New Jersey Department of the Treasury Forms

Documents:

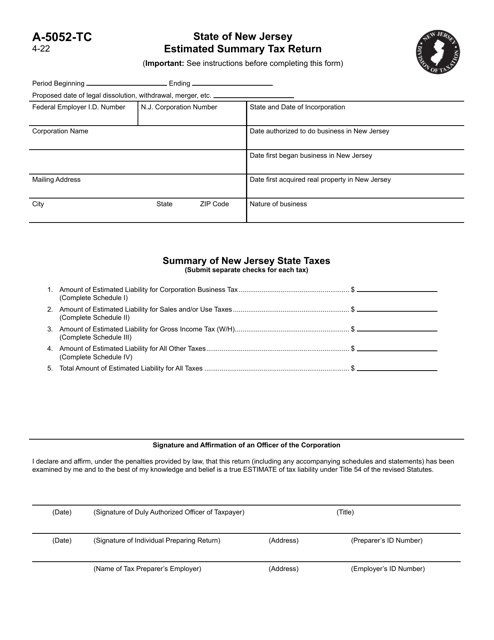

1110

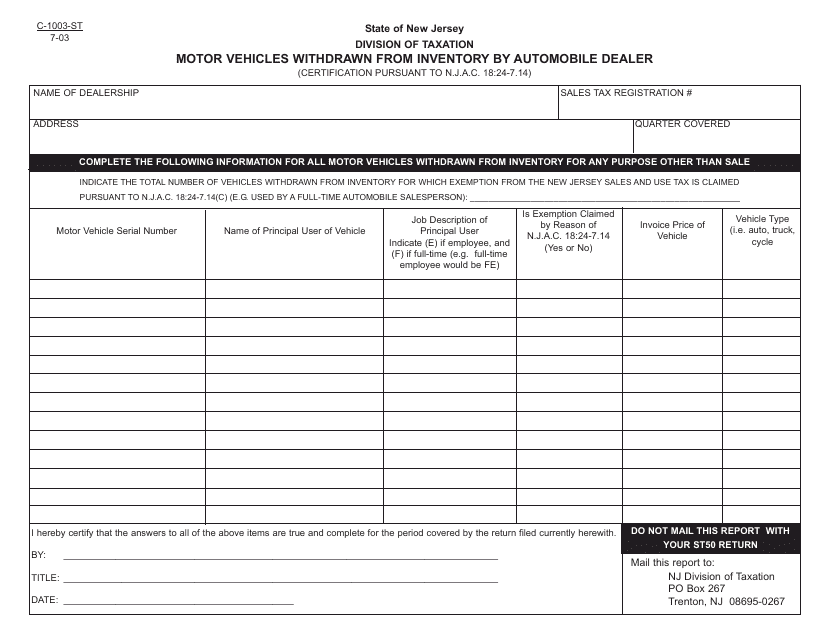

This form is used for automobile dealers in New Jersey to withdraw motor vehicles from their inventory.

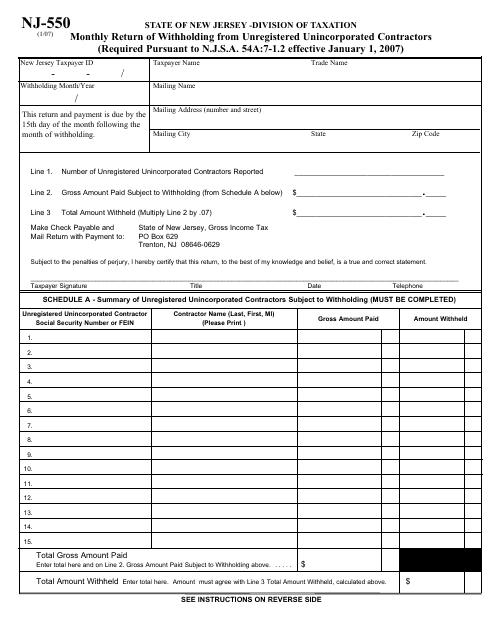

This Form is used for reporting monthly withholding from unregistered unincorporated contractors in the state of New Jersey.

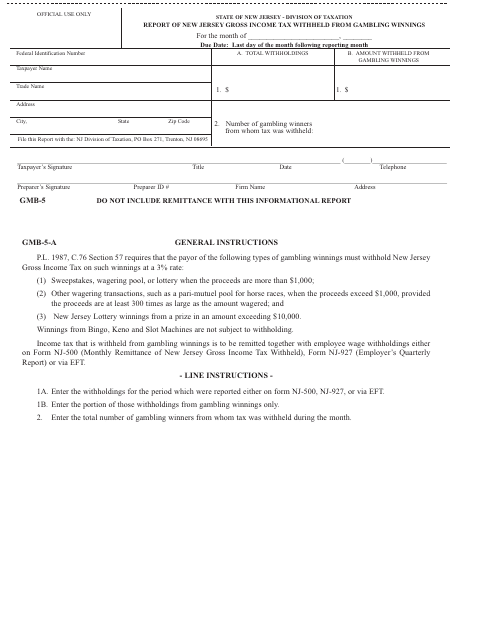

This form is used for reporting the amount of New Jersey Gross Income Tax withheld from gambling winnings in New Jersey.

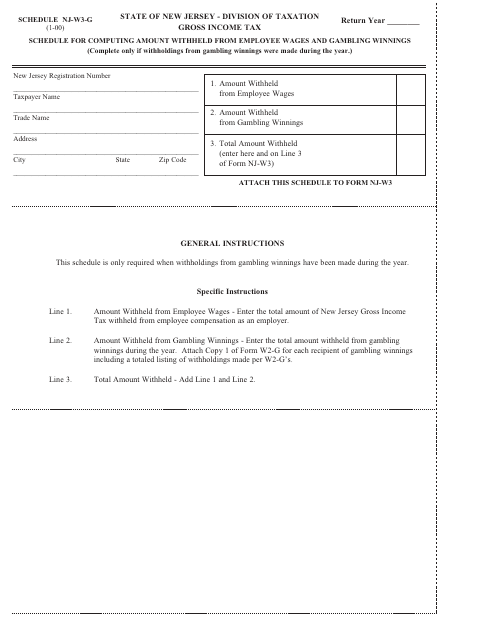

This document is used for computing the amount withheld from employee wages and gambling winnings in New Jersey.

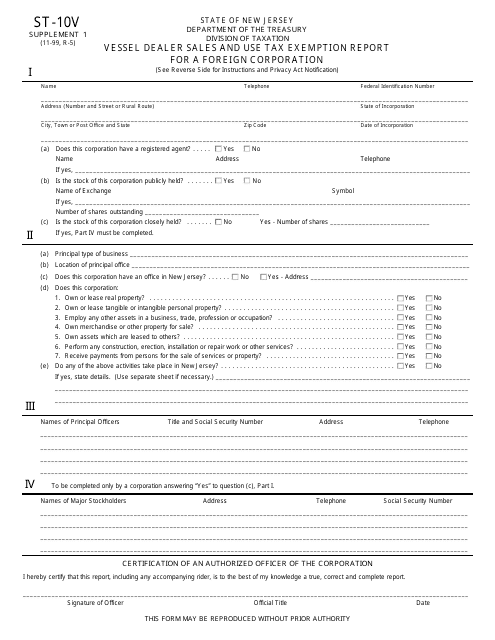

This document is a Vessel Dealer Sales and Use Tax Exemption Report for a foreign corporation in New Jersey. It is used to report and claim exemption from sales and use tax on vessel purchases made by the foreign corporation.

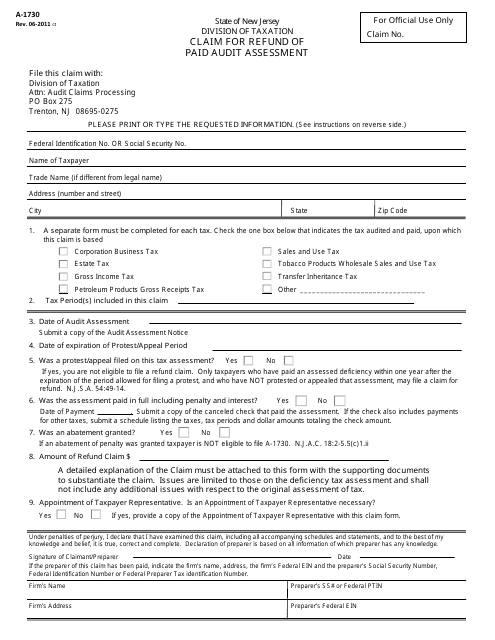

This Form is used for residents of New Jersey to claim a refund for a paid audit assessment.

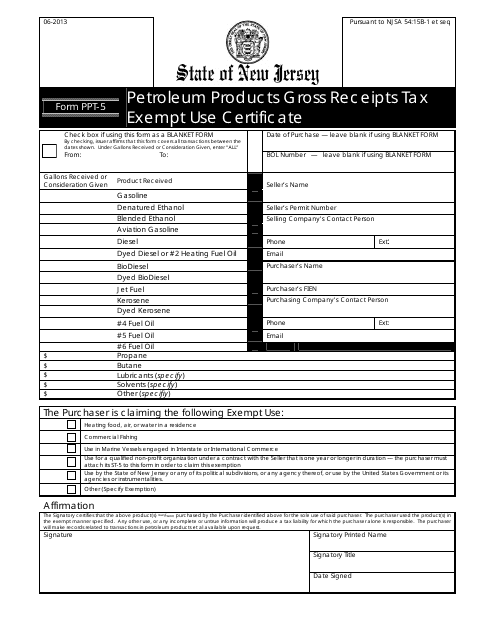

This Form is used for applying for an exemption from the gross receipts tax on the use of petroleum products in New Jersey.

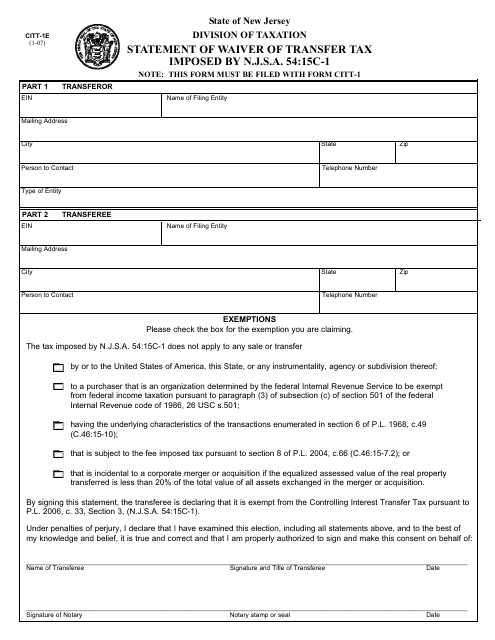

This form is used for declaring the waiver of transfer tax in the state of New Jersey.

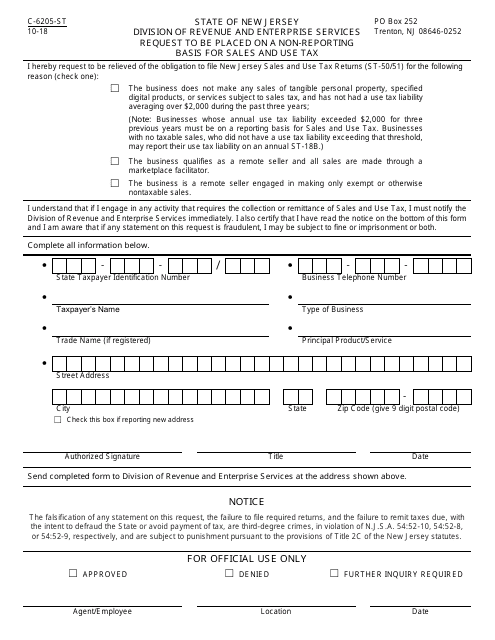

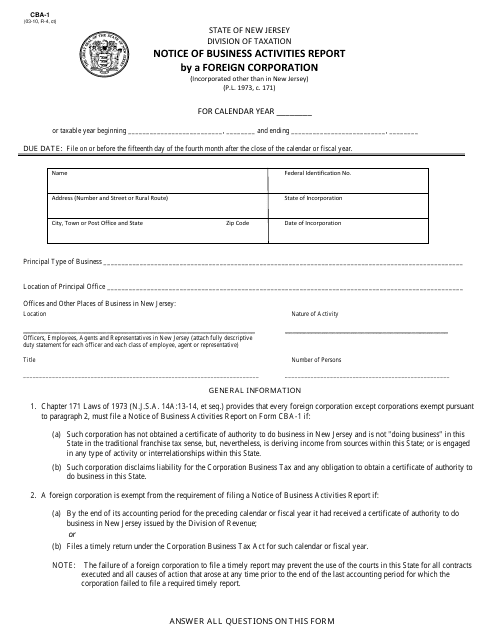

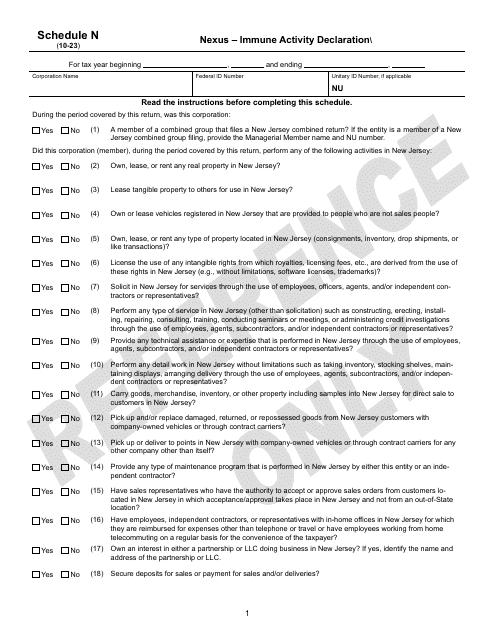

This form is used for a foreign corporation to report its business activities in the state of New Jersey. It is required by the New Jersey Division of Revenue and Enterprise Services to ensure compliance with state regulations.

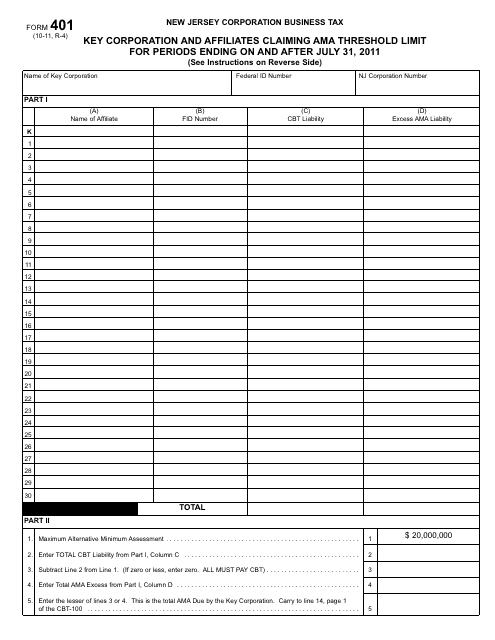

This Form is used for Key Corporation and its affiliates to claim the Ama Threshold Limit for periods ending on or after July 31, 2011 in New Jersey.

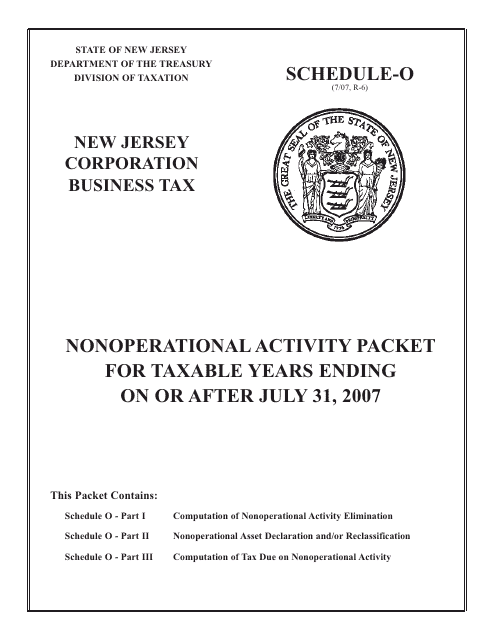

This type of document is used for nonoperational activities in New Jersey for taxable years ending on or after July 31, 2007.

This Form is used for providing instructions on how to fill out and submit Form PPT-40 and PPT-41 in the state of New Jersey.

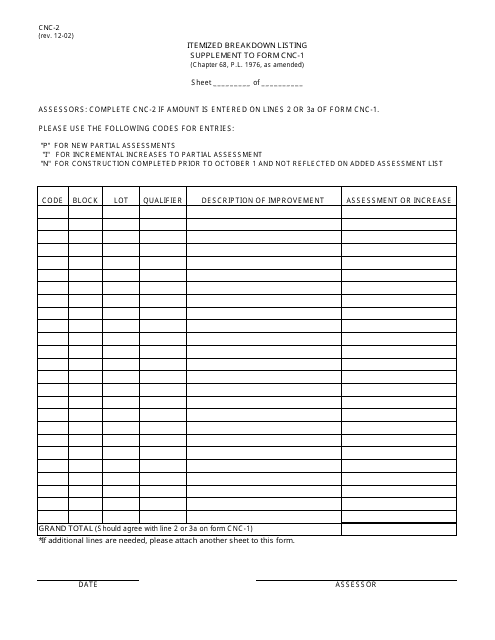

This form is used for providing a detailed breakdown of items listed on Form CNC-1 in the state of New Jersey.

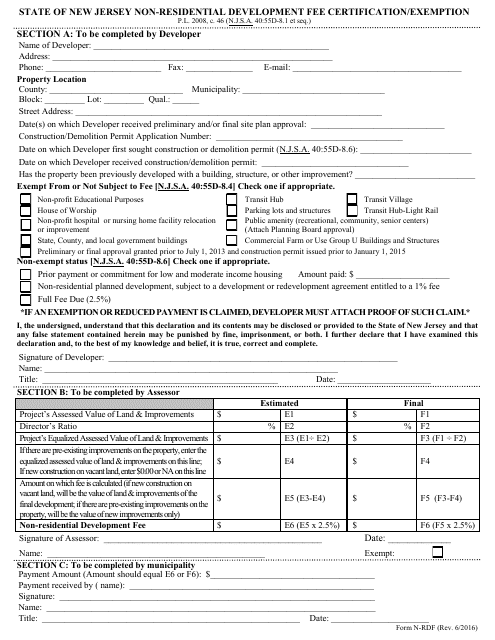

This Form is used for certifying or claiming an exemption from the non-residential development fee in New Jersey.

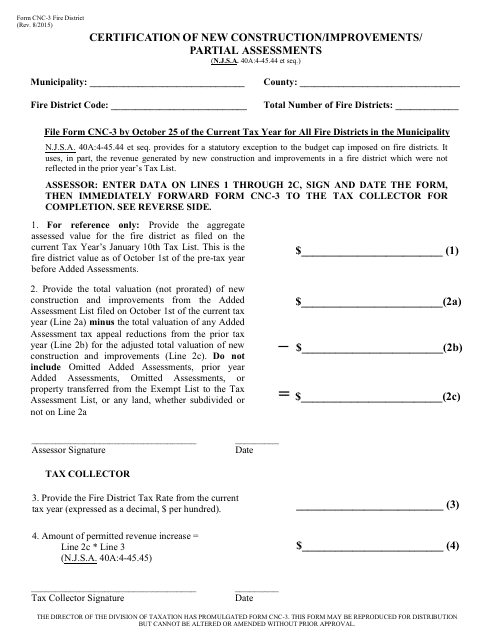

This form is used for certifying new construction, improvements, or partial assessments in the state of New Jersey.

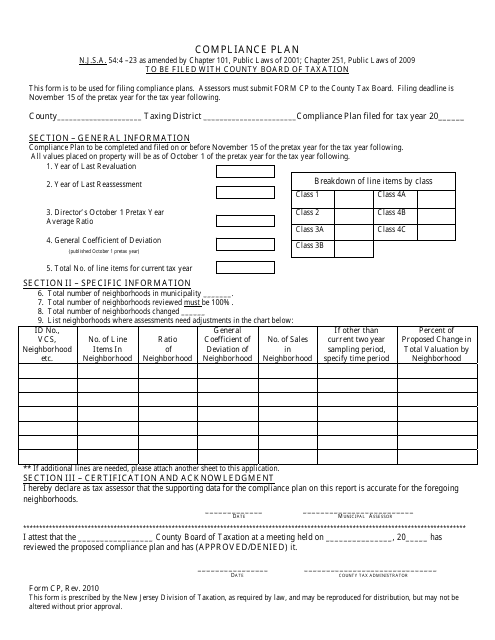

This form is used for creating a Compliance Plan in accordance with New Jersey regulations.

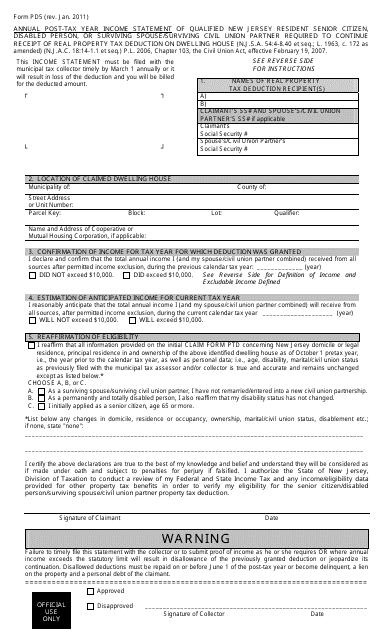

This form is used for reporting annual post-tax year income for residents of New Jersey.

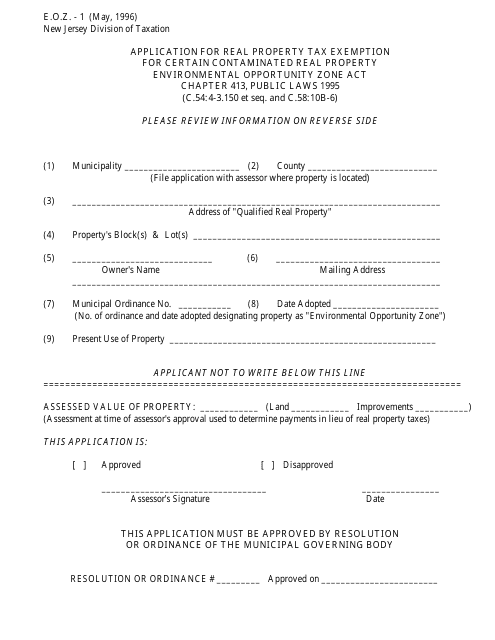

This Form is used for applying for real property tax exemption for certain contaminated properties under the Environmental Opportunity Zone Act in New Jersey.

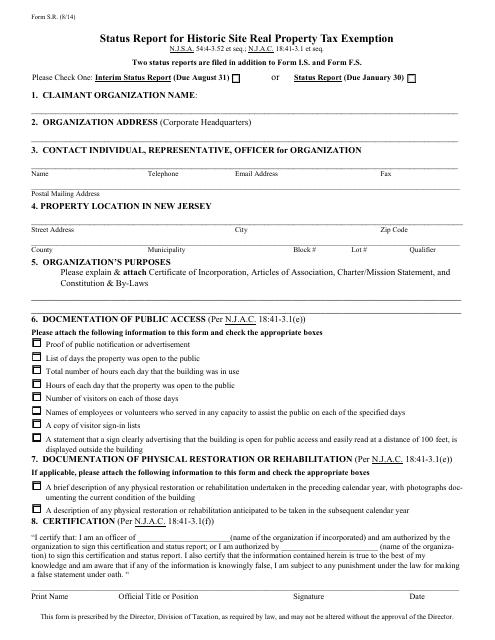

This form is used to report the status of a historic site real property tax exemption in New Jersey.

This Form is used for reporting and paying the New Jersey Motor Vehicle Tire Fee, which is required for anyone selling new tires in the state of New Jersey.

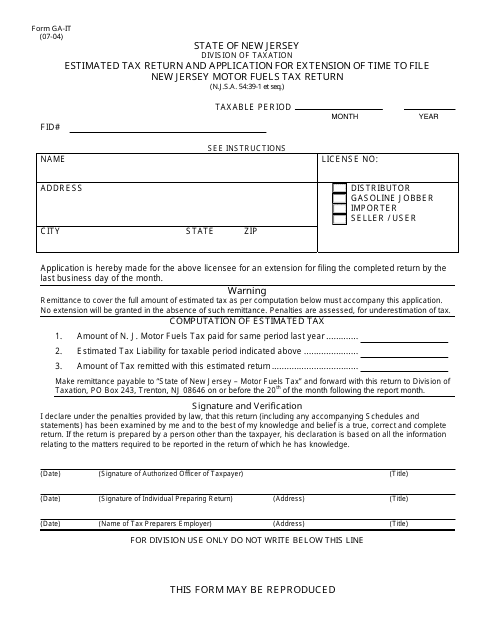

This Form is used for filing a Georgia state estimated tax return and applying for an extension of time to file a New Jersey Motor Fuels Tax Return.

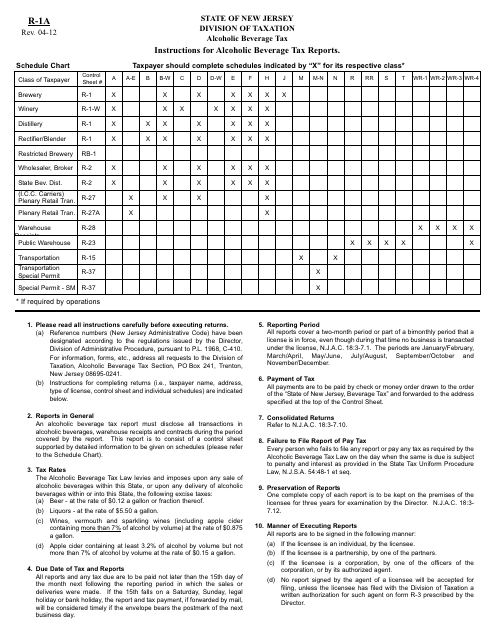

This document provides instructions for completing and filing the Alcoholic Beverage Tax Reports (Form R-1A) in the state of New Jersey. It is a necessary form for businesses involved in the sale of alcoholic beverages in order to report and pay the required taxes.

This form is used for reporting and paying inheritance tax for residents of New Jersey.

This document is used for declaring the residency status or claiming exemption as a seller in the state of New Jersey.

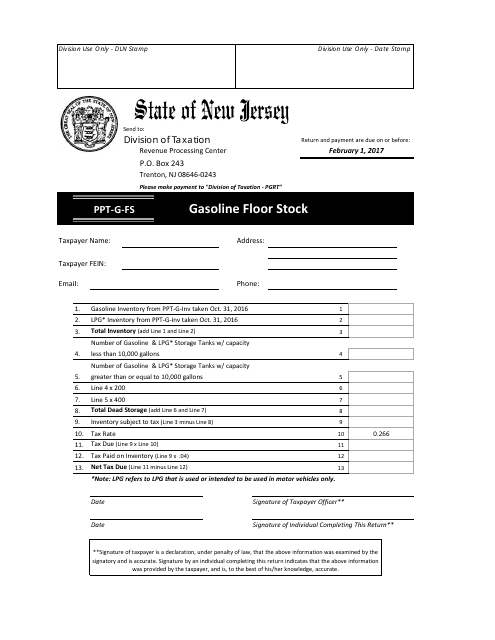

This Form is used for reporting and tracking gasoline floor stock inventory in the state of New Jersey.

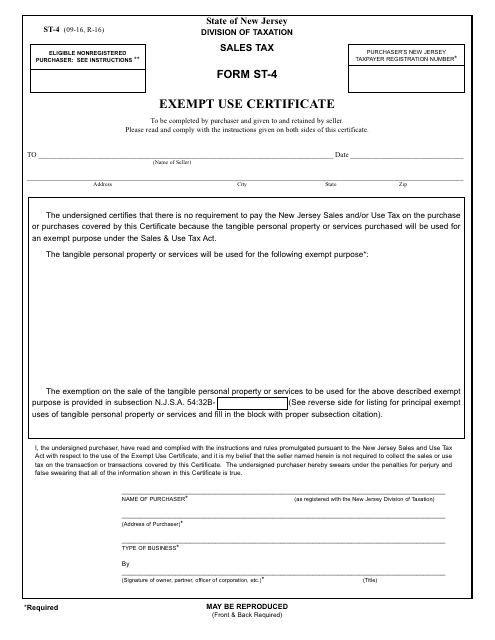

This form is used for claiming exemption from sales tax for specific items or services in the state of New Jersey.

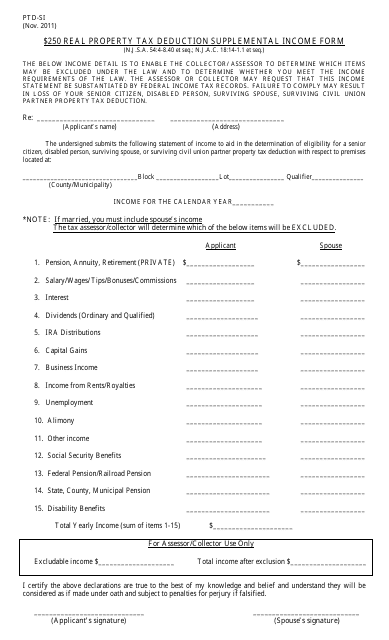

This form is used for reporting supplemental income for the Real Property Tax Deduction in New Jersey.

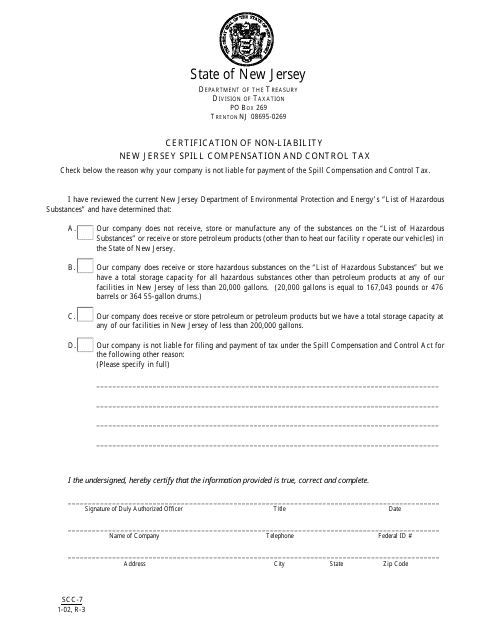

Form SCC-7 Certification of Non-liability New Jersey Spill Compensation and Control Tax - New Jersey

This form is used for certifying non-liability for the New Jersey Spill Compensation and Control Tax in the state of New Jersey.

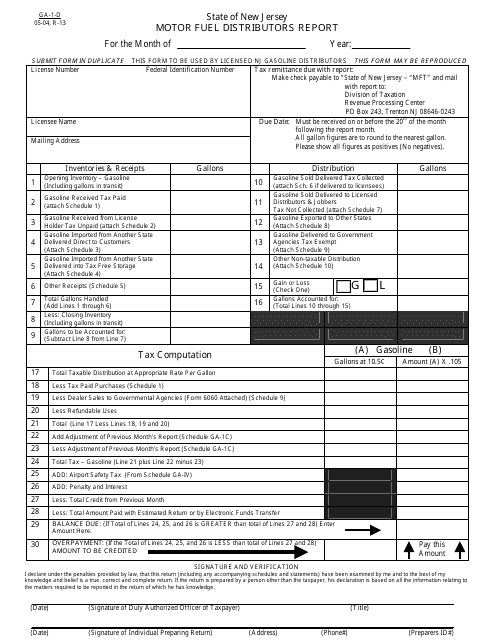

This Form is used for motor fuel distributors in New Jersey to report their activities.

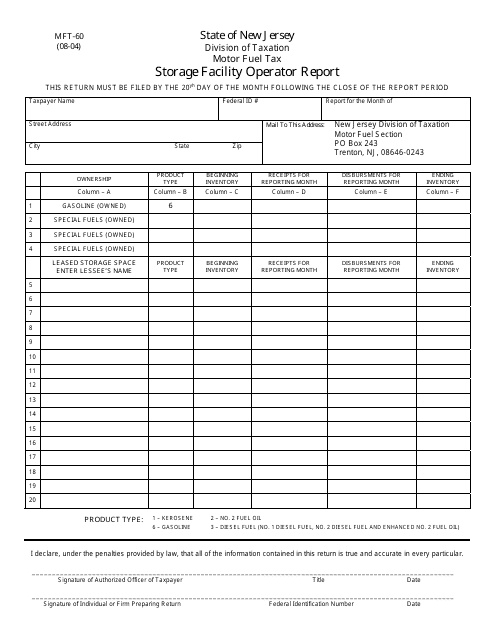

This Form is used for storage facility operators in New Jersey to report their operations and activities.

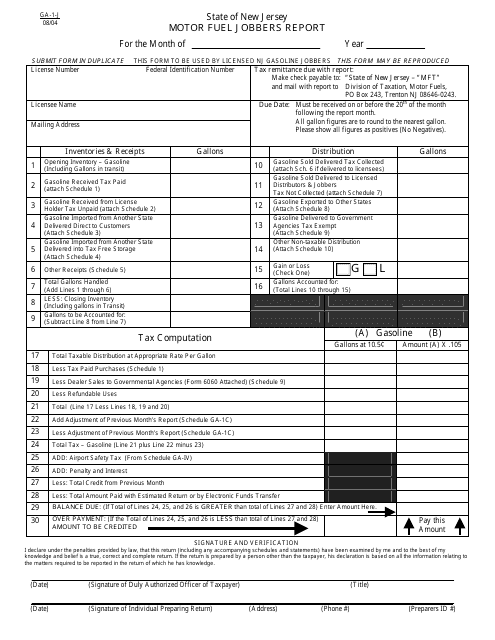

This form is used for motor fuel jobbers in New Jersey to report their activity related to fuel sales and distribution.

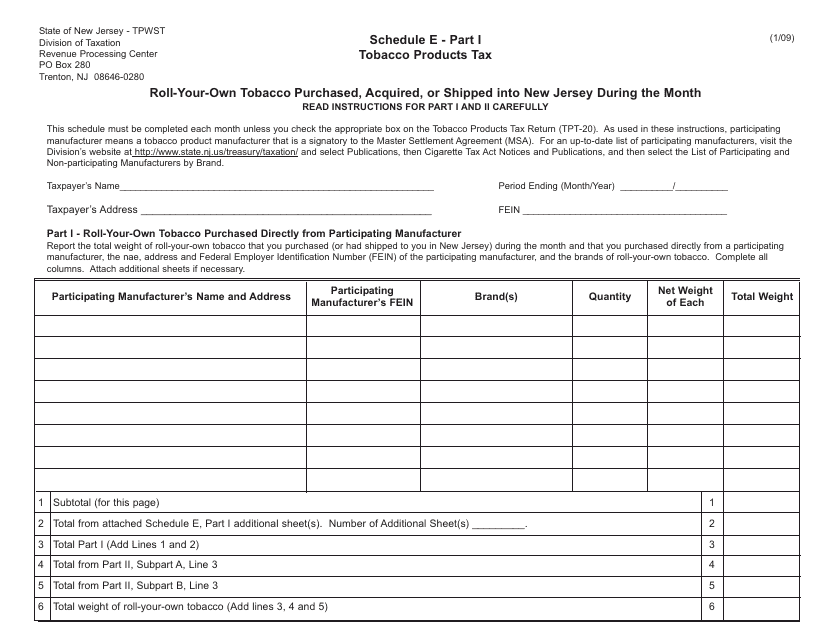

This form is used for reporting the purchase, acquisition, or shipment of roll-your-own tobacco into New Jersey during a specific month.

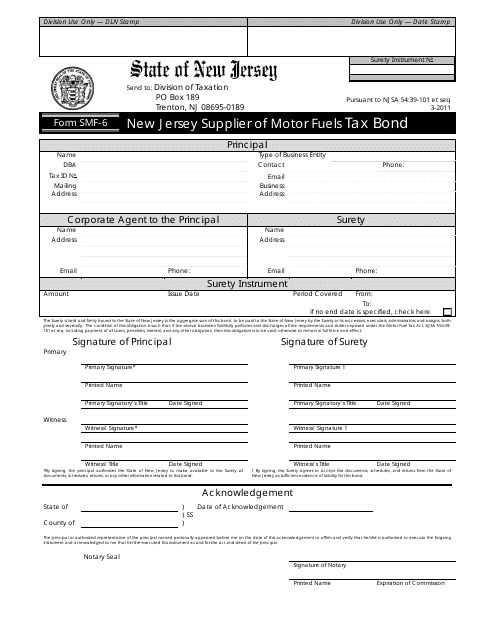

This form is used for applying for a tax bond in the state of New Jersey.

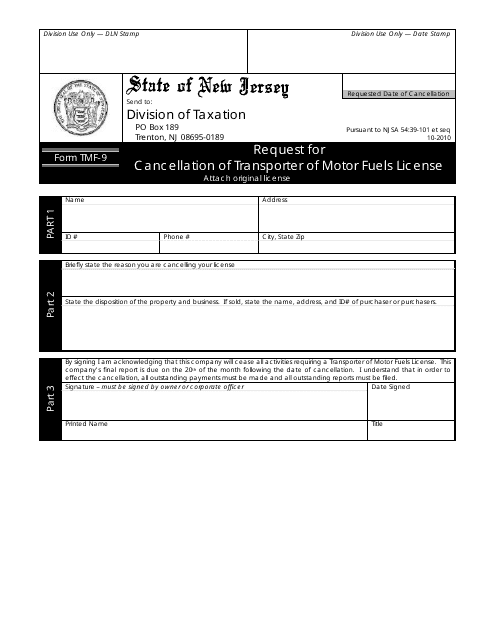

This Form is used for requesting the cancellation of a Transporter of Motor Fuels License in the state of New Jersey.

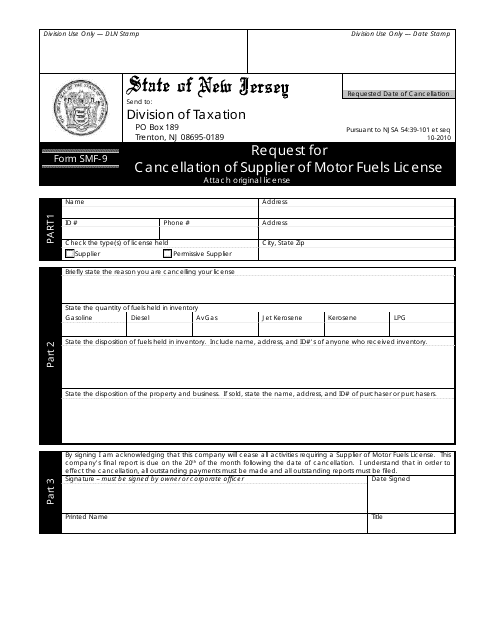

This form is used for requesting the cancellation of a Supplier of Motor Fuels License in the state of New Jersey.