New Jersey Department of the Treasury Forms

Documents:

1110

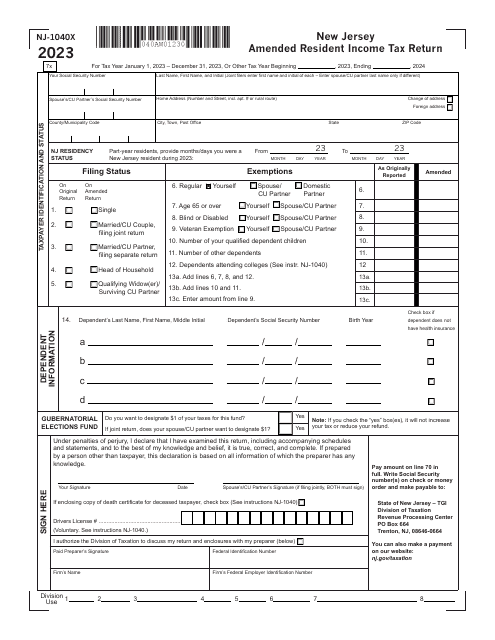

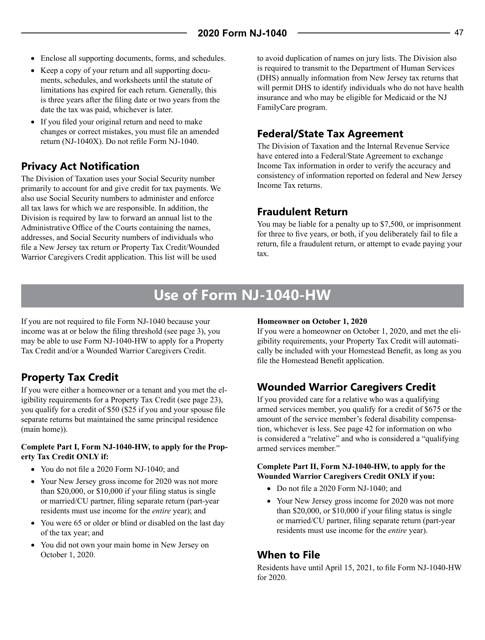

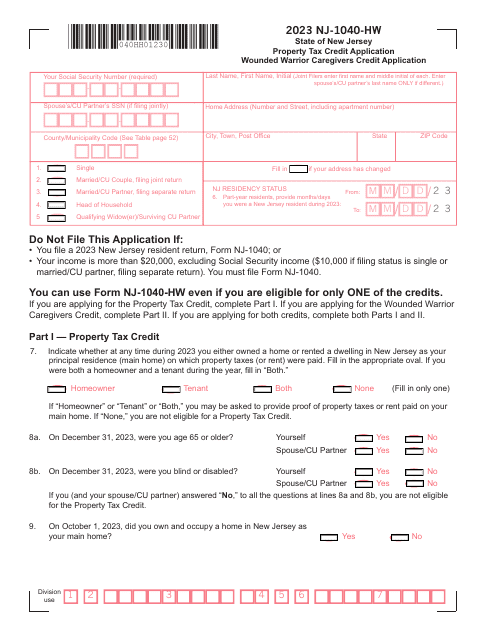

This Form is used for filing New Jersey Resident Income Tax Return for residents of New Jersey. It provides instructions for completing the form and includes information on tax filing requirements and deductions specific to New Jersey.

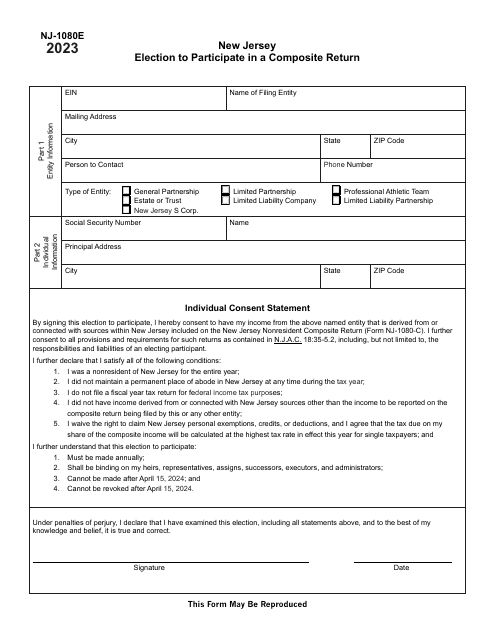

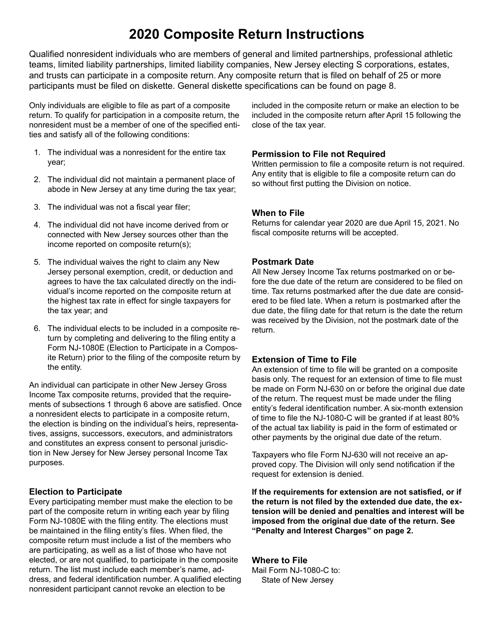

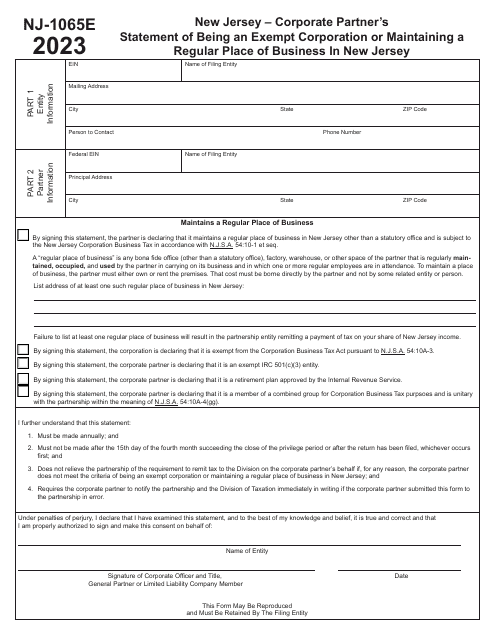

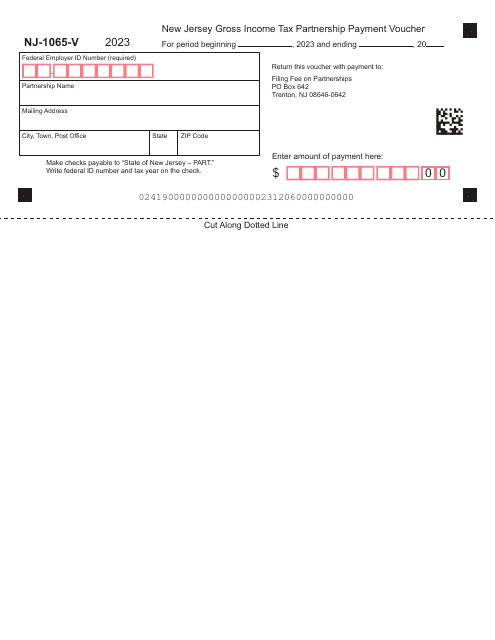

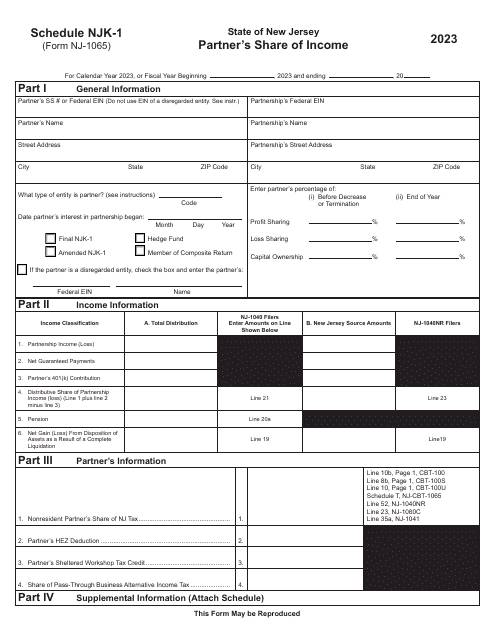

This type of document provides instructions for filing Forms NJ-1080A, NJ-1080B, NJ-1080C, and NJ-1080E in the state of New Jersey.

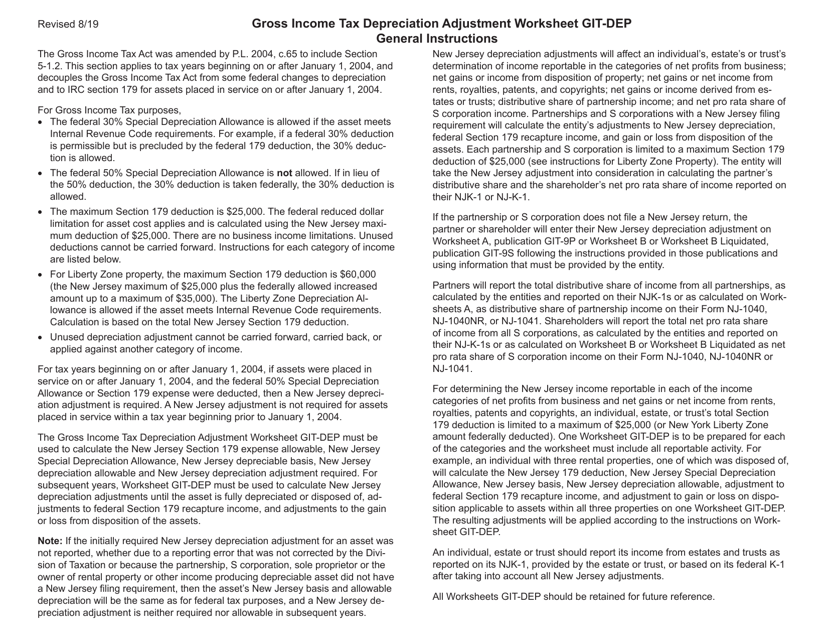

This document is used for calculating the depreciation adjustment for gross income tax in New Jersey. It is a worksheet that helps taxpayers determine their depreciation expense for tax purposes.

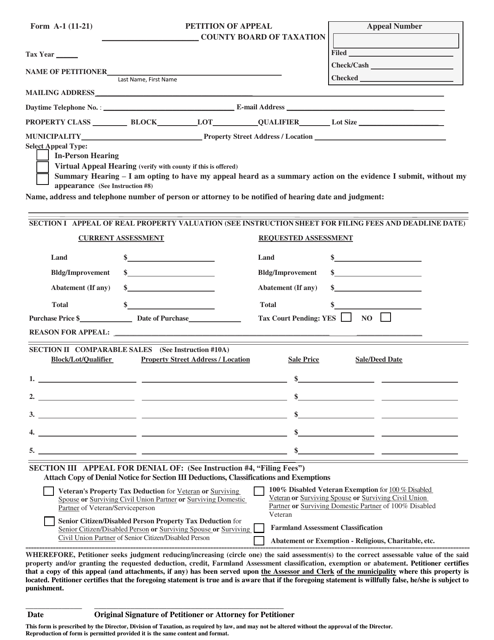

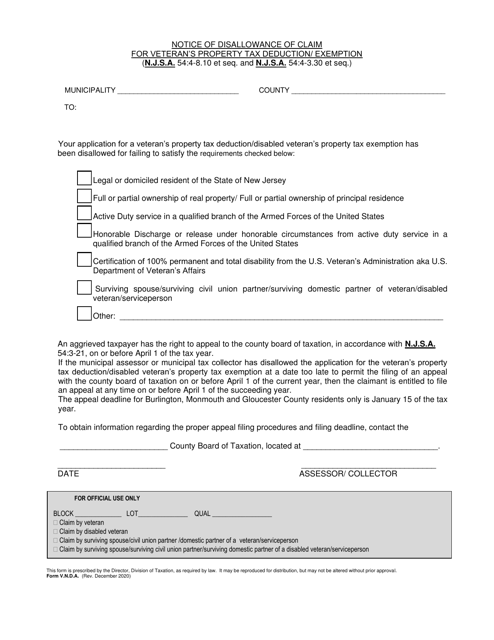

This document is used to inform veterans that their claim for property tax deduction or exemption in New Jersey has been disallowed.

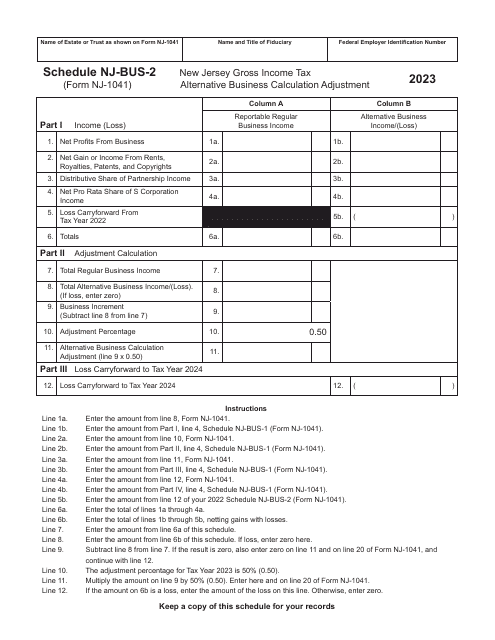

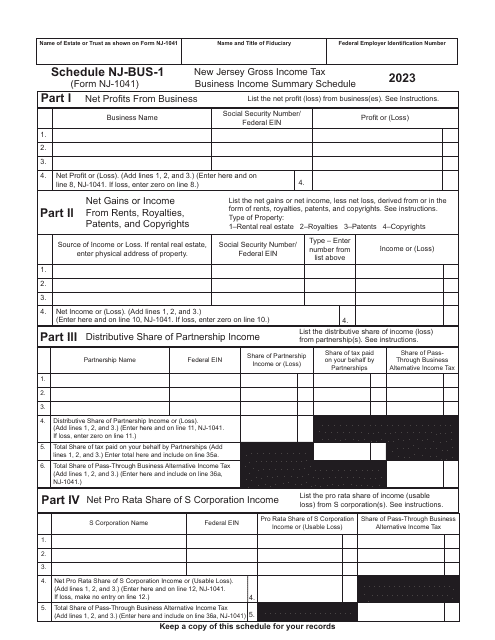

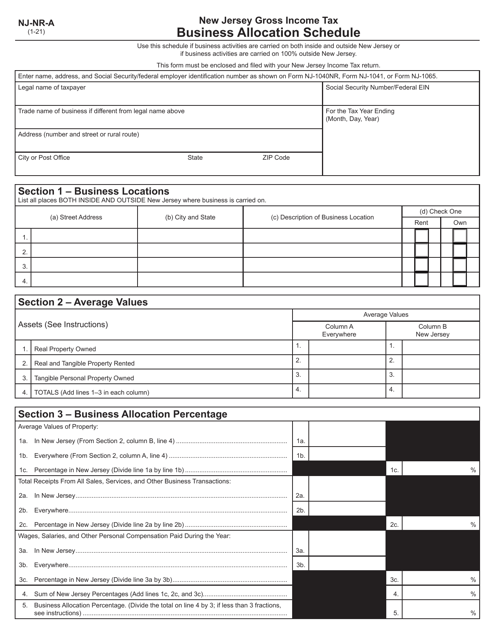

This Form is used for reporting the allocation of business income for New Jersey tax purposes.