State Tax Forms and Templates

Documents:

933

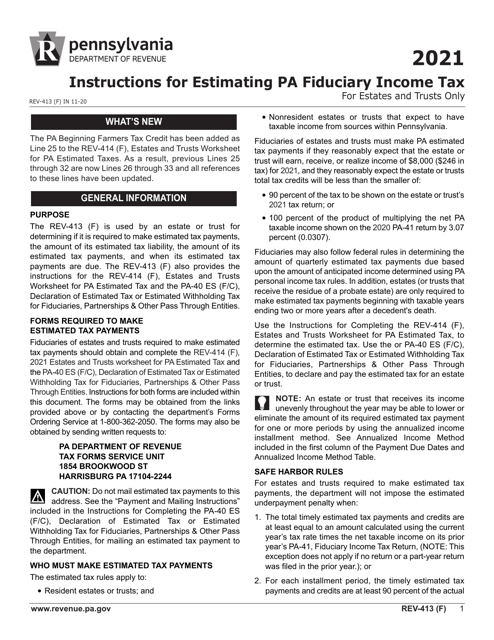

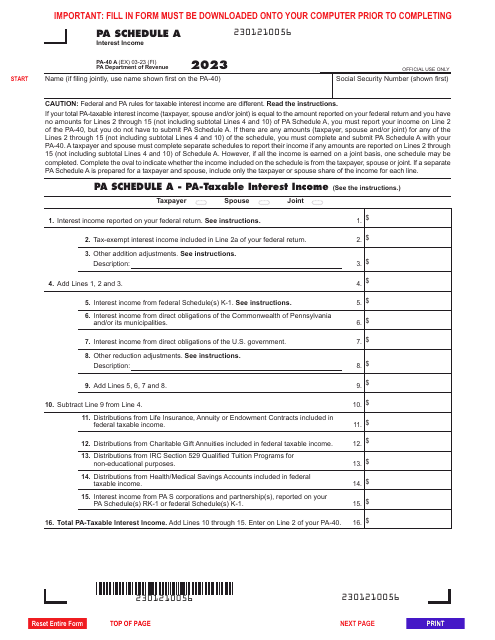

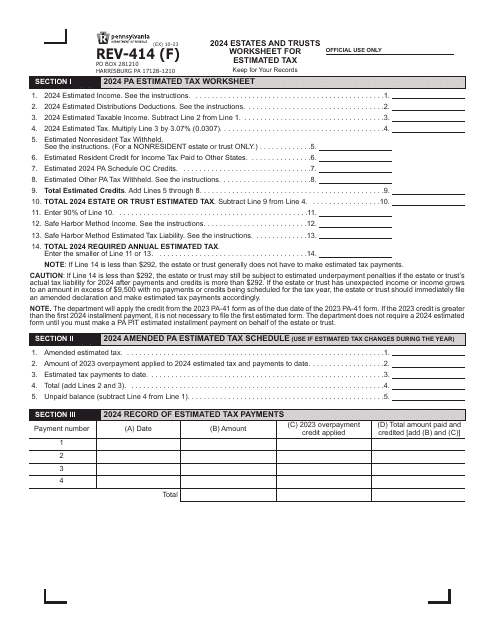

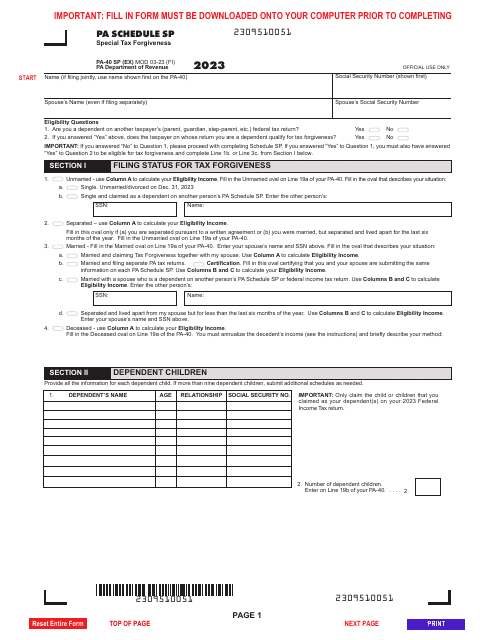

This form is used for submitting state tax payments and calculating estimated tax amounts. Instructions are provided to assist Pennsylvania residents in correctly filling out Form REV-414 (F) and Form REV-40 ES (F/C).

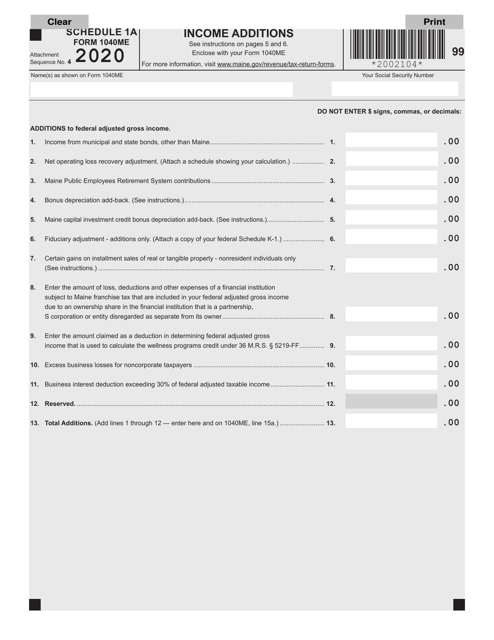

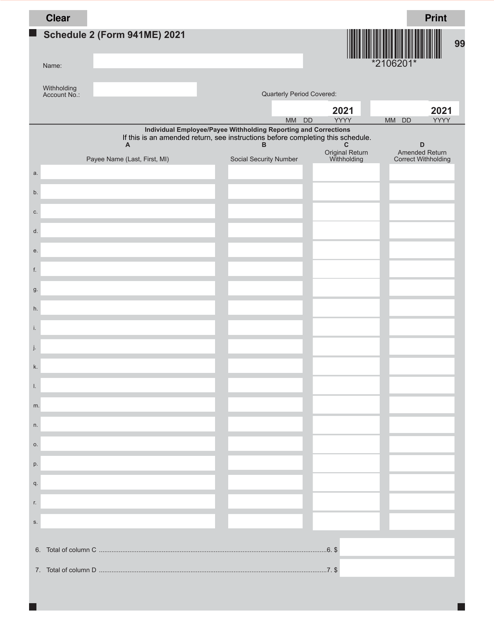

This form is used for reporting additional income additions for Maine residents filing the Form 1040ME. It helps taxpayers accurately include any income sources that need to be added to their overall income calculations.

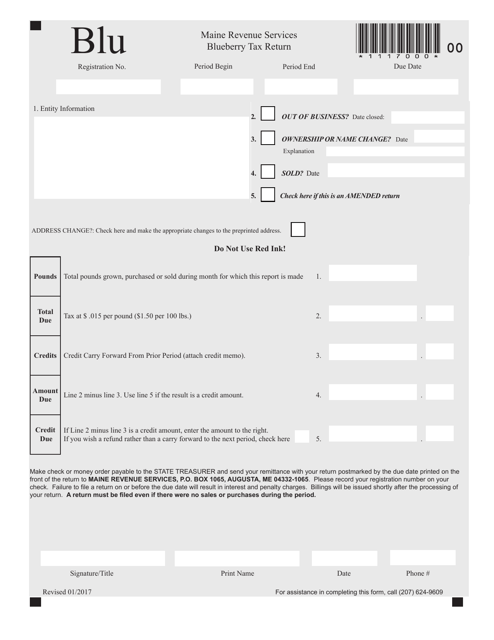

This form is used for the annual tax return specific to blueberry farmers in Maine. It includes information on income, expenses, and deductions related to blueberry farming.

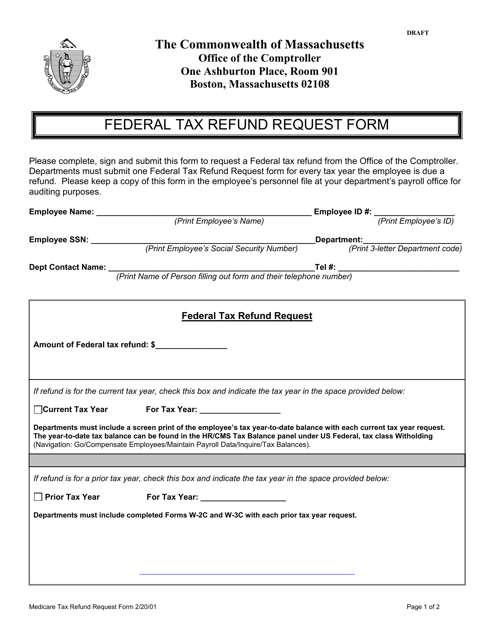

This form is used for requesting a federal tax refund in the state of Massachusetts.

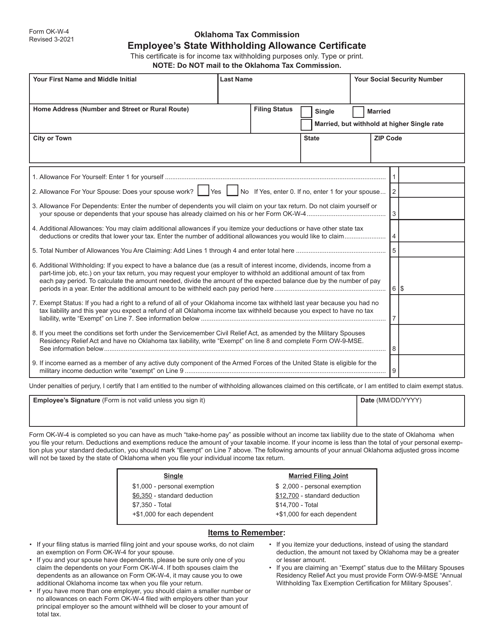

This form is used for employees in Oklahoma to declare their state withholding allowances for income tax purposes. It helps determine how much state income tax to withhold from an employee's paycheck.

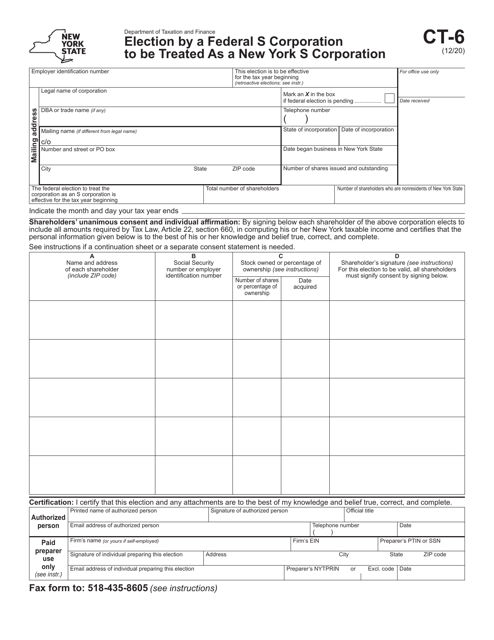

This Form is used for a Federal S Corporation to elect to be treated as a New York S Corporation. It is required for tax purposes in the state of New York.

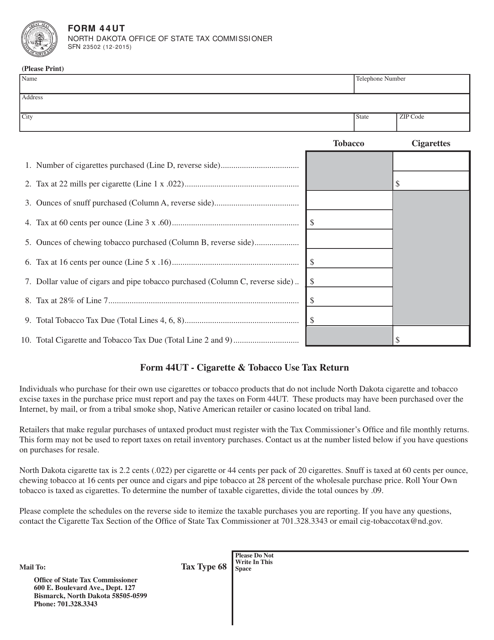

This document is used for filing the Cigarette & Tobacco Use Tax Return in North Dakota.

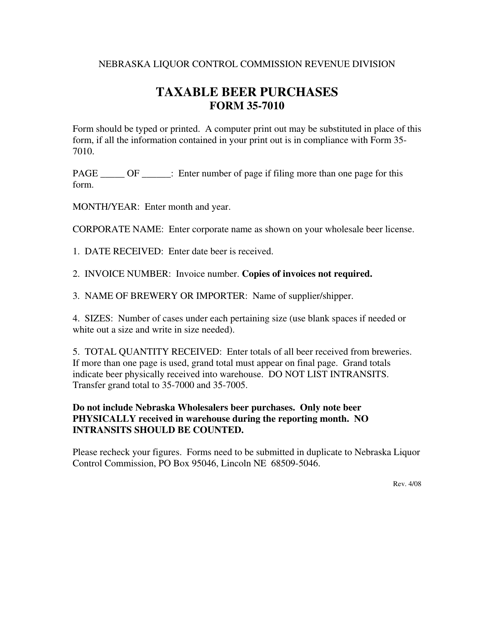

This Form is used for reporting taxable beer purchases in the state of Nebraska. It provides instructions on how to accurately fill out and submit the form to the appropriate tax authority.

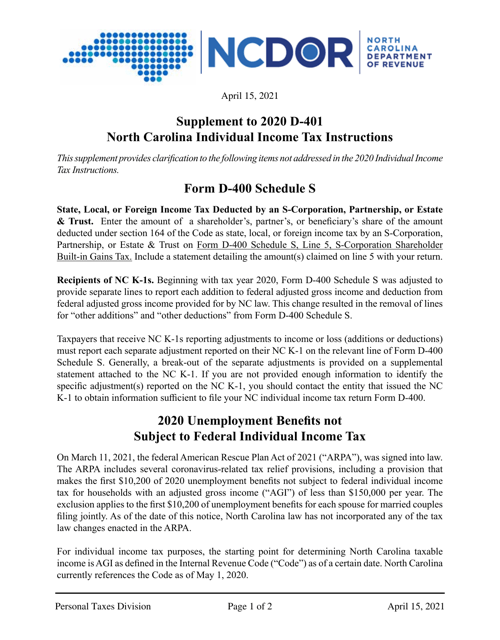

This type of document provides instructions for completing Form D-400, D-400TC Schedule 3, A, AM, PN, PN-1, which are tax forms specific to the state of North Carolina. These forms are used for reporting and calculating taxes owed in the state.

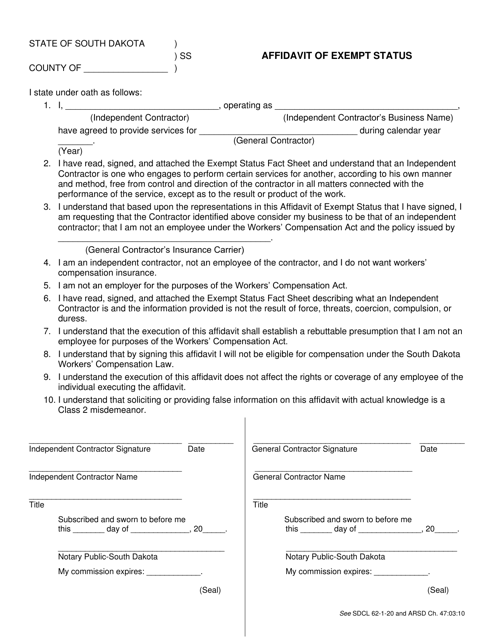

This form is used to declare exempt status for tax purposes in South Dakota.

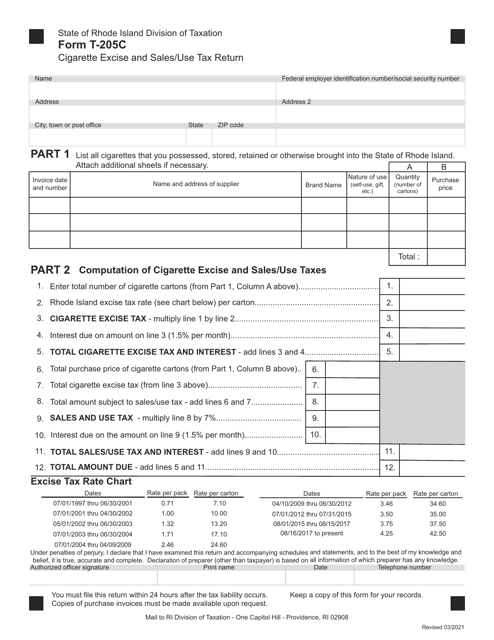

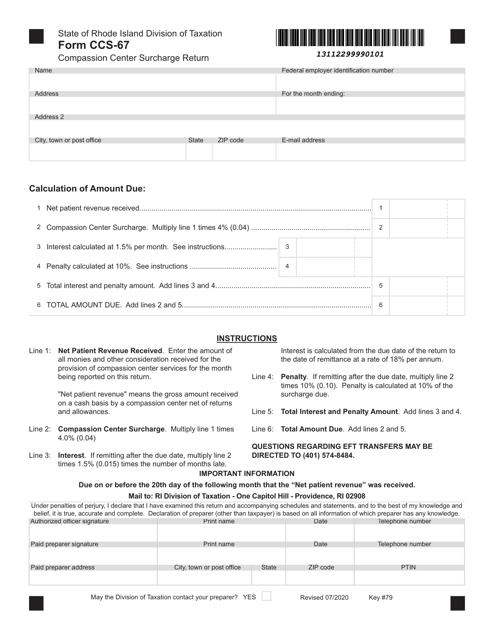

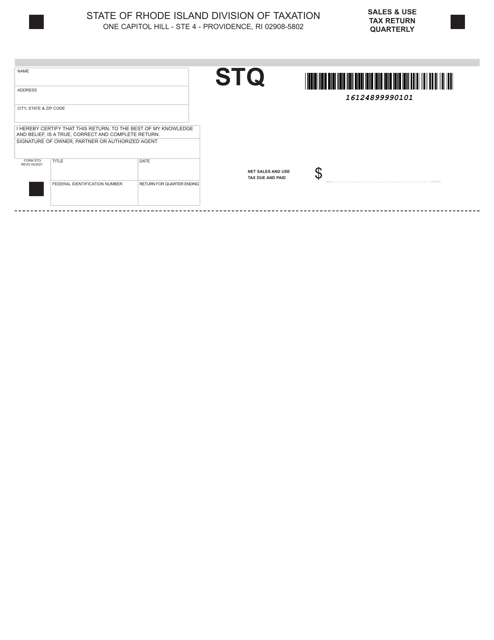

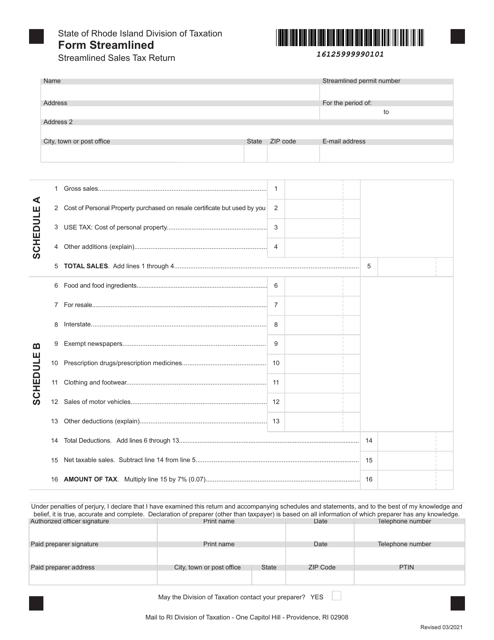

This document is for filing the Streamlined Sales Tax return in the state of Rhode Island. It is used by businesses to report their sales tax collections and remit the taxes owed to the state.