Florida Department of Revenue Forms

Documents:

473

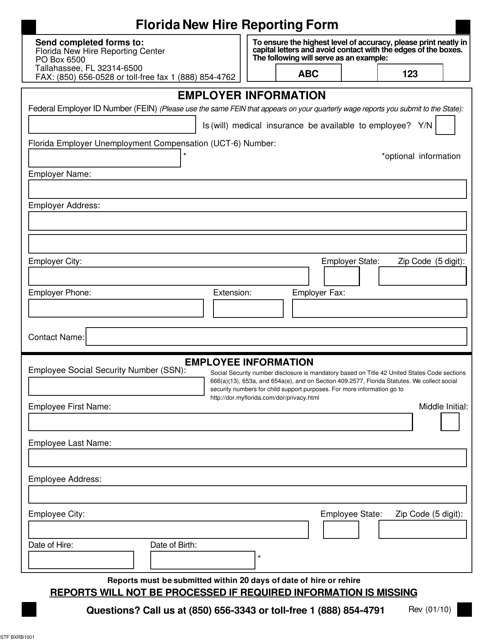

This Form is used for reporting new hires in the state of Florida. It helps employers comply with state and federal laws by reporting information about newly hired employees to the Florida Department of Revenue.

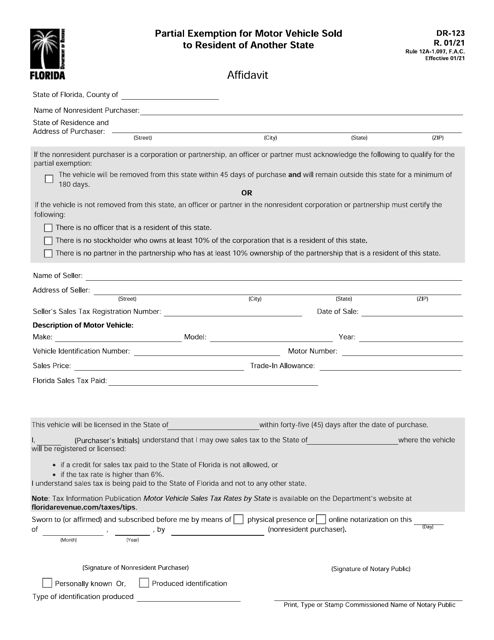

This document provides tax information for motor vehicle dealers in Florida. It covers topics such as sales tax, registration fees, and dealer licensing requirements.

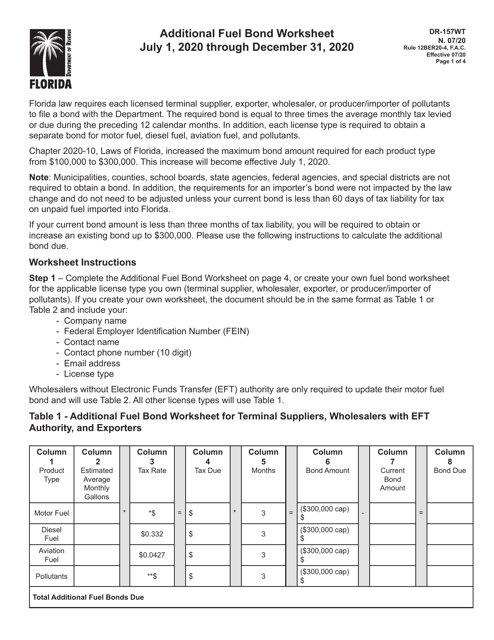

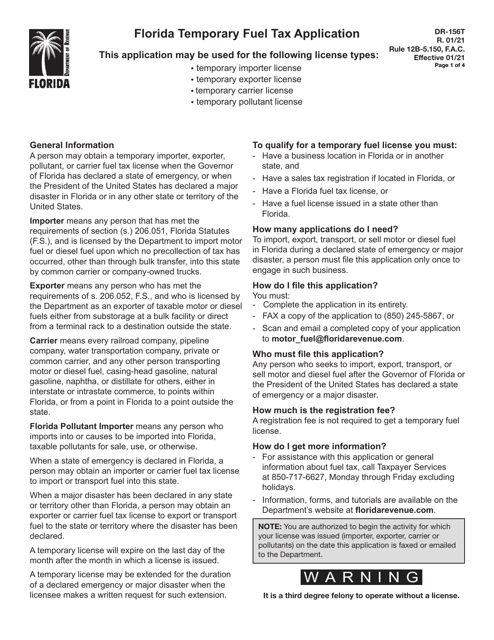

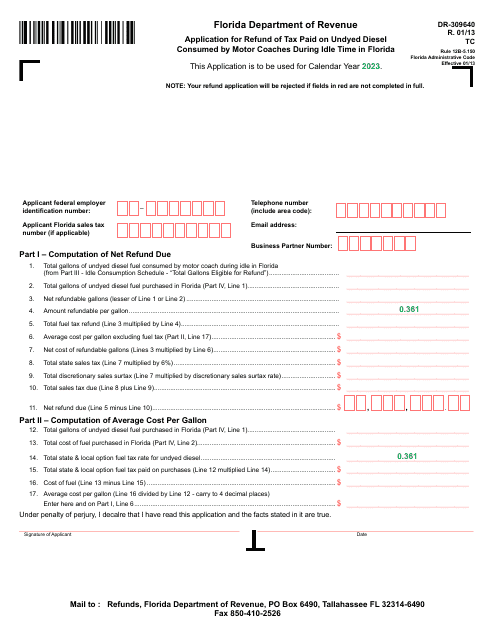

This form is used for calculating additional fuel bonds in the state of Florida. It is a worksheet that helps businesses determine the amount of bond required for the purchase and storage of additional fuel in the state.

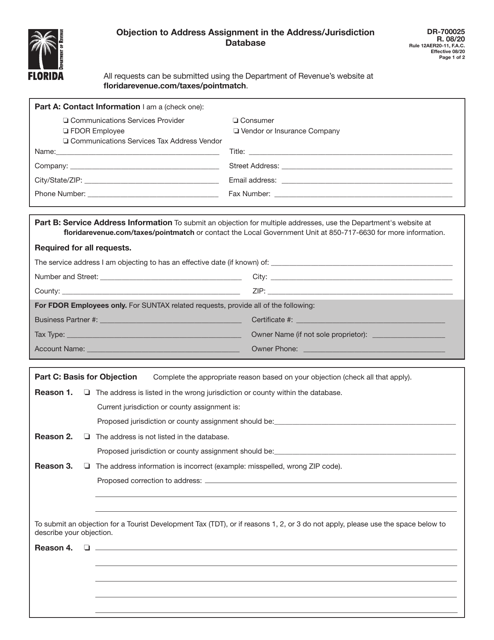

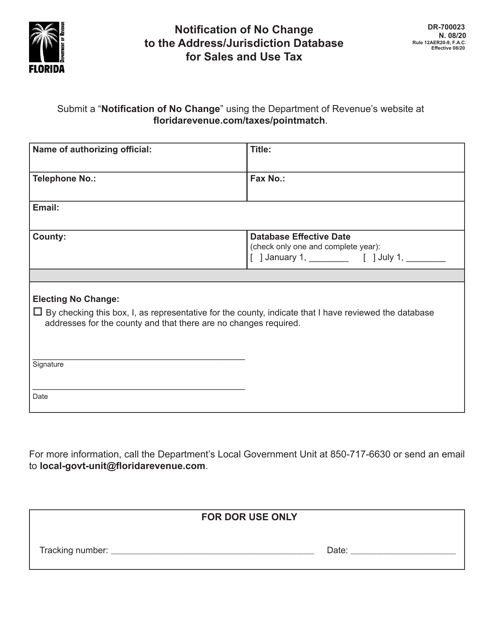

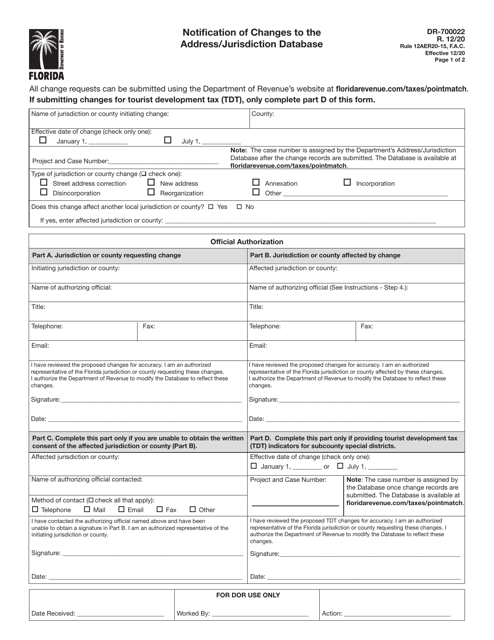

This form is used for notifying the Florida Department of Revenue about no changes to the address/jurisdiction database for sales and use tax.

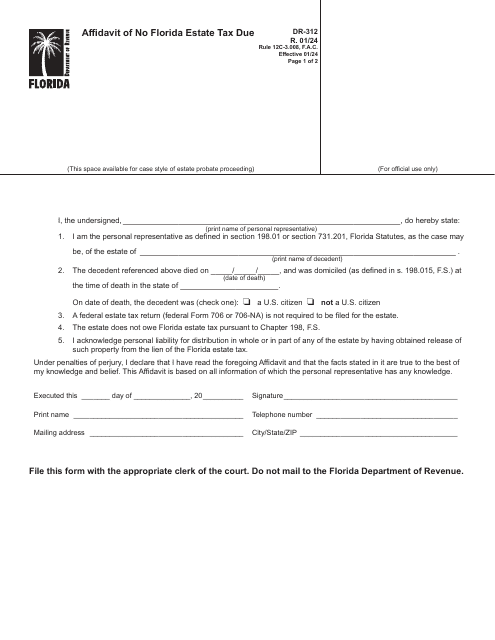

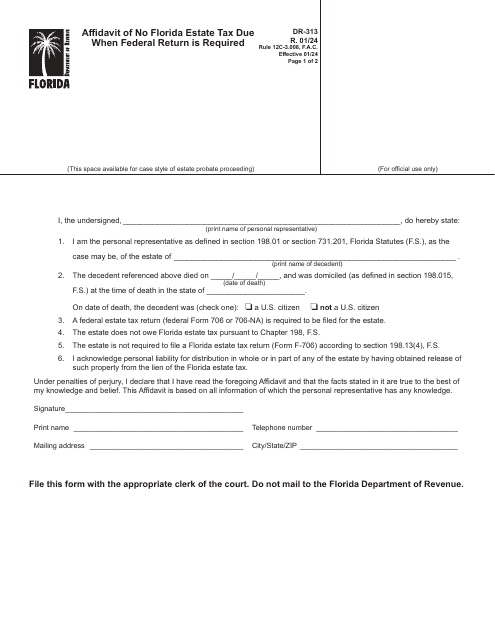

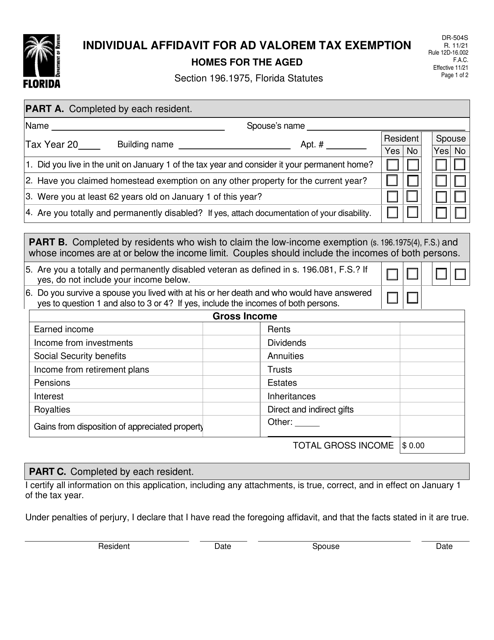

This form is a Florida legal document completed for the estates of decedents who died on or after January 1, 2005, if the estate does not require the filing of a federal estate tax return.

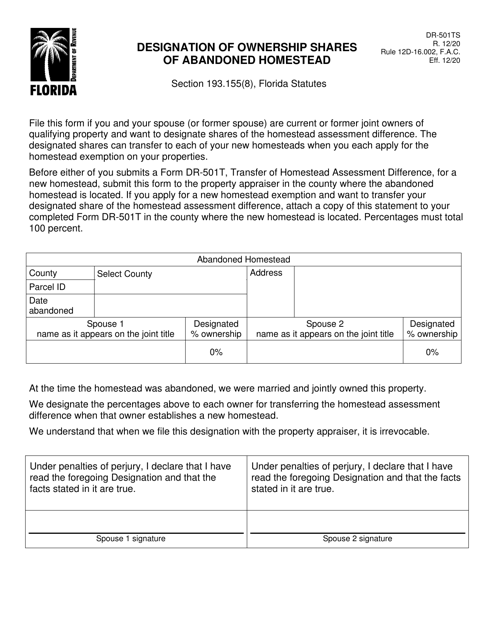

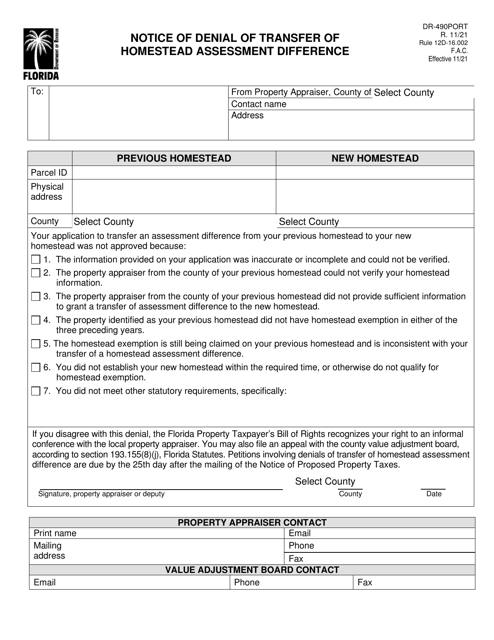

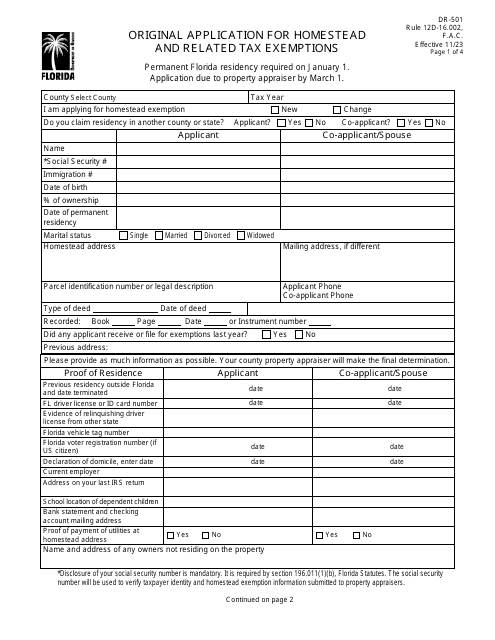

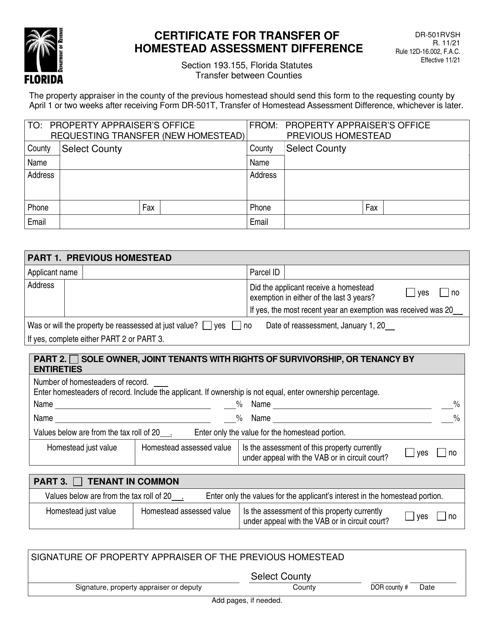

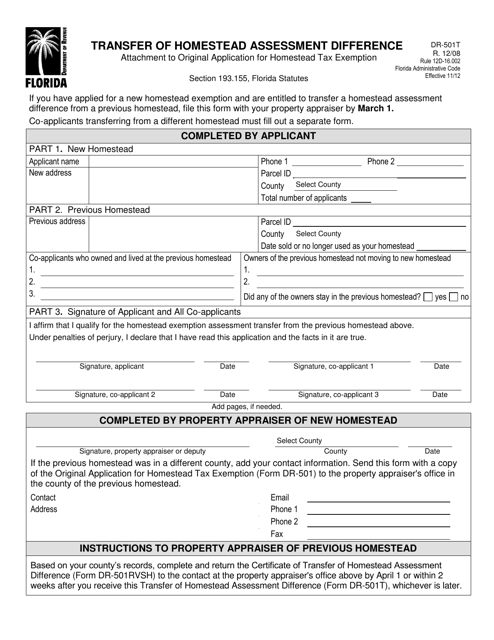

This form is used for transferring the Homestead Assessment Difference in Florida.

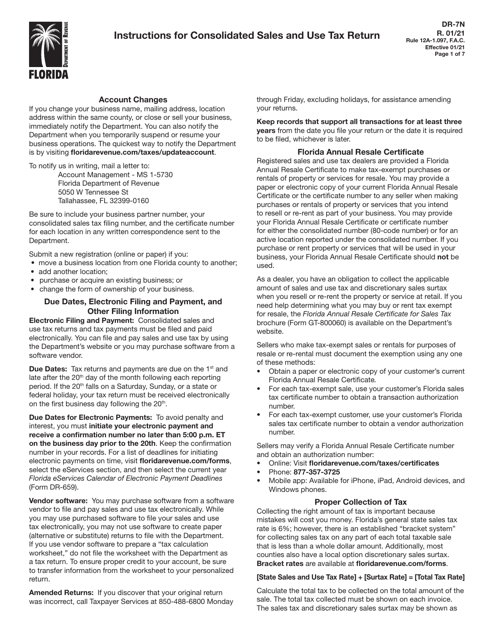

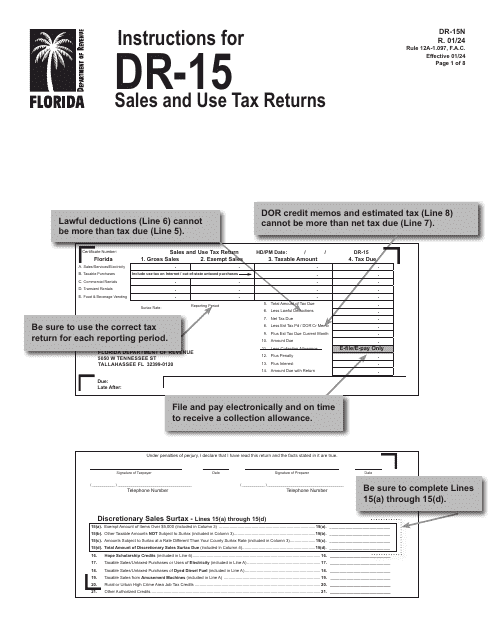

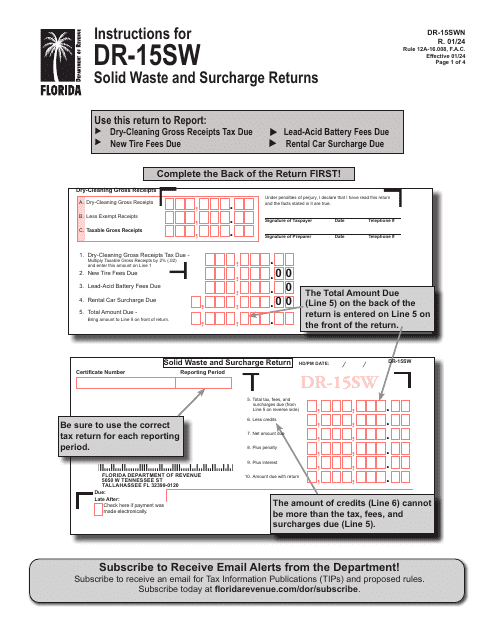

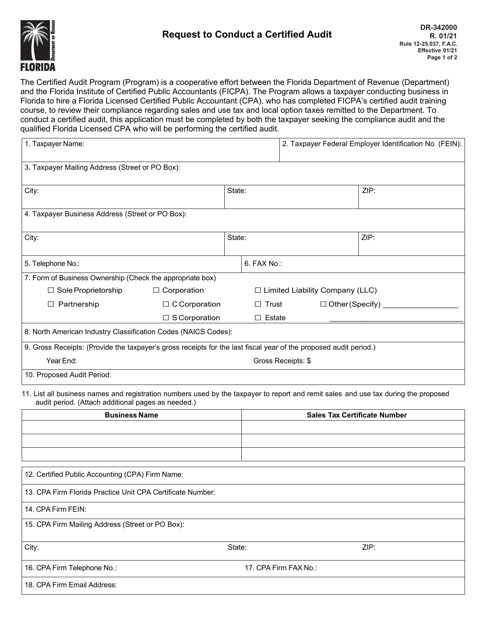

This Form is used for filing a Consolidated Sales and Use Tax Return in the state of Florida. It provides instructions on how to report and pay sales and use taxes for multiple locations or businesses on a single return.

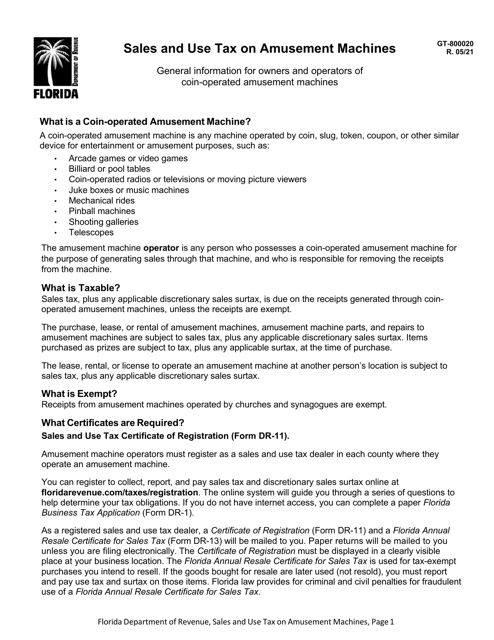

This form is used for reporting and paying sales and use tax on amusement machines in the state of Florida.

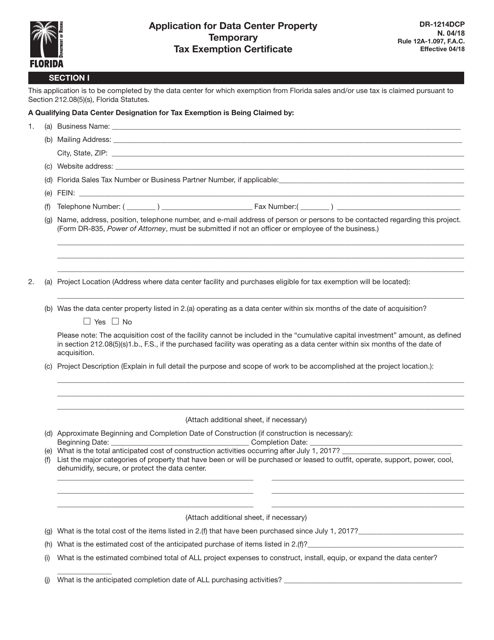

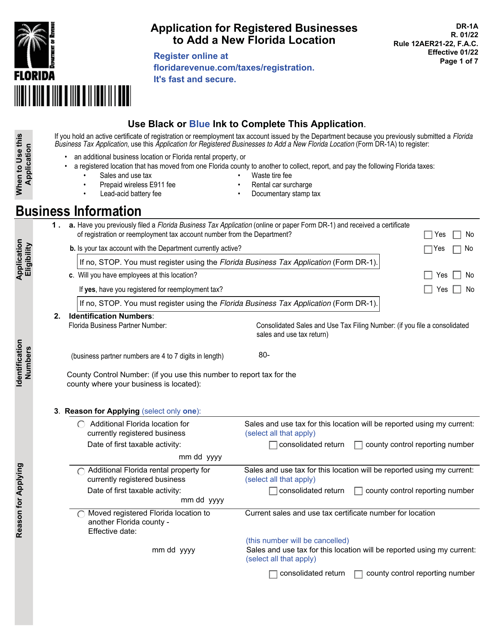

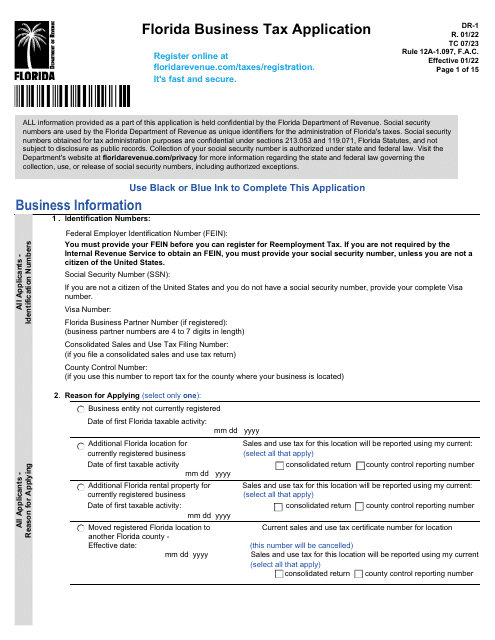

This form must be filled in by individuals before beginning to perform activities subject to taxes and fees in the state of Florida.