Business Tax Documents Templates

Documents:

611

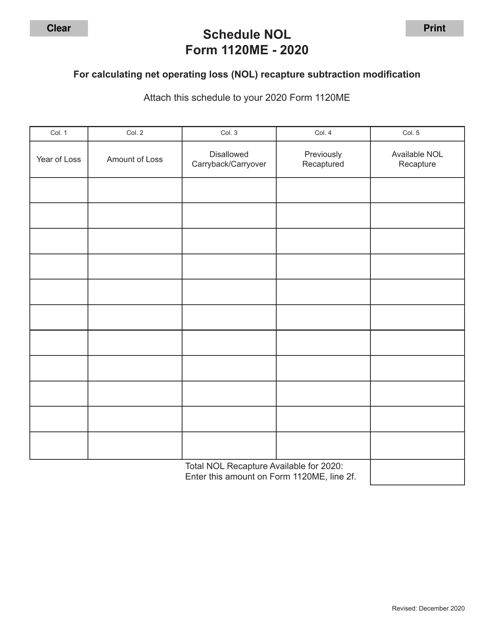

This form is used for calculating the Net Operating Loss (NOL) recapture subtraction modification in the state of Maine for businesses filing Form 1120ME.

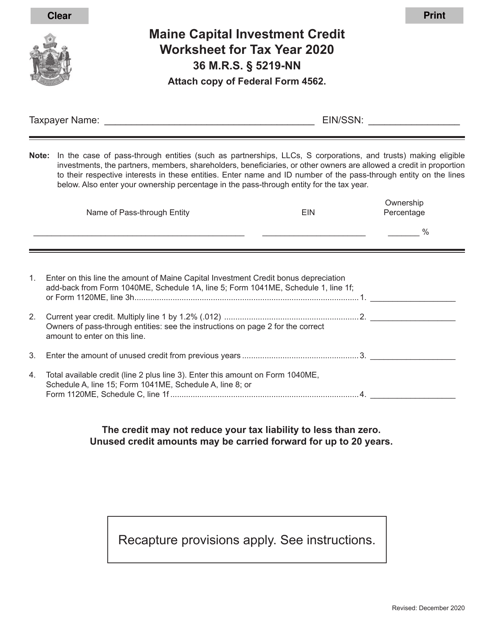

This document is used for calculating the capital investment credit in the state of Maine. It helps individuals and businesses determine the amount of credit they may be eligible for based on their qualified investments in certain industries.

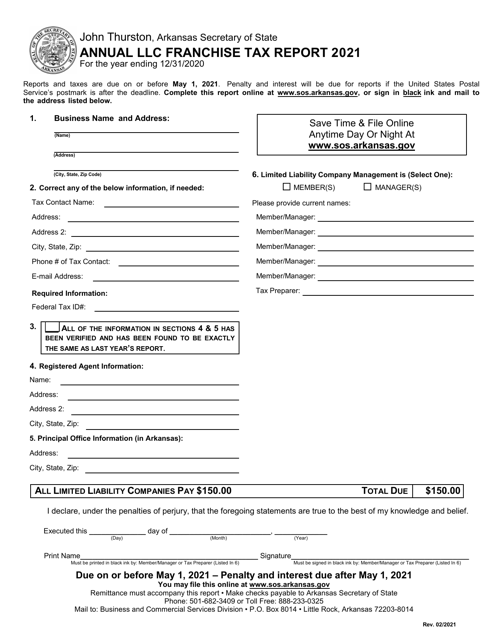

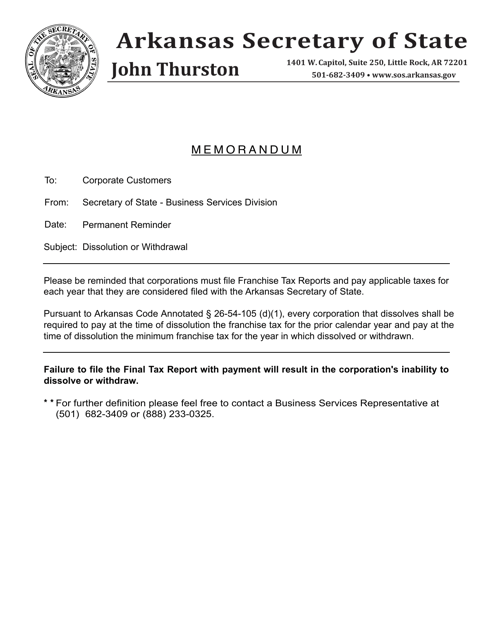

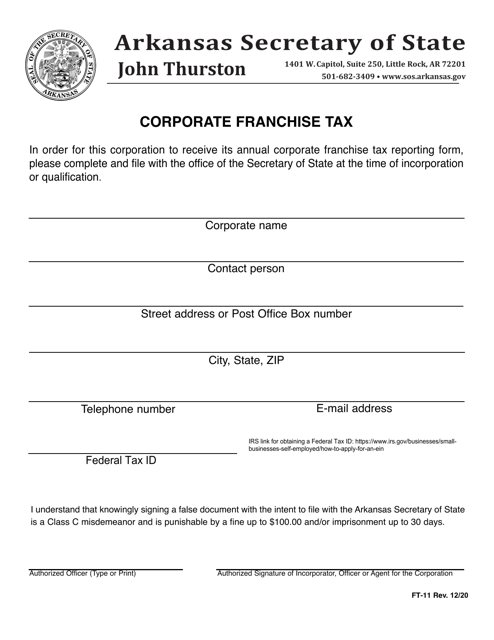

This document is the Final Franchise Tax Report for businesses in the state of Arkansas. It is used to report and pay the final franchise tax for the year.

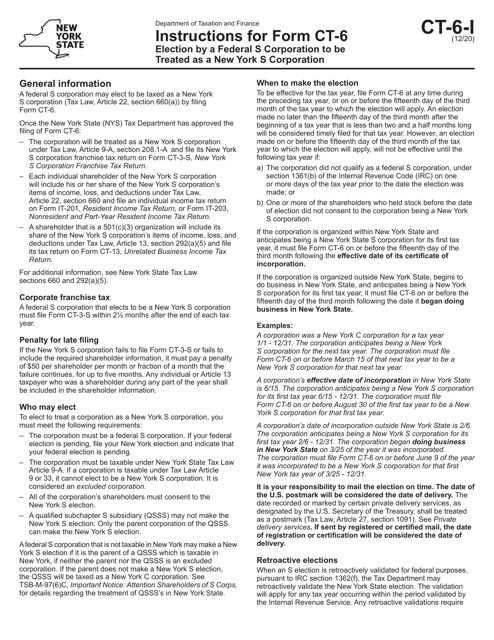

This form is used for a federal S Corporation to elect to be treated as a New York S Corporation for tax purposes in the state of New York. It provides instructions on how to make this election.

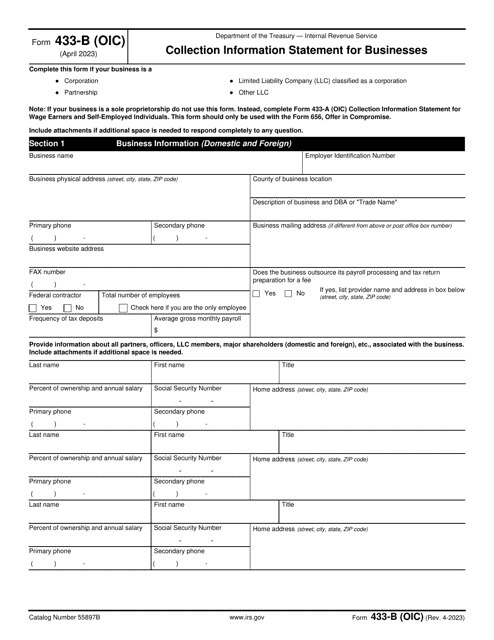

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

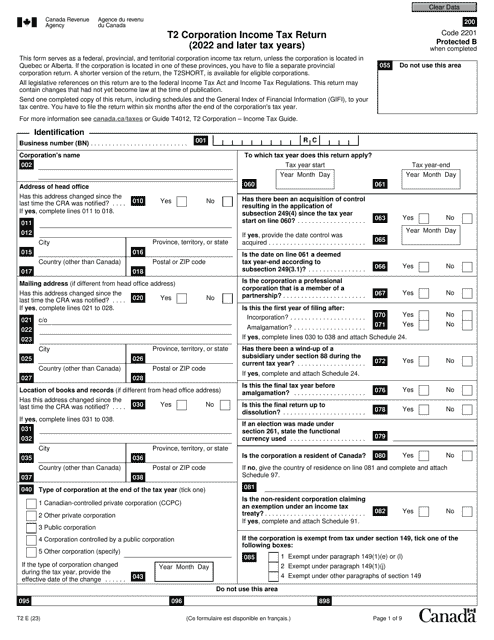

Canadian corporations must complete this main statement every year to report their income even if they eventually do not pay any tax.

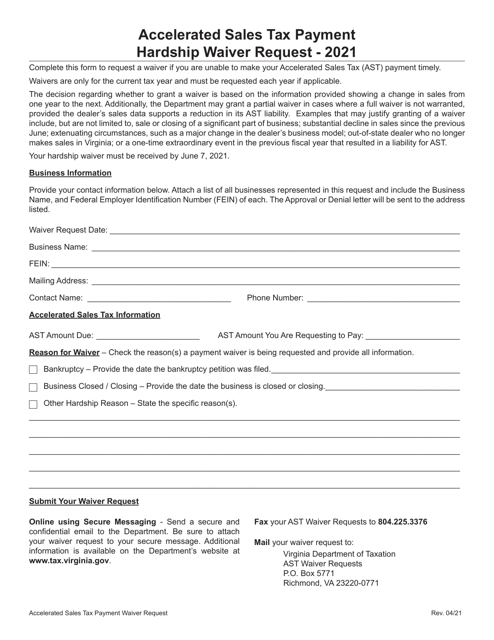

This document is a request to waive the hardship requirement for accelerated sales tax payment in Virginia.

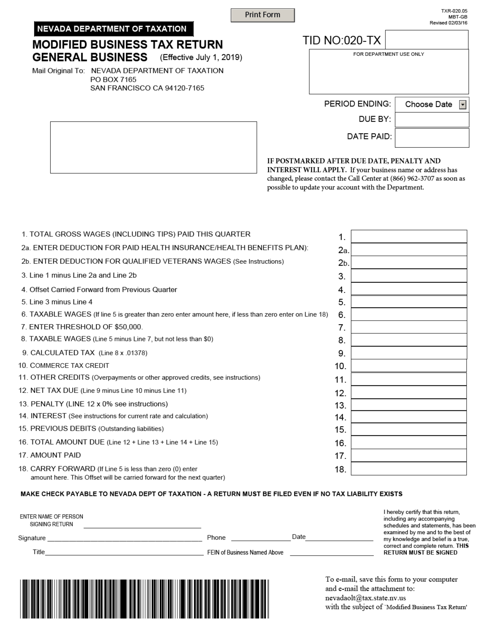

This form is used for filing the Modified Business Tax Return for General Business in the state of Nevada.

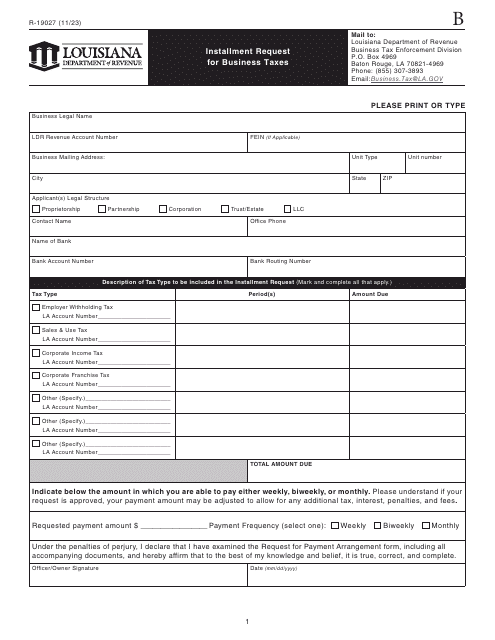

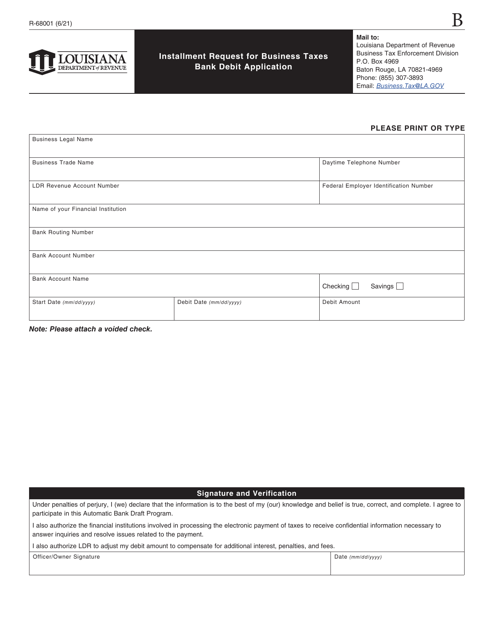

This form is used for requesting installment payments for business taxes in Louisiana. It allows businesses to set up automatic bank debit payments for their tax obligations.

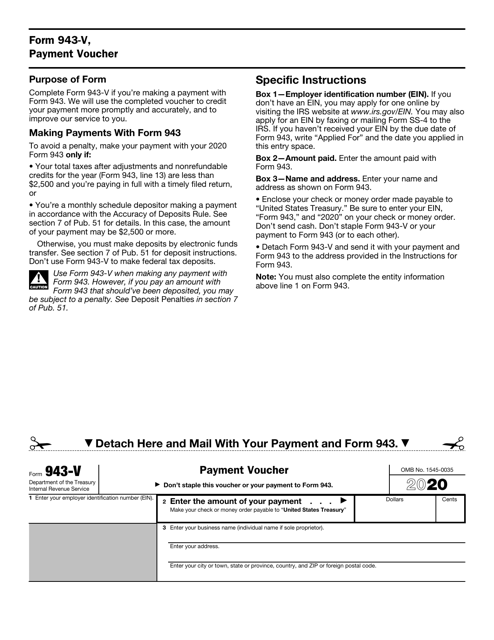

This form is used for making payment vouchers for IRS Form 943.