New Jersey Department of the Treasury Forms

Documents:

1110

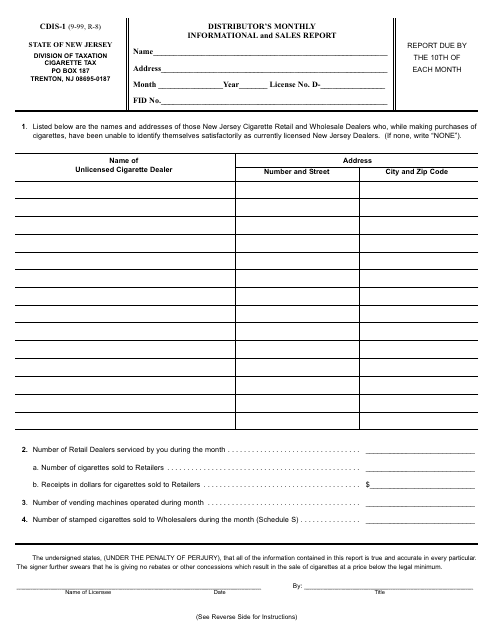

This form is used for distributors in New Jersey to submit their monthly informational and sales report.

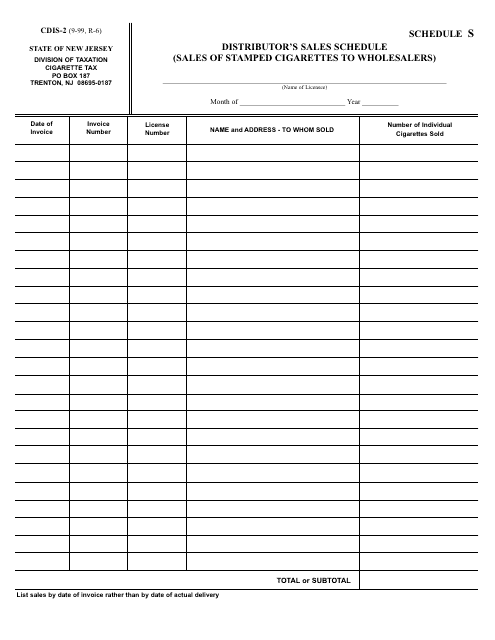

This form is used for reporting the sales of stamped cigarettes to wholesalers in New Jersey.

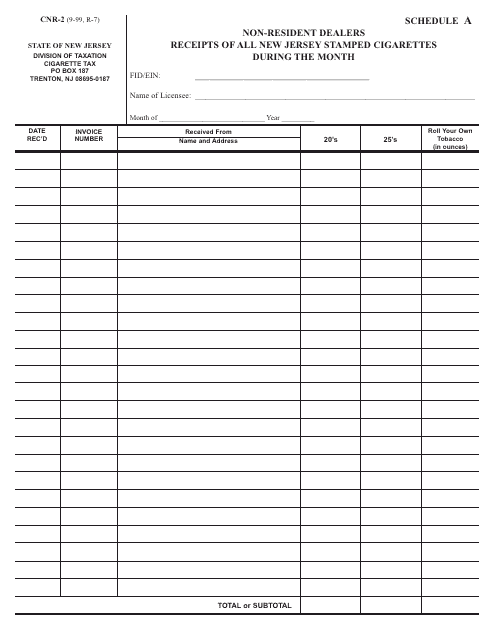

This form is used for reporting the receipts of all New Jersey stamped cigarettes by non-resident dealers during a specific month in New Jersey.

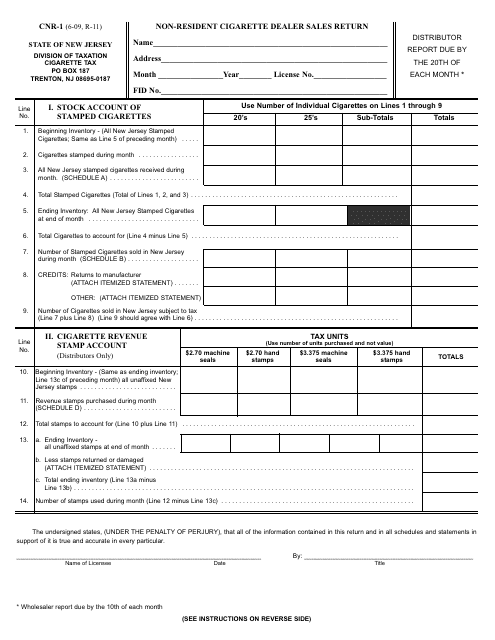

This Form is used for non-resident cigarette dealers in New Jersey to report sales returns.

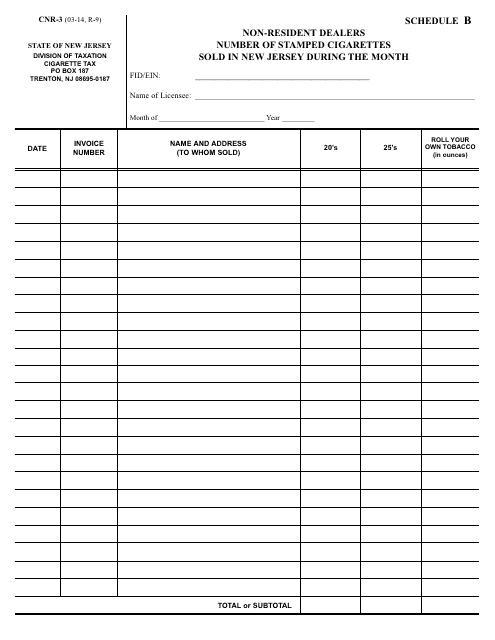

This Form is used for reporting the number of stamped cigarettes sold by non-resident dealers in New Jersey during a specific month.

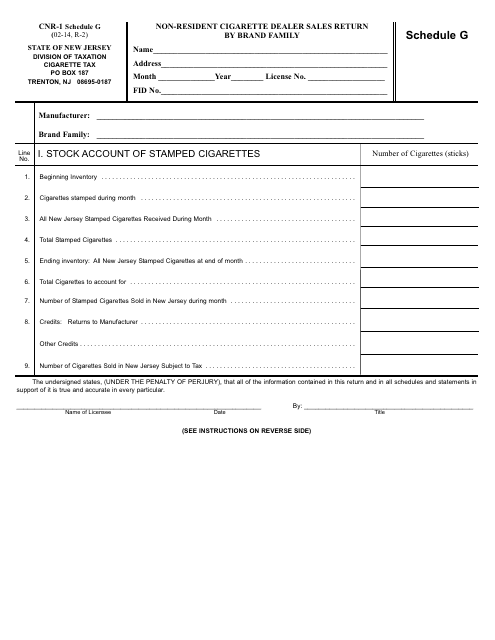

This form is used for non-resident cigarette dealers in New Jersey to report sales returns by brand family.

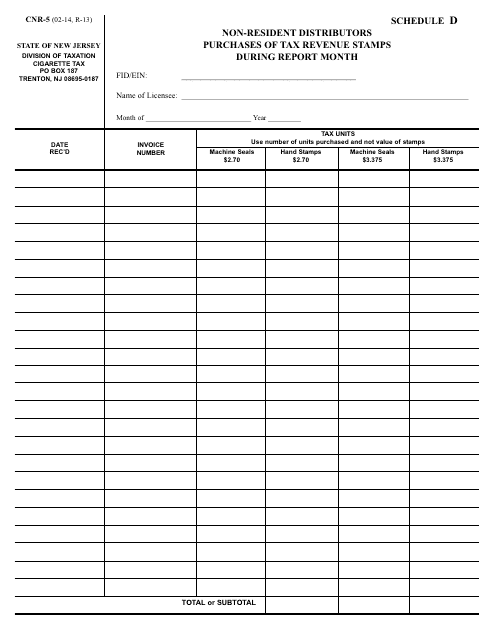

This form is used for non-resident distributors to report their purchases of tax revenue stamps in New Jersey during a specific month.

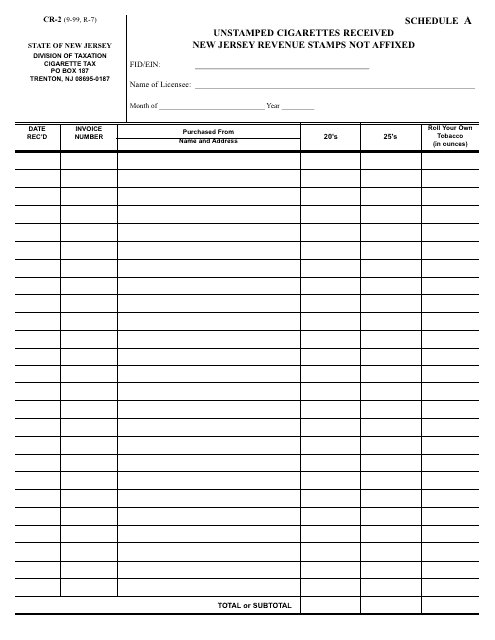

This form is used to report unstamped cigarettes received in New Jersey without the required revenue stamps affixed.

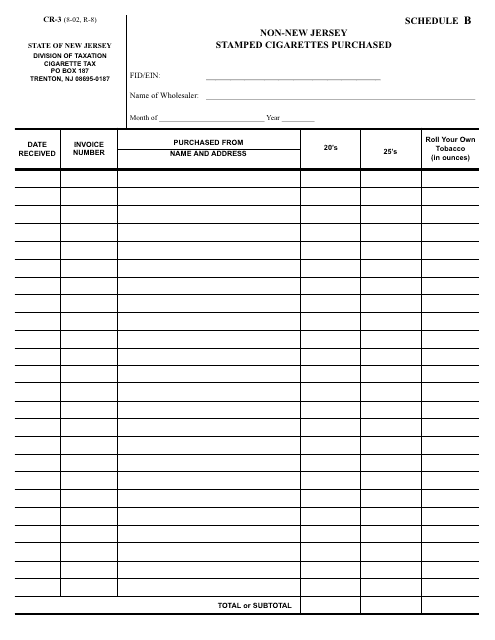

This form is used for reporting the purchase of stamped cigarettes that were not bought in the state of New Jersey.

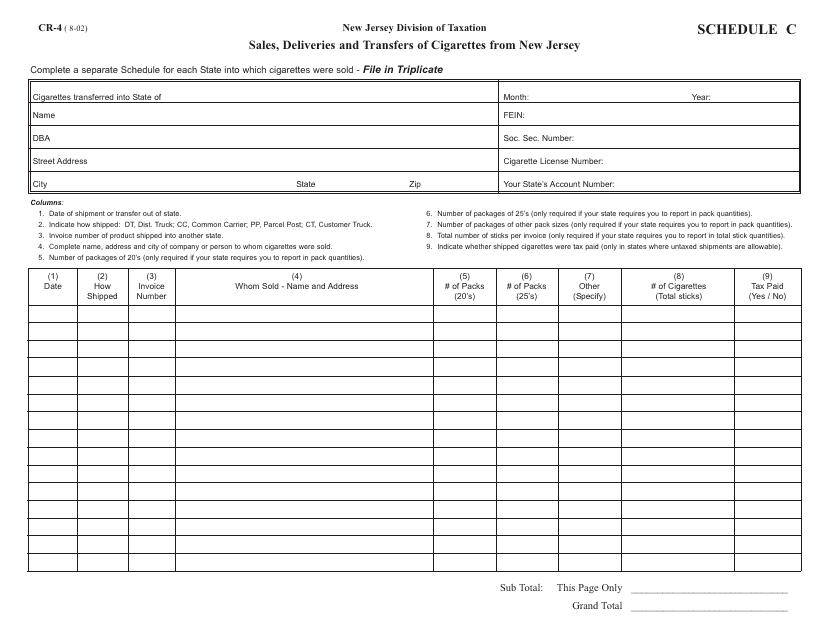

This form is used for reporting sales, deliveries, and transfers of cigarettes from New Jersey.

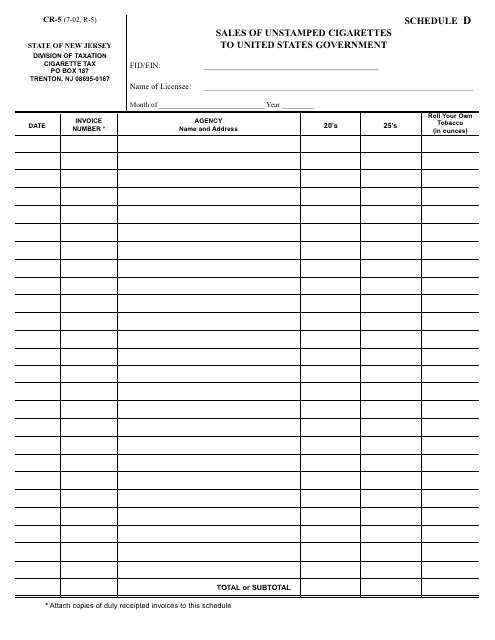

This form is used for reporting sales of unstamped cigarettes to the United States Government in New Jersey.

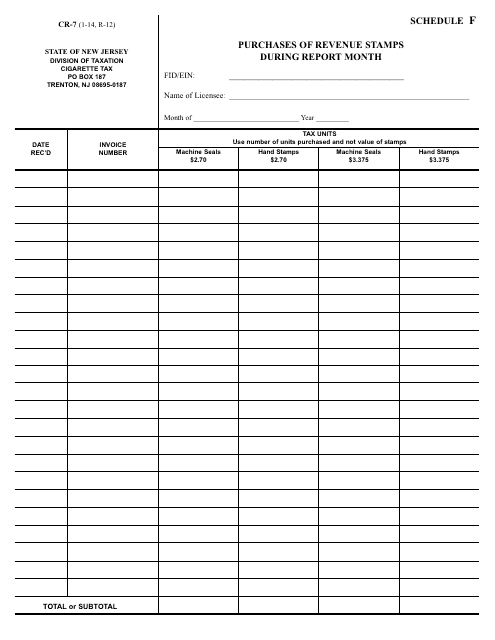

This form is used for reporting the purchases of revenue stamps during a specific month in the state of New Jersey.

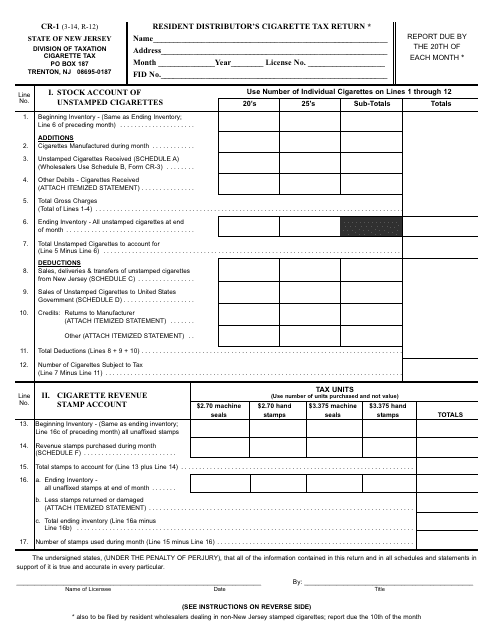

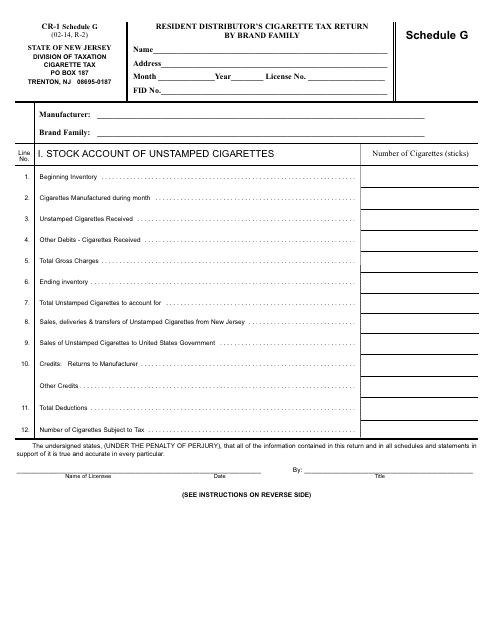

This form is used for the residents of New Jersey who are distributors of cigarettes to report and pay their cigarette tax.

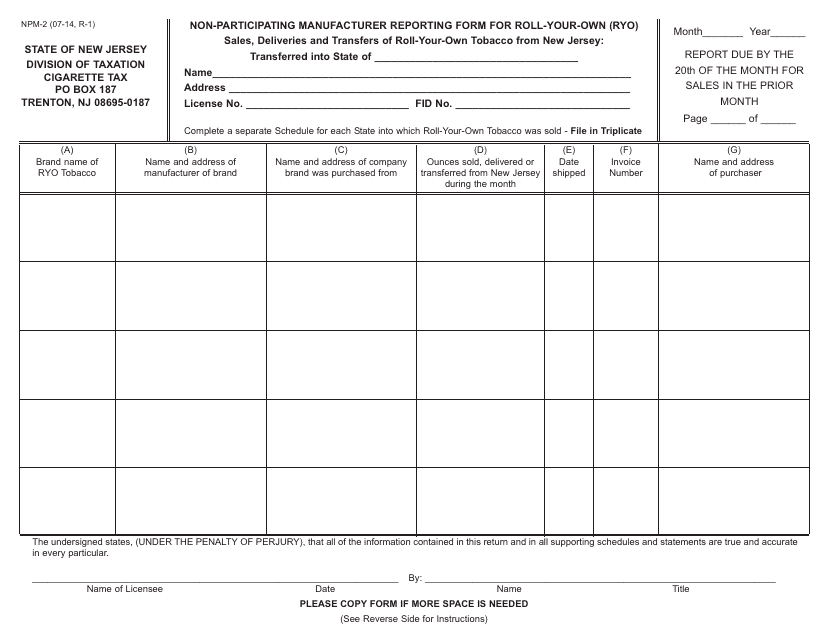

This form is used for non-participating manufacturers to report information related to the roll-your-own tobacco products in New Jersey.

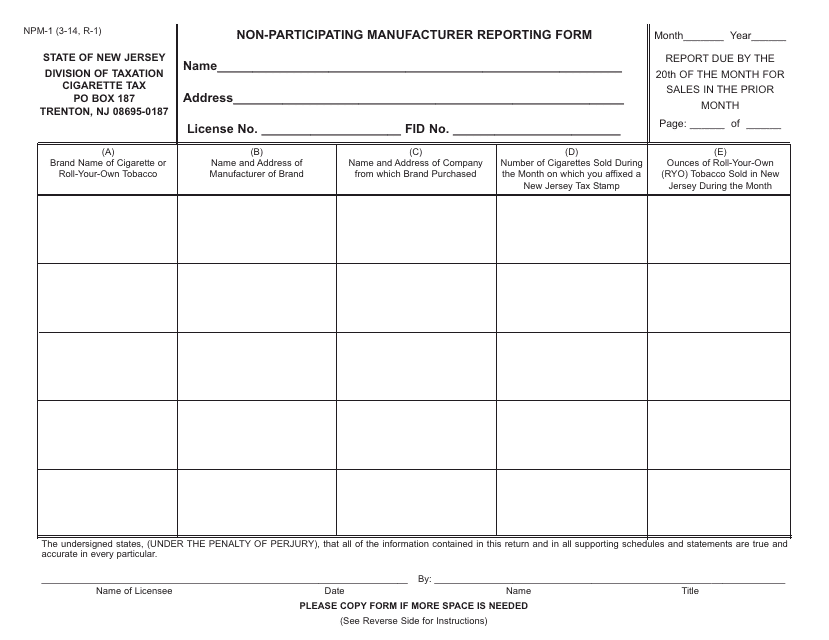

This Form is used for non-participating manufacturers to report information to the state of New Jersey. It is necessary for compliance with the state's tobacco regulations.

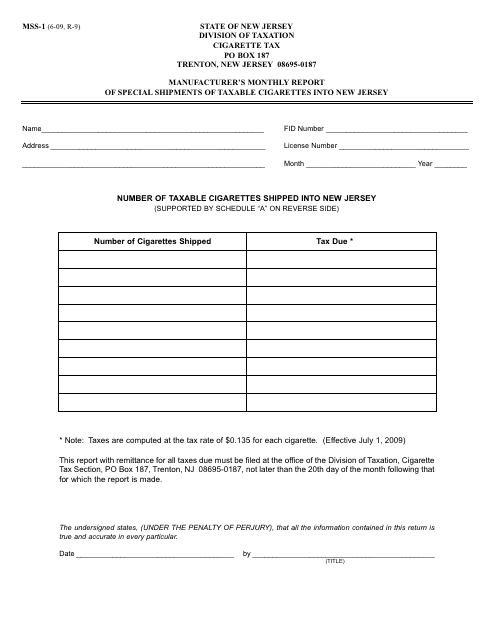

This form is used for manufacturers to report monthly shipments of taxable cigarettes into New Jersey.

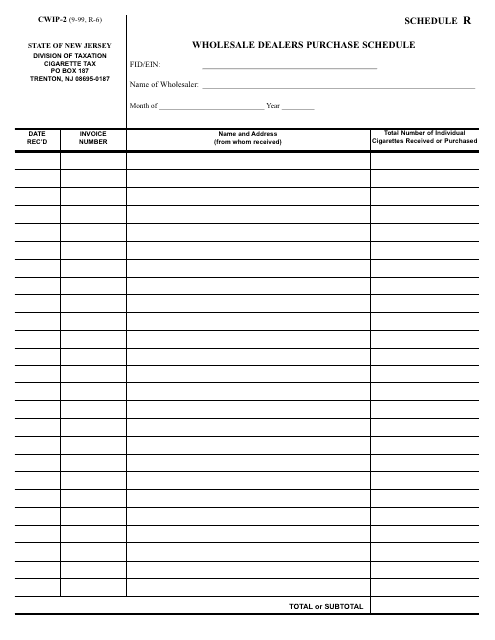

This form is used for reporting wholesale dealers' purchases in New Jersey. It is known as Schedule R and is part of the CWIP-2 form.

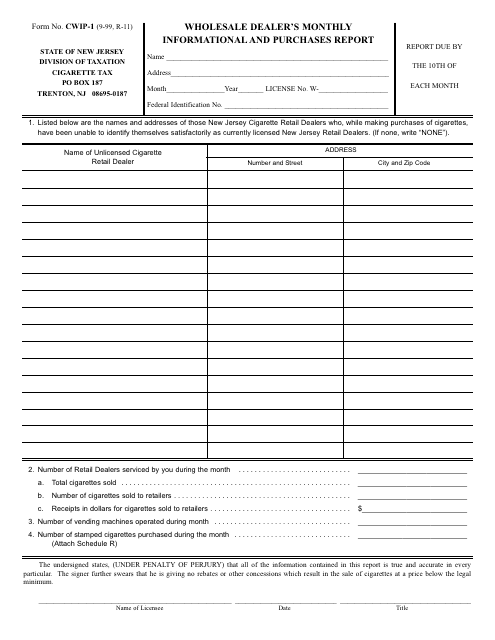

This form is used for wholesale dealers in New Jersey to report monthly information and purchases. It helps the state track and regulate wholesale activities.

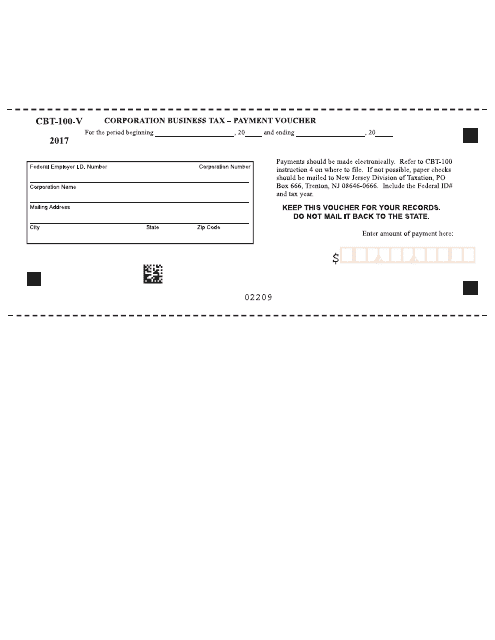

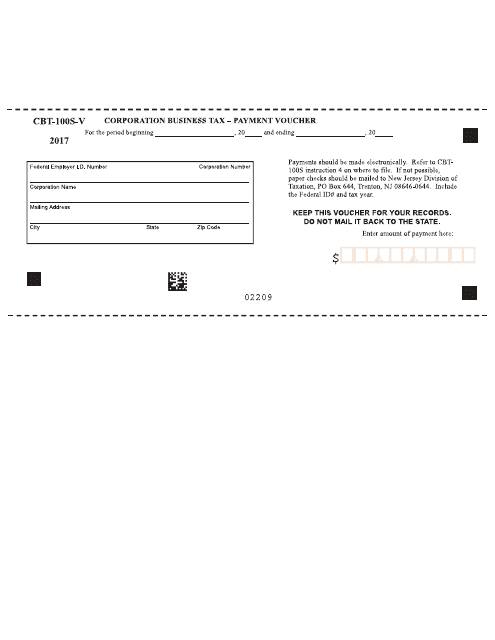

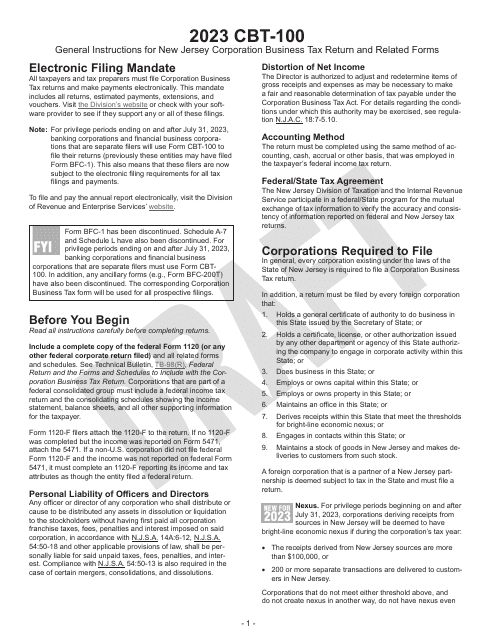

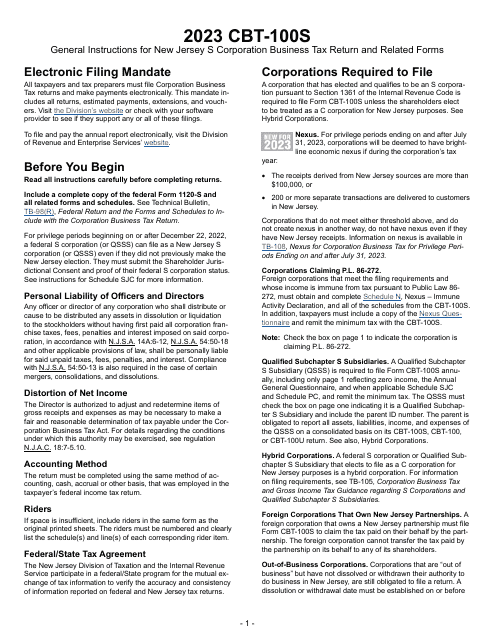

This document is a payment voucher for corporations to pay their business tax in the state of New Jersey.

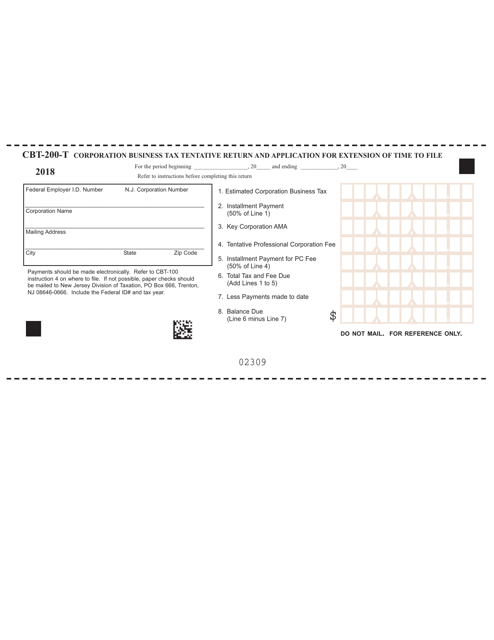

This form is used for making payments towards corporation business tax in the state of New Jersey.

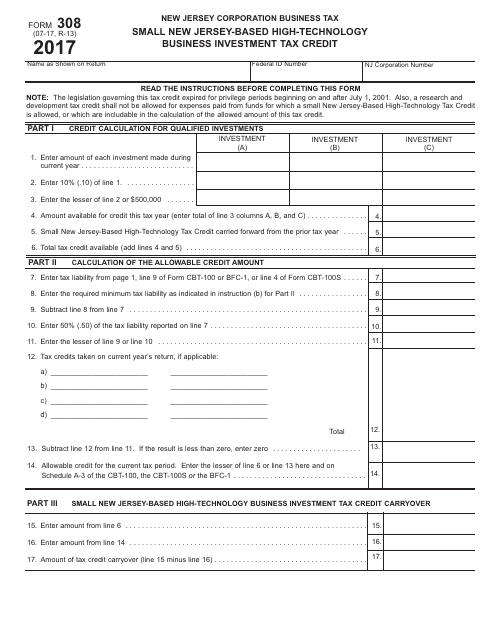

This Form is used for claiming the Small New Jersey-Based High-Technology Business Investment Tax Credit in New Jersey.

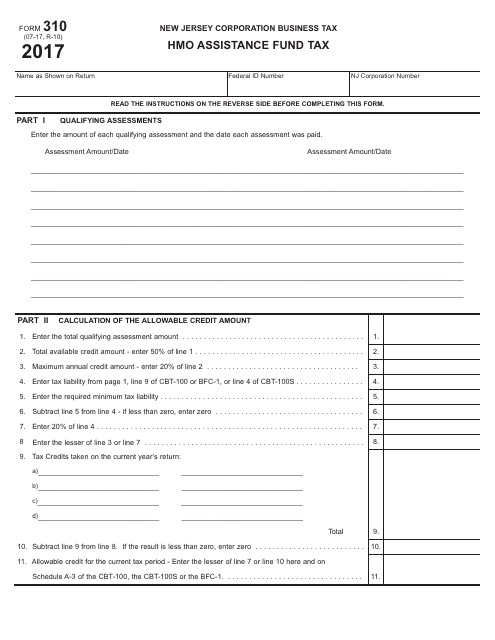

This document is used for filing taxes related to the HMO Assistance Fund in the state of New Jersey.