Louisiana Department of Revenue Forms

Documents:

687

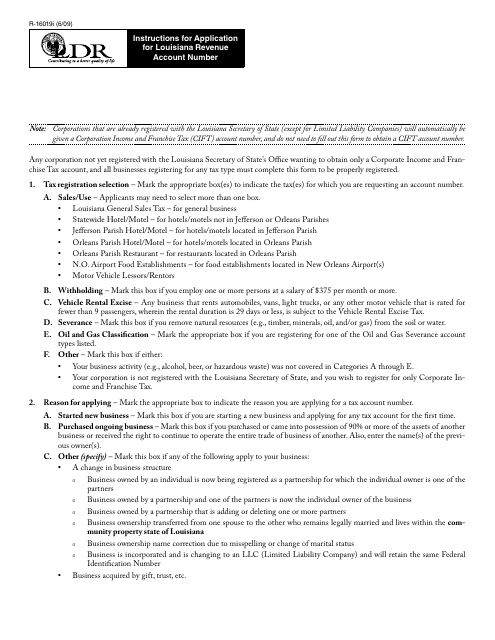

This document is used for applying for a Louisiana Revenue Account Number in Louisiana. It provides instructions on filling out Form R-16019.

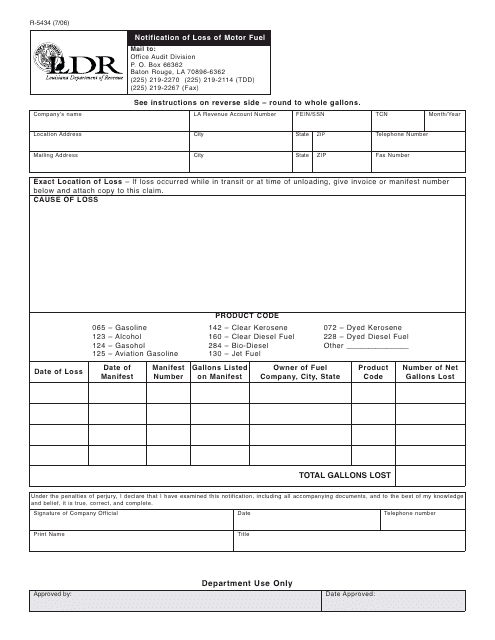

This Form is used for notifying the state of Louisiana about the loss of motor fuel.

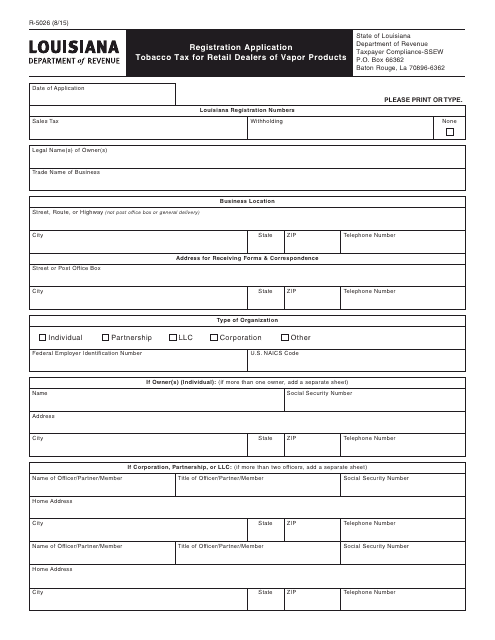

This form is used for retail dealers of vapor products in Louisiana to apply for registration and pay tobacco tax.

This Form is used for notifying the state of Louisiana about the loss of motor fuel.

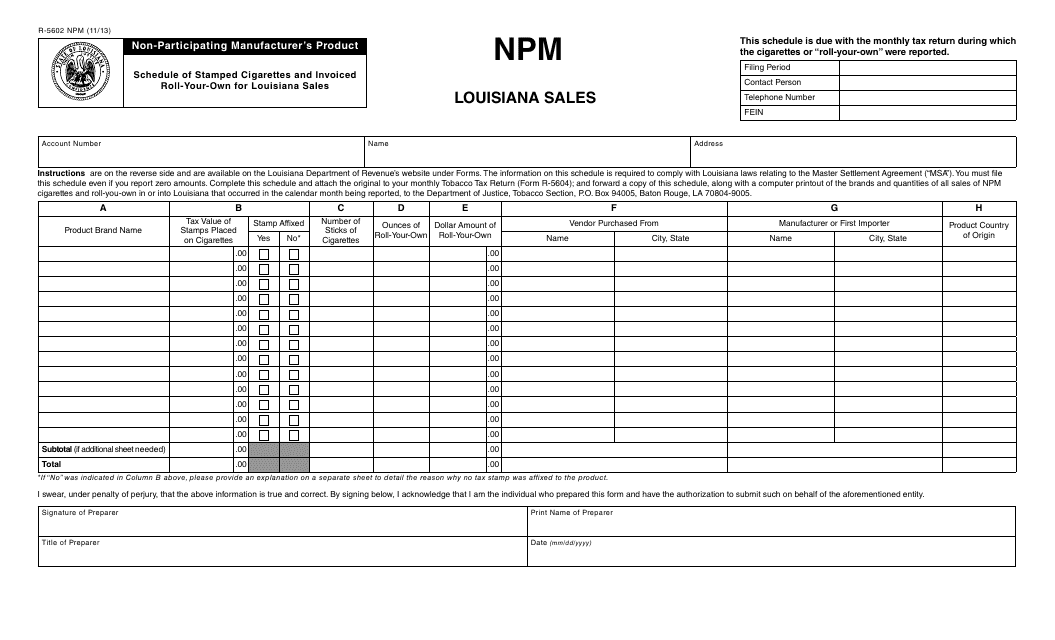

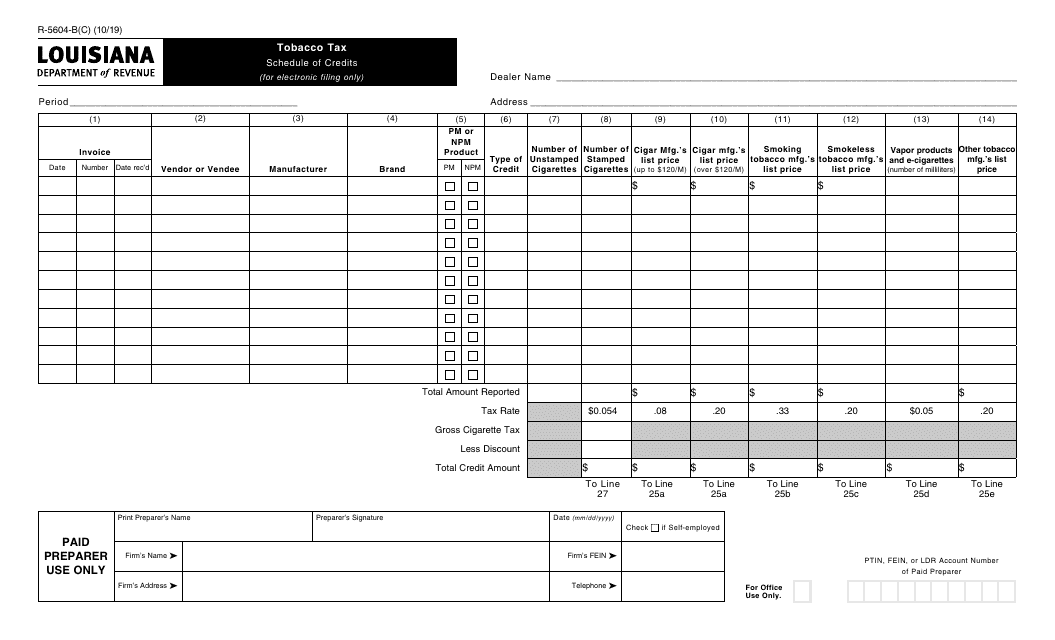

This form is used for non-participating manufacturers of cigarettes and roll-your-own tobacco products to report sales in the state of Louisiana. It includes information on stamped cigarettes and invoiced roll-your-own tobacco products.

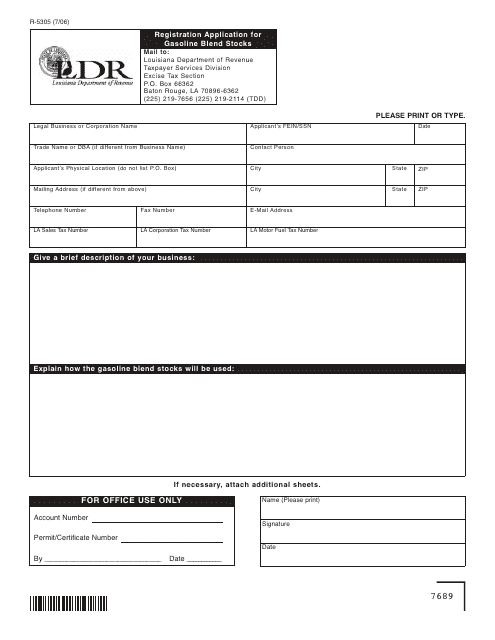

This form is used for registering gasoline blend stocks in Louisiana.

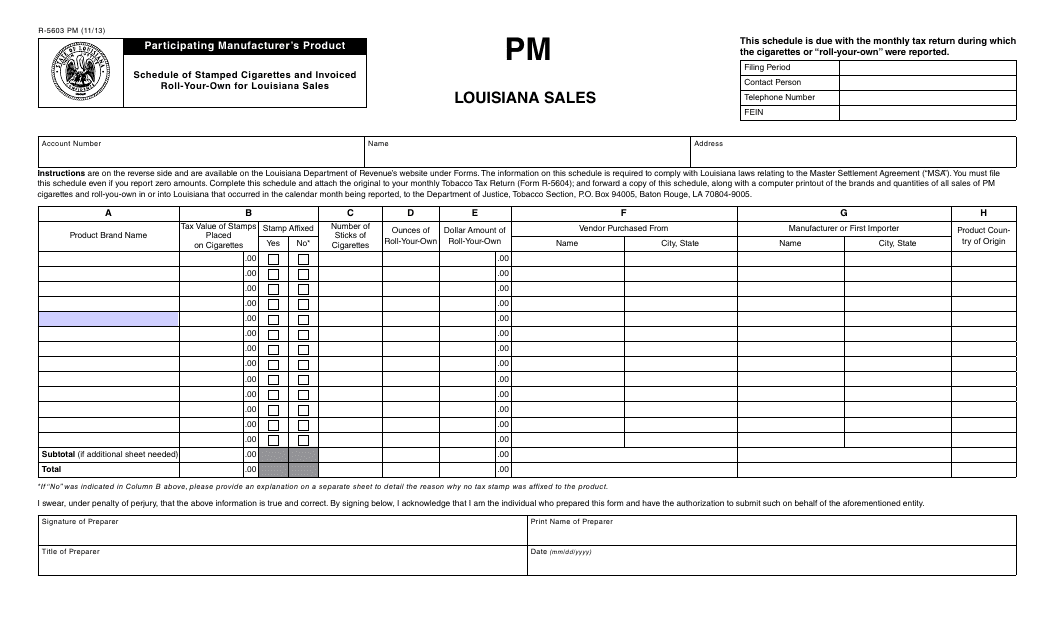

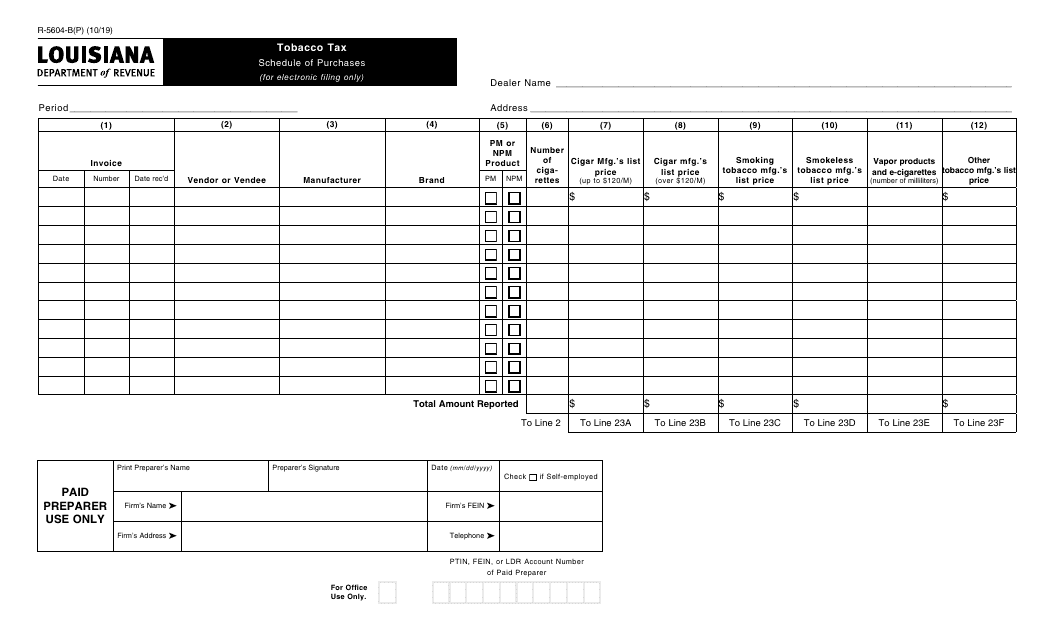

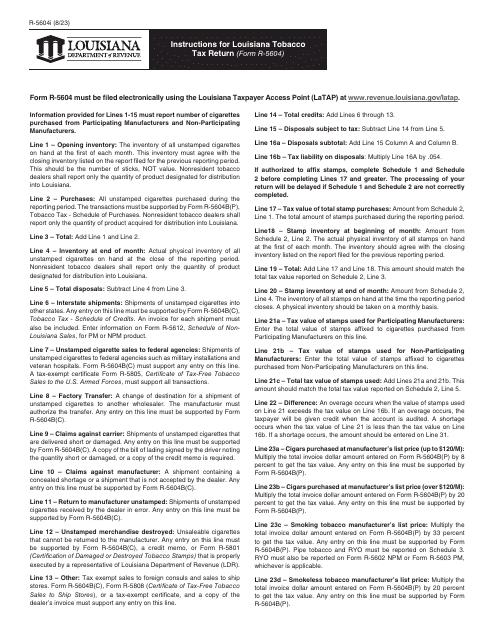

This form is used for participating cigarette manufacturers to report their sales of stamped cigarettes and roll-your-own tobacco in Louisiana.

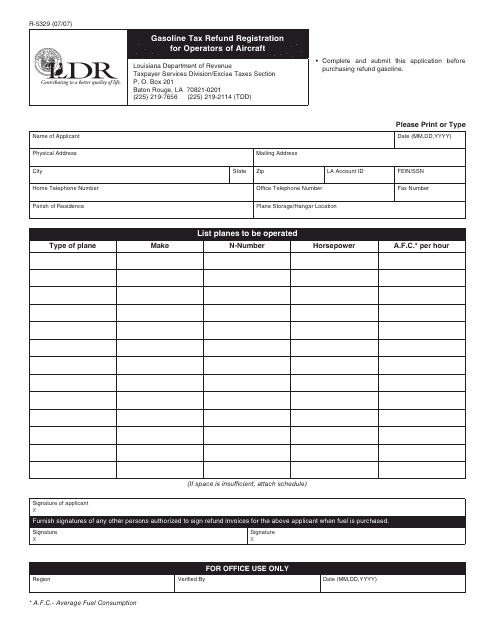

This Form is used for registering operators of aircraft in Louisiana to claim a refund of gasoline tax.

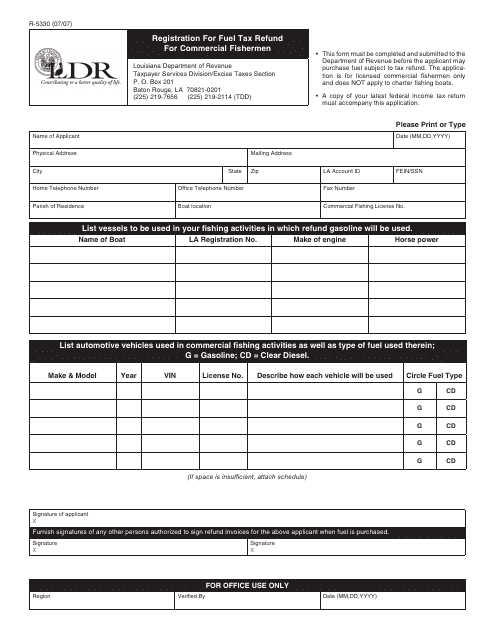

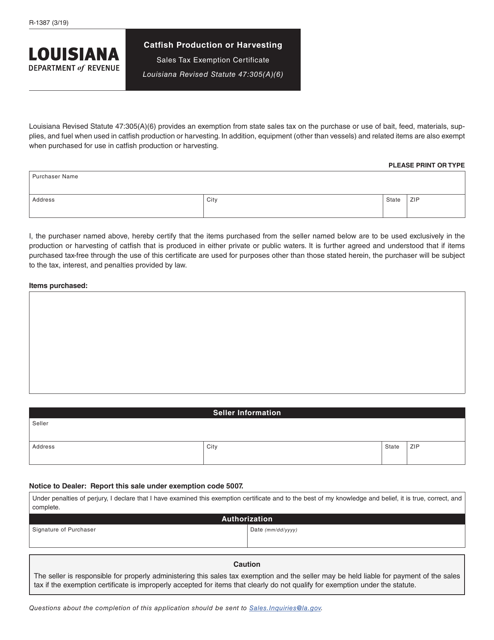

This form is used for fishermen in Louisiana to register for a fuel tax refund for their commercial fishing activities.

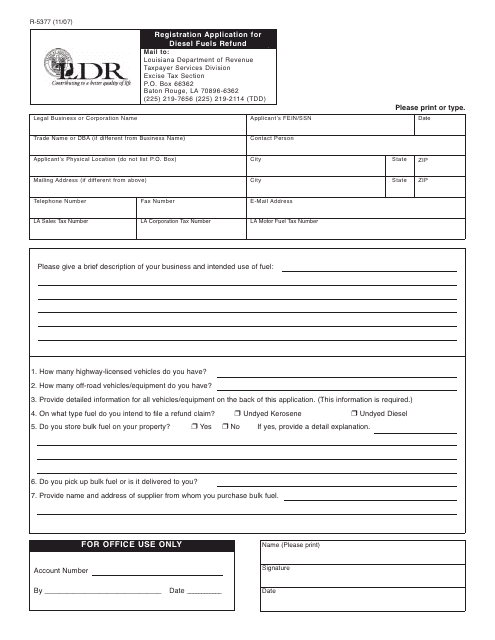

This form is used for applying for a refund on diesel fuels in the state of Louisiana.

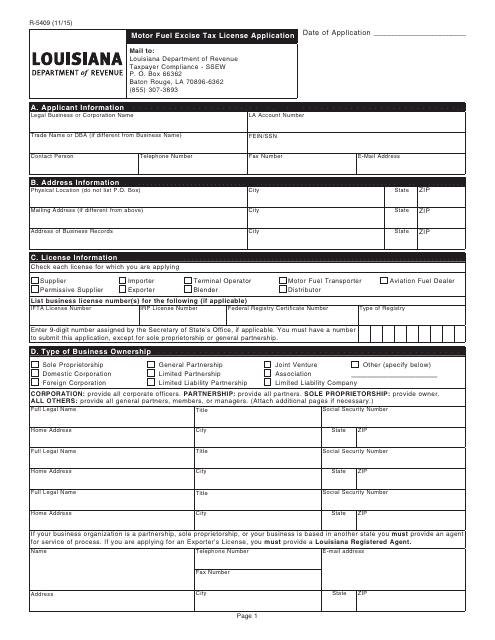

This Form is used for applying for a motor fuel excise tax license in the state of Louisiana.

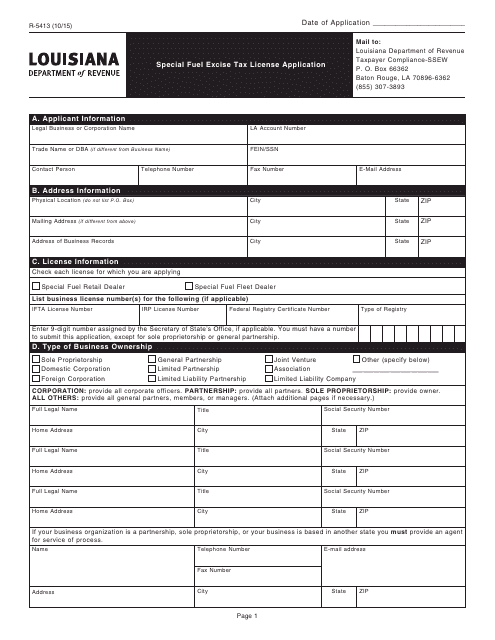

This form is used for applying for a special fuel excise tax license in the state of Louisiana.

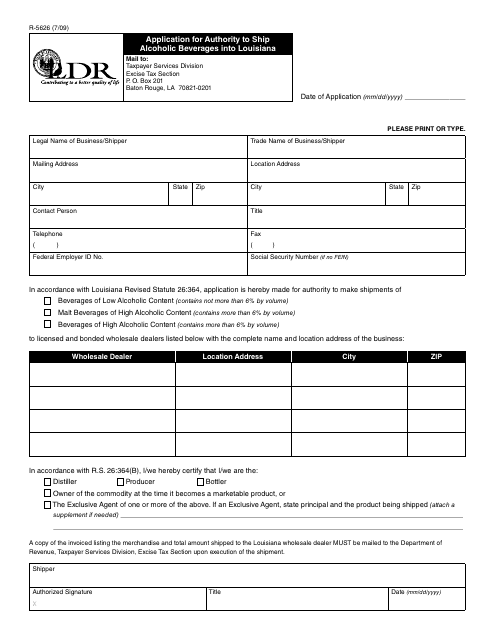

This form is used for applying for the authority to ship alcoholic beverages into Louisiana.

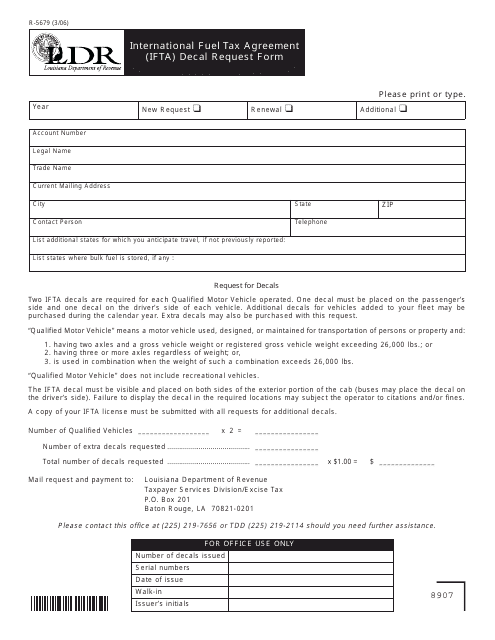

This form is used for requesting International Fuel Tax Agreement (IFTA) decals in Louisiana. It is required for commercial vehicles that operate across state lines and need to report and pay fuel taxes.

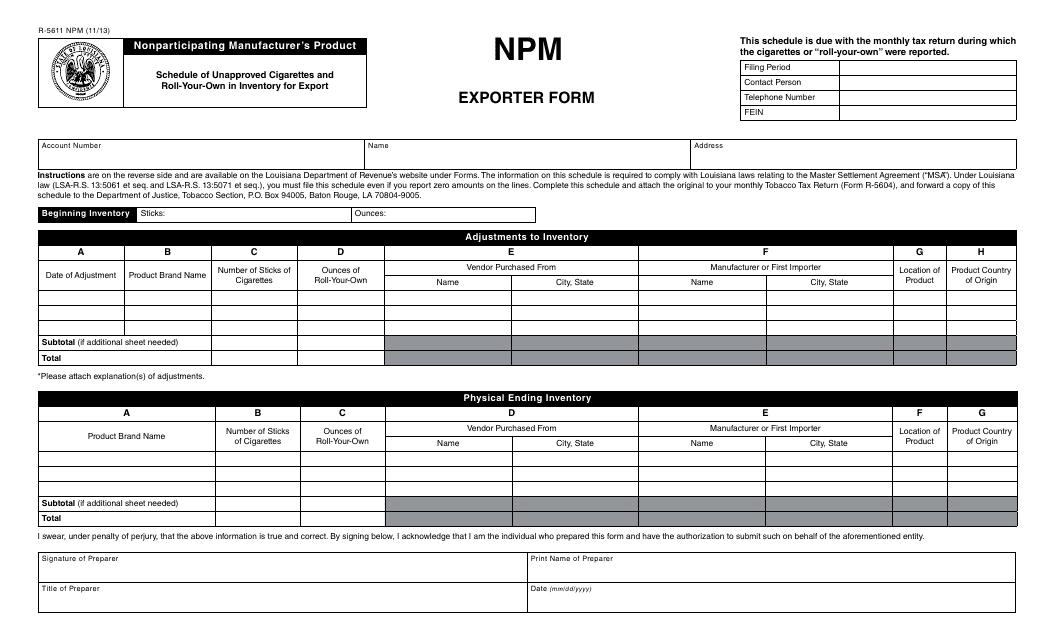

This form is used for Nonparticipating Manufacturer's (NPM) in Louisiana to submit a schedule of unapproved cigarettes and roll-your-own tobacco that are in inventory for export.

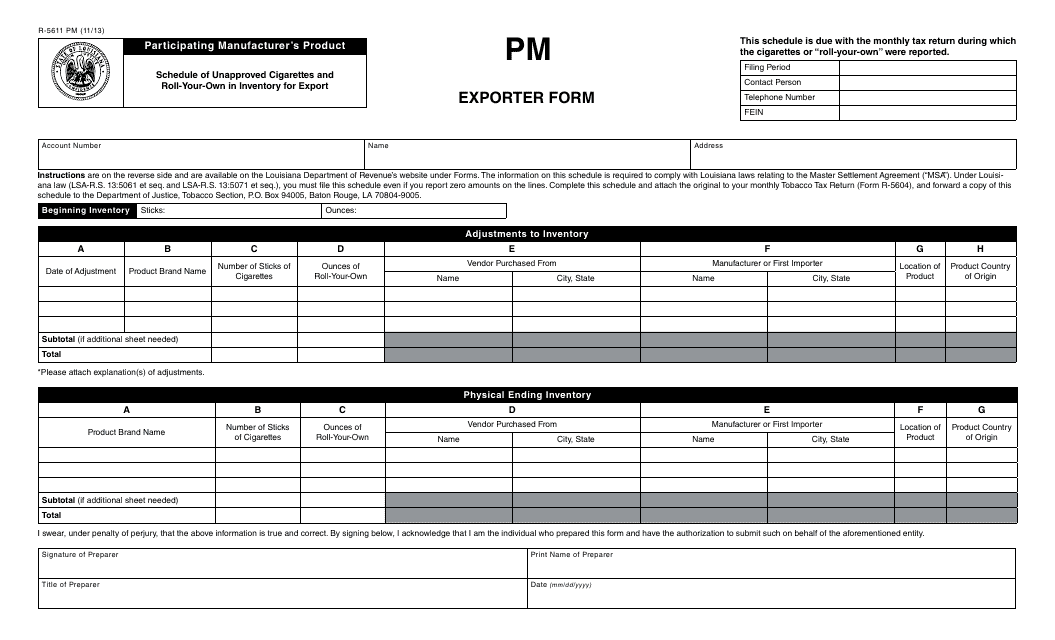

This form is used for participating manufacturers in Louisiana to list and report any unapproved cigarettes and roll-your-own products that are in their inventory for export.

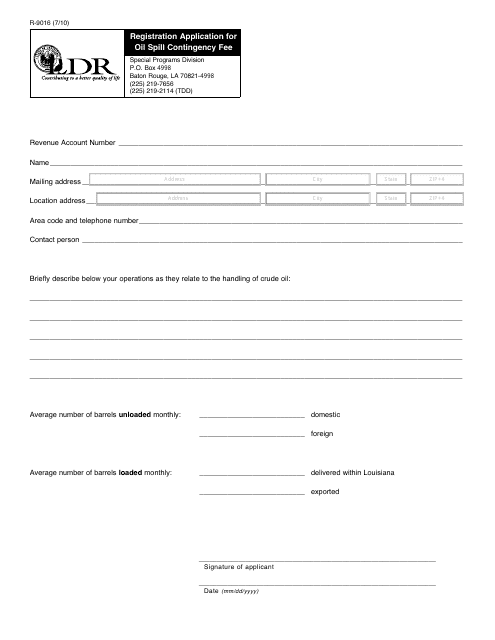

This form is used for registering and applying for an oil spill contingency fee in the state of Louisiana.

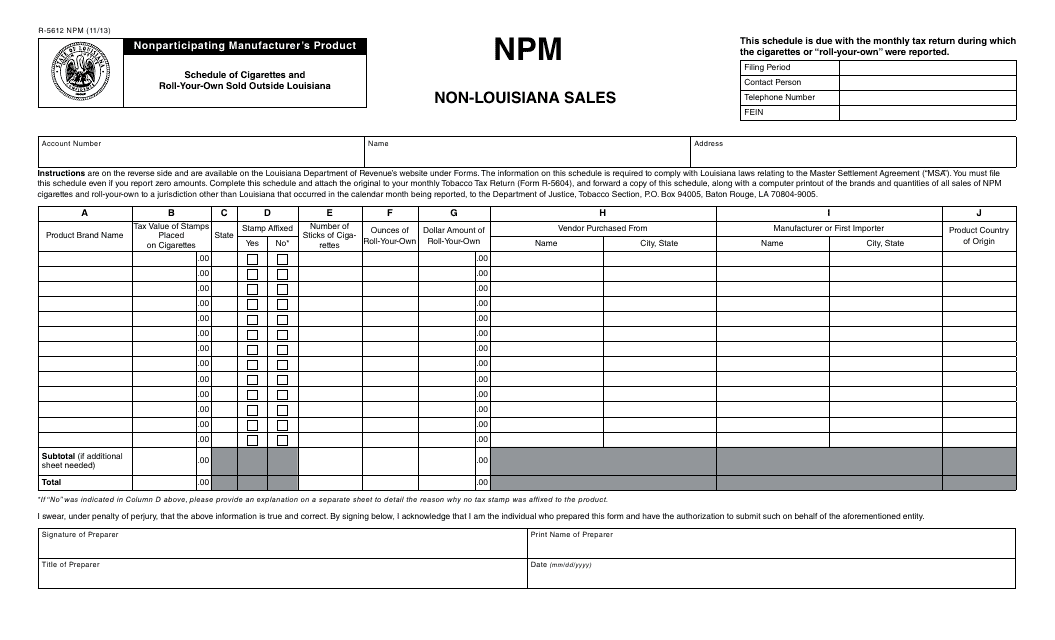

This form is used for Nonparticipating Manufacturer's to report the sale of cigarettes and roll-your-own tobacco products outside of Louisiana. It specifically focuses on sales made in areas outside of Louisiana.

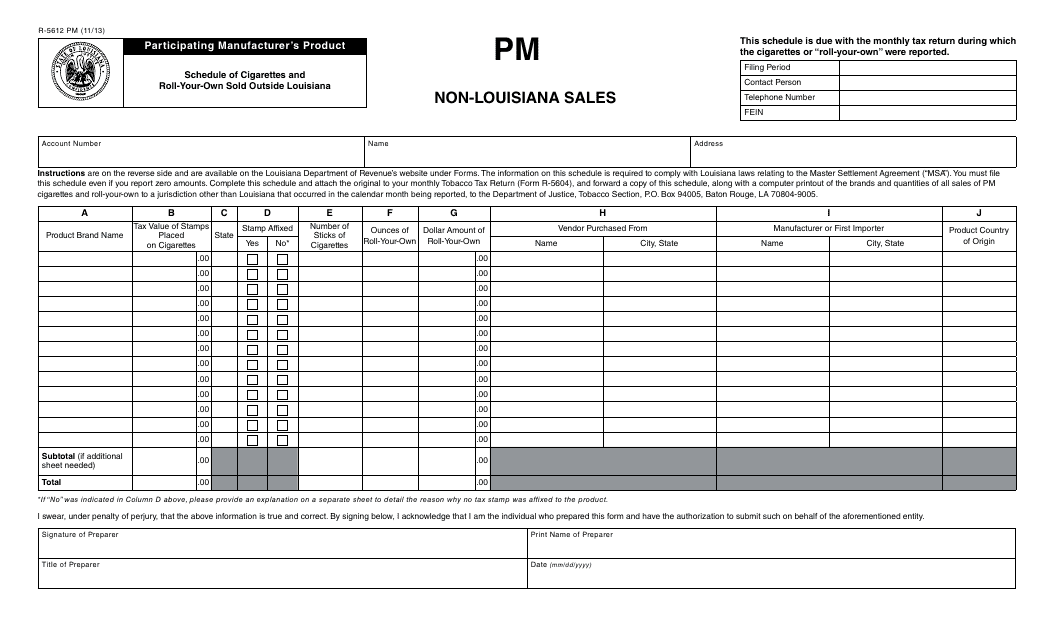

This form is used for participating manufacturers to report the sales of cigarettes and roll-your-own tobacco products that are sold outside of Louisiana. It is specifically for non-Louisiana sales.

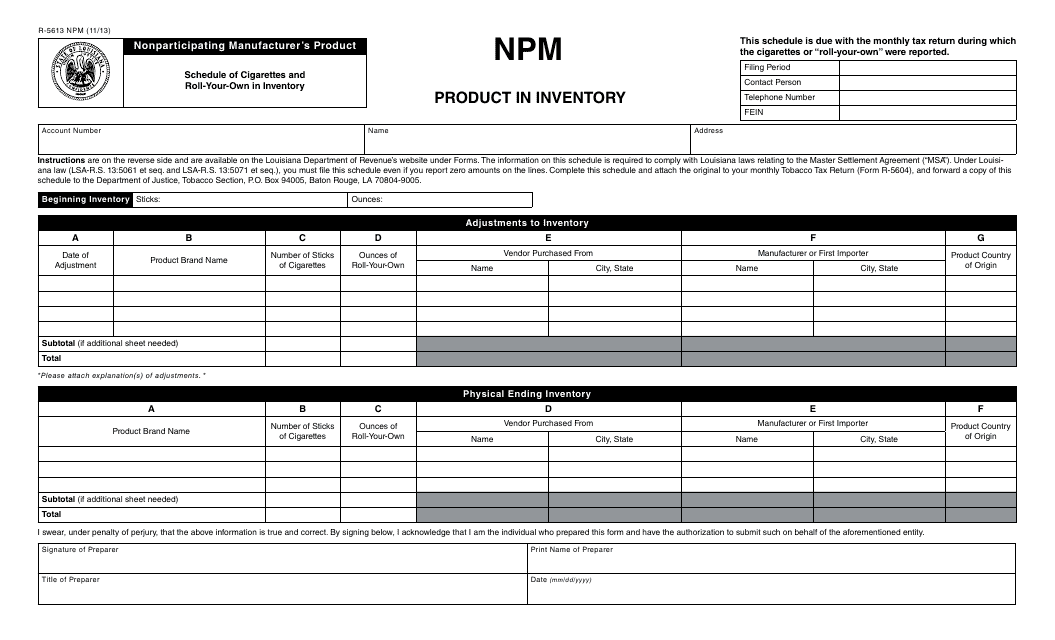

This Form is used for nonparticipating manufacturers of cigarettes and roll-your-own tobacco to report their inventory in Louisiana. It helps track the quantity and types of cigarettes and roll-your-own products in stock.

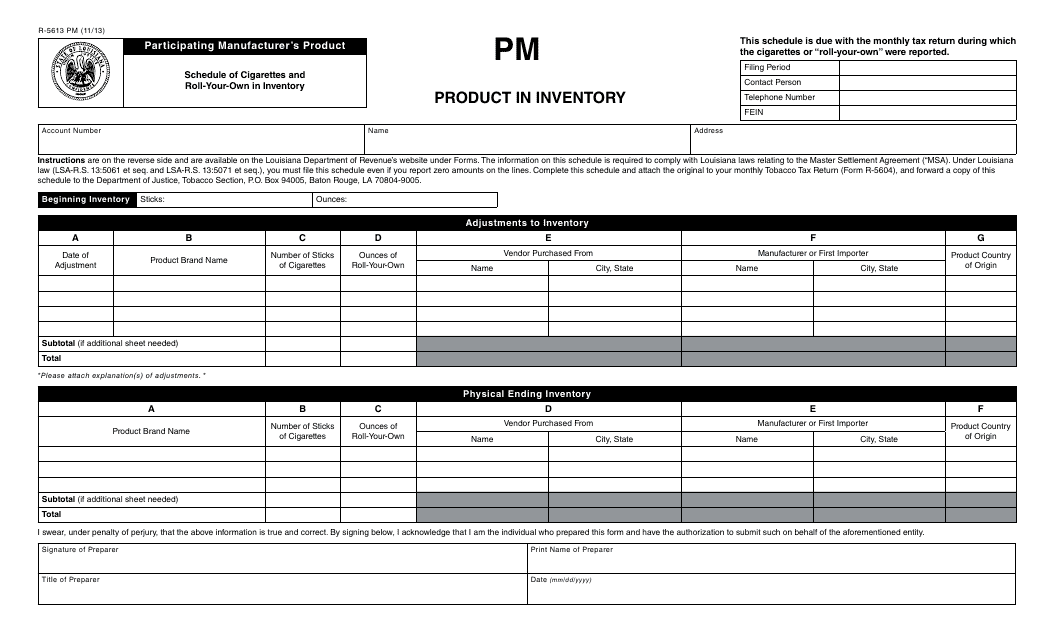

This Form is used for Participating Manufacturers in Louisiana to report their inventory of cigarettes and roll-your-own products. It is required for compliance with state tobacco regulations.

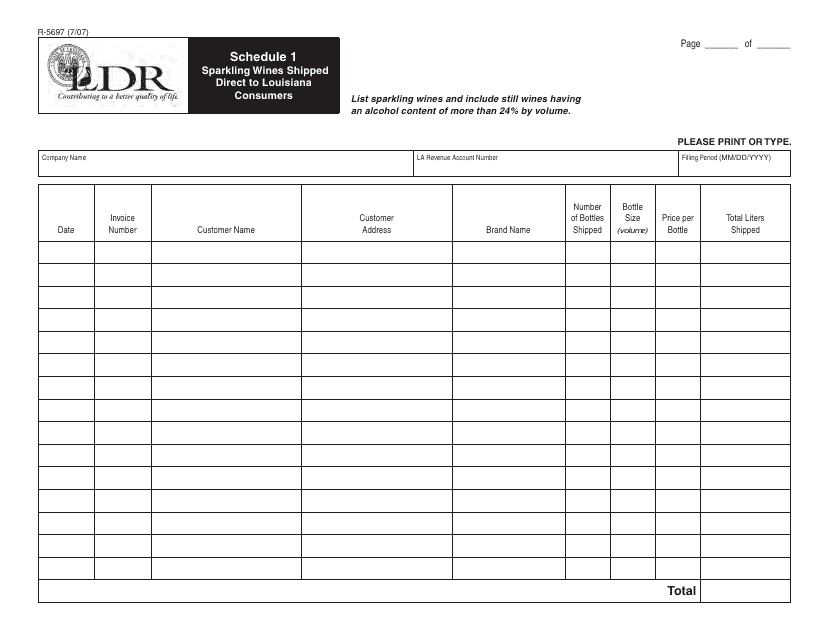

This Form is used for reporting and remitting taxes on sparkling wines shipped directly to Louisiana consumers. It applies to businesses and individuals who sell or ship sparkling wines to Louisiana residents.

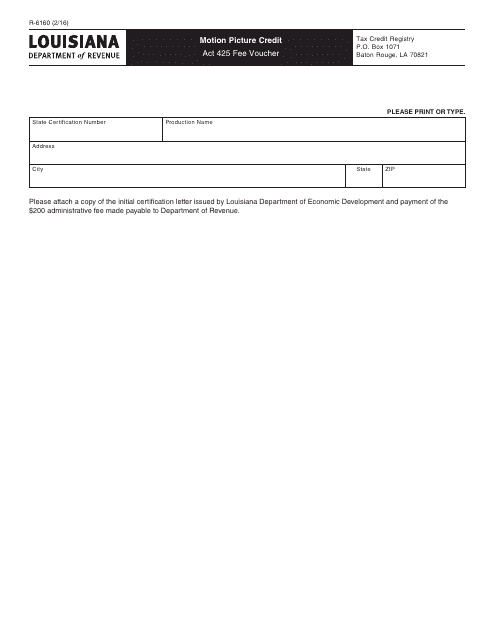

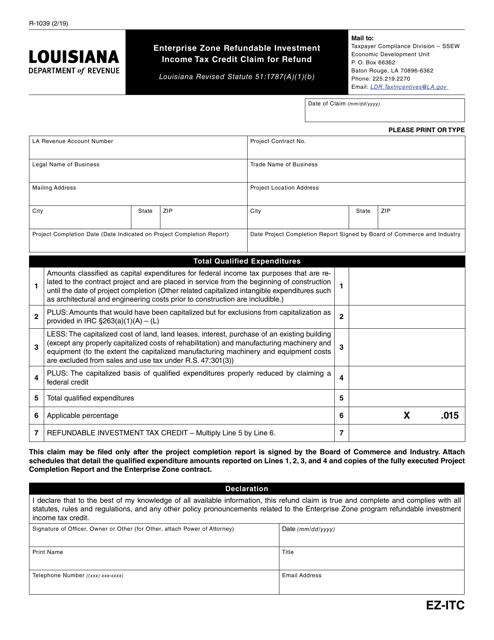

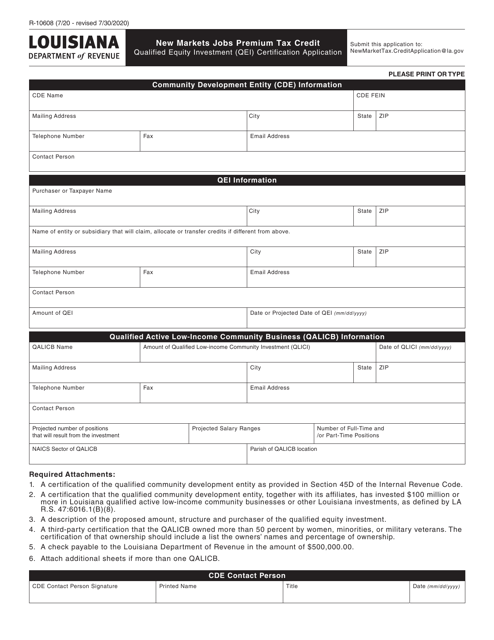

This form is used for submitting the fee voucher for the motion picture tax credit under Act 425 in the state of Louisiana.

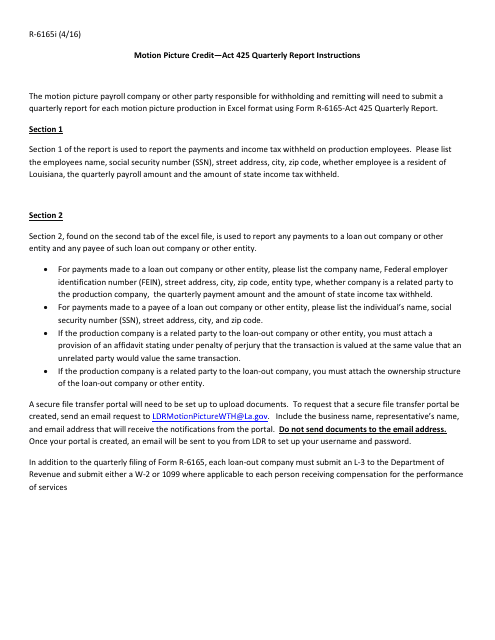

This Form is used for filing a quarterly report relating to the Louisiana Motion Picture Tax Credit.

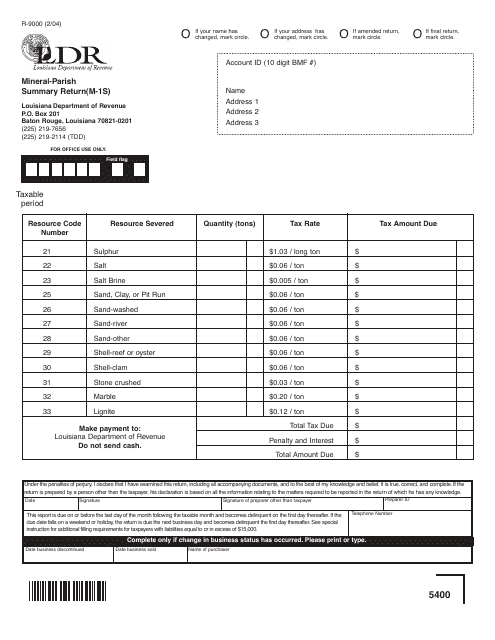

This form is used for submitting a mineral-parish summary return in Louisiana.

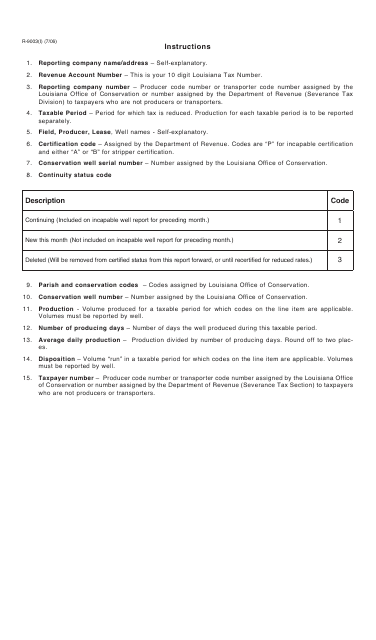

This form is used for reporting oil severance in the state of Louisiana. It provides instructions on how to properly fill out and submit the form.

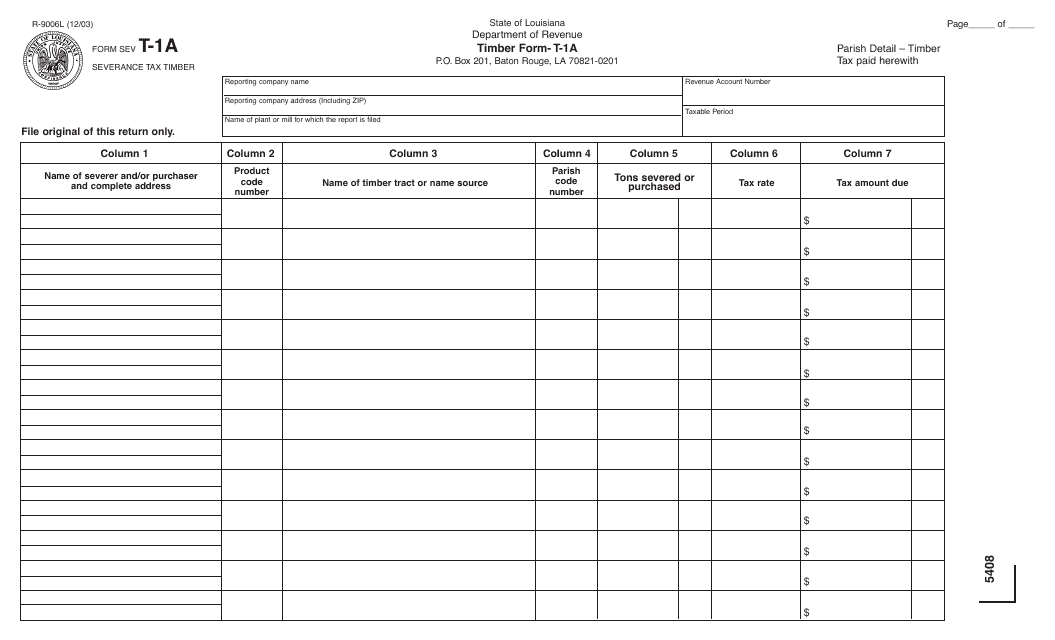

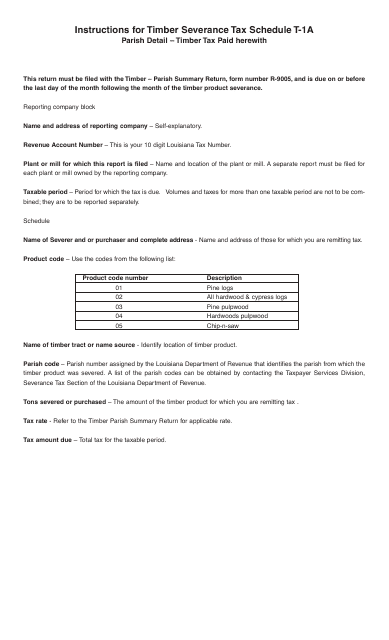

This type of document, Form R-9006L (SEV. T-1A), is used for reporting timber sales in the state of Louisiana.

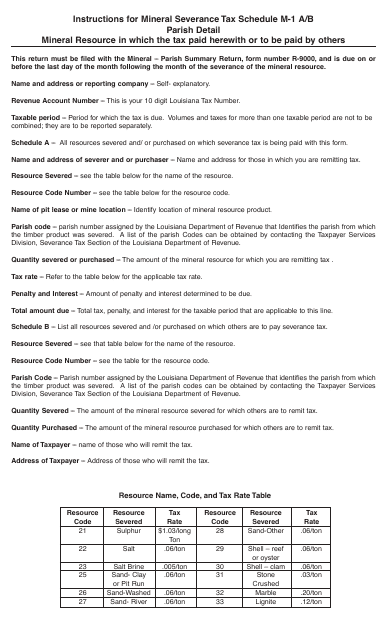

This document provides instructions for completing Schedule M-1 A/B, which is used for reporting mineral severance tax in the state of Louisiana.

This form is used for calculating and paying the timber severance tax in the state of Louisiana.

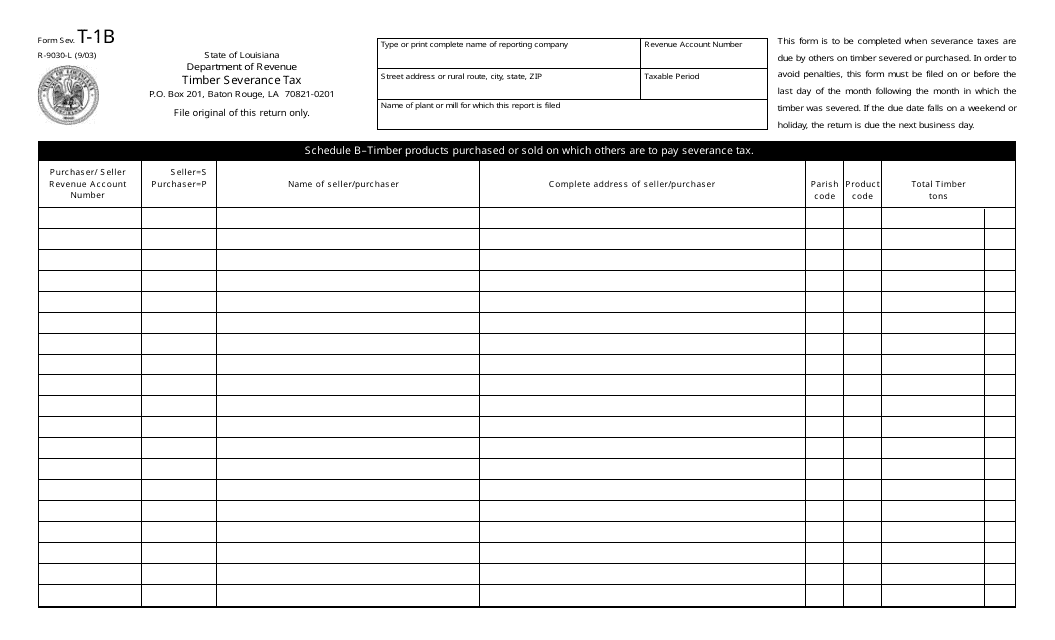

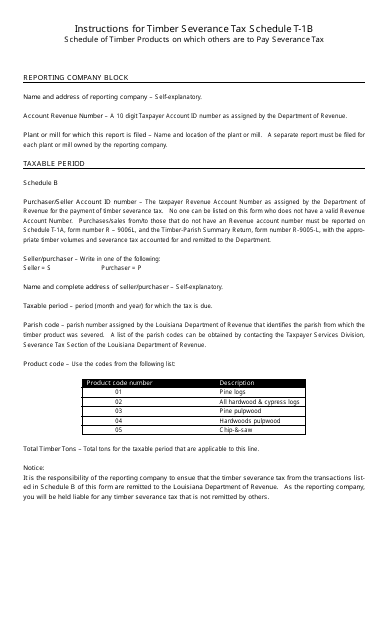

This Form is used for reporting the schedule of timber products on which others are liable to pay severance tax in the state of Louisiana.

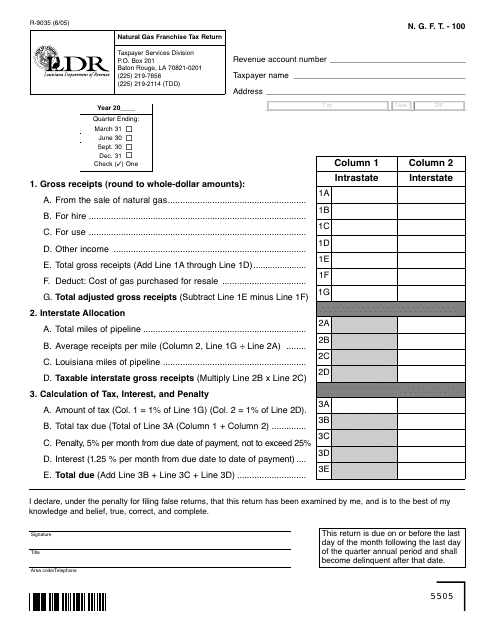

This form is used for filing the Natural Gas Franchise Tax Return in Louisiana.

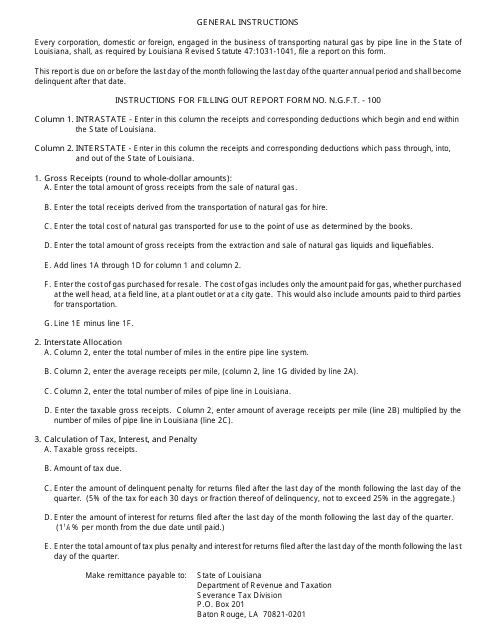

This Form is used for filing the N.G.F.T.-100 Natural Gas Franchise Tax Return in Louisiana. It provides instructions for completing the form and filing the required tax return.

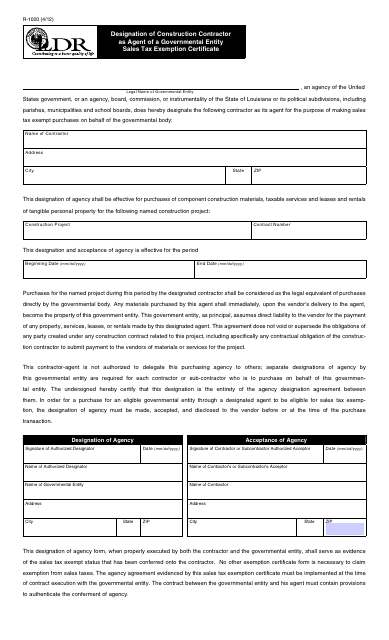

This document certifies that a construction contractor has been designated as an agent of a governmental entity for sales tax exemption in Louisiana.