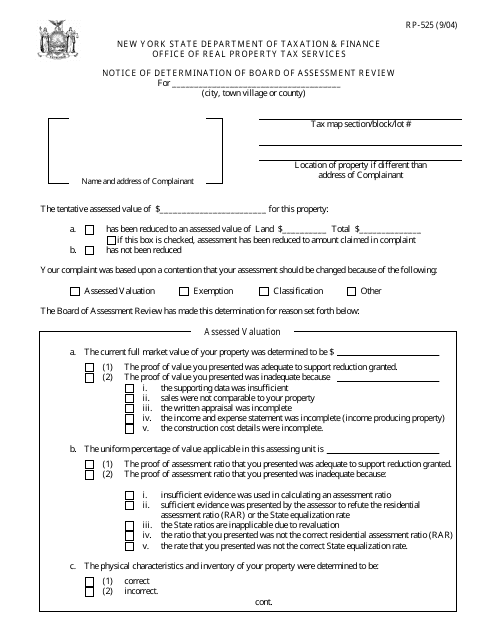

This form is used for notifying property owners in New York about the determination made by the Board of Assessment Review regarding their property assessment.

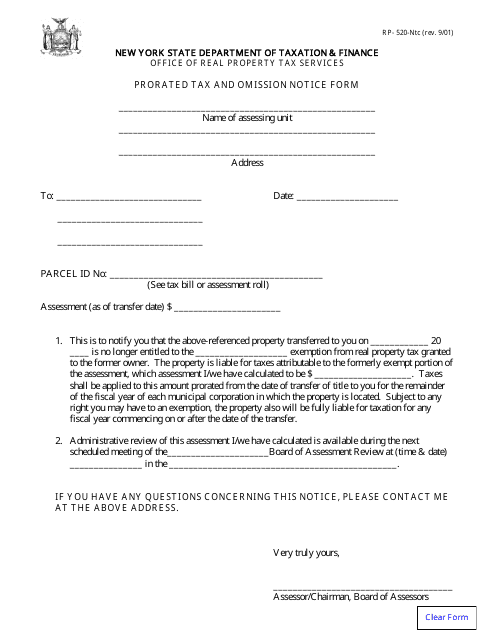

This form is used for submitting a prorated tax and omission notice in the state of New York.

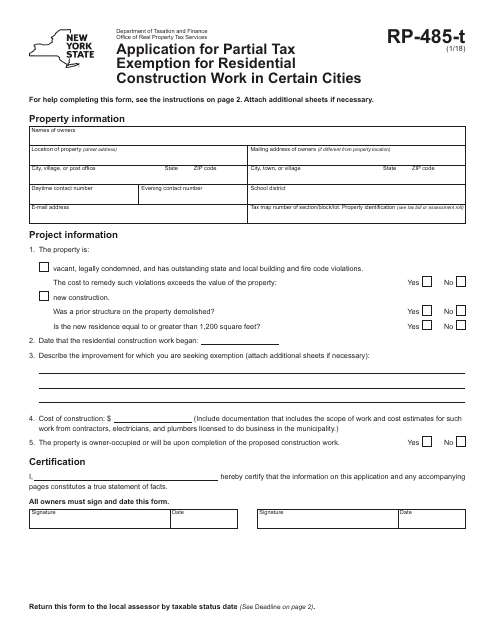

This Form is used for applying for a partial tax exemption for residential construction work in certain cities in New York. It allows individuals or businesses to request a reduction in property taxes for qualified construction projects.

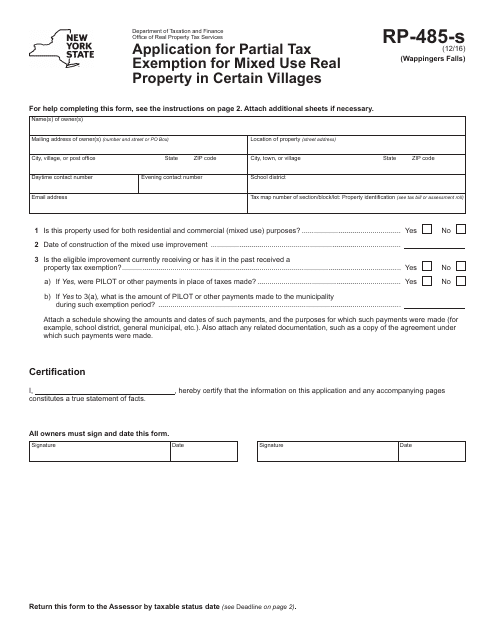

This form is used for applying for a partial tax exemption for mixed-use real property in certain villages, specifically the Village of Wappingers Falls, New York.

This form is used for applying for a residential investment real property tax exemption in certain school districts within the City of Utica, New York.

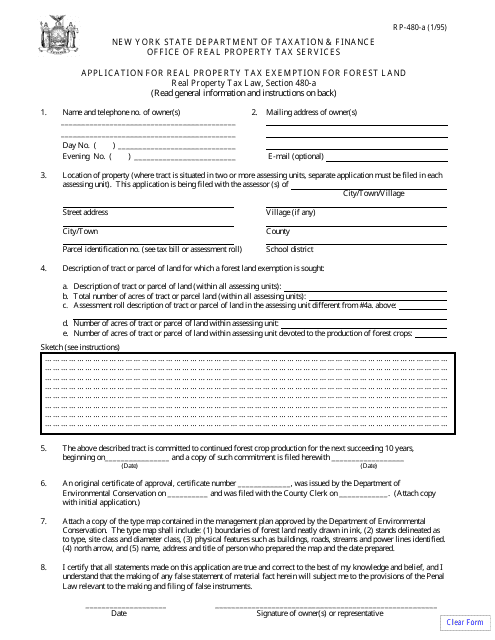

This Form is used for applying for a real property tax exemption for forest land in New York. It allows landowners to request a reduction in property taxes for qualifying forested areas.

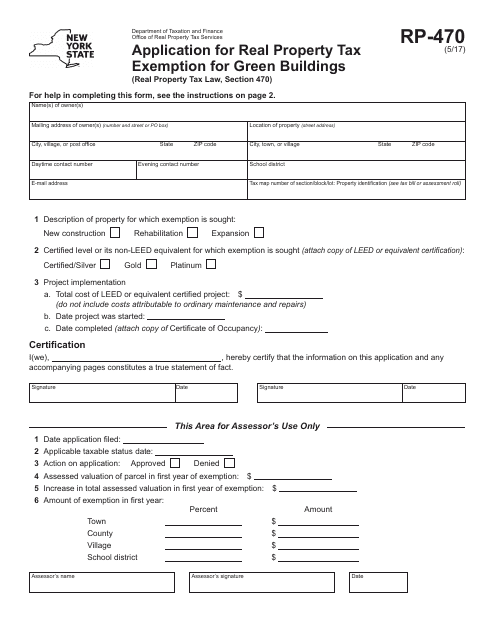

This form is used for applying for a real property tax exemption for green buildings in New York.

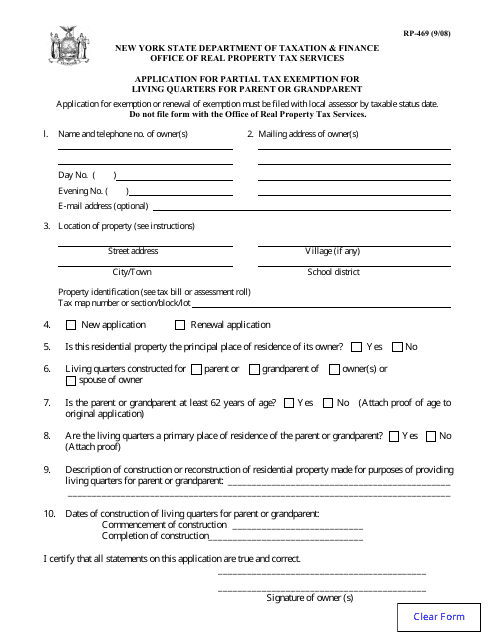

This form is used for applying for a partial tax exemption for living quarters for a parent or grandparent in New York. It allows eligible individuals to reduce their property taxes for housing their elderly family members.

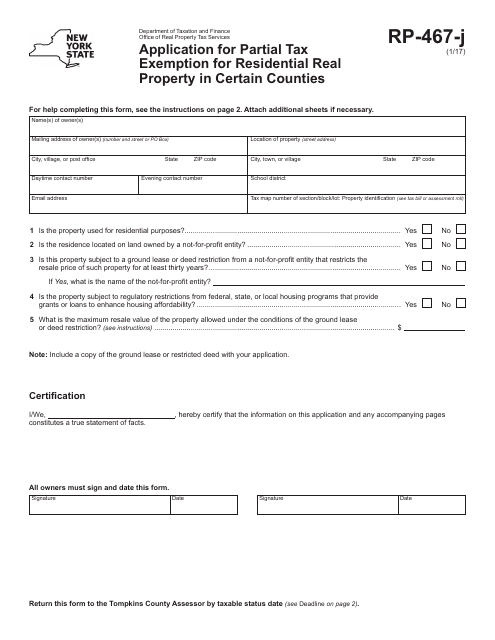

This form is used for applying for a partial tax exemption on residential real property in certain counties in New York.

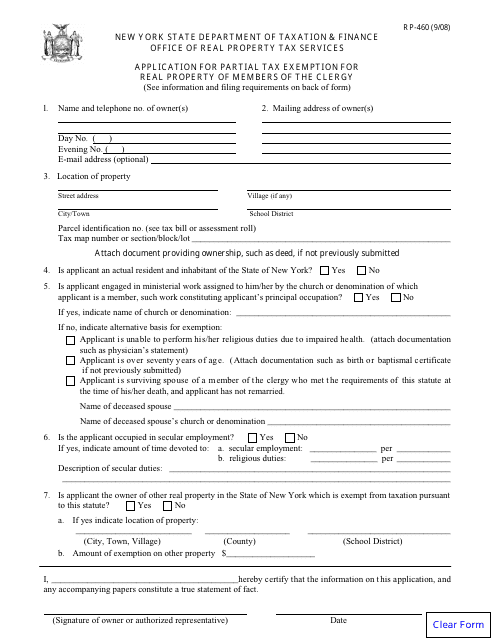

This Form is used for applying for a partial tax exemption on real property for members of the clergy in New York.

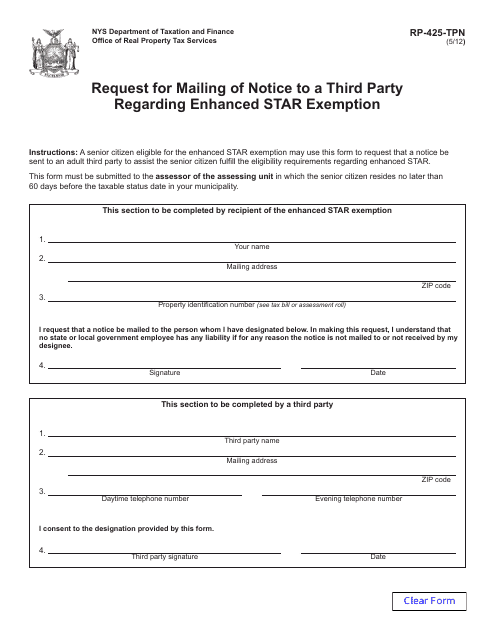

This form is used for requesting the mailing of a notice to a third party regarding the Enhanced Star Exemption in New York.

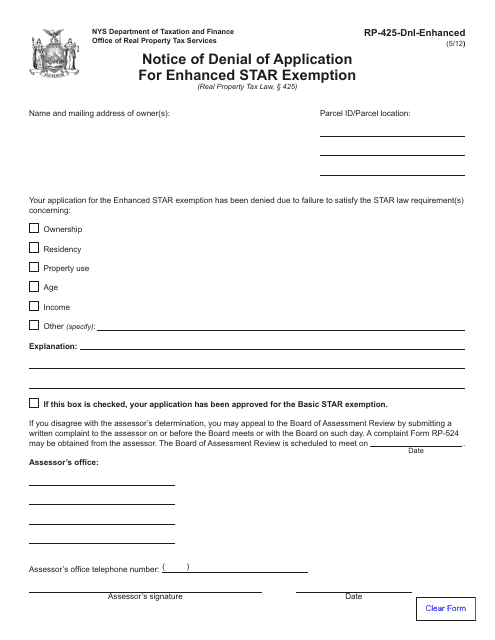

This form is used for notifying residents of New York about the denial of their application for the Enhanced Star Exemption.

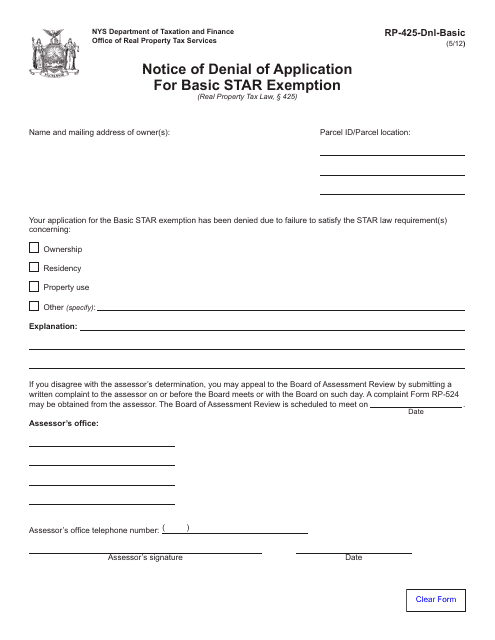

This form is used for notifying individuals in New York that their application for the Basic Star Exemption has been denied.

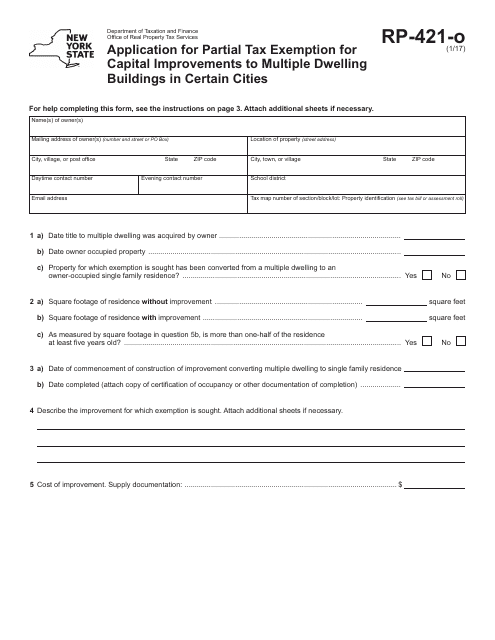

This form is used for applying for a tax exemption for capital improvements made to multiple dwelling buildings in certain cities in New York. It allows property owners to save on their taxes when making qualifying improvements to their buildings.

This Form is used for applying for a real property tax exemption for capital improvements made to multiple dwelling buildings within the City of Oneonta, New York. The form provides instructions on how to complete the application process.

This Form is used for applying for a real property tax exemption for capital improvements to multiple dwelling buildings within the City of Oneonta, New York.

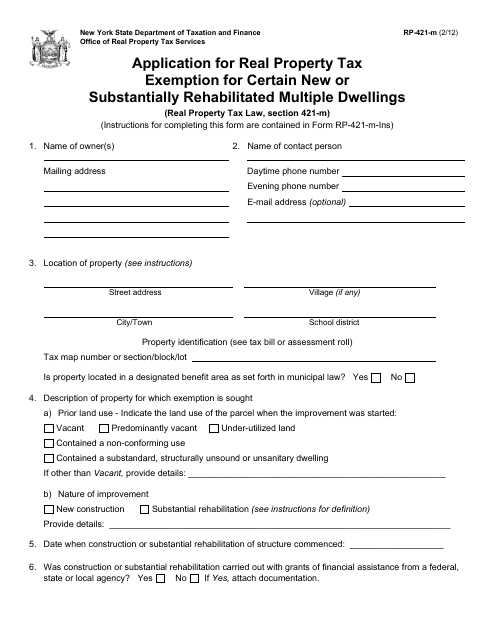

This form is used for applying for a real property tax exemption in New York for certain new or substantially rehabilitated multiple dwellings.

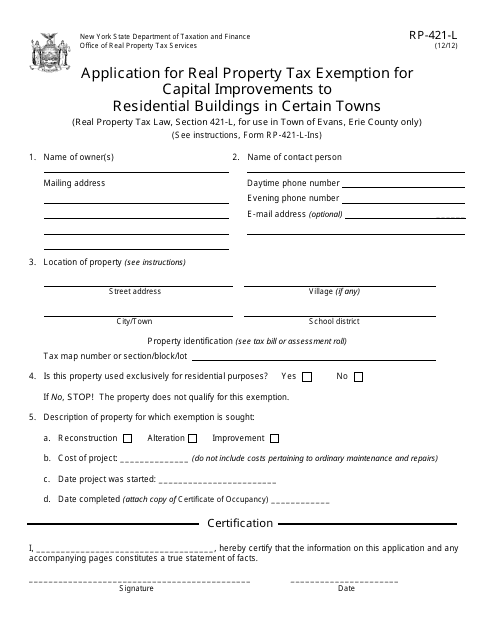

This form is used for applying for a real property tax exemption for capital improvements made to residential buildings in certain towns, specifically the Town of Evans, New York.

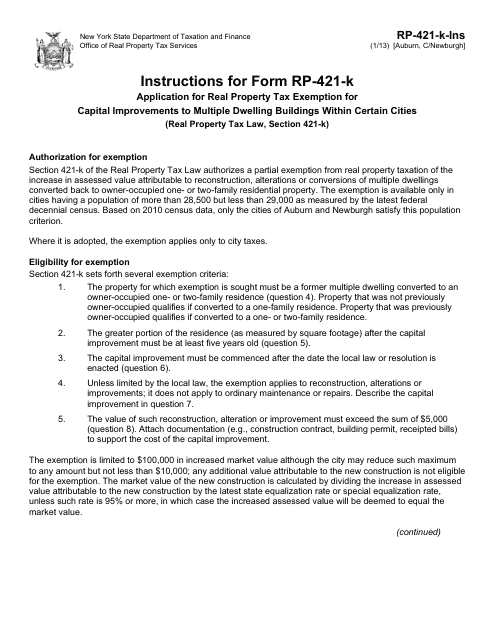

This document is used for applying for a real property tax exemption for capital improvements to multiple dwelling buildings in certain cities in New York, including Auburn and Newburgh. It provides instructions on how to fill out Form RP-421-K.

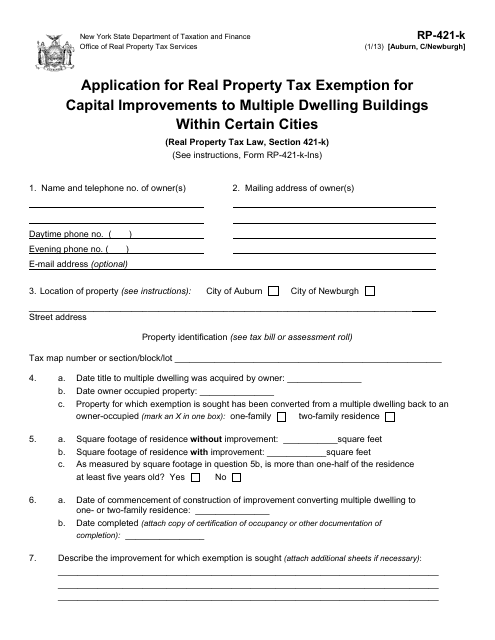

This form is used for applying for a real property tax exemption for capital improvements made to multiple dwelling buildings in certain cities in New York, specifically Auburn and Newburgh.

This form is used for applying for a capital investment tax exemption on multiple dwellings in the City of Niagara Falls, New York.

![Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/form-rp-485-k-utica-sd-application-for-residential-investment-real-property-tax-exemption-certain-school-districts-city-of-utica-new-york_big.png)

![Instructions for Form RP-421-N [ONEONTA] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Oneonta, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349853/instruction-for-form-rp-421-n-oneonta-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-oneonta-new-york_big.png)

![Form RP-421-N [ONEONTA] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Oneonta, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349854/form-rp-421-n-oneonta-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-oneonta-new-york_big.png)

![Form RP-421-J [NIAGARA FALLS] Application for Capital Investment in Multiple Dwellings Real Property Tax Exemption; Certain Cities - City of Niagara Falls, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349861/form-rp-421-j-niagara-falls-application-for-capital-investment-in-multiple-dwellings-real-property-tax-exemption-certain-cities-city-of-niagara-falls-new-york_big.png)