California Franchise Tax Board Forms

Documents:

528

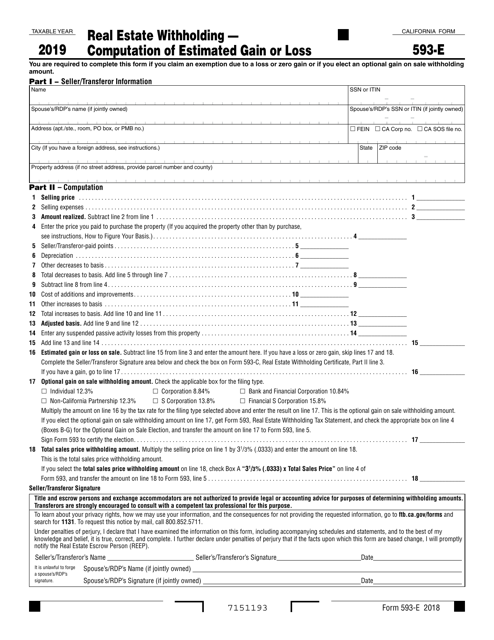

This is a California tax form required for all real estate sales or transfers for which you, the seller/ transferor, are claiming an exemption due to a loss or zero gain or if you elect an optional gain on sale withholding amount.

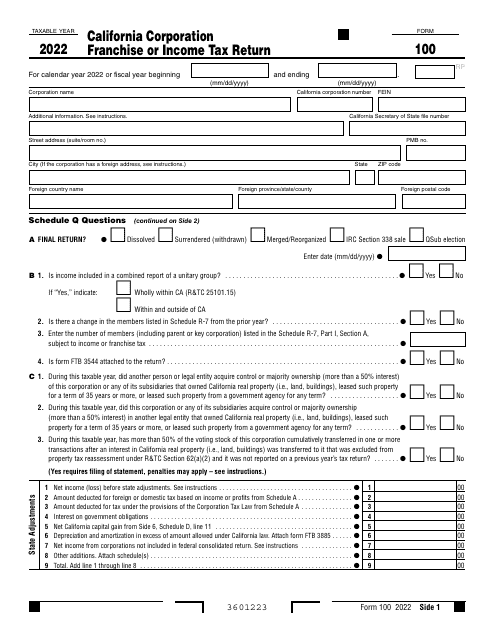

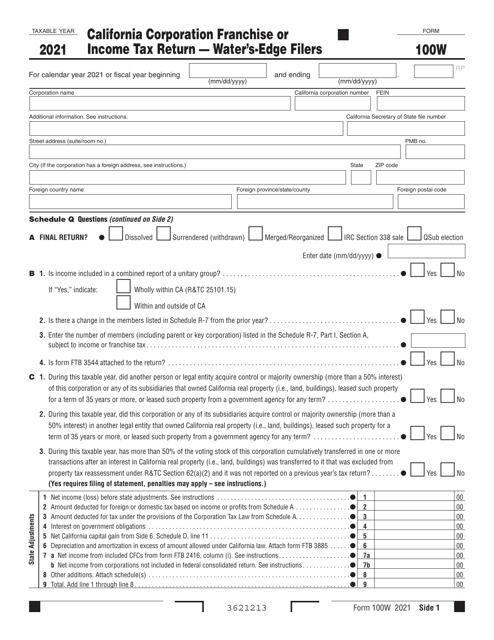

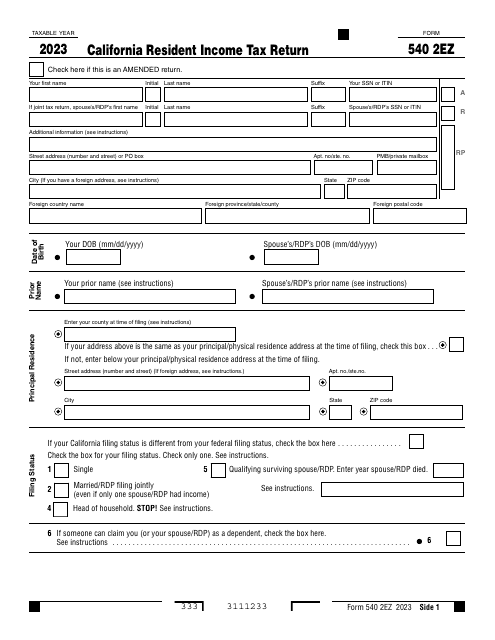

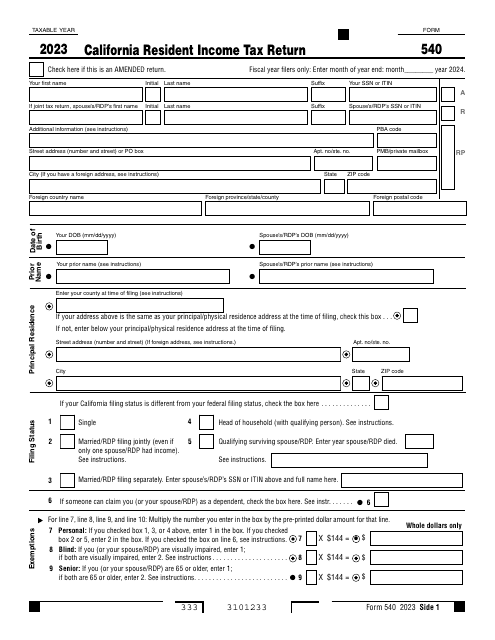

If you are a California resident you should use this form to report your income tax return. See here to check the requirements.

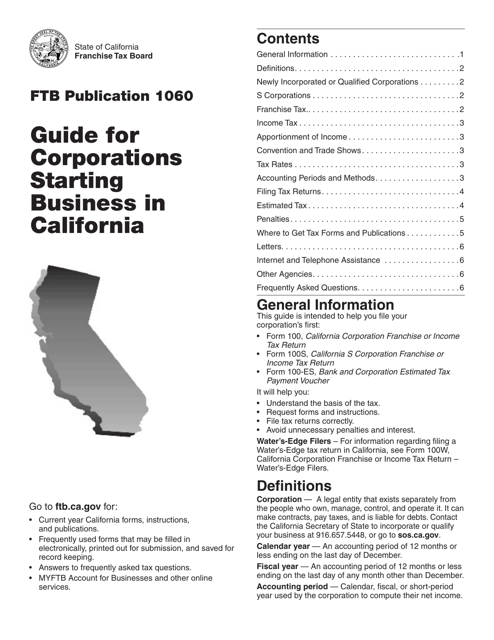

This document is a guide for corporations looking to start a business in California. It provides information and instructions on the necessary steps and requirements for setting up a corporation in the state.

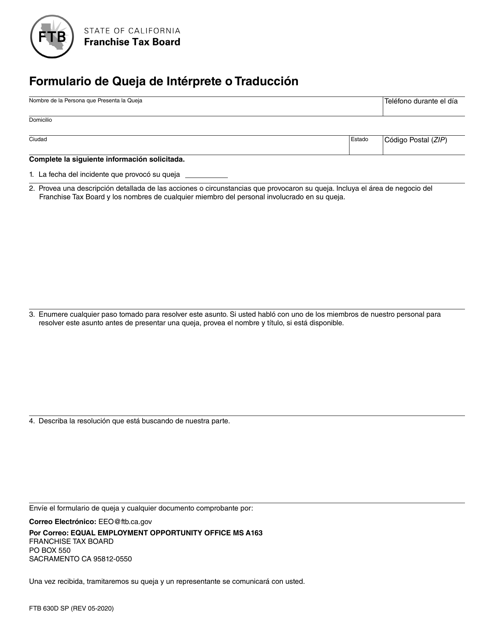

Este formulario se utiliza para presentar una queja sobre la interpretación o traducción en California.

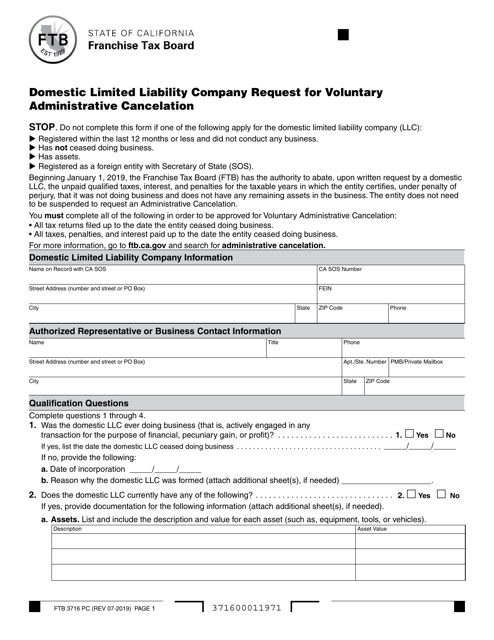

This form is used for requesting the voluntary administrative cancellation of a domestic limited liability company in California.

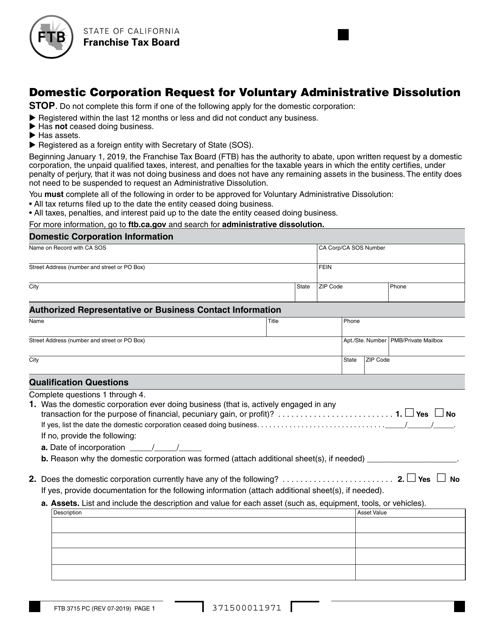

This Form is used for domestic corporations in California to request voluntary administrative dissolution.

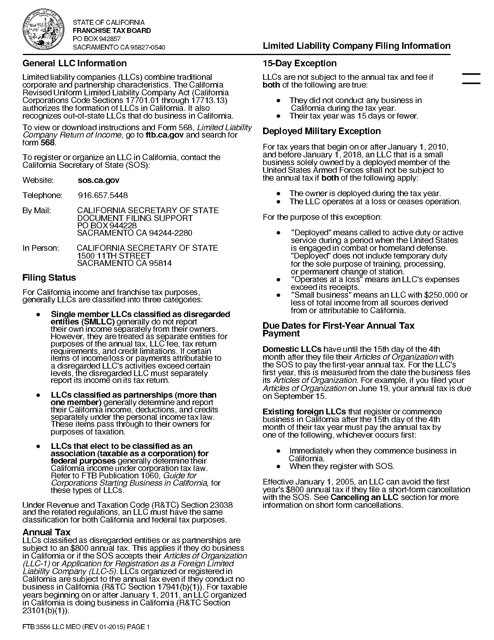

This form is used for filing information for a Limited Liability Company (LLC) in California. It is called Form FTB3556 LCC MEO.

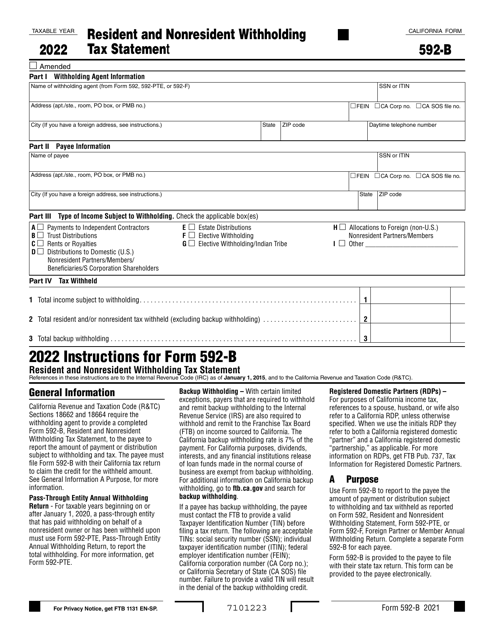

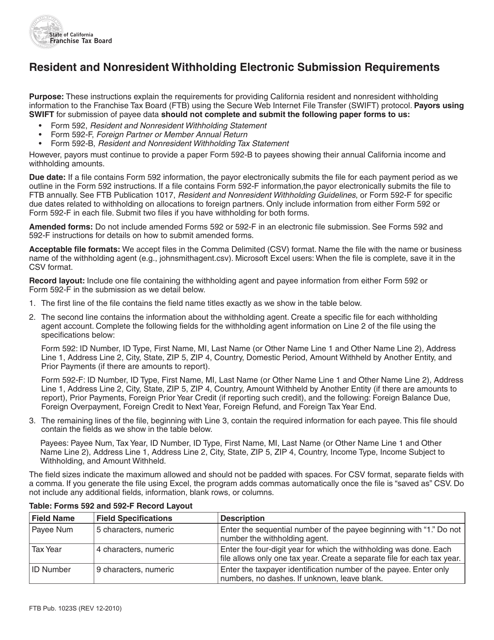

This document provides information on the electronic submission requirements for resident and nonresident withholding in California. It outlines the process and guidelines for submitting Form FTB Publication 1023s electronically.

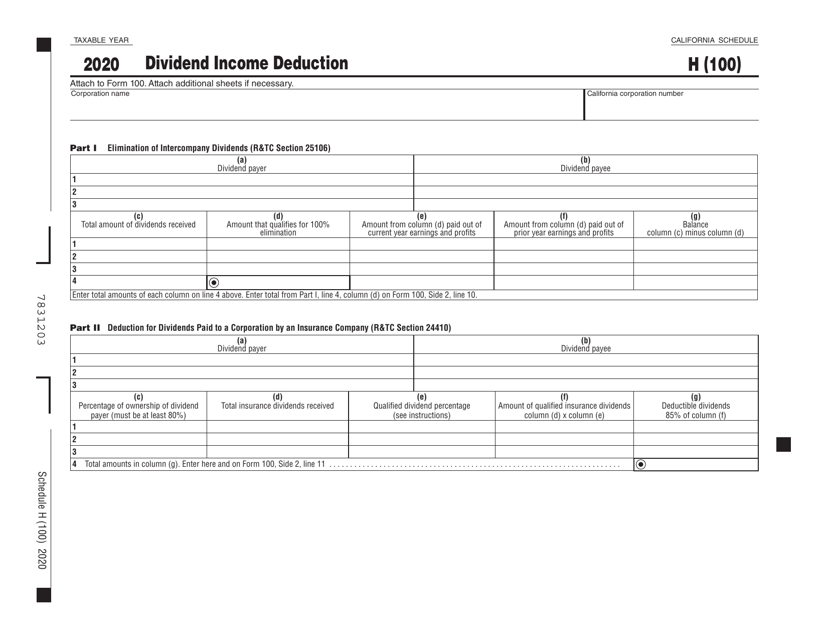

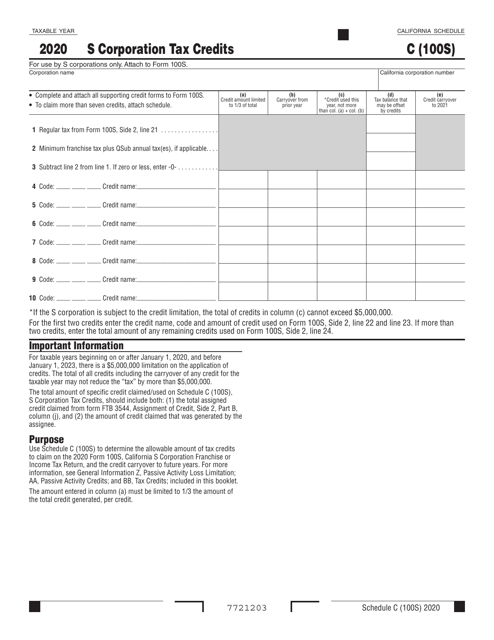

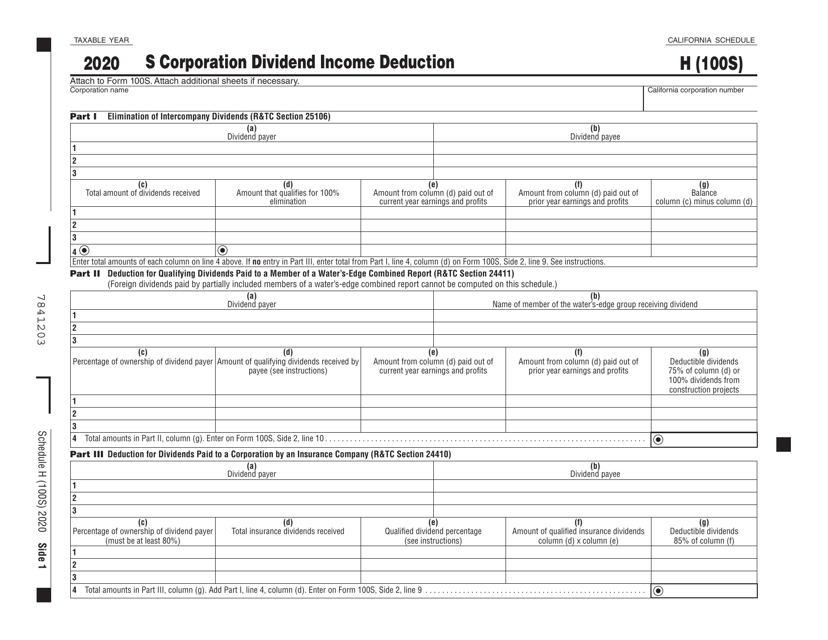

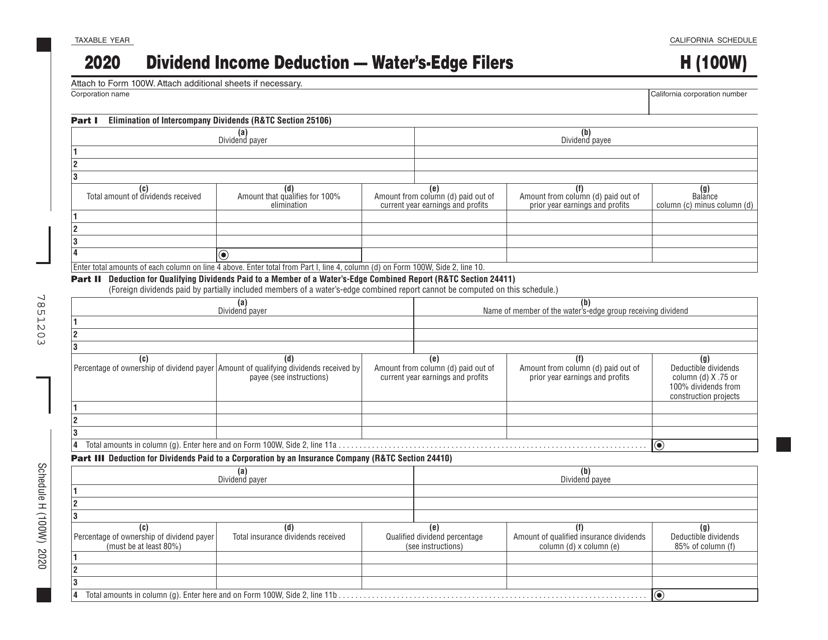

This form is used for claiming a deduction on dividend income in the state of California.

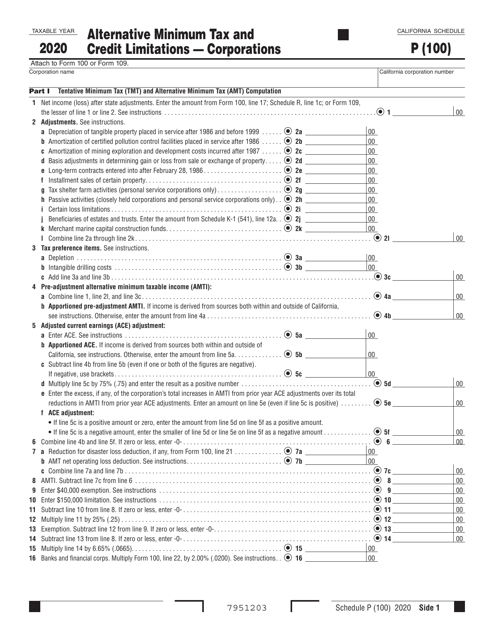

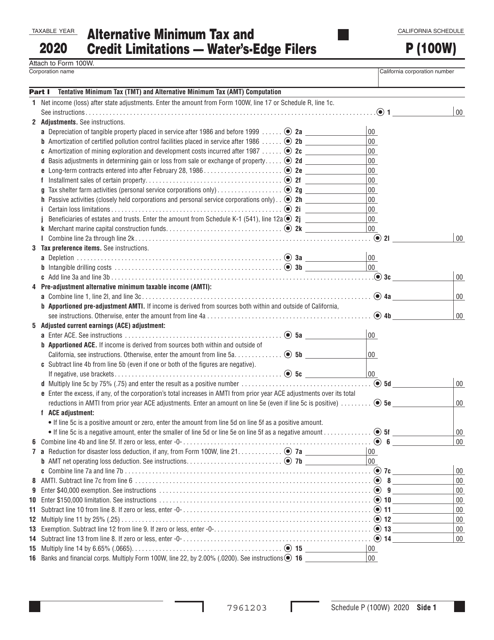

Form 100 Schedule P Alternative Minimum Tax and Credit Limitations - Corporations - California, 2020

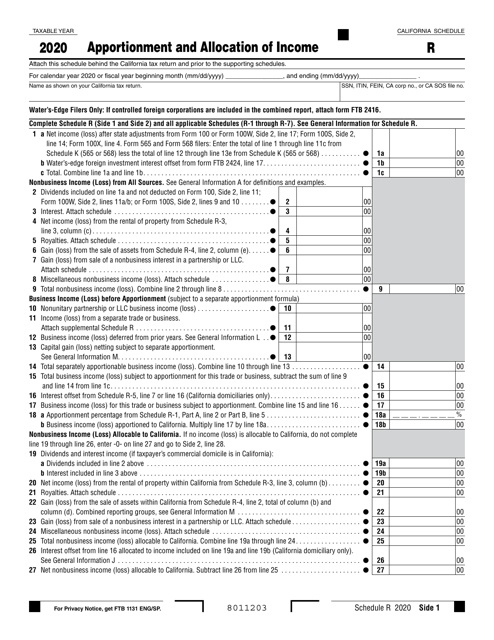

This document is used for apportioning and allocating income in the state of California. It helps to determine how much of a taxpayer's income is attributed to the state for tax purposes.

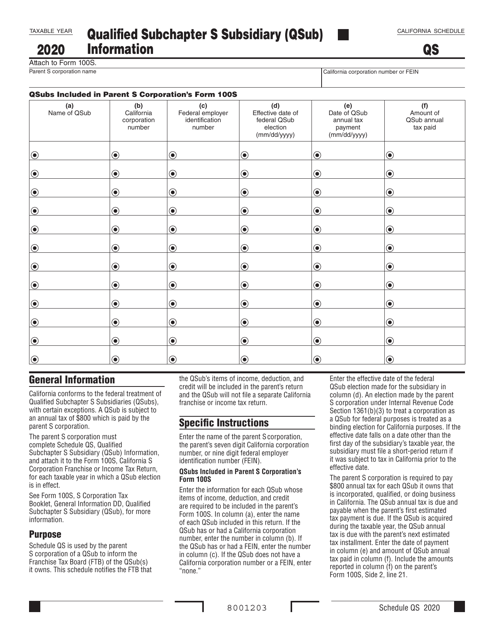

This form is used for providing information about Qualified Subchapter S Subsidiary (Qsub) in California for tax purposes.

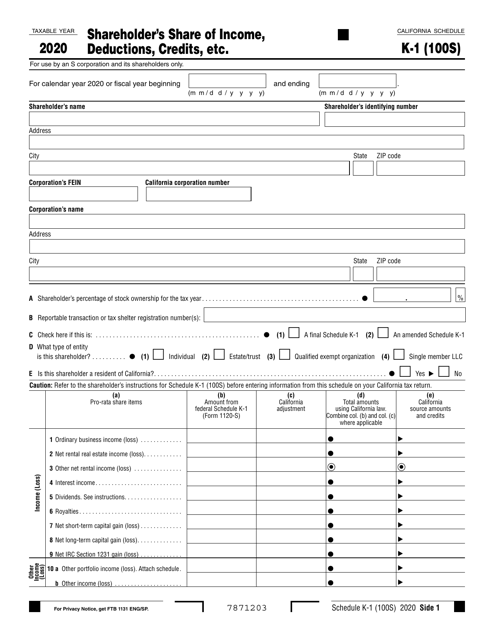

This Form is used for reporting a shareholder's share of income, deductions, credits, and other relevant information in California.