New Jersey Department of the Treasury Forms

Documents:

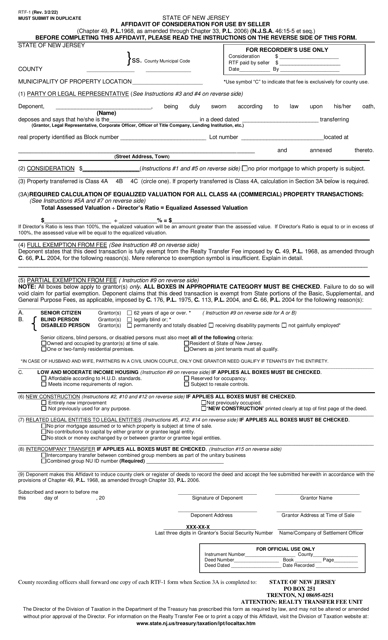

1110

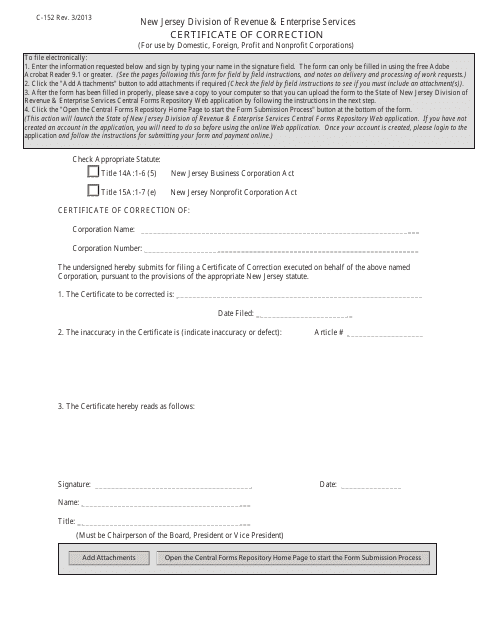

This document is used for correcting errors on a certificate in the state of New Jersey.

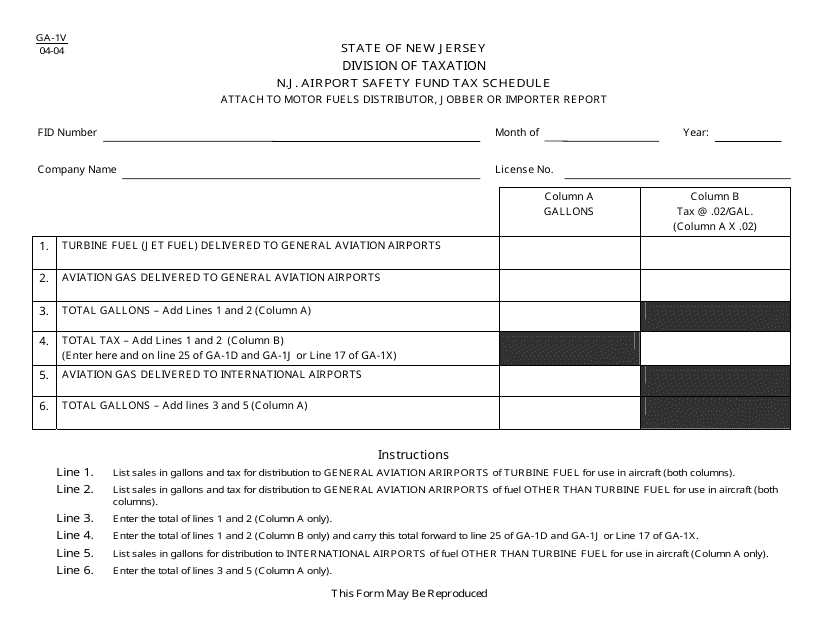

This form is used for reporting the N.J. Airport Safety Fund Tax Schedule in New Jersey.

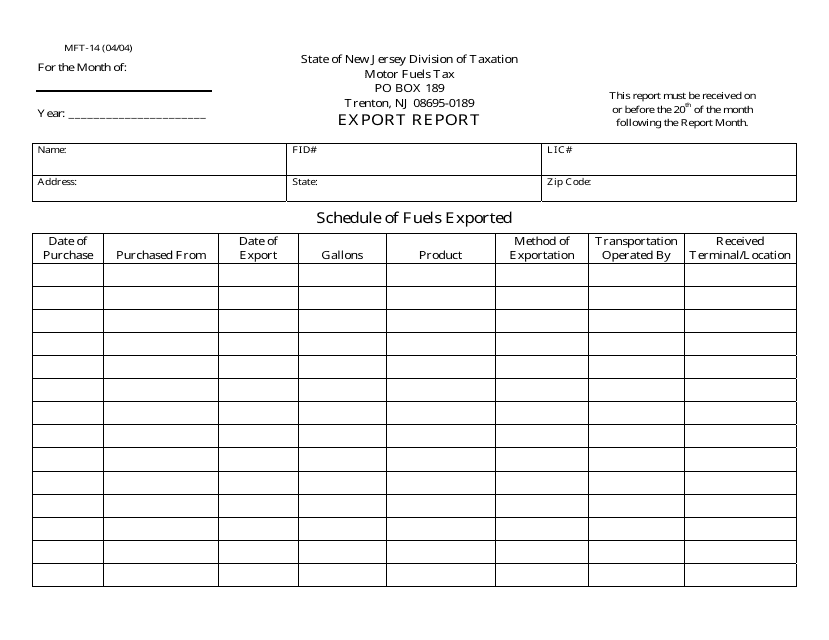

This form is used for reporting exports in the state of New Jersey.

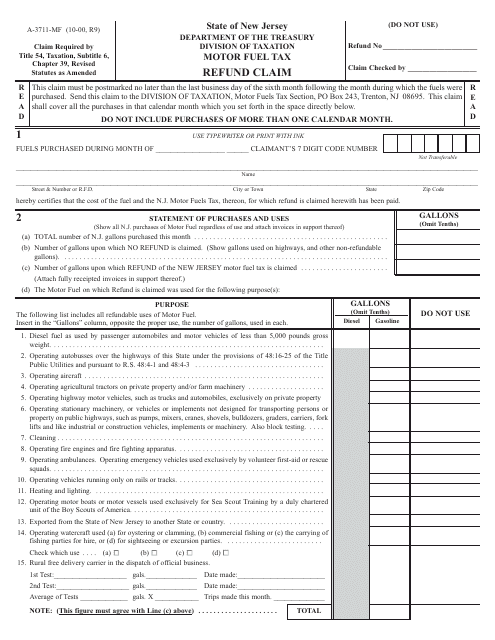

This form is used for claiming a refund on motor fuel tax in the state of New Jersey.

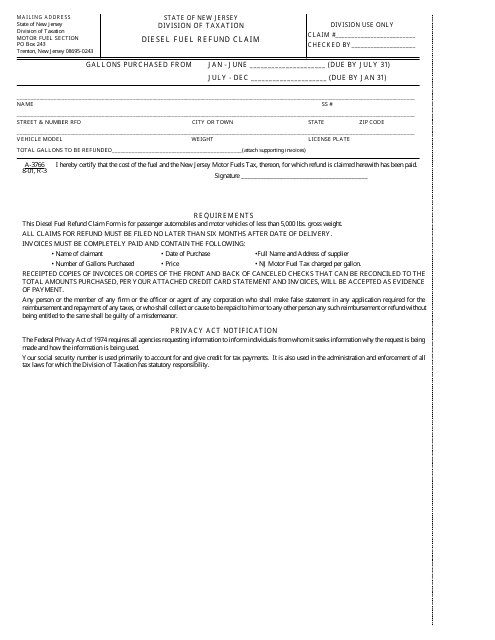

This form is used for claiming a refund on diesel fuel taxes paid in the state of New Jersey.

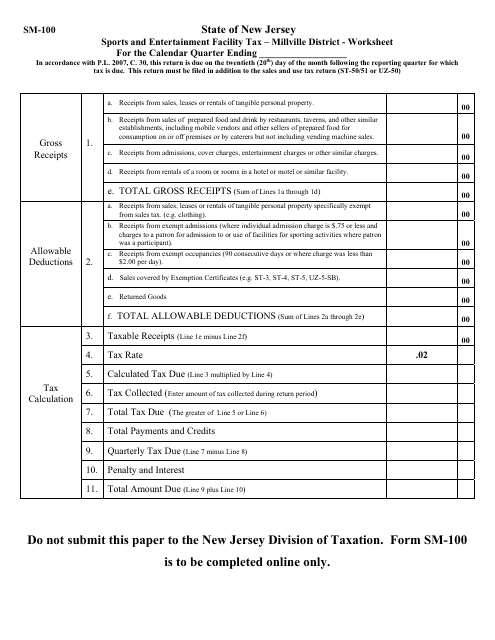

This form is used for calculating the sports and entertainment facility tax in the Millville District of New Jersey. It is specifically designed for businesses operating in the sports and entertainment industry to determine the amount of tax owed.

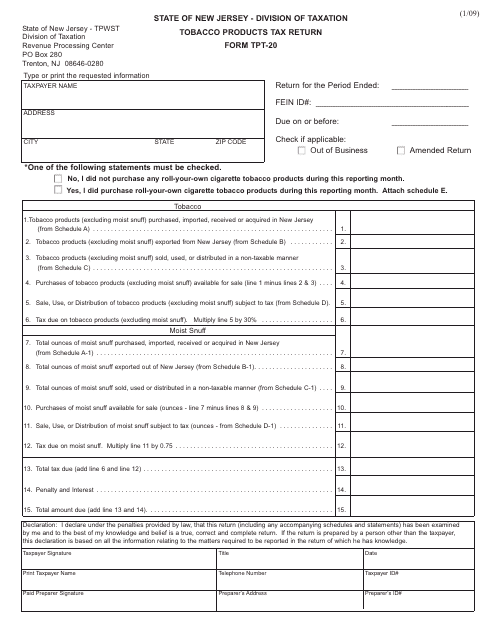

This Form is used for reporting and paying tobacco products tax in the state of New Jersey.

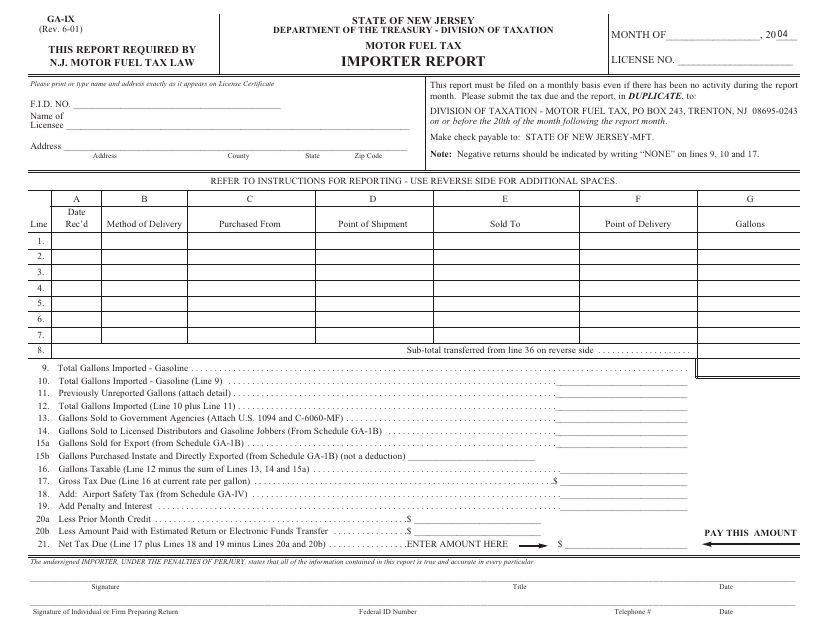

This Form is used for reporting motor fuel imports in New Jersey for tax purposes.

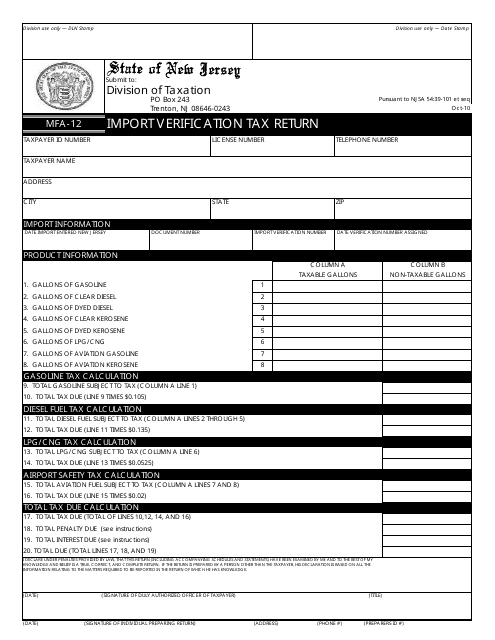

This Form is used for reporting and verifying import taxes paid by businesses in New Jersey.

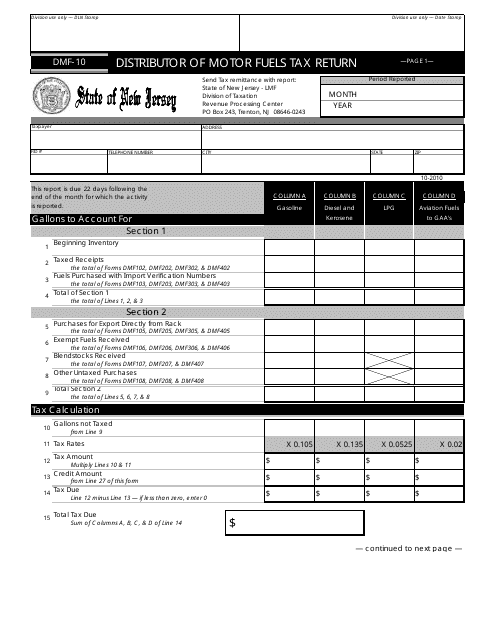

This form is used for filing the Motor Fuels Tax Return for distributors in the state of New Jersey.

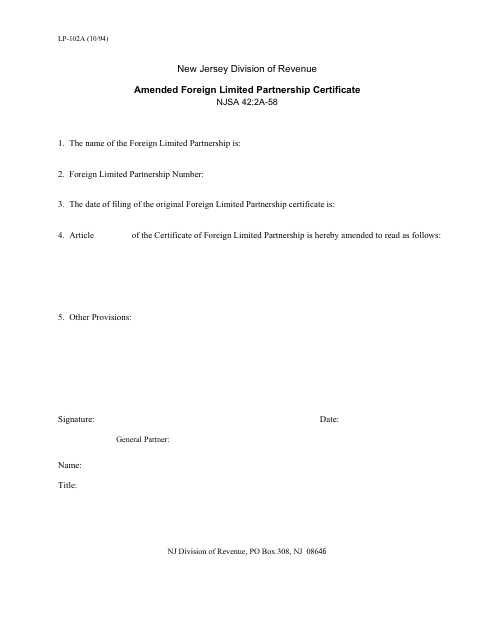

This form is used for filing an amended certificate for a foreign limited partnership in New Jersey.

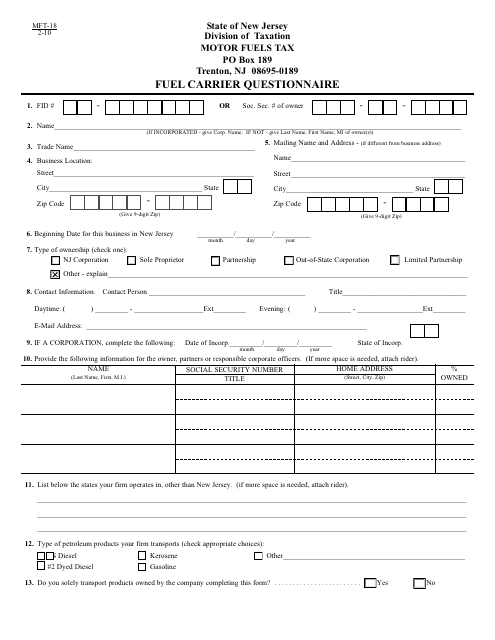

This form is used for fuel carriers in New Jersey to answer several questions regarding their operations and compliance with regulations.

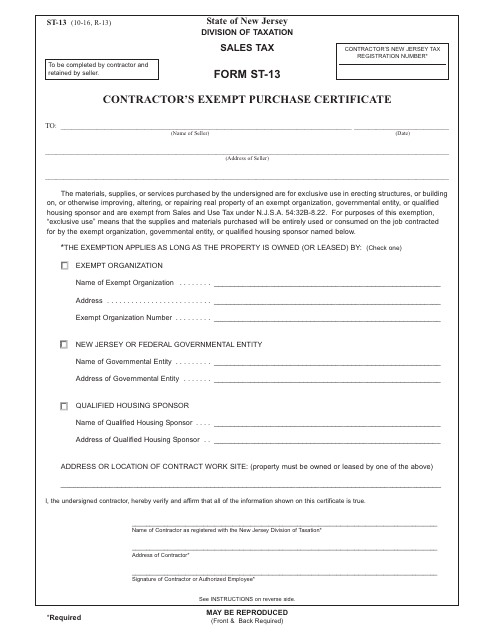

This Form is used for contractors in New Jersey to claim exemption on purchases made for construction projects.

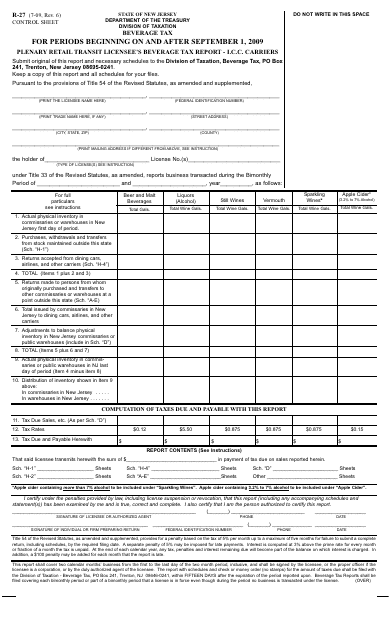

This form is used for New Jersey retailers to report and pay beverage taxes for the months of September and after.

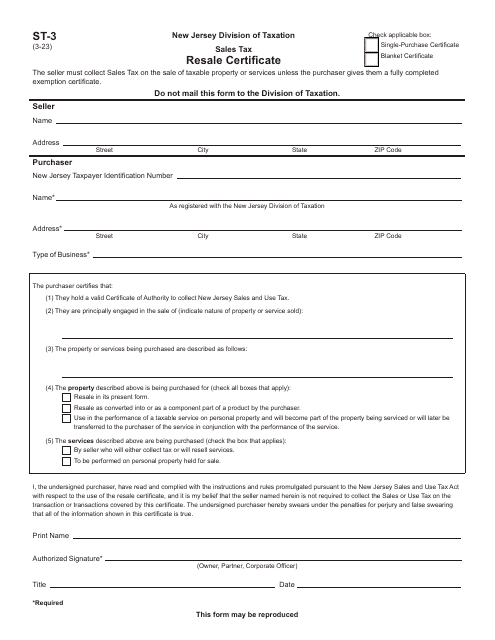

This is a legal document which is needed to be filled out to gain tax exemption for goods you plan to resell in the State of New Jersey.

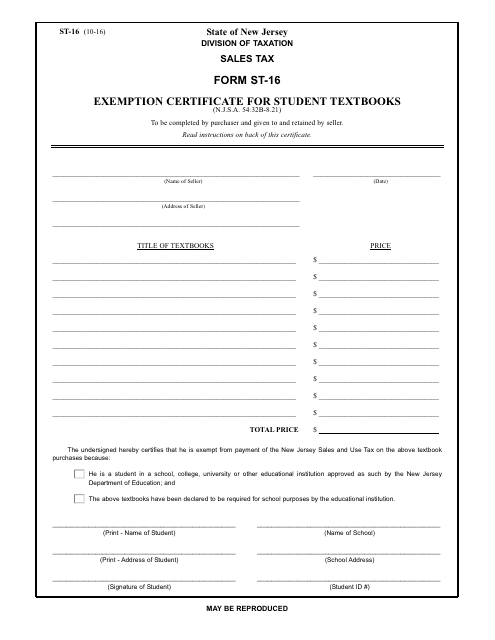

This form is used for requesting an exemption from sales tax on student textbooks in New Jersey.

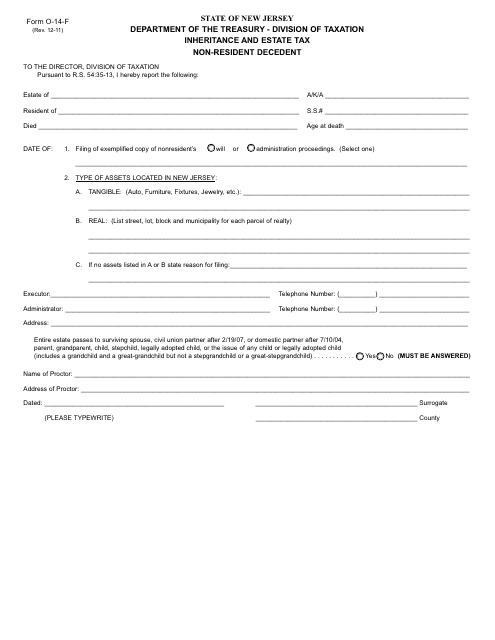

This form is used for reporting inheritance and estate taxes for non-resident decedents in the state of New Jersey.

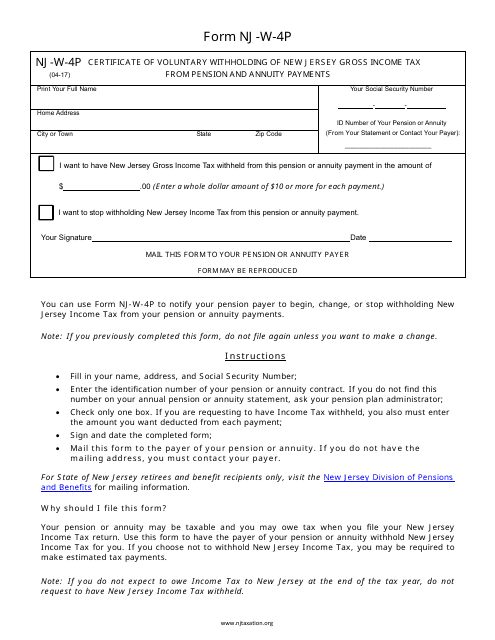

This Form is used for voluntary withholding of New Jersey Gross Income Tax from pension and annuity payments in the state of New Jersey. It allows individuals to request the withholding of a certain amount from their pension or annuity payments to cover their state income tax liability.

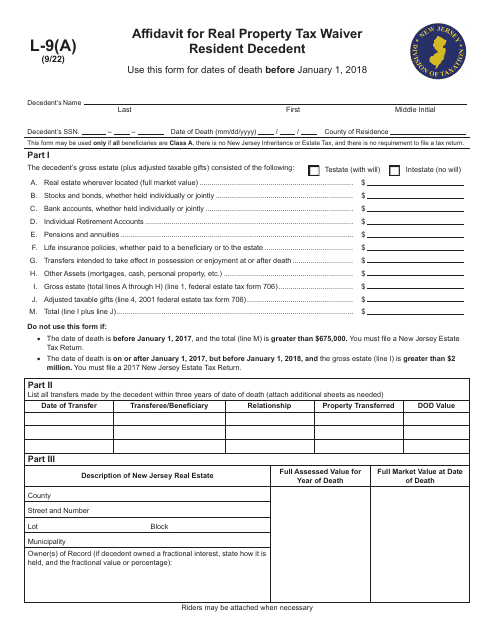

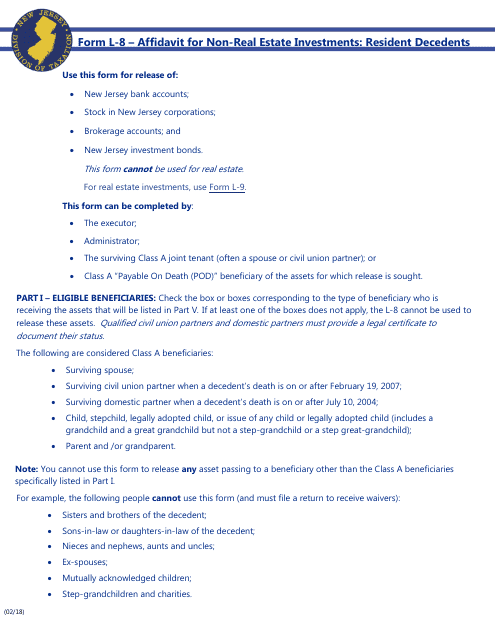

This form is used for New Jersey residents to declare their non-real estate investments in the event of a resident's death.

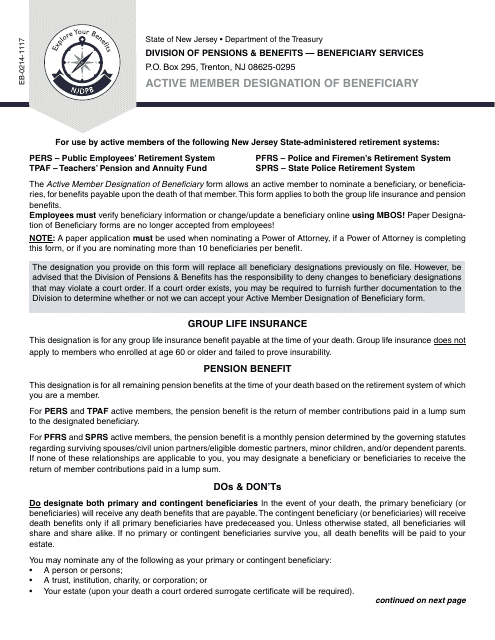

This Form is used for the designation of beneficiary by active members in the state of New Jersey.

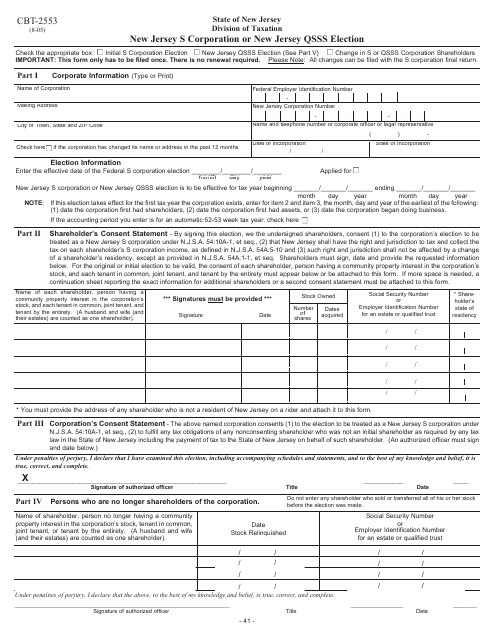

This form is used for electing New Jersey S Corporation or New Jersey Qsss status.

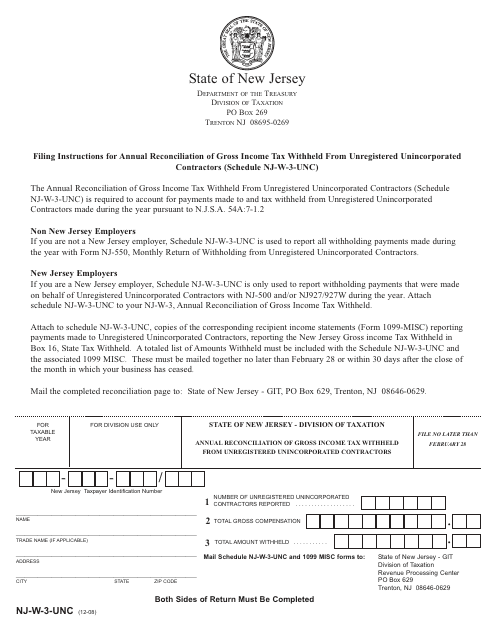

This form is used for the annual reconciliation of gross income tax withheld from unregistered unincorporated contractors in New Jersey.

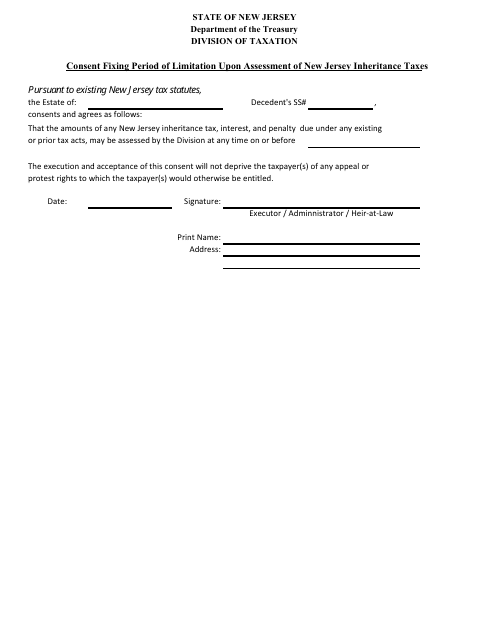

This document is used for fixing the period of limitation for assessing inheritance taxes in the state of New Jersey. It involves obtaining consent for any changes to the assessment of these taxes.

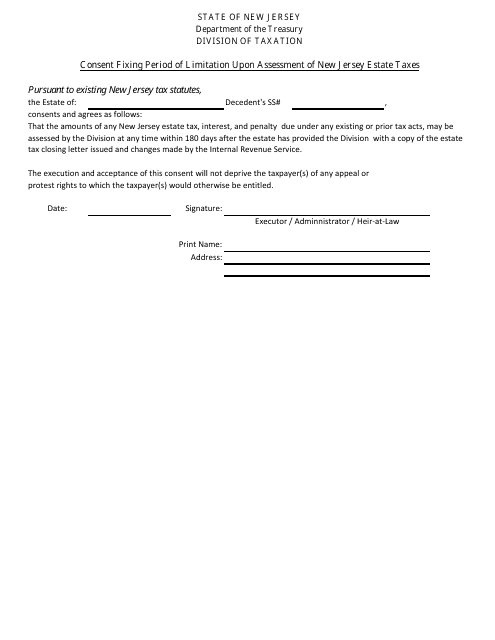

This document establishes the time limit for assessing New Jersey estate taxes.

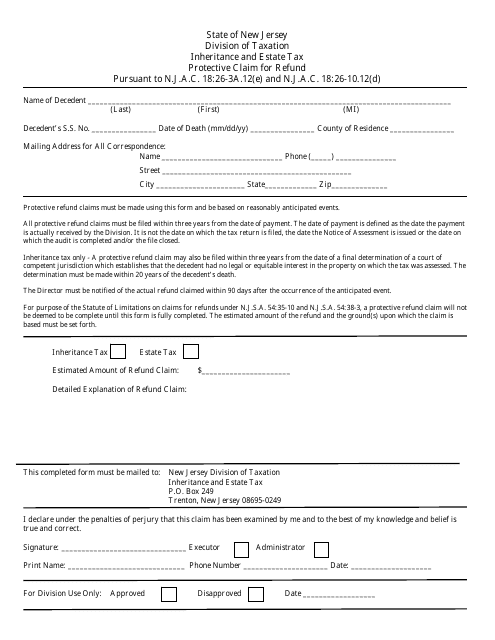

This Form is used for claiming a refund for inheritance and estate taxes paid in New Jersey.

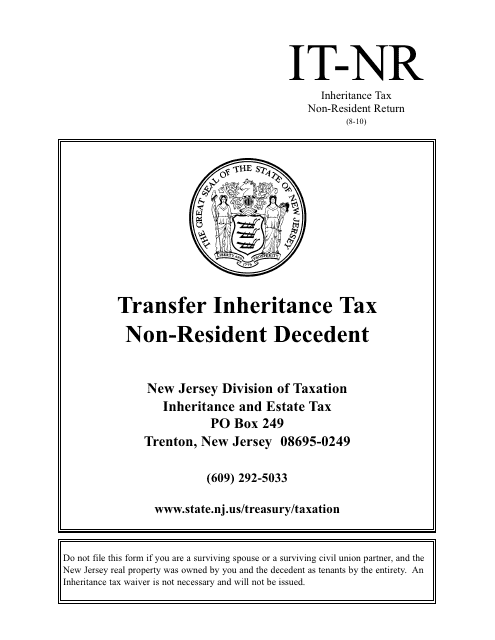

This form is used for transferring inheritance tax for non-resident decedents in New Jersey.

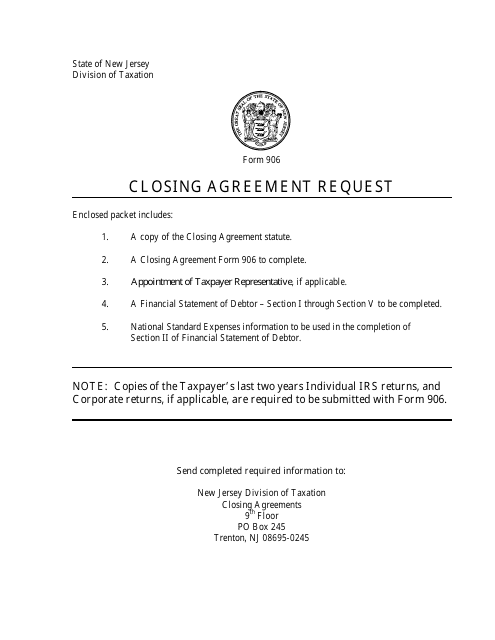

This Form is used for requesting a closing agreement in the state of New Jersey.

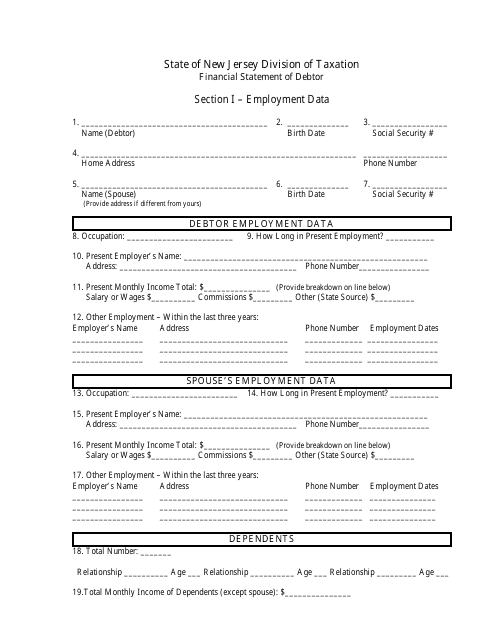

This document provides a detailed overview of the financial status of a debtor residing in New Jersey. It includes information about their income, assets, liabilities, and overall financial health.

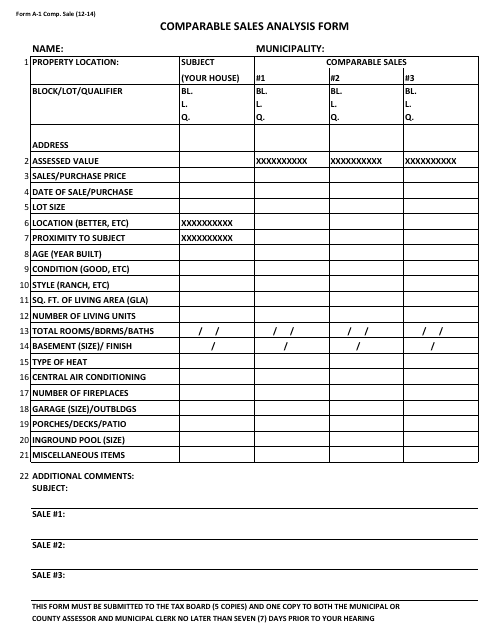

This Form is used for conducting a Comparable Sales Analysis in New Jersey. It helps in evaluating the market value of a property by comparing it to similar properties that have recently sold in the area.

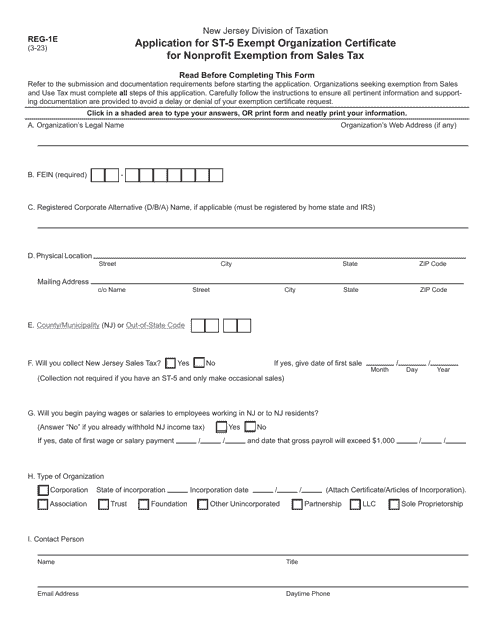

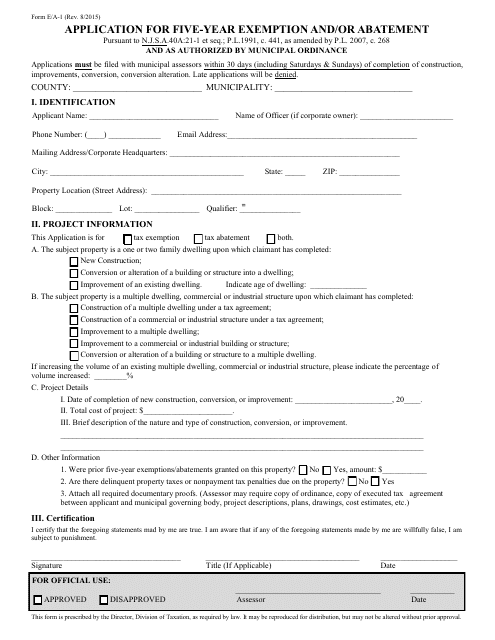

This form is used for applying for a five-year exemption and/or abatement in New Jersey.