New York State Department of Taxation and Finance Forms

The New York State Department of Taxation and Finance is responsible for administering and enforcing various tax laws in the state of New York. Its primary role is to collect and manage taxes, including income tax, sales tax, property tax, and business taxes. The department also provides taxpayer assistance and education, processes tax returns and refunds, and conducts audits to ensure compliance with tax regulations.

Documents:

2566

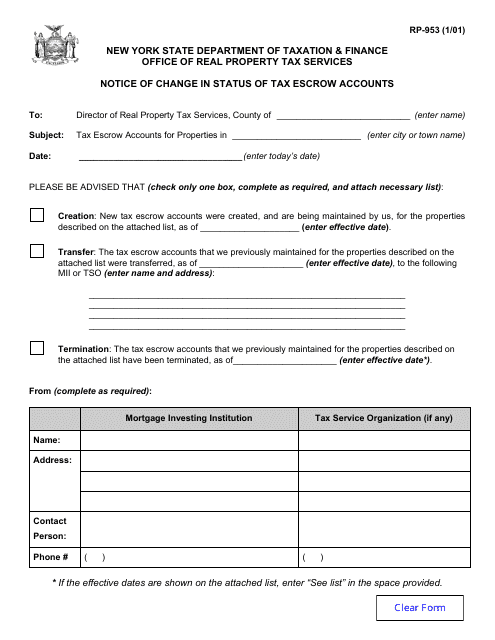

This form is used for notifying the change in status of tax escrow accounts in New York.

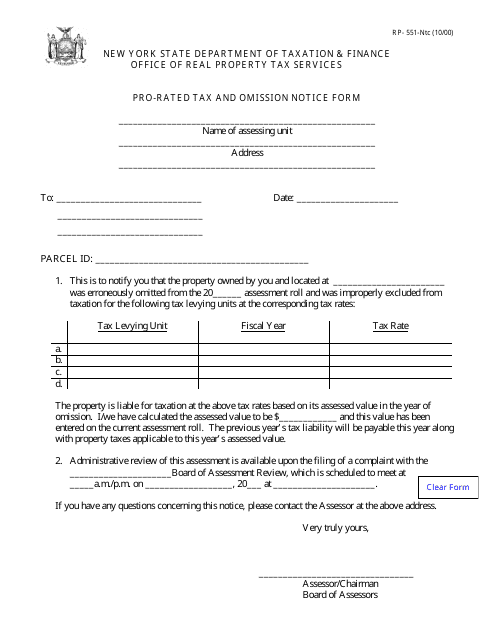

This form is used for notifying the New York State Department of Taxation and Finance about pro-rated taxes and omissions.

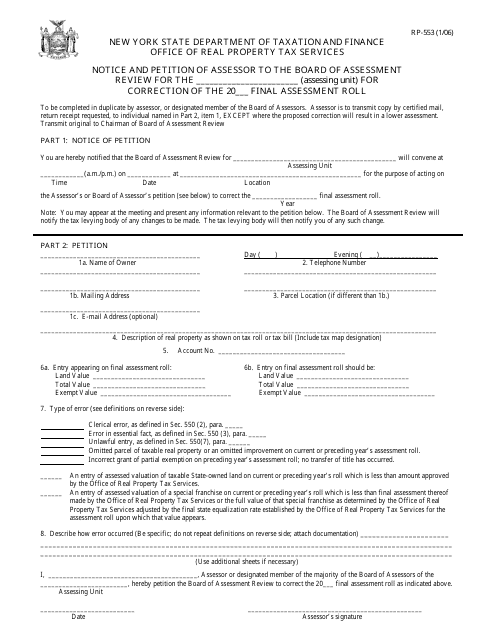

This form is used for taxpayers in New York to file a notice and petition with the Board of Assessment Review to correct errors on the final assessment roll.

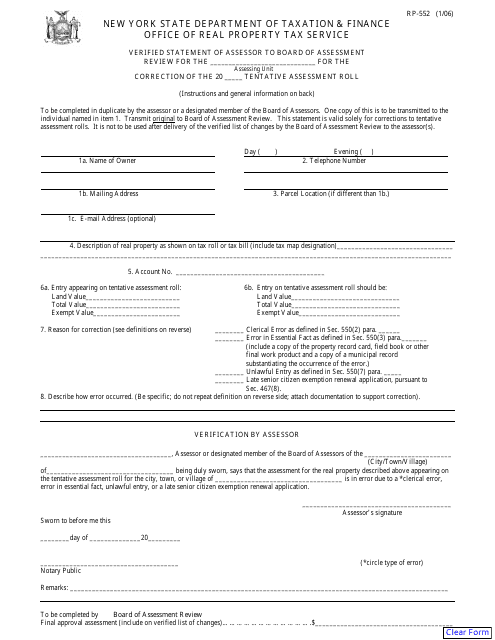

This form is used for the verified statement of the assessor to the Board of Assessment Review in New York. It is to provide accurate and verifiable information regarding assessments.

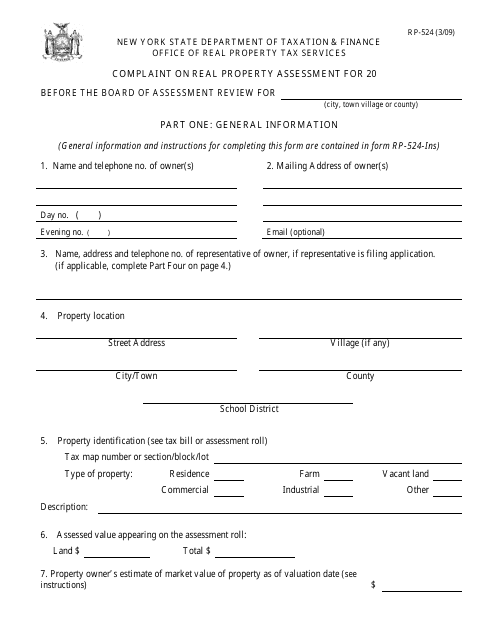

This Form is used for filing a complaint regarding real property assessment in New York. It allows property owners to challenge the assessed value of their property for tax purposes.

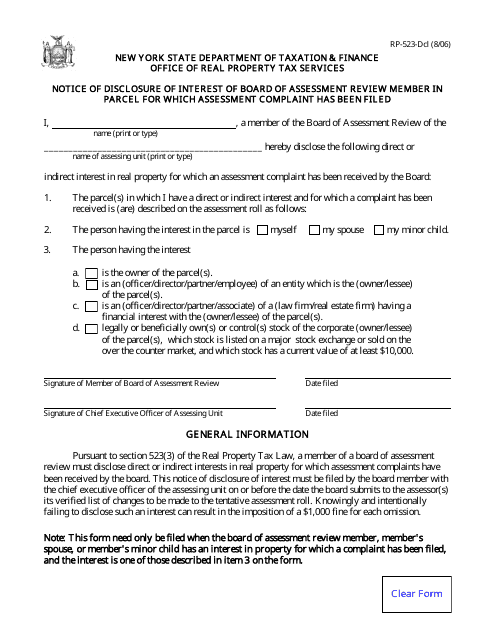

This form is used for notifying the disclosure of the Board of Assessment Review member's interests in a specific parcel of land for which an assessment complaint has been filed in New York.

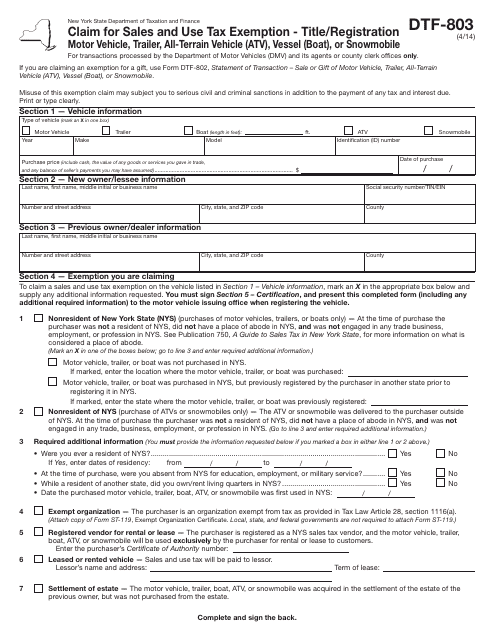

This form is used for claiming sales and use tax exemption when registering a title in New York.

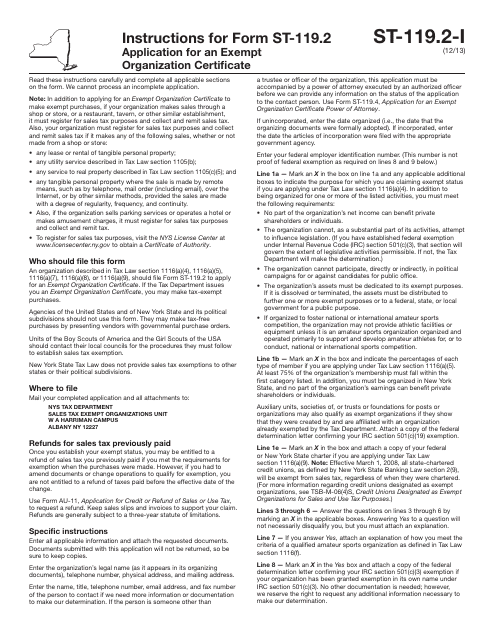

This document is used for applying for an Exempt Organization Certificate in New York.

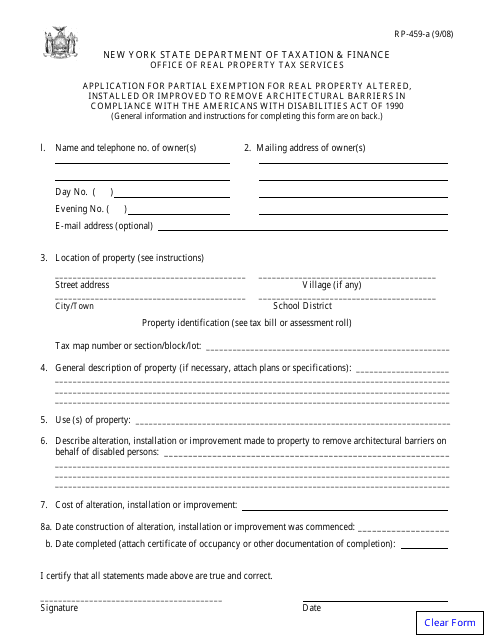

This type of document is used in New York to apply for a partial exemption for real property that has been altered or improved to remove architectural barriers in compliance with the Americans With Disabilities Act of 1990.

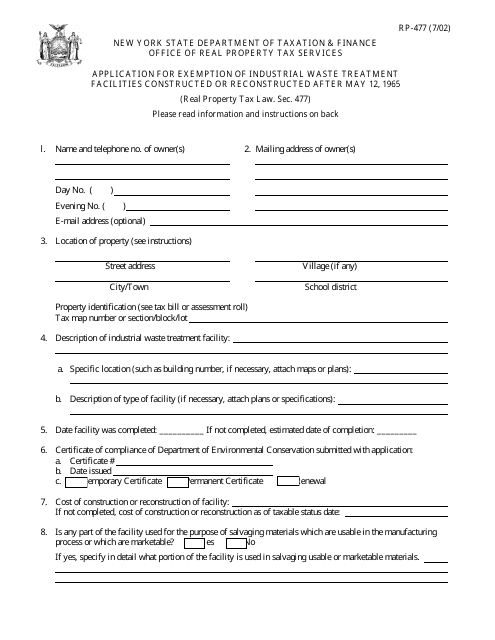

This form is used for applying for an exemption for industrial waste treatment facilities that were constructed or reconstructed after May 12, 1965 in the state of New York.

This Form is used for applying for the Volunteer Firefighters / Ambulance Workers Exemption in Westchester County, New York.

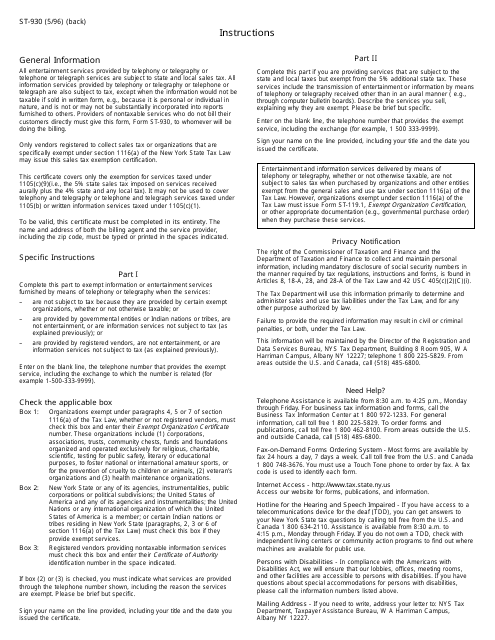

This Form is used to certify the tax status of information or entertainment services provided through telephony or telegraphy services in New York.

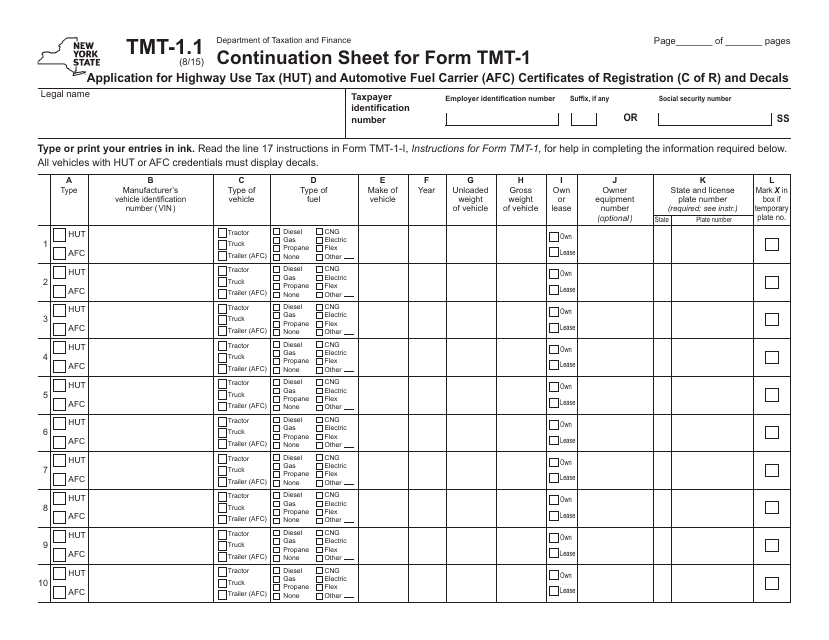

This form is used as a continuation sheet for Form TMT-1, which is an application for Highway Use Tax (HUT) and Automotive Fuel Carrier (AFC) certificates of registration and decals in the state of New York. It provides additional space to provide more information and details related to the application.

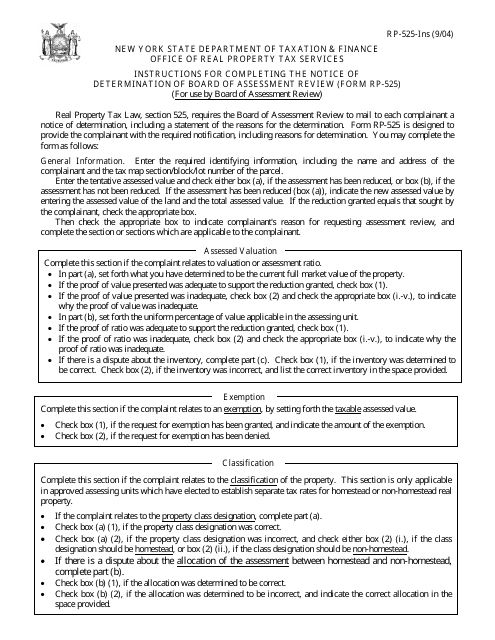

This Form is used for filing a notice of determination by the Board of Assessment Review in New York. It provides instructions on how to complete the form and submit it to the appropriate authorities.

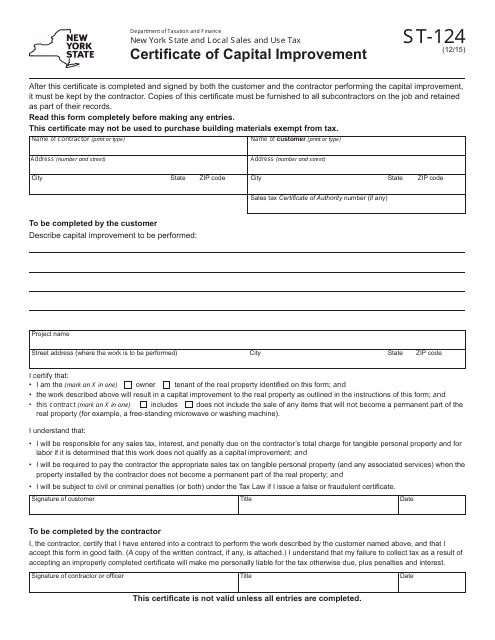

This form is used for certifying capital improvements made in the state of New York.

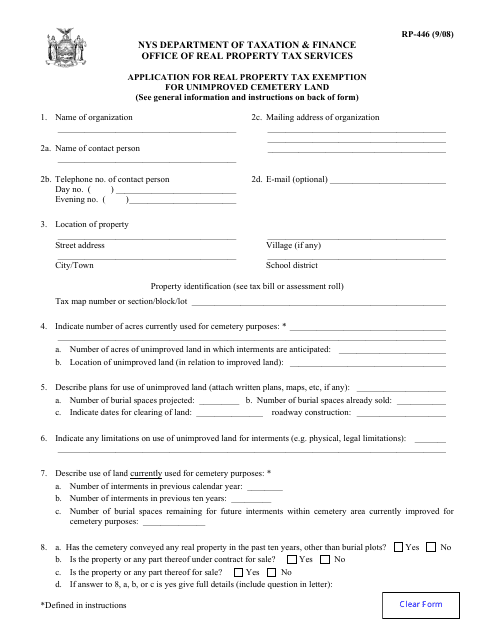

This form is used for applying for a real property tax exemption for unimproved cemetery land in New York.

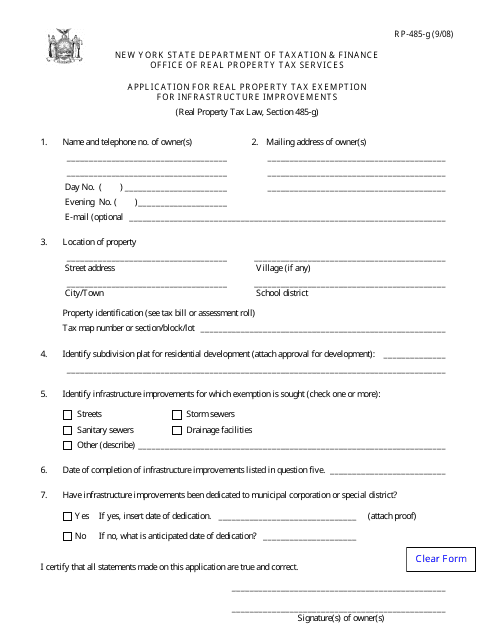

Form RP-485-G Application for Real Property Tax Exemption for Infrastructure Improvements - New York

This Form is used for applying for a real property tax exemption for infrastructure improvements in New York.

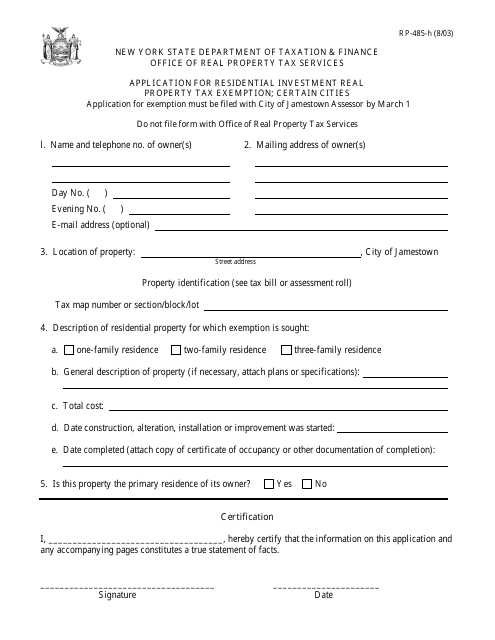

This form is used for applying for a residential investment real property tax exemption in certain cities in New York.

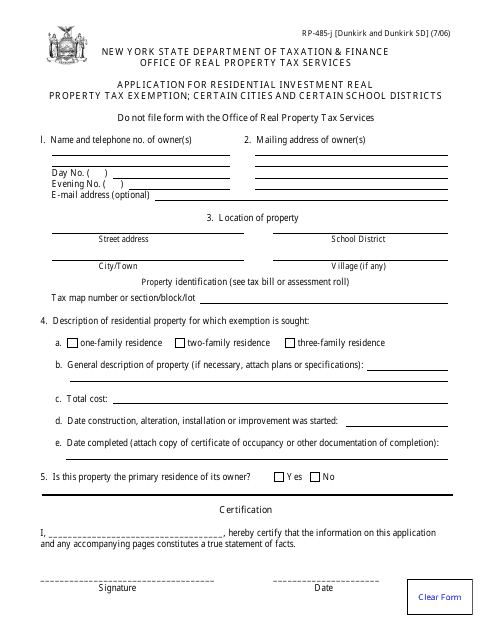

This form is used for applying for a residential investment real property tax exemption in the City of Dunkirk, New York.

This Form is used for applying for a residential investment real property tax exemption in certain school districts in New York, specifically in Jamestown SD.

This document is used for applying for a residential investment real property tax exemption in the City of Amsterdam, New York.

This form is used for applying for a residential investment real property tax exemption in the city of Syracuse, New York.

This form is used for applying for a residential investment real property tax exemption in the City of Utica, New York. It is for property owners who are looking for tax relief for their residential investments.

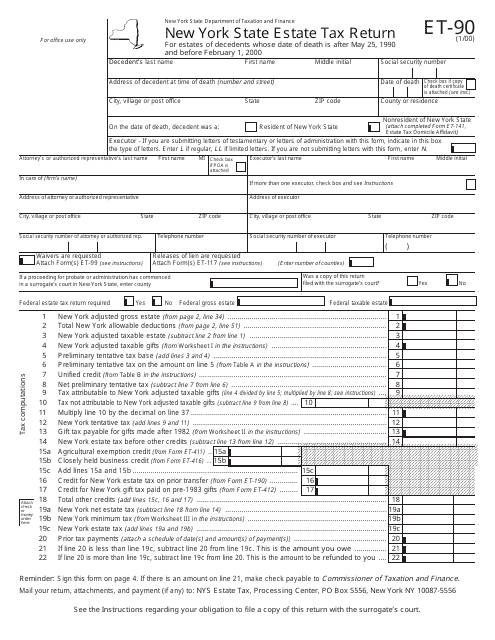

This form is used for reporting and paying estate taxes in the state of New York.

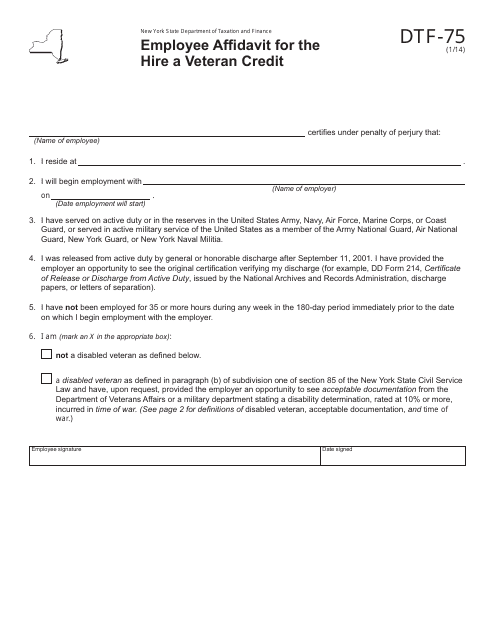

This document is used for employees in New York to apply for the Hire a Veteran Credit by submitting an affidavit.

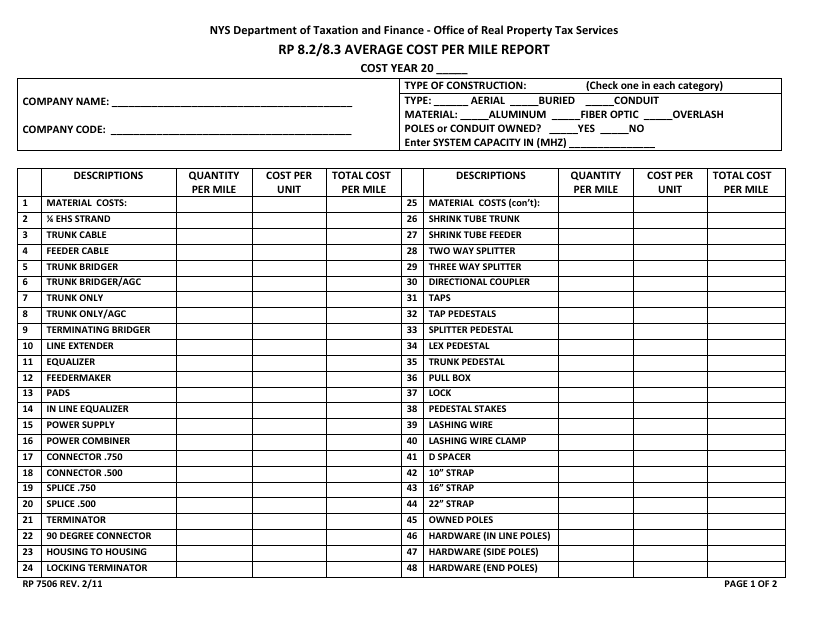

This Form is used for reporting the average cost per mile for transportation expenses in New York.

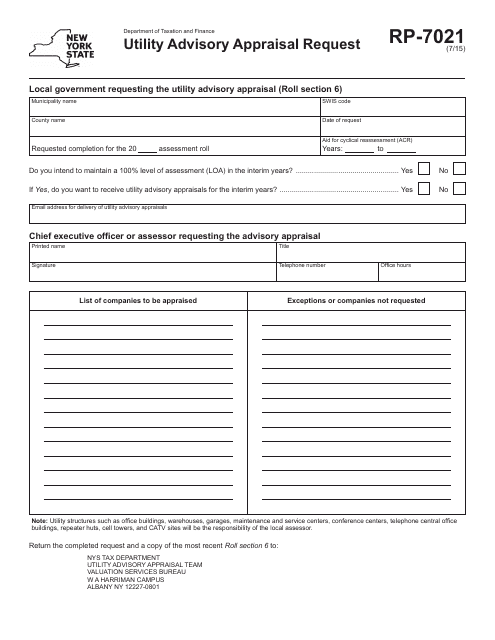

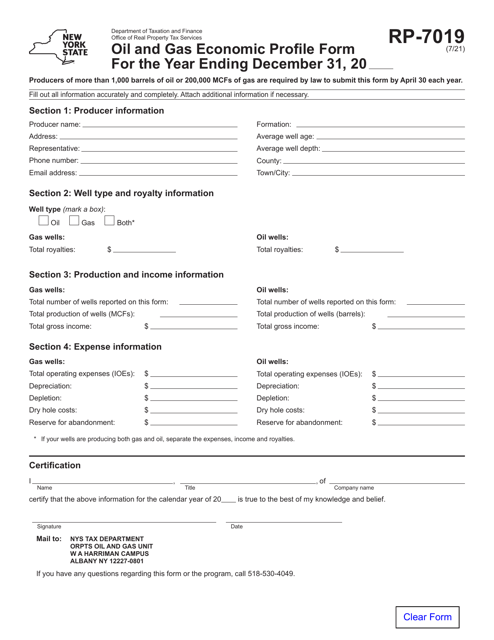

This form is used for requesting a utility advisory appraisal in New York.

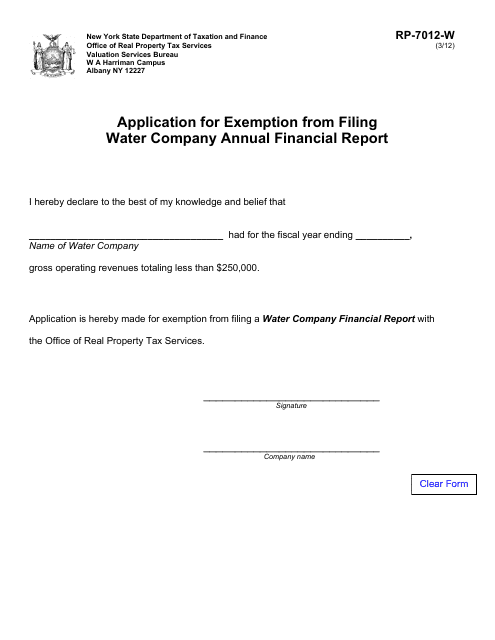

This Form is used for applying for an exemption from filing the annual financial report for a water company in the state of New York.

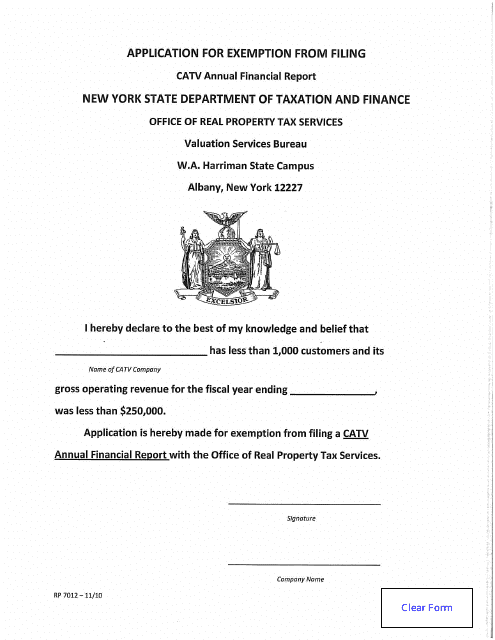

This Form is used for applying for an exemption from filing the CATV Annual Financial Report in New York.

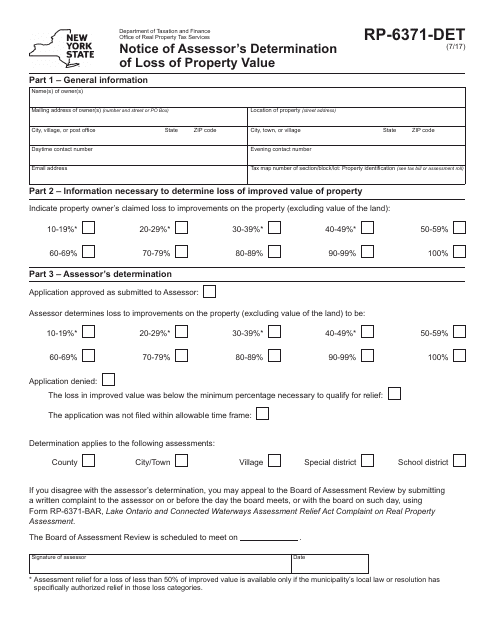

This form is used for notifying property owners in New York about the assessor's determination of a loss in property value.

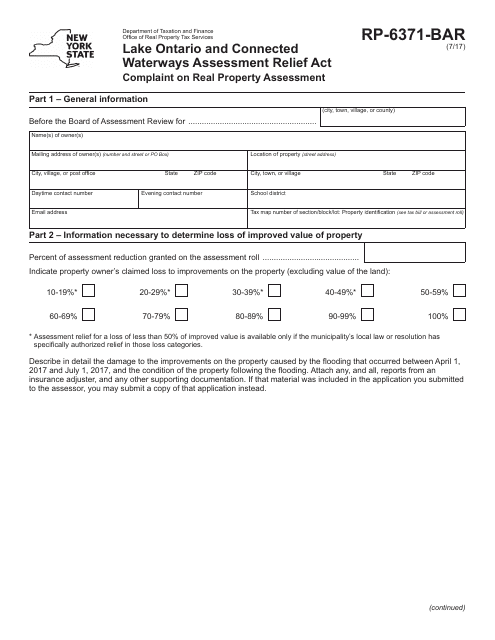

This form is used for lodging a complaint regarding the assessment of real property under the Lake Ontario and Connected Waterways Assessment Relief Act in New York.

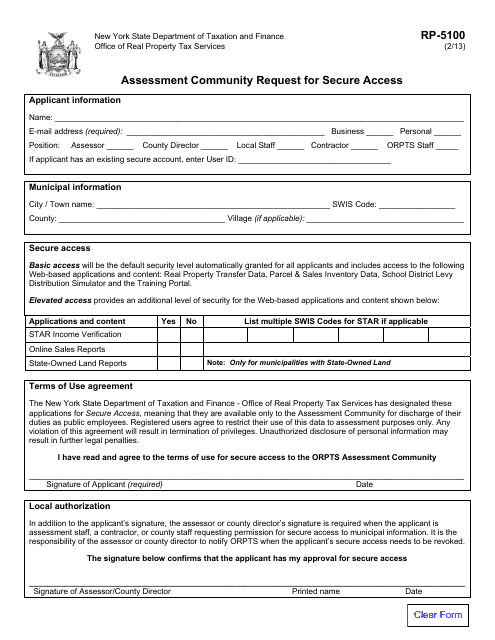

This form is used for submitting a request for secure access to the Assessment Community in New York.

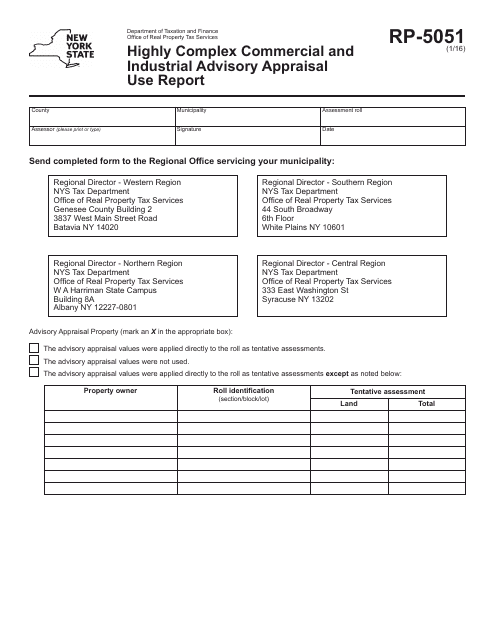

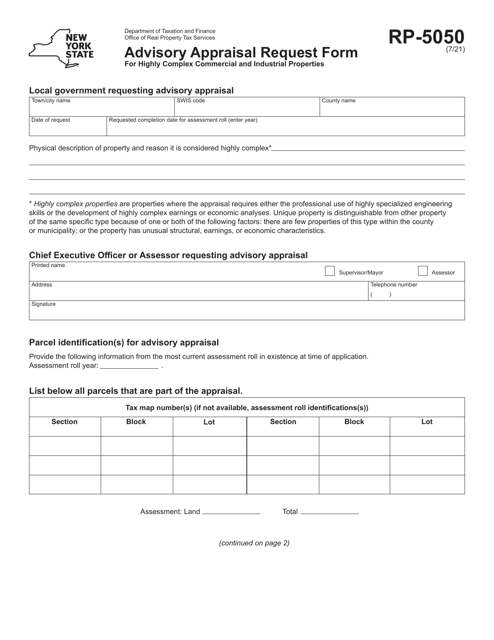

This form is used for submitting a highly complex commercial and industrial advisory appraisal use report in the state of New York.

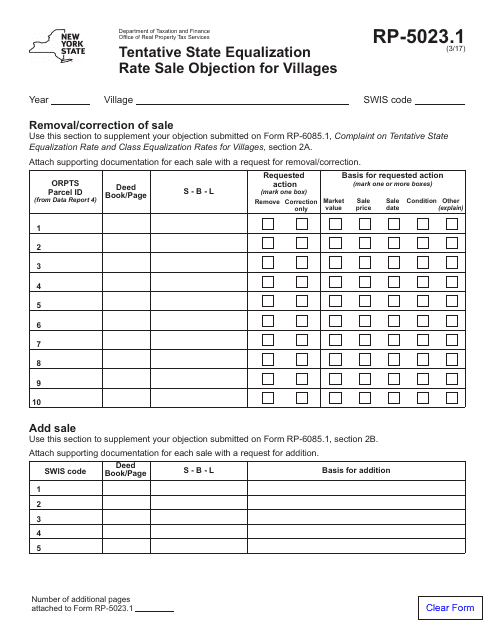

This form is used for villagers in New York to file a tentative state equalization rate sale objection.

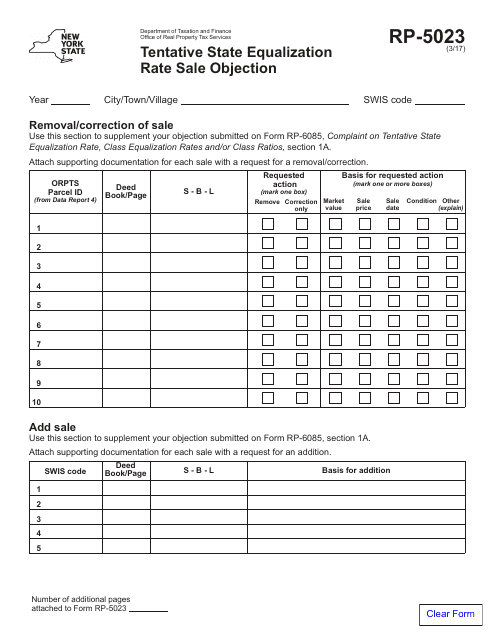

This form is used for filing an objection to the tentative state equalization rate for a property sale in New York.

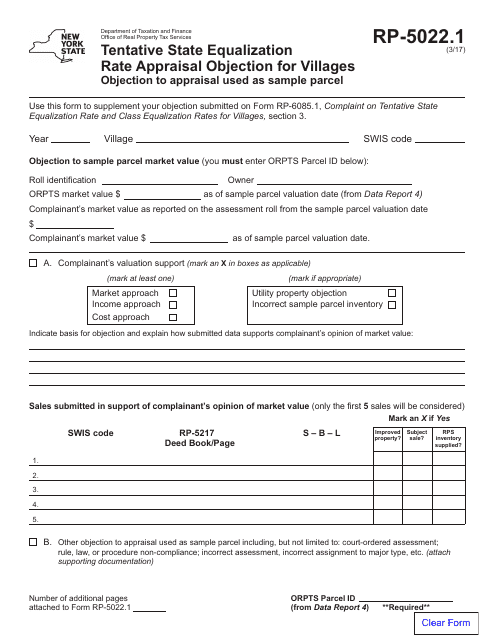

This form is used for filing an appraisal objection for villages in the state of New York regarding the Tentative State Equalization Rate.

![Form RP-466-D [WESTCHESTER] Application Form for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Westchester County Only) - New York](https://data.templateroller.com/pdf_docs_html/359/3598/359812/form-rp-466-d-westchester-application-form-volunteer-firefighters-ambulance-workers-exemption-use-in-westchester-county-only-new-york_big.png)

![Form RP-485-I [JAMESTOWN SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/578/5786/578655/form-rp-485-i-jamestown-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york_big.png)

![Form RP-485-J [AMSTERDAM] Application for Residential Investment Real Property Tax Exemption - City of Amsterdam, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578657/form-rp-485-j-amsterdam-application-for-residential-investment-real-property-tax-exemption-city-of-amsterdam-new-york_big.png)

![Form RP-485-J [SYRACUSE] Application for Residential Investment Real Property Tax Exemption - City of Syracuse, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578658/form-rp-485-j-syracuse-application-for-residential-investment-real-property-tax-exemption-city-of-syracuse-new-york_big.png)

![Form RP-485-J [UTICA] Application for Residential Investment Real Property Tax Exemption - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578659/form-rp-485-j-utica-application-for-residential-investment-real-property-tax-exemption-city-of-utica-new-york_big.png)