New Jersey Department of the Treasury Forms

Documents:

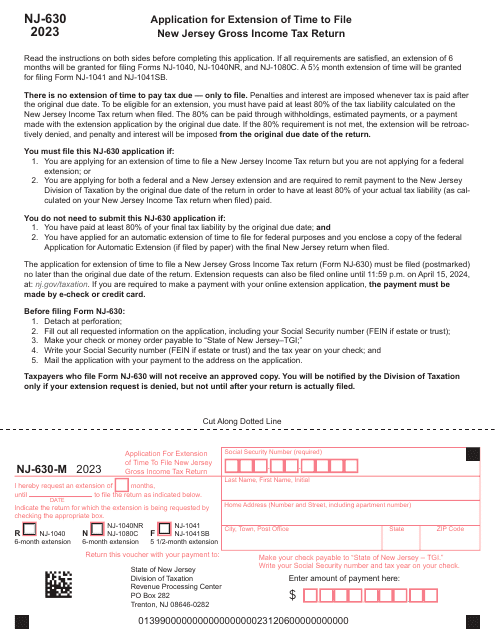

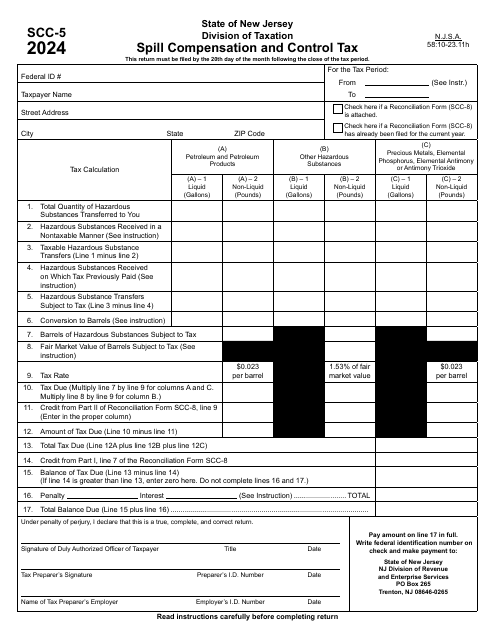

1110

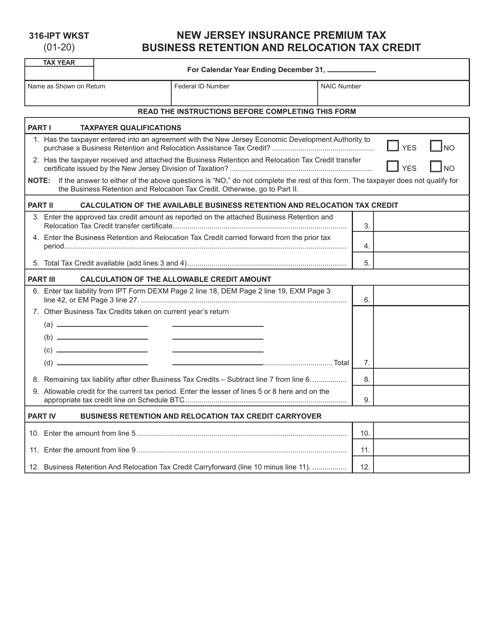

This form is used for applying for the Business Retention and Relocation Tax Credit in the state of New Jersey.

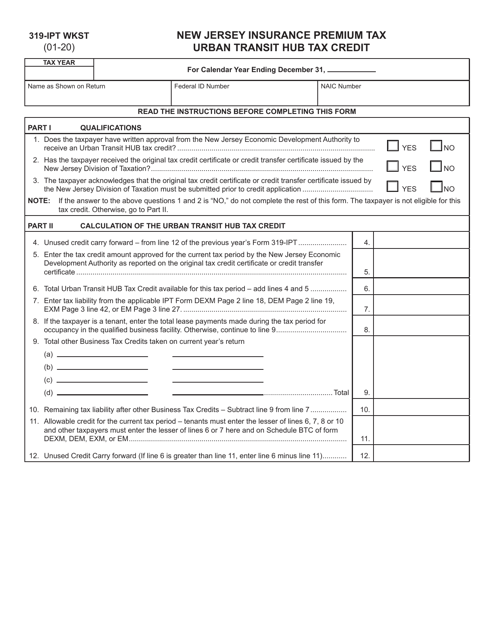

This form is used for claiming the Urban Transit Hub Tax Credit in the state of New Jersey.

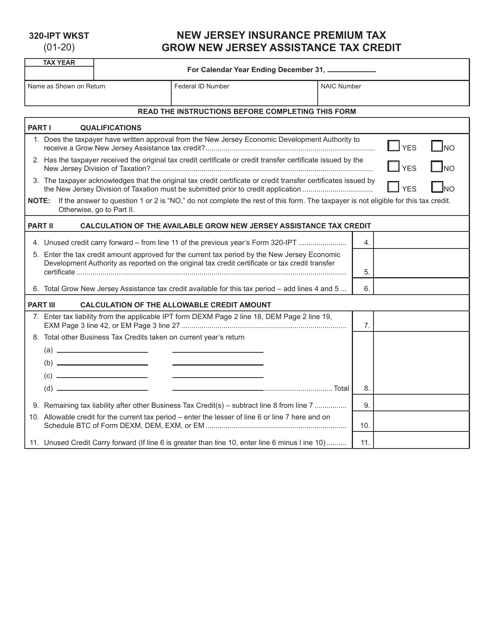

This form is used to apply for the Grow New Jersey Assistance Tax Credit in the state of New Jersey. It is used to help businesses grow and create new jobs in the state.

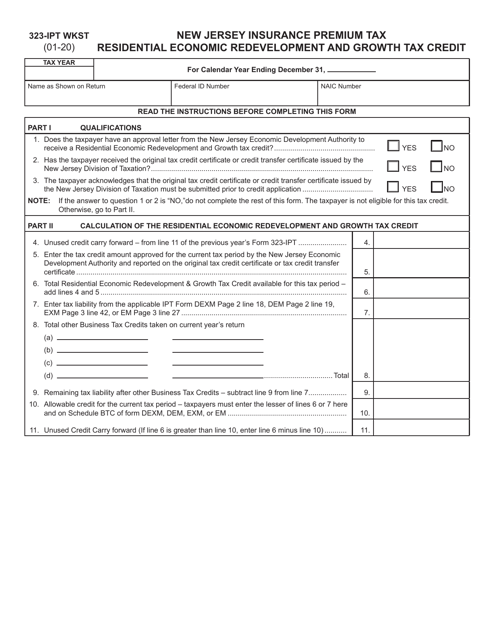

This Form is used for applying for the Residential Economic Redevelopment and Growth Tax Credit in New Jersey for residential properties that undergo economic redevelopment and growth.

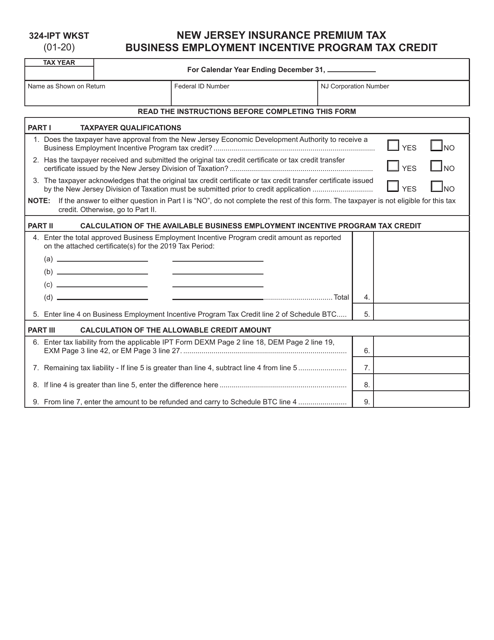

This Form is used for claiming the Business Employment Incentive Program Tax Credit in New Jersey.

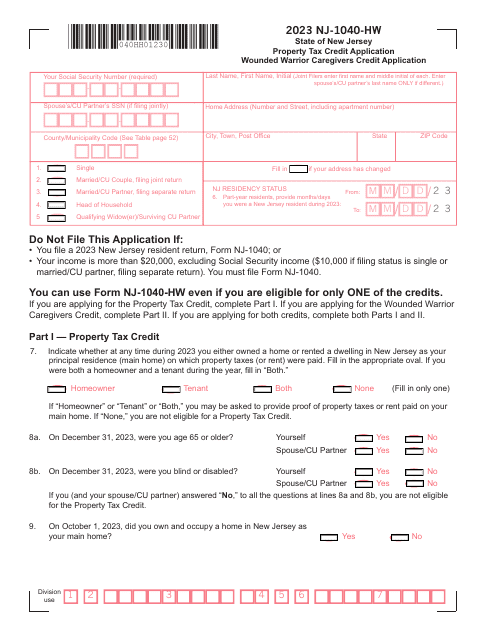

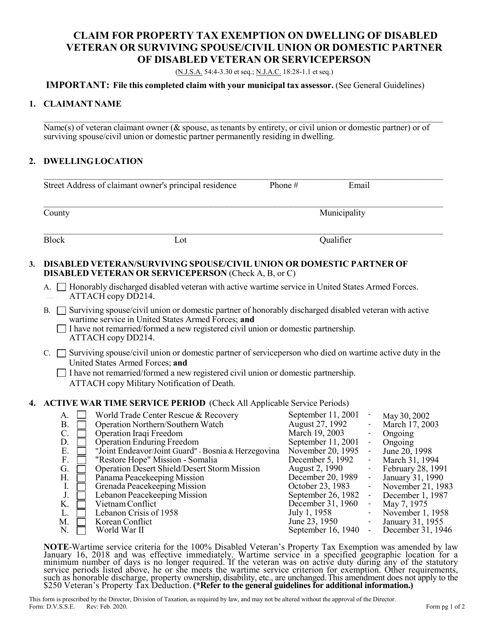

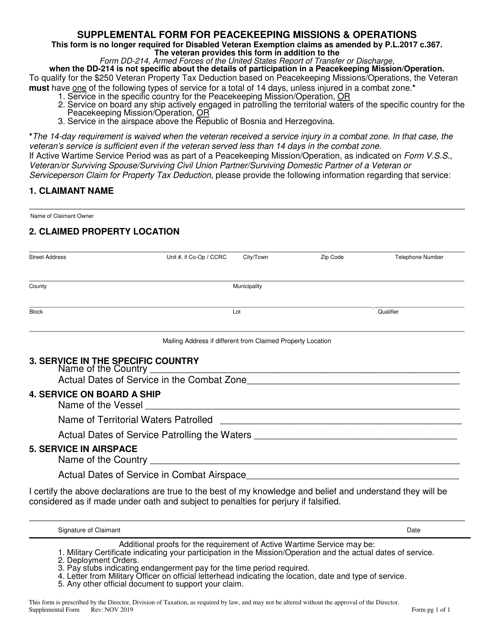

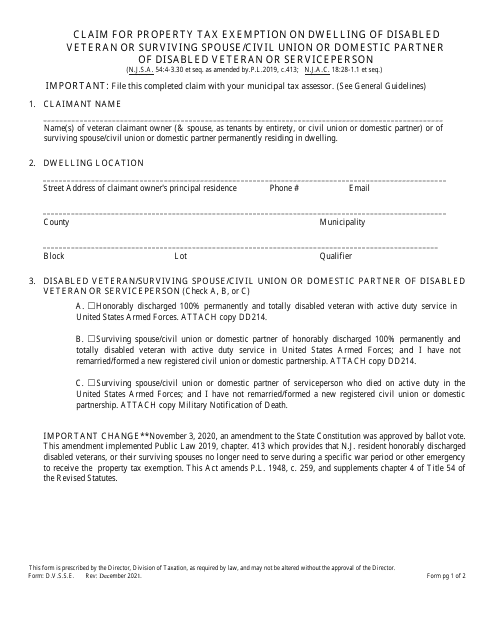

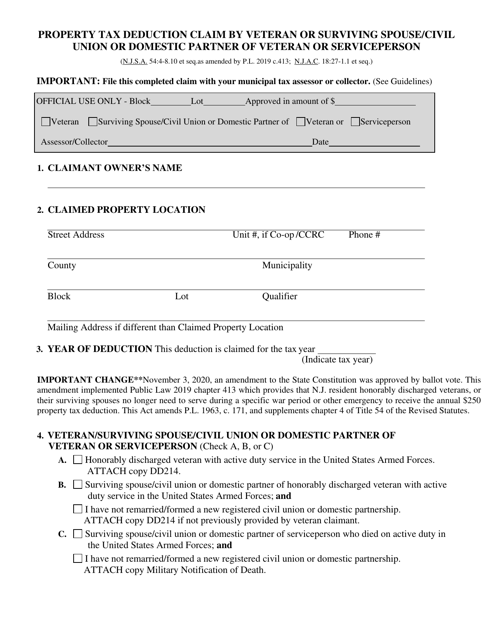

This form is used for claiming property tax exemption on the dwelling of a disabled veteran or surviving spouse or civil union or domestic partner of a disabled veteran or serviceperson in New Jersey.

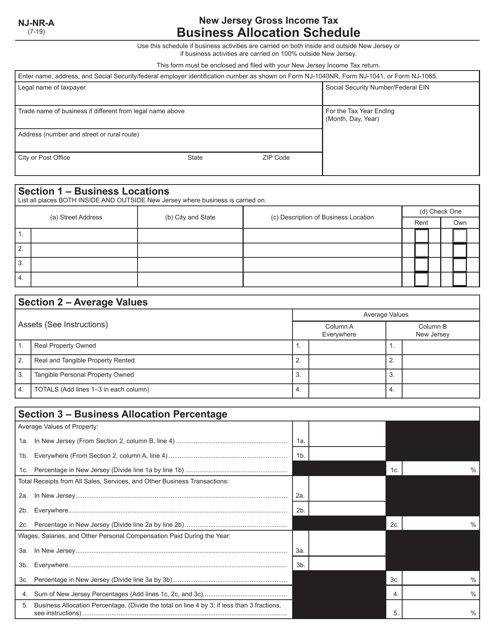

This document is used for reporting business allocation for New Jersey income tax purposes.

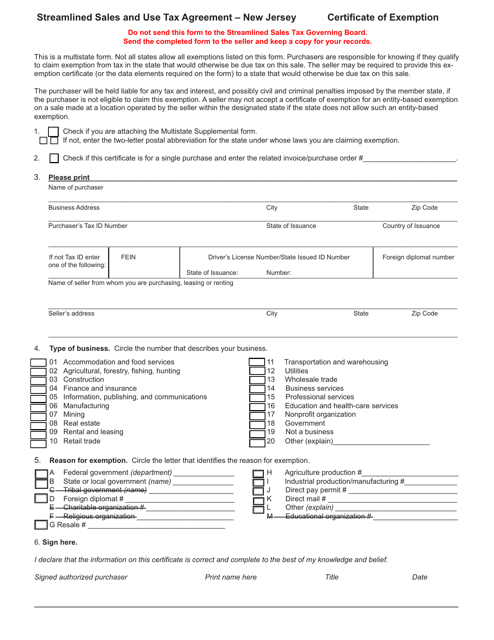

This form is used for applying for a certificate of exemption in New Jersey under the Streamline Sales & Use Tax Agreement.

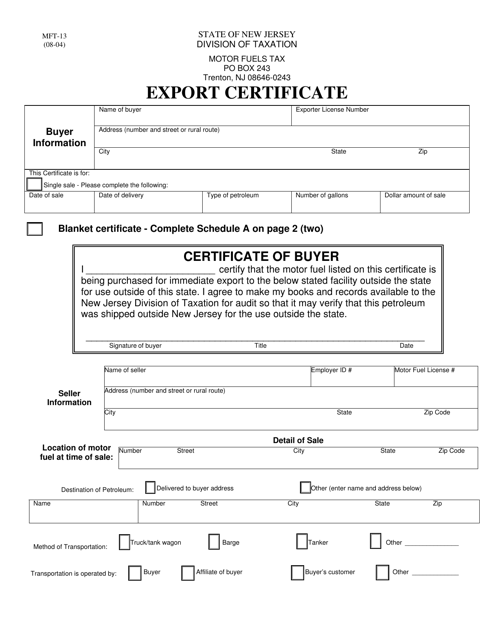

This form is used for obtaining an export certificate in New Jersey. It is required when exporting certain goods out of the state.

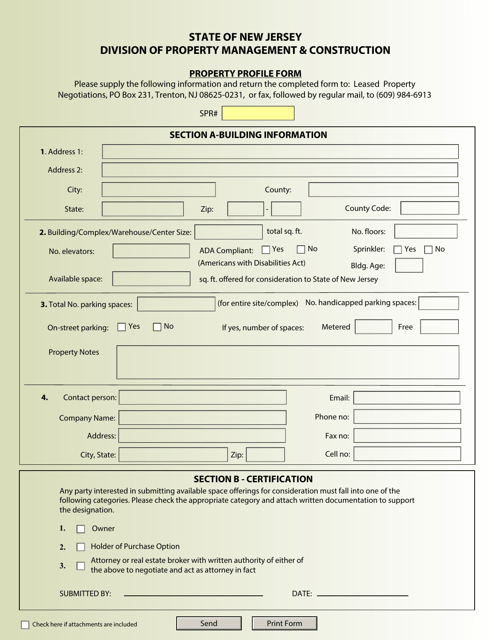

This form is used for obtaining detailed information about a property in New Jersey.

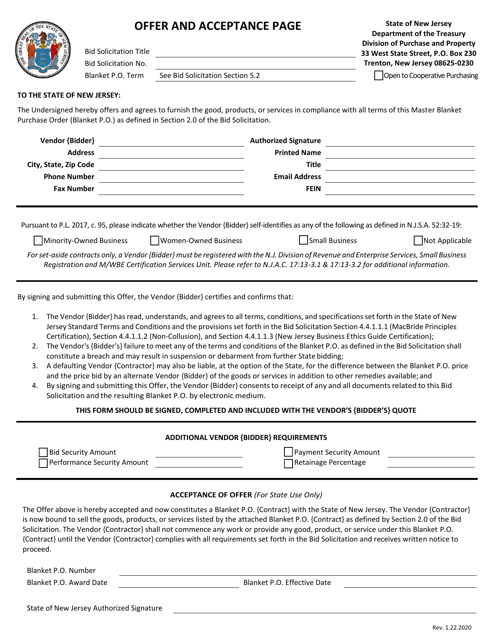

This document is used for formalizing the agreement between two parties in New Jersey. It outlines the offer made by one party and the acceptance of that offer by the other party.

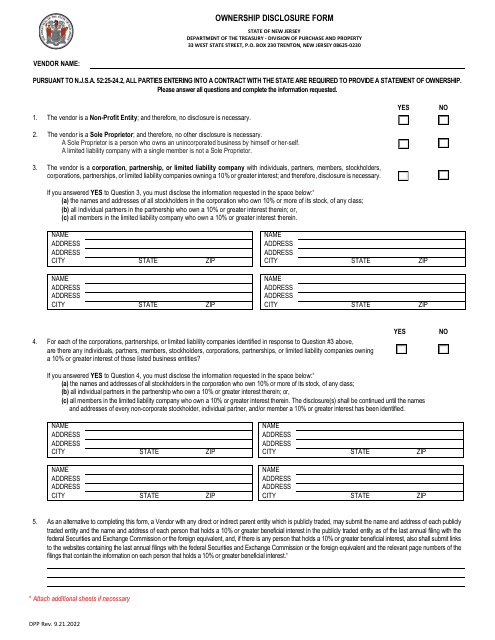

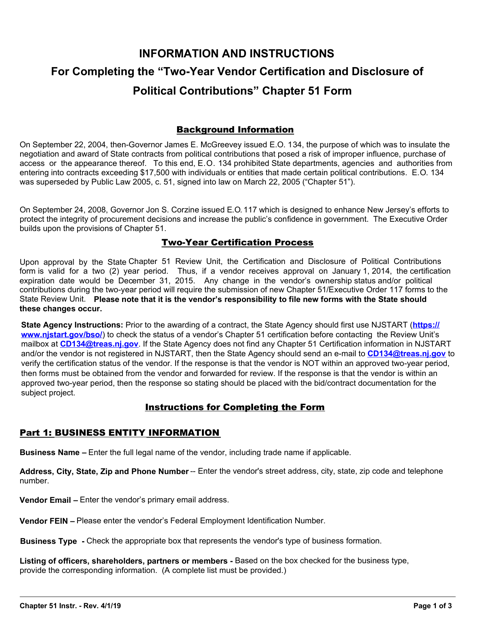

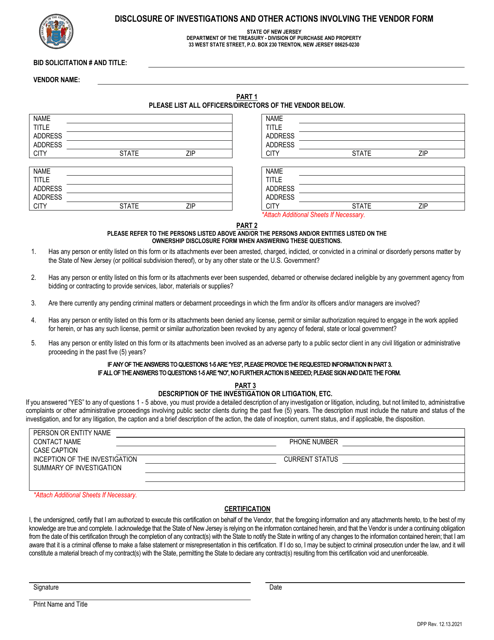

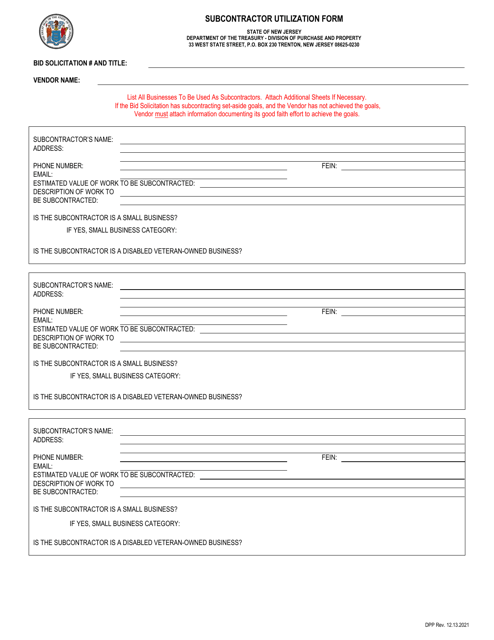

This document is a vendor certification and disclosure form required by the State of New Jersey for vendors seeking contracts under a two-year chapter 51 or executive order 117. Vendors must disclose their political contributions as part of the certification process.

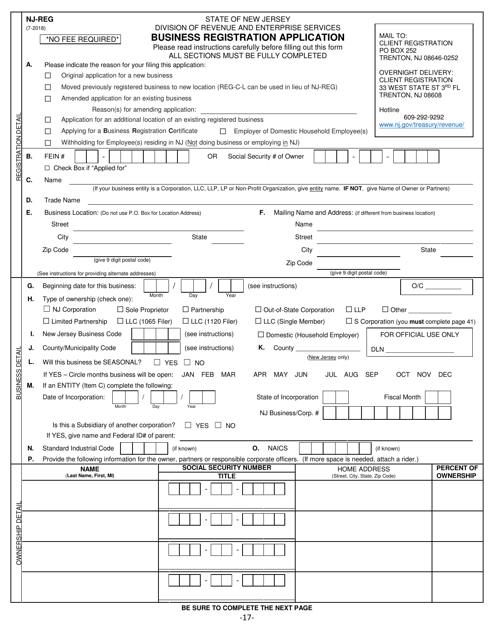

This form is used for business owners in New Jersey to register their business.

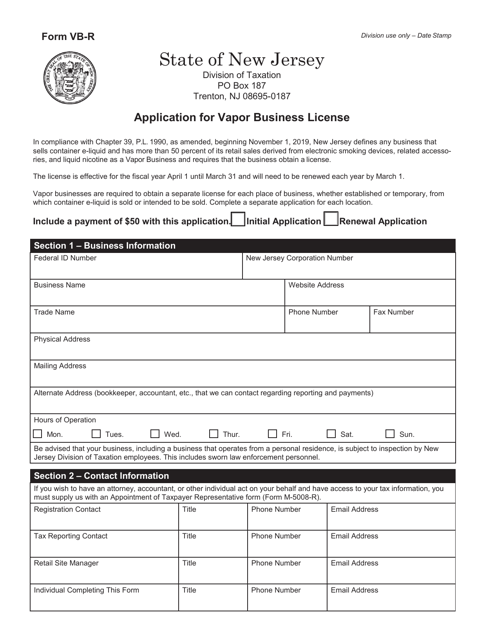

This form is used for business owners in New Jersey who want to apply for a Vapor Business License.

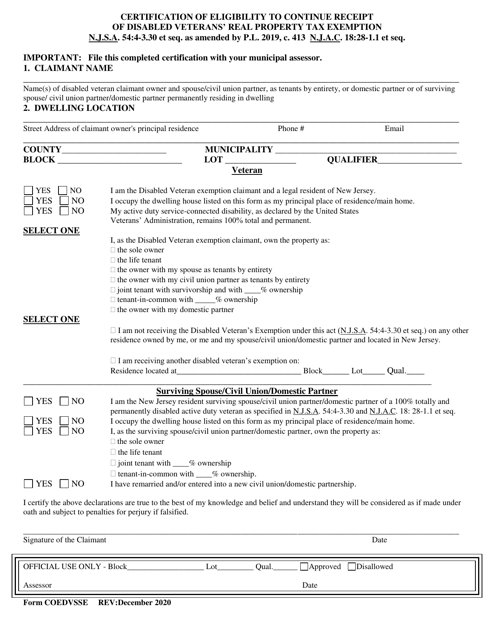

This form is used for certification of eligibility to continue receiving the Disabled Veterans' Real Property Tax Exemption in New Jersey. It allows disabled veterans to maintain their exemption and continue receiving tax benefits on their real property.