Florida Department of Revenue Forms

Documents:

473

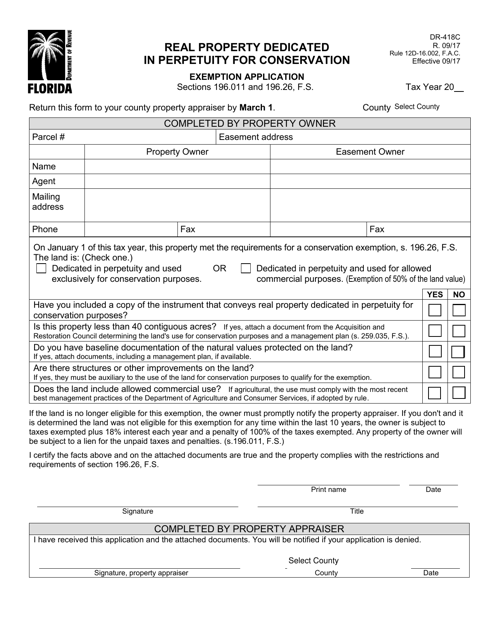

Form DR-418C Real Property Dedicated in Perpetuity for Conservation, Exemption Application - Florida

This form is used for applying for a property tax exemption in Florida for real property that is dedicated in perpetuity for conservation.

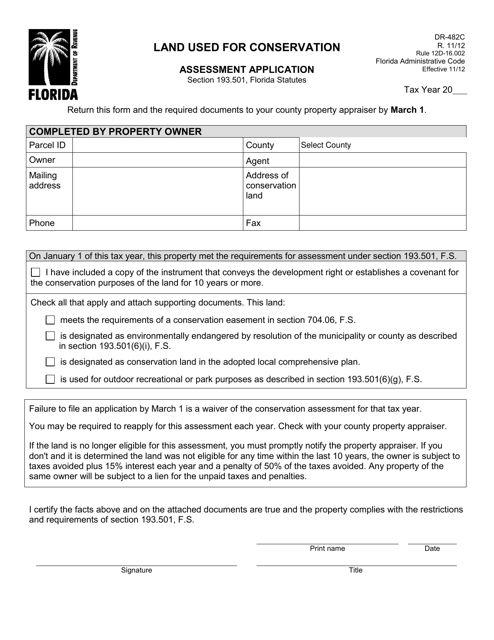

This form is used for applying for a conservation assessment on land in Florida. It is used to assess the property's eligibility for a reduced tax assessment based on conservation use.

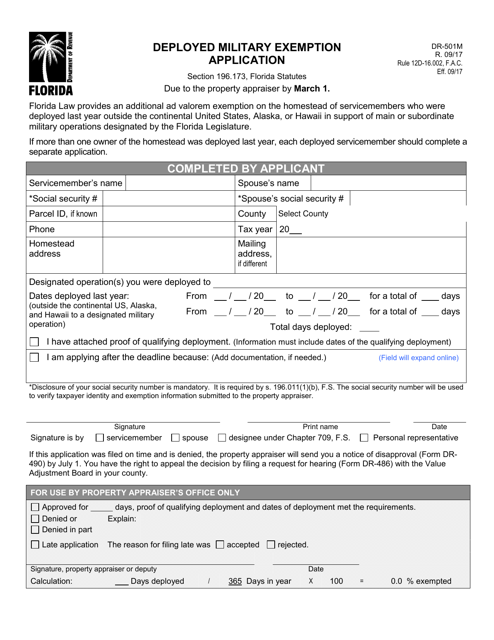

This form is used for applying for the exemption from property taxes for deployed military personnel in the state of Florida.

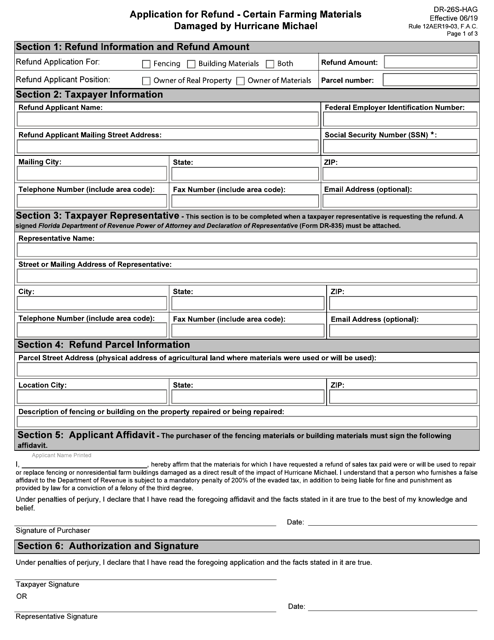

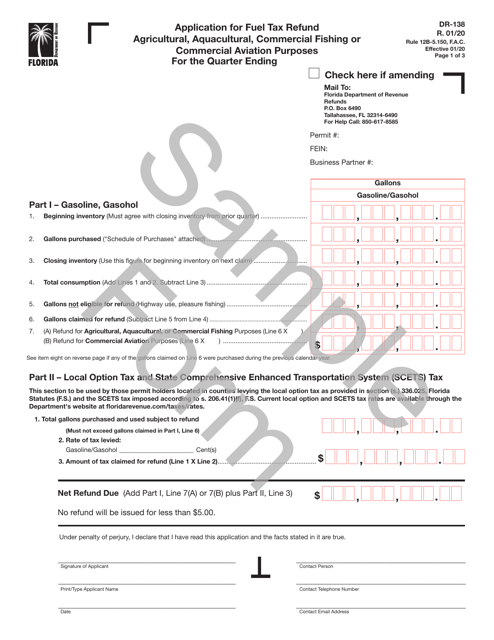

This form is used for applying for a refund for farming materials that were damaged by Hurricane Michael in Florida.

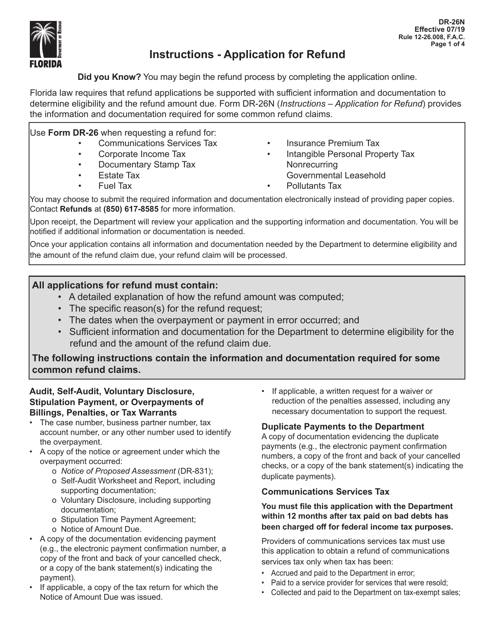

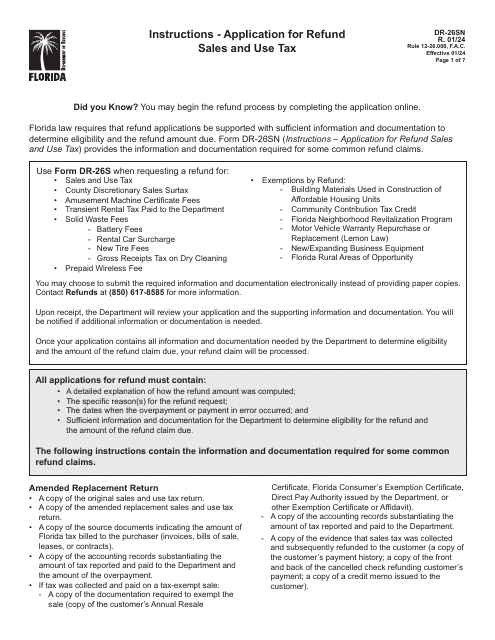

This Form is used for applying for a refund in the state of Florida. It provides instructions on how to fill out Form DR-26 to claim a refund.

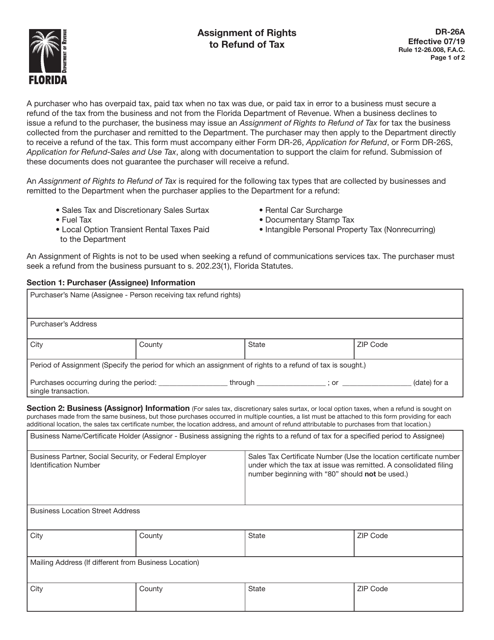

This form is used for assigning the rights to a tax refund in the state of Florida.

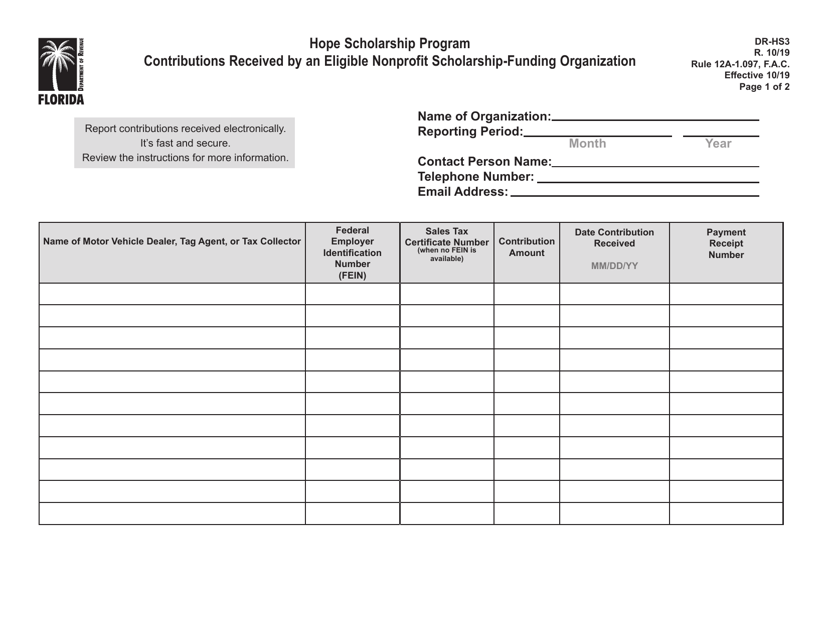

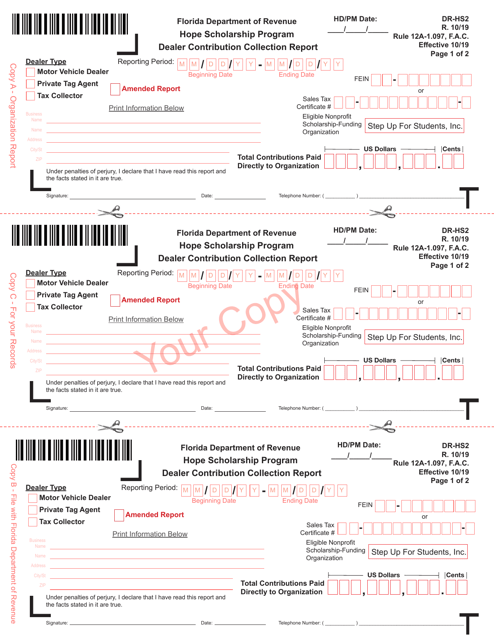

This form is used for reporting contributions received by a nonprofit organization under the Hope Scholarship Program in Florida.

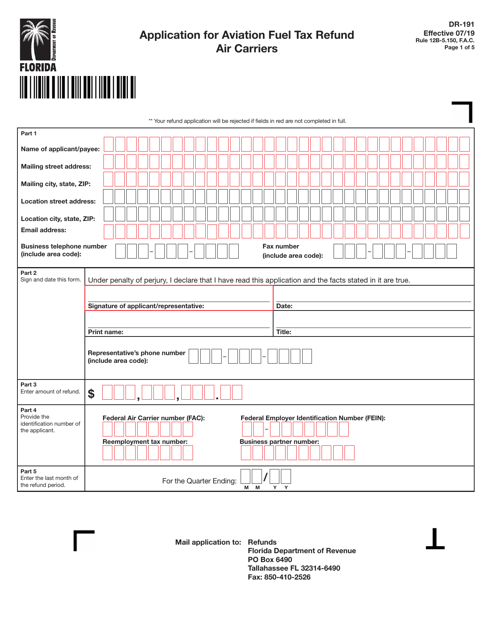

This Form is used for air carriers in Florida to apply for a refund of aviation fuel tax.

This form is used for reporting dealer contributions to the Hope Scholarship Program in Florida.

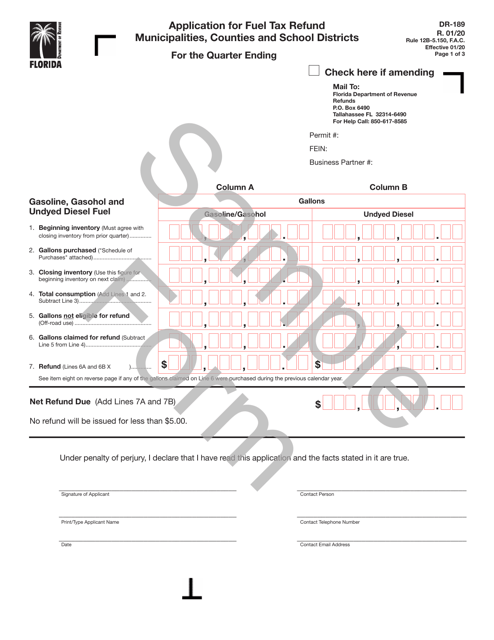

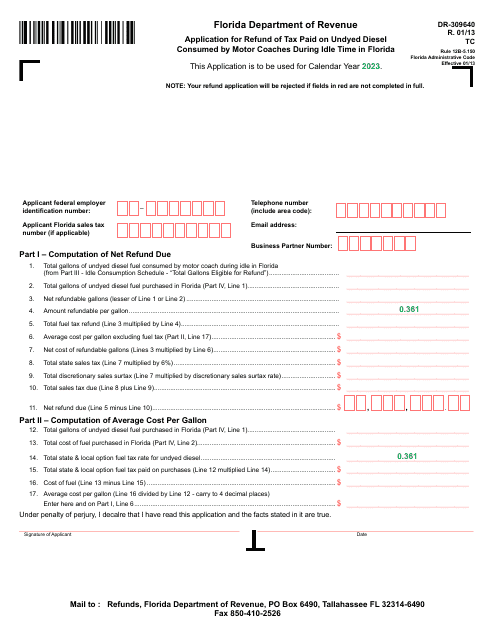

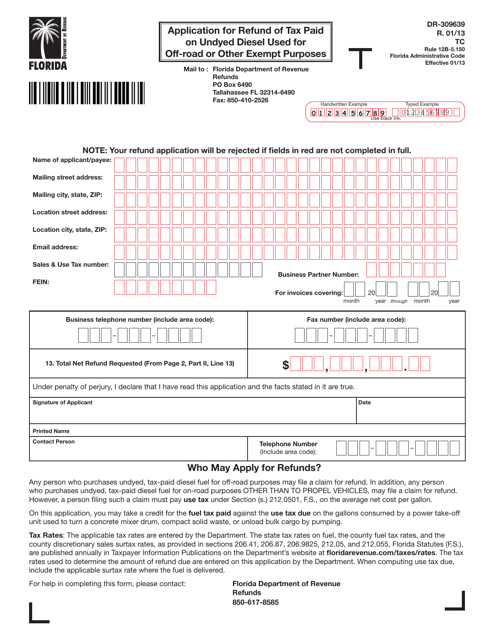

This form is used for applying for a refund of tax paid on undyed diesel fuel used for off-road or other exempt purposes in Florida.

This Form is used for applying for a Sales and Use Tax County Control Reporting Number in Florida.

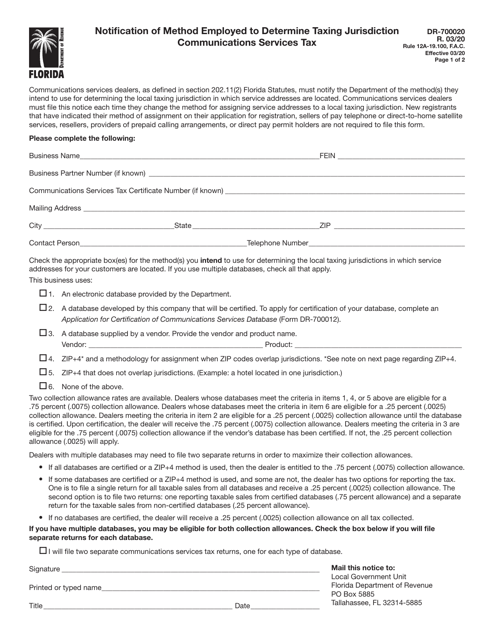

This form is used for notifying the method employed to determine taxing jurisdiction in the state of Florida.

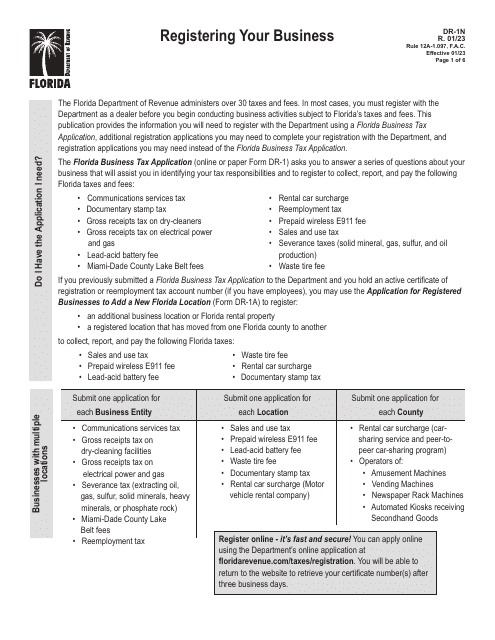

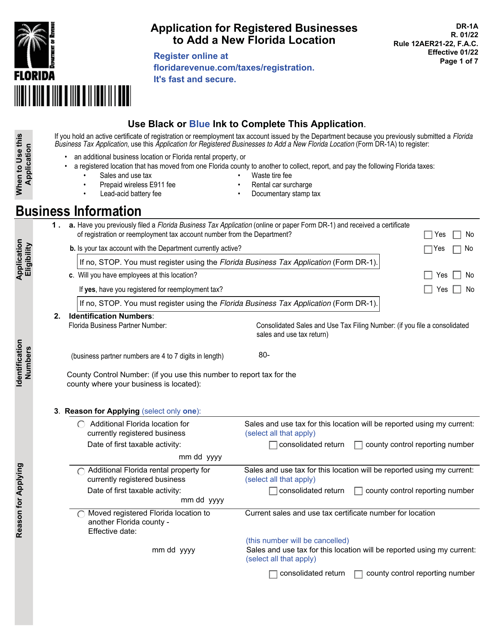

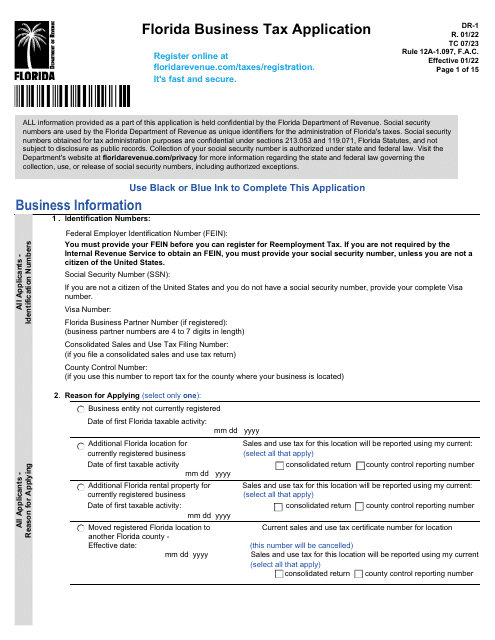

This form must be filled in by individuals before beginning to perform activities subject to taxes and fees in the state of Florida.

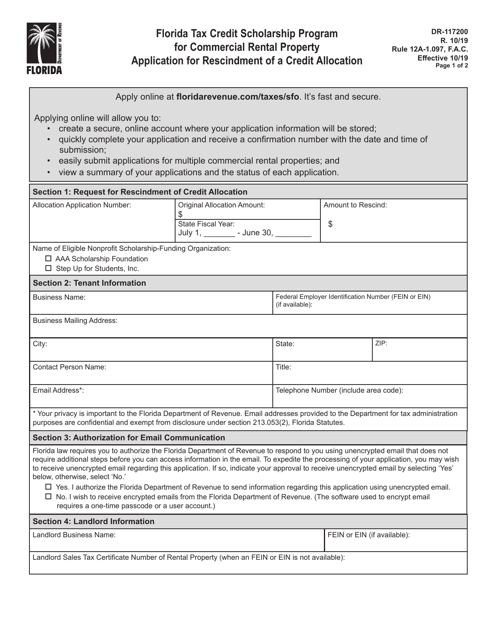

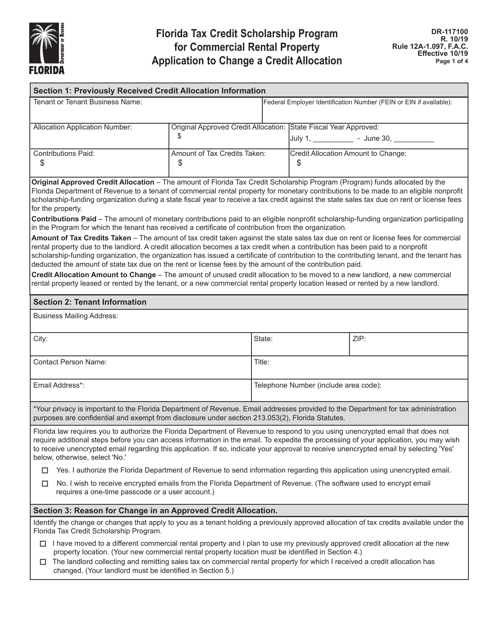

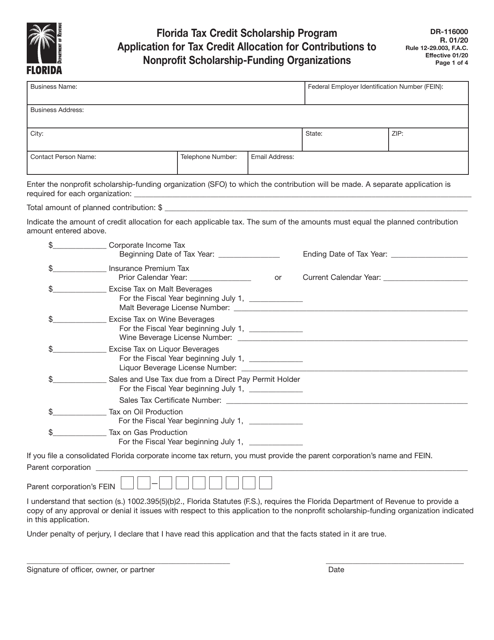

This form is used for applying for a tax credit allocation for contributions to nonprofit scholarship funding organizations (SFOs) in Florida.

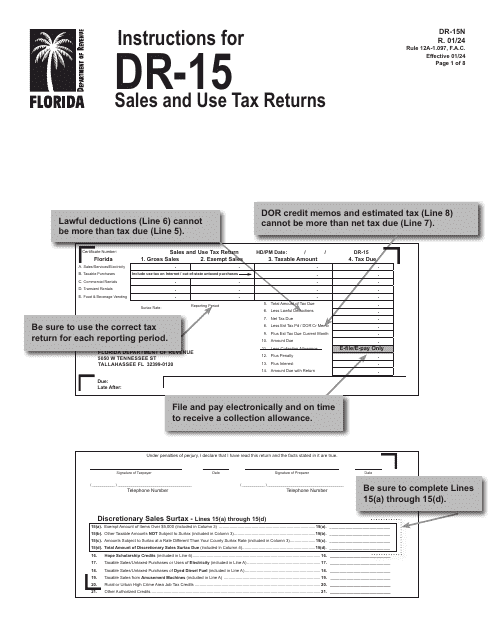

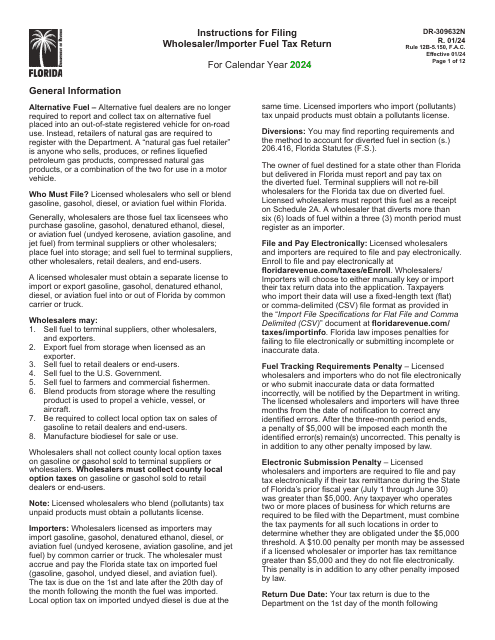

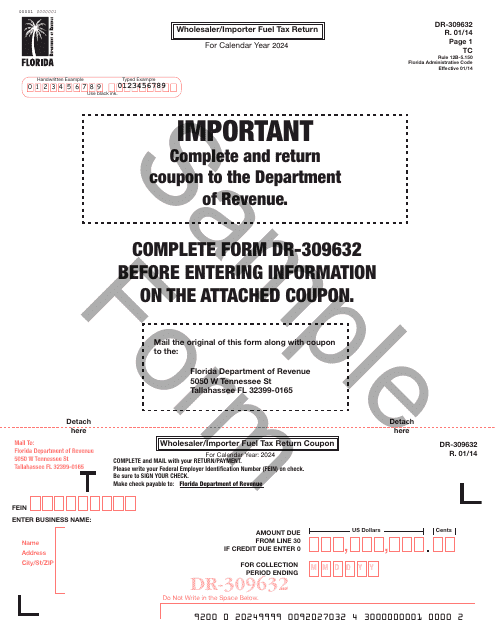

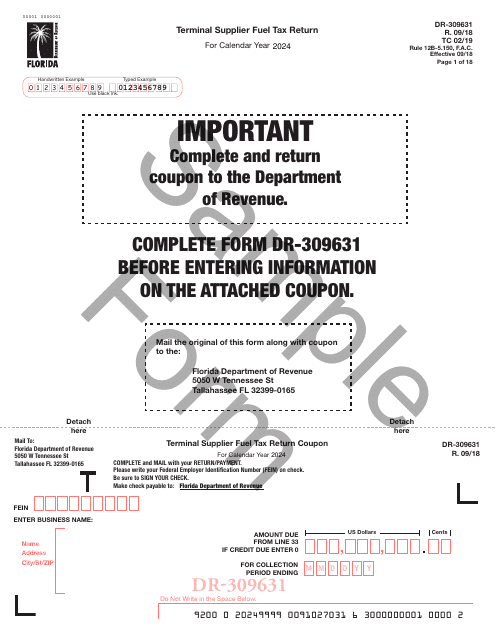

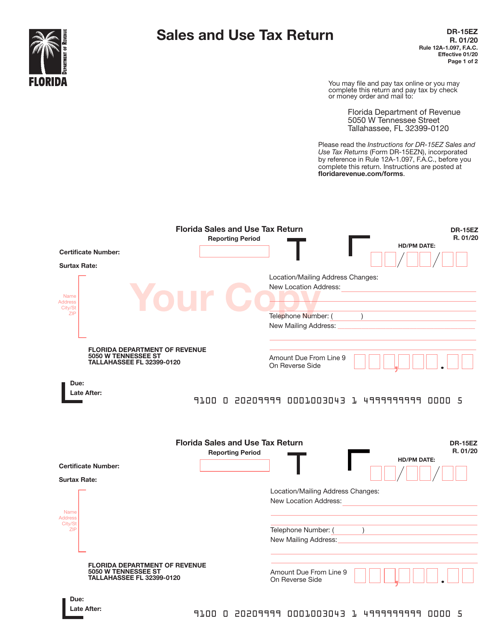

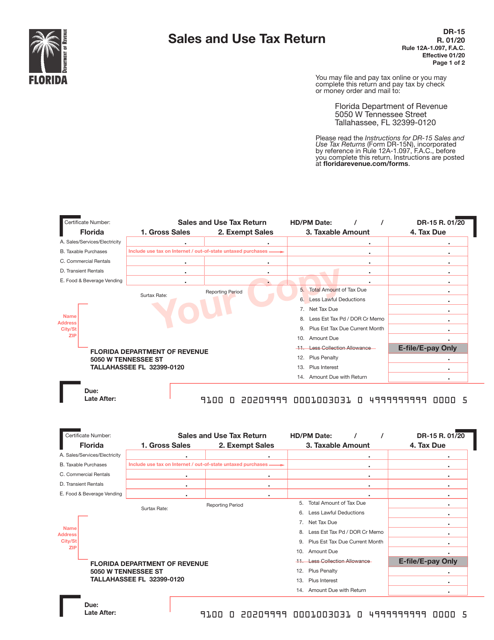

This Form is used for reporting sales and use tax in the state of Florida.

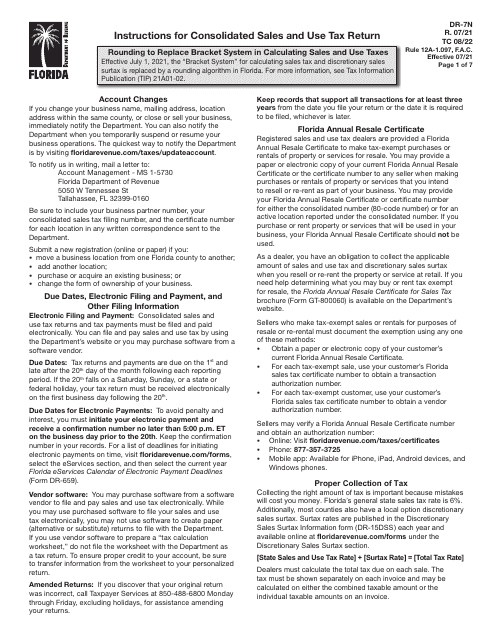

This Form is used for the filing of Sales and Use Tax Return in the state of Florida.

This form is used for determining the local option transient rental tax rates, also known as the tourist development tax rates, in the state of Florida. It provides the necessary information to calculate the tax rates applicable to transient rentals.

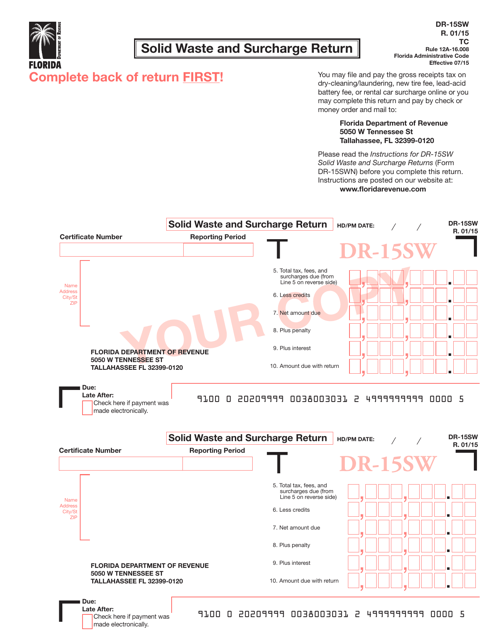

This form is used for filing the Solid Waste and Surcharge Return in the state of Florida.