Louisiana Department of Revenue Forms

Documents:

687

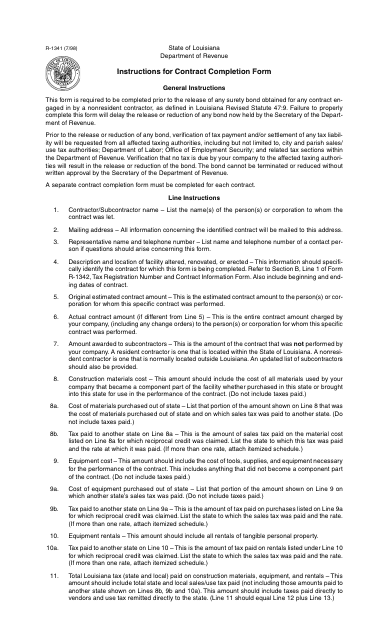

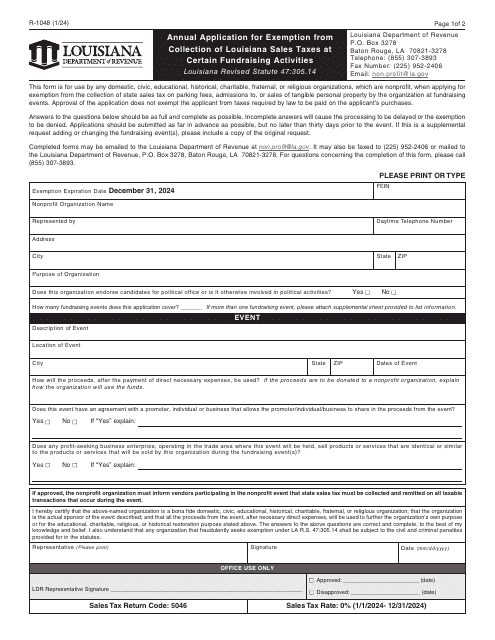

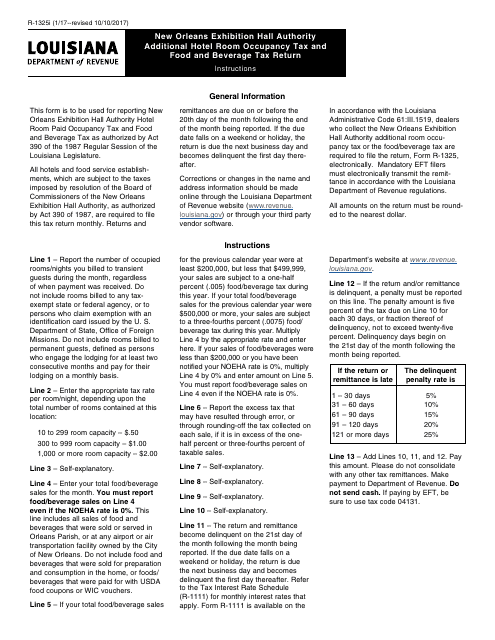

This Form is used for submitting the Contract Completion Form in the state of Louisiana. It provides instructions on how to fill out and submit the form.

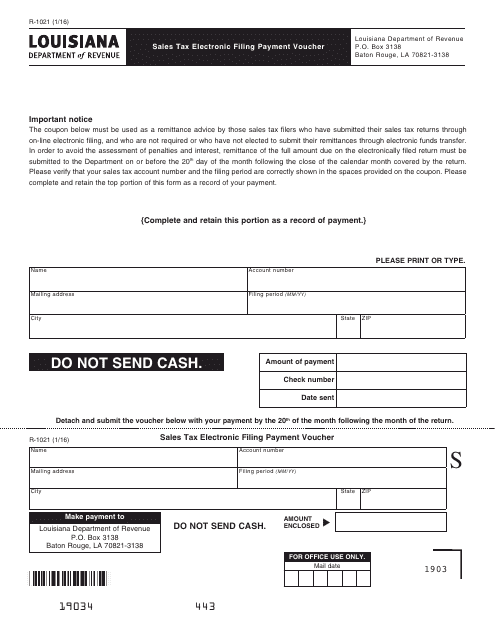

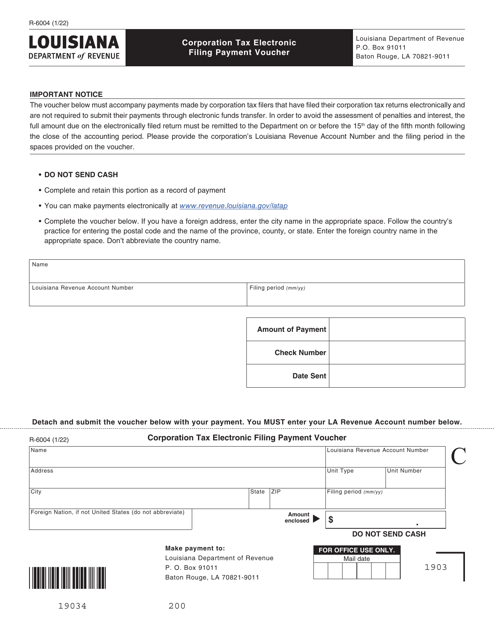

This form is used for electronically filing and making payments for sales tax in Louisiana.

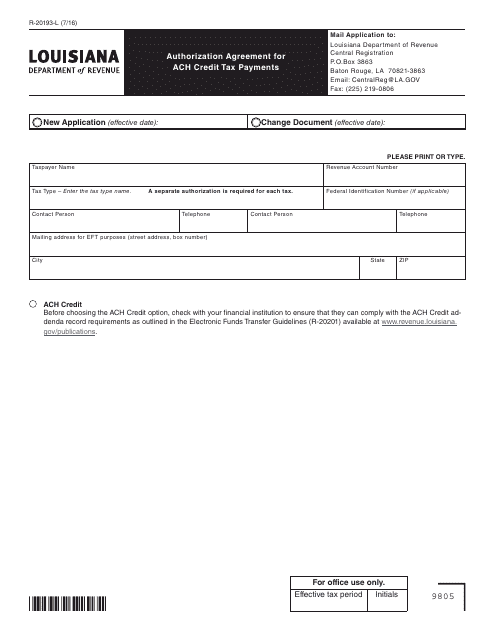

This form is used for authorizing automatic tax payments via ACH credit in the state of Louisiana.

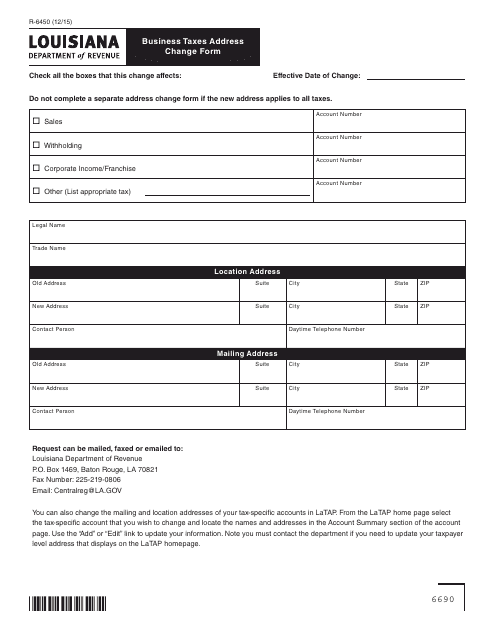

This Form is used for reporting any changes in business address for tax purposes in the state of Louisiana.

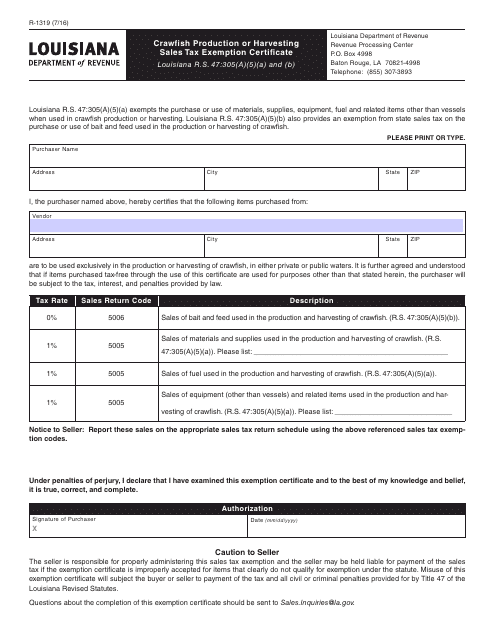

This document is used for applying for a sales tax exemption for crawfish production or harvesting in Louisiana.

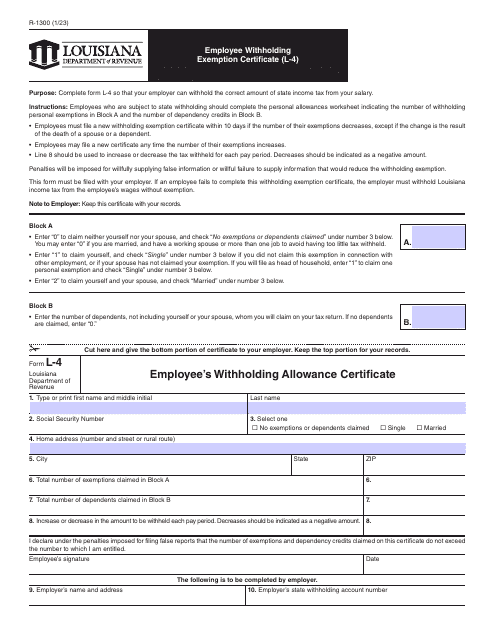

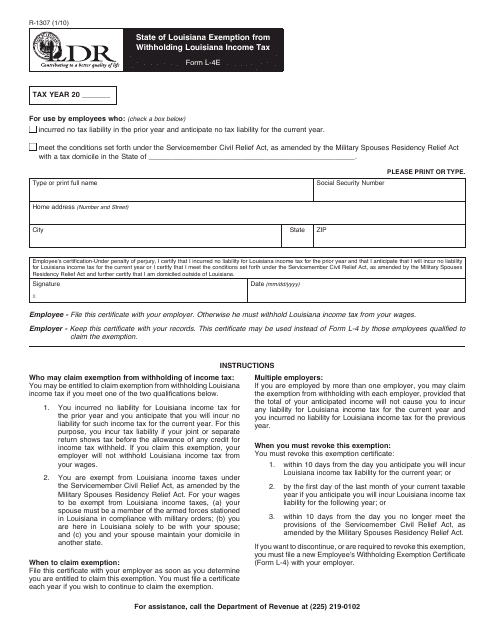

This form is used for individuals in Louisiana to claim an exemption from withholding Louisiana income tax.

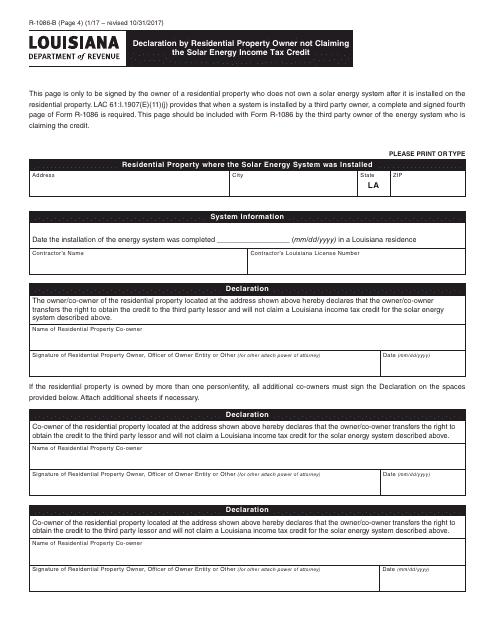

This form is used for residential property owners in Louisiana who are not claiming the Solar Energy Income Tax Credit.

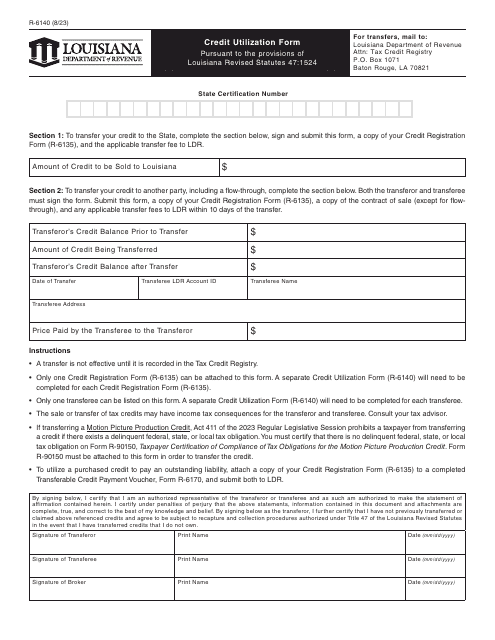

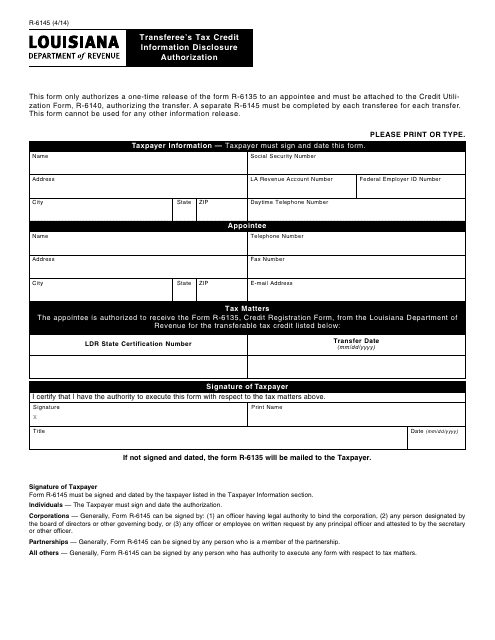

This form is used for requesting authorization to disclose tax credit information for the transferee in Louisiana.

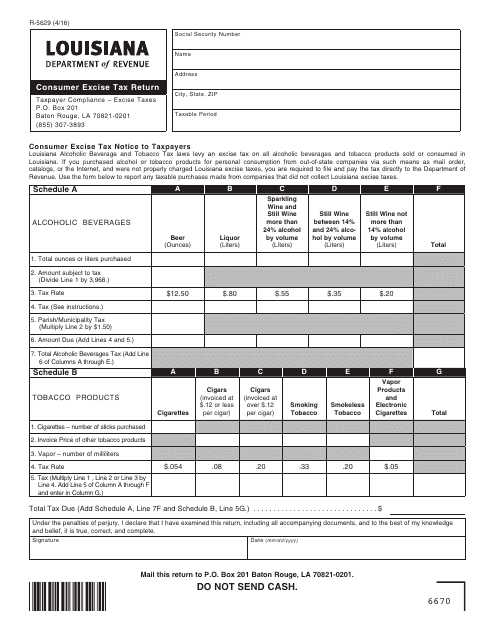

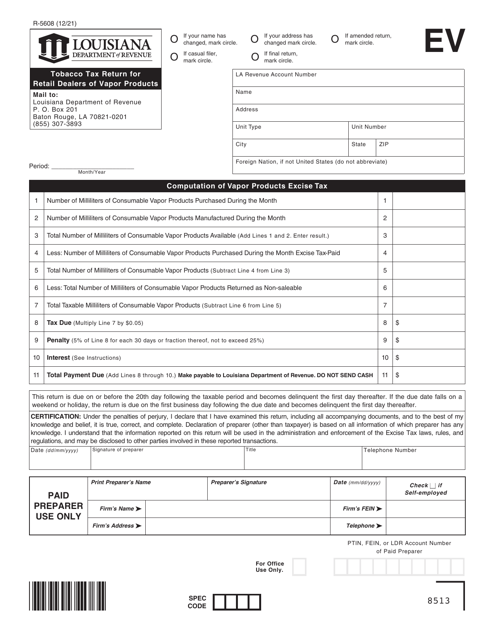

This Form is used for reporting and paying consumer excise taxes in the state of Louisiana.

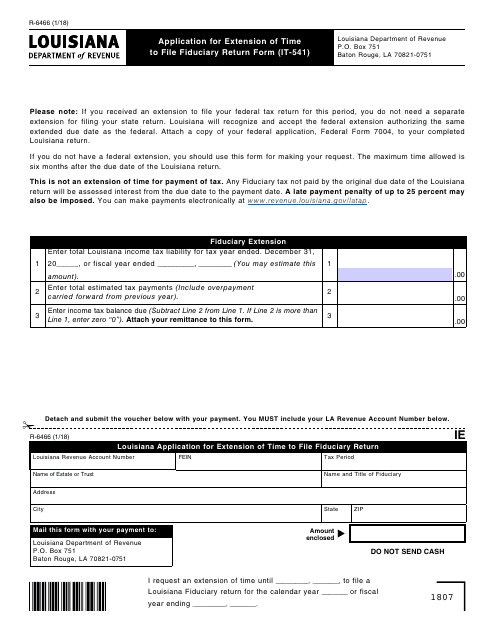

This form is used for applying for an extension of time to file the fiduciary return form (IT-541) in Louisiana.

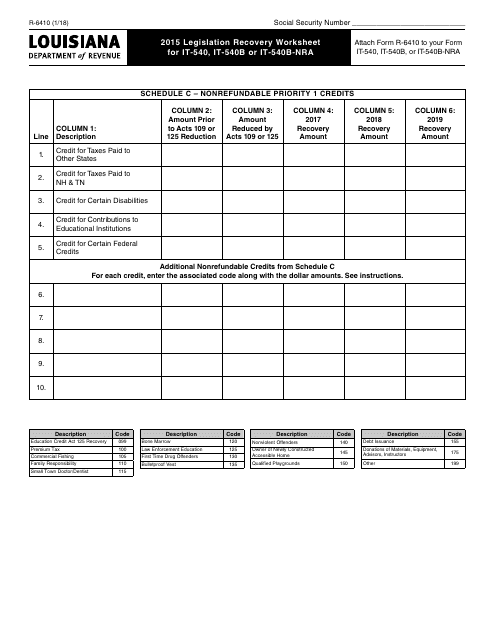

This form is used for reporting and calculating the legislative recovery amount for individuals filing the It-540, It-540b, or It-540b-Nra tax forms in the state of Louisiana. It helps taxpayers determine if they are eligible for a legislative recovery credit or if they owe any additional taxes due to recent legislation changes.

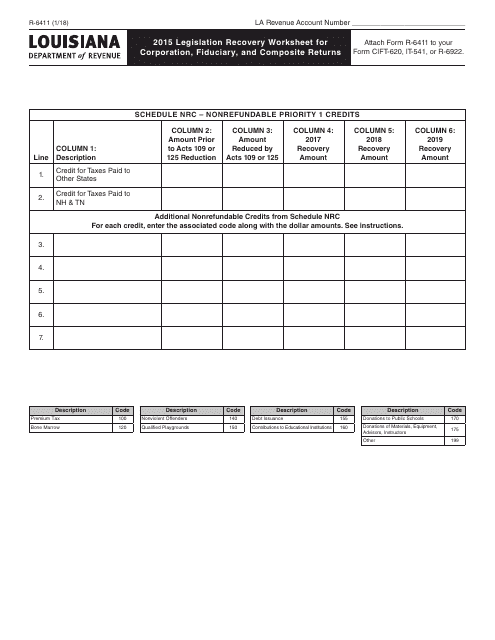

This Form is used for the 2015 Legislation Recovery Worksheet for Corporation, Fiduciary, and Composite Returns in the state of Louisiana. It helps entities calculate their recovery amount under the legislation.

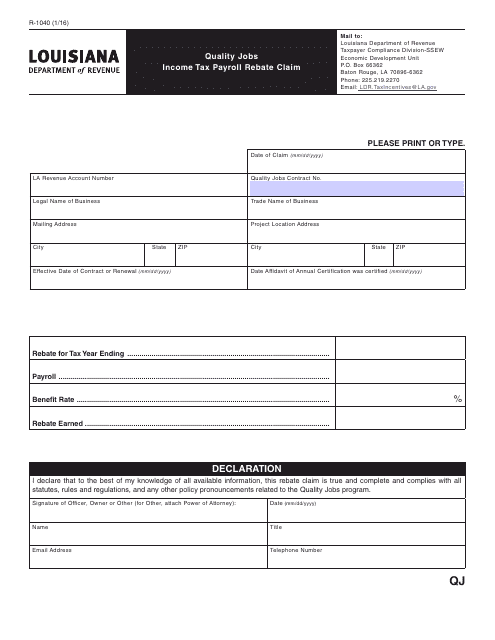

This form is used for claiming a rebate on income tax payroll for quality jobs in Louisiana. It helps taxpayers to receive a refund for their contribution to job growth and development in the state.

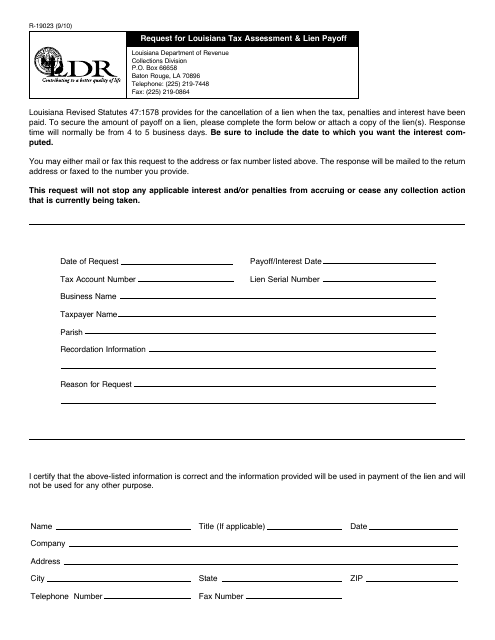

This form is used for requesting a tax assessment and lien payoff in the state of Louisiana.

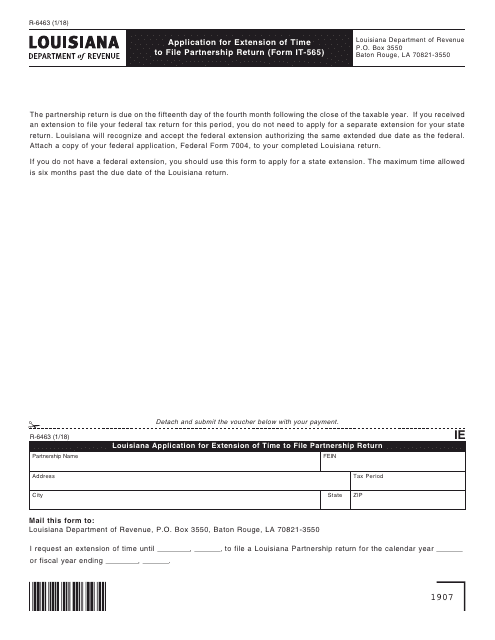

This Form is used for Louisiana partnerships to apply for an extension of time to file their partnership return (Form IT-565).

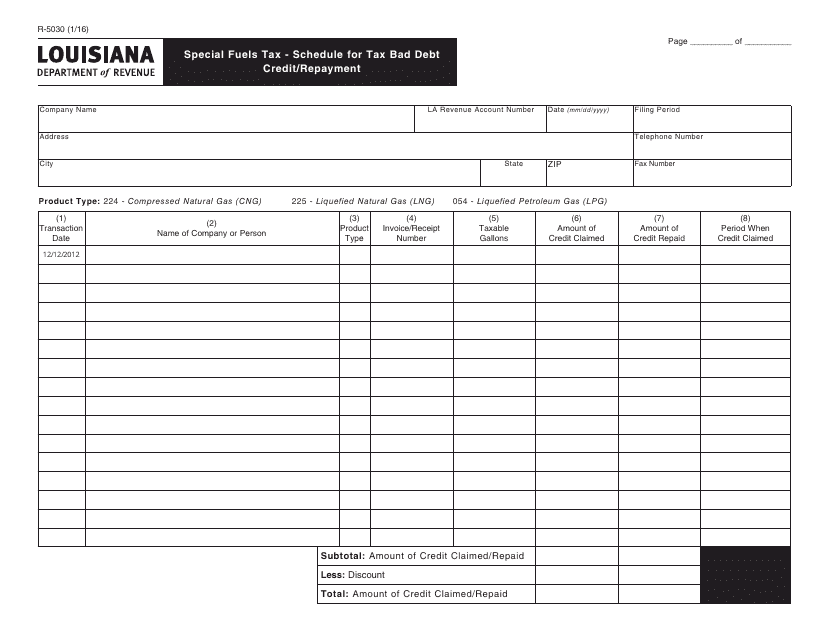

This document is used for scheduling tax bad debt credit or repayment for special fuels tax in the state of Louisiana.

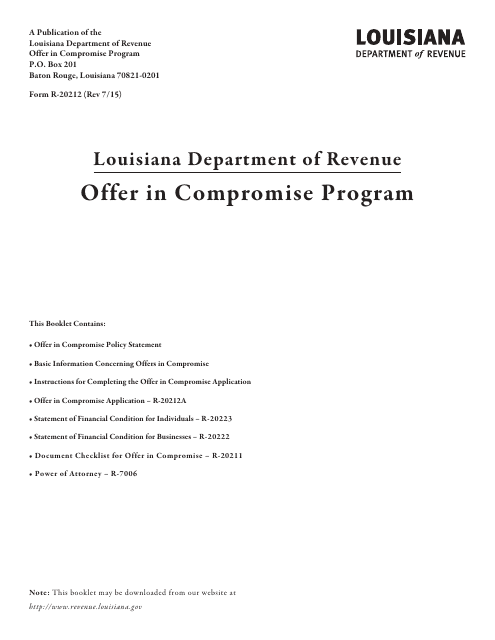

This form is used for the Offer in Compromise Program in the state of Louisiana. It allows taxpayers to settle their tax debts with the state for a reduced amount.

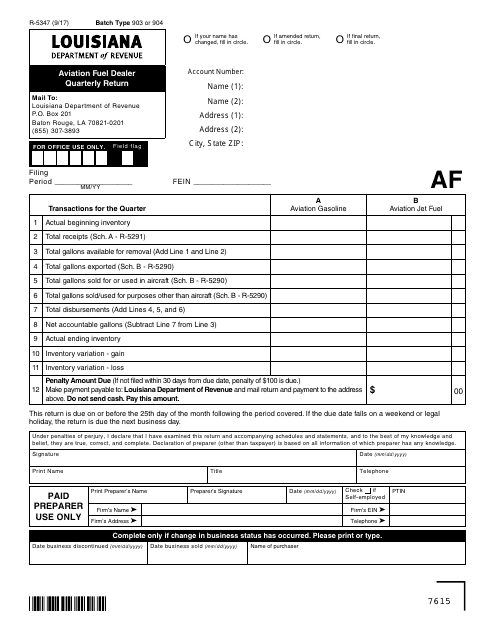

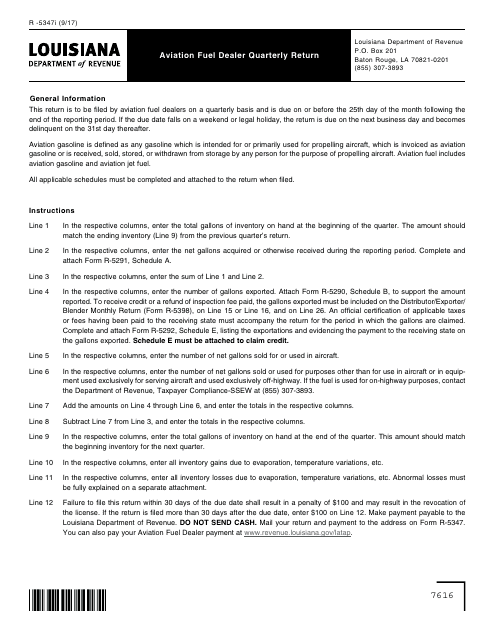

This Form is used for reporting aviation fuel sales and purchases by aviation fuel dealers in Louisiana on a quarterly basis.

This form is used for the Aviation Fuel Dealer Quarterly Return in Louisiana. It provides instructions on how to properly fill out the form for aviation fuel dealers in the state.

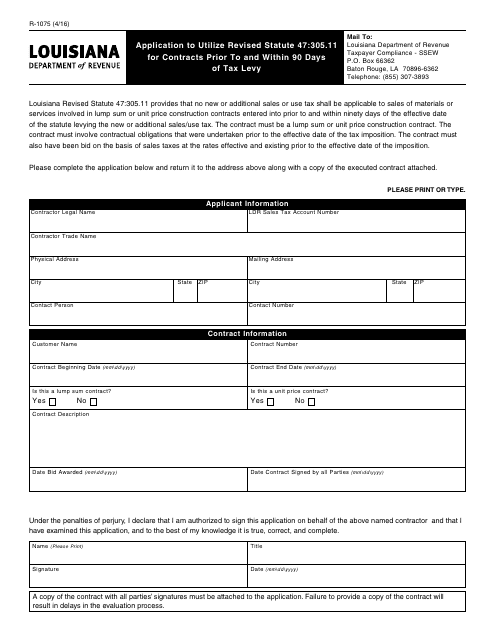

This form is used for applying to utilize Revised Statute 47:305.11 for contracts in Louisiana that are prior to and within 90 days of tax levy.

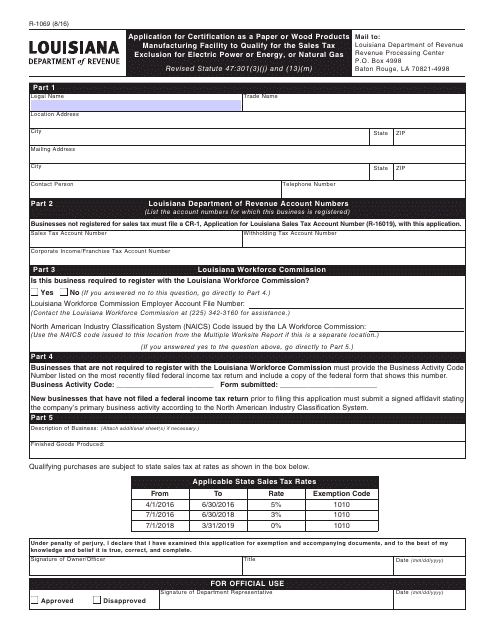

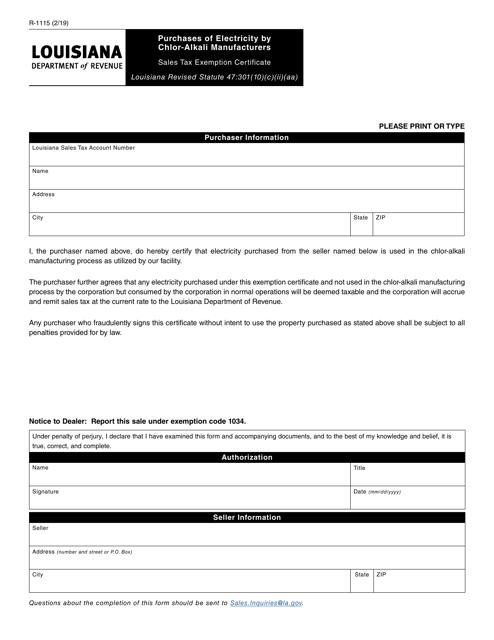

This form is used for applying for certification as a paper or wood products manufacturing facility in Louisiana to qualify for the sales tax exclusion for electric power, energy, or natural gas.

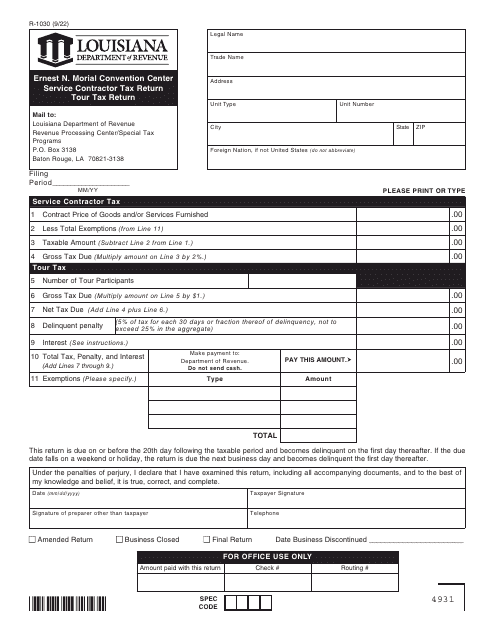

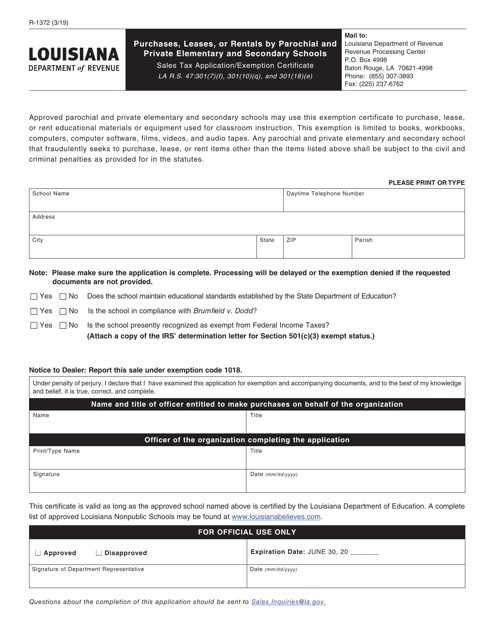

This Form is used for filing additional hotel room occupancy tax and food and beverage tax returns in Louisiana.

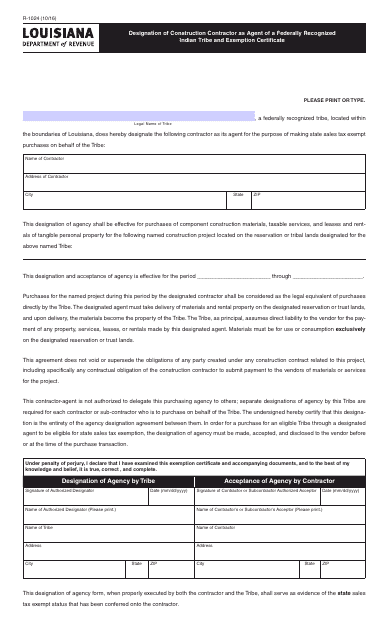

This type of document is used for designating a construction contractor as an agent of a federally recognized Indian tribe in Louisiana and for obtaining an exemption certificate.