California Franchise Tax Board Forms

Documents:

528

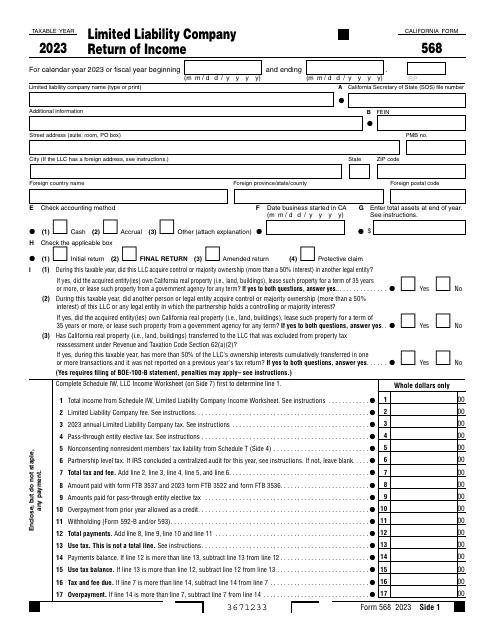

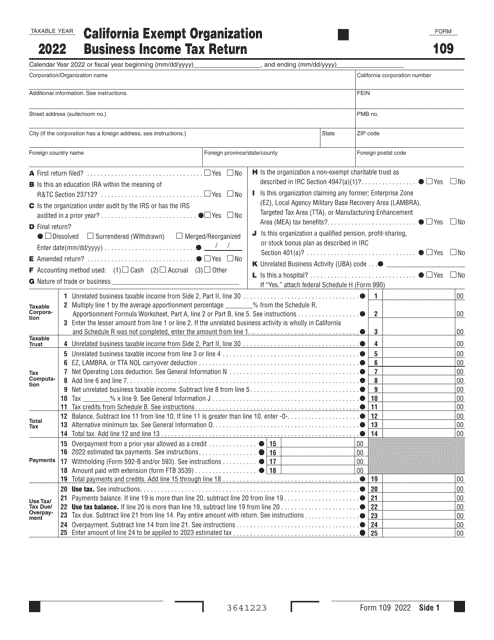

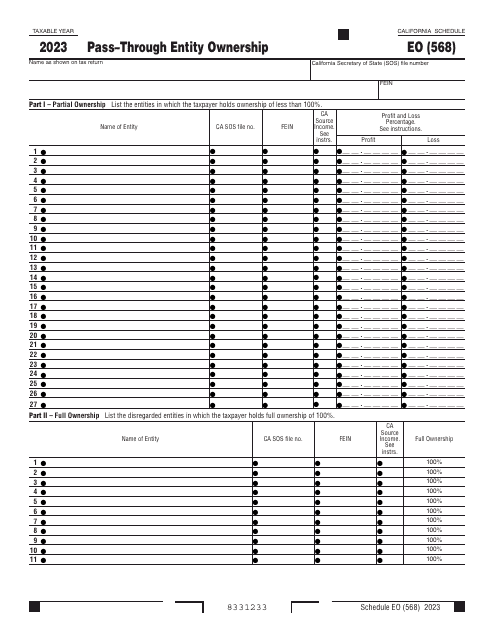

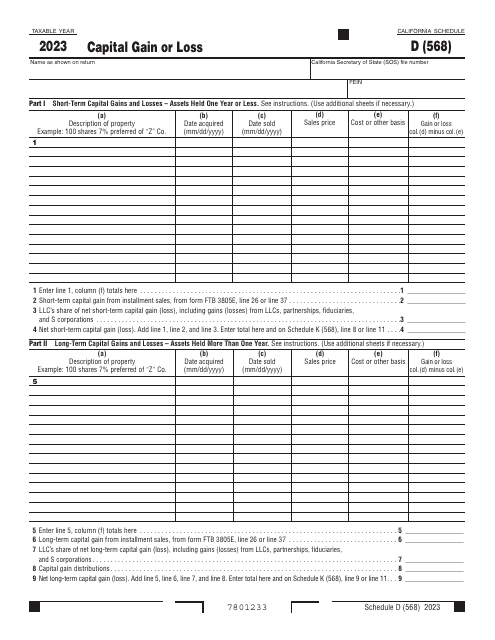

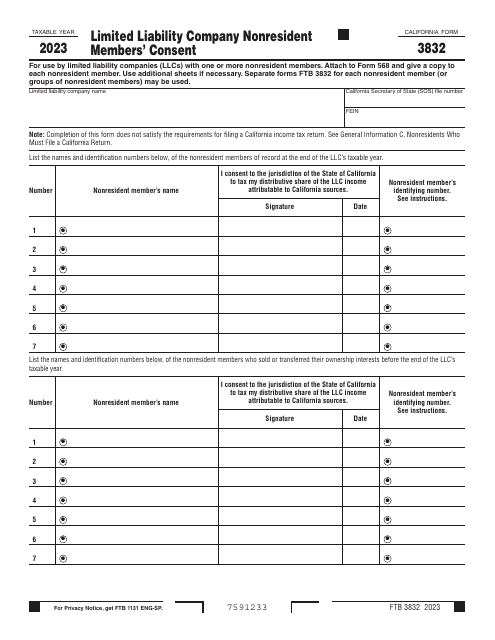

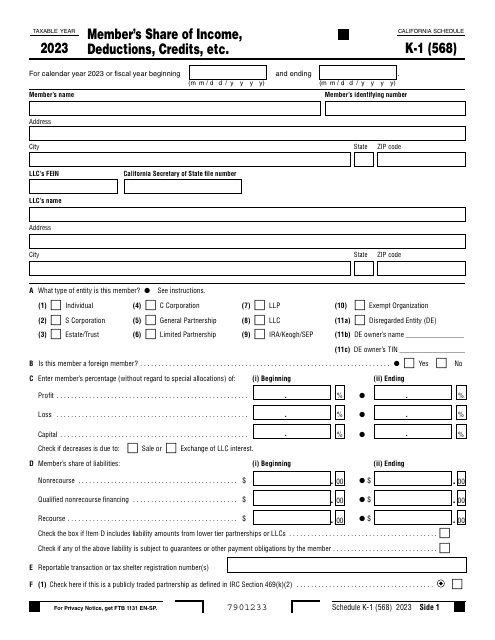

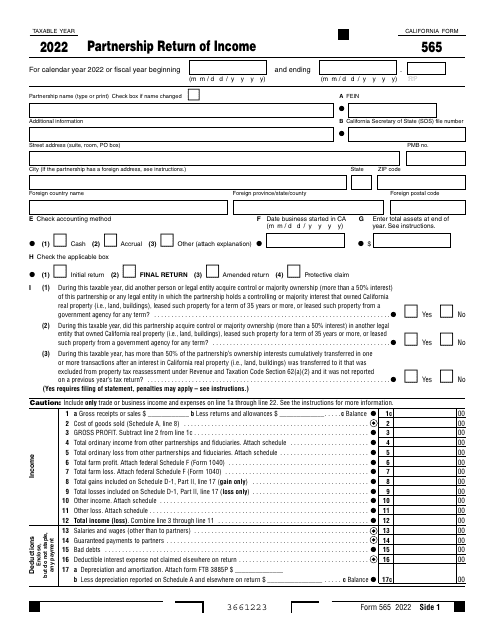

This document is supposed to be filled out only by a Limited Liability Company (LLC) classified as a Partnership. They should use this form as an income tax return that should be filed every year.

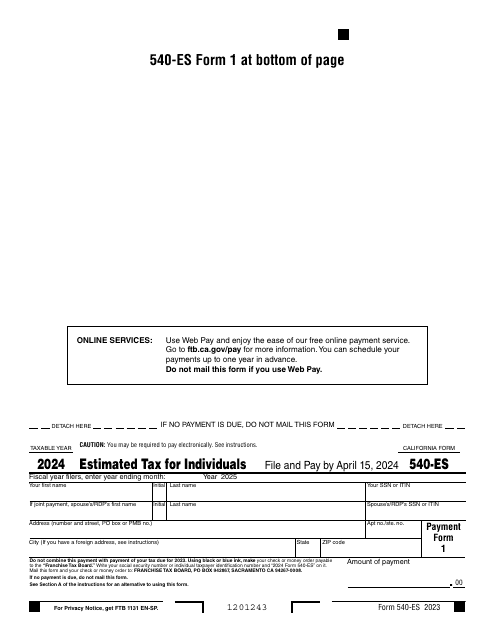

Fill out this form over the course of a year to pay your taxes in the state of California.

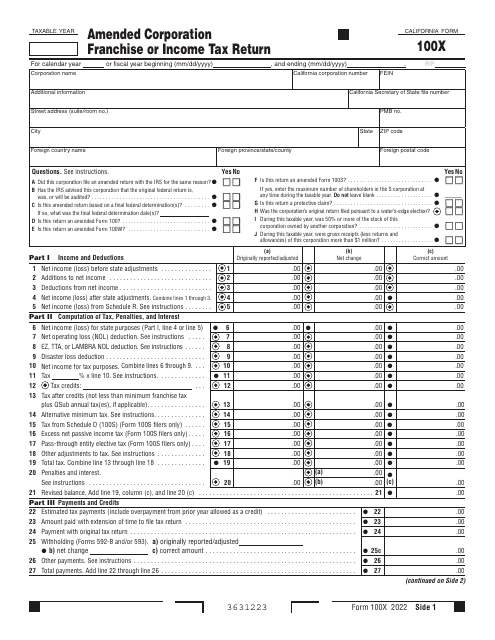

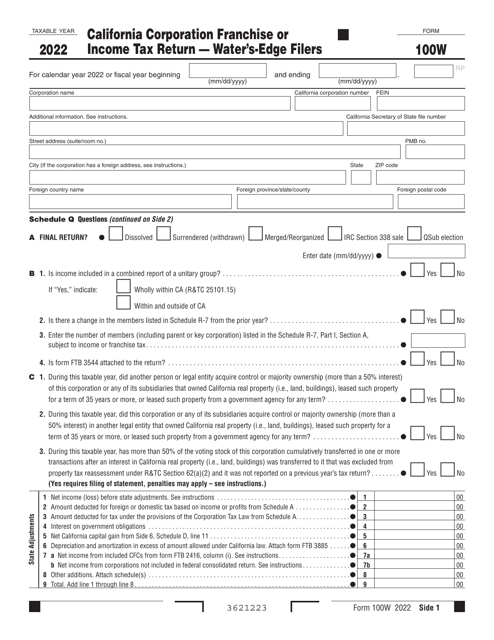

This Form is used for California corporations that are filing their franchise or income tax return as water's-edge filers.

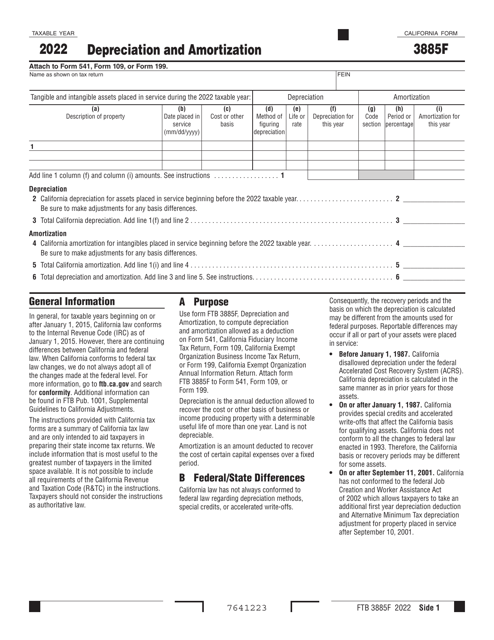

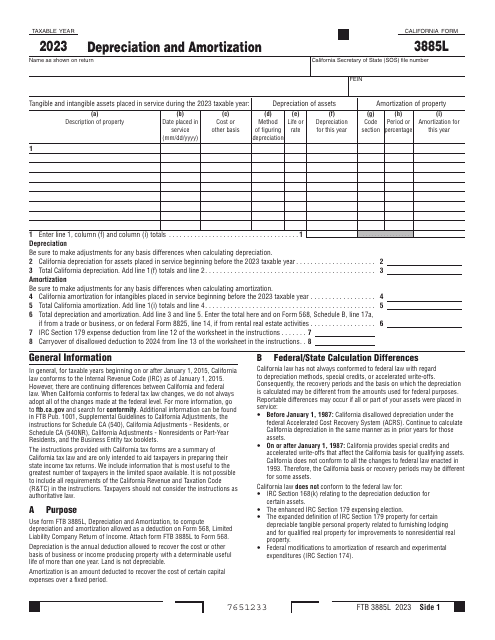

This form is used for reporting depreciation and amortization expenses specifically for taxpayers in California.

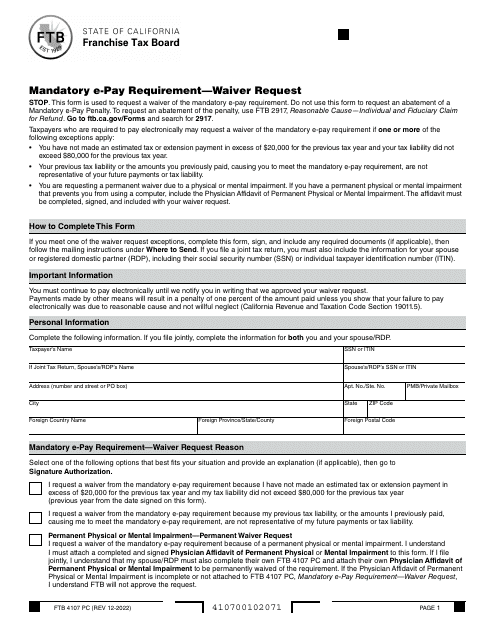

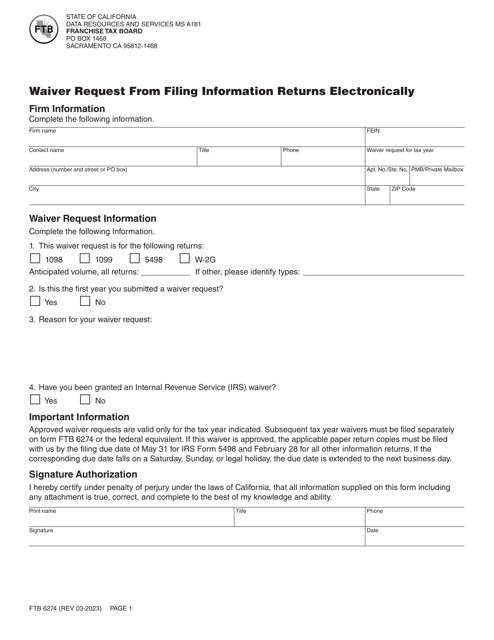

This form is used for requesting a waiver from filing information returns electronically in California.

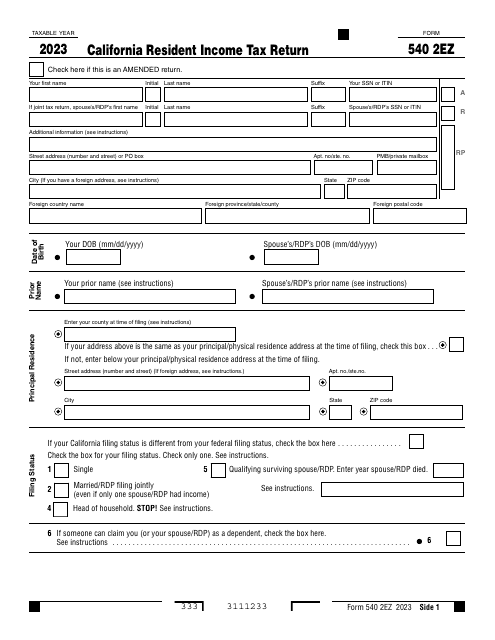

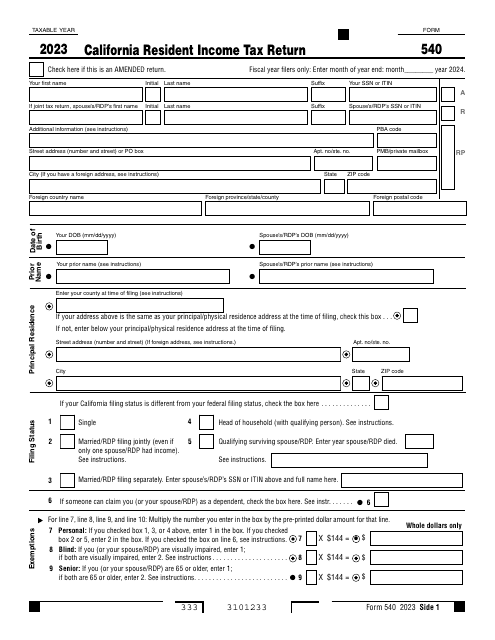

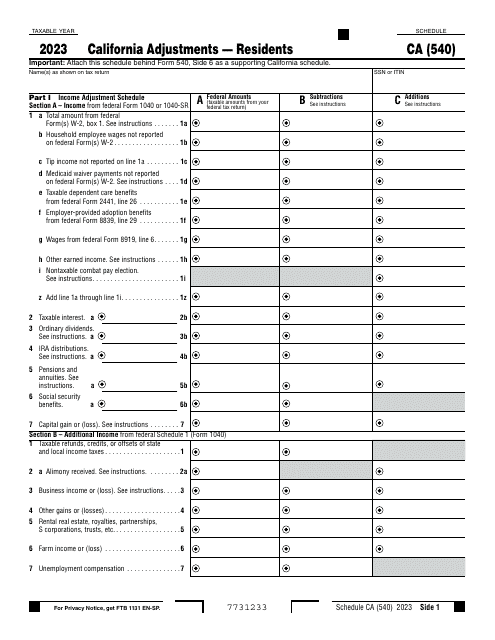

If you are a California resident you should use this form to report your income tax return. See here to check the requirements.

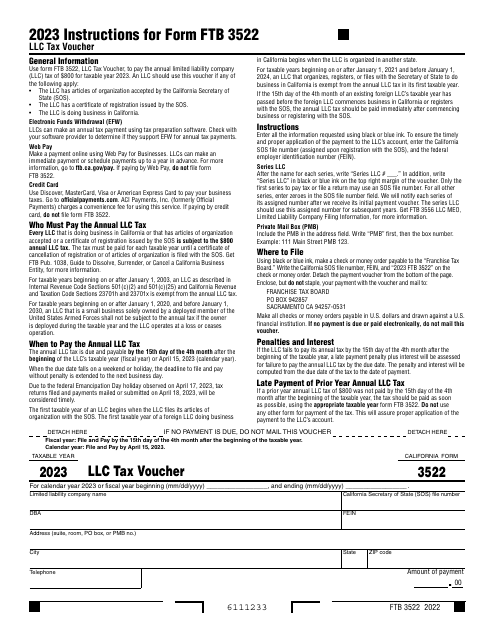

This is a legal document every California-based limited liability company (LLC) needs to submit to pay the annual LLC tax of $800. This form is a tax voucher - it details payment information you need to provide with your check or money order.