Fill and Sign Maine Legal Forms

Documents:

2481

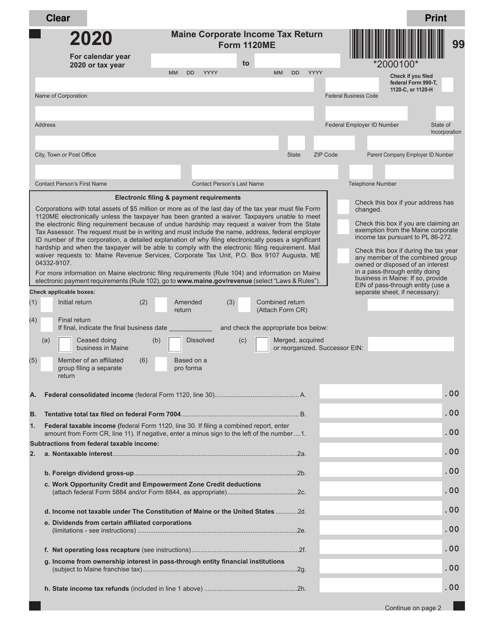

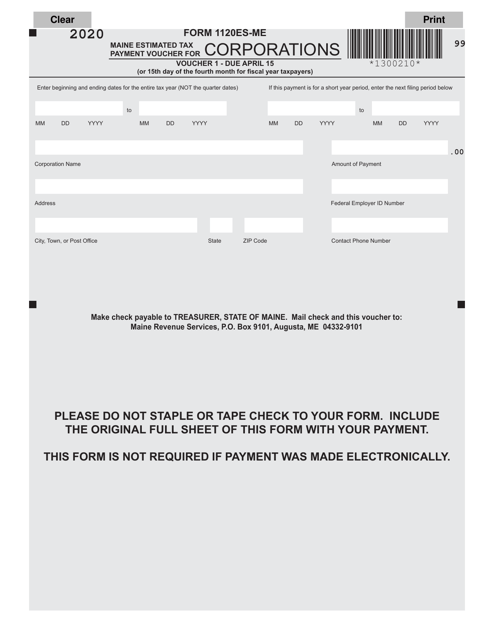

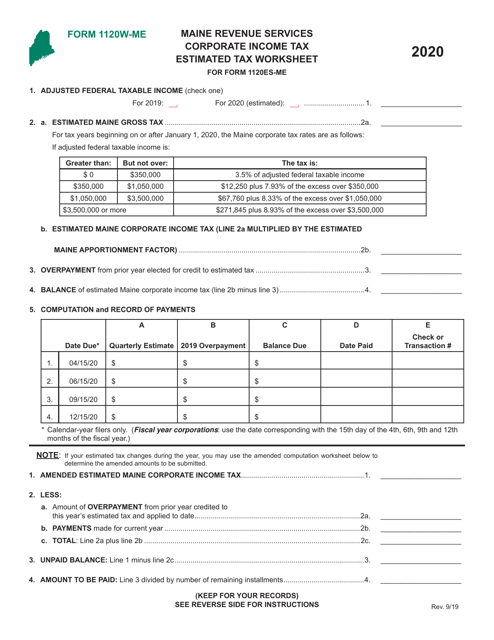

This form is used for filing the Maine Corporate Income Tax Return for businesses operating in the state of Maine.

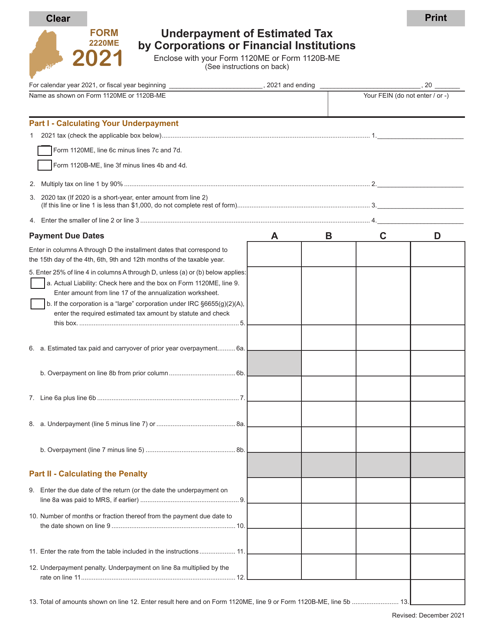

This form is used for calculating and reporting the underpayment of estimated tax by corporations and financial institutions in the state of Maine.

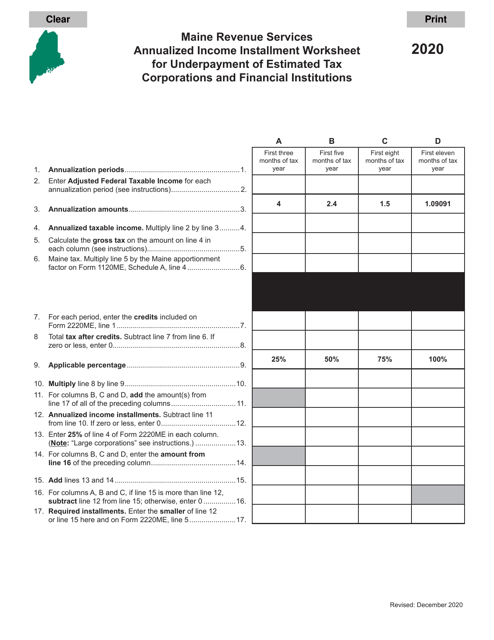

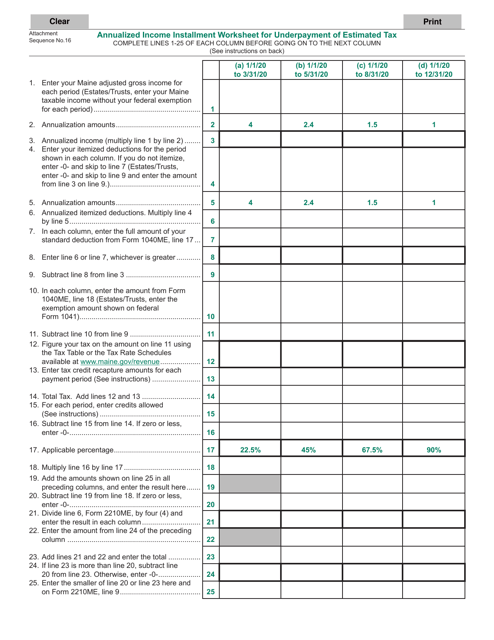

This document helps Maine residents calculate the amount of underpayment of estimated tax based on their annual income.

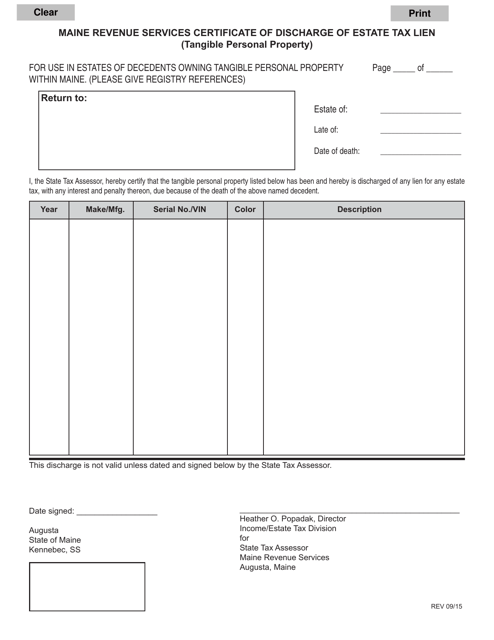

This document is a certificate issued by the Maine Revenue Services to discharge a lien on tangible personal property for estate taxes in the state of Maine.

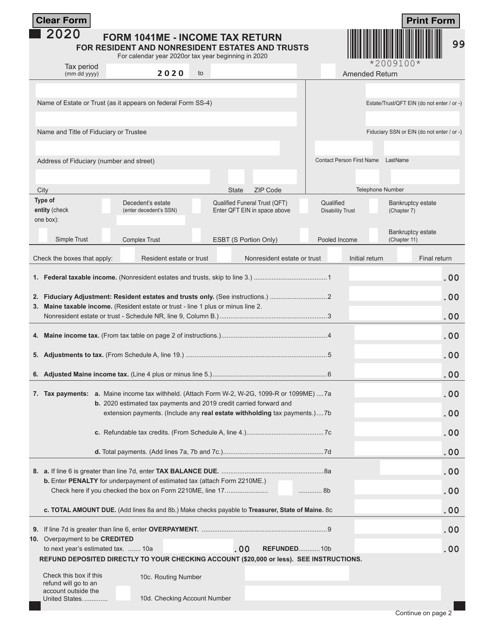

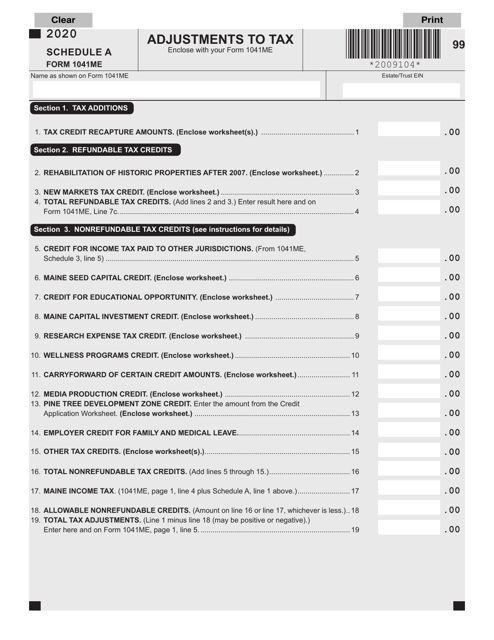

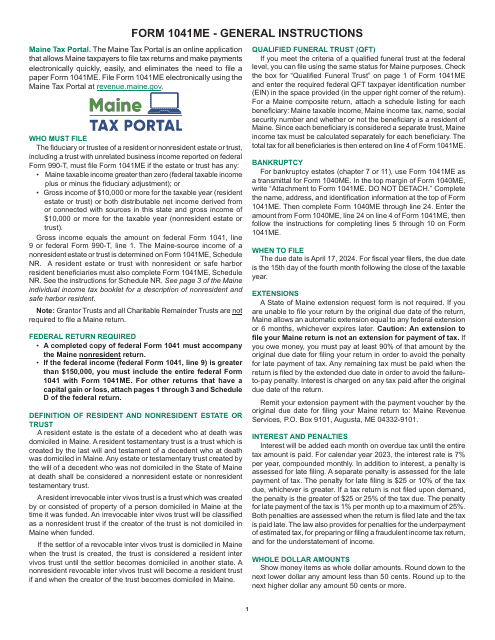

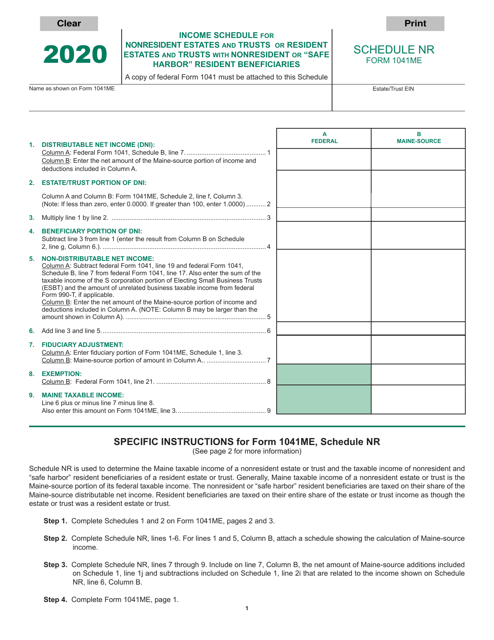

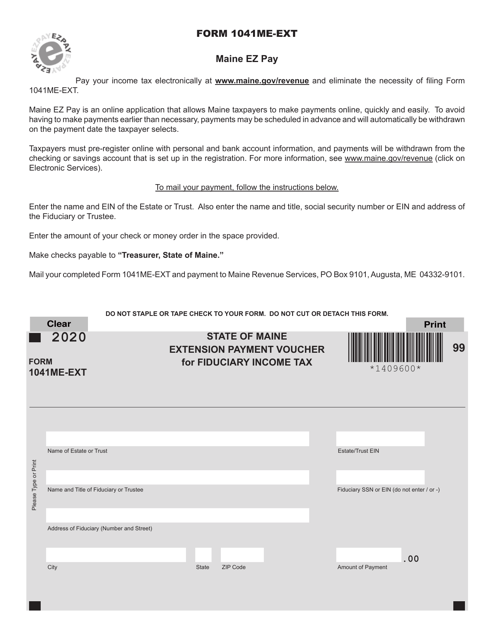

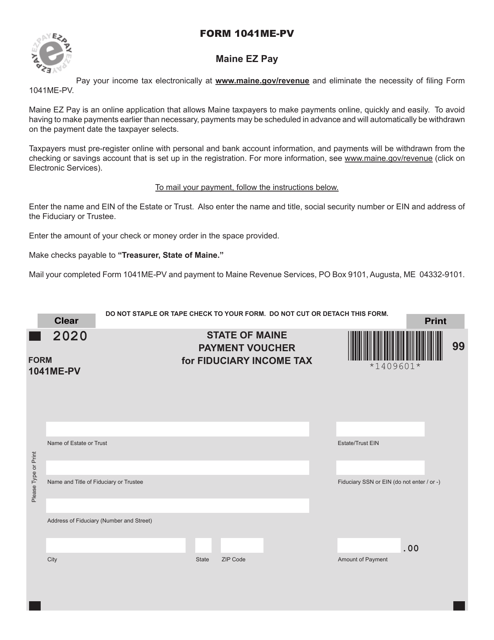

This form is used for making payments towards fiduciary income tax in the state of Maine.

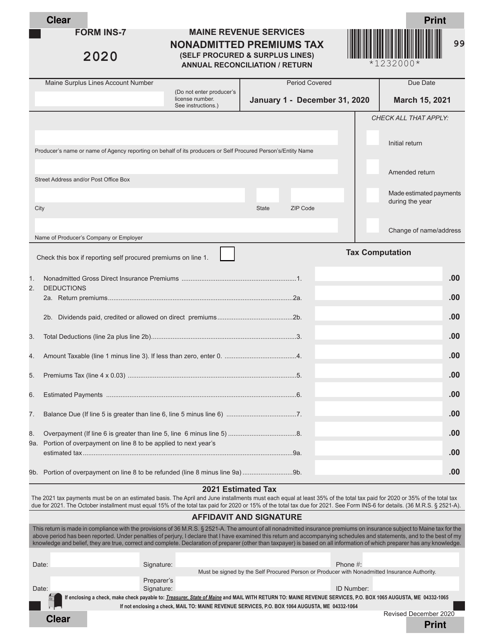

This form is used for the annual reconciliation and return of nonadmitted premiums tax for self-procured and surplus lines insurance in the state of Maine.

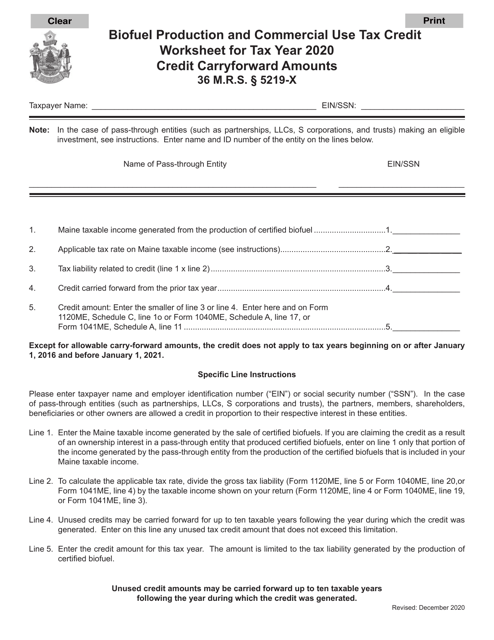

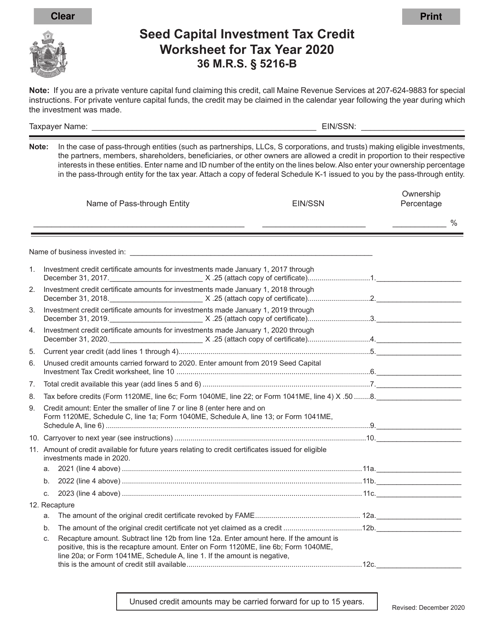

This document is a worksheet used in Maine to calculate tax credits for the production and commercial use of biofuels. It helps individuals and businesses determine their eligibility for tax credits related to biofuel production and use.

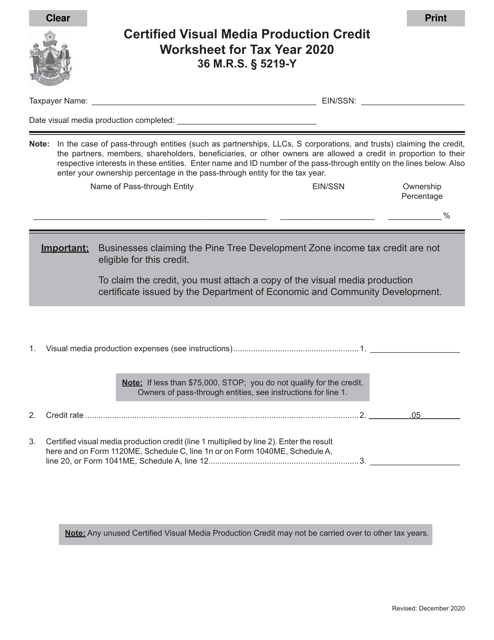

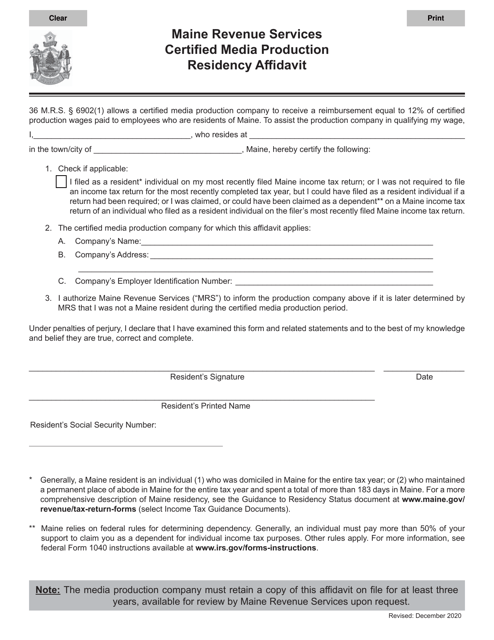

This document is used for calculating certified visual media production credits in the state of Maine.

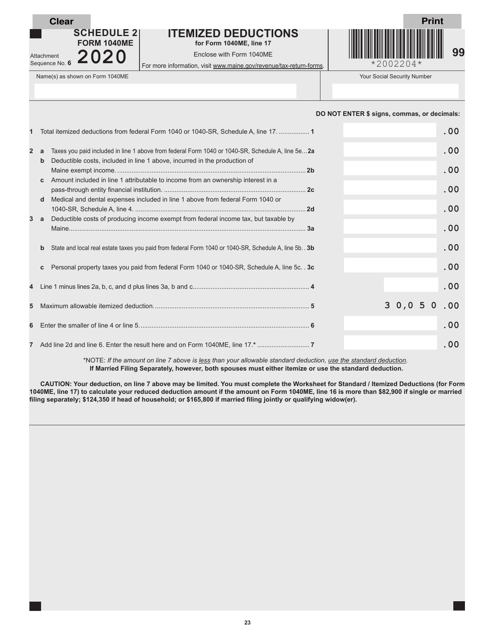

This document is for residents of Maine to report itemized deductions on their state income tax return.

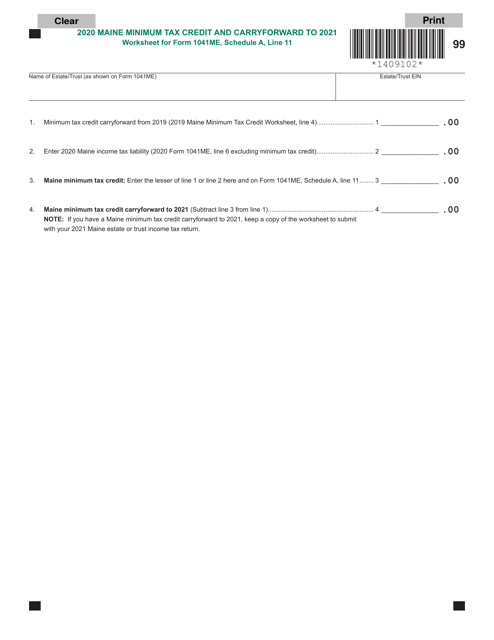

This Form is used for calculating the minimum tax credit for individuals in the state of Maine.

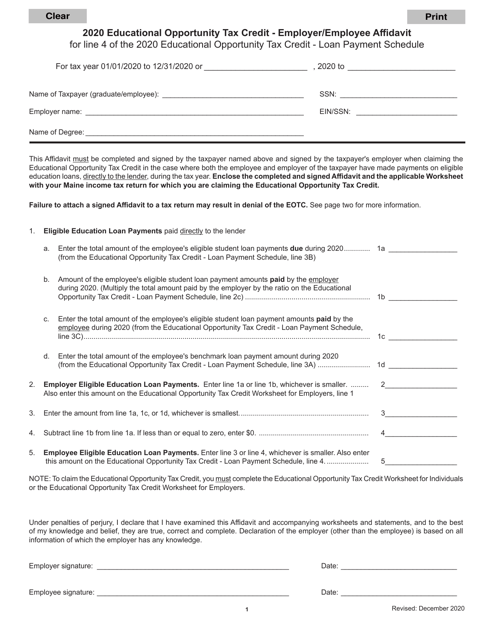

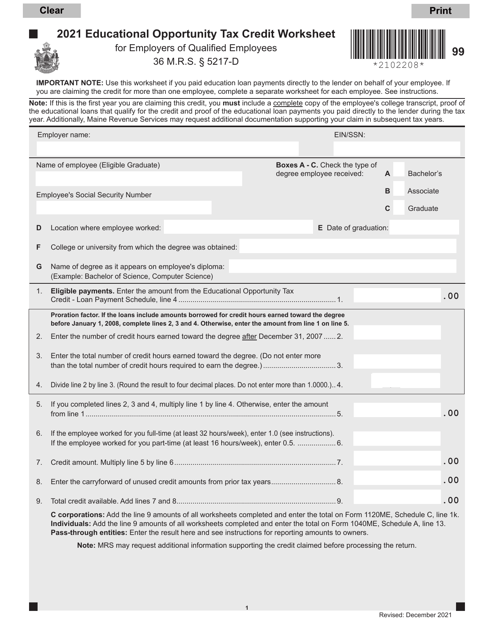

This document is for employers and employees in Maine who are applying for the Educational Opportunity Tax Credit. It is an affidavit form specifically for Line 4 of the tax credit application. It may be used to provide proof of employer contributions towards the employee's education loan payments.

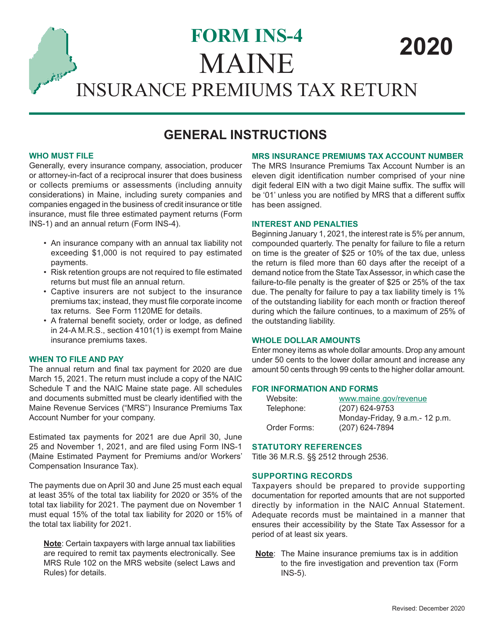

This Form is used for reporting and paying insurance premiums tax in the state of Maine. It is filed by insurance companies to report their taxable premiums and calculate the amount of tax owed to the state.

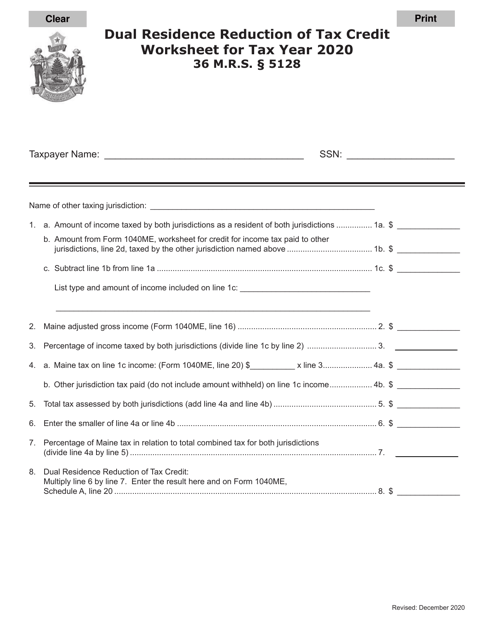

This document helps Maine residents determine their eligibility for the Dual Residence Reduction of Tax Credit. It provides a worksheet that allows residents to calculate the amount of credit they may be able to claim on their taxes.

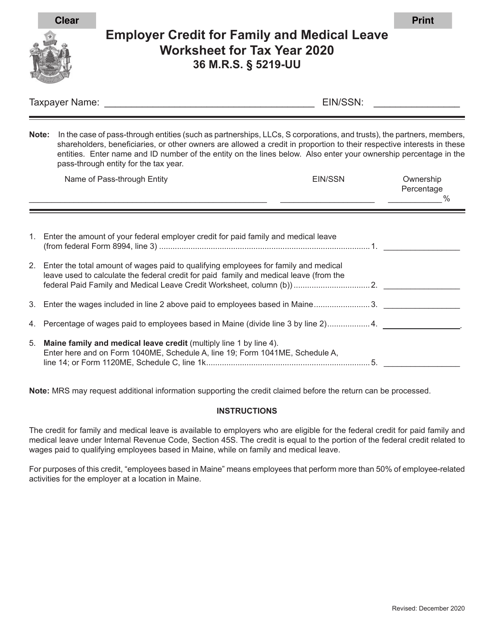

This worksheet is used by employers in Maine to calculate the credit for family and medical leave. The credit is a tax incentive designed to encourage employers to provide paid leave for their employees.

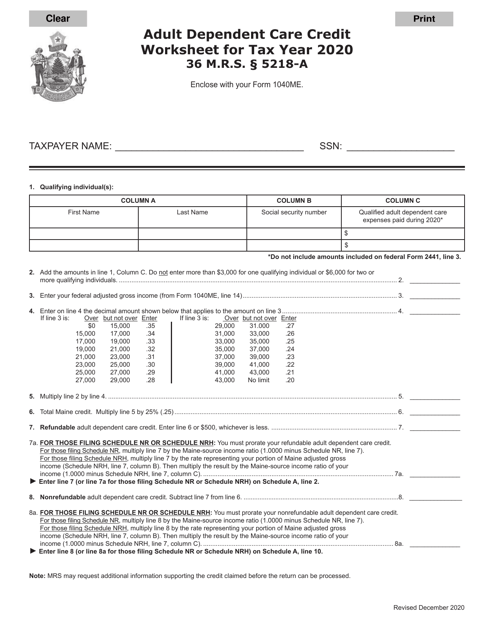

This document is used for calculating the Adult Dependent Care Credit in the state of Maine.

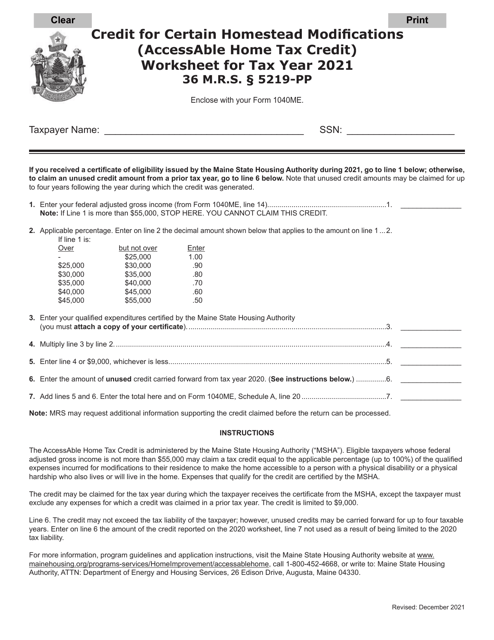

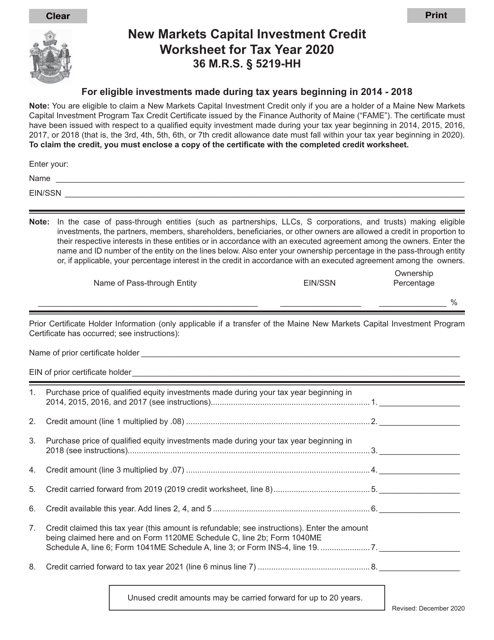

This document is a worksheet used in Maine for calculating tax credits related to capital investments in new markets.

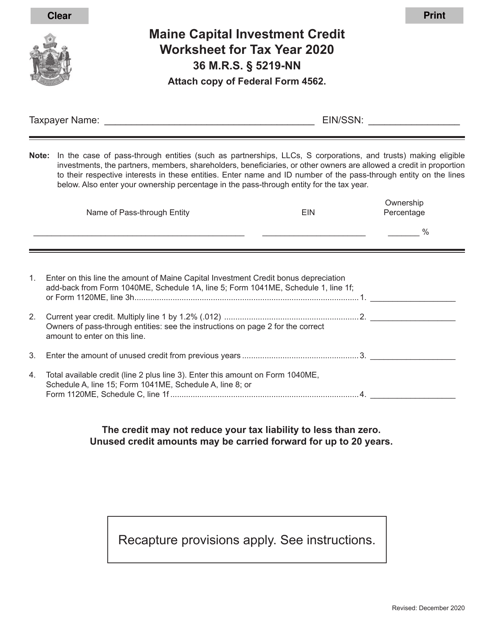

This document is used for calculating the capital investment credit in the state of Maine. It helps individuals and businesses determine the amount of credit they may be eligible for based on their qualified investments in certain industries.

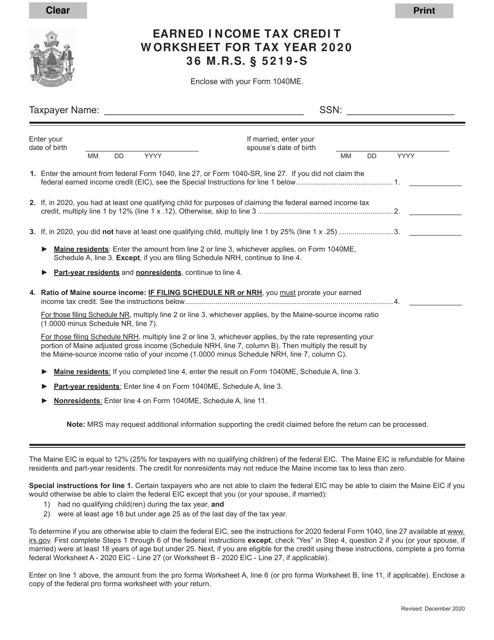

This document is used for calculating the Earned Income Tax Credit in the state of Maine. It provides a worksheet to help residents determine their eligibility and calculate the amount of credit they may qualify for.

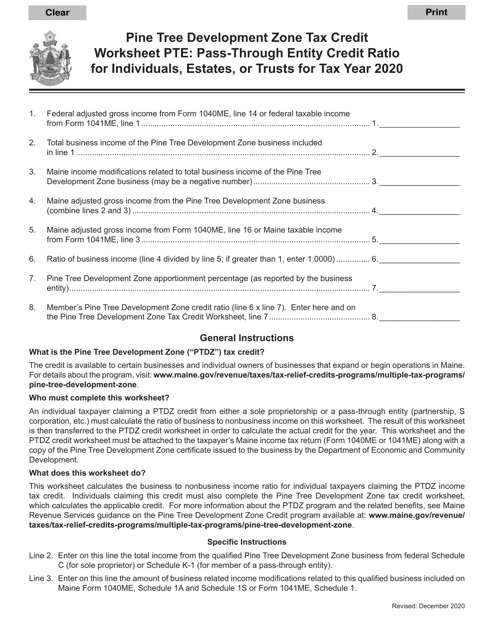

This document is used for calculating the PTE credit ratio for individuals claiming the Pine Tree Development Zone tax credit in Maine.

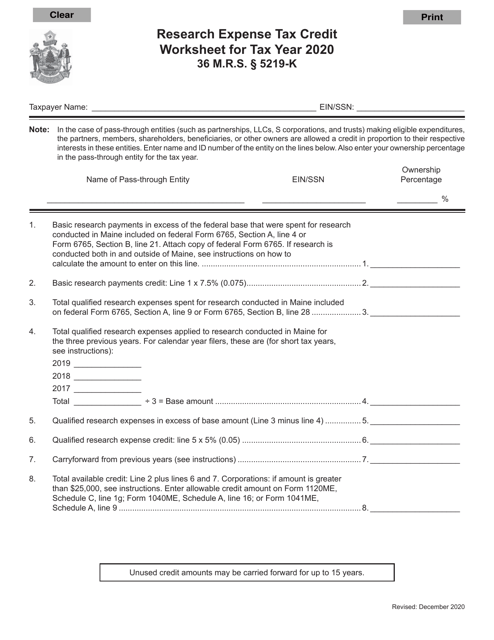

This document is a worksheet used in Maine to calculate the tax credit for investments in seed capital. It helps individuals determine the amount of credit they are eligible for based on their investment amount.

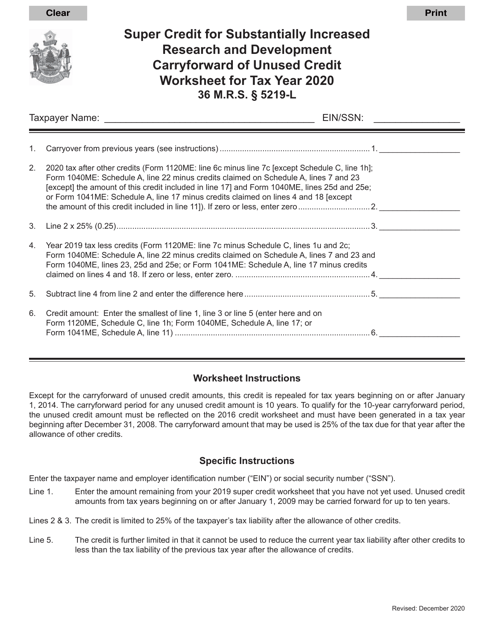

This Form is used for calculating the Super Credit for substantially increased research and development carryforward of unused credit in the state of Maine.

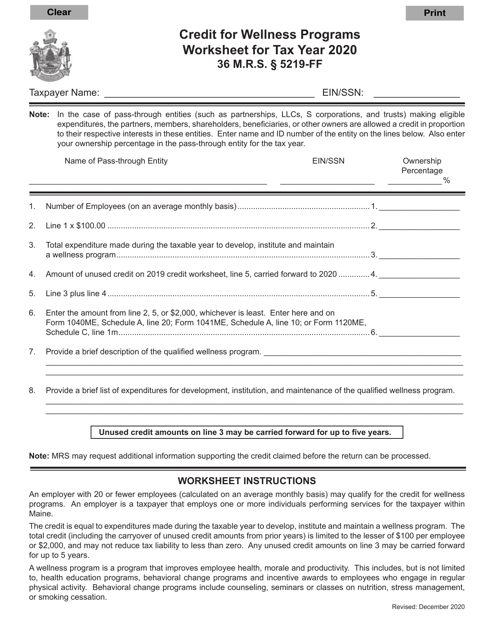

This form is used for calculating and claiming tax credits for wellness programs in the state of Maine. It helps businesses and organizations track and document their spending on employee wellness initiatives.