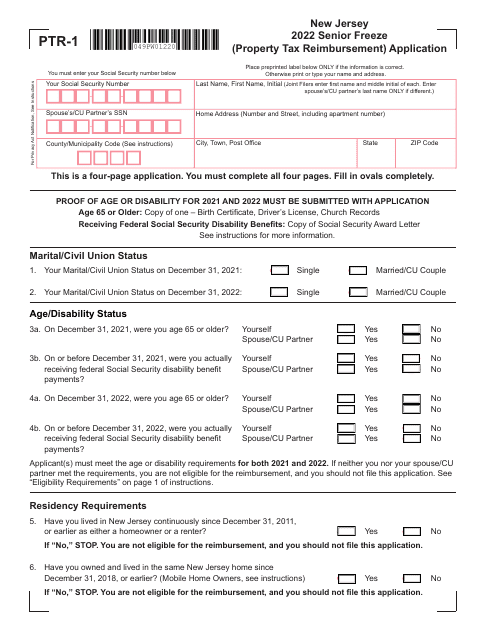

New Jersey Department of the Treasury Forms

Documents:

1110

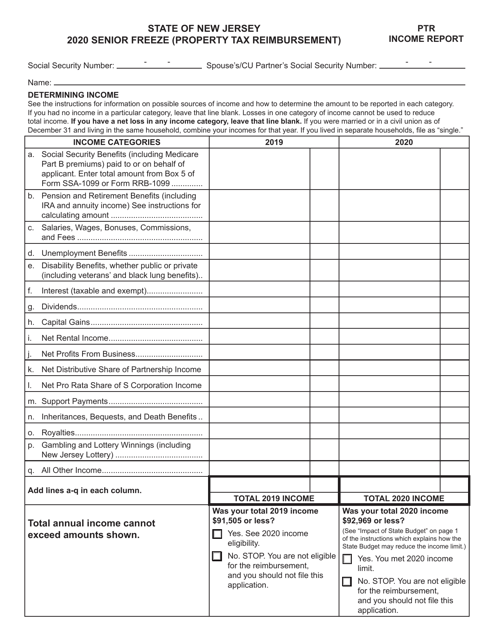

This Form is used for reporting property tax reimbursement income in New Jersey. It is used by taxpayers to report their income earned from property tax reimbursements and calculate any potential tax liability.

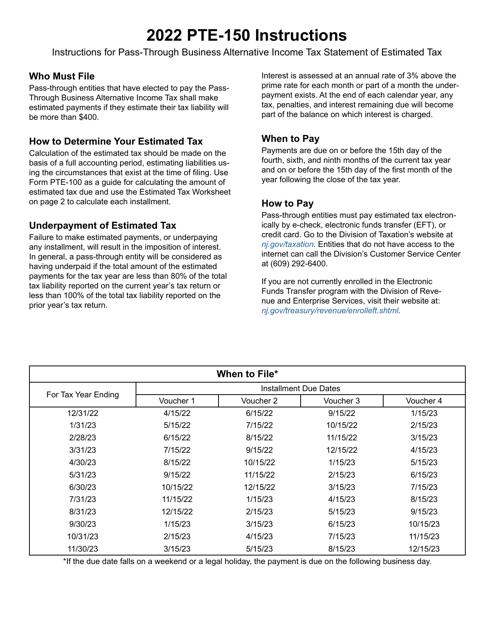

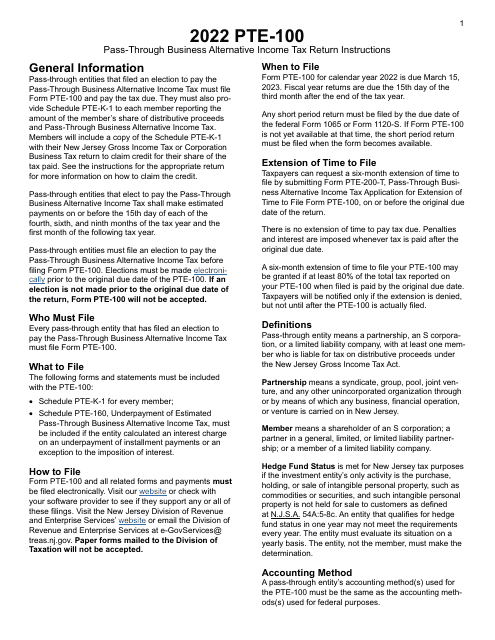

Instructions for Form PTE-100 Pass-Through Business Alternative Income Tax Return - New Jersey, 2022

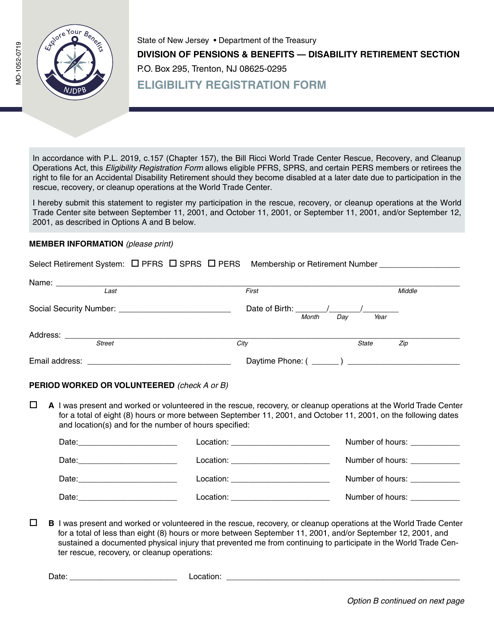

This Form is used for registering for eligibility in New Jersey.

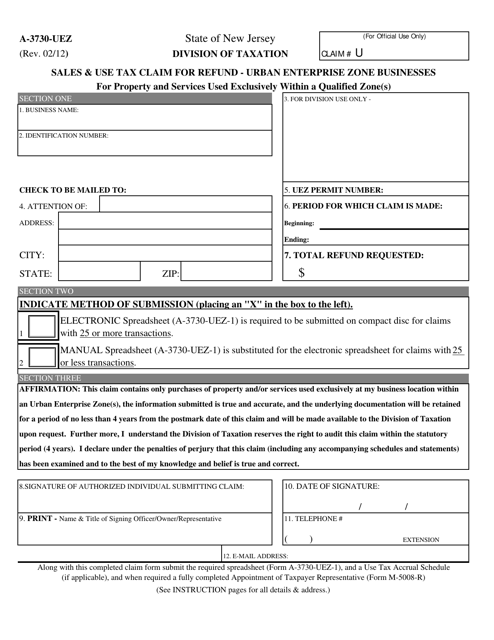

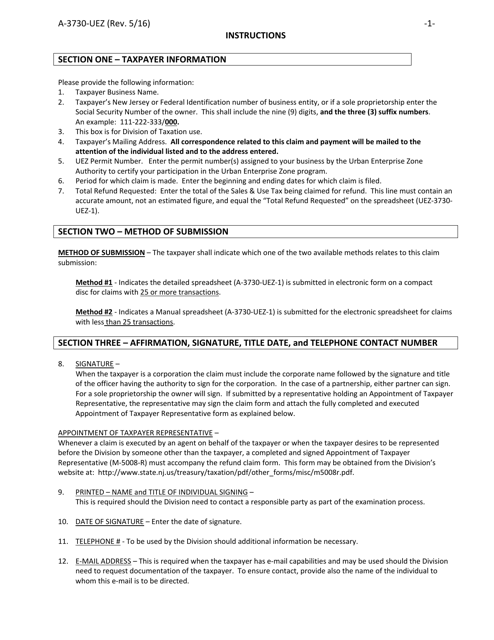

This document is used for urban enterprise zone businesses in New Jersey to claim a refund for sales and use tax paid on property and services used exclusively within a qualified zone.

This Form is used for Urban Enterprise Zone (UEZ) businesses in New Jersey to claim a refund for sales and use tax on property and services used exclusively within a qualified zone(s). It provides instructions on how to fill out the form and submit it for a refund.

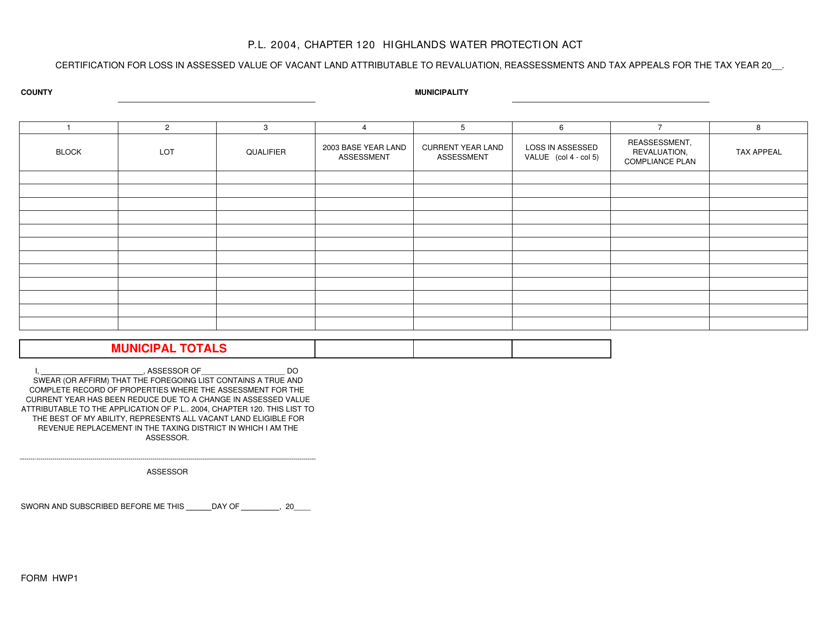

This form is used for certifying the loss in assessed value of vacant land in New Jersey due to revaluation, reassessments, and tax appeals.

This Form is used for certification of loss in assessed value of vacant land in New Jersey due to revaluation, reassessments, and tax appeals.

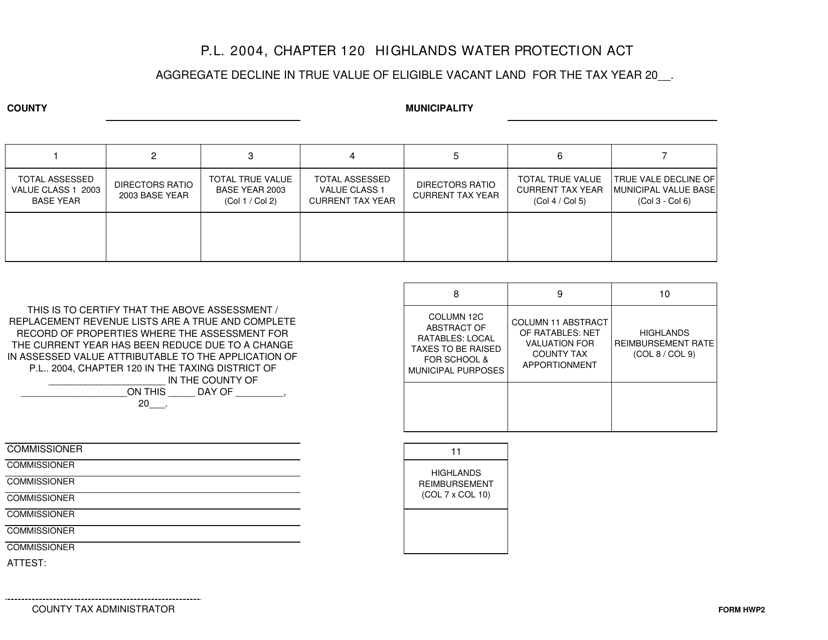

This form is used for reporting the aggregate decline in the true value of eligible vacant land in New Jersey.

This Form is used for reporting the aggregate decline in true value of eligible vacant land in New Jersey.

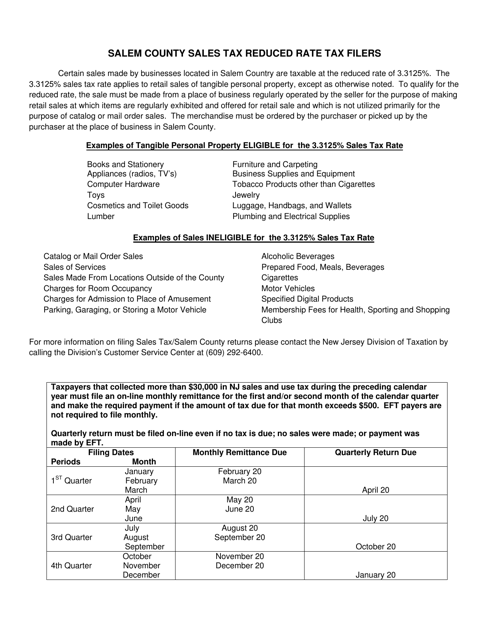

This form is used for filing the Salem County Quarterly Return Worksheet in Salem County, New Jersey. It is used to report quarterly tax information.

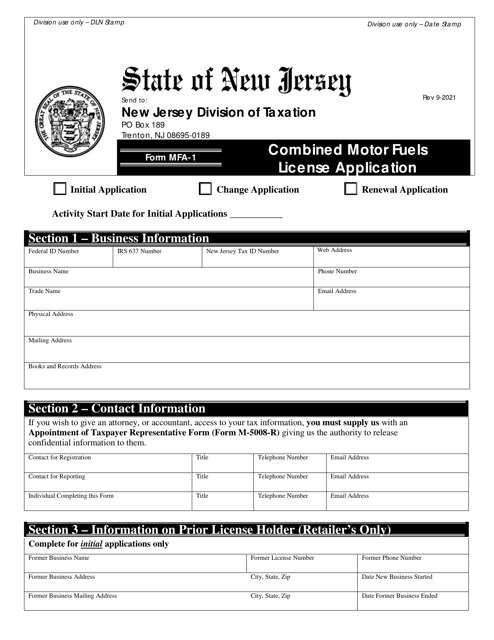

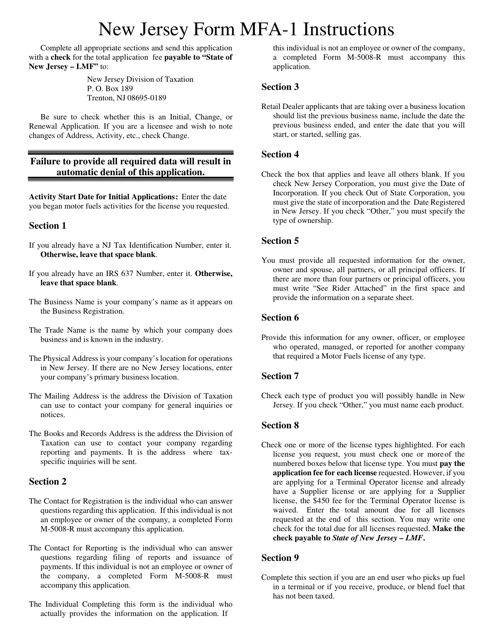

This document is used for applying for a combined motor fuels license in New Jersey. It provides instructions on how to fill out and submit Form MFA-1.