Business Tax Documents Templates

Documents:

611

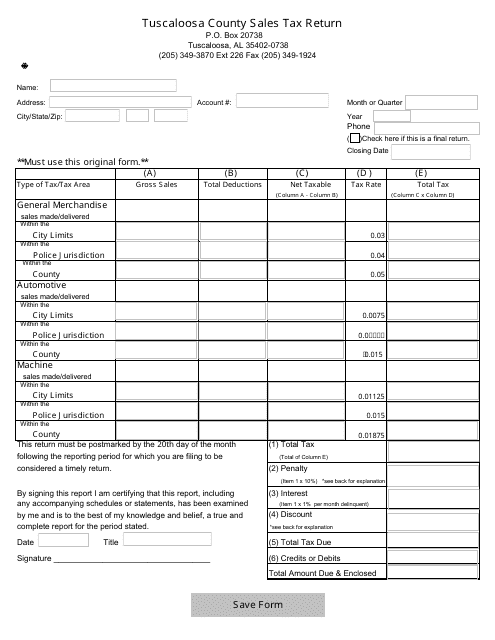

This form is used for submitting sales tax returns to the City of Tuscaloosa, Alabama.

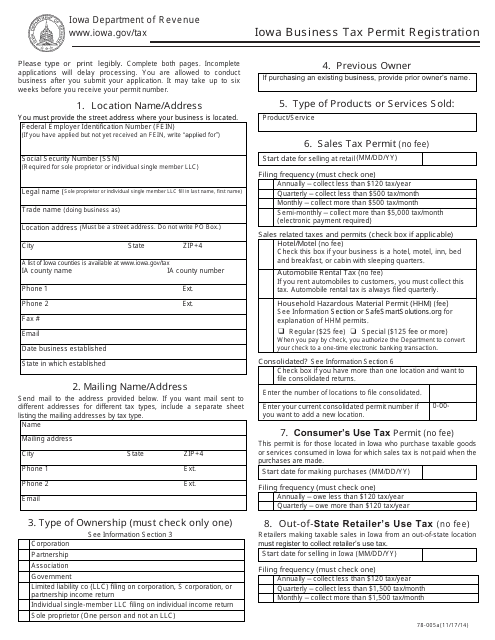

This form is used for business owners in Iowa to register for a tax permit.

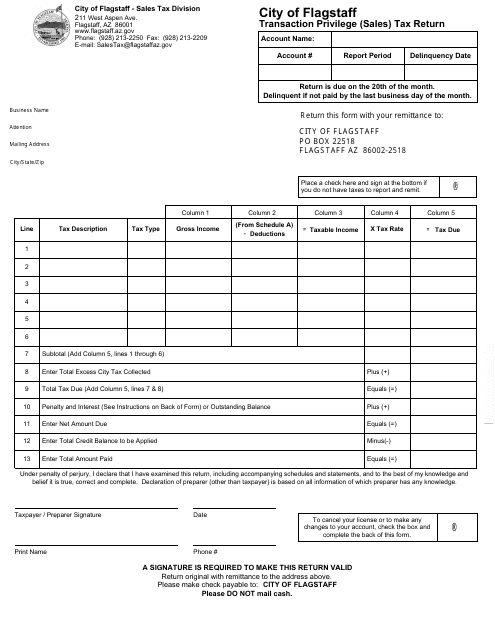

This document is used for filing sales tax returns with the City of Flagstaff, Arizona.

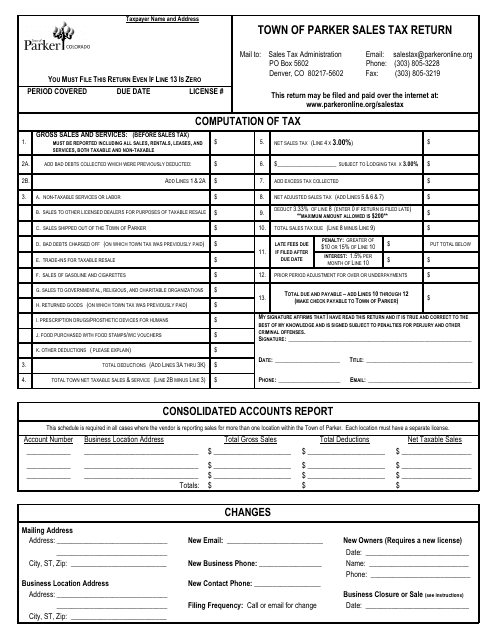

This form is used for filing sales tax returns in the Town of Parker, Colorado. It is used by businesses to report and remit the sales tax collected from their customers.

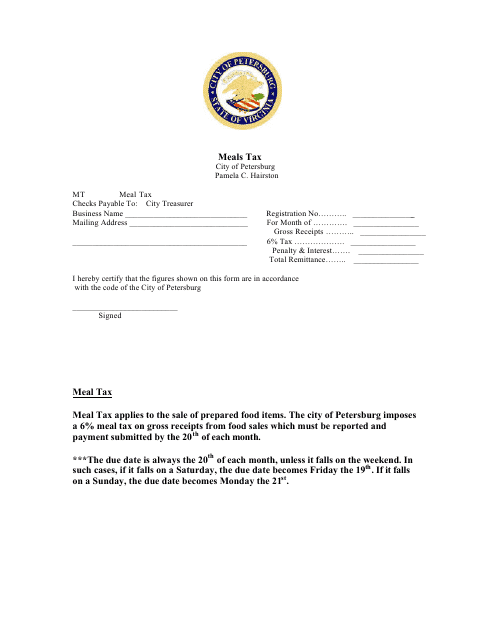

This form is used for reporting and paying the meals tax in Petersburg, Virginia. Businesses in the city that sell prepared meals are required to complete and submit this form to the local tax authority.

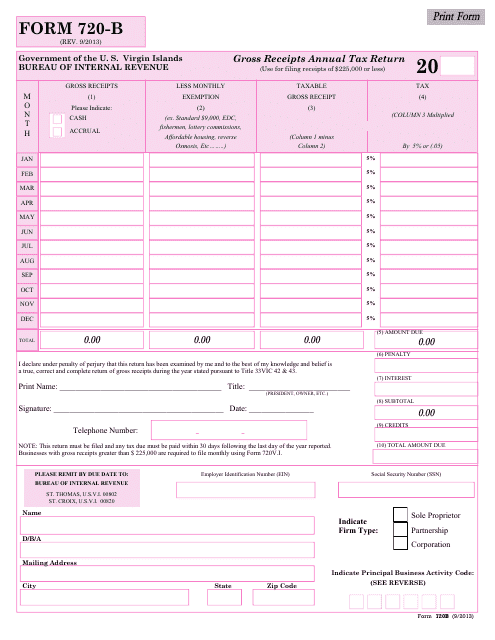

This Form is used for filing the Gross Receipts Annual Tax Return specifically for businesses operating in the Virgin Islands.

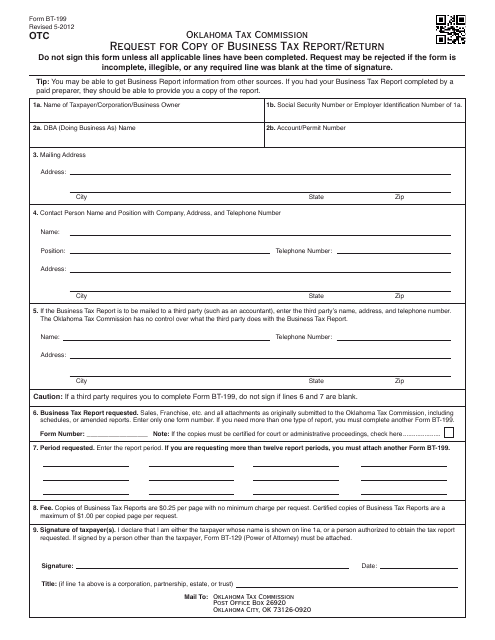

This form is used for requesting a copy of your business tax report or return in the state of Oklahoma.

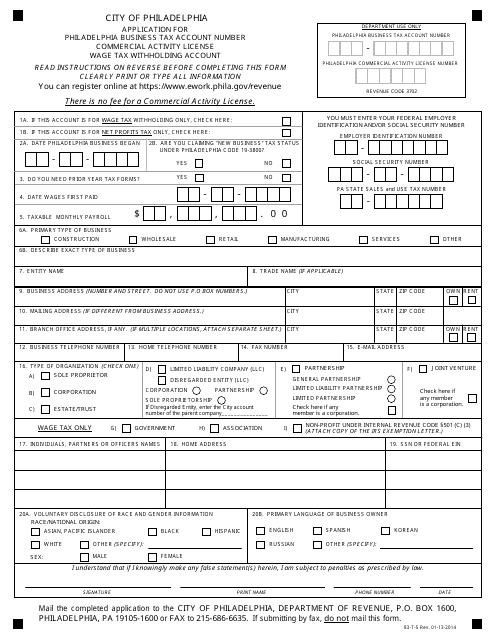

This form is used for applying for a business tax account number, commercial activity license, and wage tax withholding account in the City of Philadelphia, Pennsylvania.

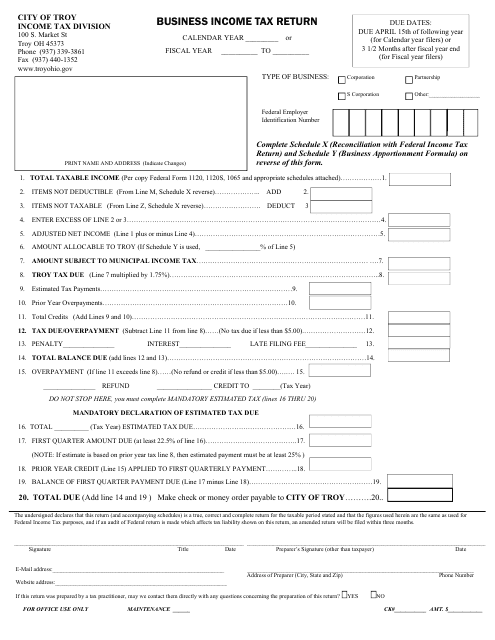

This document is used for filing your business income tax return specifically for the City of Troy, Ohio. It is required for businesses operating within the city to report their income and pay the appropriate taxes.

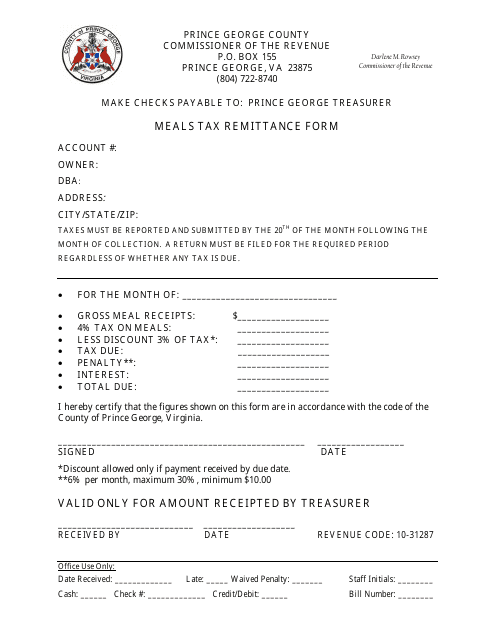

This form is used for remitting the meals tax in Prince George County, Virginia.

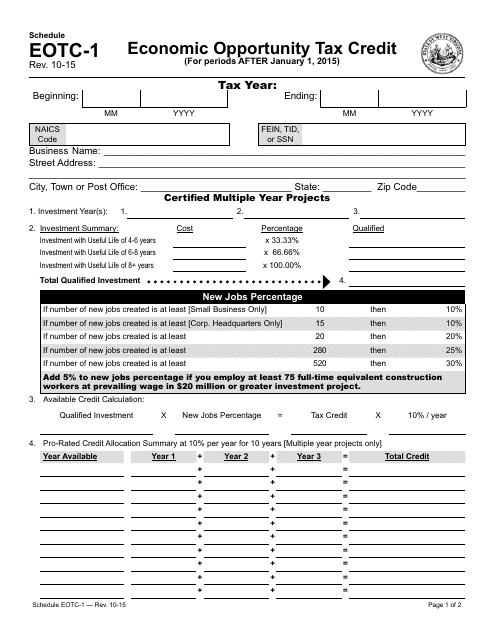

This document is for claiming the Economic Opportunity Tax Credit in West Virginia. It is used to report and apply for this tax credit available to businesses who have made qualified investments in designated distressed areas in the state.

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

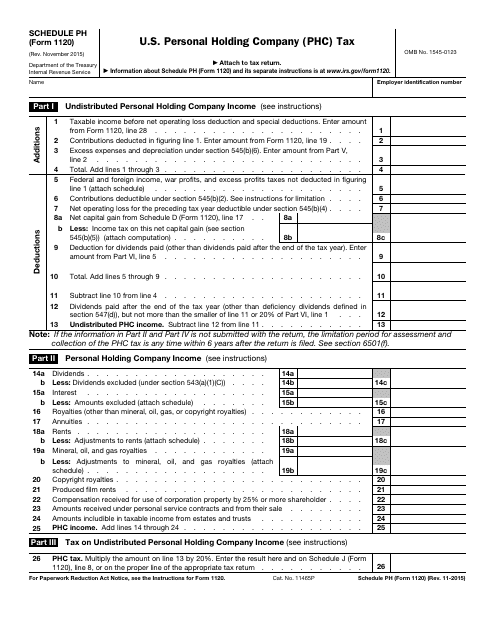

This form is used for reporting and paying U.S. Personal Holding Company (PHC) Tax for companies classified as personal holding companies.

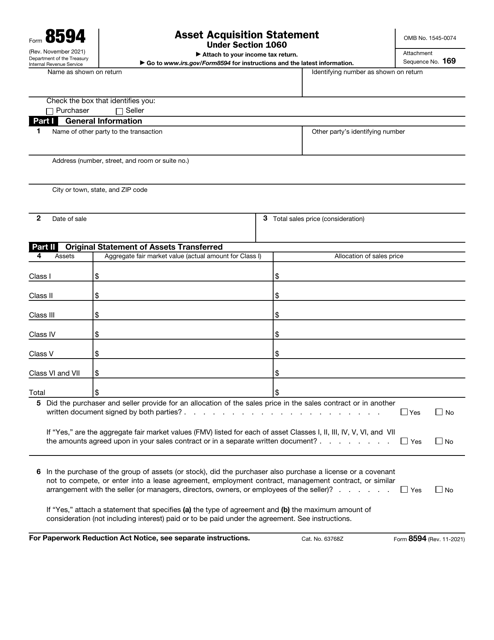

This is a fiscal form designed for taxpayers that carried out a sale of assets used for a business or trade.

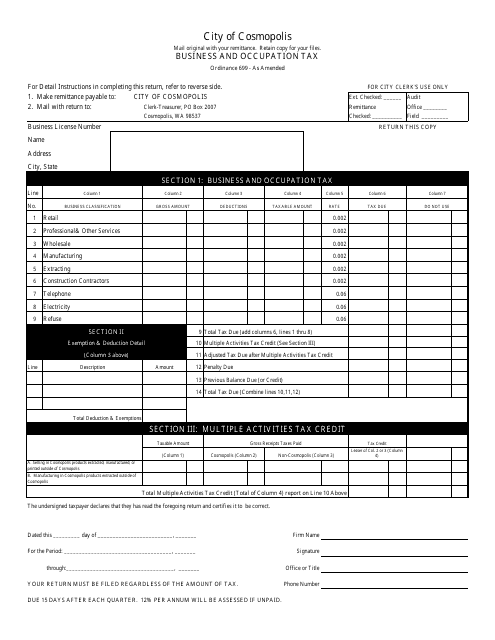

This form is used to report and pay business and occupation taxes to the City of Cosmopolis, Washington.

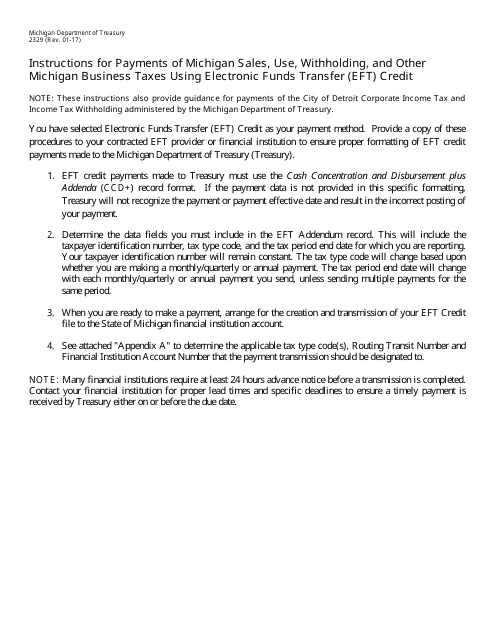

This form provides instructions for making electronic payments for various types of Michigan business taxes, including sales tax, use tax, withholding tax, and other taxes. It explains how to use the Electronic Funds Transfer (EFT) credit method for submitting these payments.

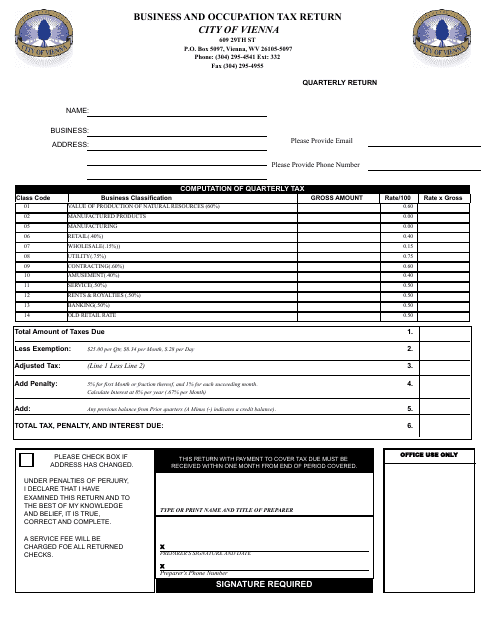

This form is used for filing the Business and Occupation Tax Return with the City of Vienna, West Virginia.

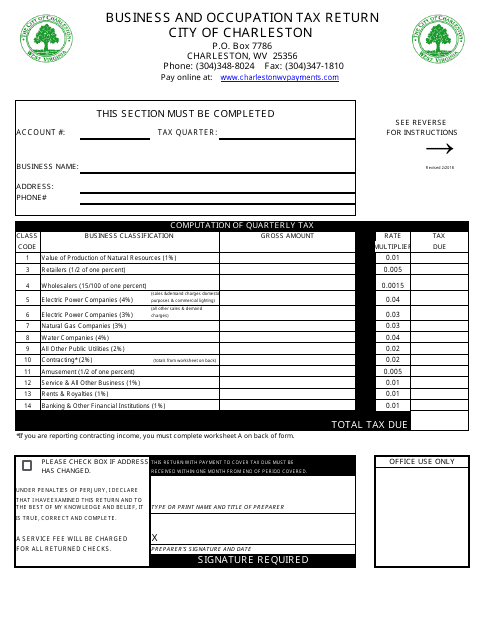

This Form is used for filing the Business and Occupation Tax Return in West Virginia. Businesses are required to report their income and calculate their tax liability using this form.

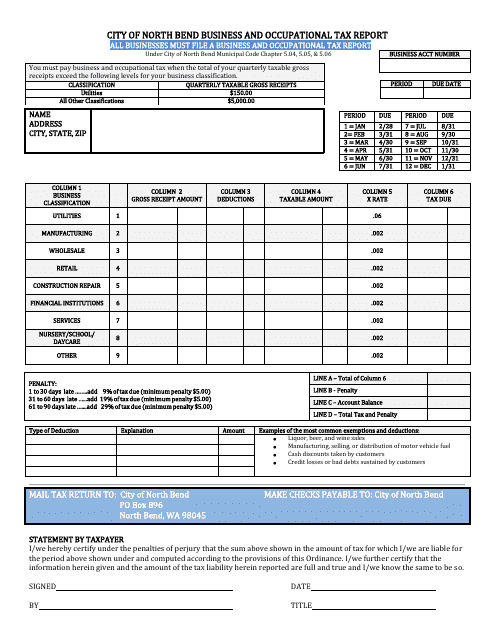

This document is used for reporting business and occupational taxes to the City of North Bend in Washington. It is required for all businesses operating within the city limits.

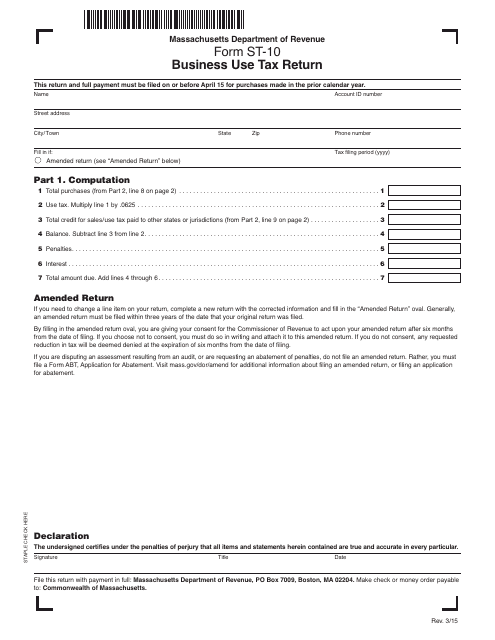

This form is used for reporting and paying business use tax in the state of Massachusetts.

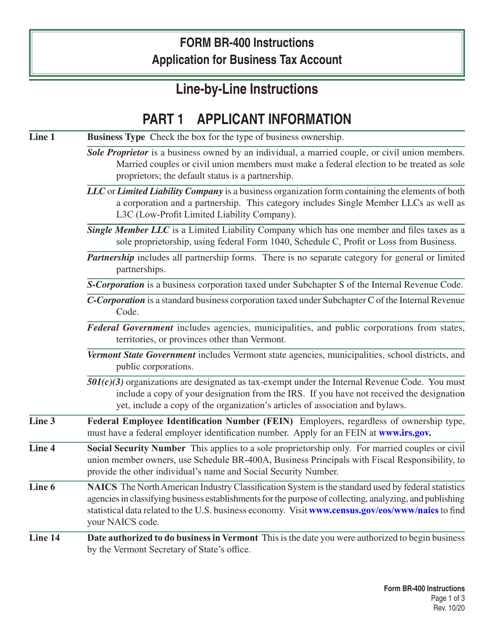

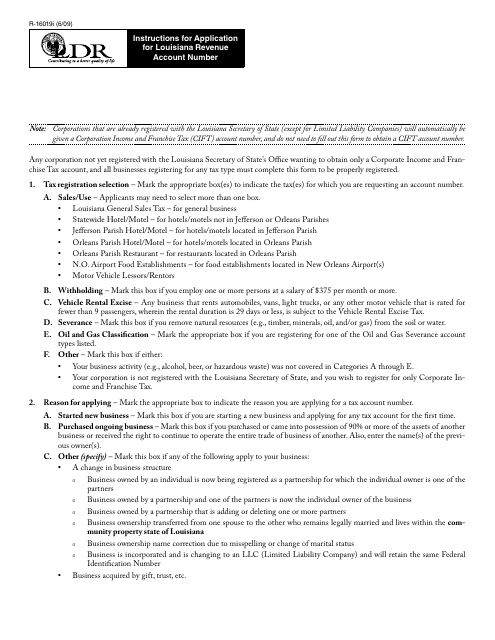

This document is used for applying for a Louisiana Revenue Account Number in Louisiana. It provides instructions on filling out Form R-16019.

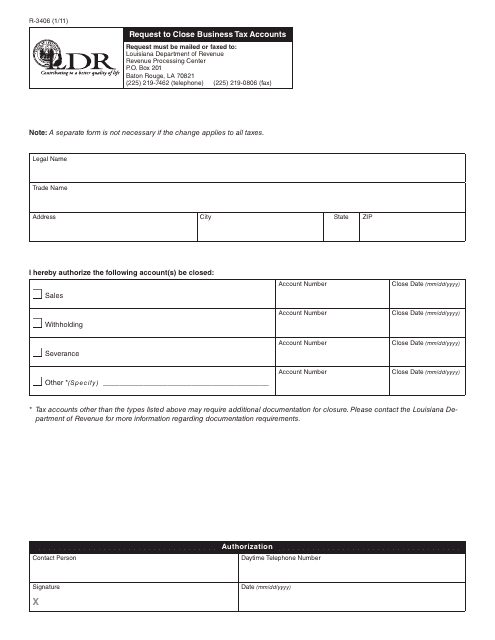

This form is used for requesting the closure of business tax accounts in the state of Louisiana.

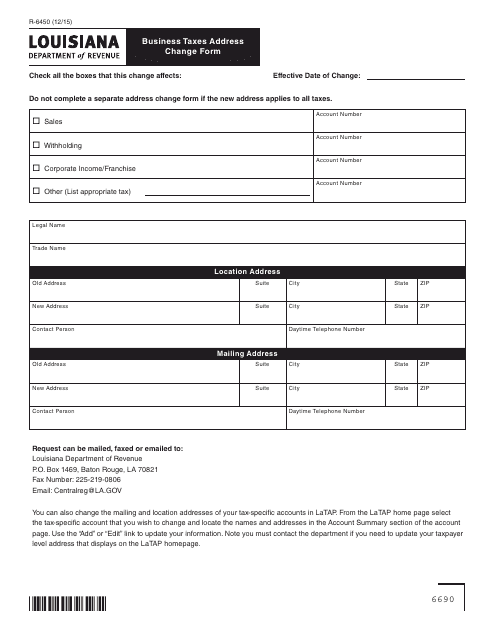

This Form is used for reporting any changes in business address for tax purposes in the state of Louisiana.

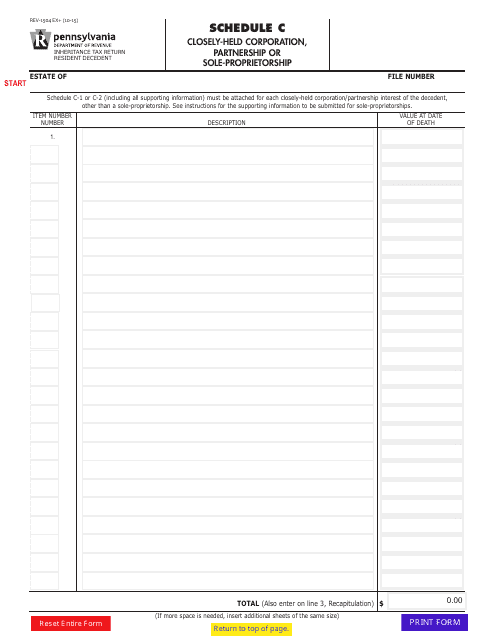

Form REV-1504 Schedule C Closely-Held Corporation, Partnership or Sole-Proprietorship - Pennsylvania

This Form is used for reporting the income, deductions, and credits of a closely-held corporation, partnership, or sole-proprietorship in the state of Pennsylvania.

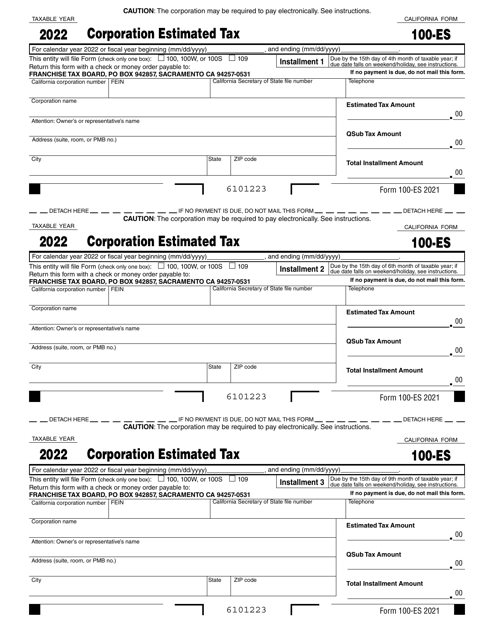

This is a legal document that various financial corporations based in California use to figure estimated tax for a corporation and then mail to the Franchise Tax Board to pay corporate income tax.

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

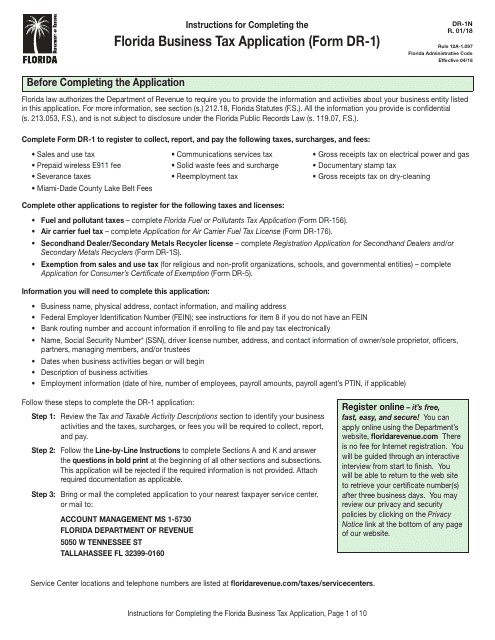

This Form is used for applying for a Florida Business Tax and includes instructions on how to complete it.