Fill and Sign Maine Legal Forms

Documents:

2481

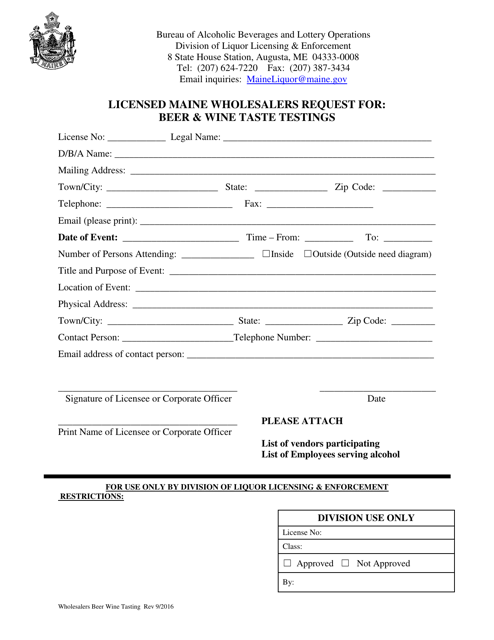

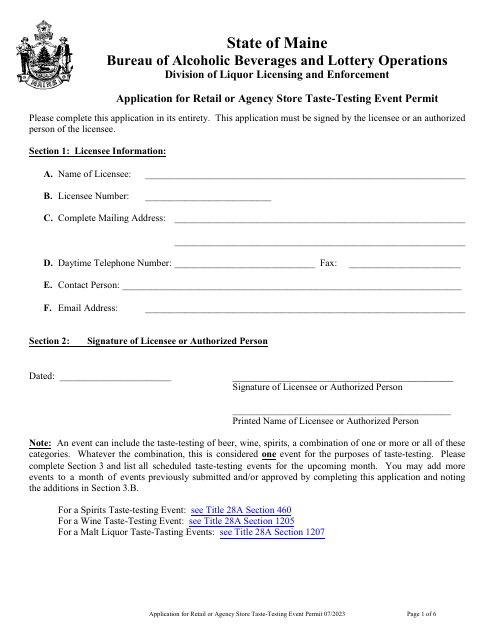

This document is used for licensed wholesalers in Maine to request beer and wine taste testings.

This document is used for employees in the state of Maine to provide a sworn statement or declaration for legal purposes.

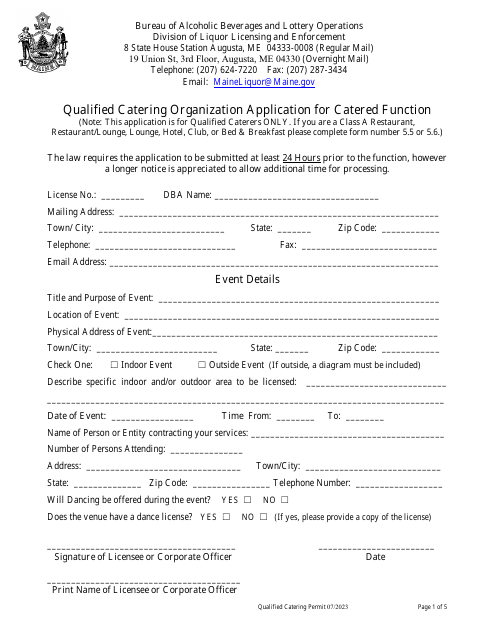

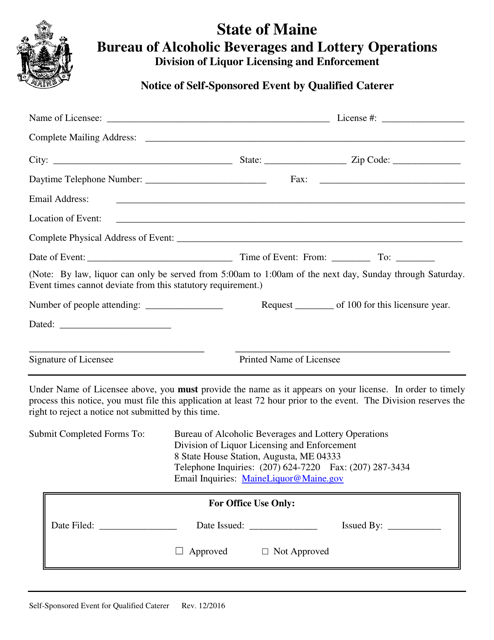

This document is a notice of a self-sponsored event by a qualified caterer in the state of Maine. It provides information about the event and its catering services.

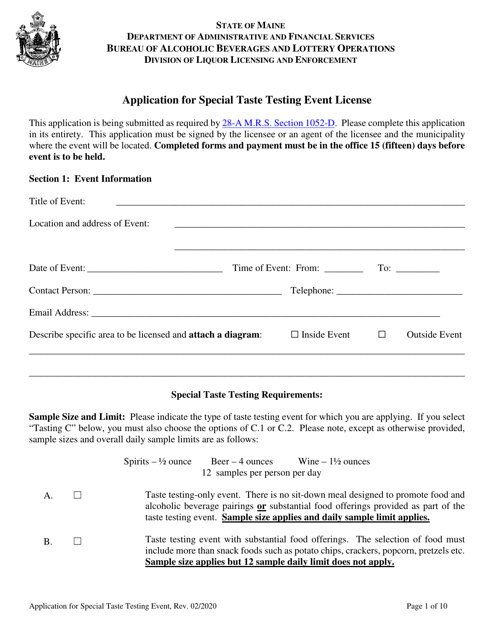

This form is used for applying for a special taste testing event license in Maine.

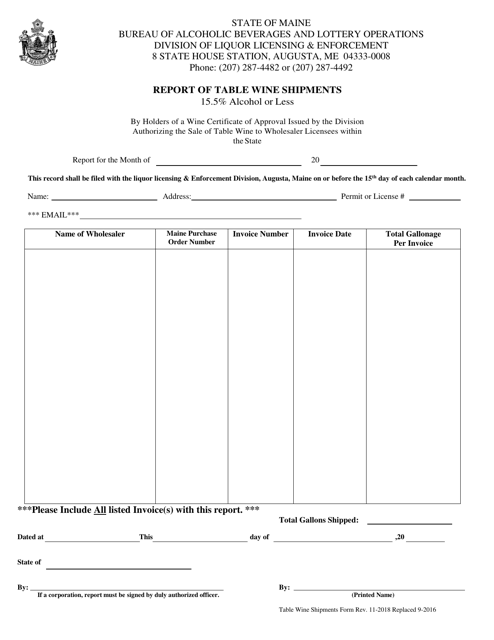

This Form is used for reporting table wine shipments with an alcohol content of 15.5% or less in the state of Maine.

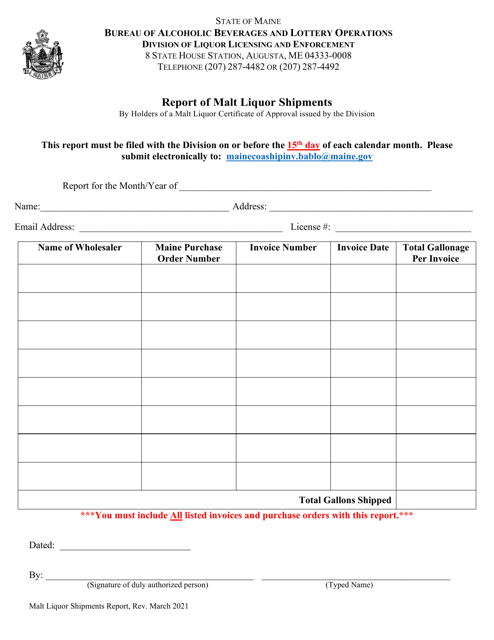

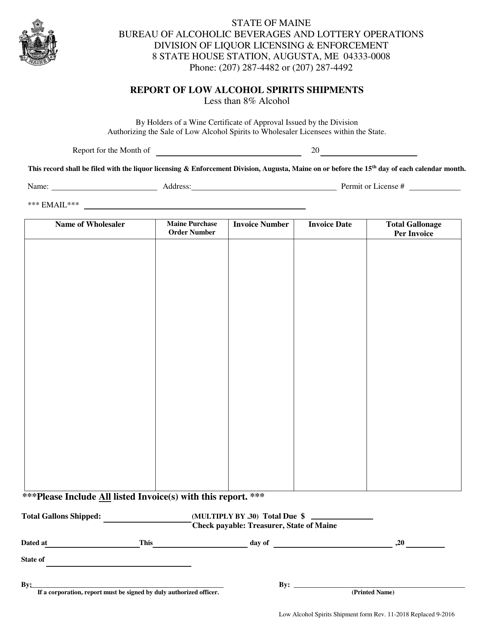

This document provides a report on the shipments of low alcohol spirits with an alcohol content less than 8% in the state of Maine.

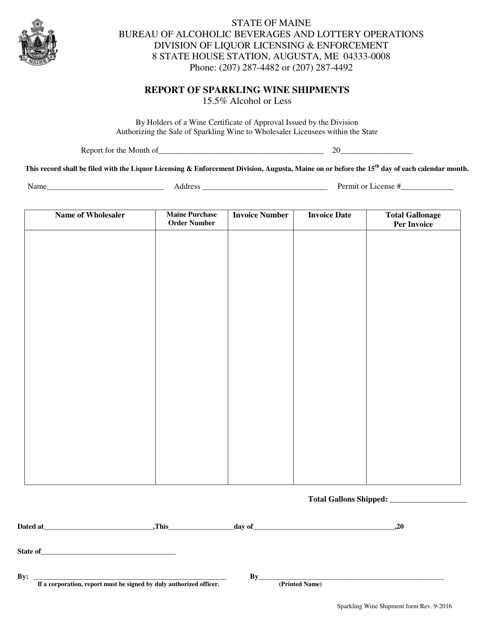

This document is a report detailing the shipments of sparkling wine in Maine that have an alcohol content of 15.5% or less. It provides information about the quantities and types of sparkling wine being shipped within the state.

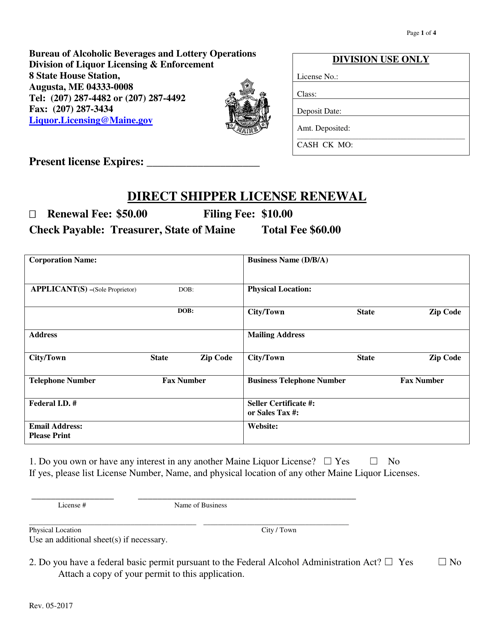

This form is used for renewing a direct shipper license in the state of Maine. It is required for businesses that wish to ship alcohol directly to consumers in Maine.

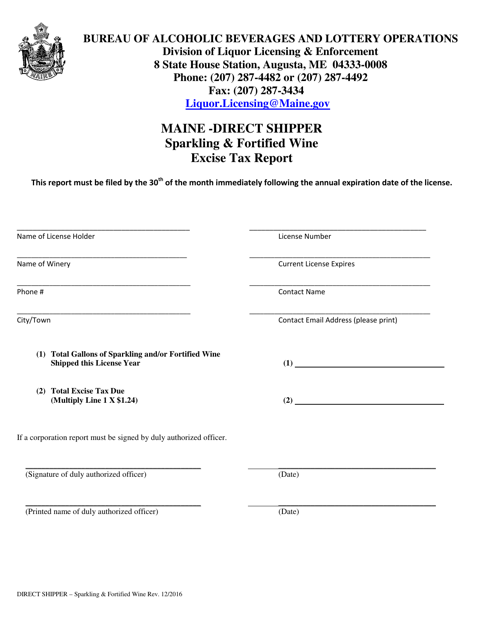

This document is used for reporting the excise tax on sparkling and fortified wine shipments made by direct shippers in Maine.

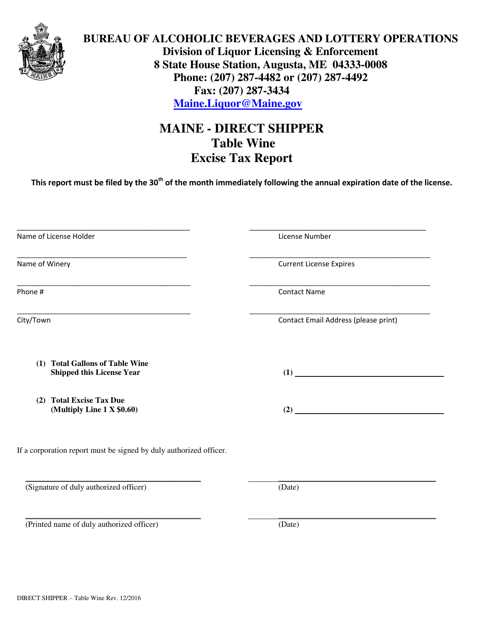

This document is a report used by direct shippers of table wine in Maine to report and pay excise taxes.

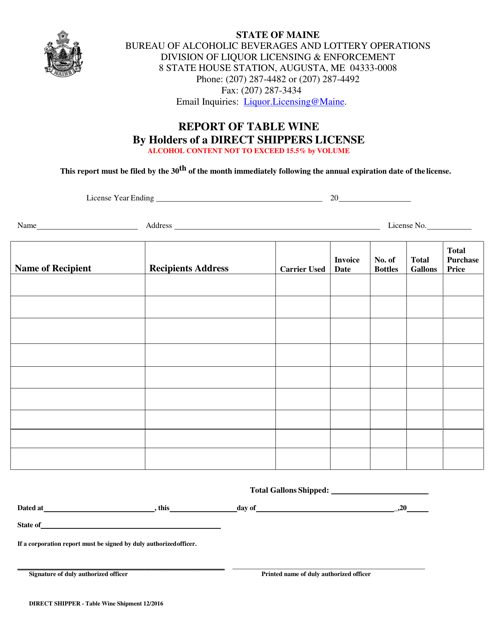

This form is used for reporting the sales and shipment of table wine by holders of a direct shippers license in the state of Maine.

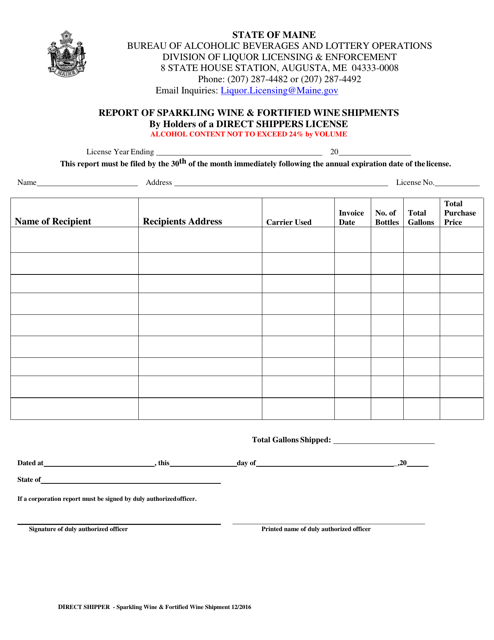

This document provides a report on the shipments of sparkling wine and fortified wine by holders of a direct shippers license in the state of Maine. It contains information on the quantity and type of wine being shipped.

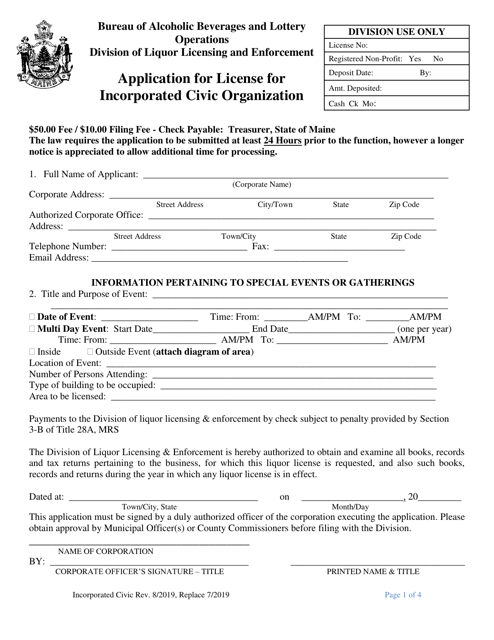

This type of document is used to apply for a license for an incorporated civic organization in the state of Maine.

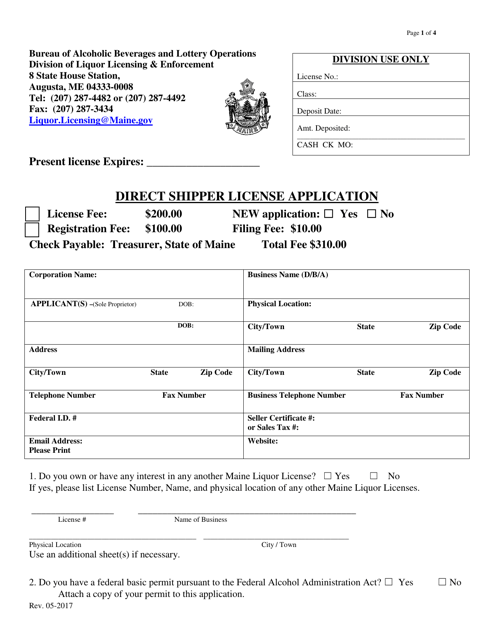

This document is an application for a Direct Shipper License in the state of Maine. It is used by individuals or businesses seeking to obtain a license to ship alcohol directly to consumers in Maine.

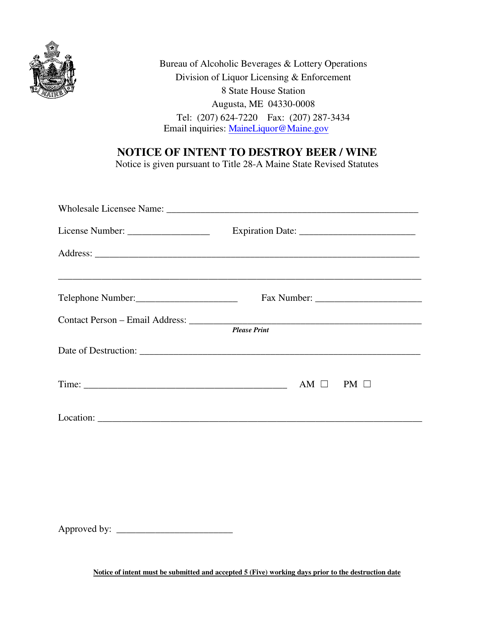

This document is a Notice of Intent to Destroy Beer/Wine in the state of Maine. It is used when a party wishes to dispose of alcoholic beverages that may be expired or no longer needed.

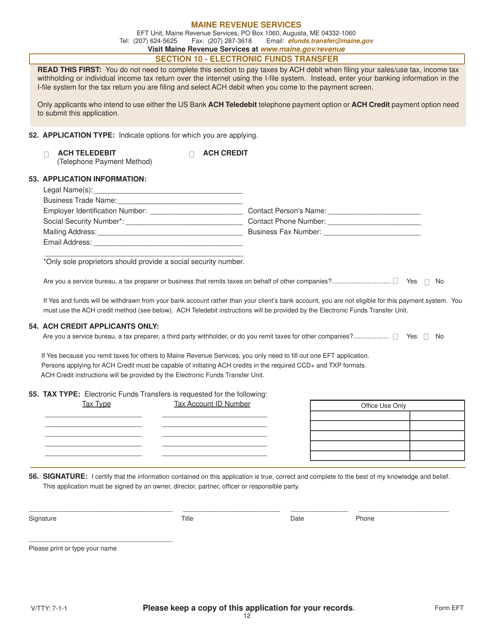

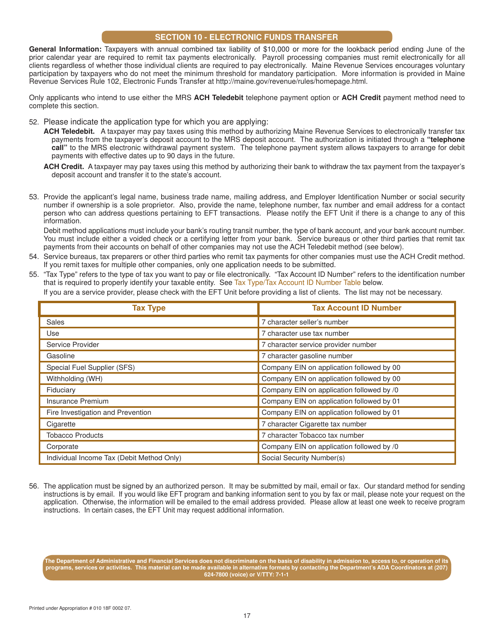

This form is used for applying for electronic funds transfer using the ACH credit/debit method in the state of Maine.

This Form is used for applying for electronic funds transfer using the ACH credit/debit method in the state of Maine.

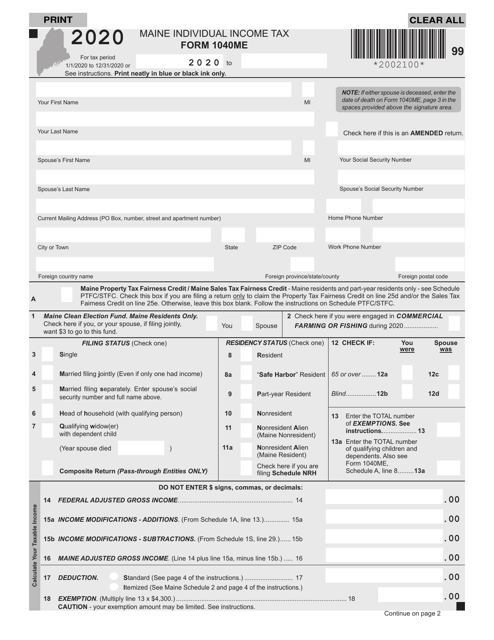

This type of document is used for filing individual income tax in the state of Maine.

This Form is used for filing individual income tax returns in the state of Maine. It is specifically designed for residents of Maine to report their income, deductions, and credits for the purpose of determining their state income tax liability.

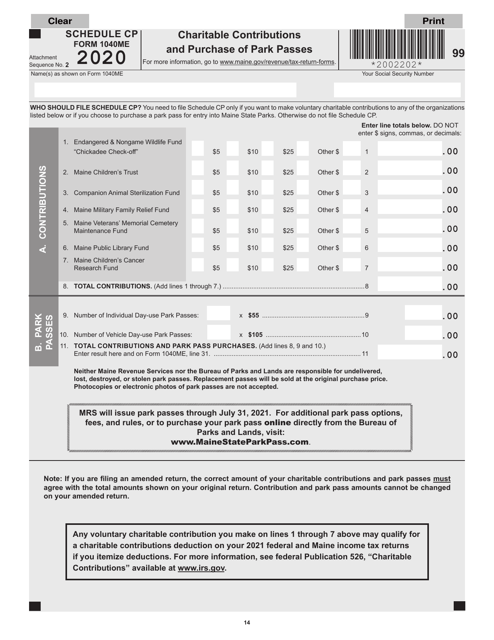

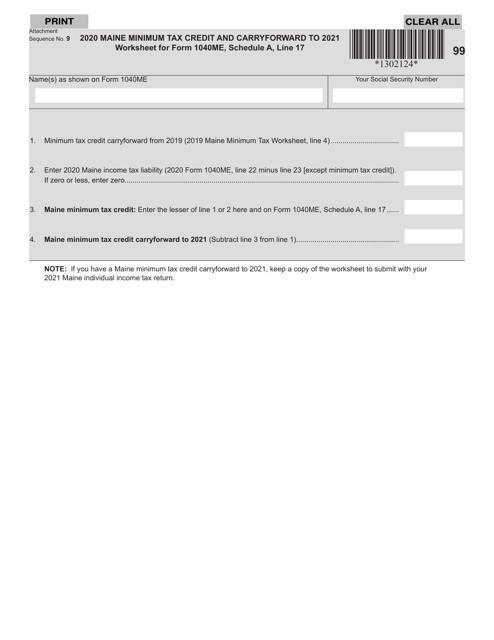

This form is used for reporting charitable contributions and the purchase of park passes in the state of Maine on the Maine tax return.

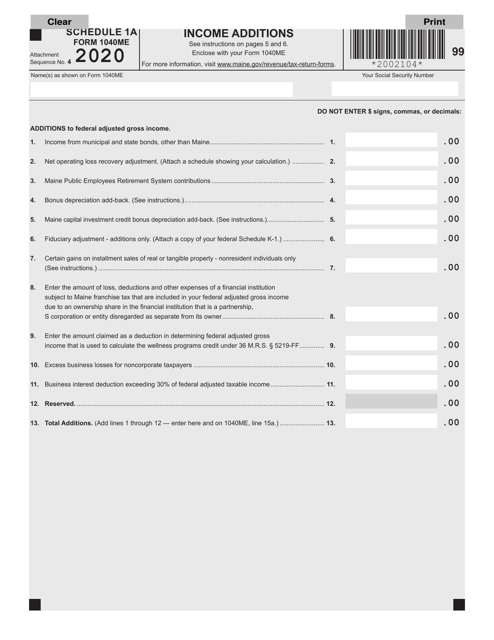

This form is used for reporting additional income additions for Maine residents filing the Form 1040ME. It helps taxpayers accurately include any income sources that need to be added to their overall income calculations.

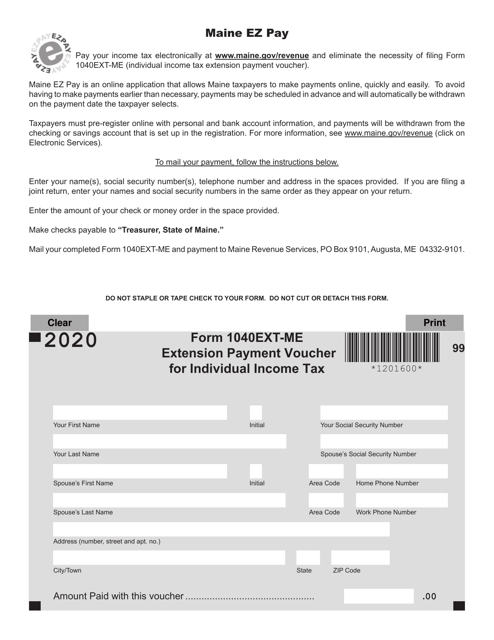

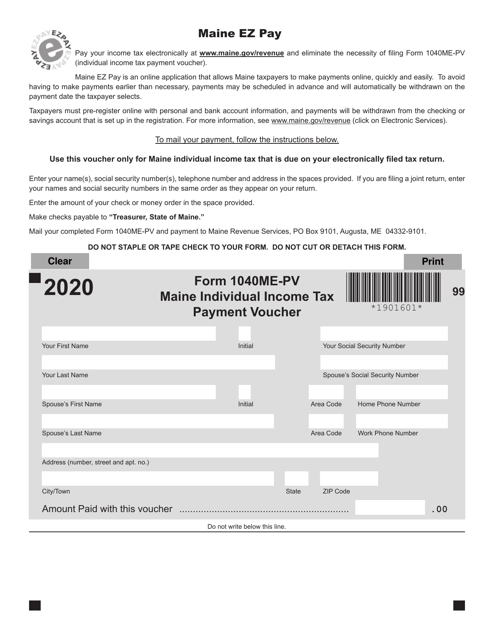

This form is used for making payment for Maine individual income tax.

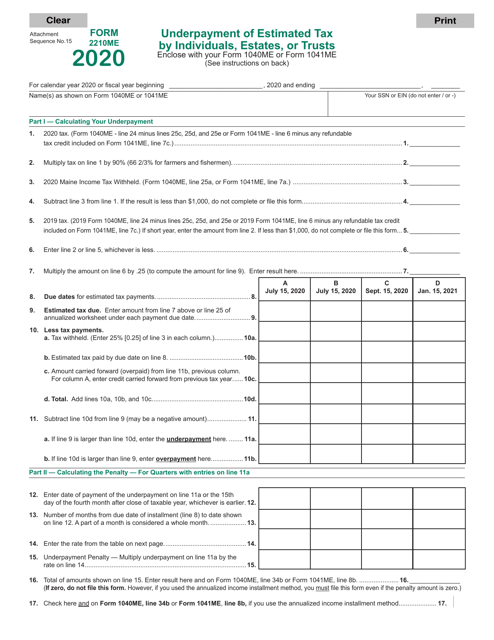

This form is used for calculating the underpayment of estimated tax by individuals, estates, or trusts in the state of Maine.

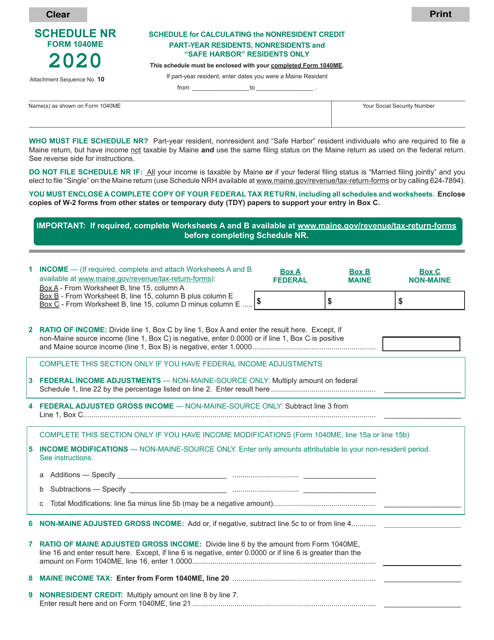

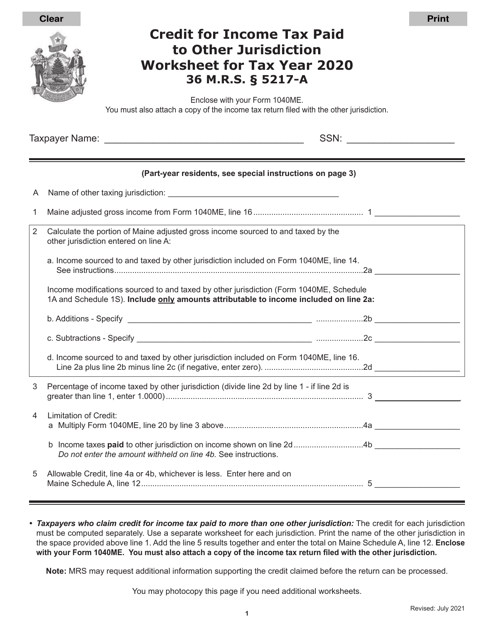

This form is used for calculating the nonresident credit for part-year residents, nonresidents, and "safe harbor" residents in Maine.

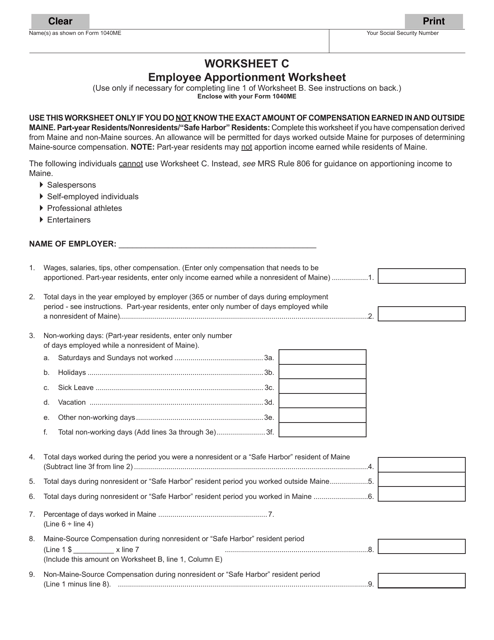

This form is used for calculating the apportionment of employees for tax purposes in the state of Maine.

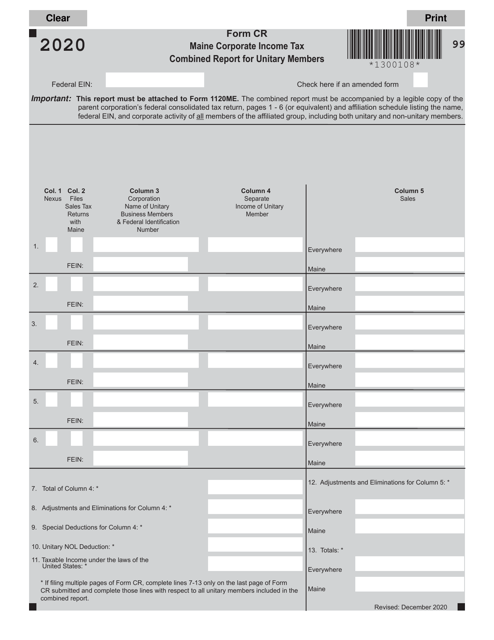

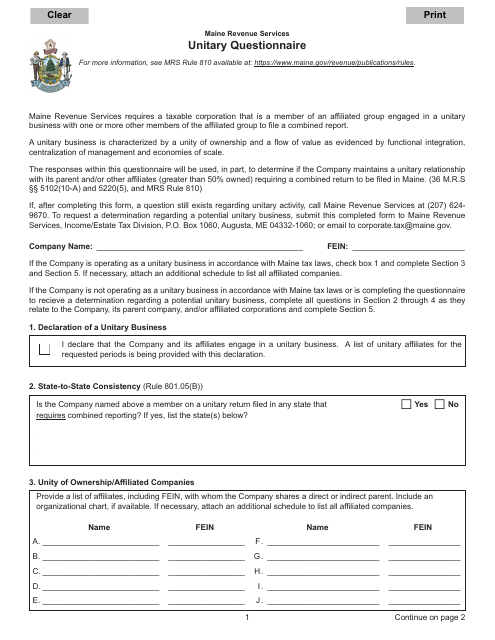

This form is used for submitting a combined report for unitary members in the state of Maine. It is required to report the combined income, deductions, and apportionment factors of all unitary members.

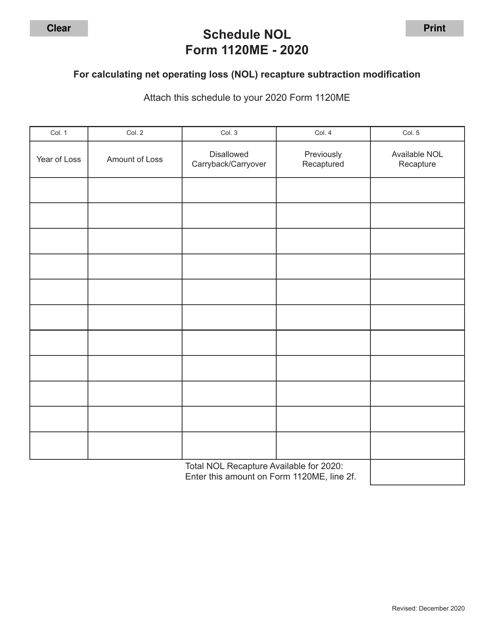

This form is used for calculating the Net Operating Loss (NOL) recapture subtraction modification in the state of Maine for businesses filing Form 1120ME.

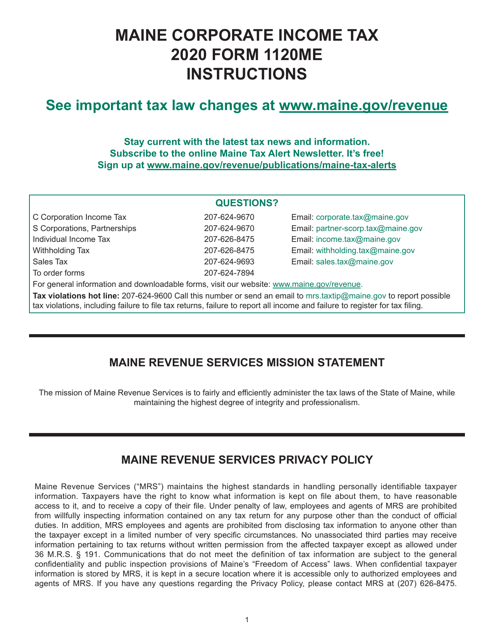

This form is used for filing corporate income tax returns for businesses in the state of Maine. It provides instructions on how to accurately fill out and submit Form 1120ME.