State Tax Forms and Templates

Documents:

933

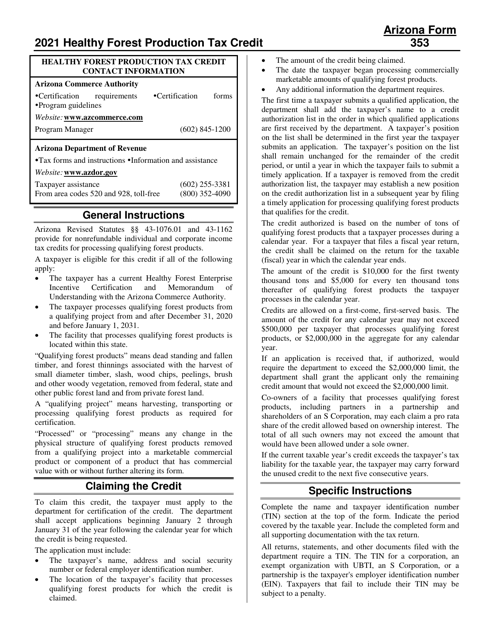

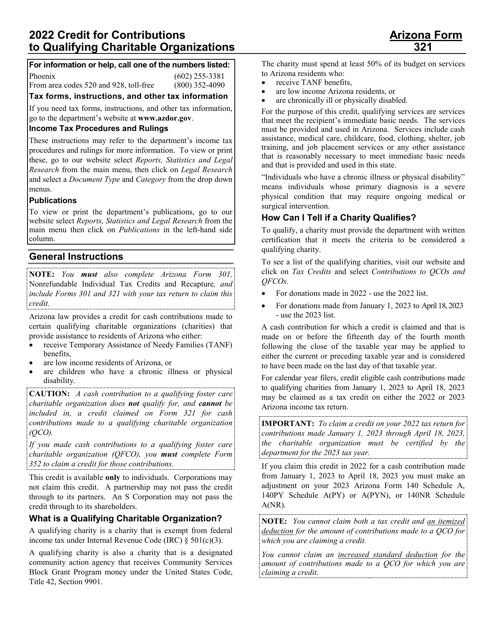

This document provides instructions for filling out various forms related to tax reporting in Arizona. It includes information for Form 353, ADOR11394, Form 353-P, ADOR111395, and Form 353-S, ADOR111396. The instructions will help individuals and businesses accurately complete these forms and fulfill their tax obligations in Arizona.

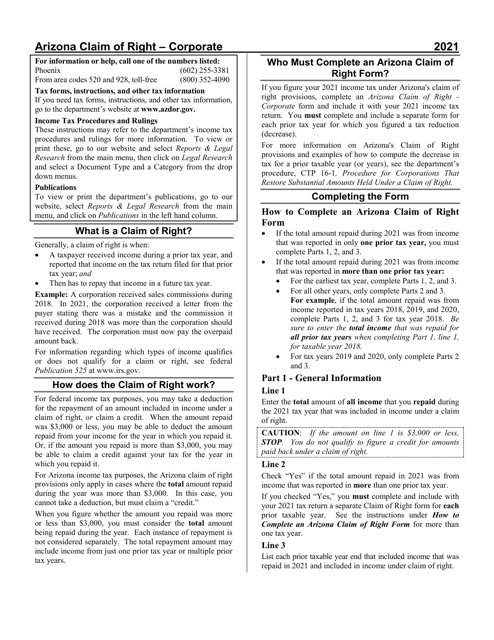

This document is used for filing a request to restore a substantial amount held under a claim of right for a corporate entity in the state of Arizona. It provides instructions on how to complete the form ADOR11289.

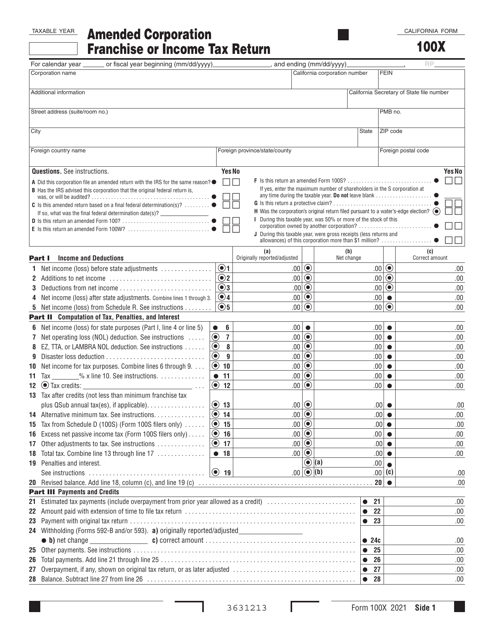

This Form is used for filing an amended corporation franchise or income tax return in California. It allows corporations to correct errors or make changes to their original tax return.

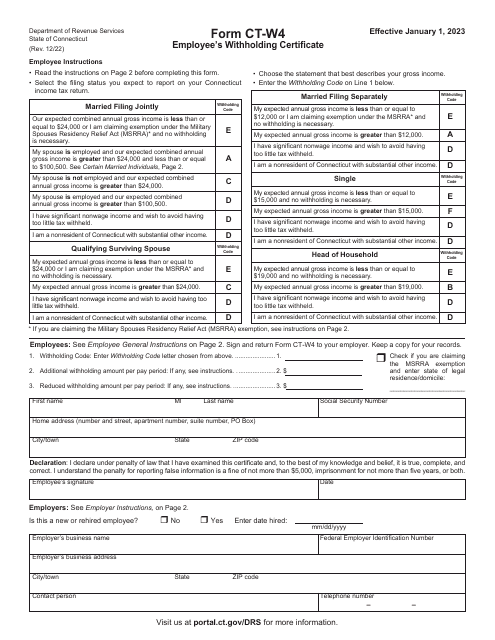

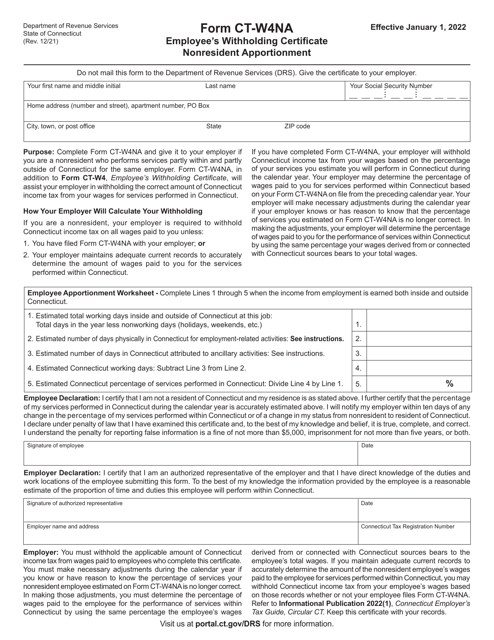

Use this form to withhold the proper amount of taxes when being employed in the state of Connecticut.

This form is used for nonresident employees in Connecticut who need to apportion their withholding taxes.

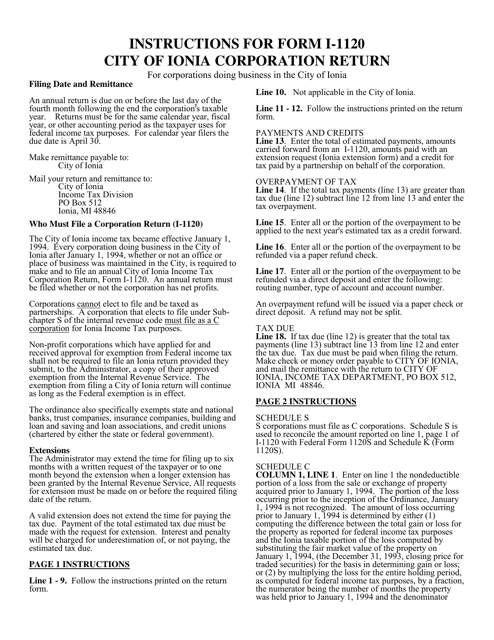

This Form is used for filing the Corporation Income Tax Return for businesses in the City of Ionia, Michigan. It includes instructions on how to accurately report income, deductions, and credits for the tax year.

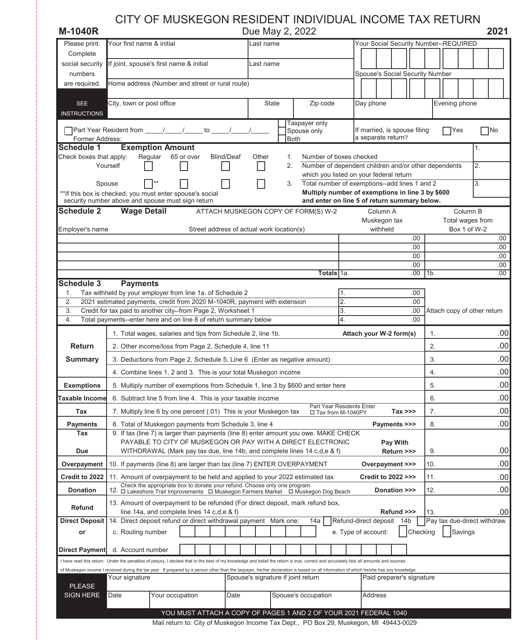

This form is used for reporting and filing resident individual income taxes for residents of Muskegon, Michigan.

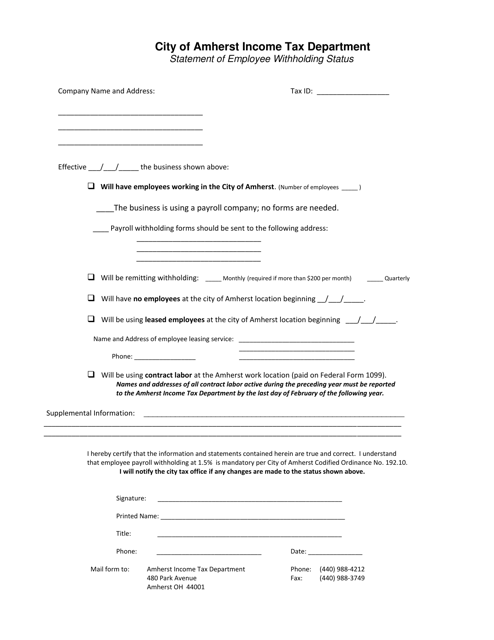

This document is for employees in the City of Amherst, Ohio to declare their withholding status for tax purposes.

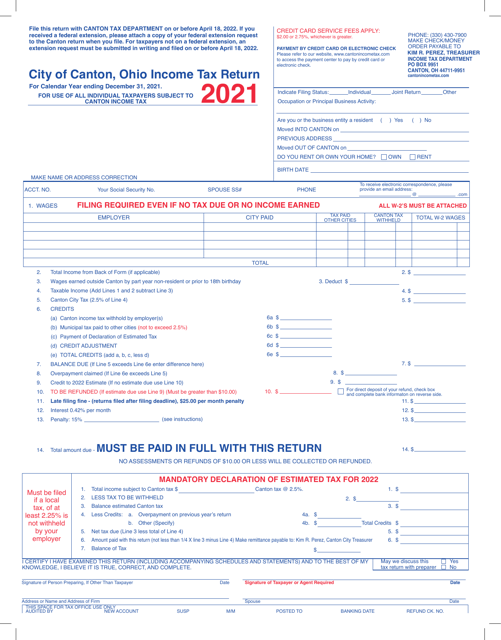

This form is used for filing the individual income tax return for residents of the city of Canton, Ohio.

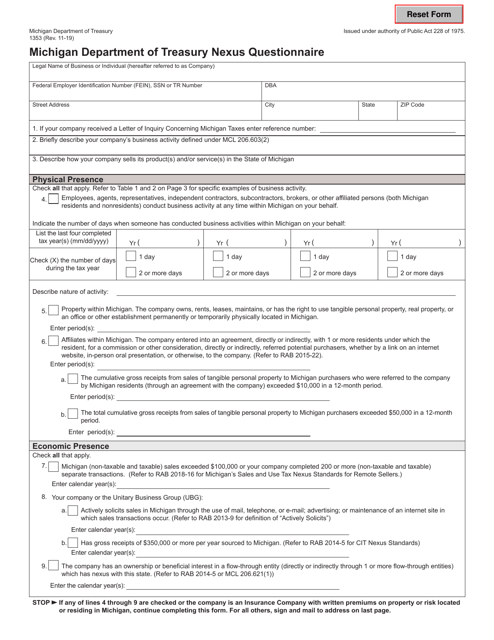

This form is used for the Nexus Questionnaire required by the Michigan Department of Treasury to determine if a business has sufficient presence in Michigan to be subject to state taxes.

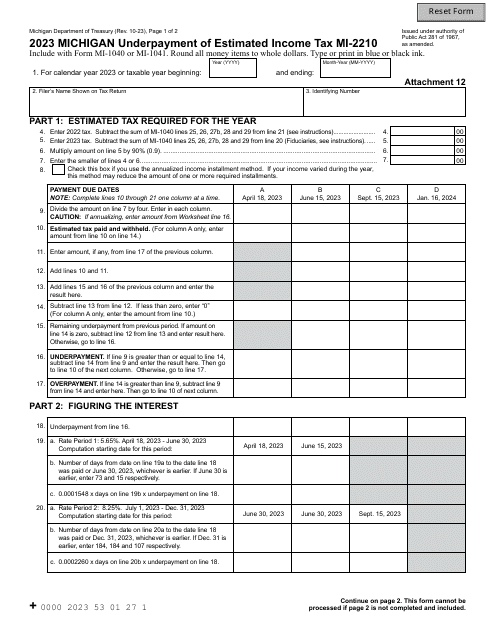

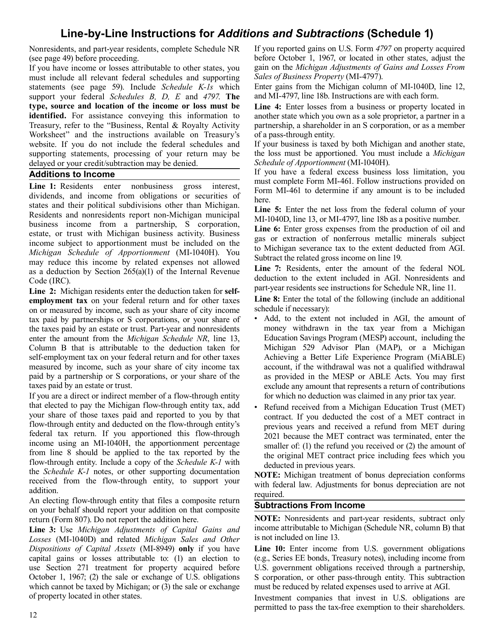

This document provides instructions for completing Schedule 1, which is used to report any additions or subtractions to your Michigan income tax return. It guides you through the process of determining what types of income or deductions should be included, and how to fill out the necessary forms.

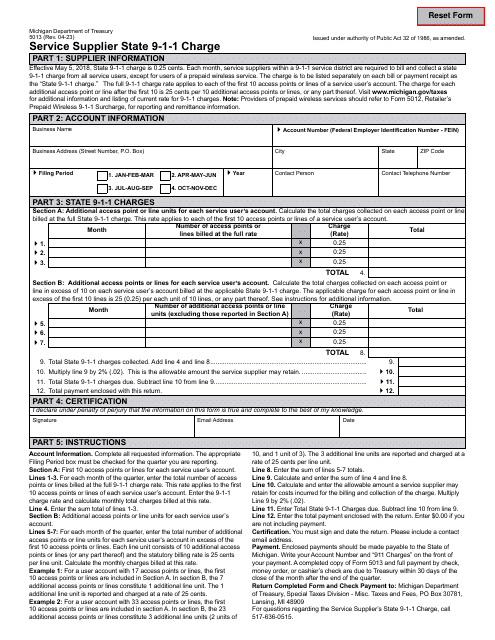

This form is used for reporting and paying the State Convention Facility Development Tax in Michigan. The form provides instructions on how to calculate the tax and where to submit the payment.