Internal Revenue Service Forms and Templates

Documents:

273

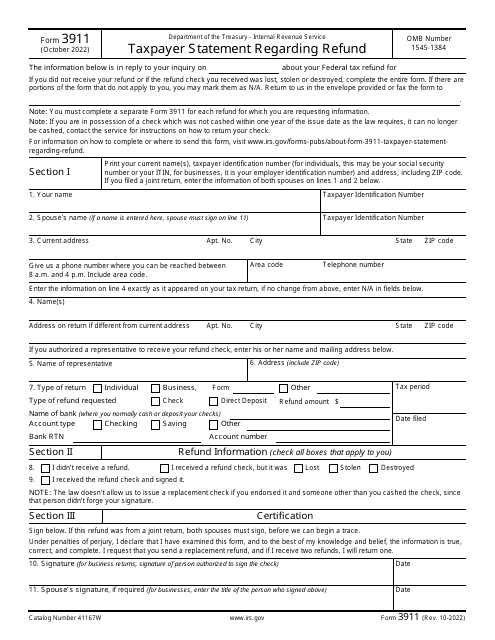

This is an IRS legal document completed by individuals who want to inquire about the status of an expected tax refund.

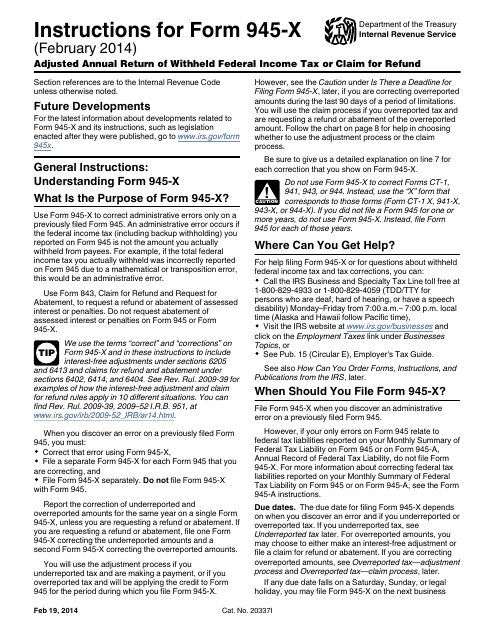

This Form is used for making adjustments to the annual return of withheld federal income tax or claiming a refund. It is specifically designed for the IRS Form 945-X.

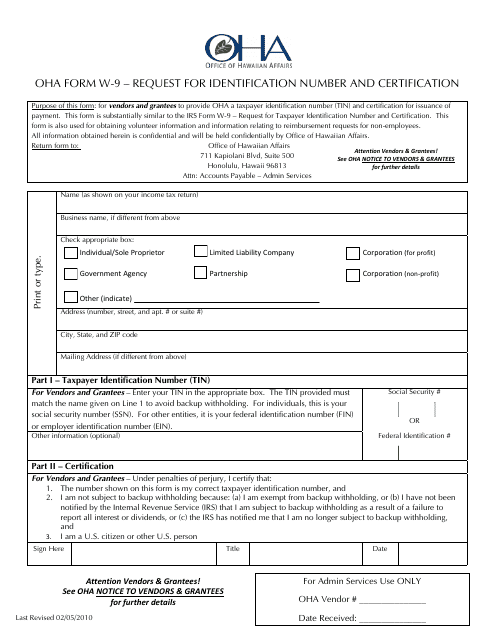

This Form is used for requesting identification number and certification in the state of Hawaii.

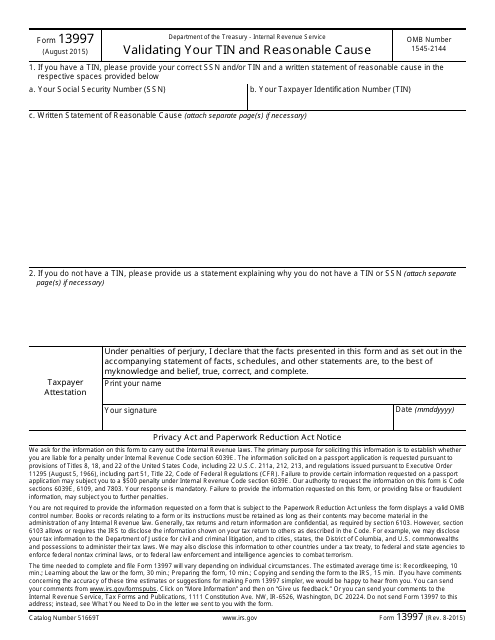

This Form is used for validating your Taxpayer Identification Number (TIN) and providing a reasonable cause explanation.

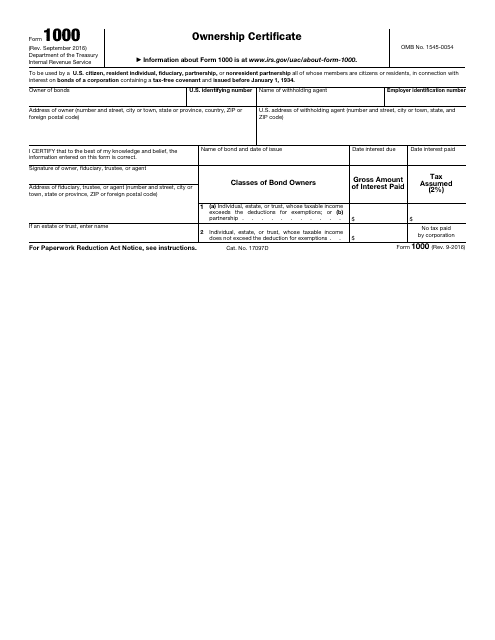

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

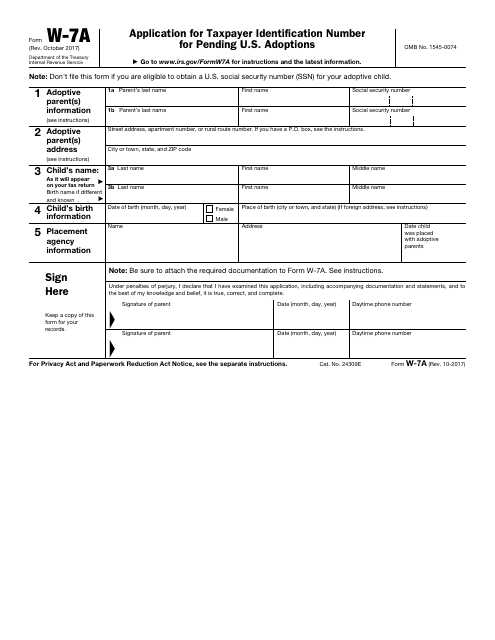

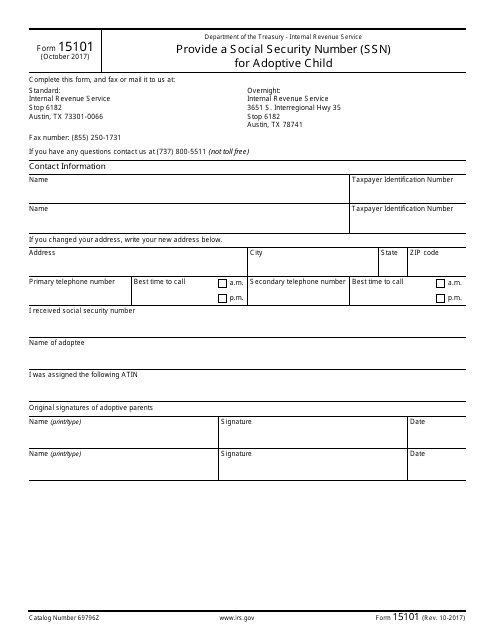

This form is used for applying for a taxpayer identification number for pending U.S. adoptions. It is required to establish the adoptive parent's identity for tax purposes.

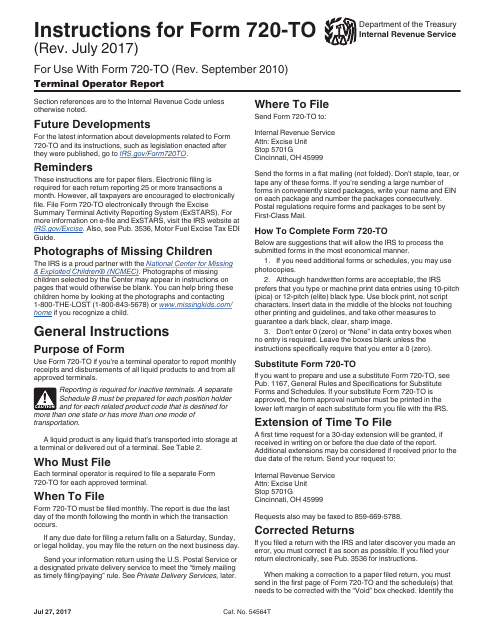

This document is for reporting activities of terminal operators to the IRS.

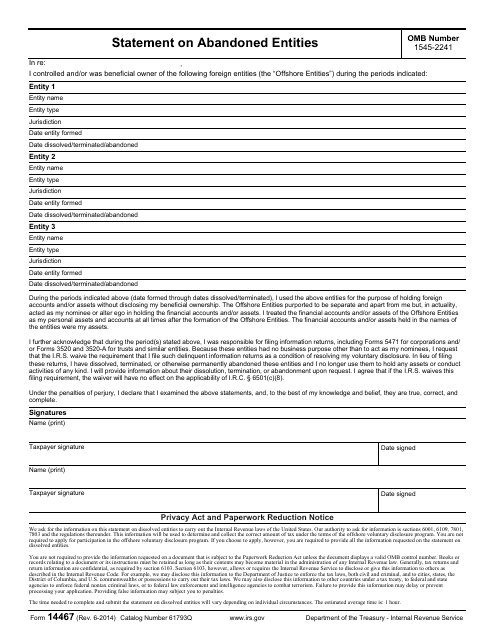

This document is a statement used by the IRS to report abandoned entities.

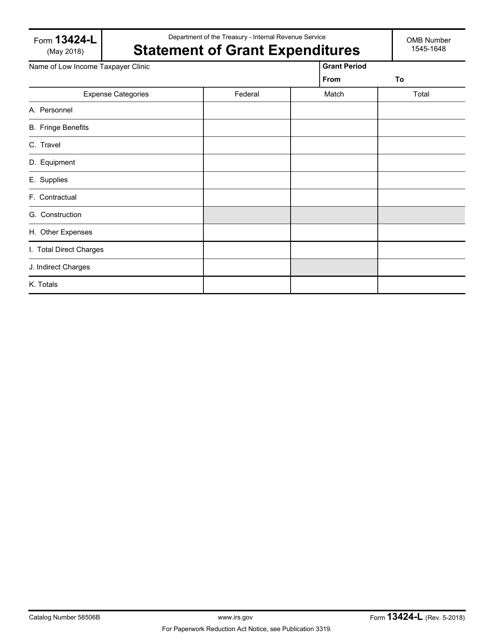

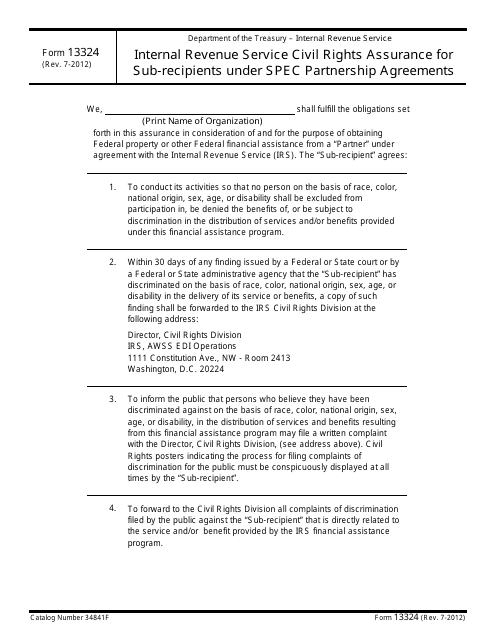

This form is used for subrecipients under specified partnership agreements to provide assurance of civil rights compliance with the Internal Revenue Service (IRS).

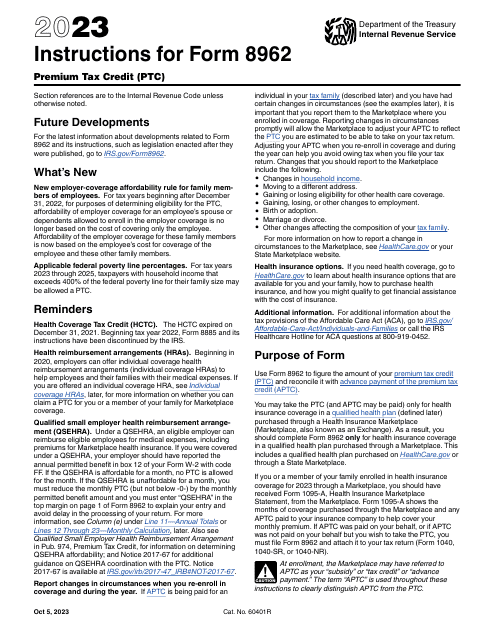

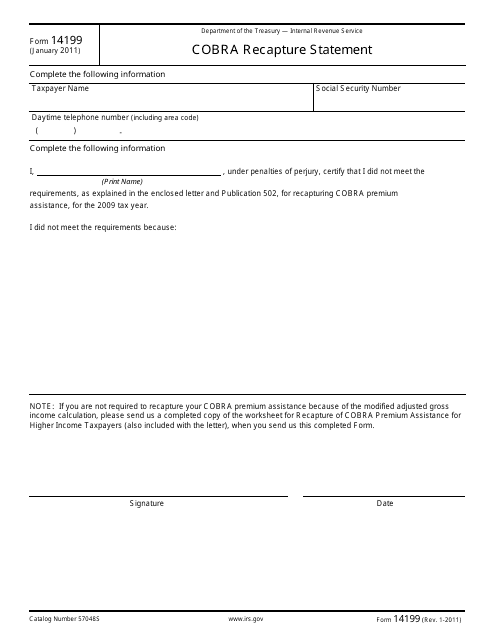

This Form is used for reporting and reconciling excess premiums paid for COBRA coverage.

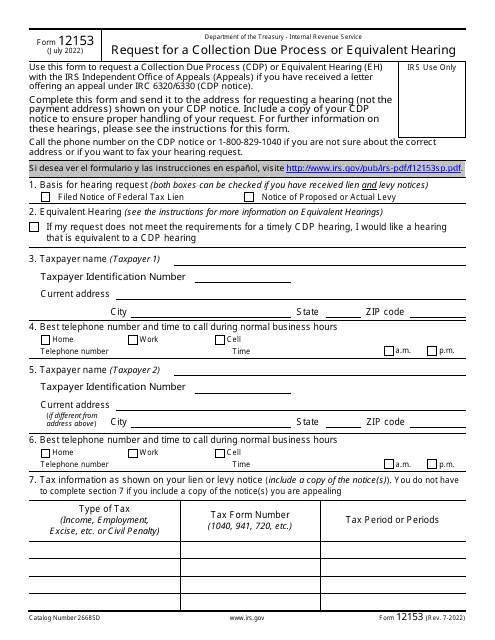

This is a fiscal form filled out by a taxpayer to appeal an upcoming tax levy or lien.

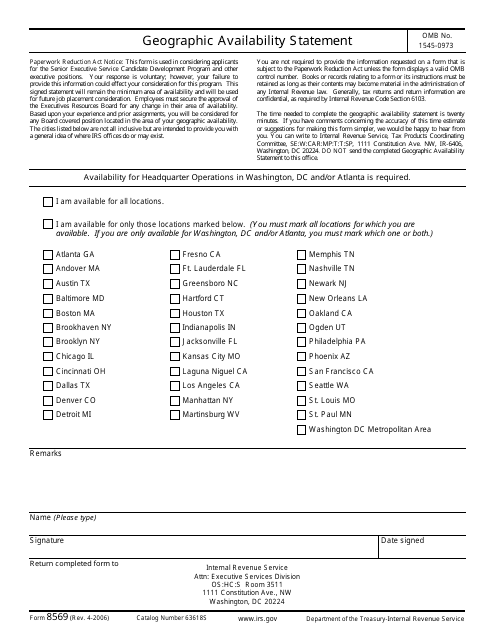

This form is used for providing information about the geographic availability of services provided by an organization to the Internal Revenue Service (IRS).

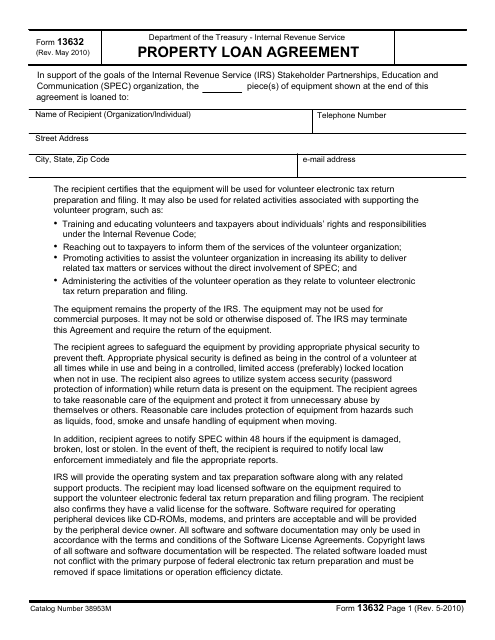

This document is used for property loan agreements with the Internal Revenue Service (IRS).

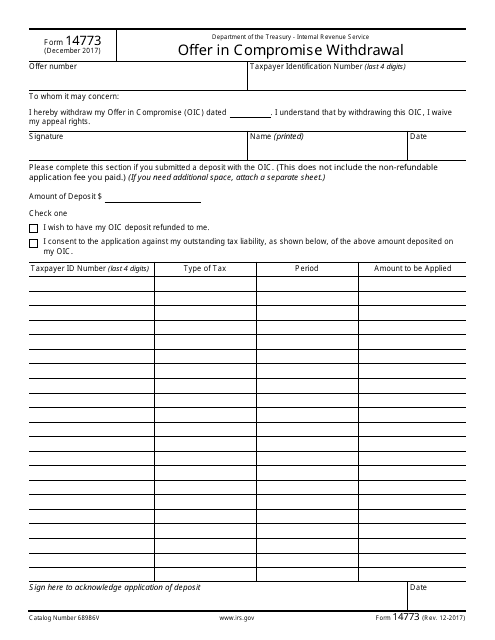

This Form is used for withdrawing an offer in compromise with the Internal Revenue Service (IRS).

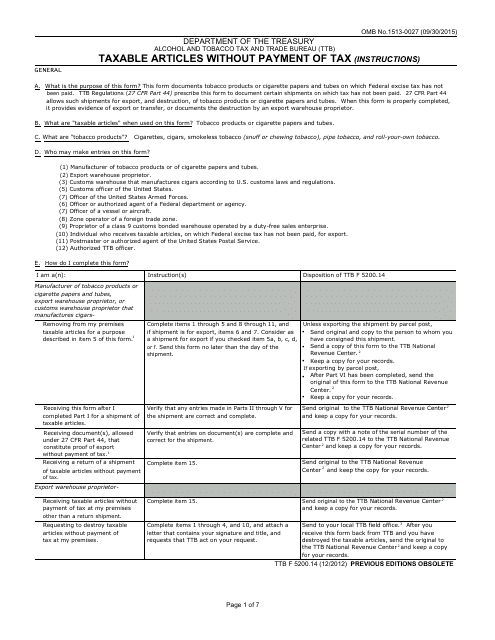

This document is used for reporting the taxable articles that are not paid for with tax.

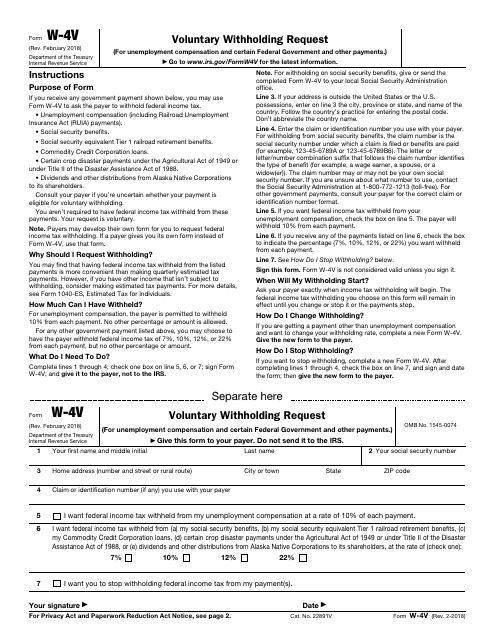

This is a fiscal document used by recipients of government payments to secure tax deductions from those amounts before the payments are sent to them.

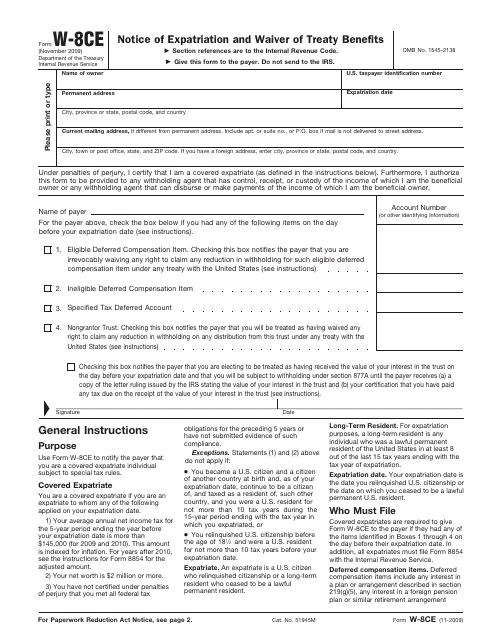

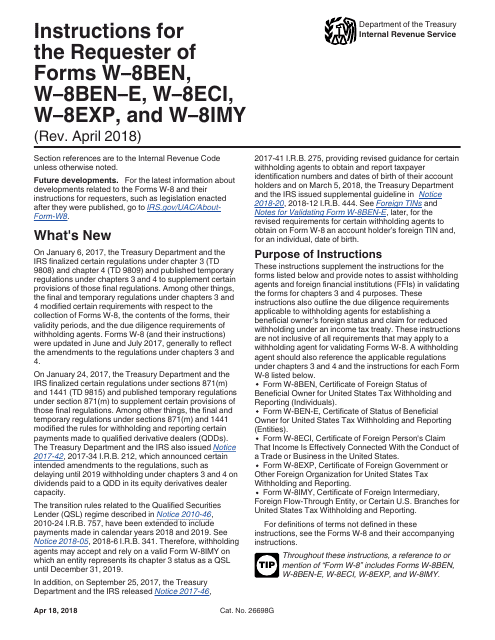

This document provides instructions for various IRS forms including W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. These forms are used to certify the foreign status of the taxpayer and claim eligibility for tax treaty benefits, exemption from withholding, or reduced withholding rates. The instructions guide taxpayers on how to complete these forms correctly and provide required information to the IRS.

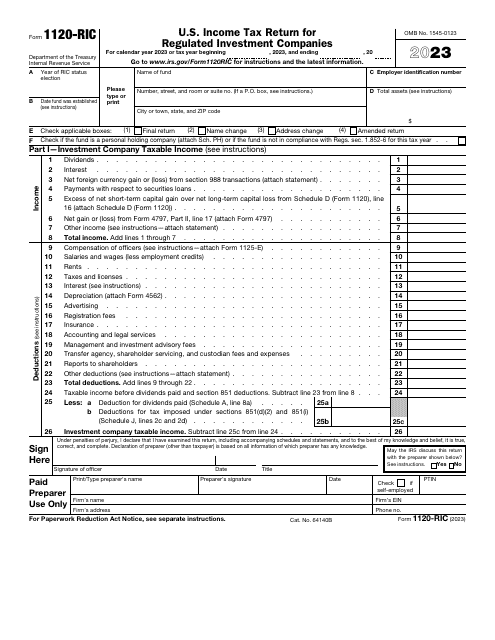

This is a fiscal form used by regulated investment companies to inform the government about their revenue over the course of the tax year, describe their losses and gains, claim tax deductions and credits, and compute their tax liability correctly.

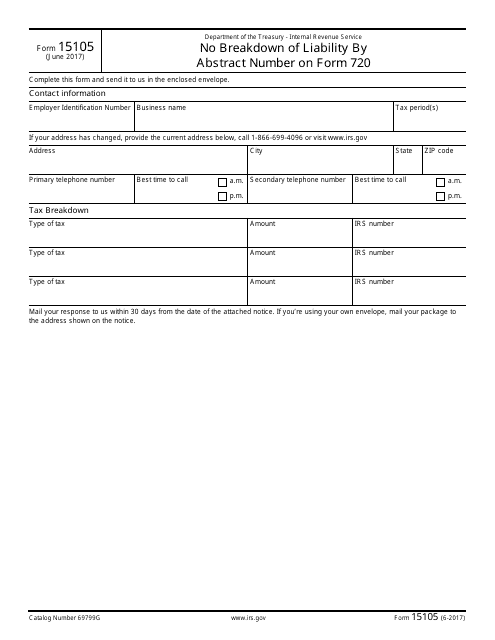

This type of document, IRS Form 15105, does not provide a breakdown of liability by abstract number on Form 720.