Louisiana Department of Revenue Forms

Documents:

687

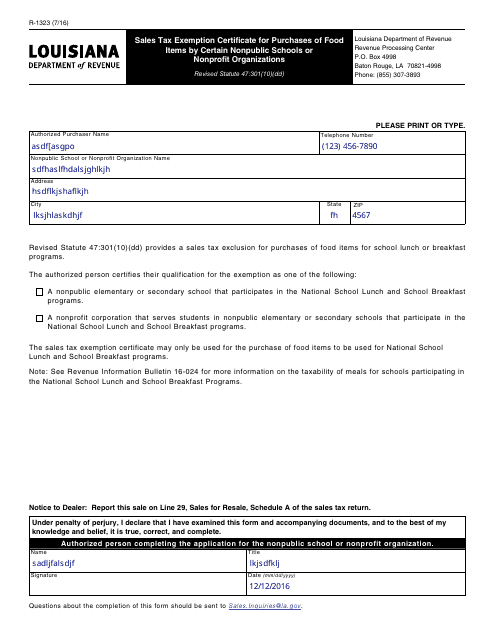

This form is used for obtaining a sales tax exemption certificate in Louisiana for the purchase of food items by certain nonpublic schools or nonprofit organizations.

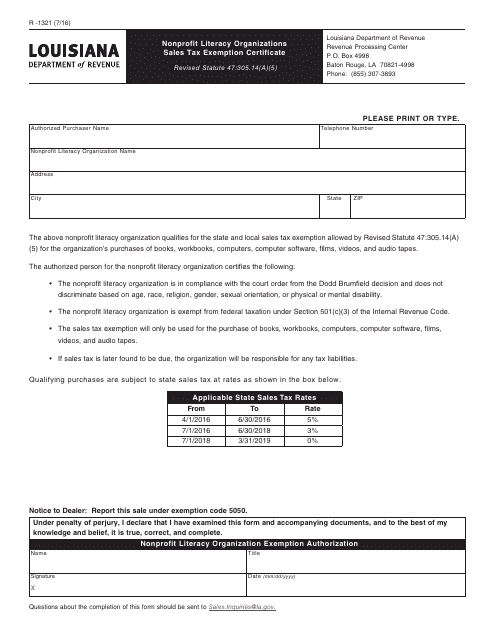

This form is used for nonprofit literacy organizations in Louisiana to request a sales tax exemption certificate.

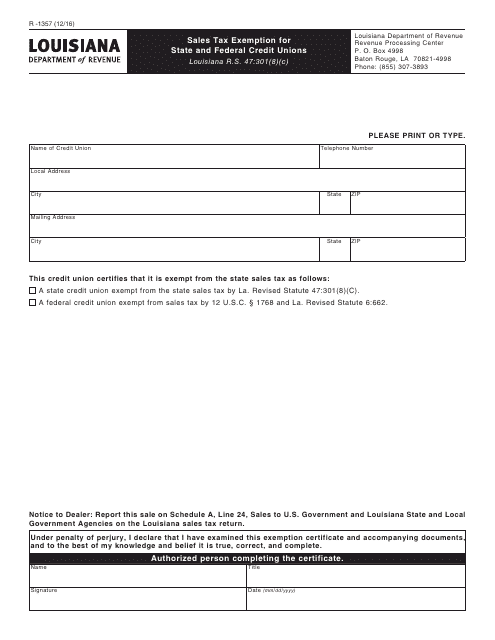

This form is used for state and federal credit unions in Louisiana to claim an exemption from sales tax.

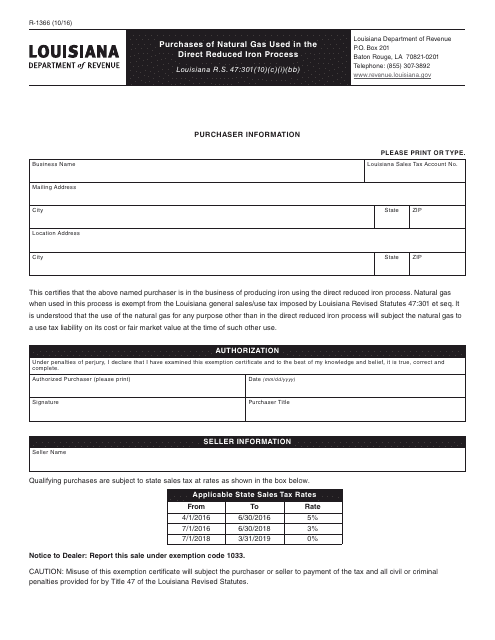

This form is used for reporting the purchases of natural gas that is used in the direct reduced iron process in the state of Louisiana.

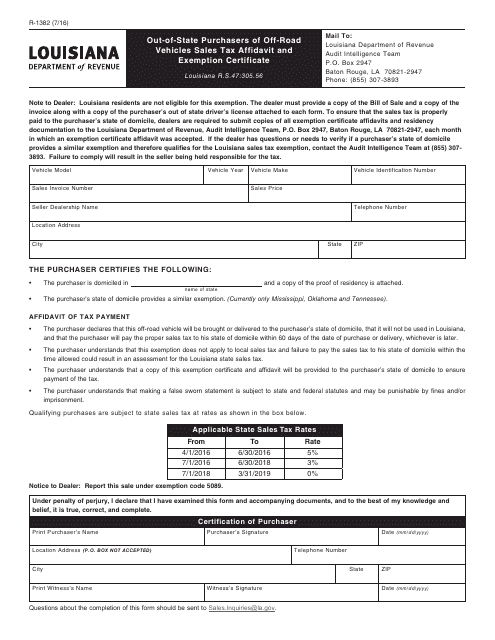

This form is used for out-of-state purchasers of off-road vehicles in Louisiana to declare their sales tax exemption and provide necessary information.

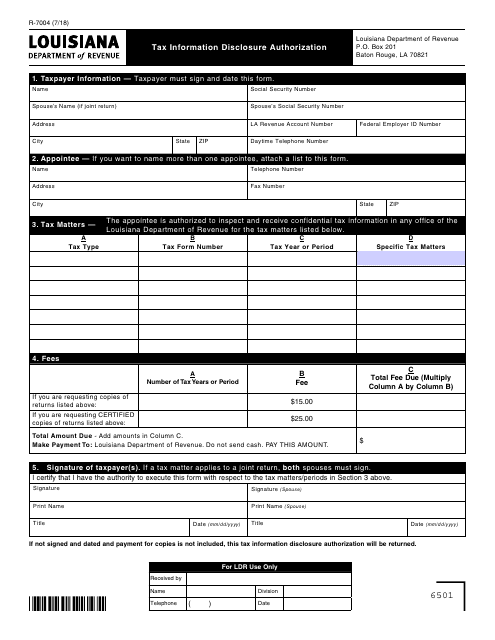

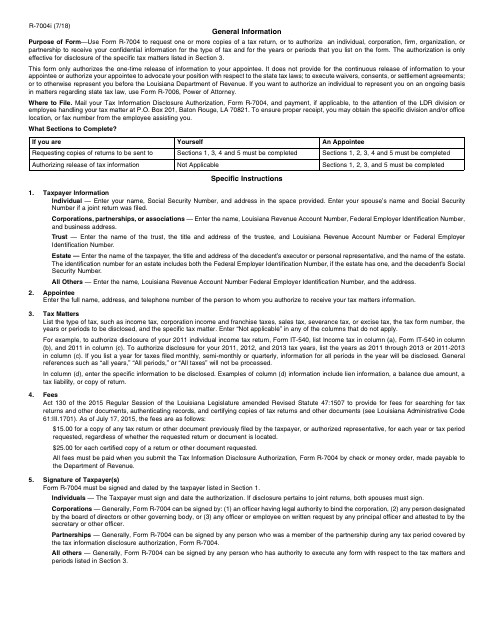

This form is used for authorizing the disclosure of tax information in the state of Louisiana.

This document is for taxpayers in Louisiana who need to authorize the disclosure of tax information. It provides instructions for completing Form R-7004, which is used to request authorization for the release of tax information to a designated party.

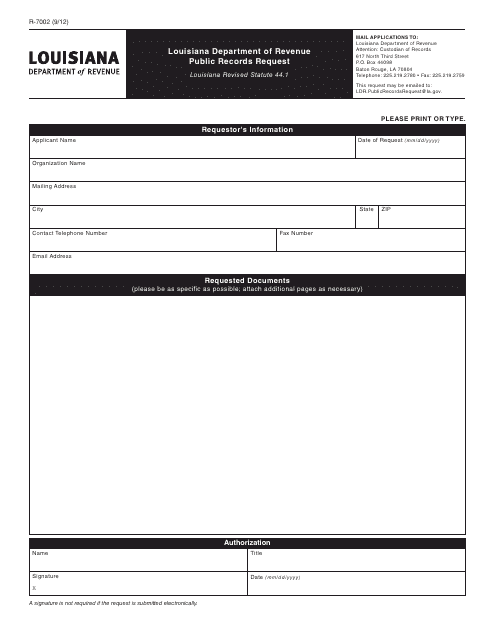

This form is used for requesting public records in the state of Louisiana. It allows residents to obtain information from government agencies and is a crucial tool for promoting transparency and accountability.

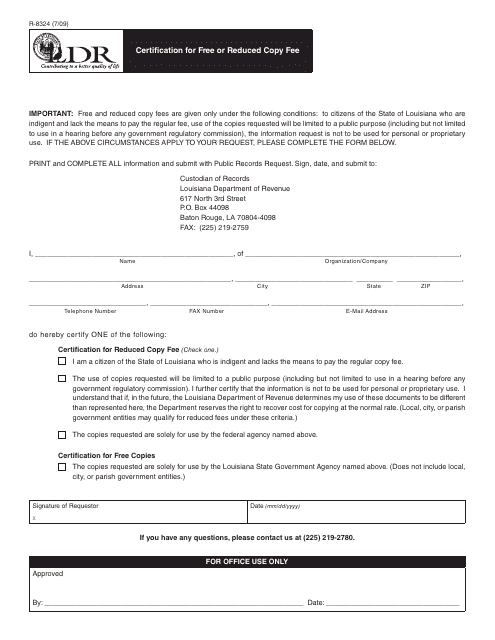

This form is used for certifying eligibility for free or reduced copy fees in the state of Louisiana. It allows individuals to request copies of documents at a lower cost if they meet certain income requirements.

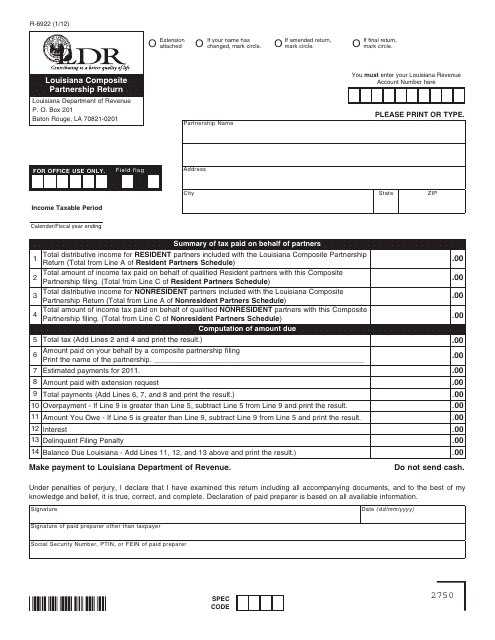

This Form is used for filing the Louisiana Composite Partnership Return for partnerships in Louisiana. It is required to report the income, deductions, and tax liability of the partnership.

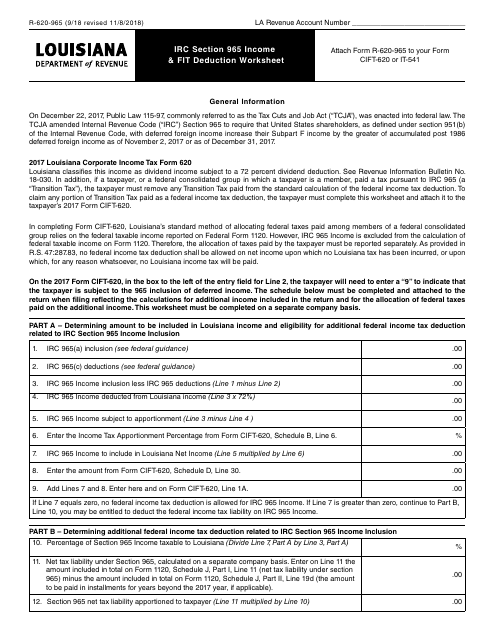

This form is used for calculating the income and fit deduction under IRC Section 965 for residents of Louisiana.

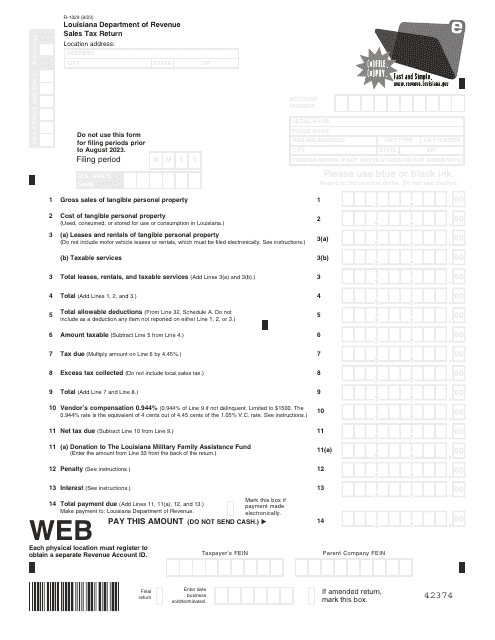

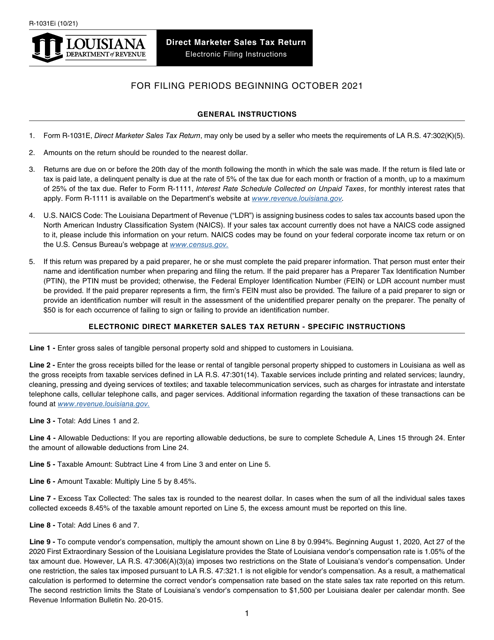

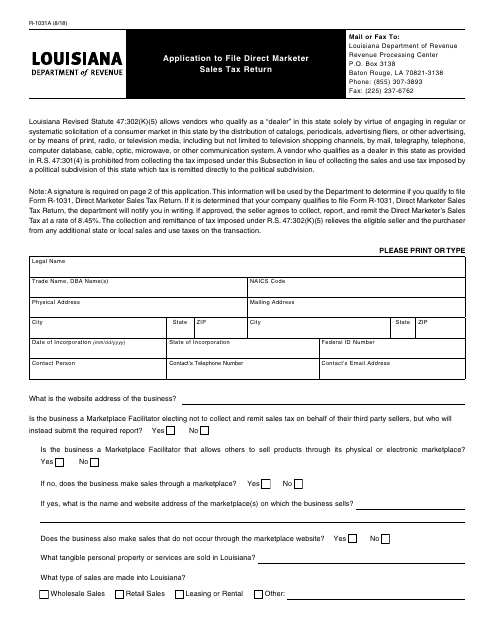

This Form is used for applying to file the Direct Marketer Sales Tax Return in Louisiana.

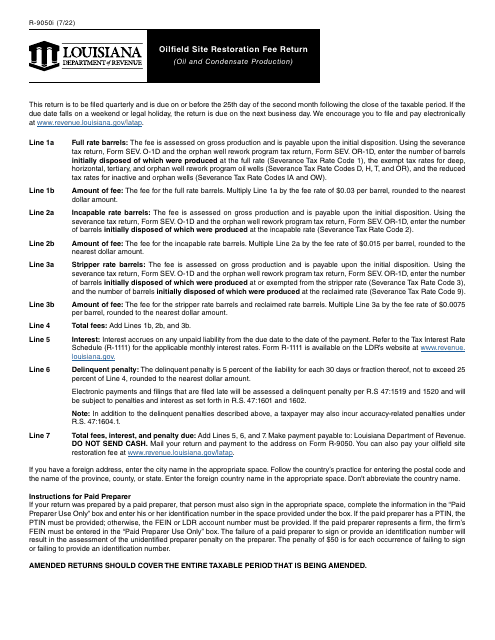

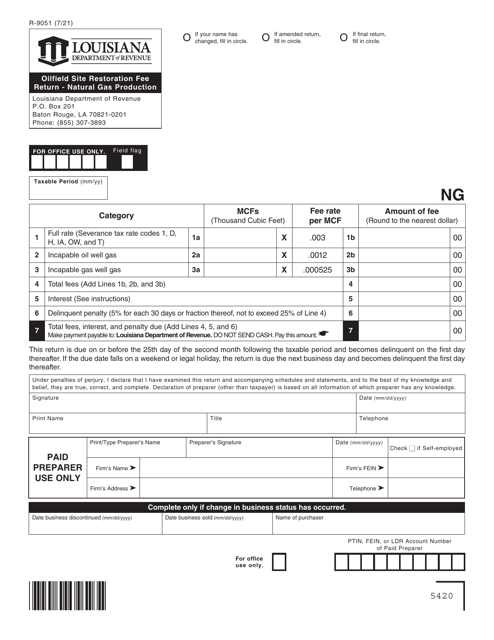

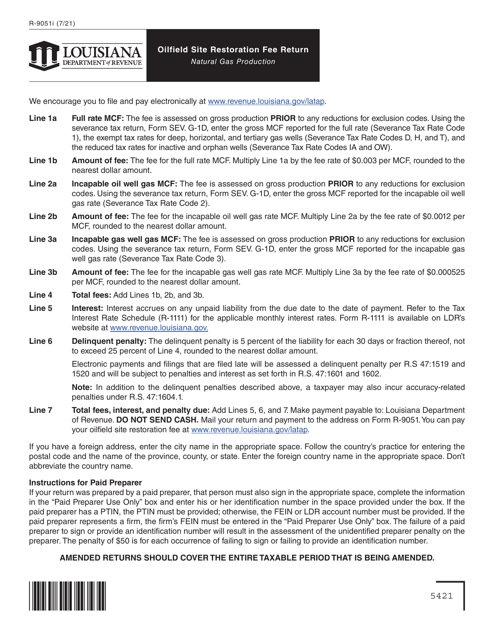

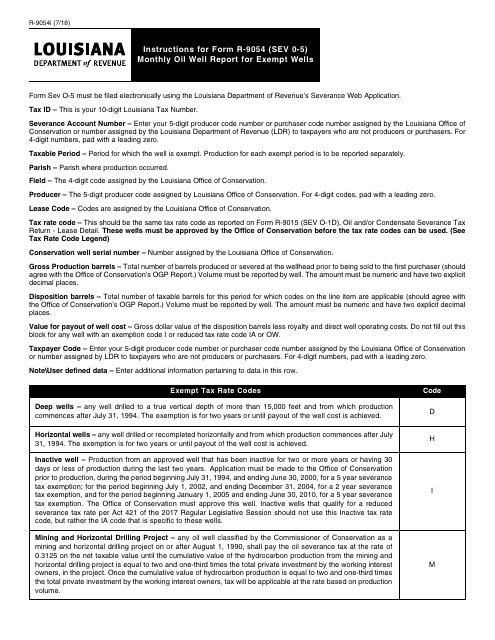

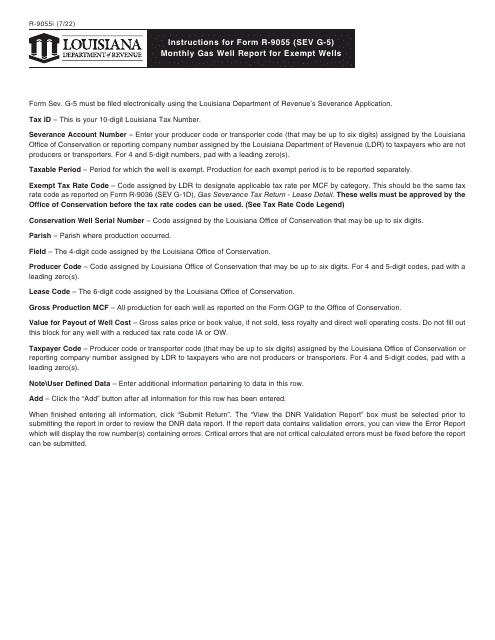

This document provides instructions for completing Form R-9054, which is used to report monthly oil production for exempt wells in the state of Louisiana.

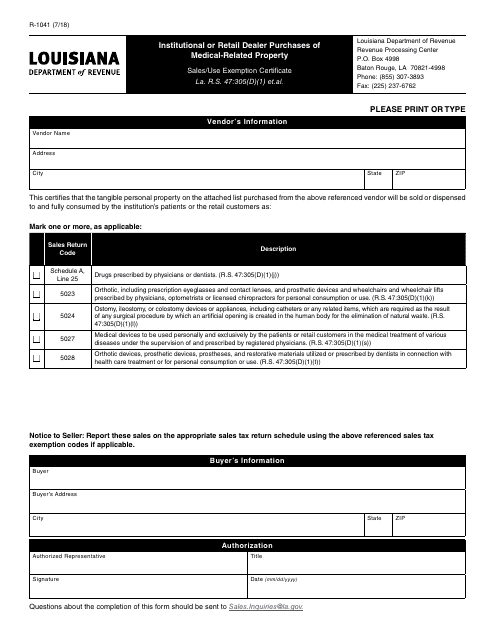

This form is used for requesting a sales/use tax exemption when institutional or retail dealers purchase medical-related property in Louisiana.

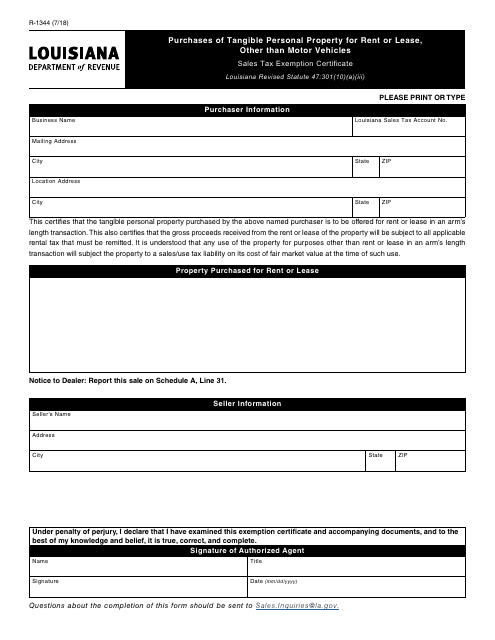

This form is used for claiming a sales tax exemption in Louisiana when purchasing tangible personal property for rent or lease, except for motor vehicles.