Florida Department of Revenue Forms

Documents:

473

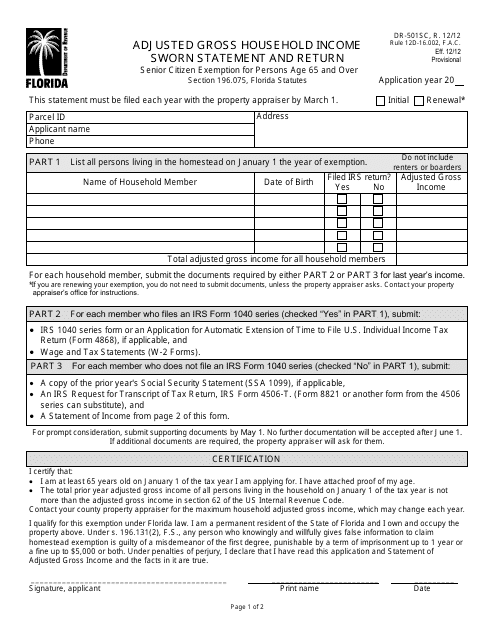

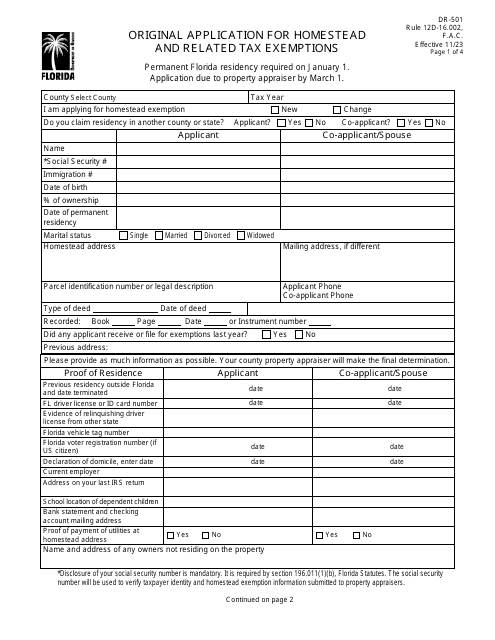

This form is used for reporting the adjusted gross household income in Florida and is required to be accompanied by a sworn statement.

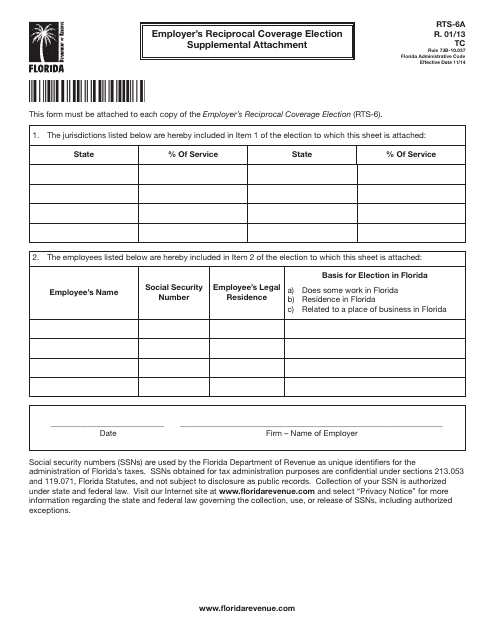

This form is used for employers in Florida to provide additional information and make an election for reciprocal coverage.

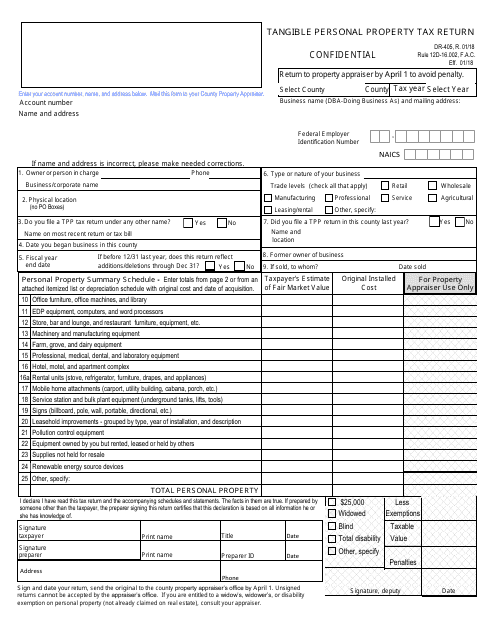

This Form is used for reporting tangible personal property and calculating tax owed in the state of Florida.

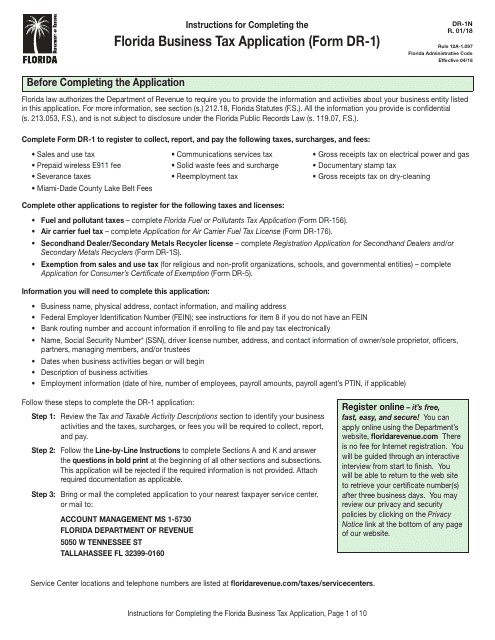

This Form is used for applying for a Florida Business Tax and includes instructions on how to complete it.

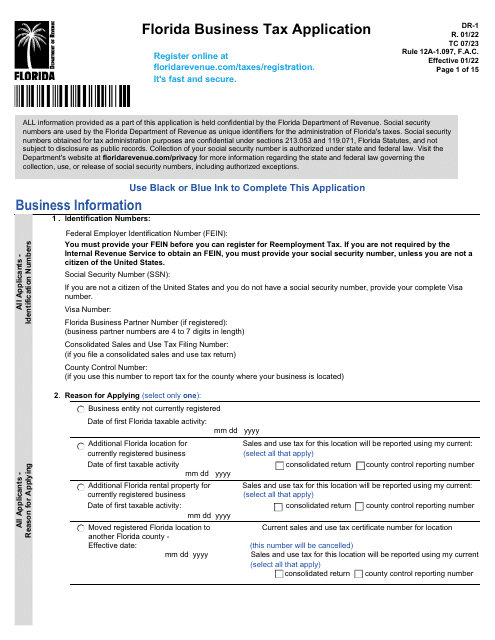

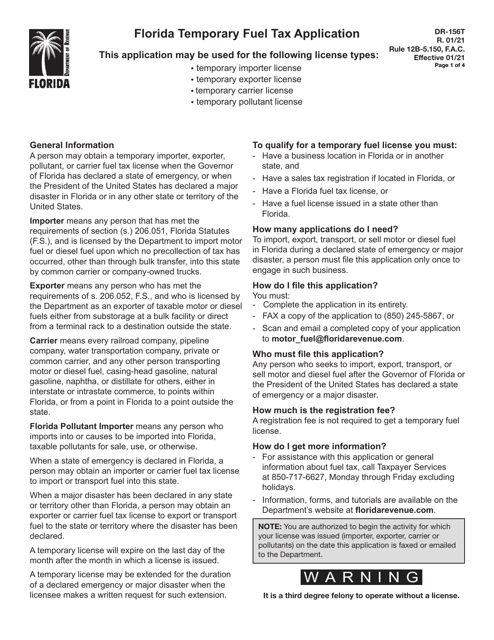

This form must be filled in by individuals before beginning to perform activities subject to taxes and fees in the state of Florida.

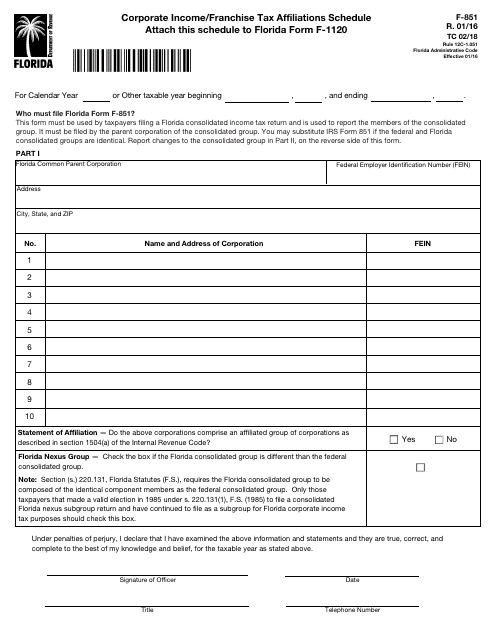

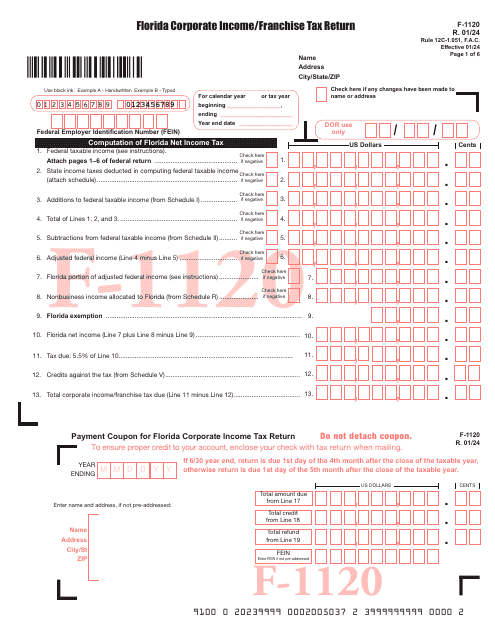

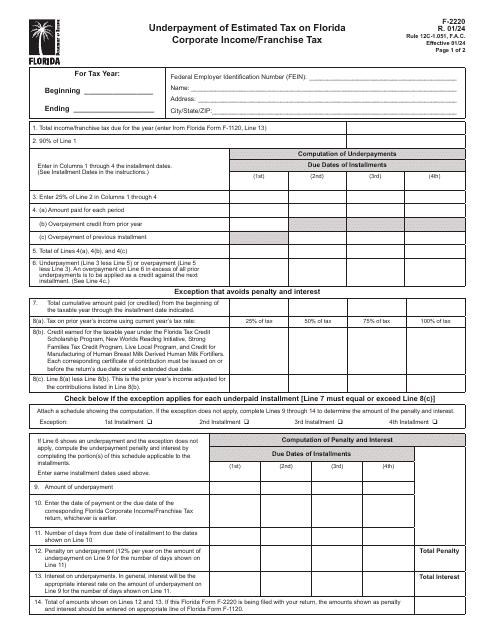

This Form is used for reporting corporate income and franchise tax affiliations in the state of Florida.

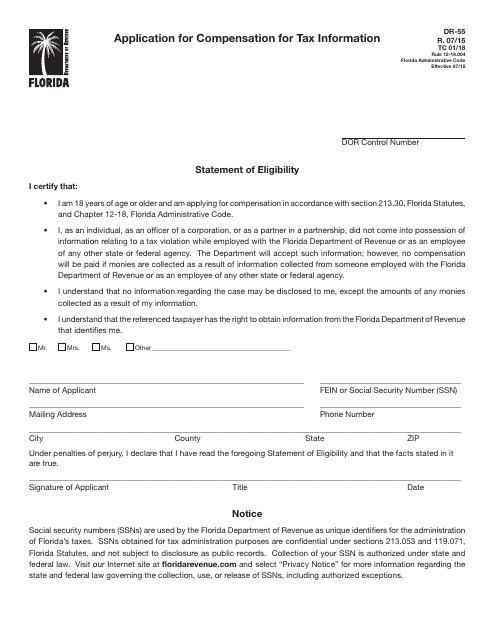

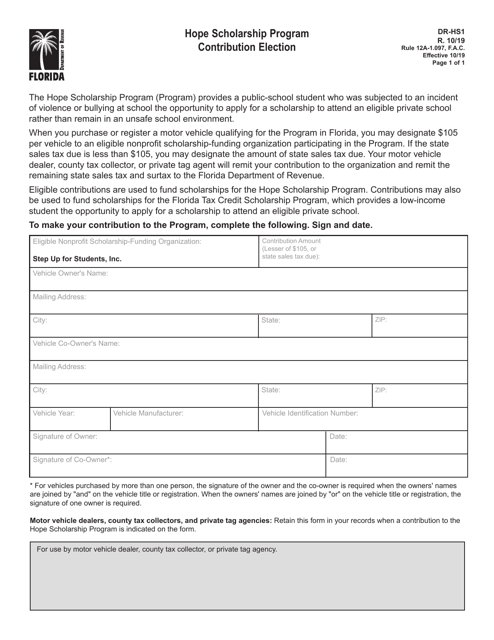

This Form is used for the residents of Florida to apply for compensation for tax information.

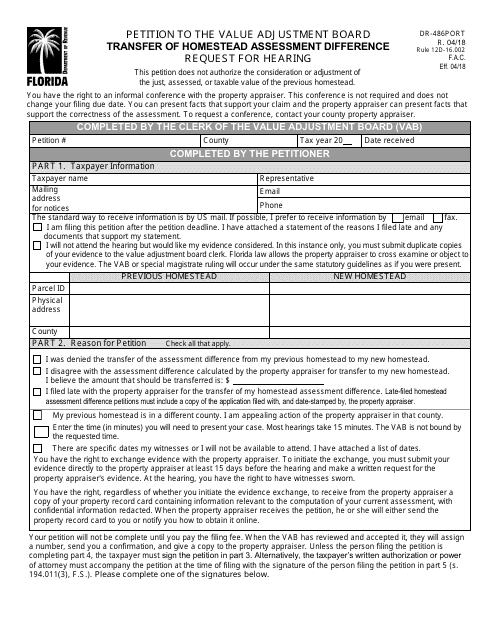

This form is used for petitioning the Value Adjustment Board in Florida to request a hearing for the transfer of a homestead assessment difference.

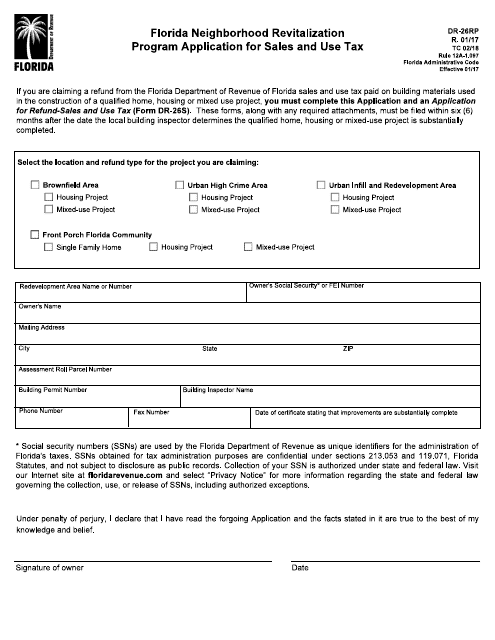

This Form is used for applying to the Florida Neighborhood Revitalization Program and requesting a sales and use tax exemption in Florida.

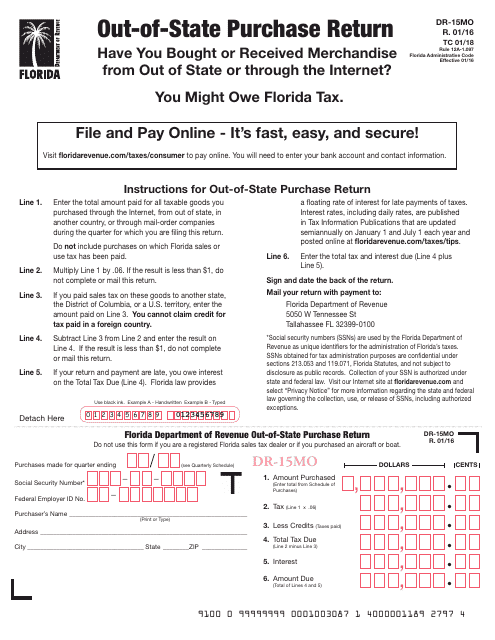

This form is used for reporting out-of-state purchases made by residents of Florida. It is used to calculate and pay the appropriate sales and use tax on these purchases.

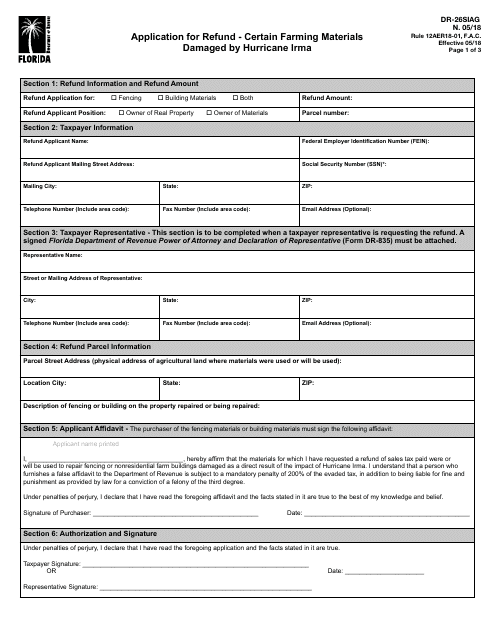

This form is used for applying for a refund for farming materials that were damaged by Hurricane Irma in Florida.

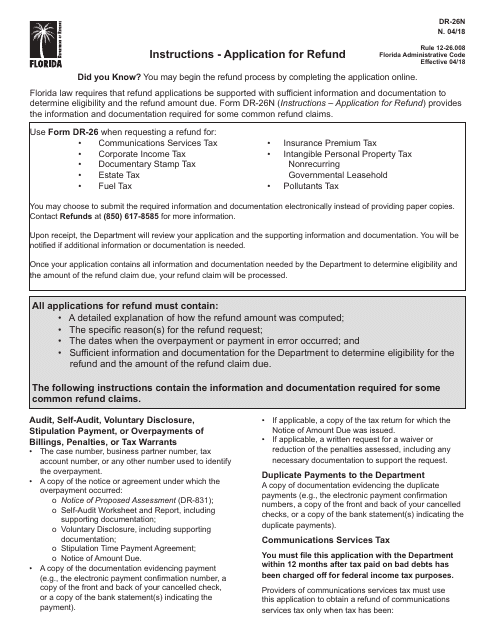

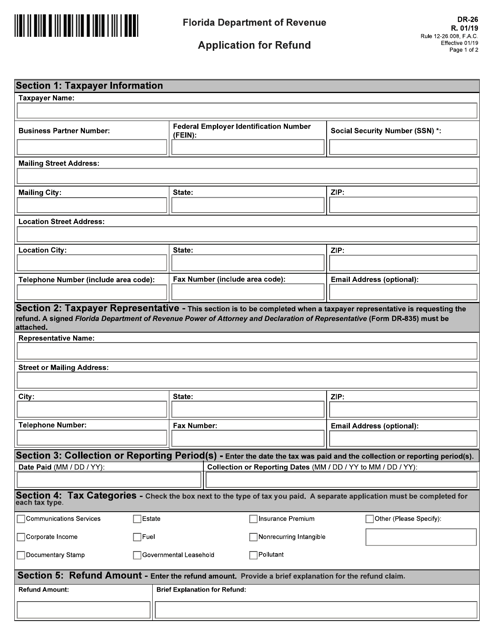

This Form is used for applying for a refund for all taxes in Florida, except Sales and Use Tax. It provides instructions on how to fill out and submit the DR-26 Application.

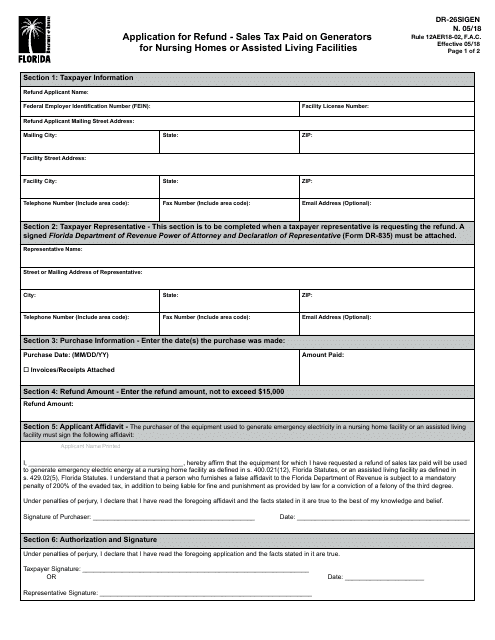

This form is used for applying for a refund of sales tax paid on generators used in nursing homes or assisted living facilities in Florida.

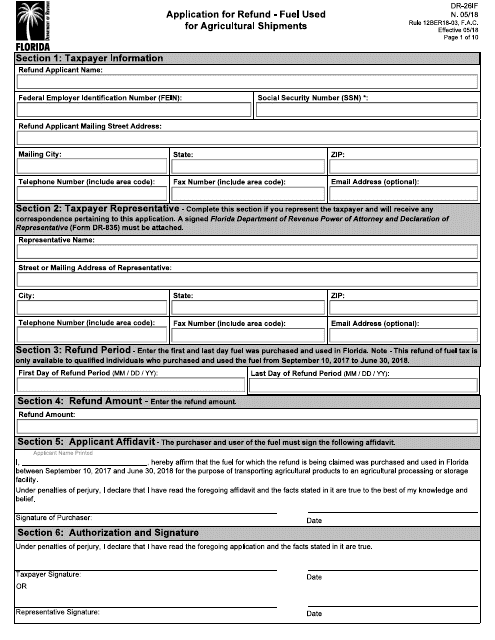

This Form is used for applying for a refund of fuel used for agricultural shipments in Florida.

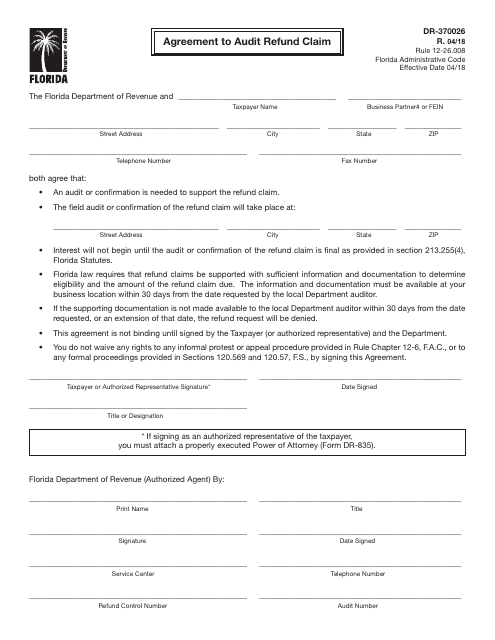

This Form is used for agreeing to audit a refund claim in the state of Florida.

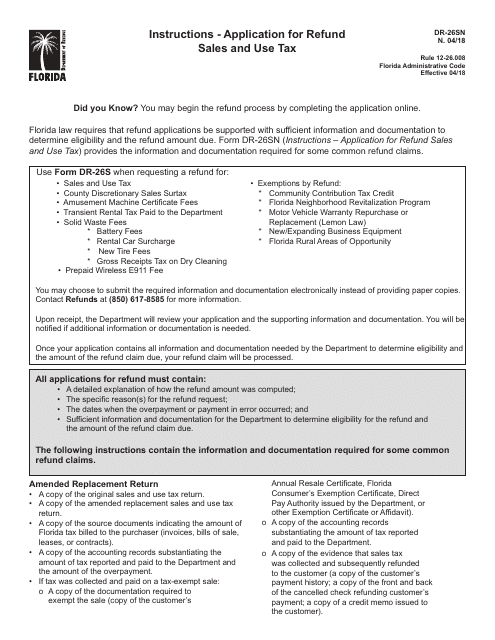

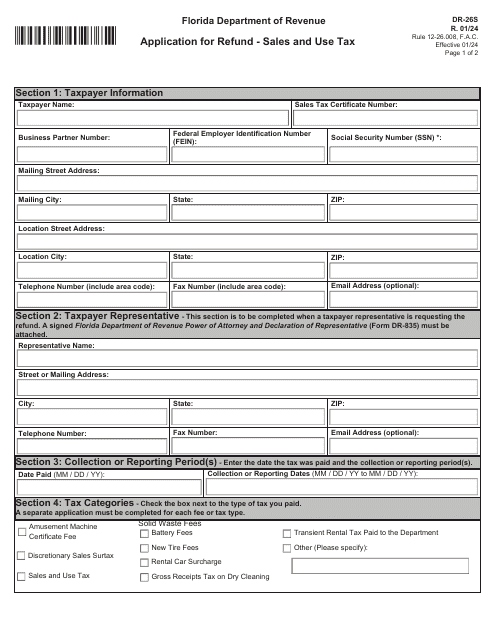

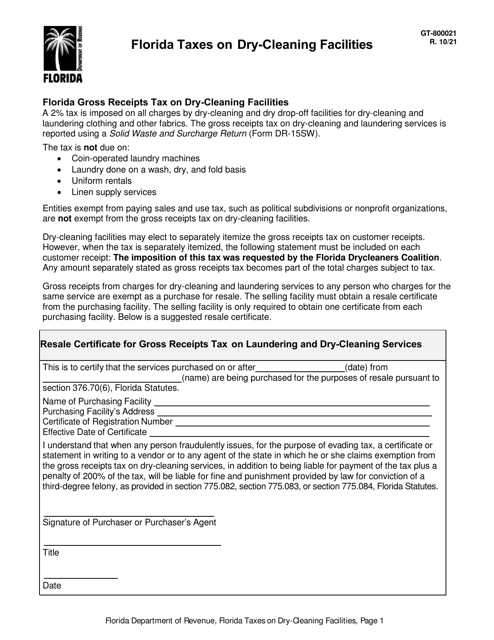

This document is used for applying for a refund of sales and use tax in the state of Florida. It provides instructions on how to fill out Form DR-26SN and Form DR-26S to request a refund.

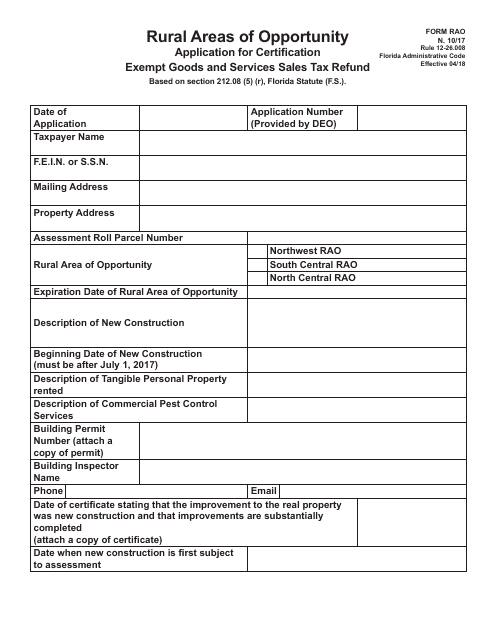

This form is used for applying for a certification of sales tax refund for exempt goods and services in rural areas of opportunity in Florida.

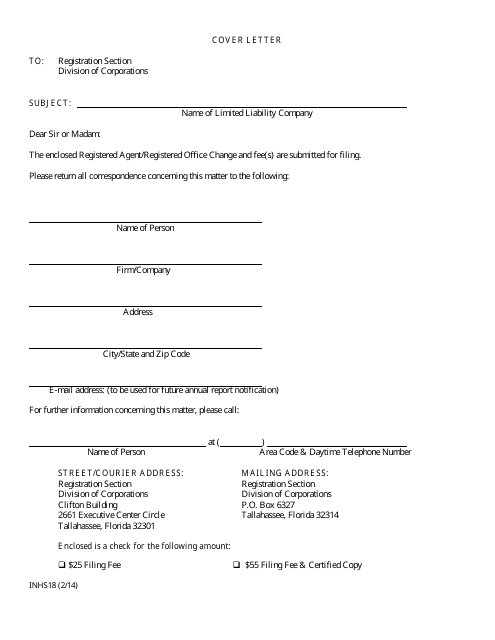

This form is used for limited liability companies in Florida to change their registered office, registered agent, or both.

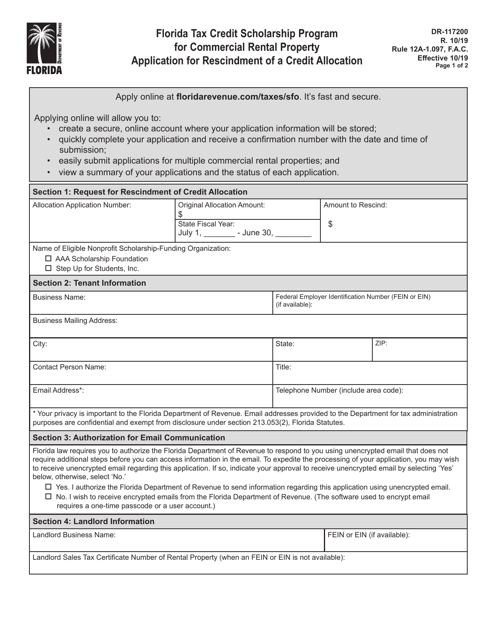

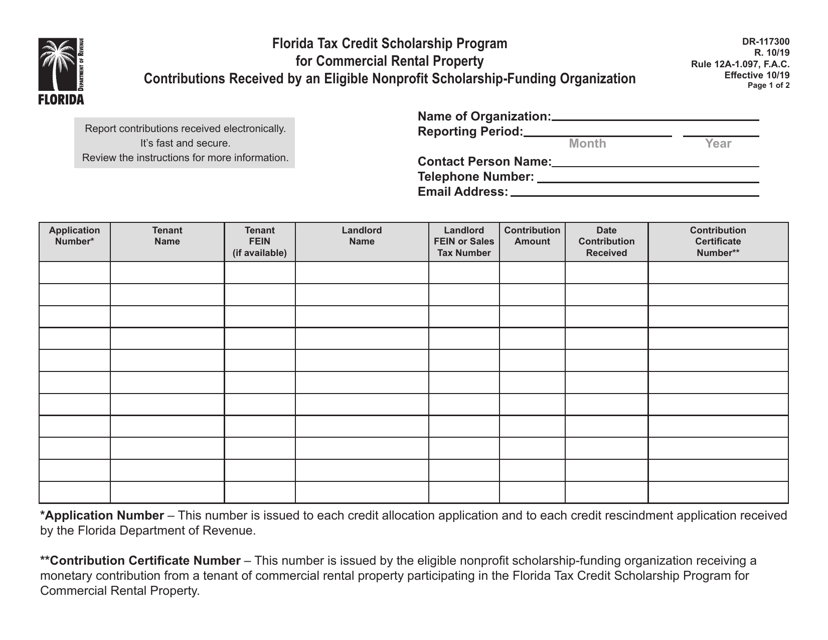

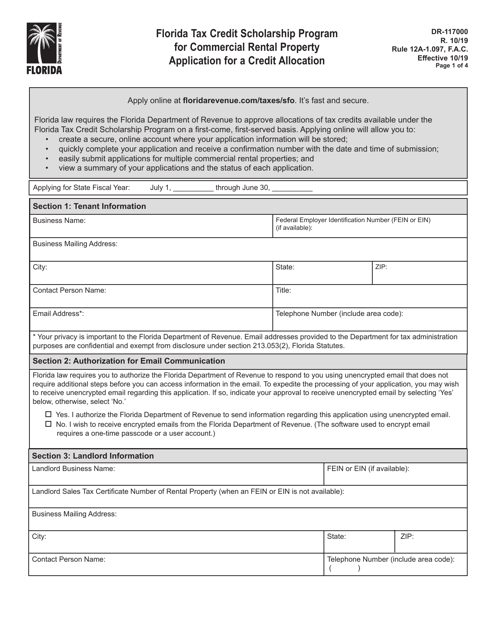

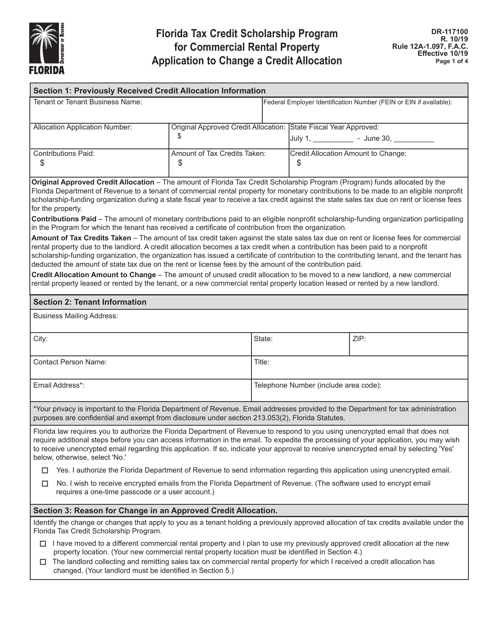

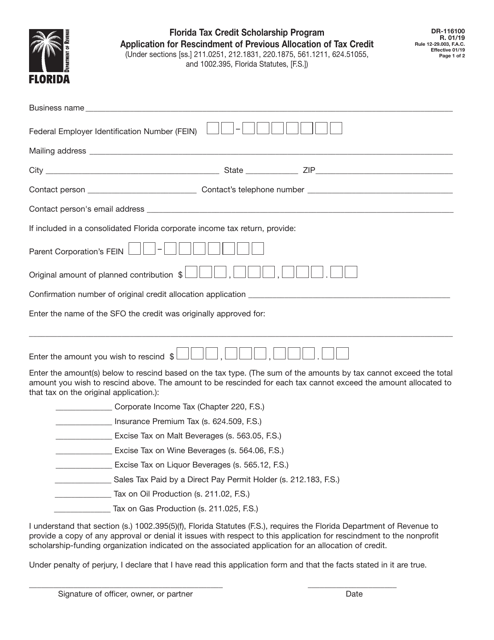

This form is used for the Florida Tax Credit Scholarship Program to apply for the rescindment of a previous allocation of tax credit.

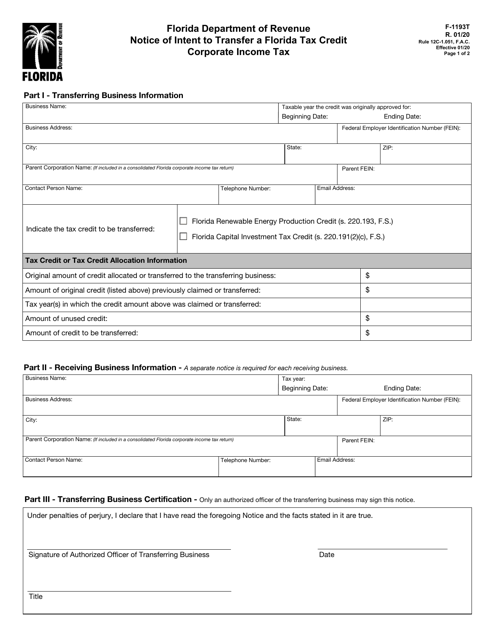

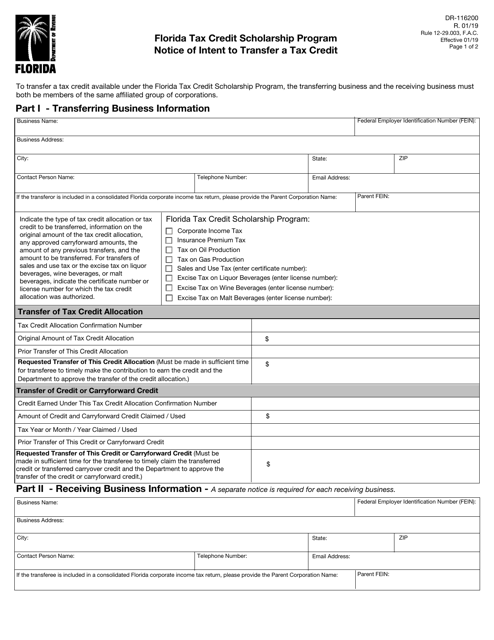

This form is used for notifying the Florida Tax Credit Scholarship Program of the intent to transfer a tax credit in Florida.

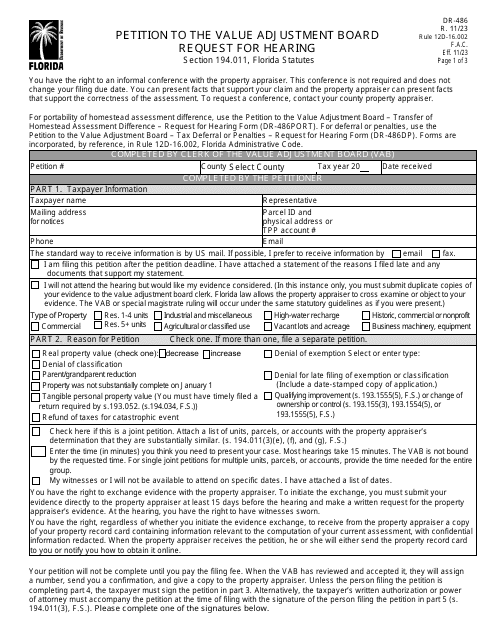

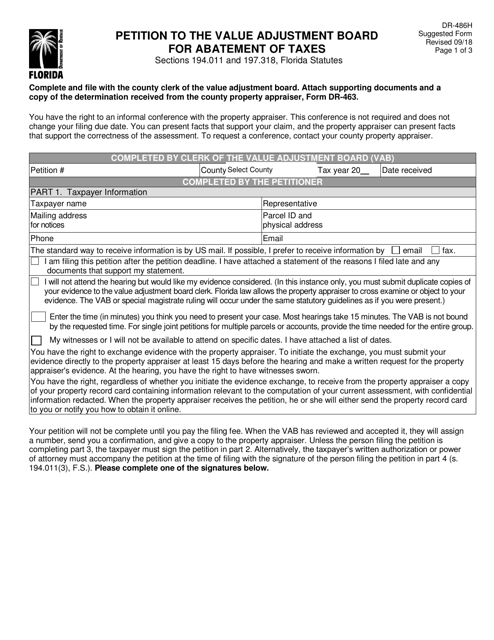

This Form is used for taxpayers in Florida to file a petition with the Value Adjustment Board to request a reduction in property taxes.

This form is used for applying for a refund in the state of Florida.

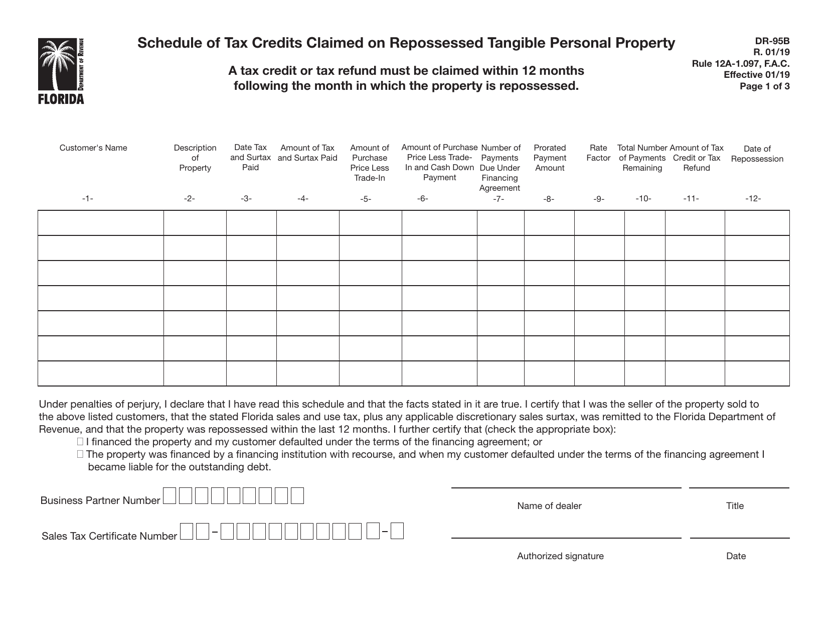

This form is used for reporting and claiming tax credits on repossessed tangible personal property in the state of Florida.