Arizona Department of Revenue Forms

Documents:

626

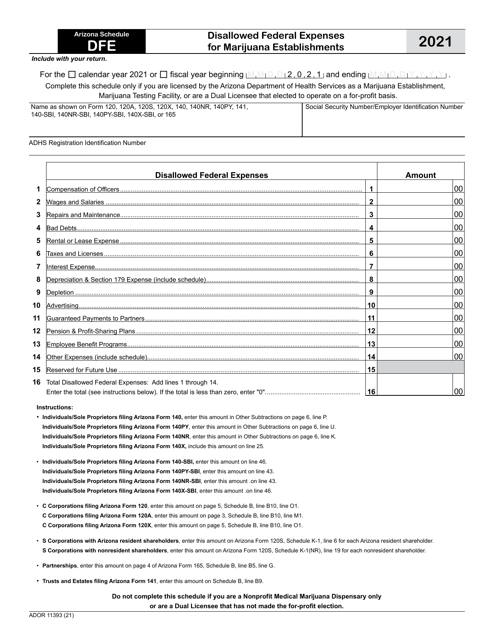

Form ADOR11393 Schedule DFE Disallowed Federal Expenses for Marijuana Establishments - Arizona, 2021

This form is used in Arizona for reporting disallowed federal expenses for marijuana establishments.

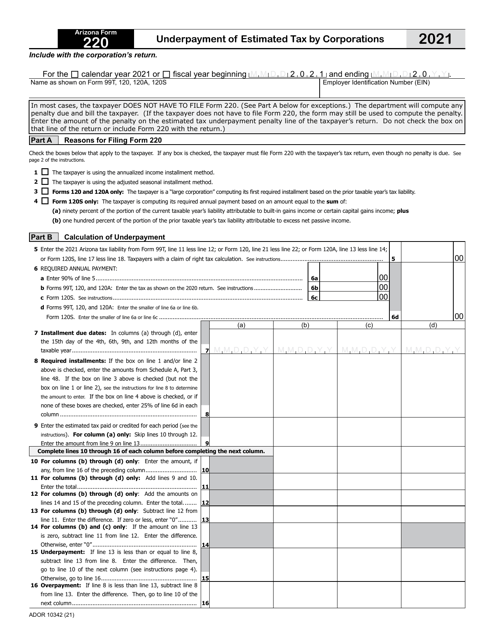

This form is used for calculating and reporting the underpayment of estimated tax by corporations in the state of Arizona.

This form is used for addressing underpayment of estimated tax by corporations in Arizona. It provides instructions for filing Form 220, ADOR10342.

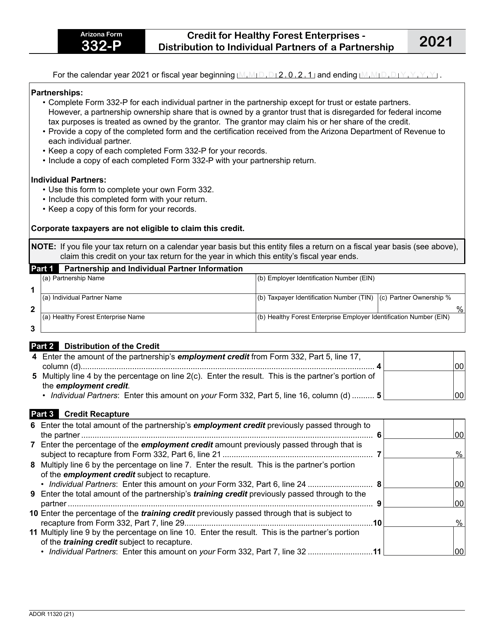

This Form is used for claiming the Credit for Healthy Forest Enterprises in Arizona, specifically for distributing the credit to individual partners of a partnership.

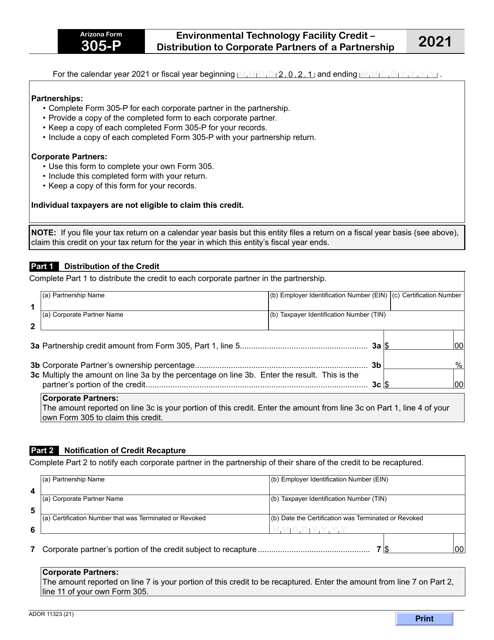

This form is used for claiming the Environmental Technology Facility Credit in Arizona. It is specifically for distributing the credit to corporate partners of a partnership.

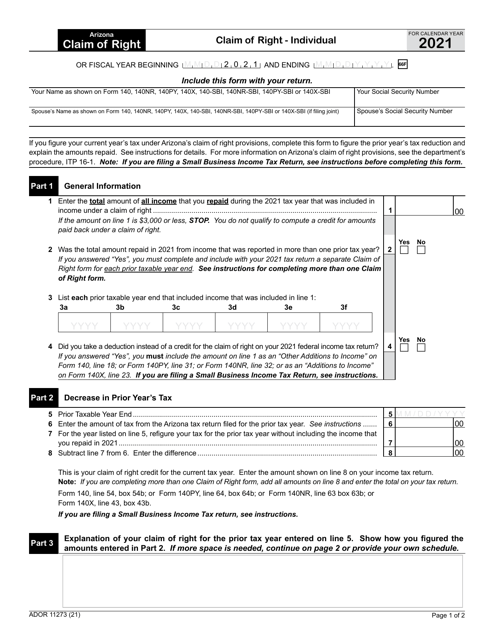

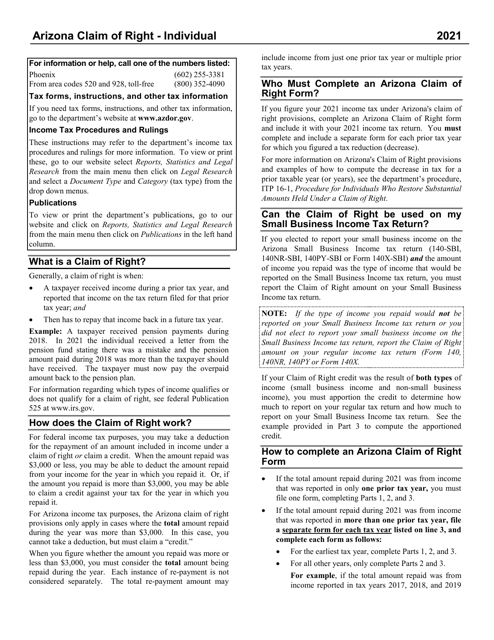

This form is used for individuals in Arizona to make a Claim of Right. It provides a way for individuals to express their claim to certain funds or property.

This Form is used for claiming the right to a refund on individual taxes paid in Arizona. It provides instructions for completing and filing Form ADOR11273.

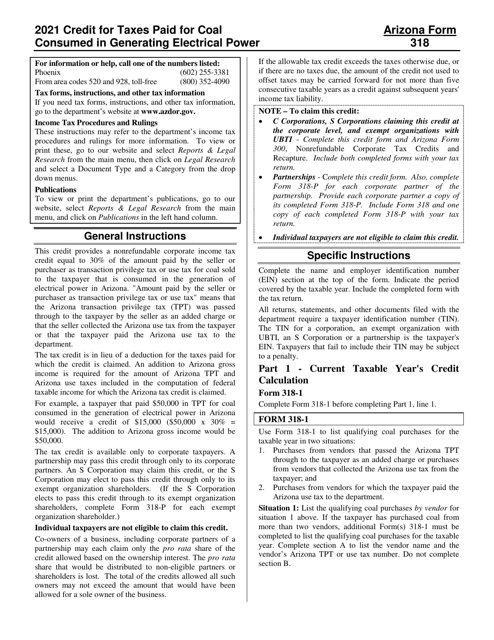

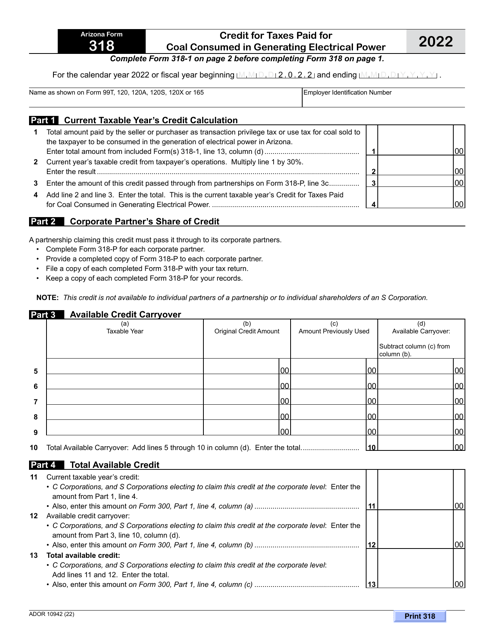

This type of document provides instructions for filling out Arizona Form 318, Arizona Form 318-P, ADOR10942, and ADOR11325 in Arizona.

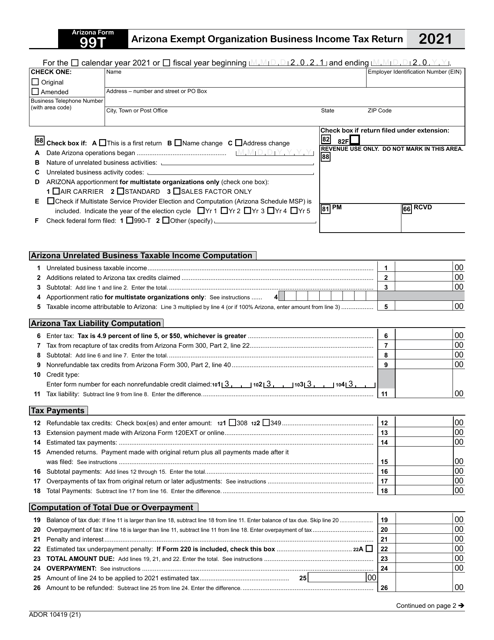

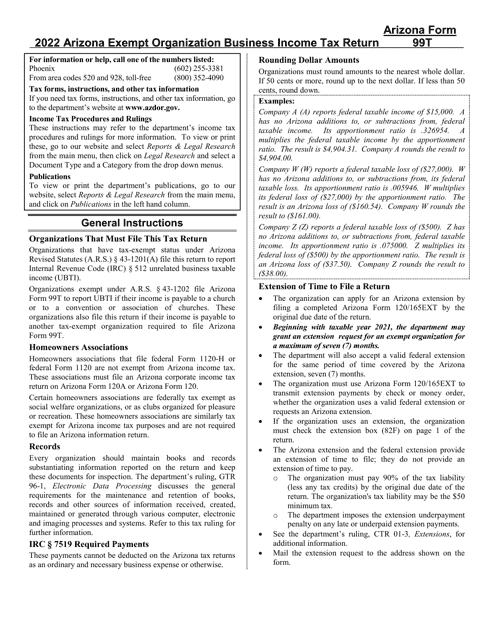

This Form is used for filing Arizona Exempt Organization Business Income Tax Return in Arizona.

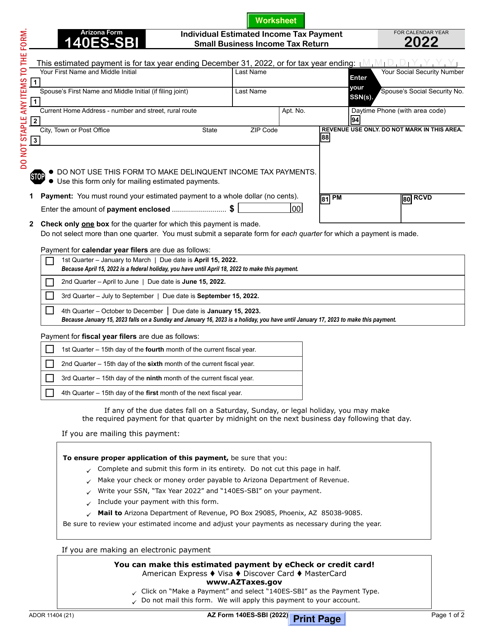

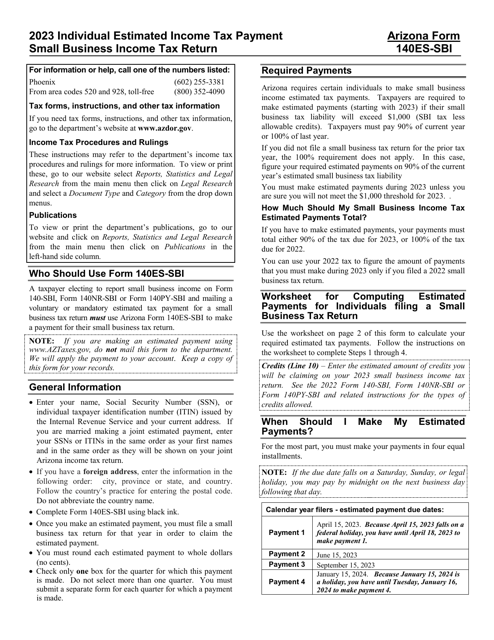

This Form is used for making estimated income tax payments for individuals who own a small business in Arizona.

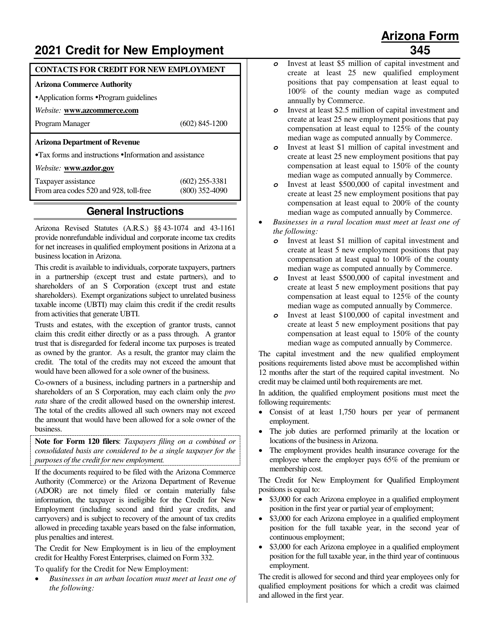

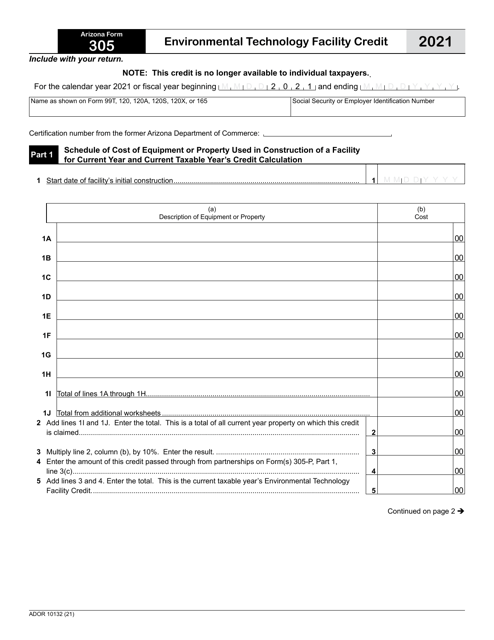

This form is used for claiming the Environmental Technology Facility Credit in Arizona. It is used by businesses to report and request a tax credit for investments in environmental technology facilities.

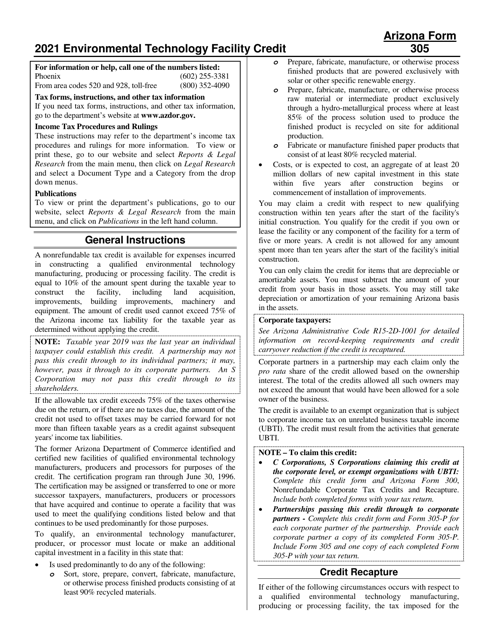

This type of document provides instructions for filling out Arizona Form 305, Arizona Form 305-P, ADOR10132, and ADOR11323 in Arizona.

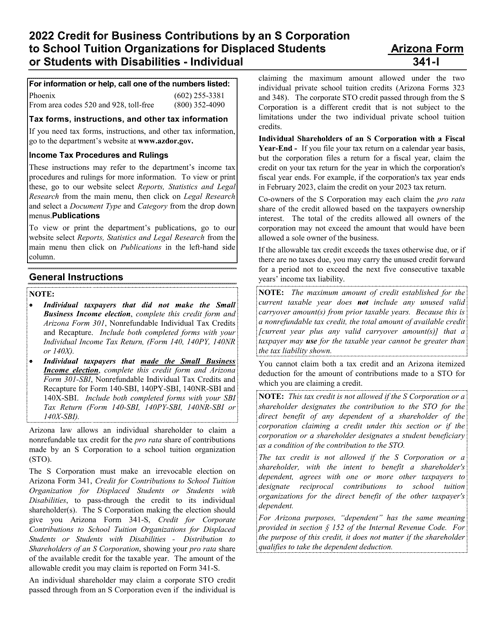

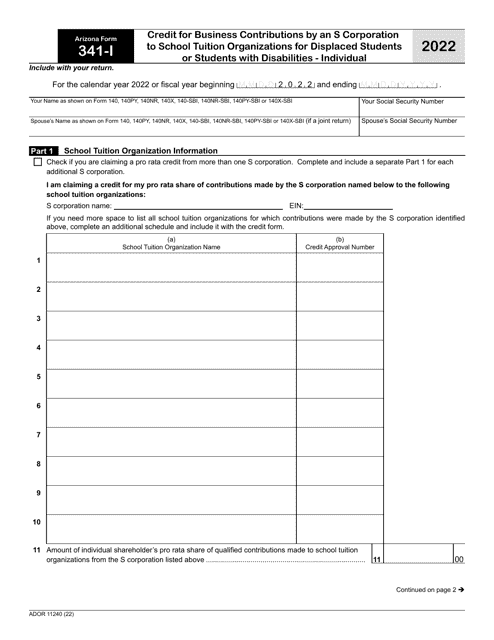

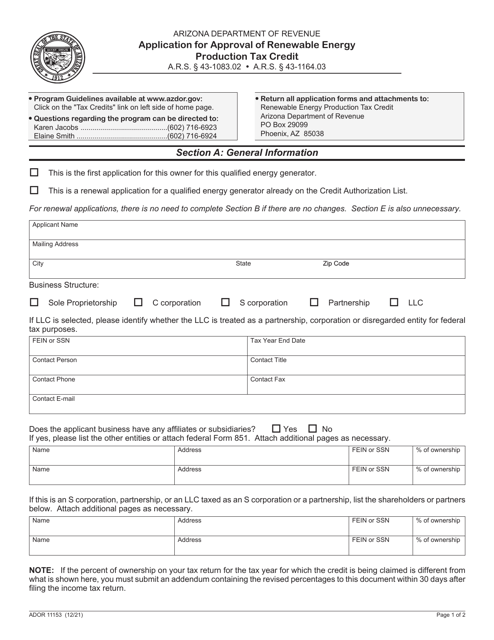

This form is used for applying for approval of the Renewable Energy Production Tax Credit in Arizona.

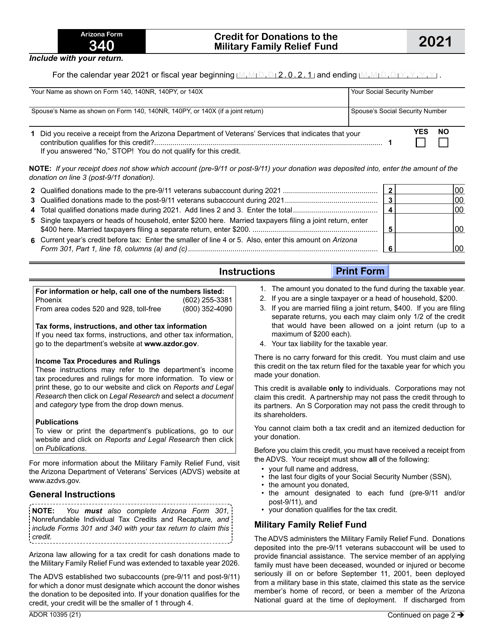

Arizona Form 340 (ADOR10395) Credit for Donations to the Military Family Relief Fund - Arizona, 2021

This form is used for claiming a credit for donations made to the Military Family Relief Fund in Arizona.

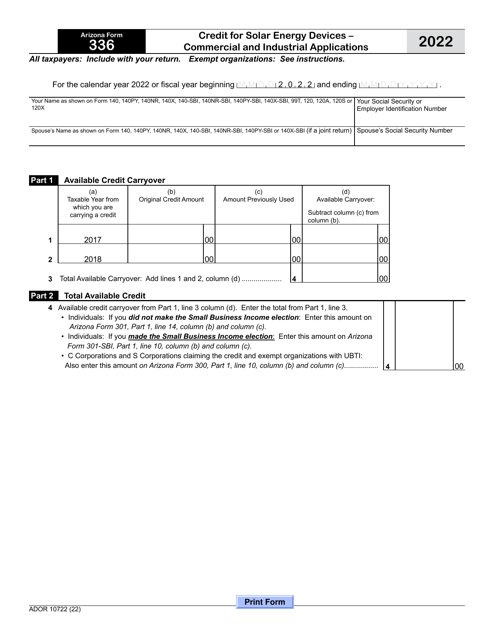

This form is used for claiming a credit for solar energy devices used in commercial and industrial applications in Arizona. It provides instructions on how to complete and submit the form to the Arizona Department of Revenue.

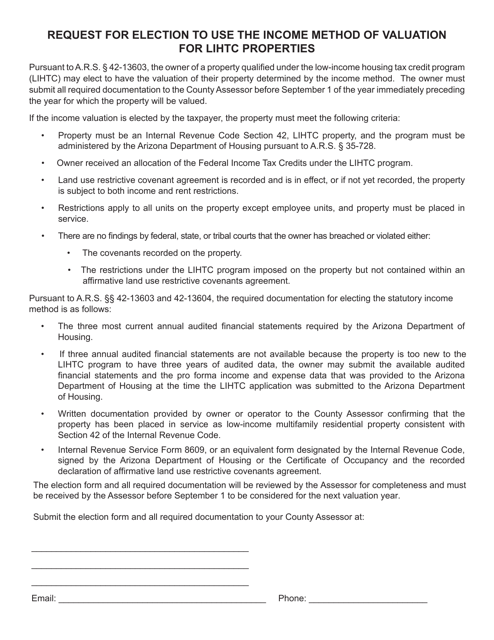

This form is used for requesting the use of the Income Method for valuing LIHTC properties in Arizona.