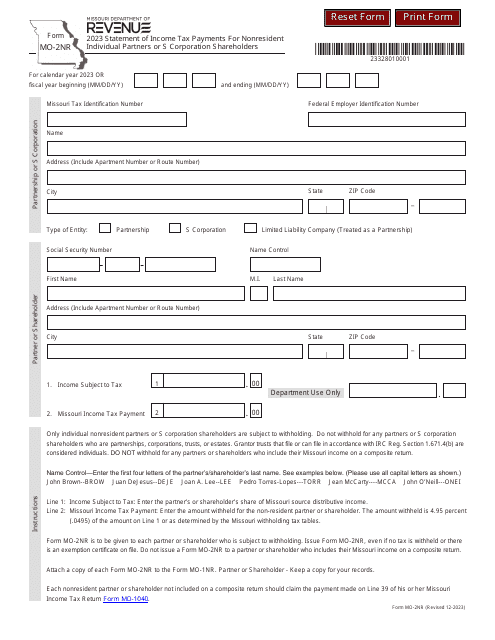

State Tax Forms and Templates

Documents:

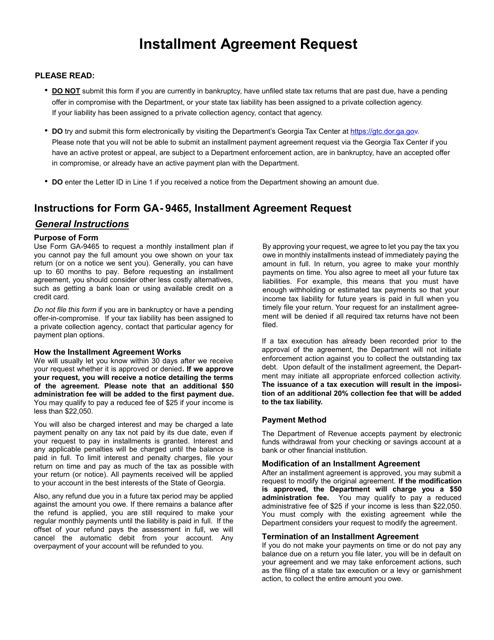

933

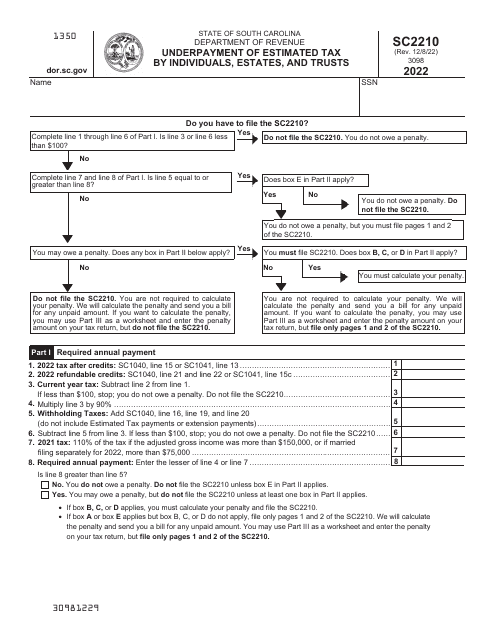

Form SC2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts - South Carolina, 2022

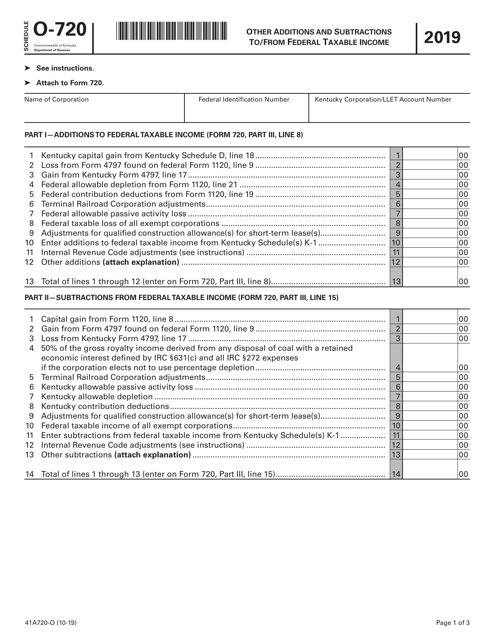

This form is used for reporting other additions and subtractions to or from federal taxable income for residents of Kentucky on their state tax return.

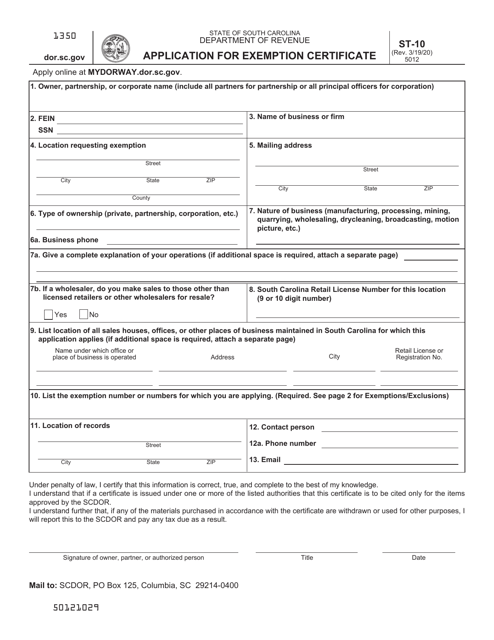

This form is used for applying for an exemption certificate in South Carolina.

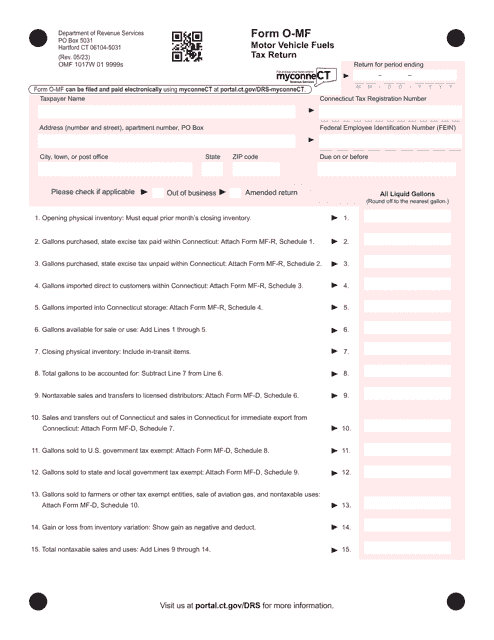

This document provides tax information for motor vehicle dealers in Florida. It covers topics such as sales tax, registration fees, and dealer licensing requirements.

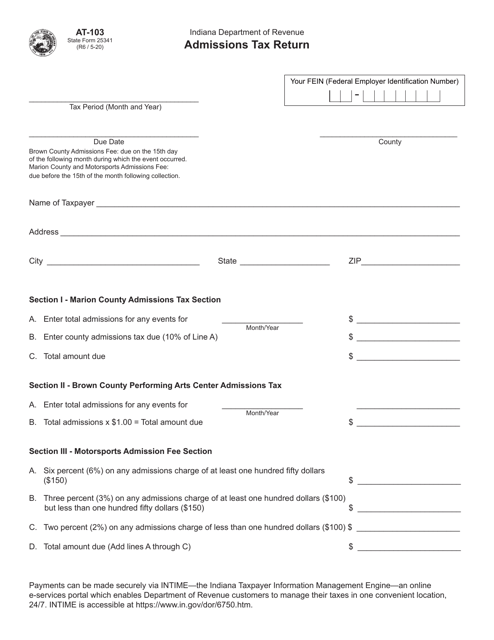

This Form is used for filing the Admissions Tax Return in the state of Indiana.

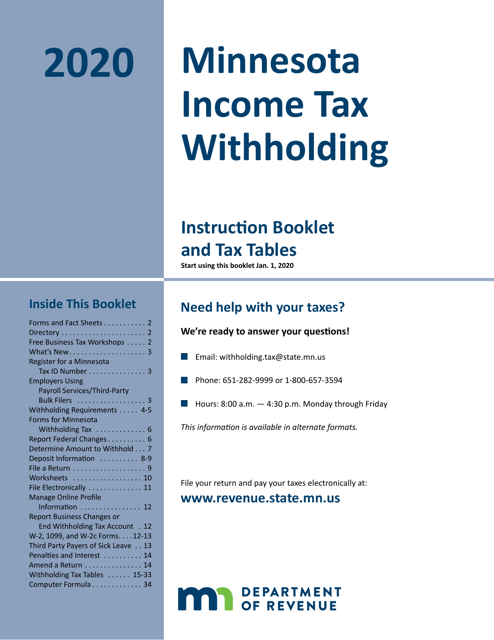

This type of document is the Minnesota Income Tax Withholding form, which is used to determine the amount of state income tax that employers should withhold from employees' paychecks in Minnesota.

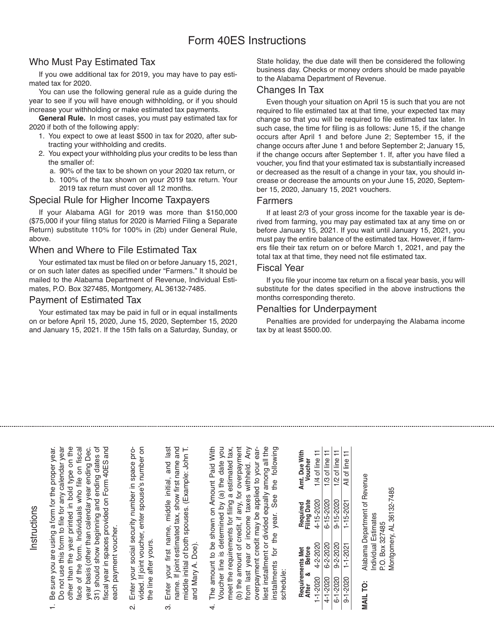

This form is used for making estimated income tax payments in Alabama. It provides instructions for filling out and submitting the Form 40ES voucher.

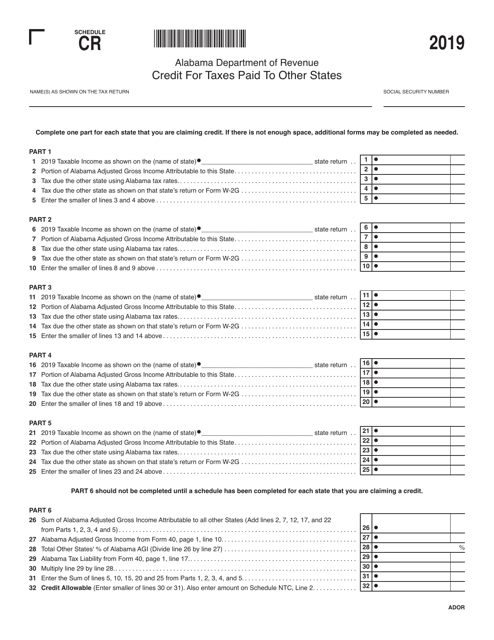

This form is used for claiming a credit for taxes paid to other states if you are a resident of Alabama.

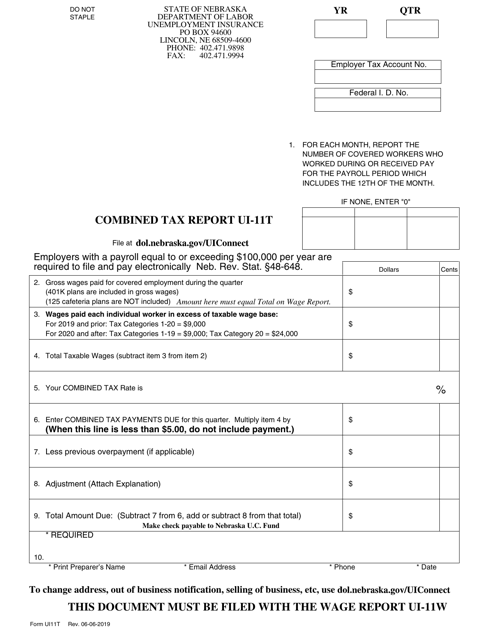

This document is used for filing a combined tax report in Nebraska. It is known as Form UI-11T.

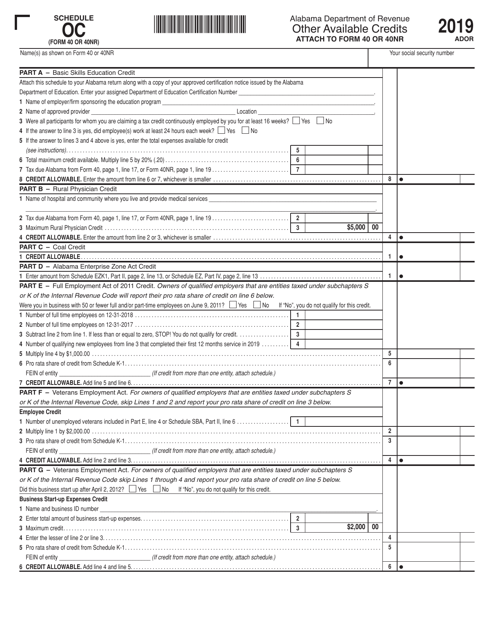

This document is used for reporting Other Available Credits for Alabama state taxes. It allows taxpayers to claim credits that are not listed on other tax forms.

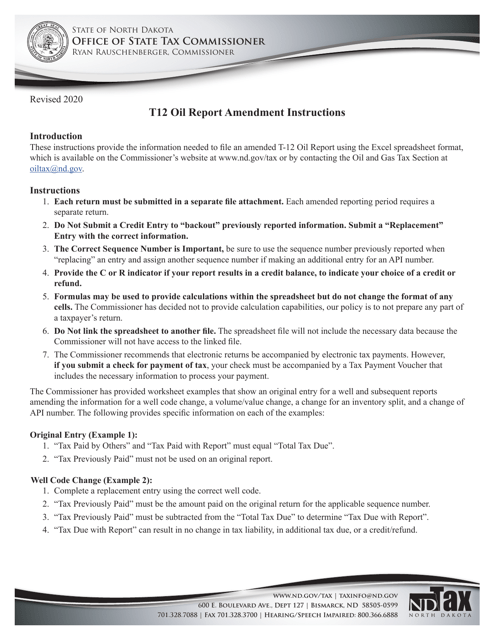

This Form is used for reporting oil gross production and oil extraction tax in North Dakota. It provides instructions on how to complete the T-12 Oil Gross Production and Oil Extraction Tax Report.

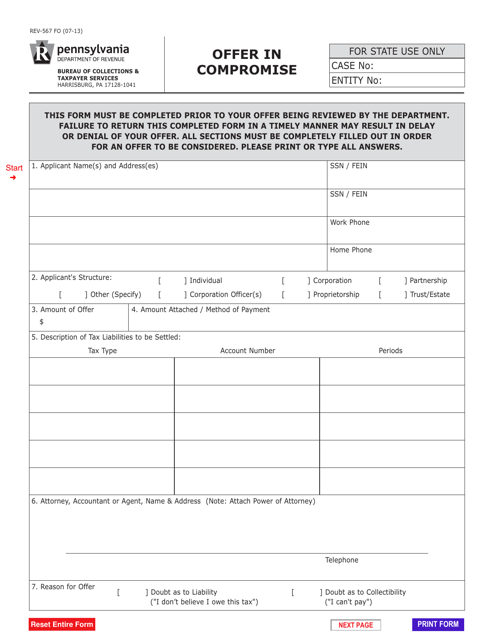

This Form is used for making an offer in compromise with the state of Pennsylvania to settle your tax debt for less than the full amount owed.

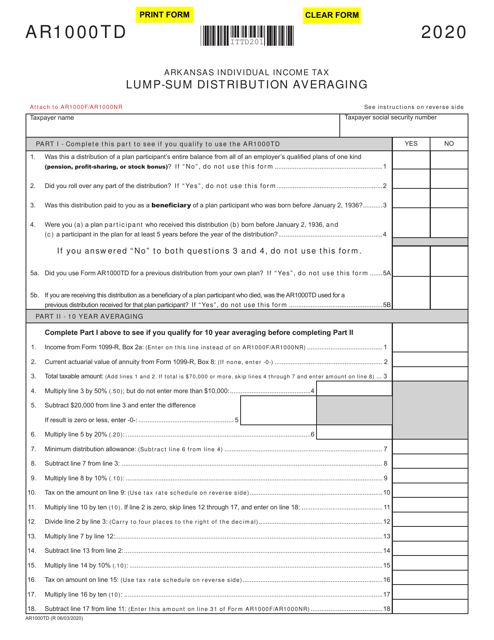

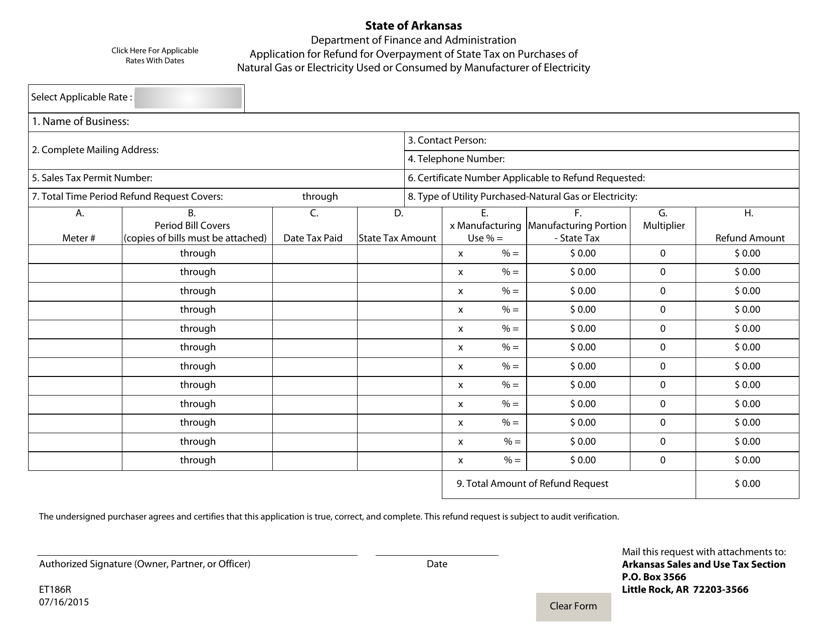

This form is used for applying for a refund for overpayment of state tax on purchases of natural gas or electricity used or consumed by a manufacturer of electricity in Arkansas.