State Tax Forms and Templates

Documents:

933

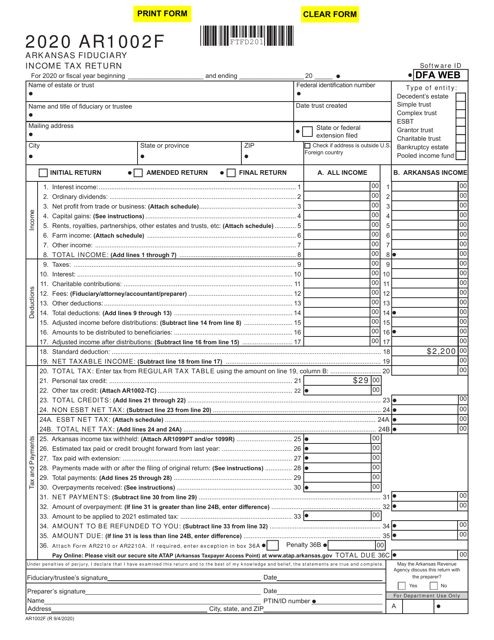

This Form is used for filing the Arkansas Fiduciary Income Tax Return for residents of Arkansas who have income from a trust or estate.

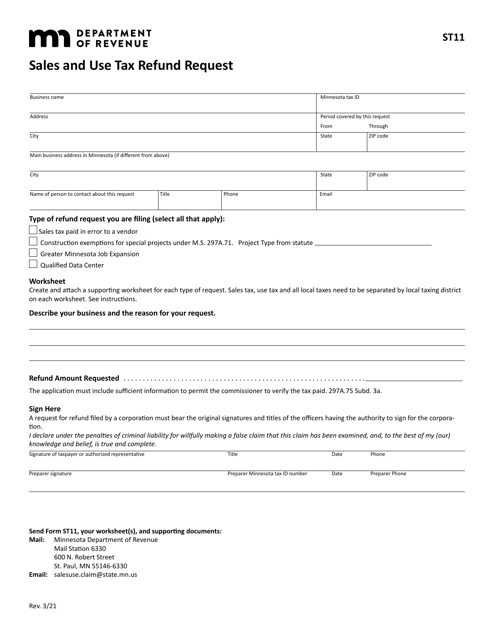

This form is used for requesting a refund of sales and use tax in the state of Minnesota.

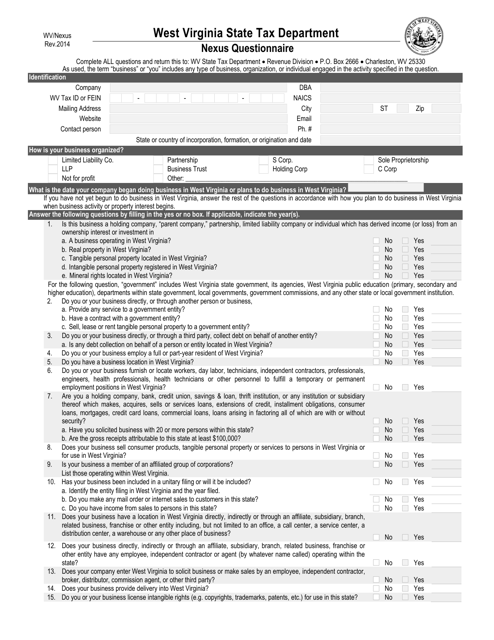

This document is for the West Virginia State Tax Department in West Virginia.

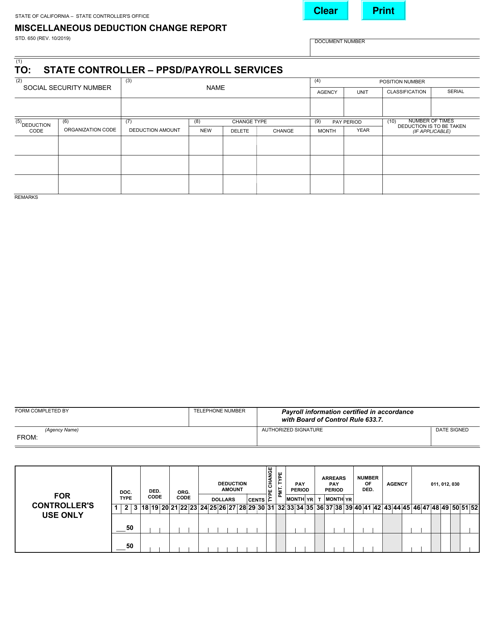

This form is used for reporting changes in miscellaneous deductions in the state of California.

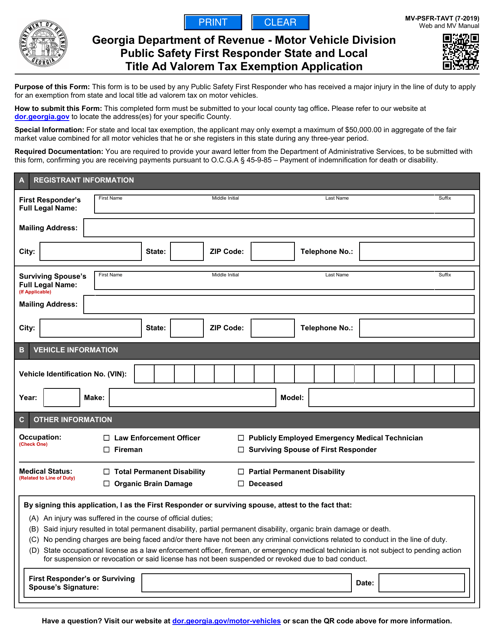

This Form is used for applying for the Public Safety First Responder State and Local Title Ad Valorem Tax (TAVT) Exemption in the state of Georgia.

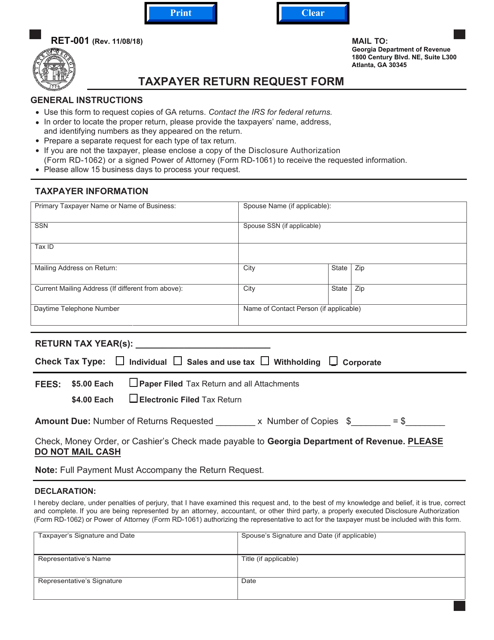

This form is used for requesting taxpayer return in the state of Georgia, United States.

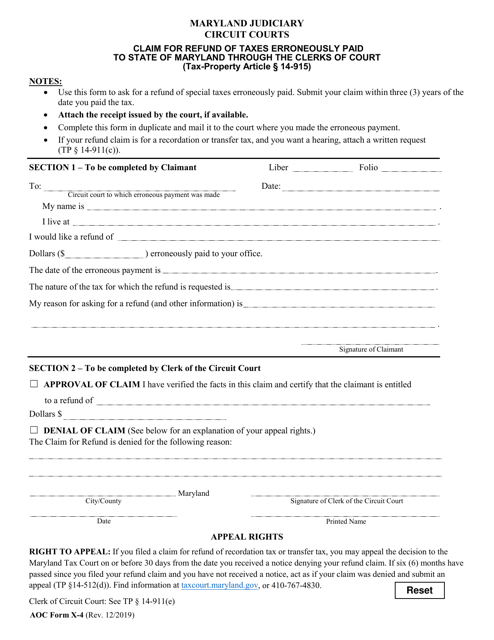

This form is used for claiming a refund of taxes that were mistakenly paid to the State of Maryland through the Clerks of Court.

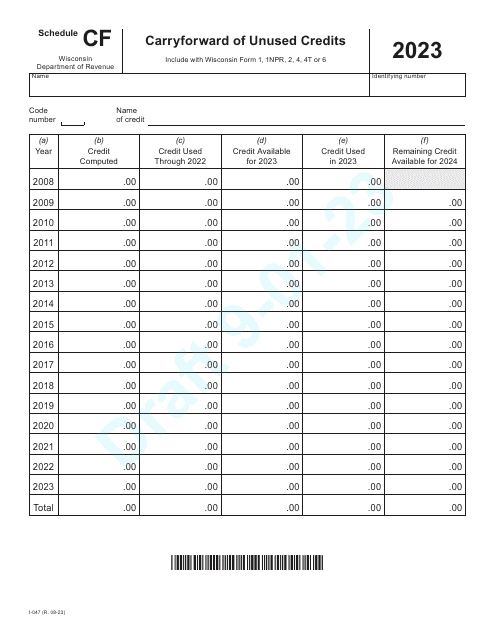

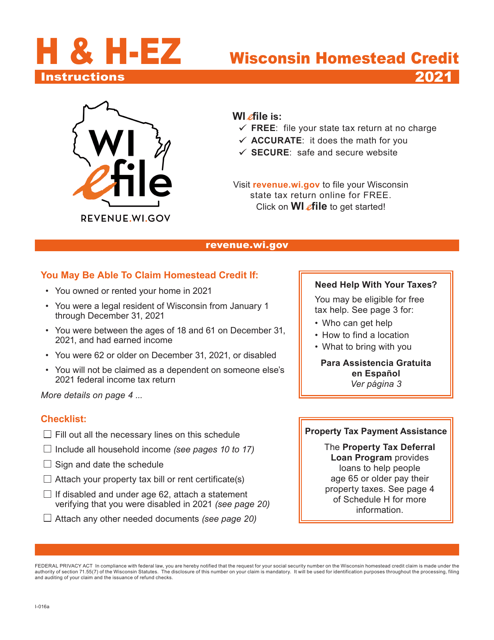

This Form is used for providing instructions on how to fill out Form I-015, I-016 Schedule H, H-EZ specific to individuals residing in Wisconsin.

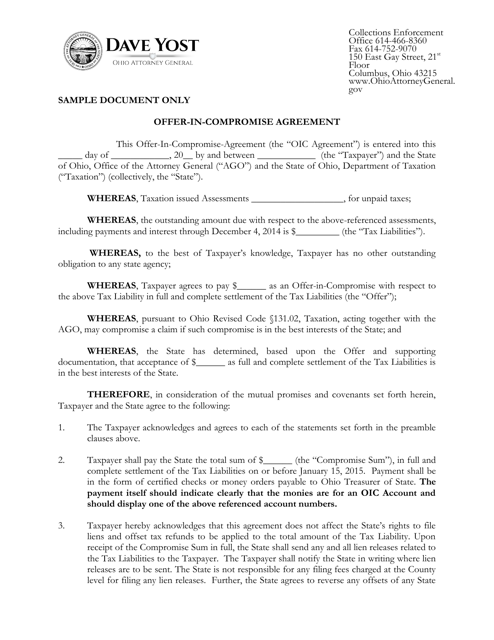

This document is a sample agreement for an offer-in-compromise in the state of Ohio. It outlines the terms and conditions for settling a tax debt with the Ohio Department of Taxation.

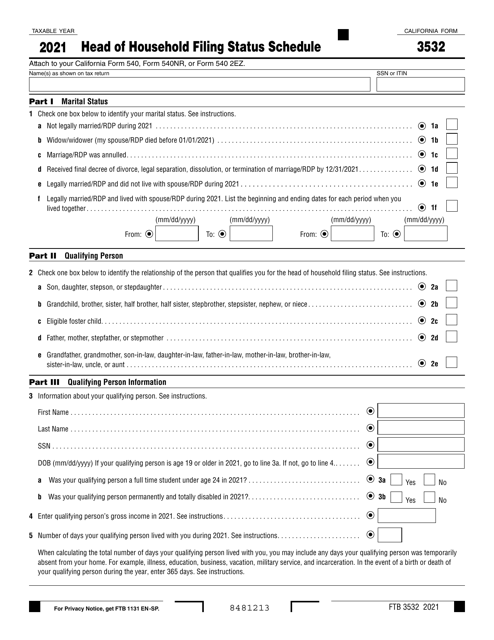

This form is used for individuals in California who qualify for the head of household filing status. It is used to calculate the correct amount of tax owed based on this status.

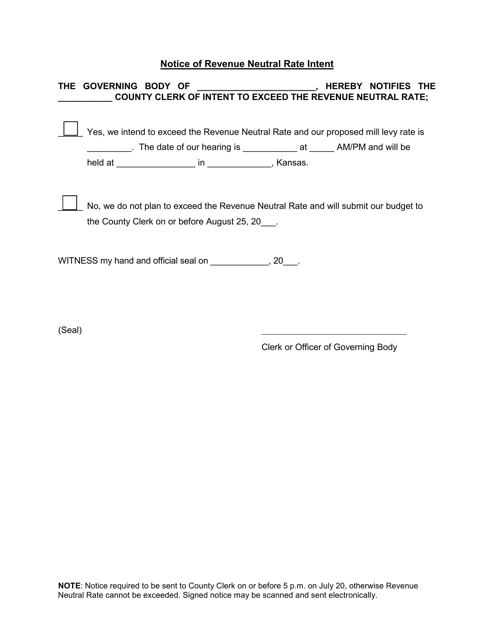

This type of document is a notice issued by the state of Kansas regarding their intent to determine a revenue neutral rate. It may contain information about how the state plans to maintain revenue neutrality in regards to taxes or any changes that may be made.

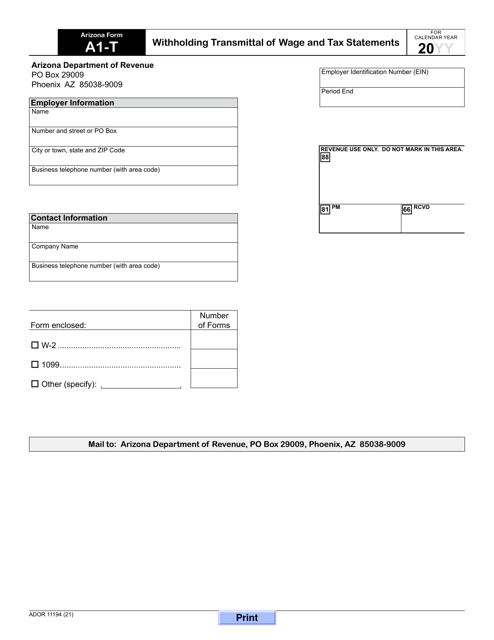

This form is used for transmitting wage and tax statements to the Arizona Department of Revenue (ADOR) for withholding purposes.

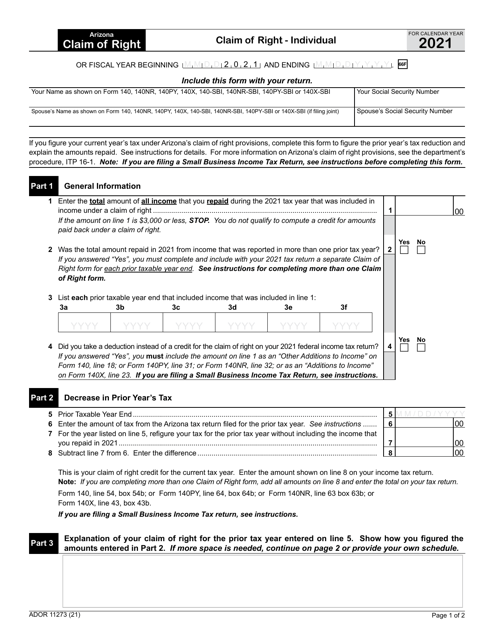

This form is used for individuals in Arizona to make a Claim of Right. It provides a way for individuals to express their claim to certain funds or property.