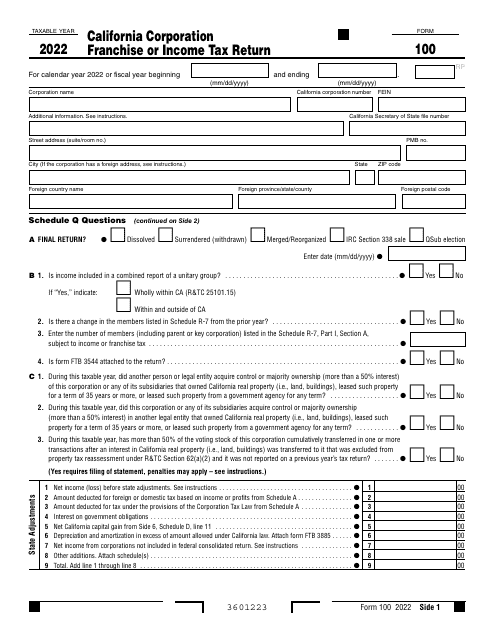

California Franchise Tax Board Forms

Documents:

528

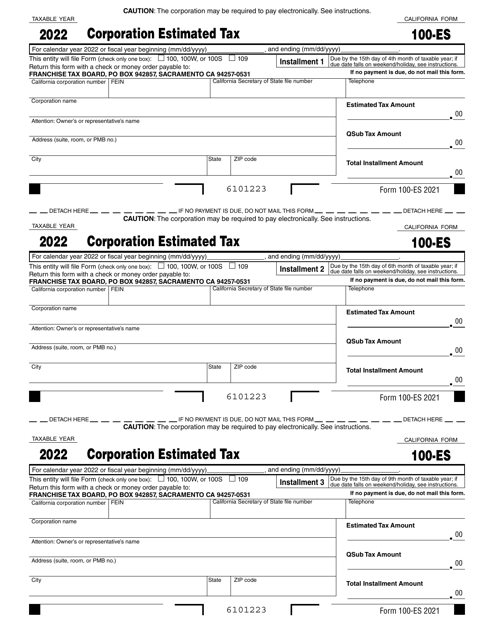

This is a legal document that various financial corporations based in California use to figure estimated tax for a corporation and then mail to the Franchise Tax Board to pay corporate income tax.

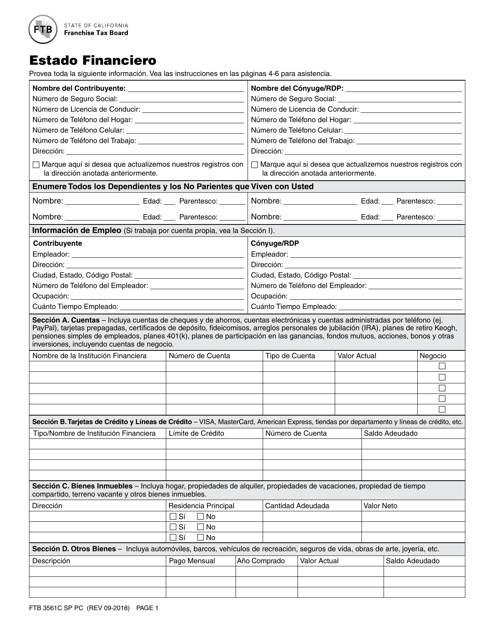

This form is used for filing the Financial Statement with the California Franchise Tax Board. It is in Spanish.

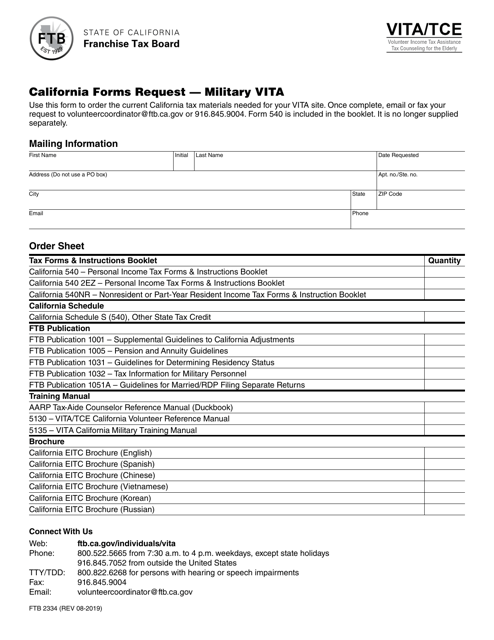

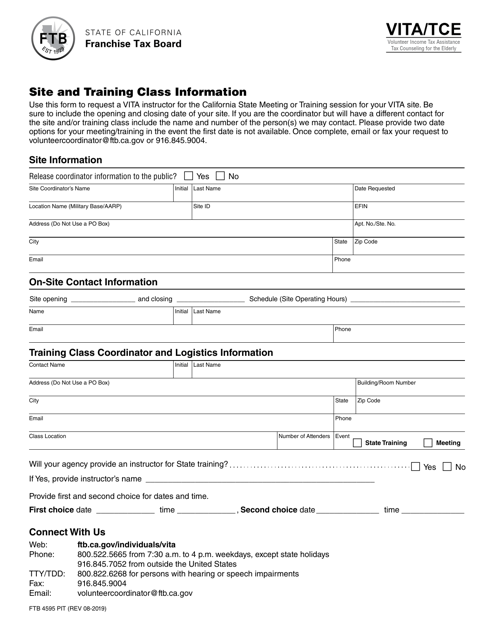

This document provides information about the Form FTB 4595 PIT Site and Training Class, specifically for VITA/TCE (Volunteer Income Tax Assistance/ Tax Counseling for the Elderly) in California. It covers details about the available training classes and the site locations for this program.

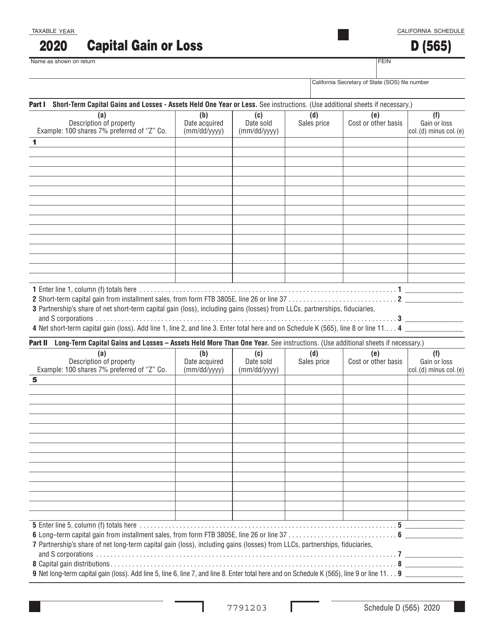

This form is used for reporting capital gains or losses in the state of California. It is part of Form 565, which is used for filing a partnership return in the state.

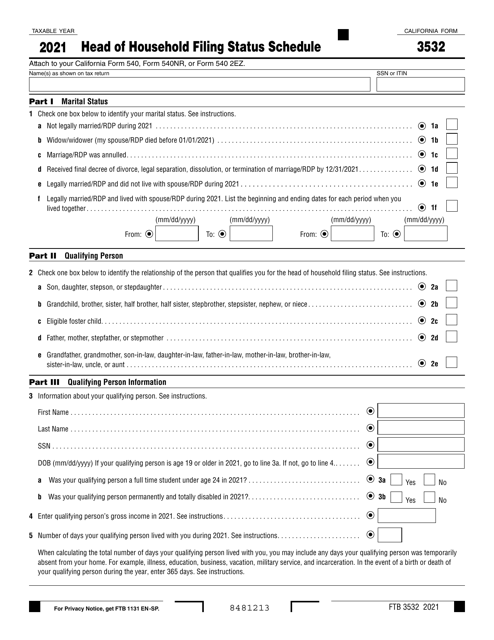

This form is used for individuals in California who qualify for the head of household filing status. It is used to calculate the correct amount of tax owed based on this status.

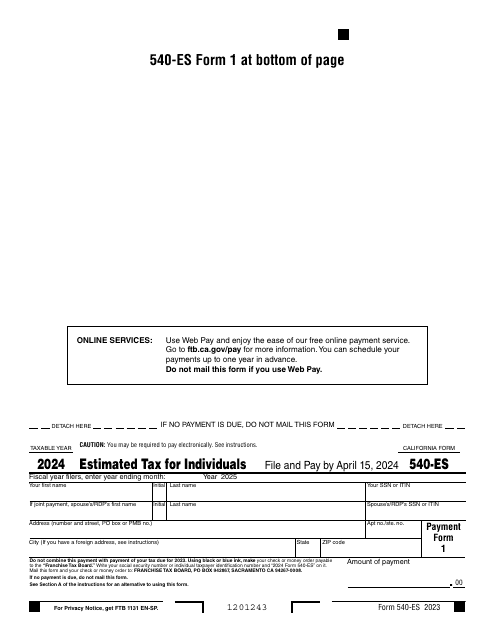

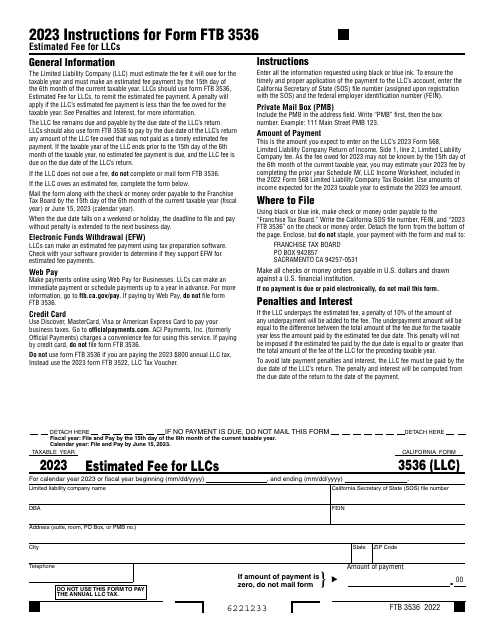

Fill out this form over the course of a year to pay your taxes in the state of California.

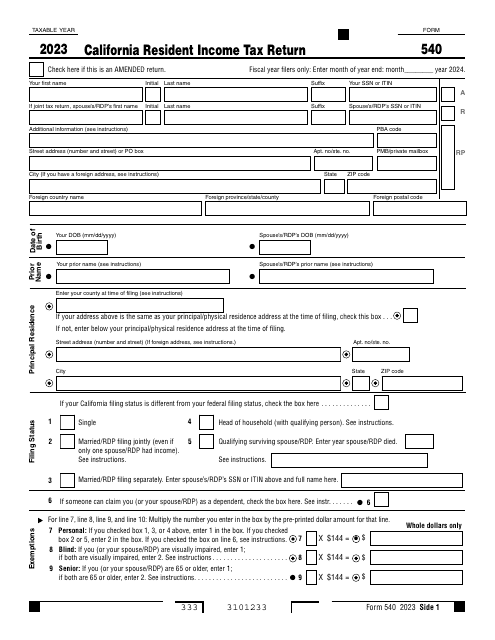

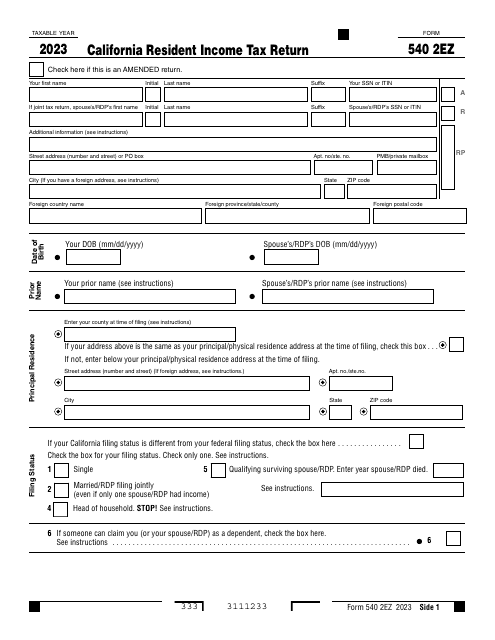

If you are a California resident you should use this form to report your income tax return. See here to check the requirements.

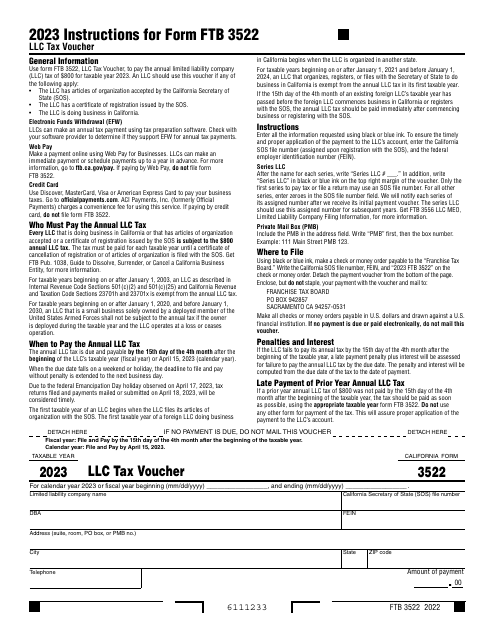

This is a legal document every California-based limited liability company (LLC) needs to submit to pay the annual LLC tax of $800. This form is a tax voucher - it details payment information you need to provide with your check or money order.

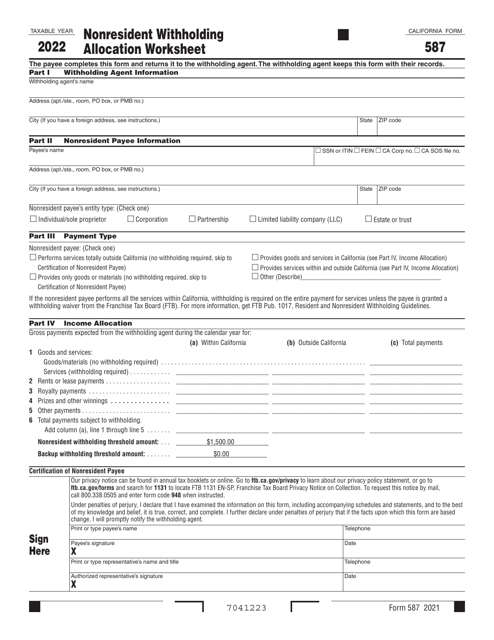

This form is used for allocating withholding between nonresident partners and members in a California partnership or limited liability company. It is used to determine how much income tax should be withheld from each partner or member's distributive share of income.

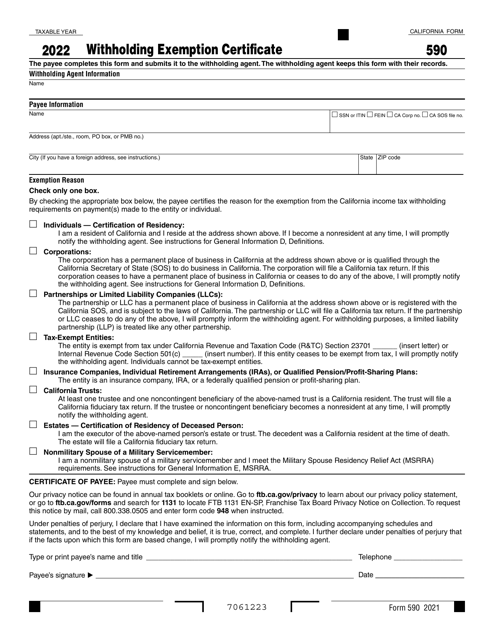

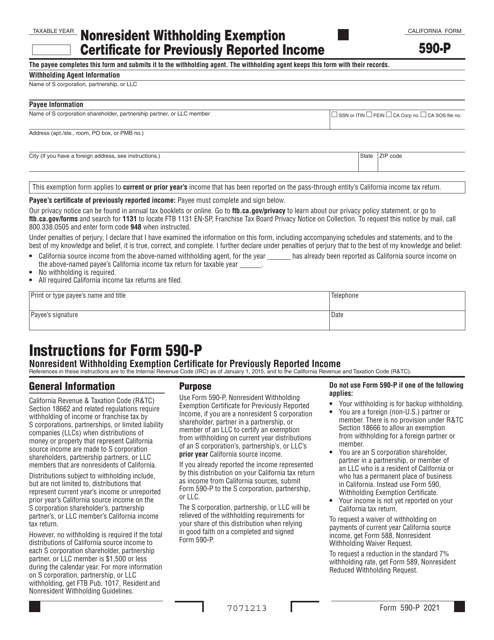

Form 590-P Nonresident Withholding Exemption Certificate for Previously Reported Income - California

This Form is used for claiming an exemption from nonresident withholding for previously reported income in California.