Arizona Department of Revenue Forms

Documents:

626

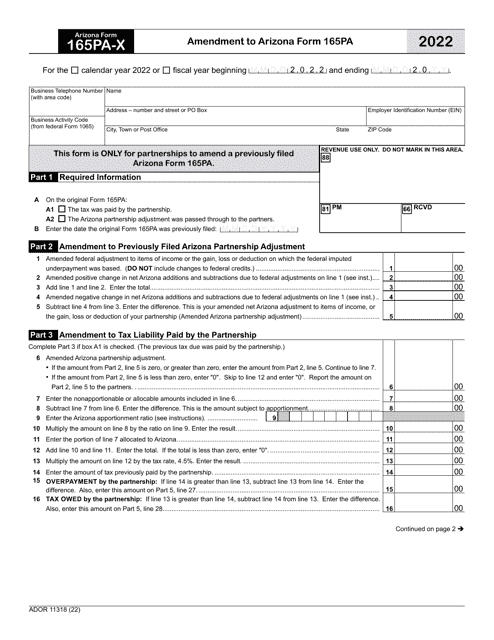

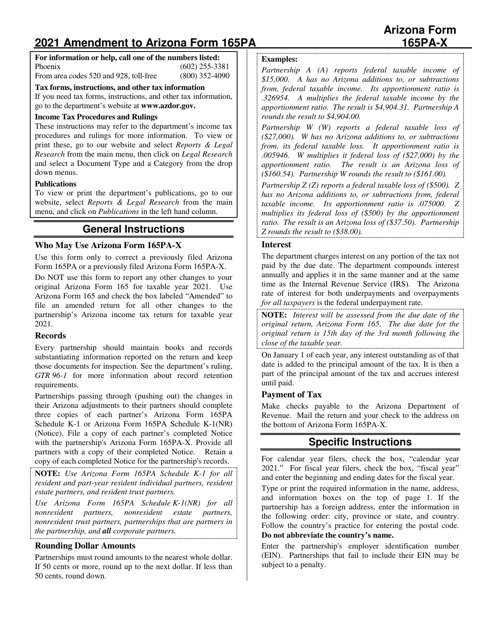

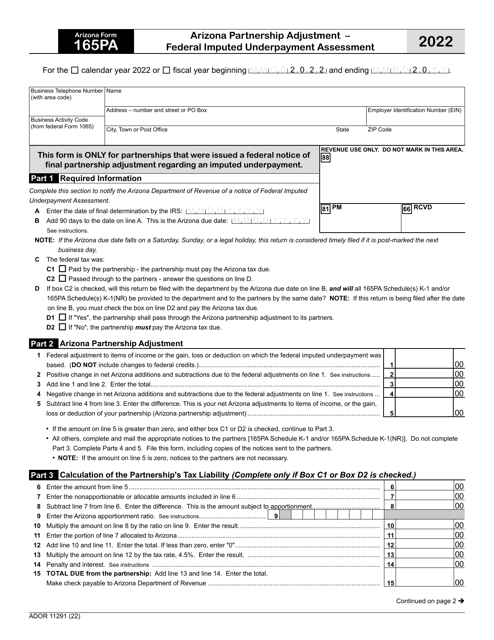

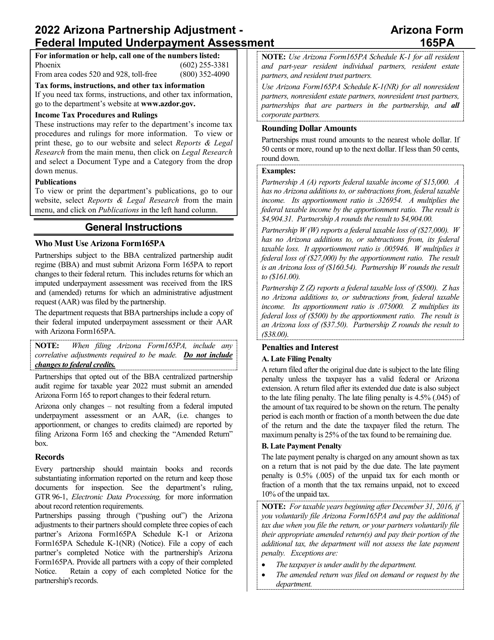

This Form is used for making amendments to Arizona Form 165PA. It is specifically designed for taxpayers in Arizona who need to make changes to their previous tax return. The form is provided by the Arizona Department of Revenue (ADOR).

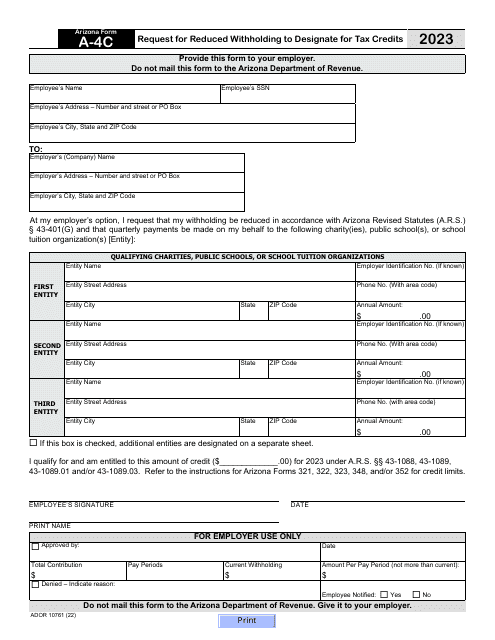

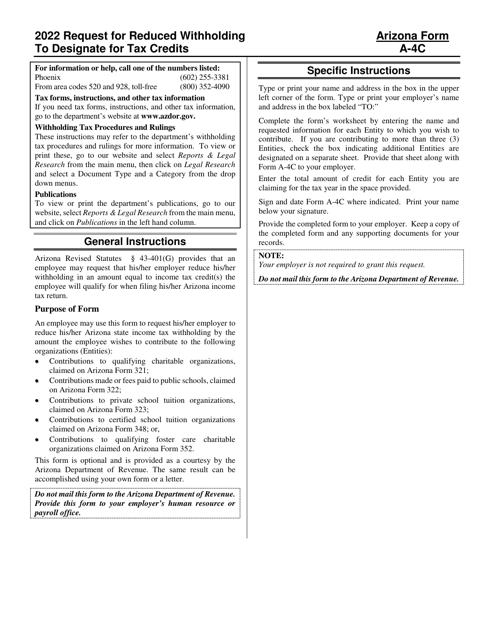

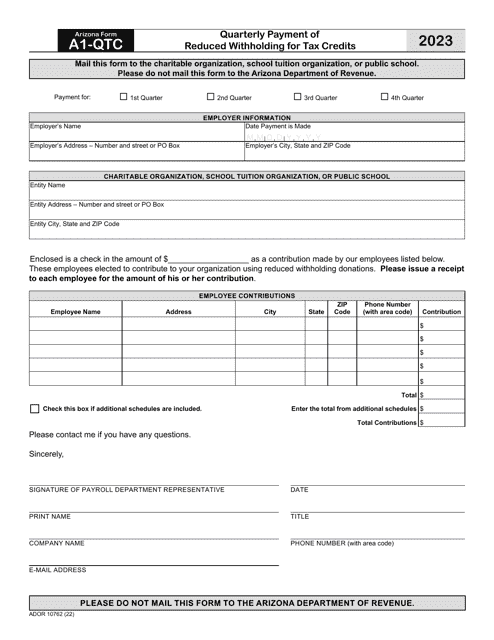

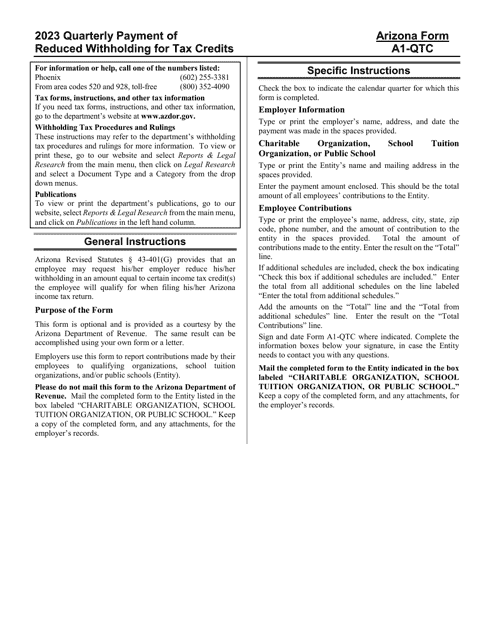

This document is used for requesting a reduction in withholding taxes in Arizona, specifically to designate funds for tax credits. It provides instructions on how to fill out Form A-4C ADOR10761.

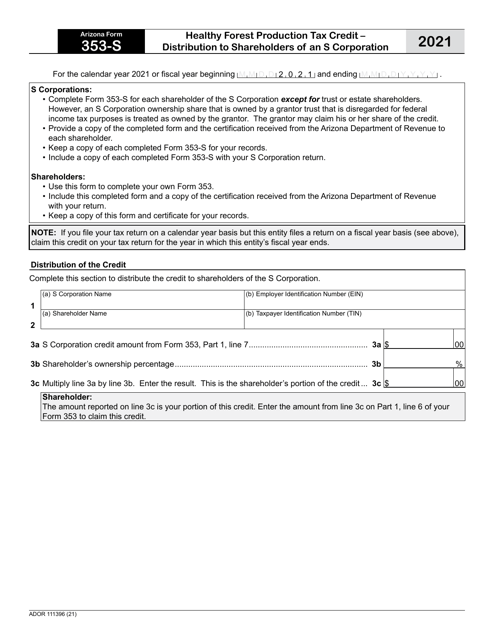

This Form is used for claiming the Healthy Forest Production Tax Credit in Arizona as a shareholder of an S Corporation.

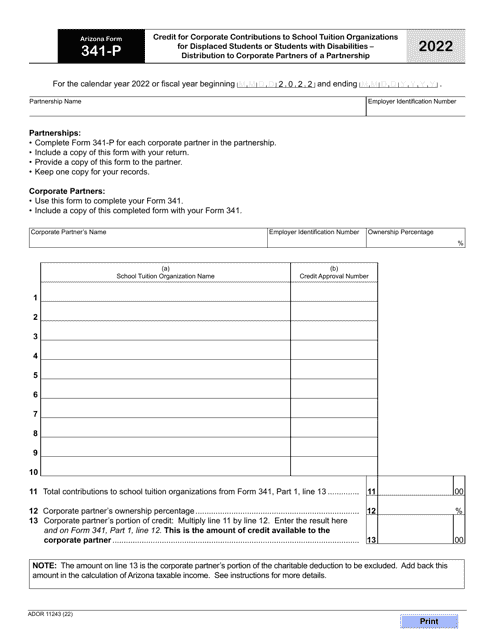

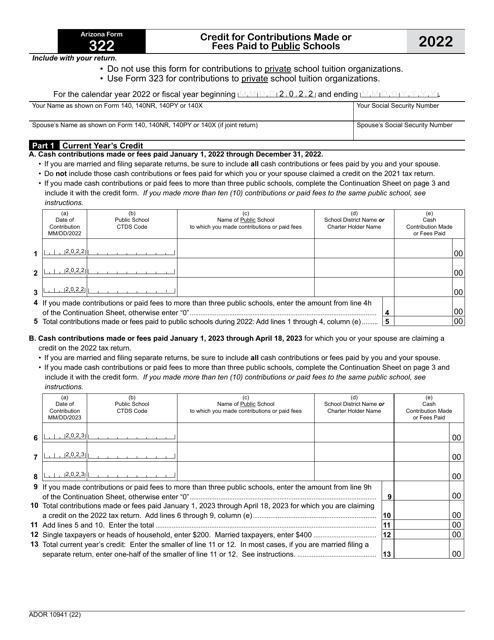

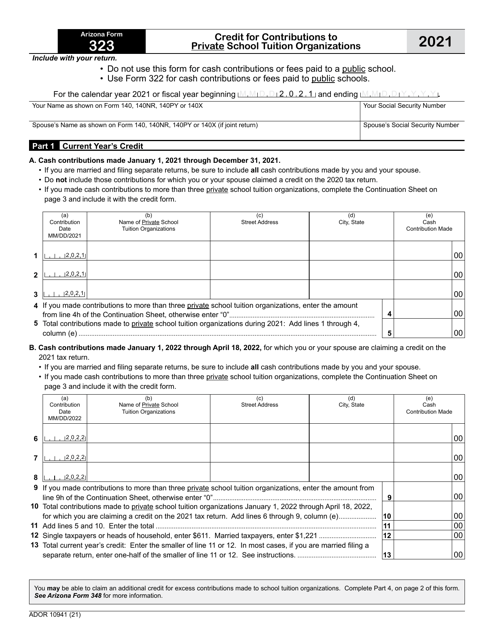

This form is used for claiming a credit for making contributions to private school tuition organizations in Arizona. It allows taxpayers to receive a tax credit for donations made to these organizations.

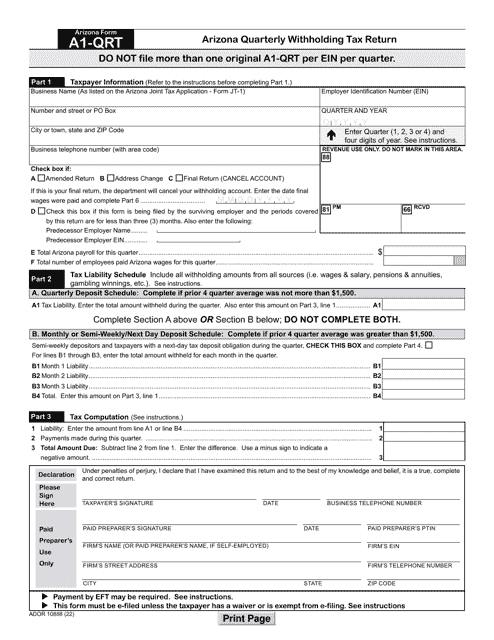

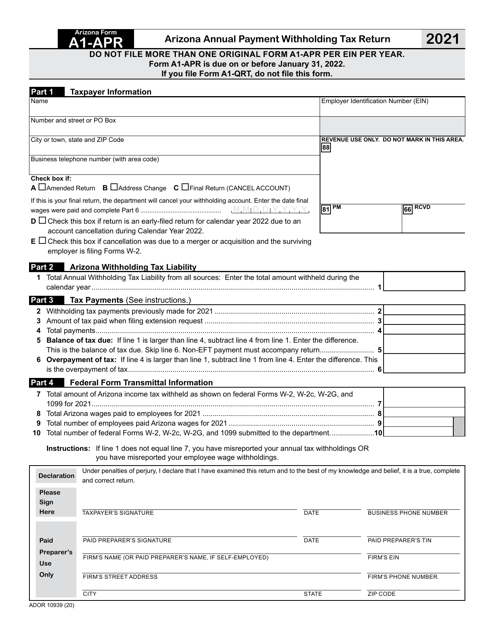

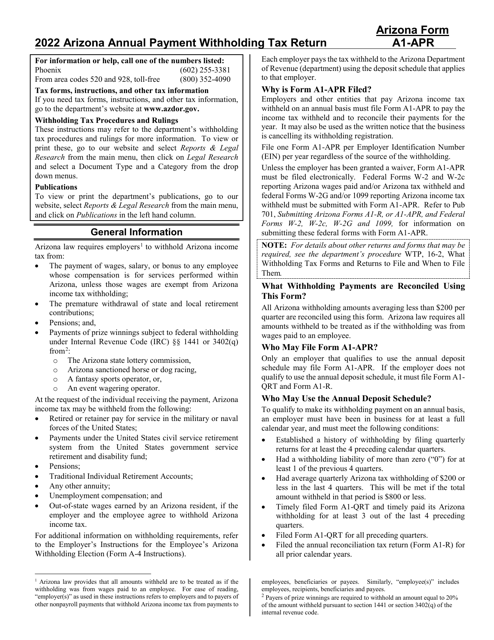

This Form is used for filing the Arizona Annual Payment Withholding Tax Return in Arizona. It is used by employers to report and remit the withholding taxes they have deducted from their employees' wages.

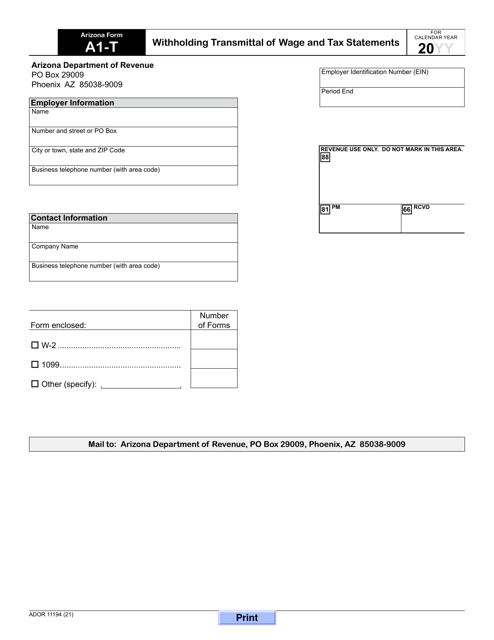

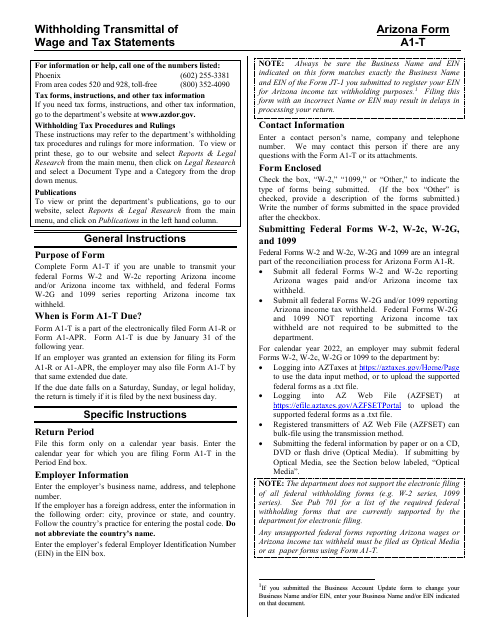

This form is used for transmitting wage and tax statements to the Arizona Department of Revenue (ADOR) for withholding purposes.

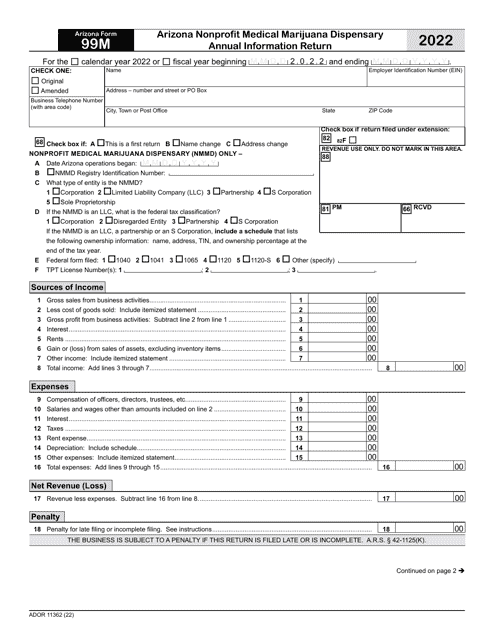

This Form is used for filing the annual information return for nonprofit medical marijuana dispensaries in Arizona. It is required by the Arizona Department of Revenue (ADOR).

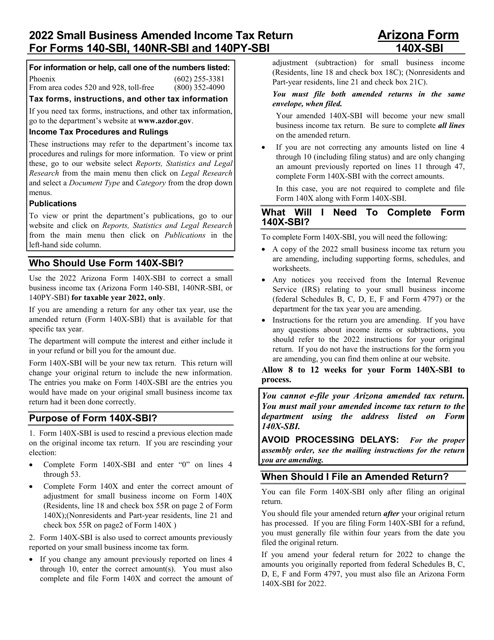

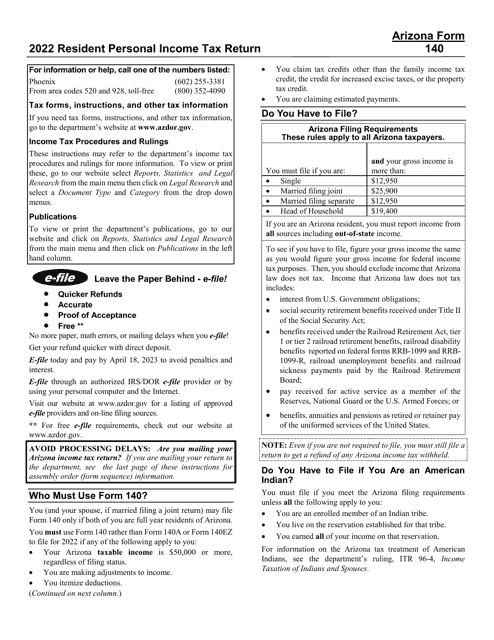

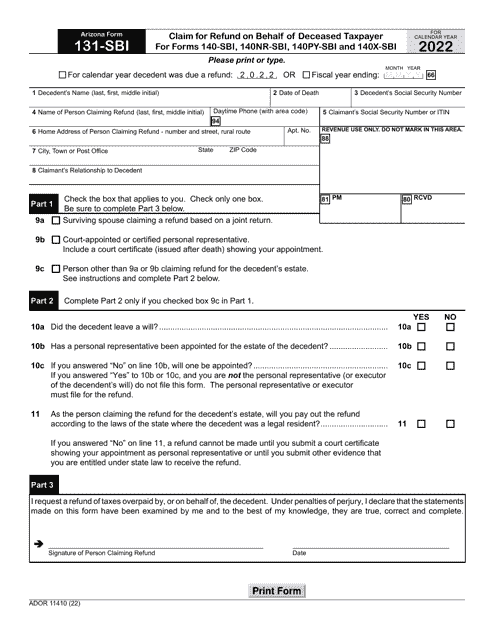

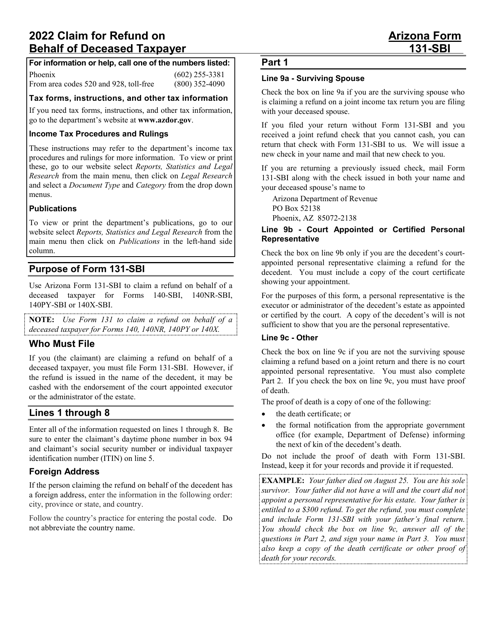

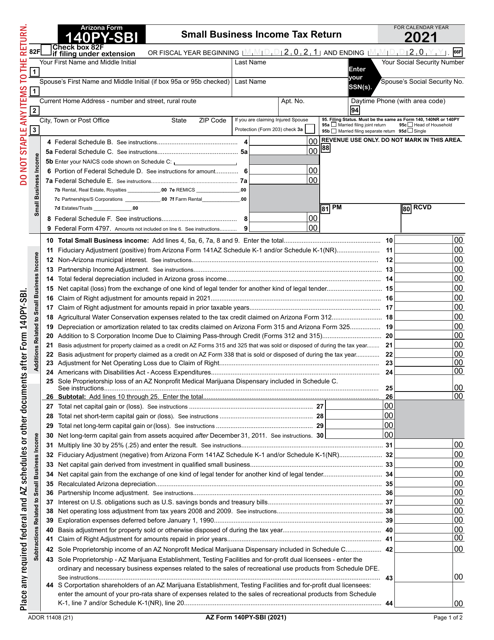

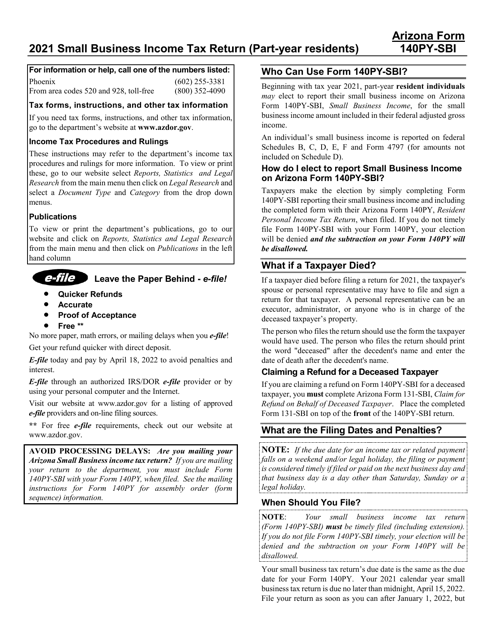

This form is used for filing small business income tax returns in Arizona.

This type of document is the form required for filing the Small Business Income Tax Return in Arizona for individuals with a small business. It provides instructions on how to properly fill out and submit the Form 140PY-SBI.