California Franchise Tax Board Forms

Documents:

528

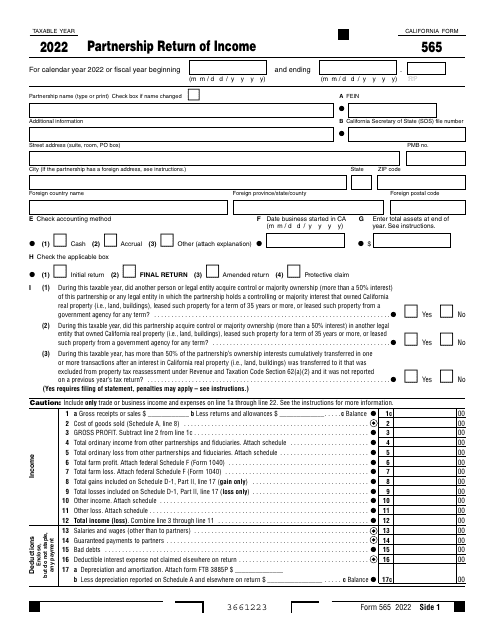

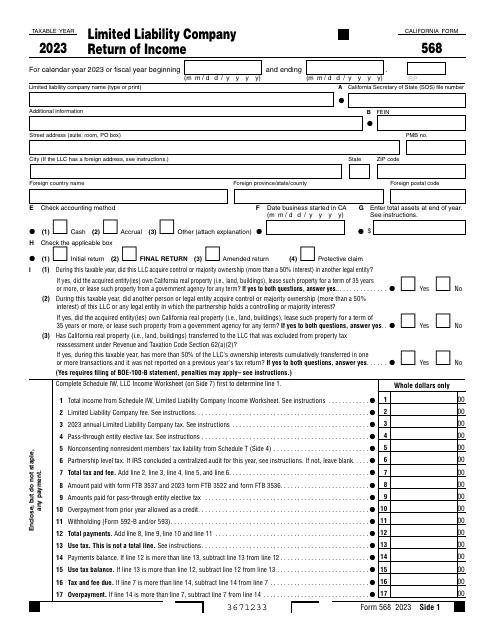

This document is supposed to be filled out only by a Limited Liability Company (LLC) classified as a Partnership. They should use this form as an income tax return that should be filed every year.

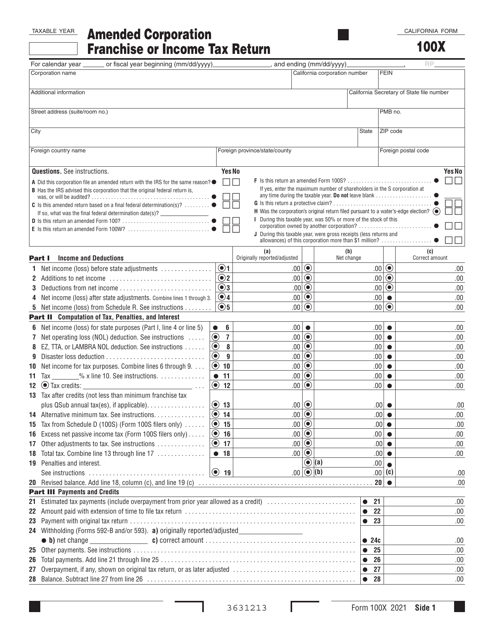

This Form is used for filing an amended corporation franchise or income tax return in California. It allows corporations to correct errors or make changes to their original tax return.

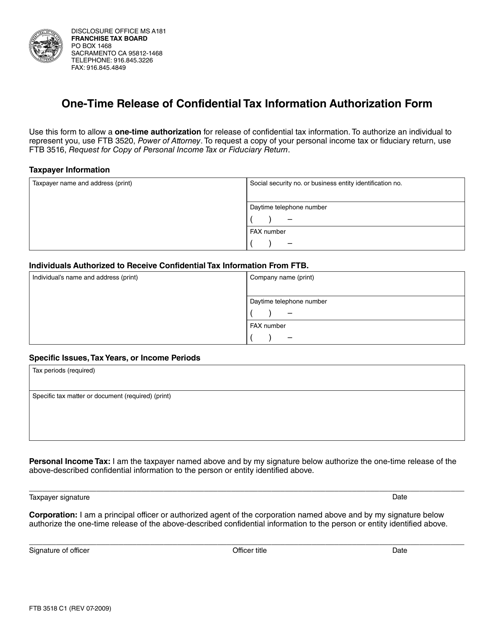

This form is used for authorizing the one-time release of confidential tax information in California.

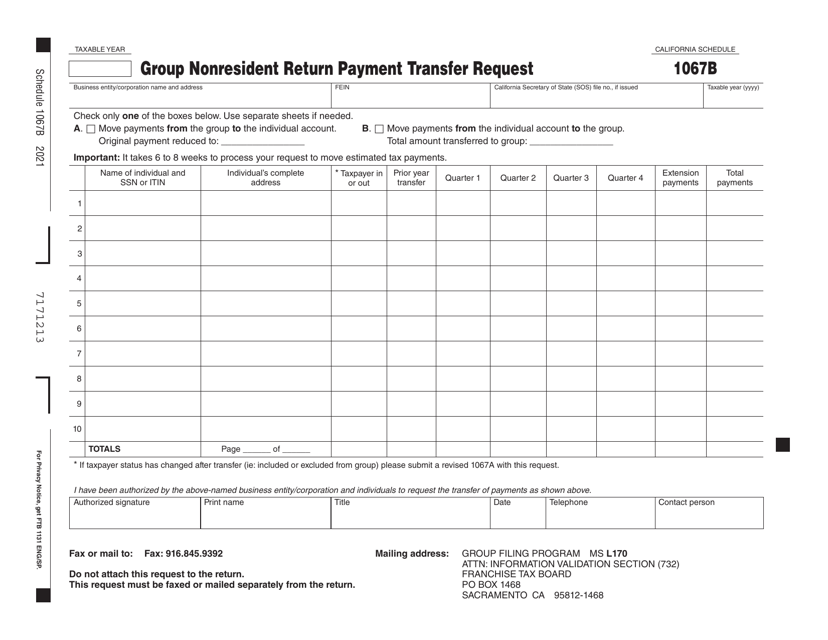

This document is used for requesting the transfer of payment for a group nonresident return in the state of California.

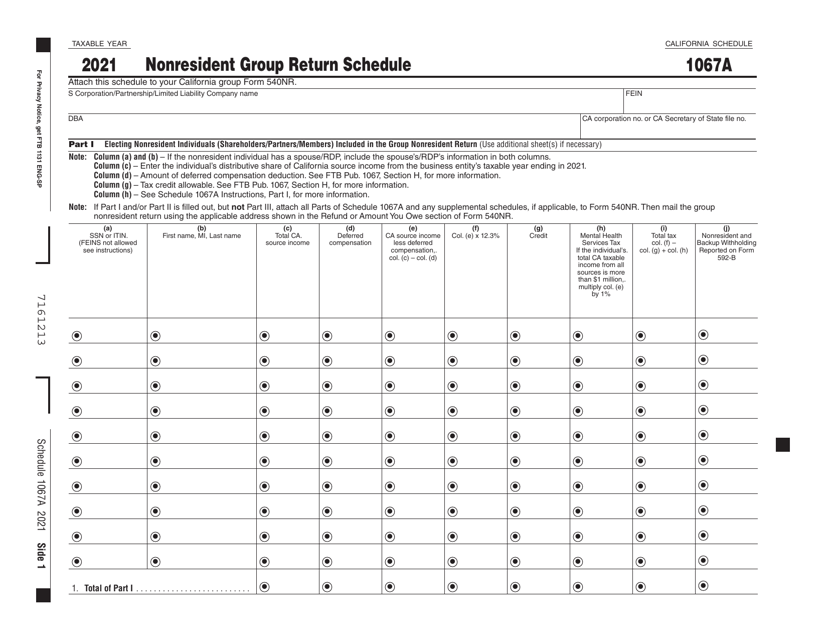

This document is used for filing a nonresident group return schedule in the state of California.

This document is used for recalculating the federal adjusted gross income for California state taxes. It is a worksheet used by registered domestic partners (RDP) in California to make adjustments to their federal income when filing their state taxes.