State Tax Forms and Templates

Documents:

933

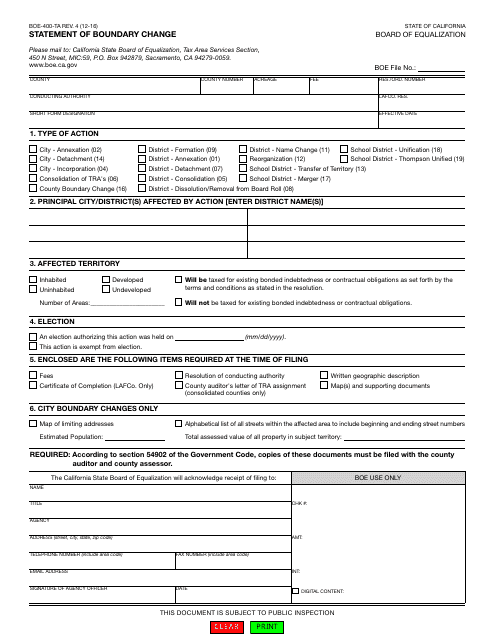

This form is used for reporting boundary changes in California.

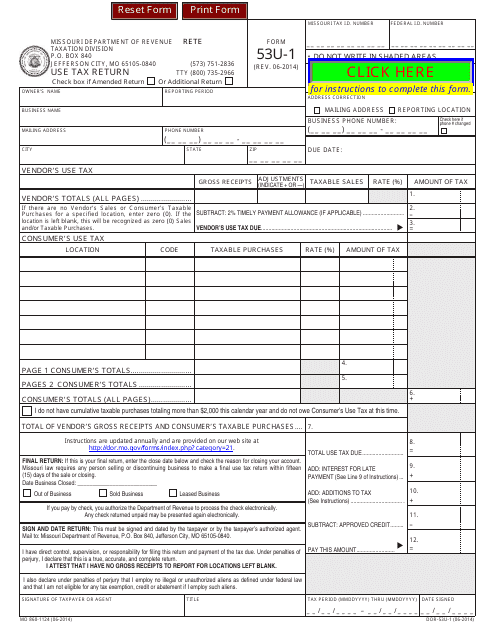

This Form is used for reporting and paying use tax in the state of Missouri. Use tax is owed on taxable items that were purchased tax-free and used in Missouri. The Form 53U-1 is used to calculate the use tax owed and submit it to the Missouri Department of Revenue.

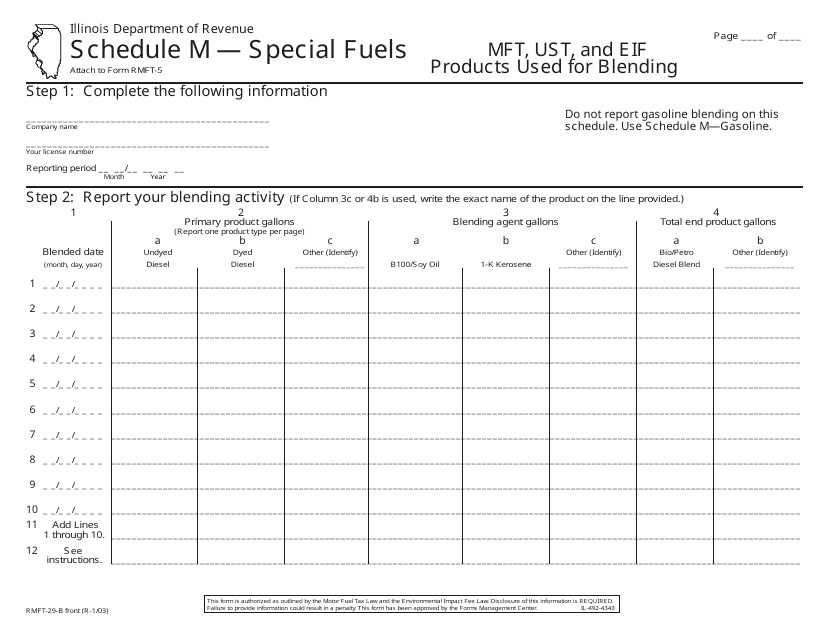

This Form is used for reporting special fuel usage in the state of Illinois.

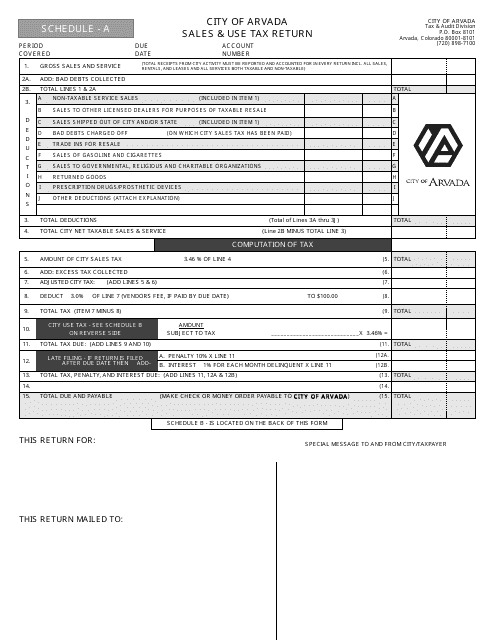

This document is used for filing Sales & Use Tax returns for businesses in the City of Arvada, Colorado.

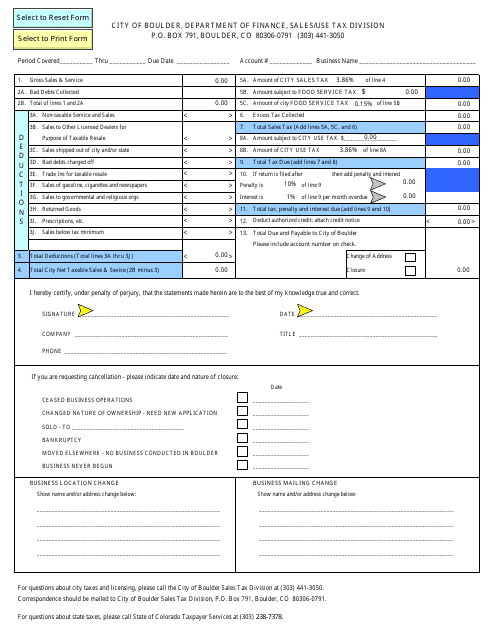

This form is used for reporting and remitting sales and use taxes to the City of Boulder, Colorado.

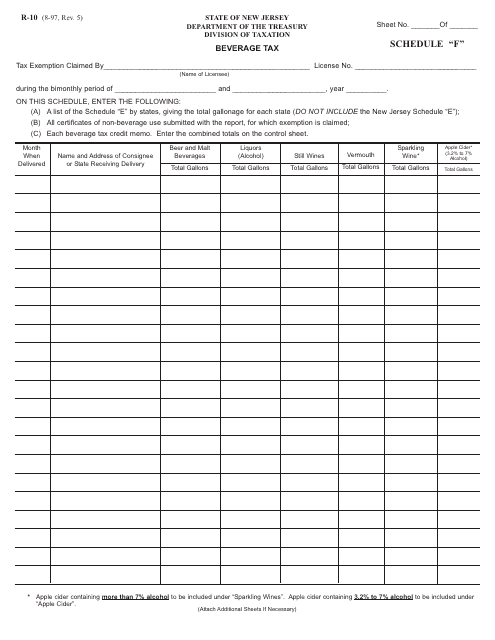

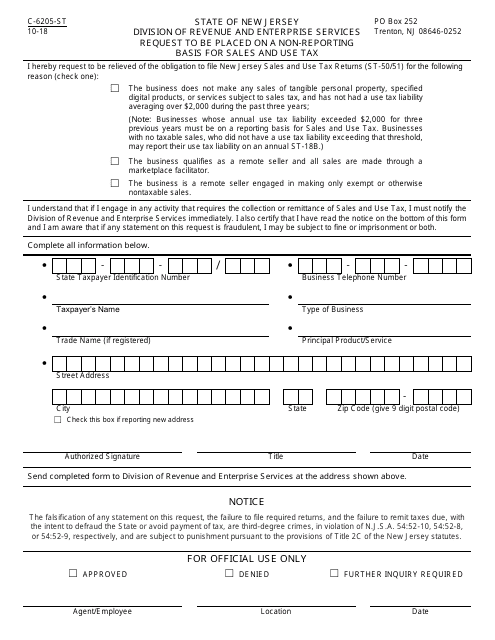

This form is used for reporting beverage taxes in New Jersey

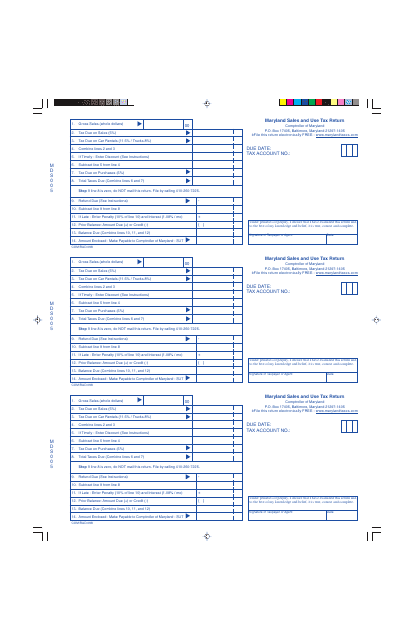

This document is used to report and remit sales and use tax in the state of Maryland. Businesses must submit this return to the Maryland Comptroller's Office to report the sales they have made and the corresponding sales tax collected.

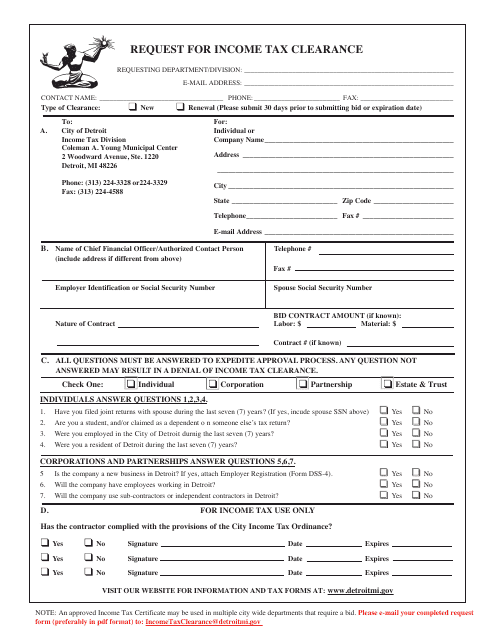

This form is used for requesting an income tax clearance in Detroit, Michigan. It is required to ensure all income taxes have been paid before certain transactions or activities can take place.

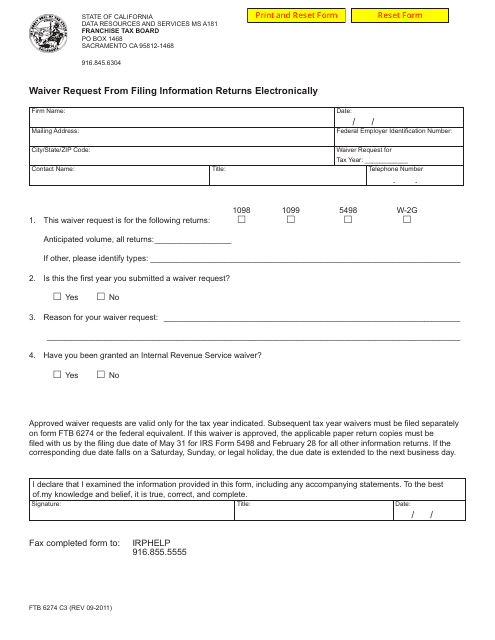

This form is used for requesting a waiver from filing information returns electronically in California.

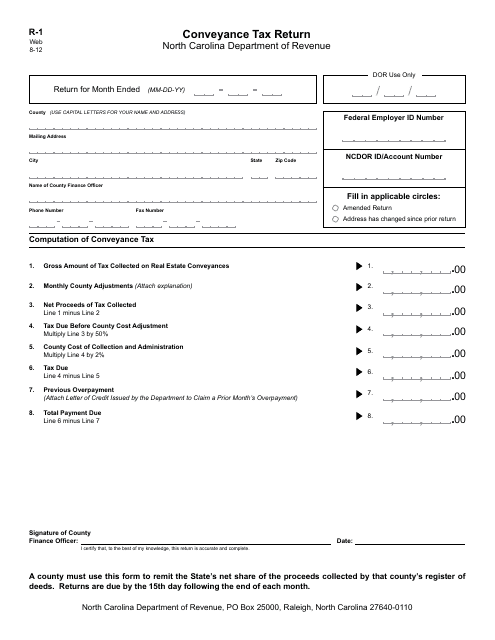

This Form is used for filing a Conveyance Tax Return in North Carolina.

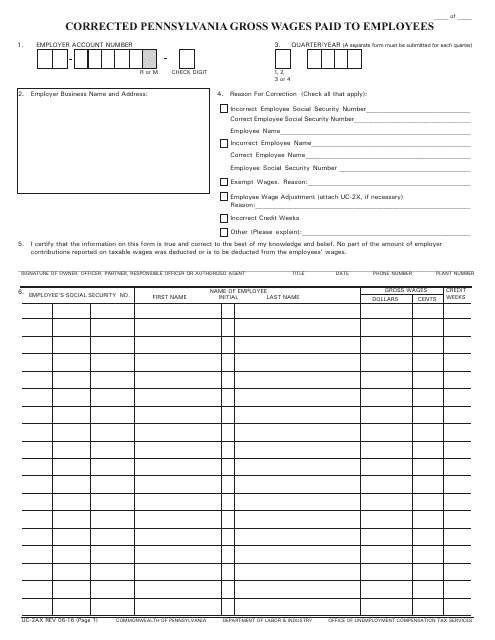

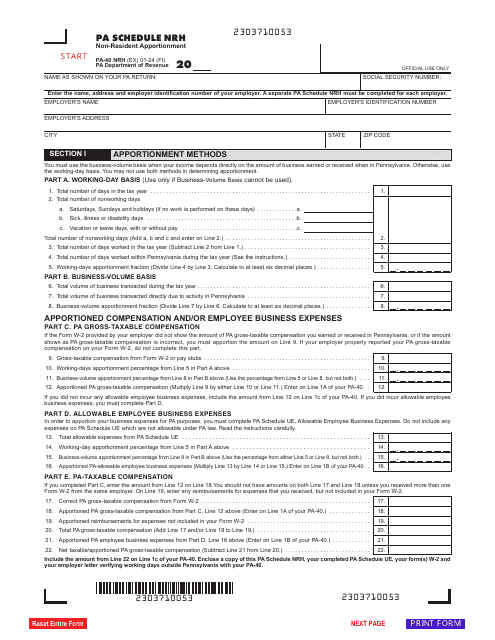

This form is used for reporting corrected gross wages paid to employees in Pennsylvania. It helps to ensure accurate reporting for tax purposes.

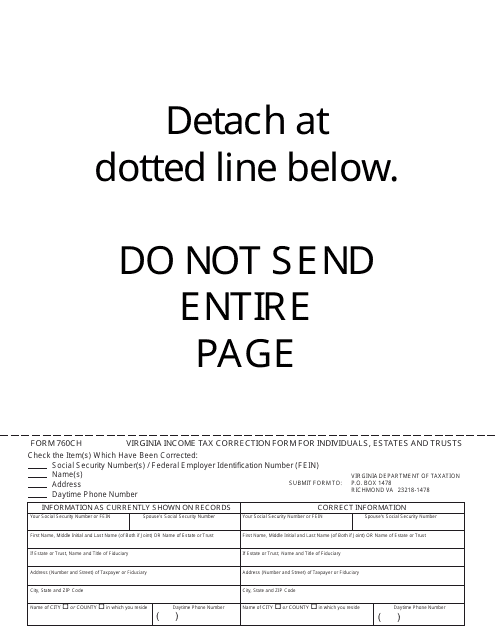

This form is used for correcting Virginia income tax filings for individuals, estates, and trusts in the state of Virginia. It is used to amend any errors or omissions made on previous tax returns.

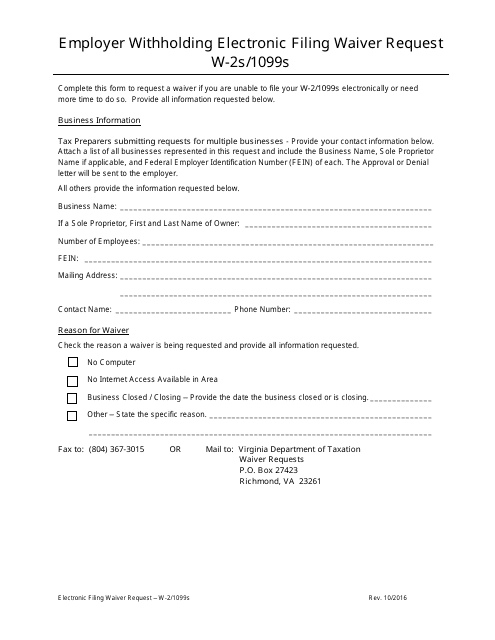

This form is used for employers in Virginia to request a waiver from electronic filing requirements for Form W-2S or 1099S.

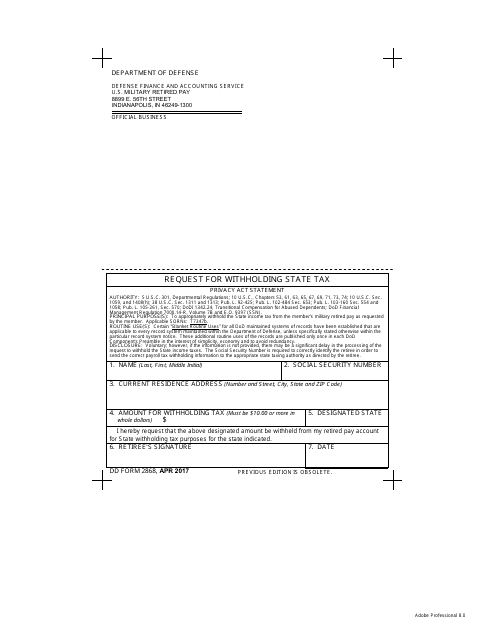

This form is used for requesting withholding of state tax from military pay.

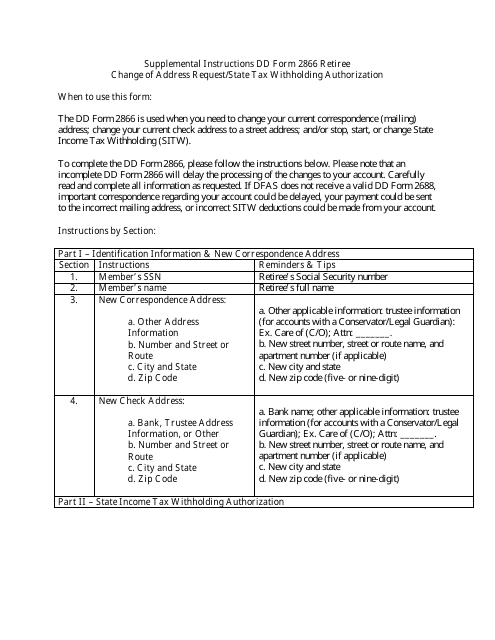

This document is used for retirees to request a change of address and authorize state tax withholding. It provides instructions on how to complete DD Form 2866.

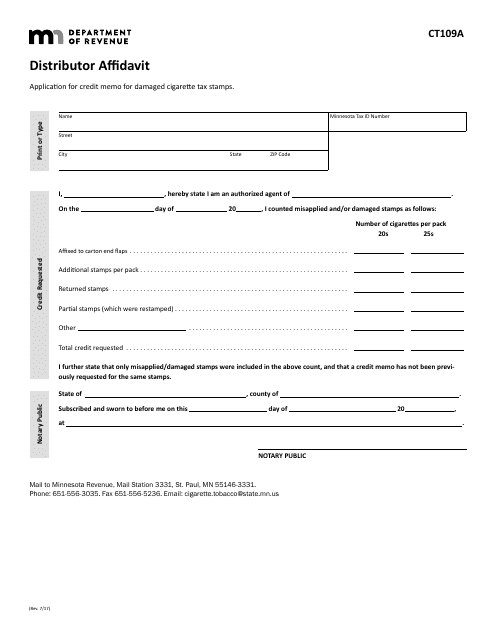

This Form is used for distributors in Minnesota to provide an affidavit.

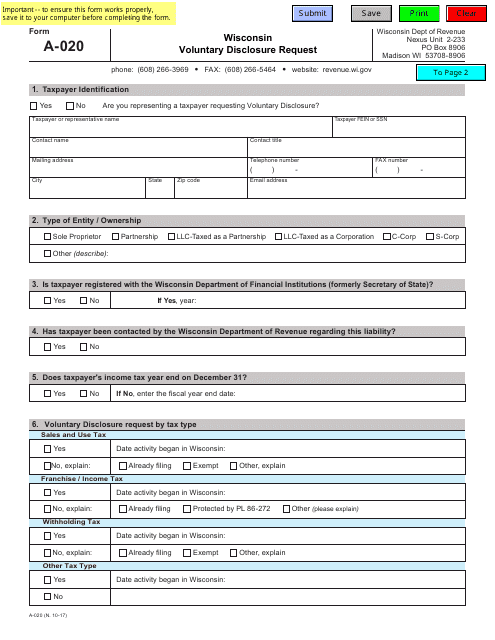

This form is used for individuals or businesses in Wisconsin to request a voluntary disclosure of taxes owed to the state.

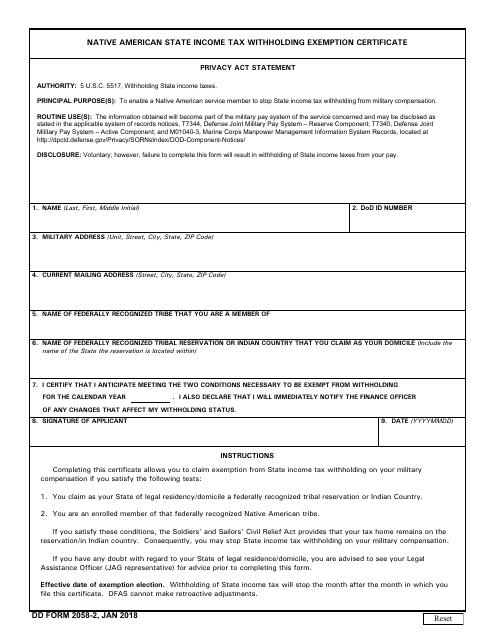

This is a document used by Native American service men and service women to claim state income tax exemption on their military pay.

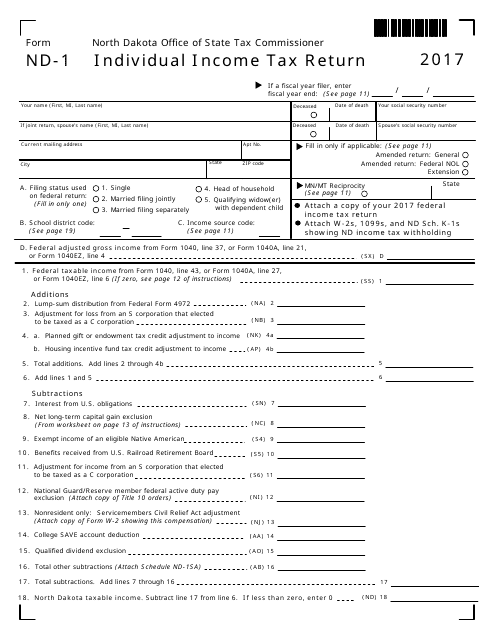

This form is used for filing individual income tax returns in the state of North Dakota.

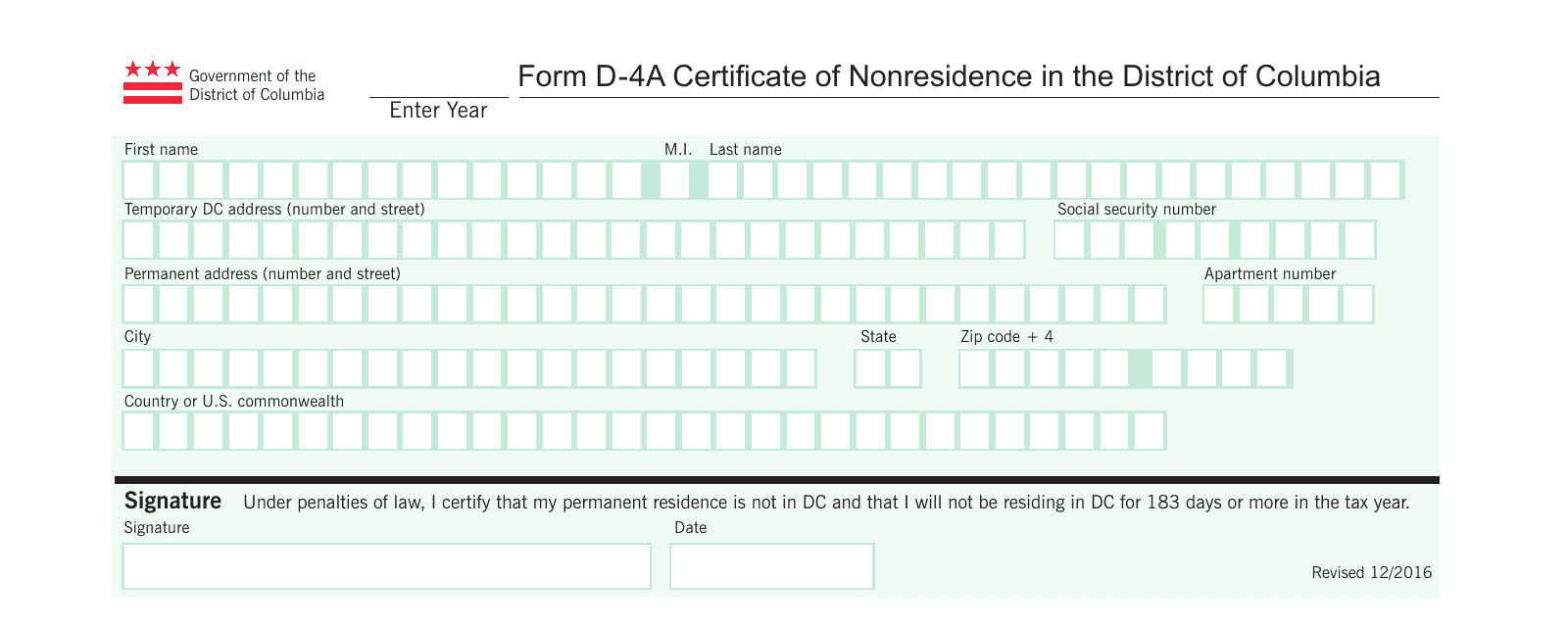

This Form is used for declaring nonresidence status in the District of Columbia for tax purposes.

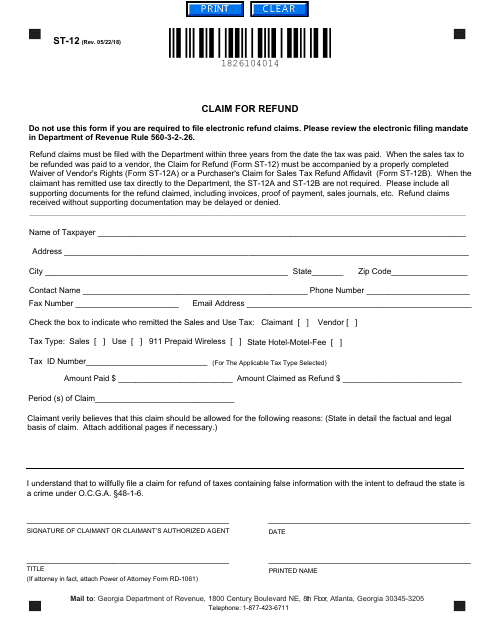

This Form is used for claiming a refund in the state of Georgia, United States.

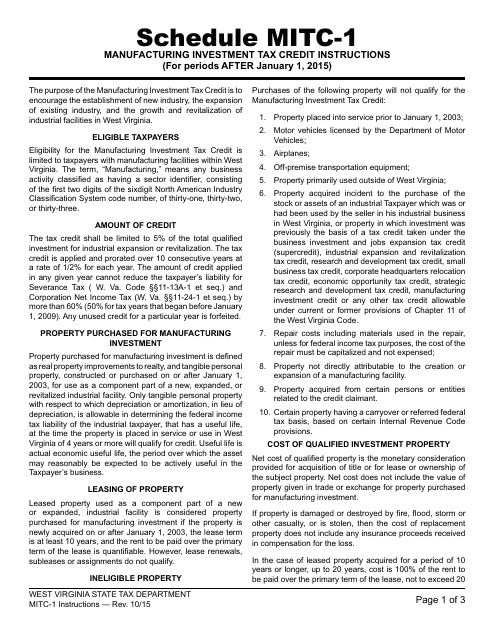

This Form is used to claim a tax credit for manufacturing investment in West Virginia for periods after January 1, 2015. It provides instructions on how to fill out the form and what documentation is required.

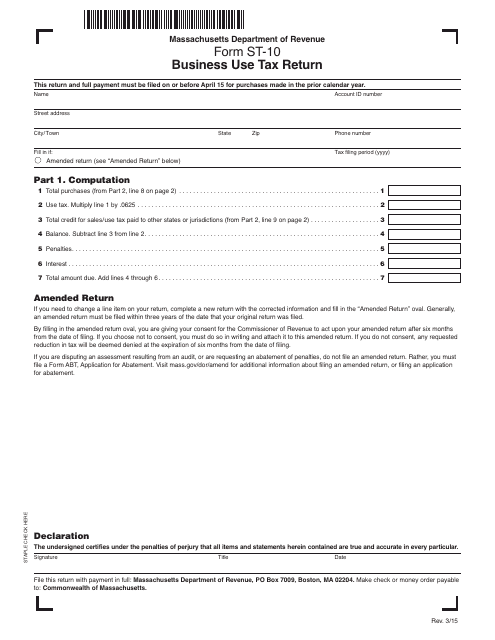

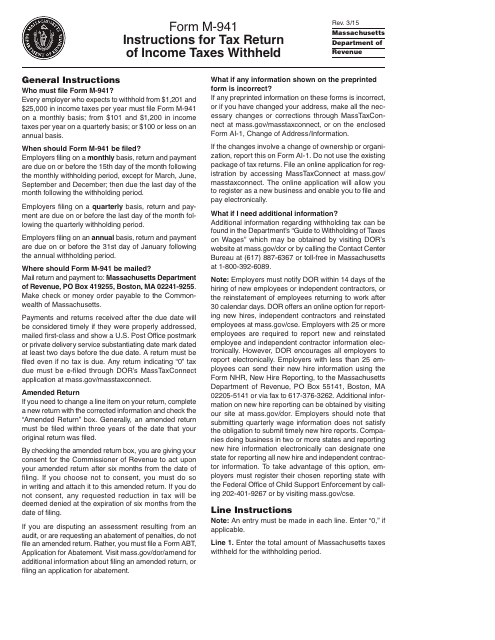

This form is used for reporting and paying business use tax in the state of Massachusetts.

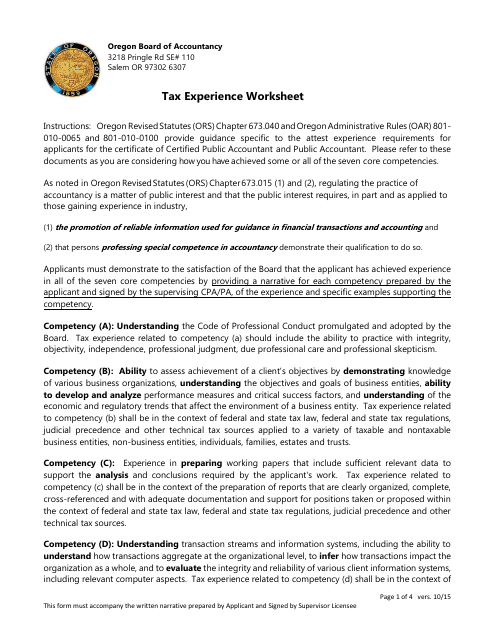

This document is a worksheet specifically for individuals with tax experience in Oregon. It can be used to organize and track relevant information when preparing state taxes in Oregon.

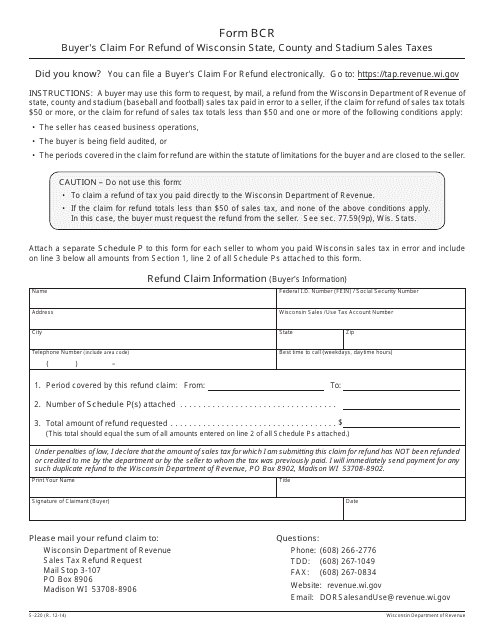

This form is used for buyers to claim a refund of Wisconsin state, county, and stadium sales taxes in Wisconsin.

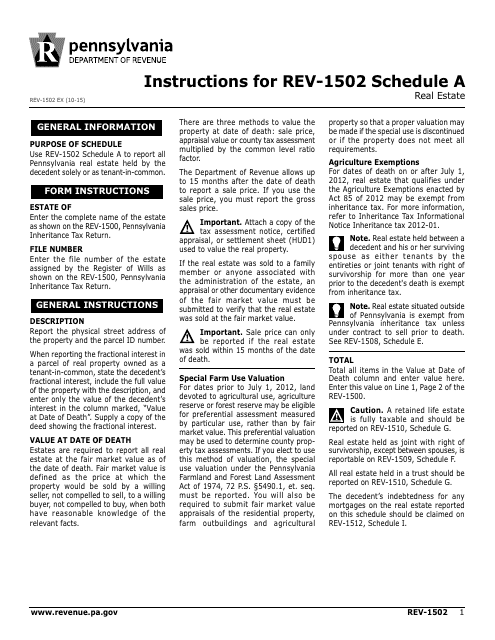

This document provides instructions for completing Form REV-1502 Schedule A, which is a real estate schedule in Pennsylvania. It guides taxpayers on how to report their real estate income and expenses accurately.

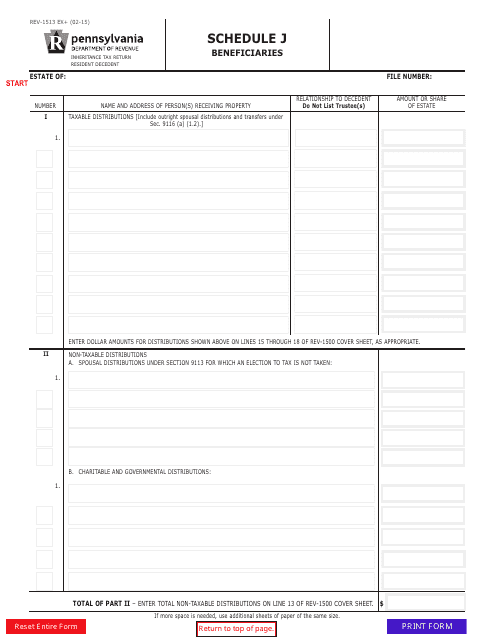

This form is used for reporting beneficiaries in the state of Pennsylvania.

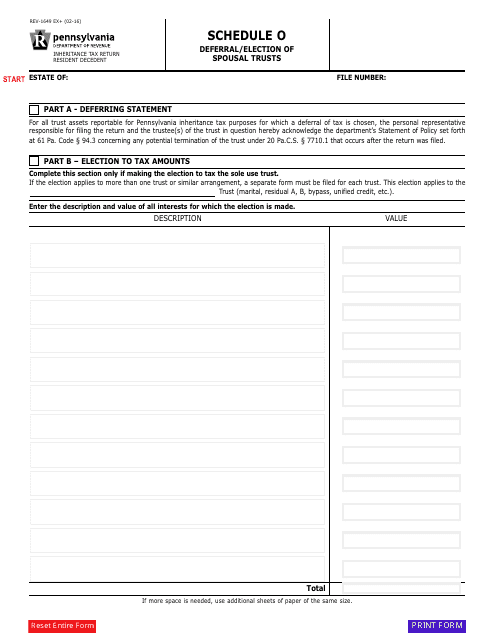

This form is used for deferral or election of spousal trusts in Pennsylvania.

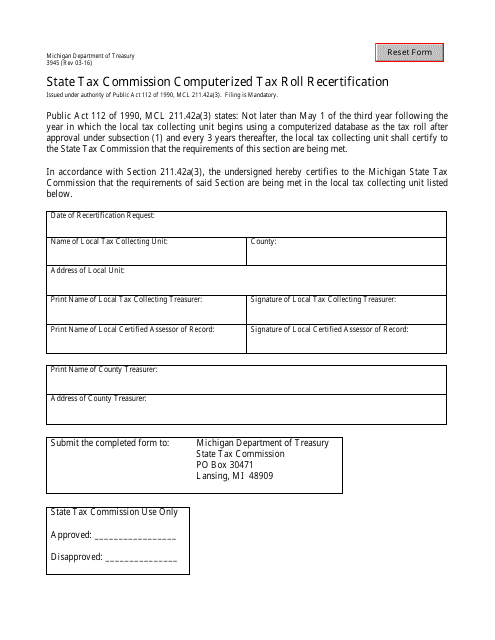

This document is used for recertifying the computerized tax roll with the State Tax Commission in Michigan.

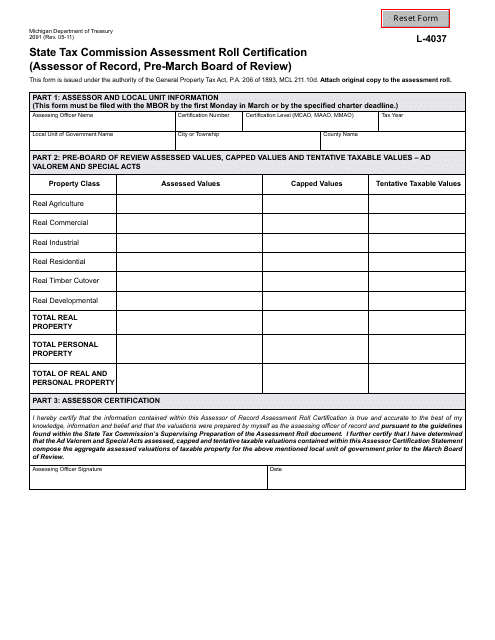

This form is used for the State Tax Commission Assessment Roll Certification in the state of Michigan.