Arizona Department of Revenue Forms

Documents:

626

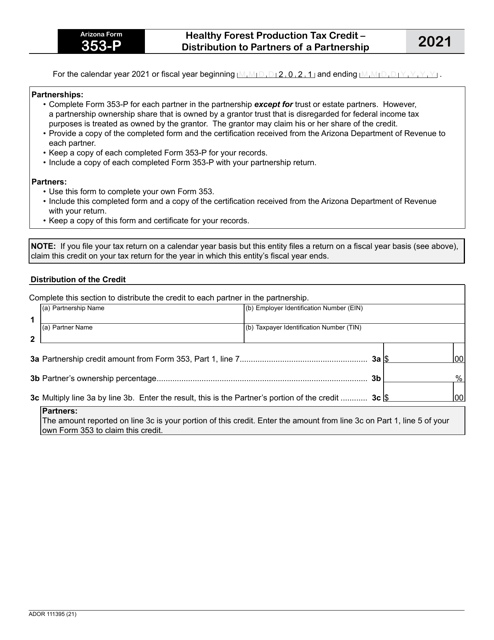

This Form is used for distributing the Healthy Forest Production Tax Credit to partners of a partnership in Arizona.

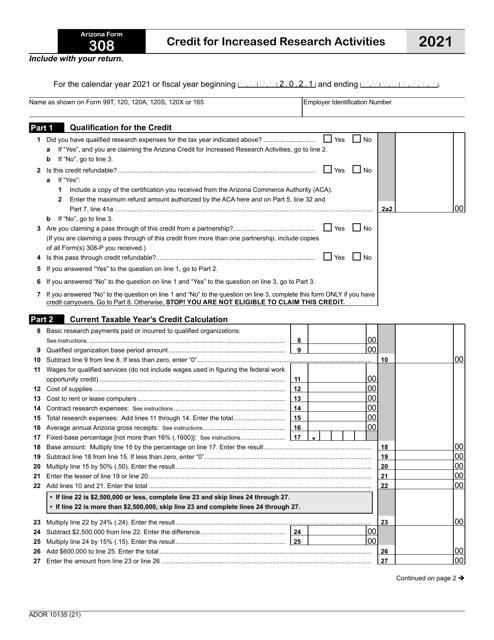

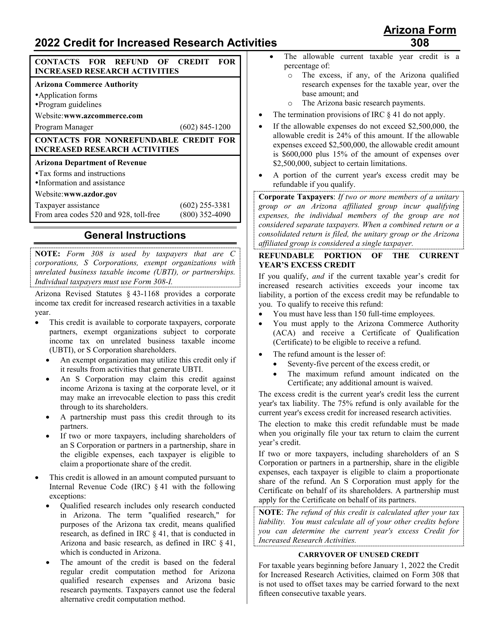

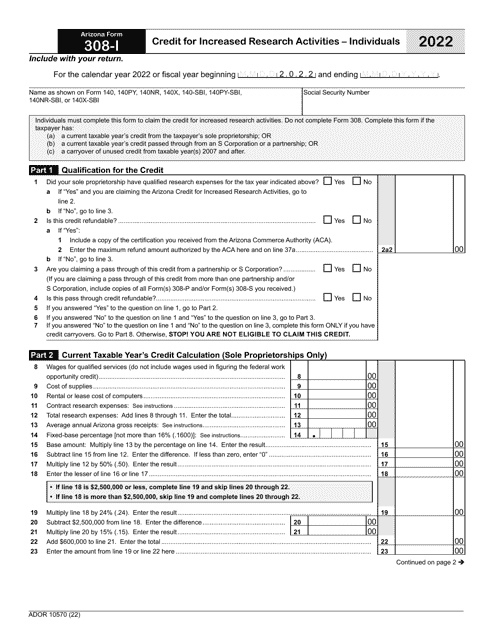

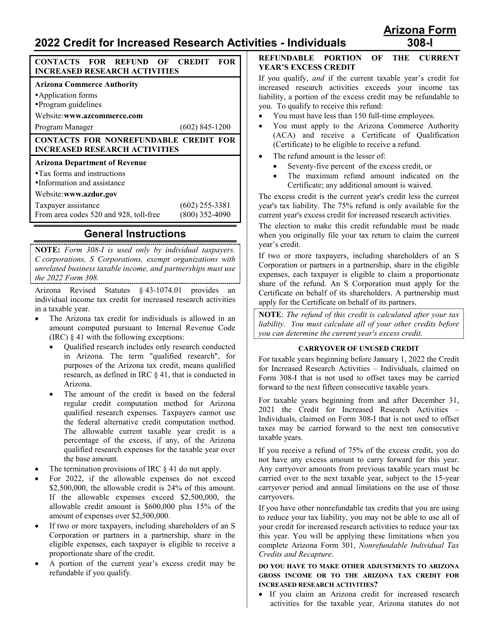

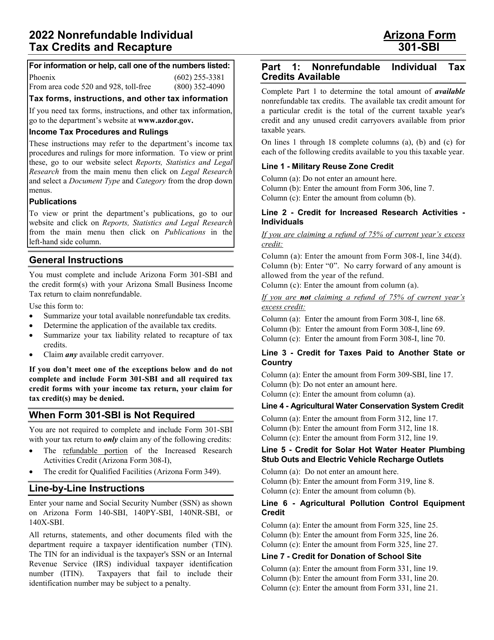

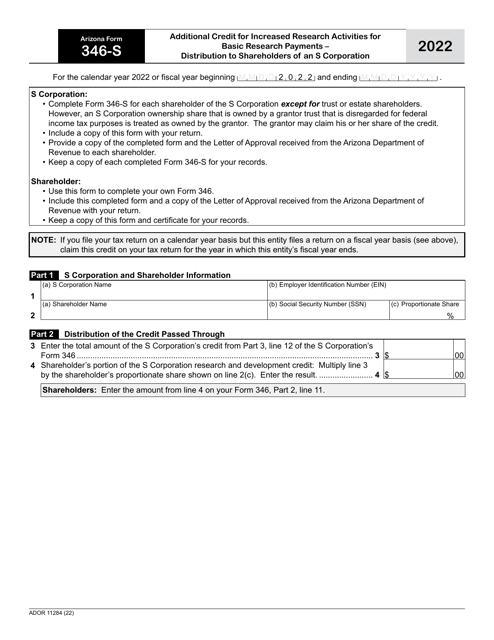

This Form is used for claiming a credit for increased research activities in Arizona.

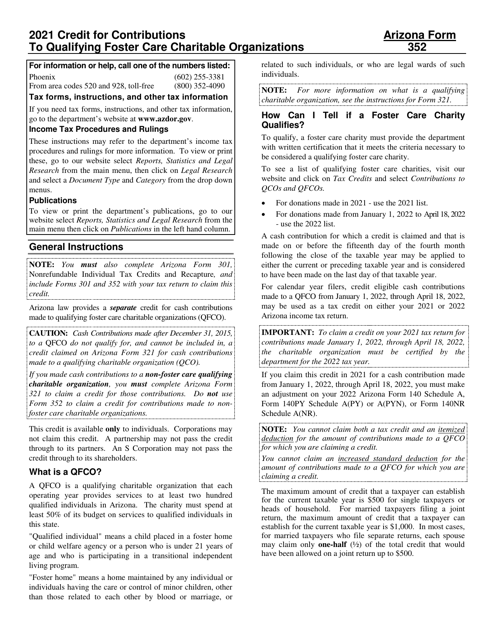

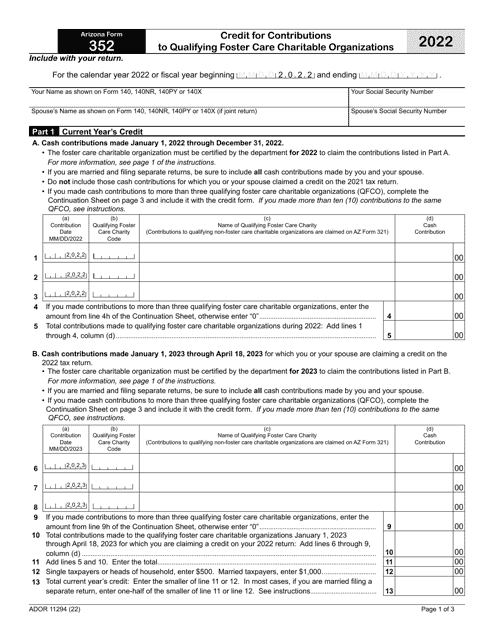

This form is used for claiming a tax credit for contributions made to qualifying foster care charitable organizations in the state of Arizona. It provides instructions on how to complete the form and properly report the contributions.

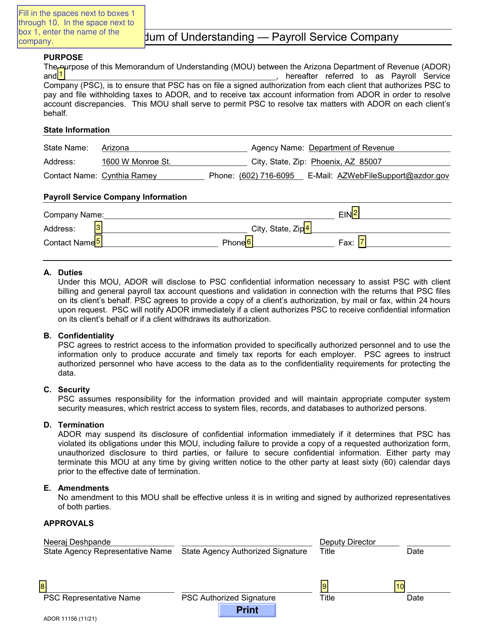

This form is used for creating a Memorandum of Understanding (MOU) between a company and a payroll service provider in the state of Arizona. The MOU outlines the agreement and responsibilities regarding payroll services.

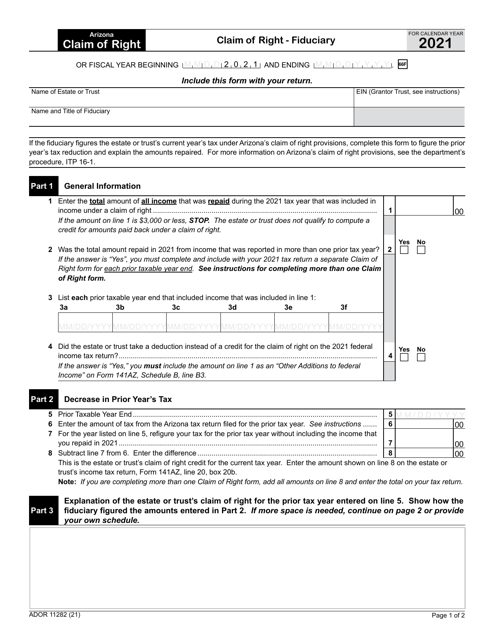

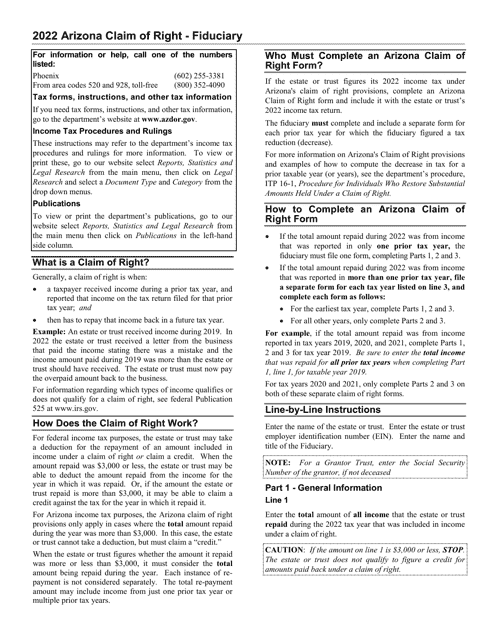

This Form is used for claiming a fiduciary's right in the state of Arizona.

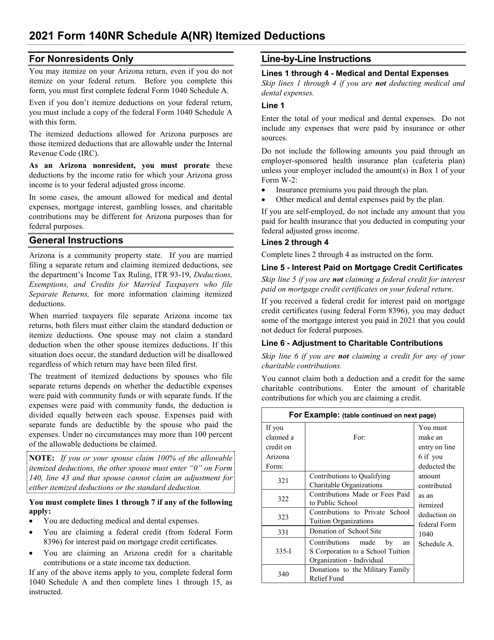

This Form is used for reporting itemized deductions for nonresidents of Arizona on their Arizona tax return. It provides instructions on how to fill out Schedule A(NR) of Arizona Form 140NR.

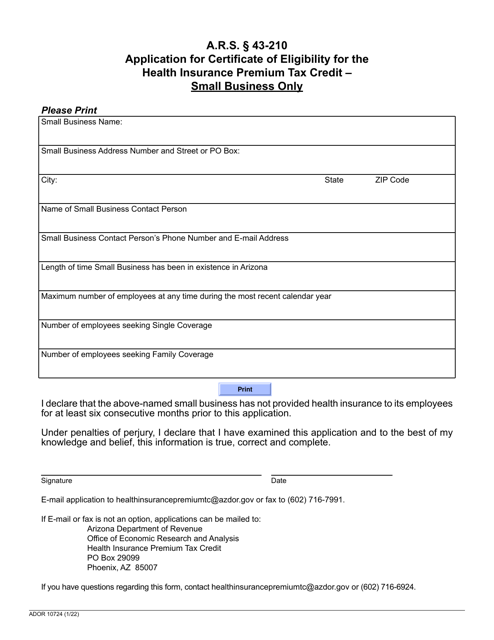

This form is used for small businesses in Arizona to apply for a Certificate of Eligibility for the Health Insurance Premium Tax Credit.

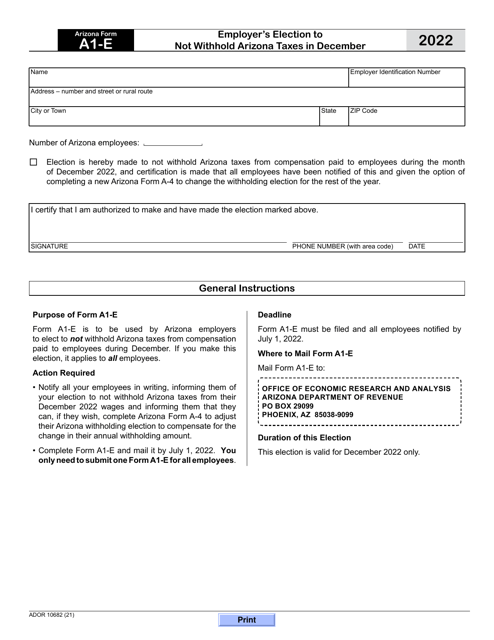

This form is used for employers in Arizona to elect not to withhold Arizona taxes in December.

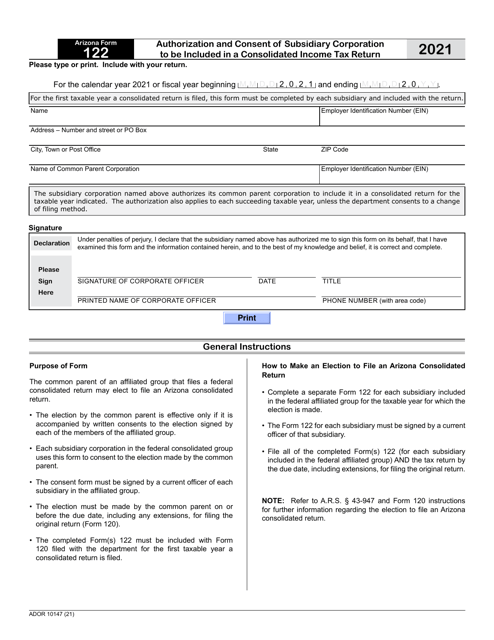

This form is used for authorizing and consenting a subsidiary corporation to be included in a consolidated income tax return in the state of Arizona.

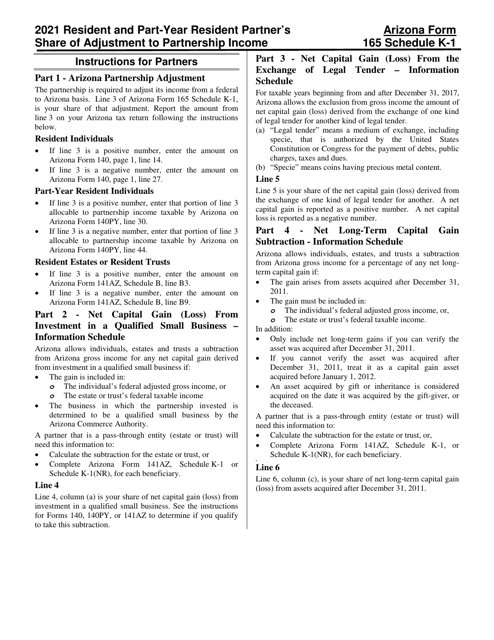

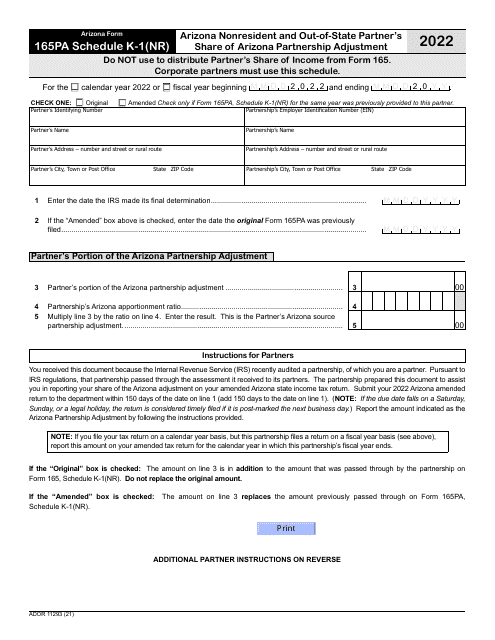

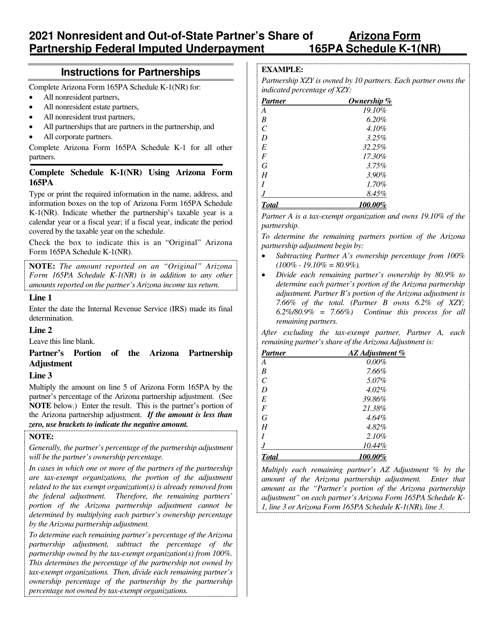

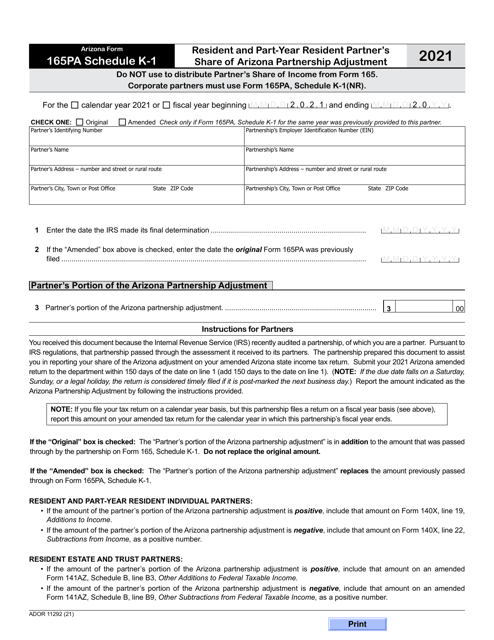

This Form is used for reporting a resident or part-year resident partner's share of Arizona Partnership Adjustment on Schedule K-1.