Fill and Sign Maine Legal Forms

Documents:

2481

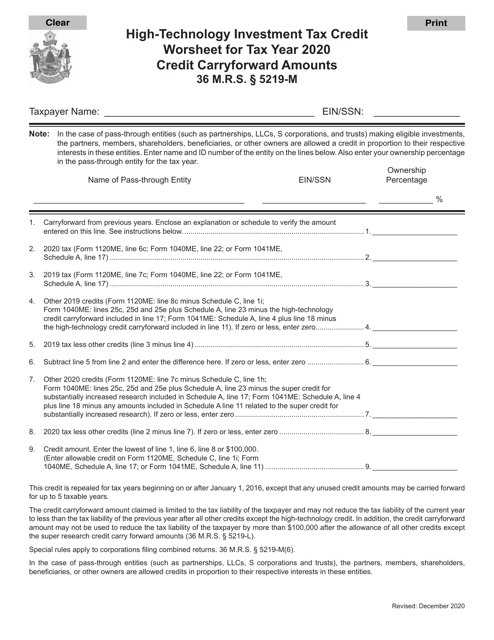

This document is a worksheet used for calculating the high-technology investment tax credit in the state of Maine. It helps taxpayers determine their eligibility and the amount of credit they may be eligible for.

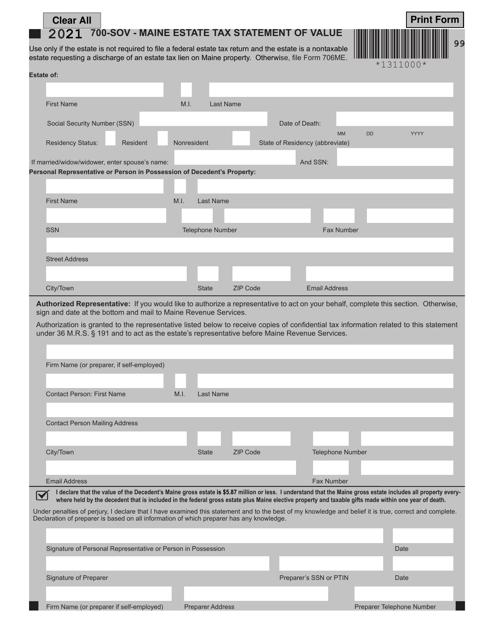

This form is used for reporting the value of an estate in Maine for estate tax purposes.

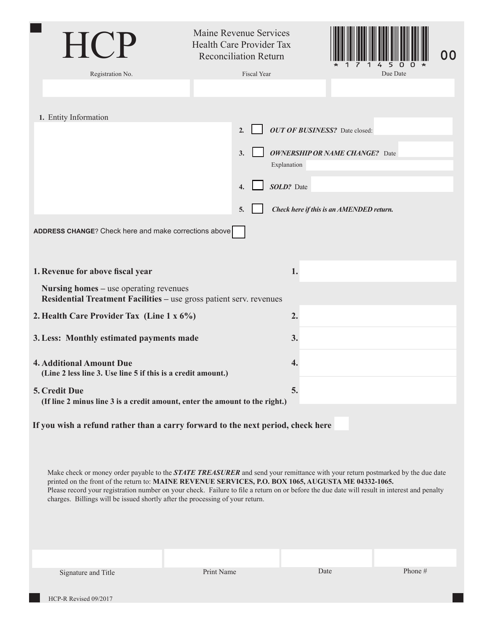

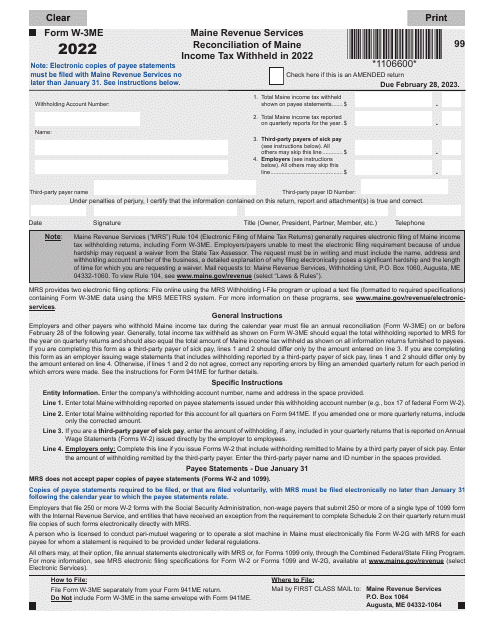

This form is used for health care providers in Maine to reconcile their taxes.

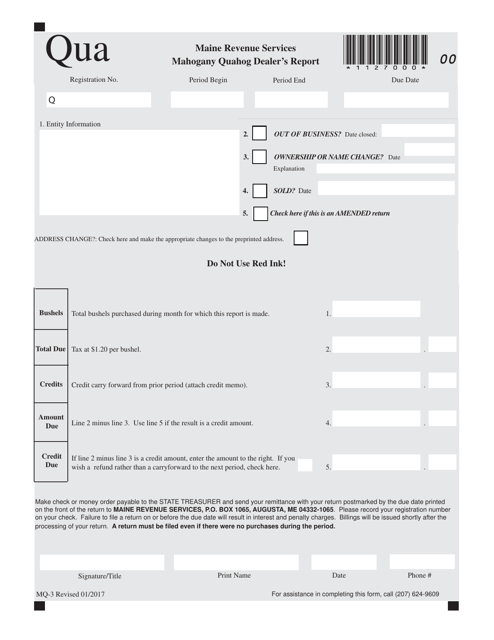

This form is used for Mahogany Quahog dealers in Maine to report their activities.

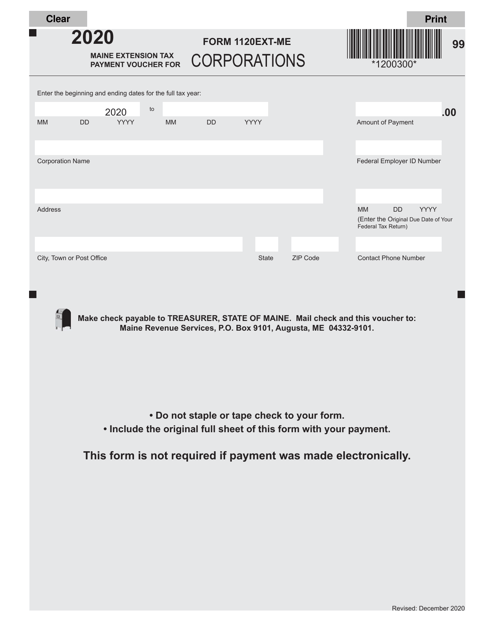

This form is used for making tax payments and extensions for corporations based in the state of Maine.

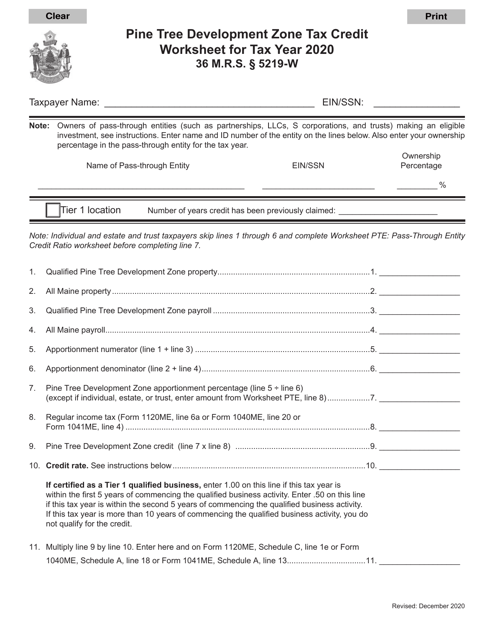

This document is used for calculating the tax credit for businesses located in the Pine Tree Development Zone in Maine. It helps businesses determine the amount of tax credit they are eligible for based on specific criteria.

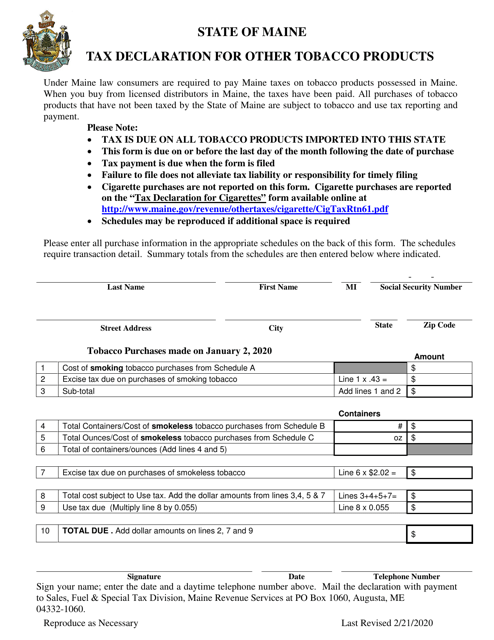

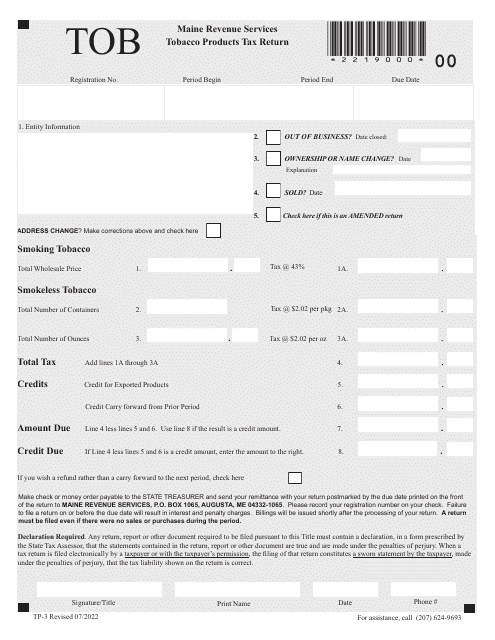

This document is used to declare taxes on other tobacco products in the state of Maine.

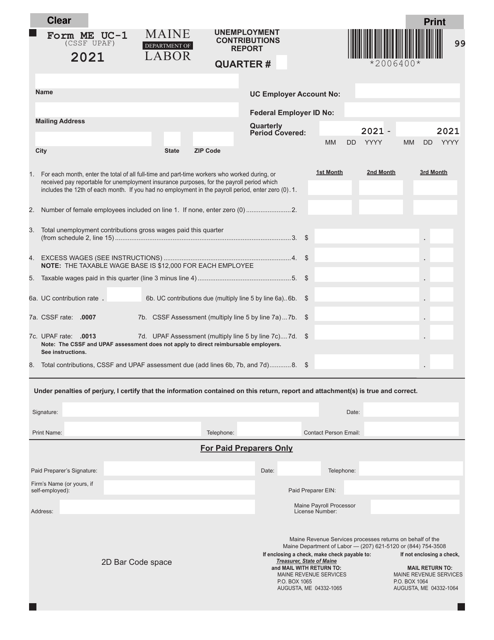

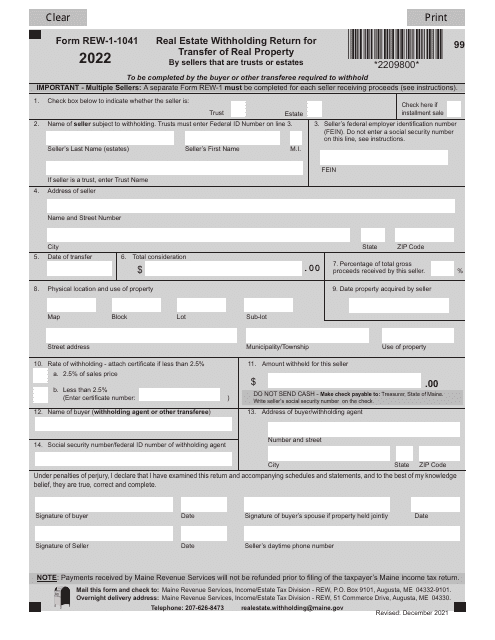

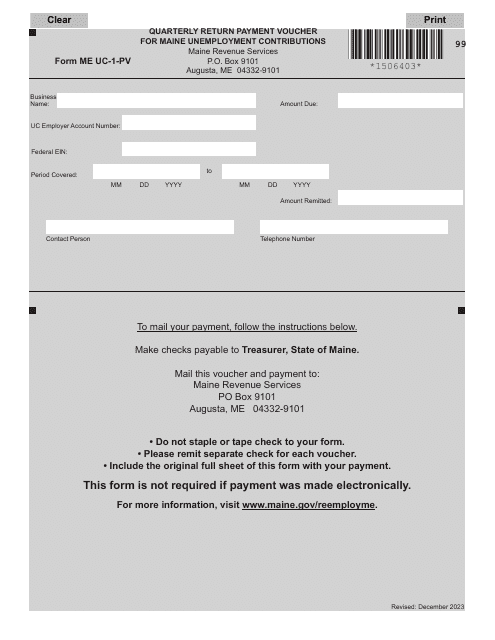

This Form is used for reporting unemployment contributions in the state of Maine.

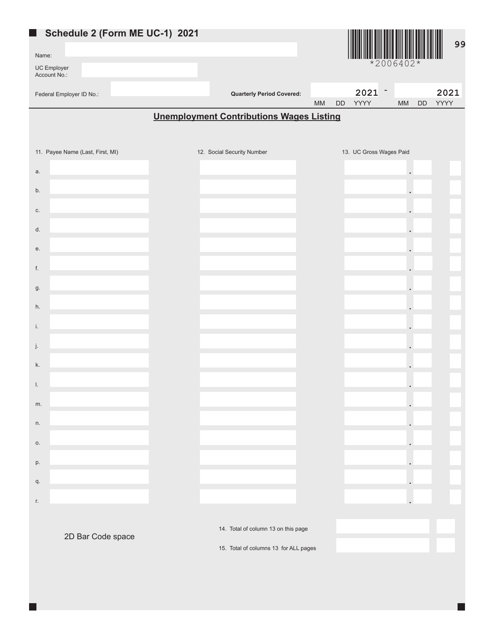

This Form is used for providing a listing of wages for unemployment contributions in the state of Maine.

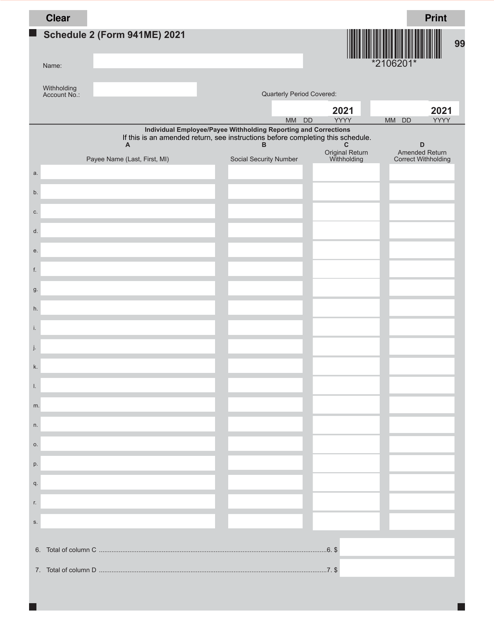

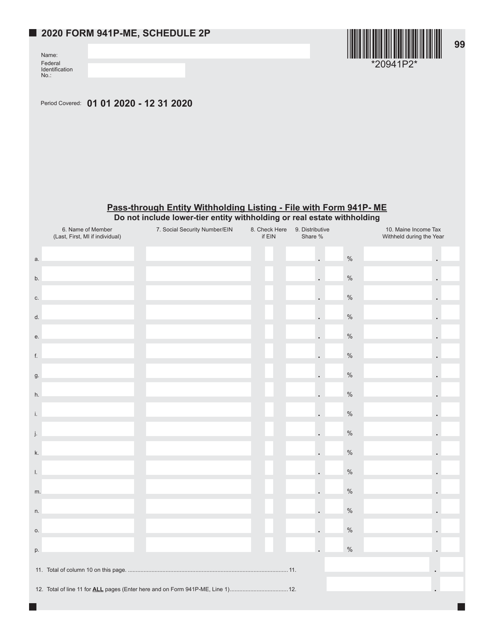

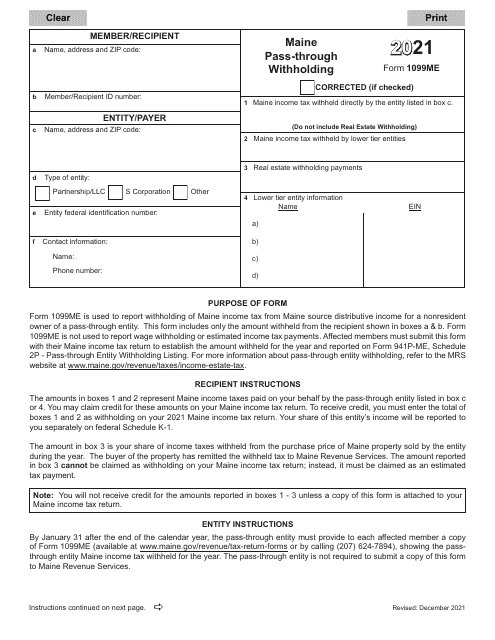

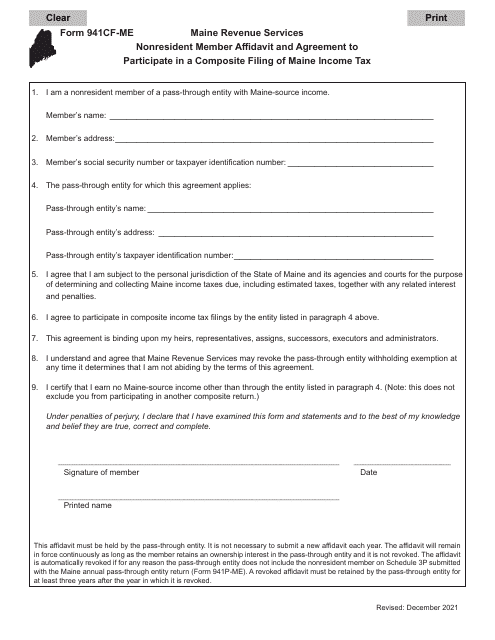

This type of document is used for listing withholding information for Maine state taxes on Form 941P-ME Schedule 2P.

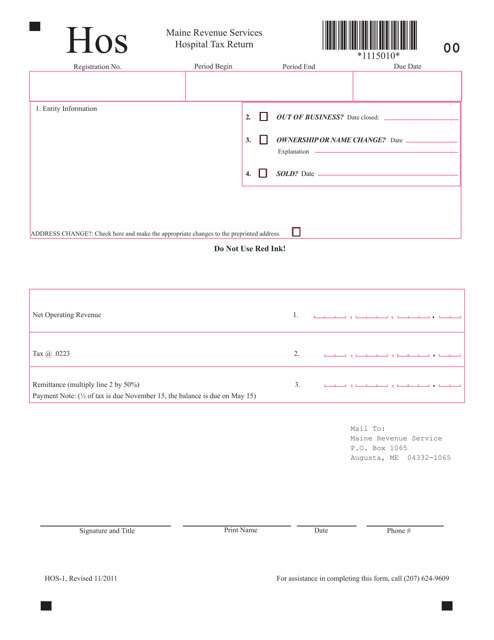

This Form is used for filing hospital tax returns in the state of Maine. It is used by hospitals to report and pay their taxes to the state revenue department.

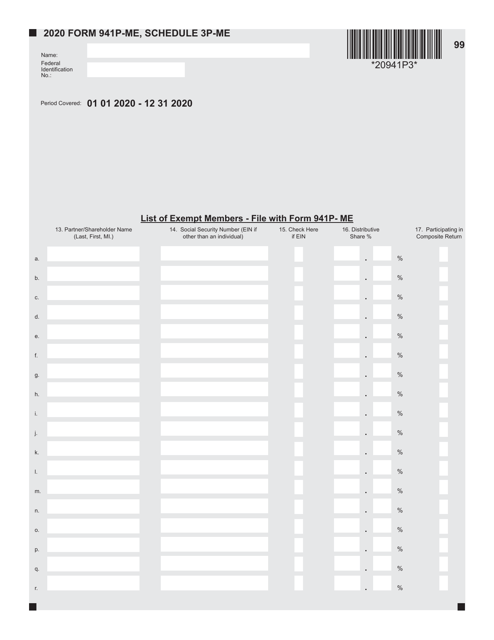

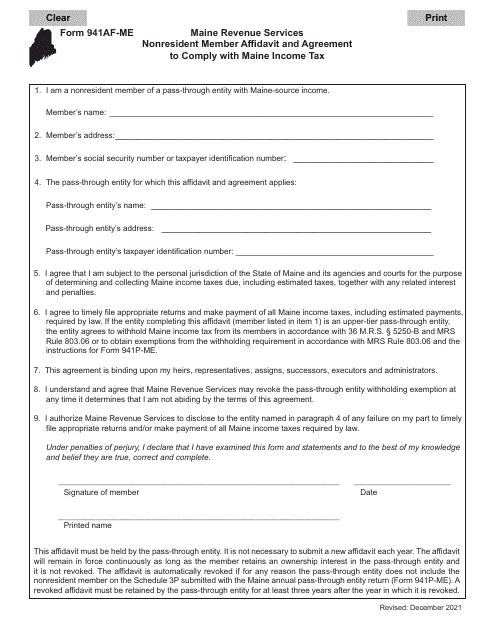

This document is used to provide a list of exempt members in the state of Maine for Form 941P-ME Schedule 3P-ME. It is important for employers to accurately report and document individuals who are exempt from certain tax obligations.

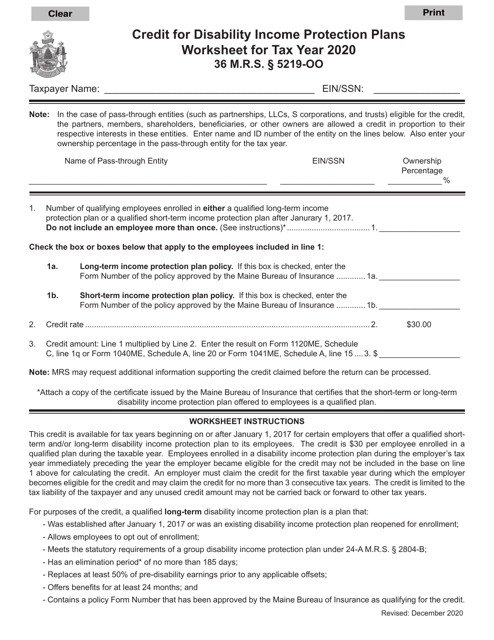

This form is used for calculating and determining the credit eligibility for Disability Income Protection Plans in the state of Maine.

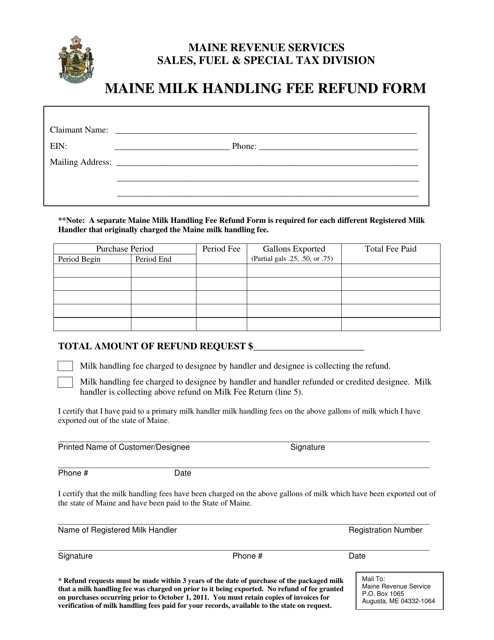

This Form is used for requesting a refund of the milk handling fee paid in the state of Maine.

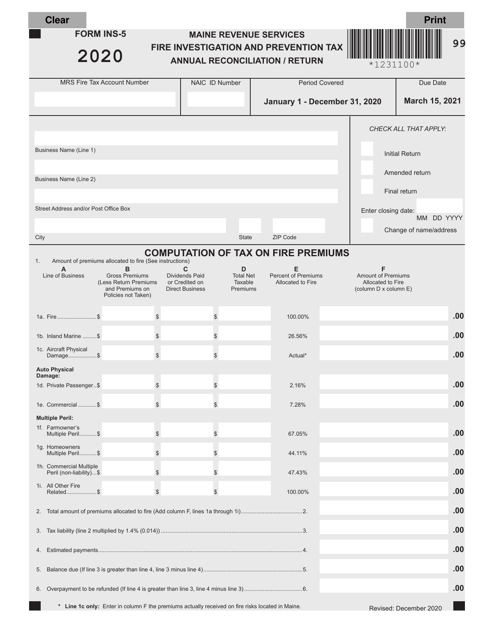

This Form is used for the annual reconciliation and return of fire investigation and prevention tax in Maine.

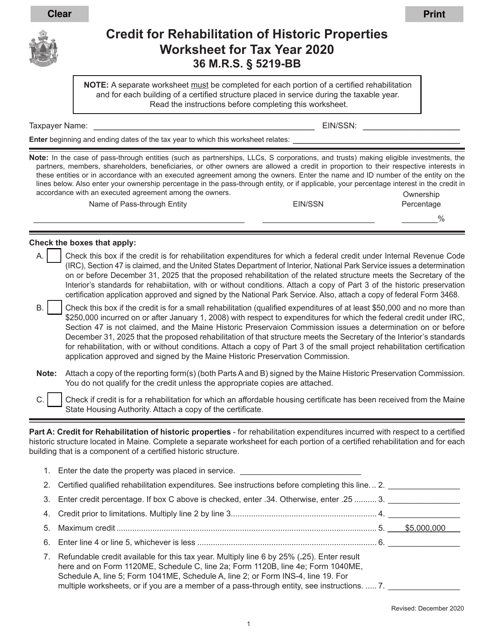

This Form is used for calculating and claiming tax credits for rehabilitating historic properties in the state of Maine.

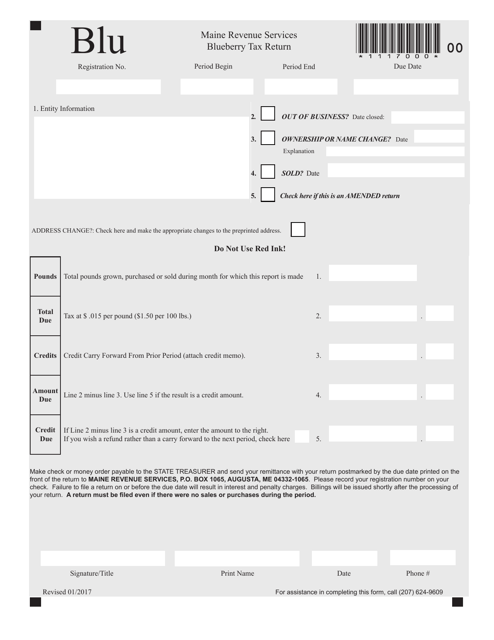

This form is used for the annual tax return specific to blueberry farmers in Maine. It includes information on income, expenses, and deductions related to blueberry farming.

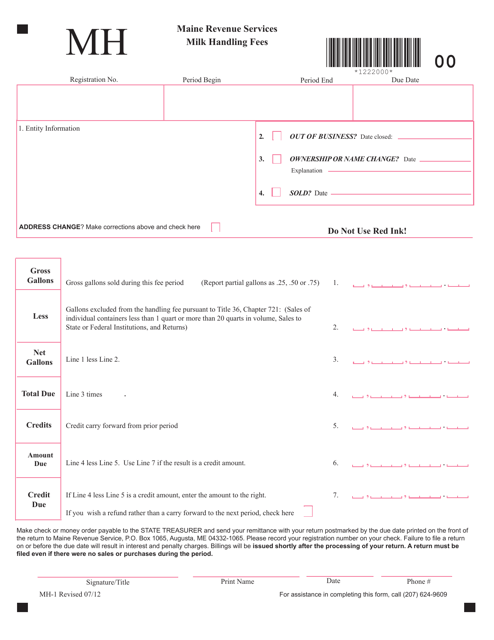

This Form is used for paying milk handling fees in the state of Maine.