Arizona Department of Revenue Forms

Documents:

626

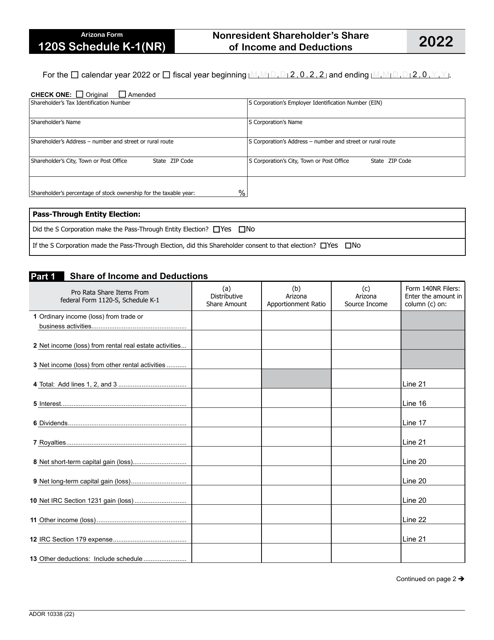

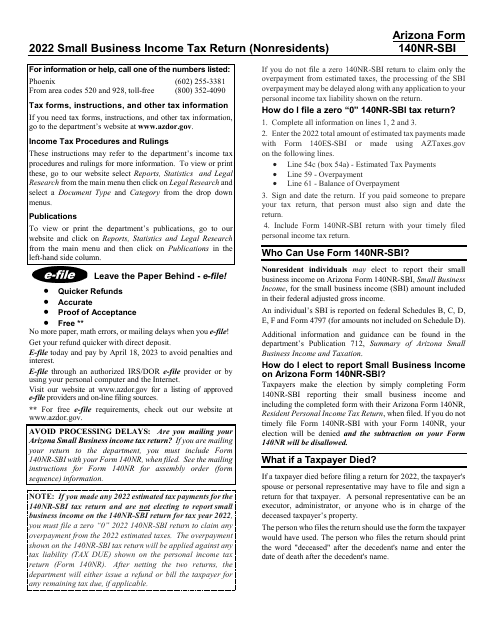

This Form is used for reporting the nonresident shareholder's share of income and deductions in Arizona.

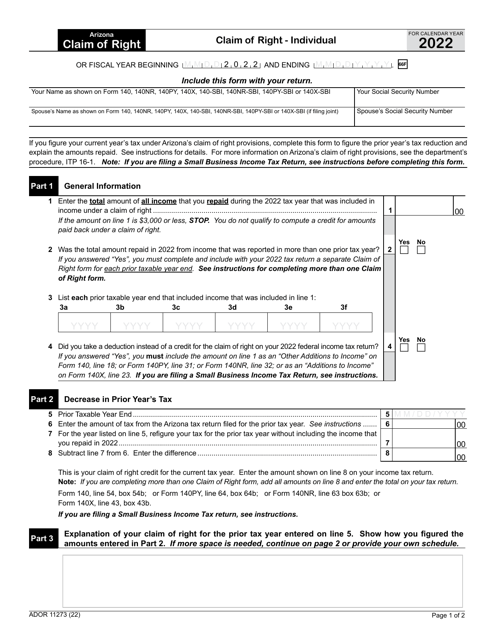

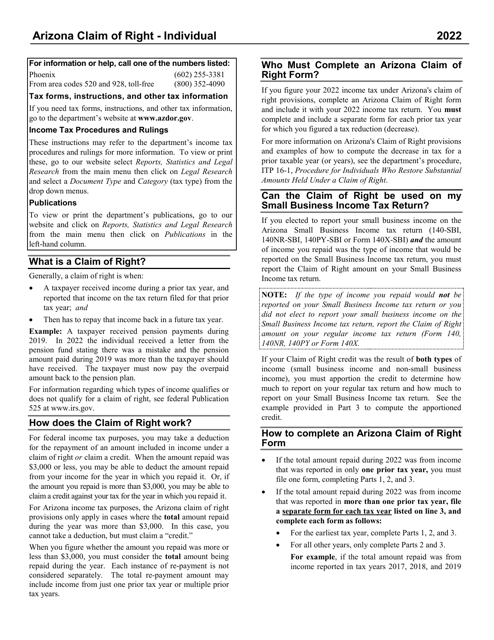

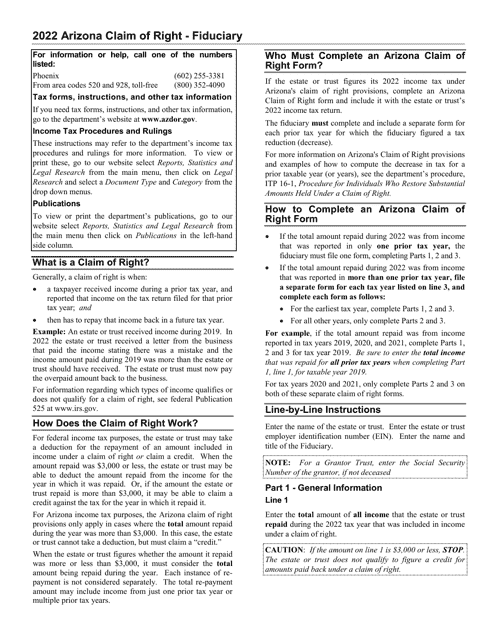

This Form is used for filing a Claim of Right by an individual in Arizona. The claim asserts the individual's right to keep income that would otherwise be subject to tax.

This Form is used for claiming the right to property, income, or other assets in Arizona as an individual. It is known as the Arizona Claim of Right form.

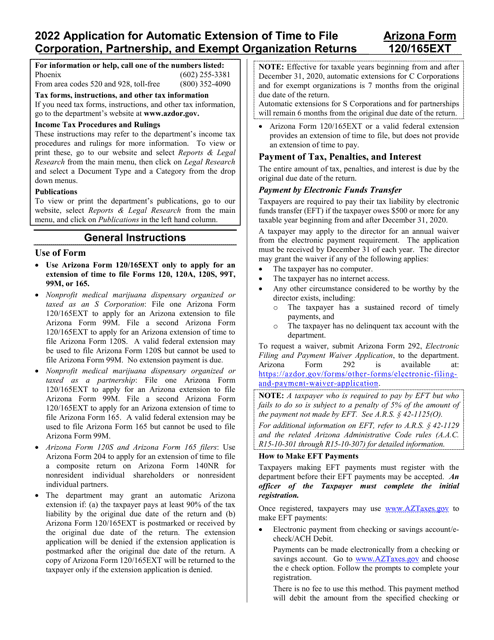

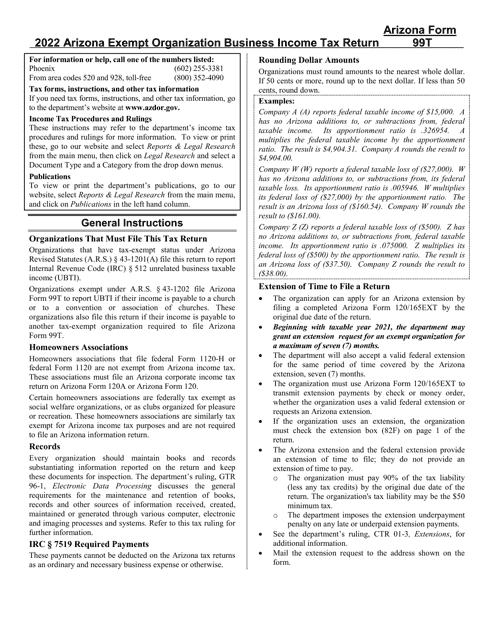

This type of document is used for requesting an automatic extension of time to file corporation, partnership, and exempt organization returns in Arizona.

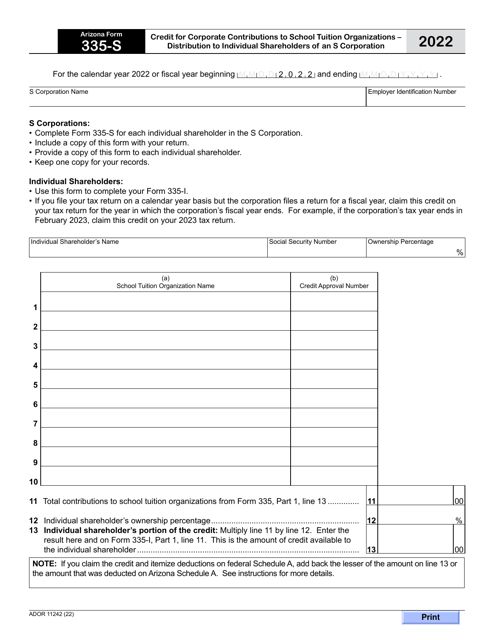

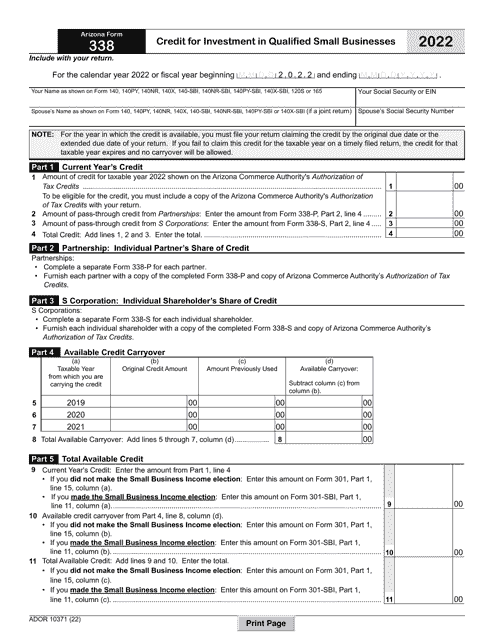

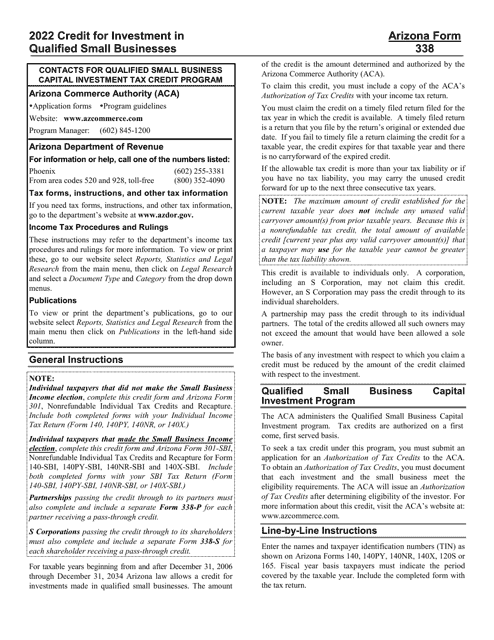

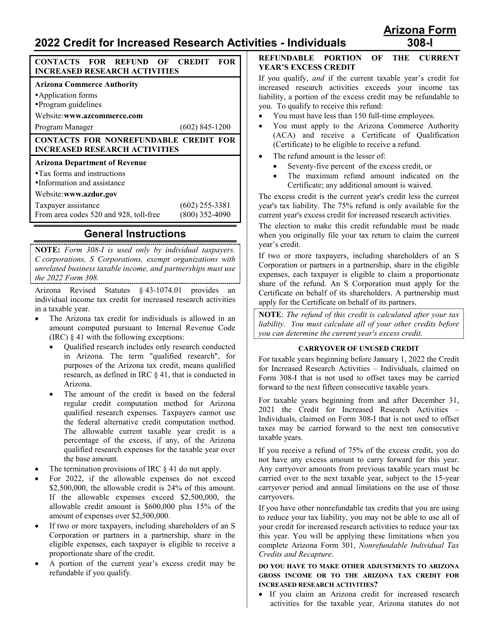

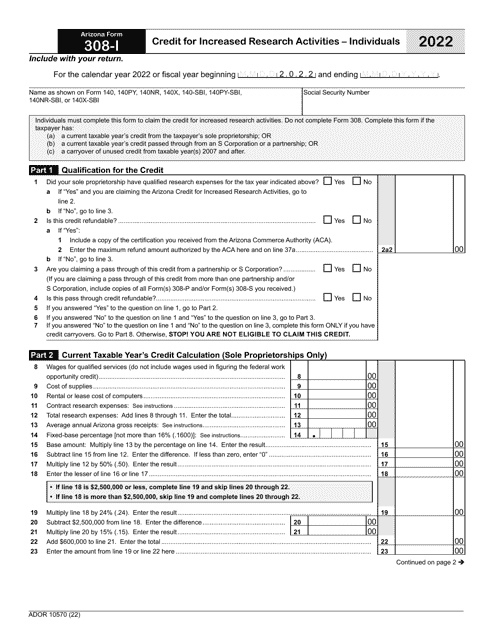

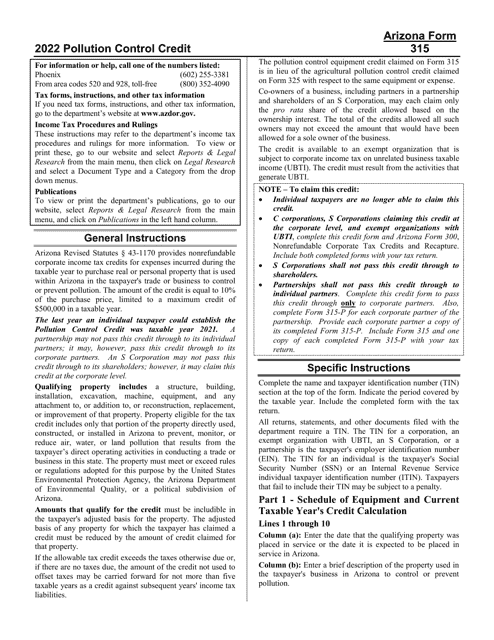

This Form is used for filling out various Arizona tax forms such as Arizona Form 338, Arizona Form 338-P, Arizona Form 338-S, ADOR11317, ADOR10371, and ADOR11316. These forms are used to report and pay state taxes in Arizona.

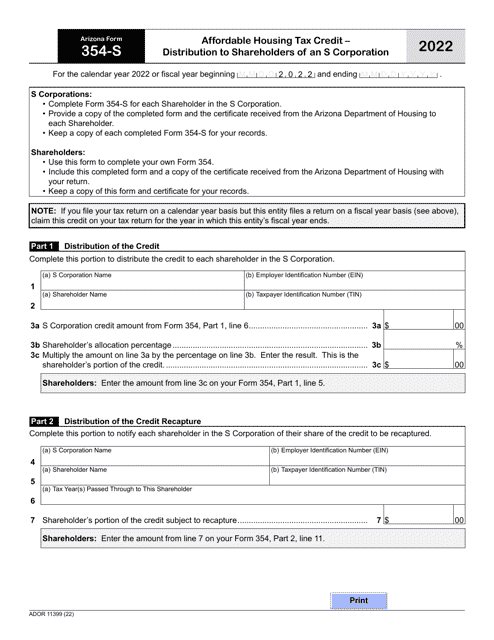

This form is used for distributing affordable housing tax credits to shareholders of an S Corporation in Arizona.

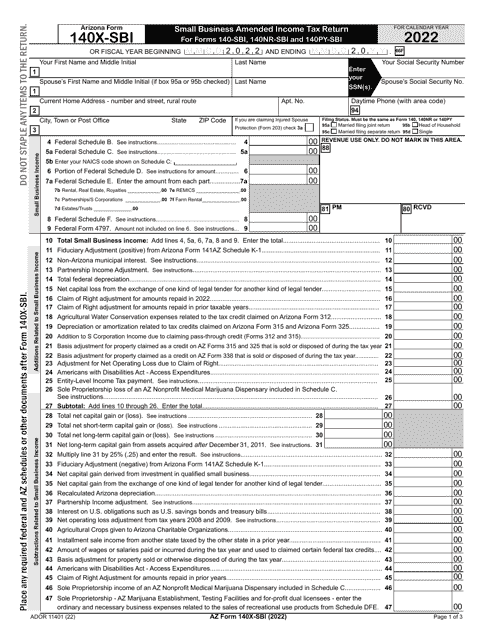

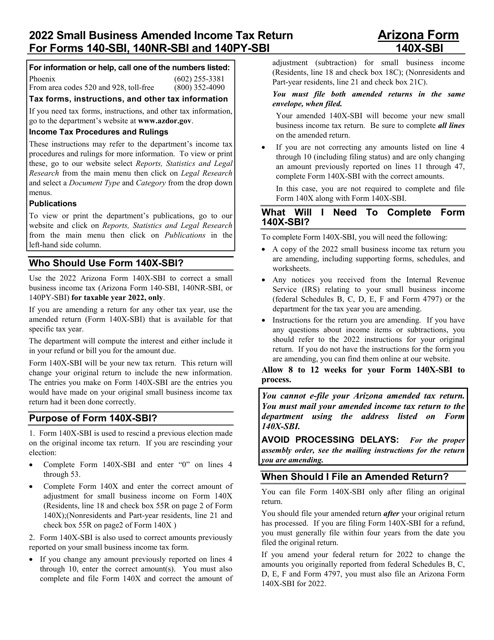

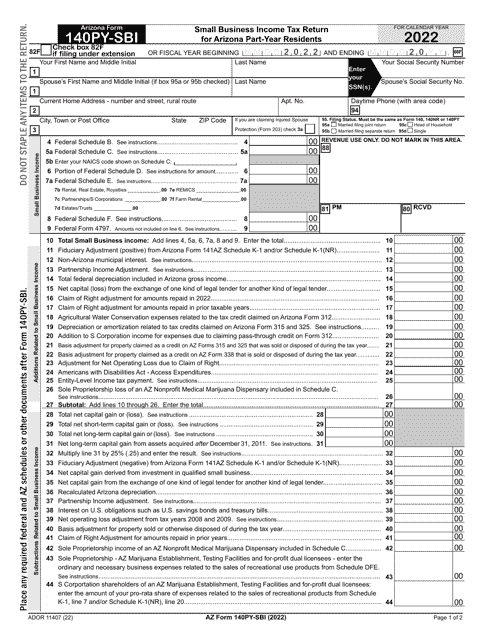

This Form is used for filing the small business income tax return in Arizona for part-year residents.