California Franchise Tax Board Forms

Documents:

528

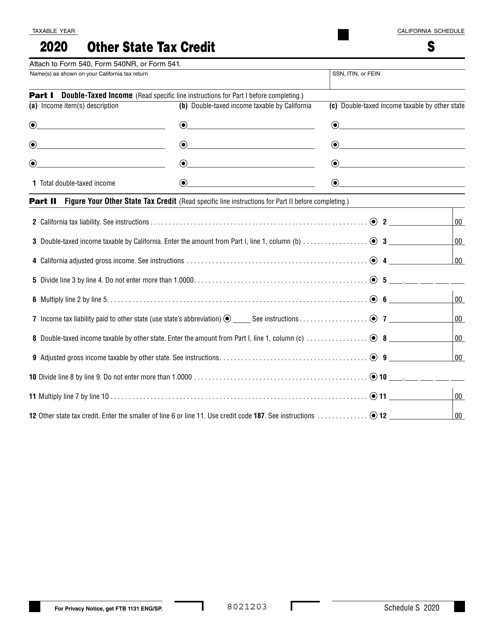

This document is used for claiming a tax credit for taxes paid to another state while being a resident of California.

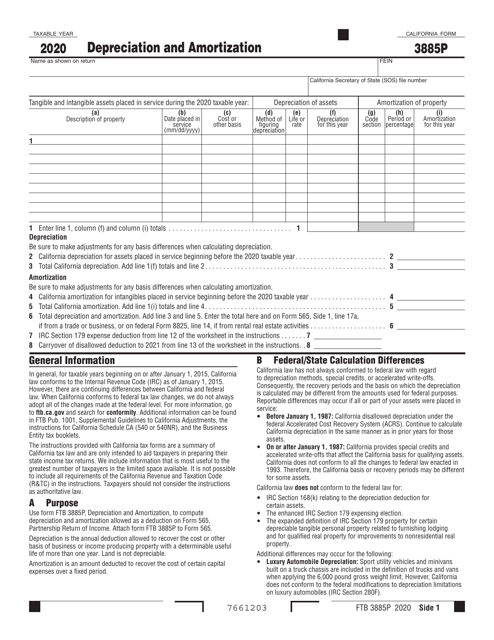

This Form is used for reporting depreciation and amortization expenses for California state tax purposes.

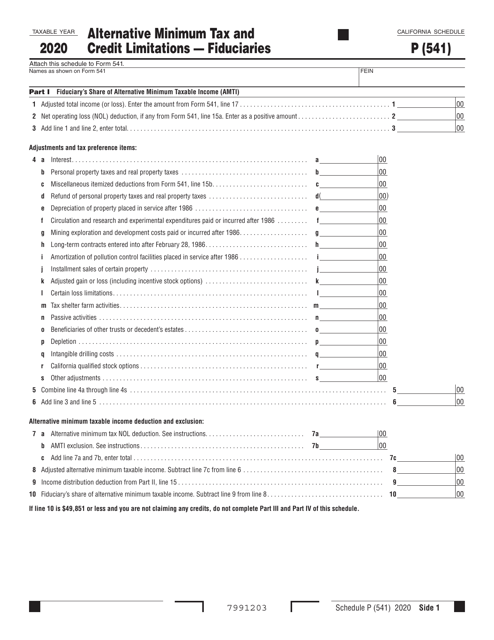

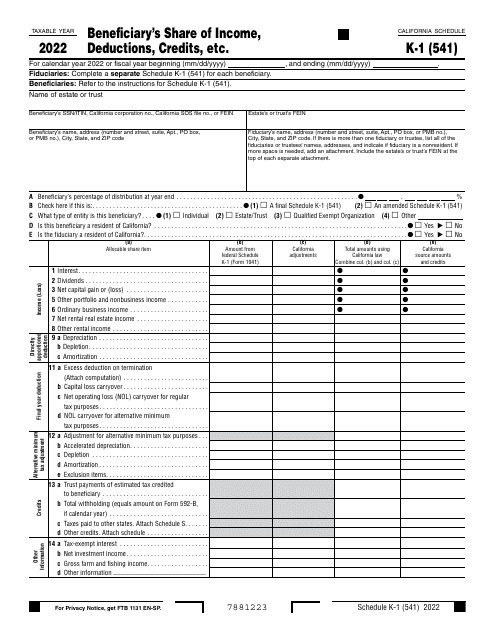

This Form is used for calculating alternative minimum tax and credit limitations for fiduciaries in California.

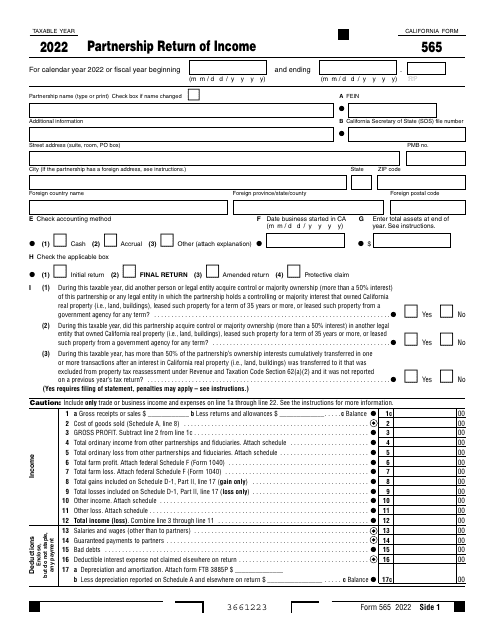

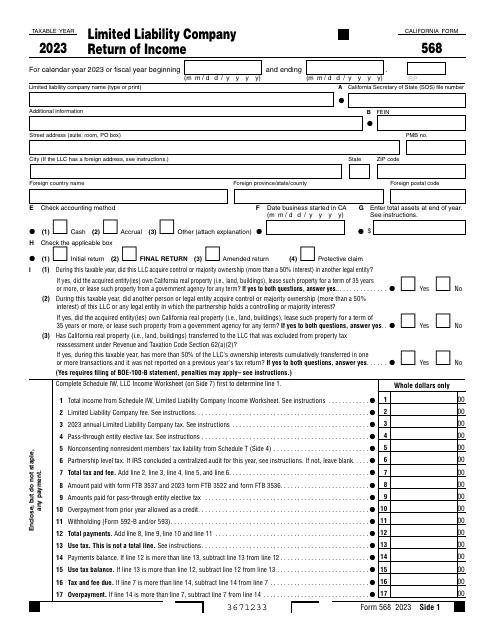

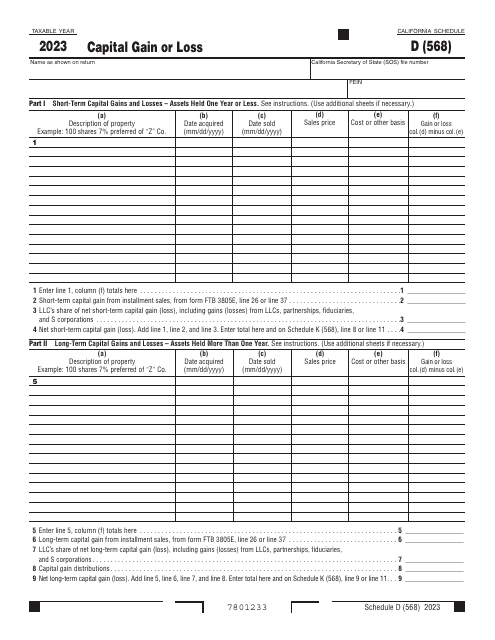

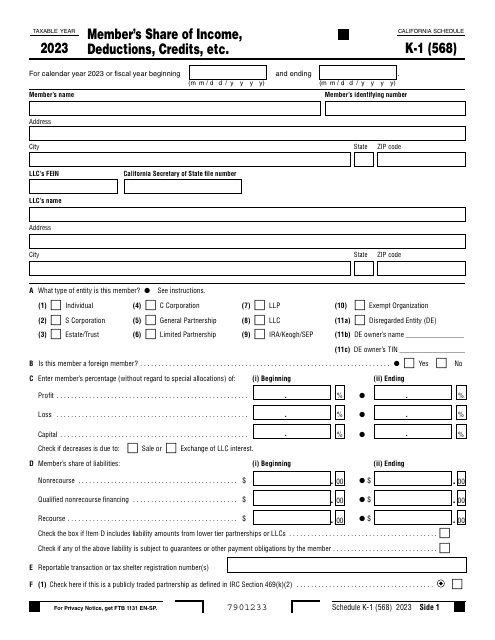

This document is supposed to be filled out only by a Limited Liability Company (LLC) classified as a Partnership. They should use this form as an income tax return that should be filed every year.

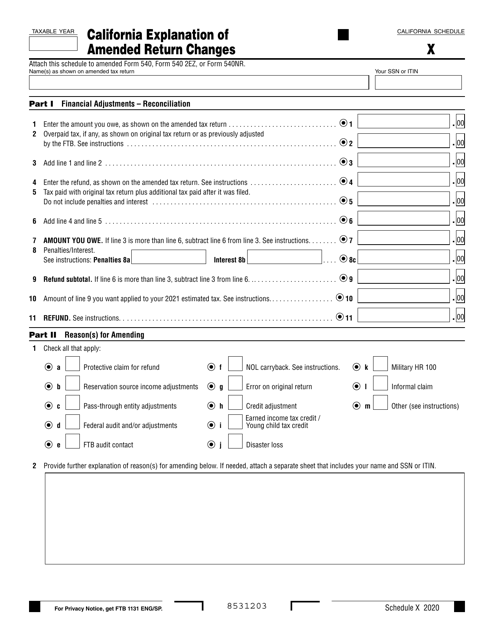

This document provides an explanation of the changes made to an amended tax return in California. It helps to understand the modifications made to the original return and how they may impact your tax liability.

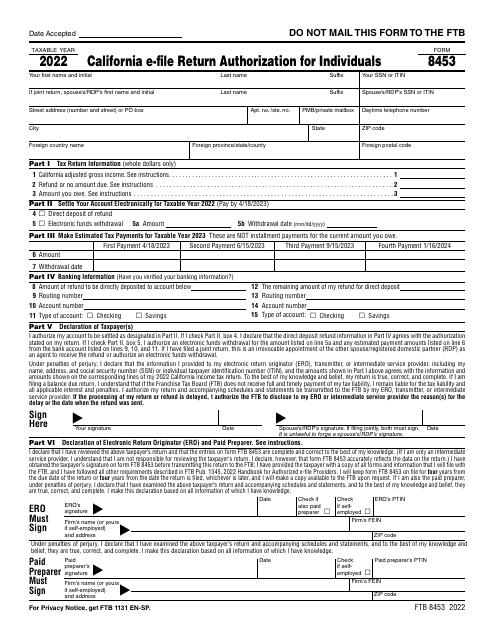

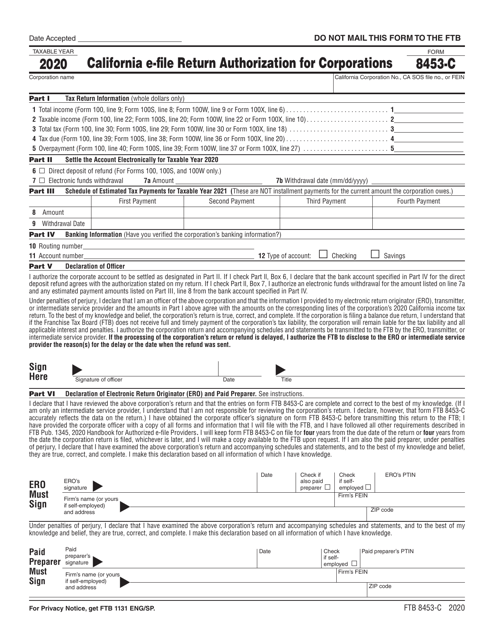

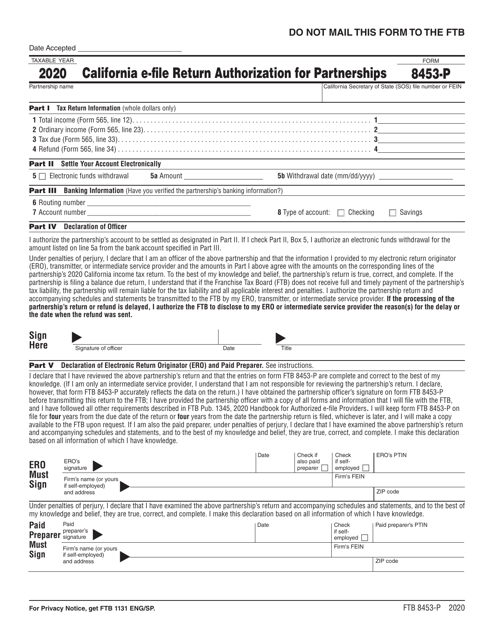

This Form is used for providing the authorization for corporations in California to electronically file their tax returns.

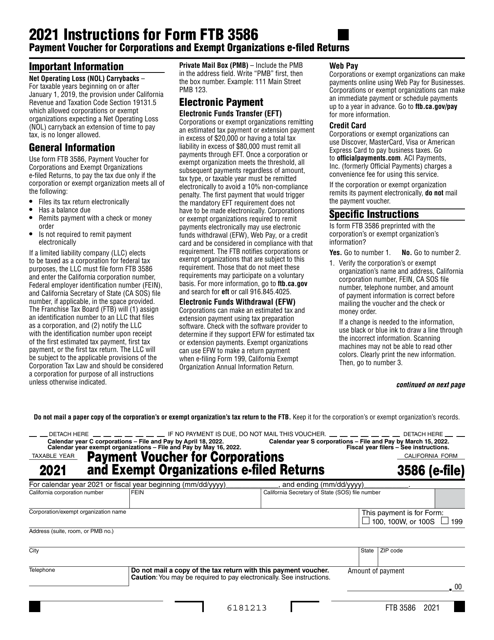

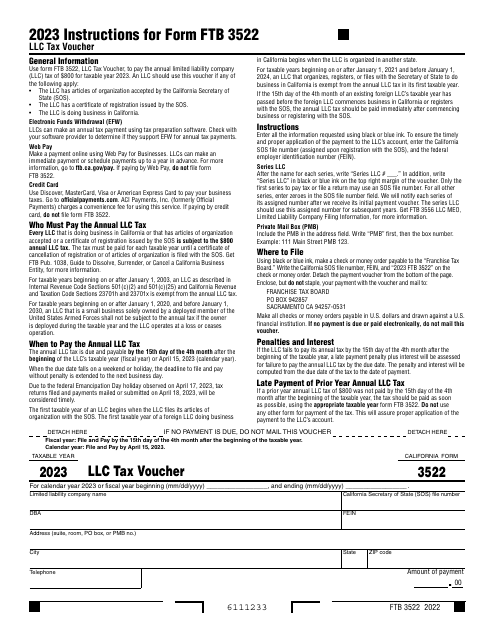

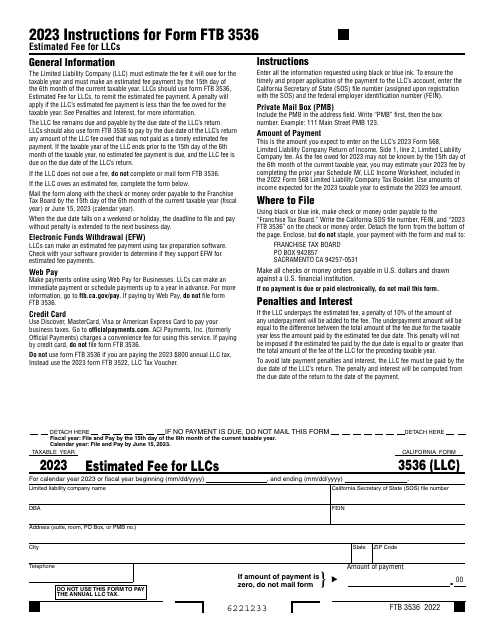

This is a legal document every California-based limited liability company (LLC) needs to submit to pay the annual LLC tax of $800. This form is a tax voucher - it details payment information you need to provide with your check or money order.

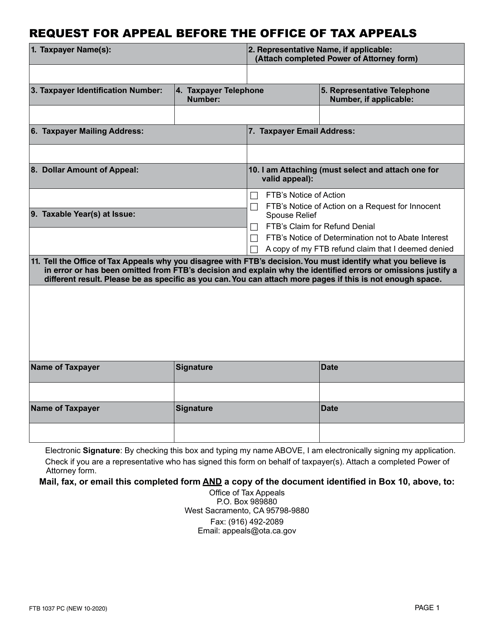

This form is used to request an appeal before the Office of Tax Appeals in California for tax-related matters.