Arizona Department of Revenue Forms

Documents:

626

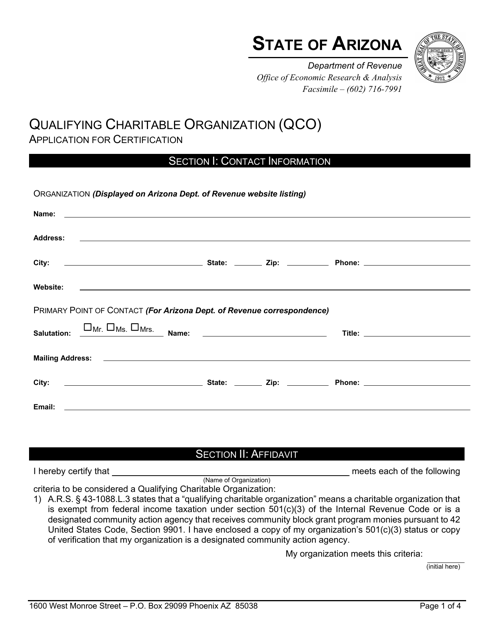

This Form is used for applying for certification as a Qualifying Charitable Organization in Arizona.

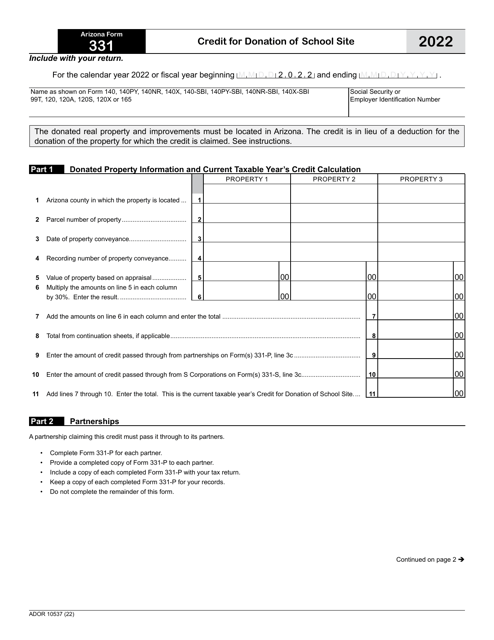

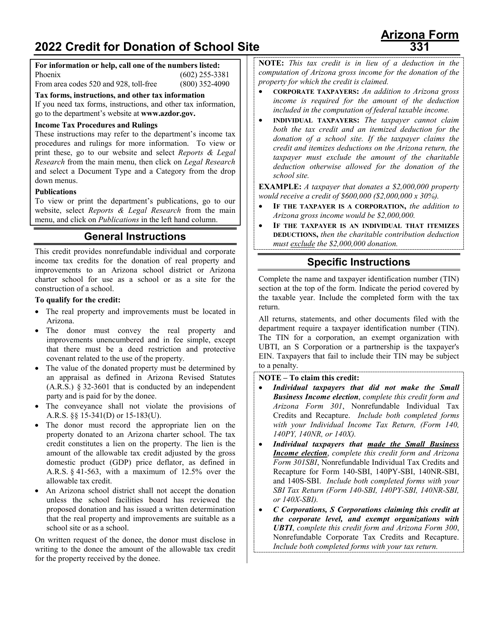

This Form is used for claiming a tax credit for donating a school site in Arizona. It provides instructions on how to fill out Form 331 - ADOR10537.

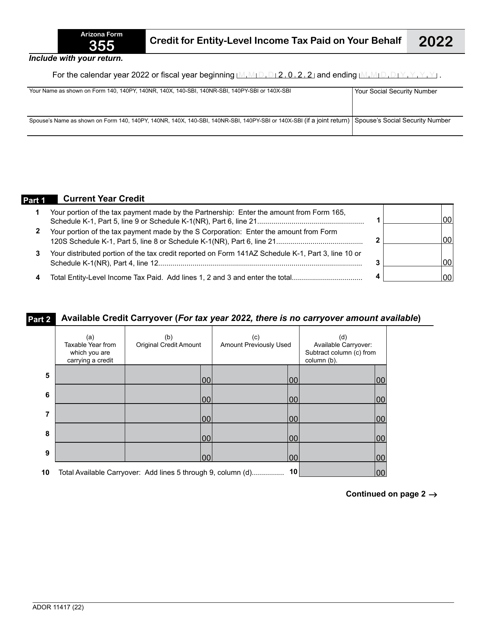

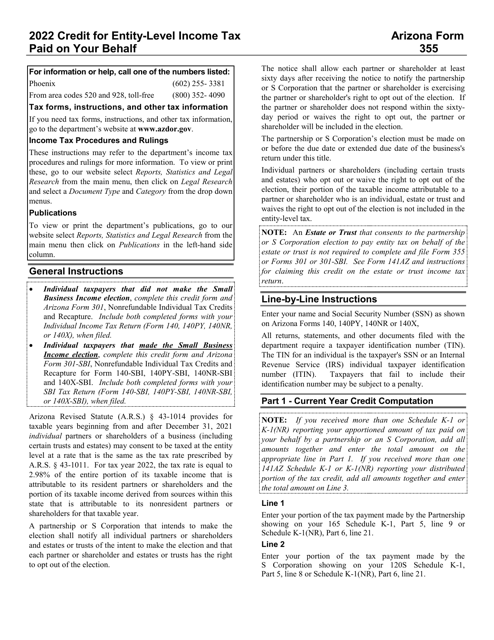

This Form is used for claiming a credit for entity-level income tax paid on your behalf in Arizona.

This Form is used for claiming the credit for entity-level income tax paid on your behalf in the state of Arizona. Follow the instructions provided to correctly complete and submit Form 355 to the Arizona Department of Revenue (ADOR).

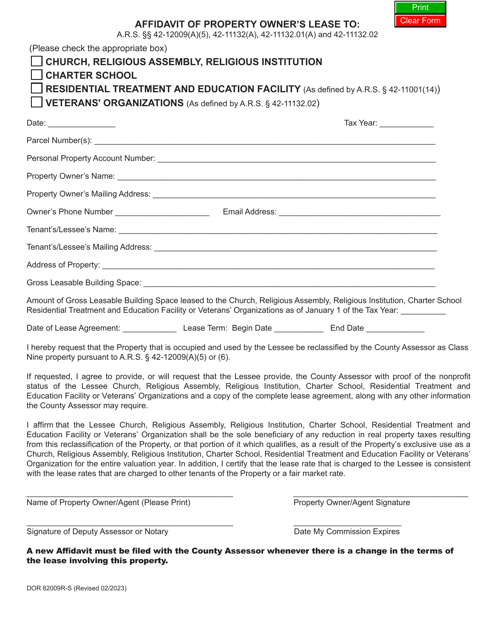

This form is used for property owners in Arizona to provide an affidavit for their lease agreement.

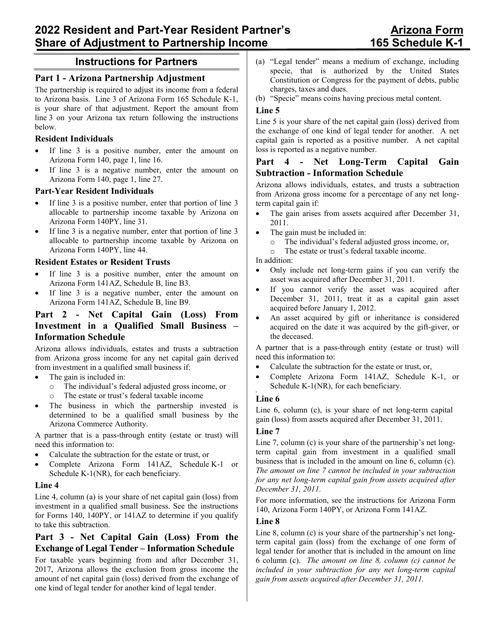

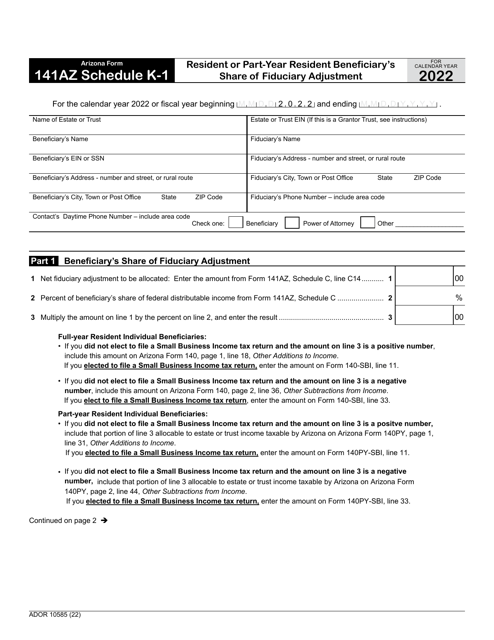

This type of document, Arizona Form 165, ADOR10344 Schedule K-1 Resident Partner's Share of Adjustment to Partnership Income - Arizona, provides instructions for Arizona residents who need to report their share of adjustment to partnership income on their state tax return.

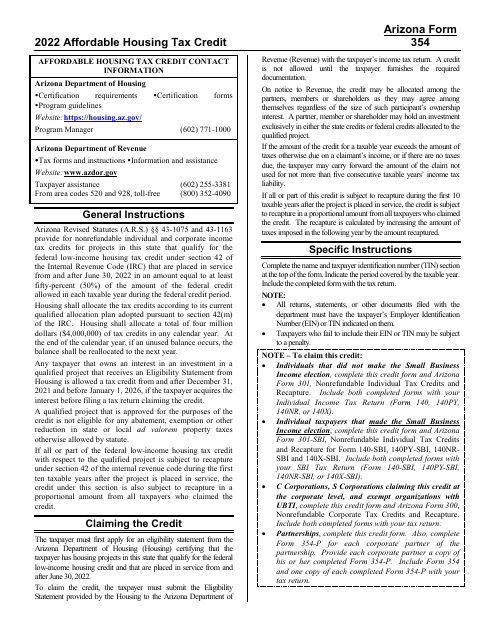

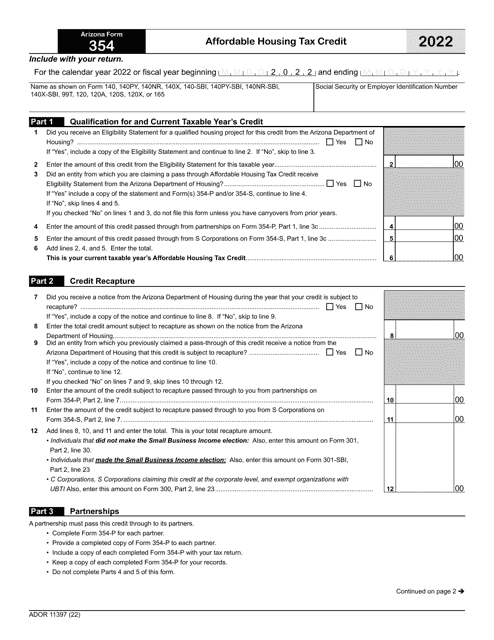

This document provides instructions for various Arizona tax forms including Form 354, Form 354-P, and Form 354-S. It includes information on how to fill out these forms correctly for tax purposes in Arizona.

This form is used for claiming the Affordable Housing Tax Credit in Arizona.