Fuel Tax Form Templates

Documents:

319

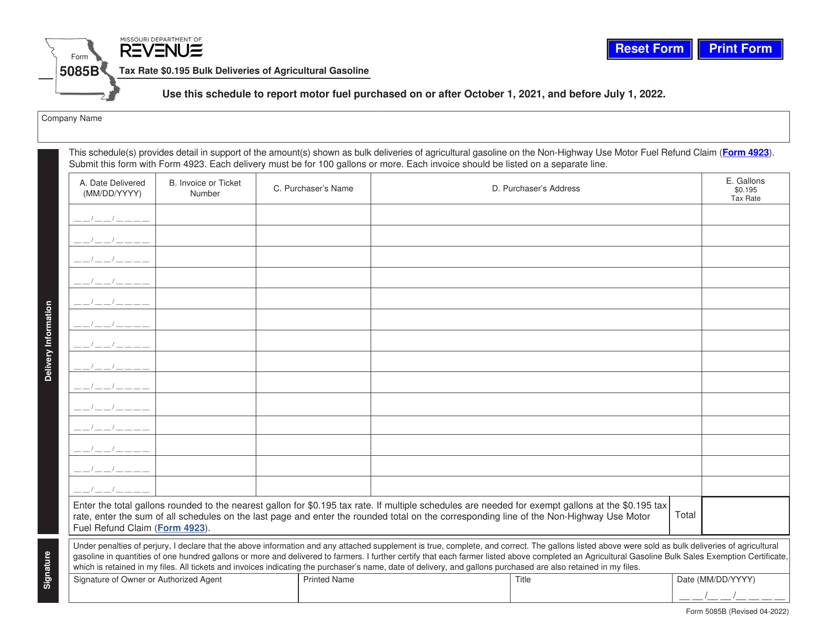

This form is used for reporting and paying a tax rate of $0.195 on bulk deliveries of agricultural gasoline in the state of Missouri.

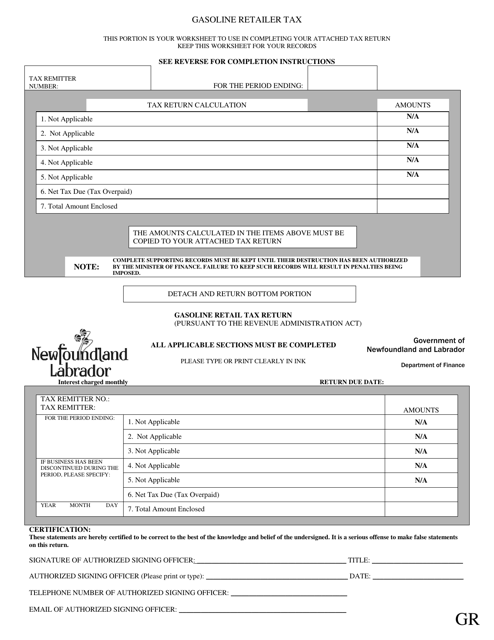

This document is used to schedule and pay the gasoline retailer tax in Newfoundland and Labrador, Canada.

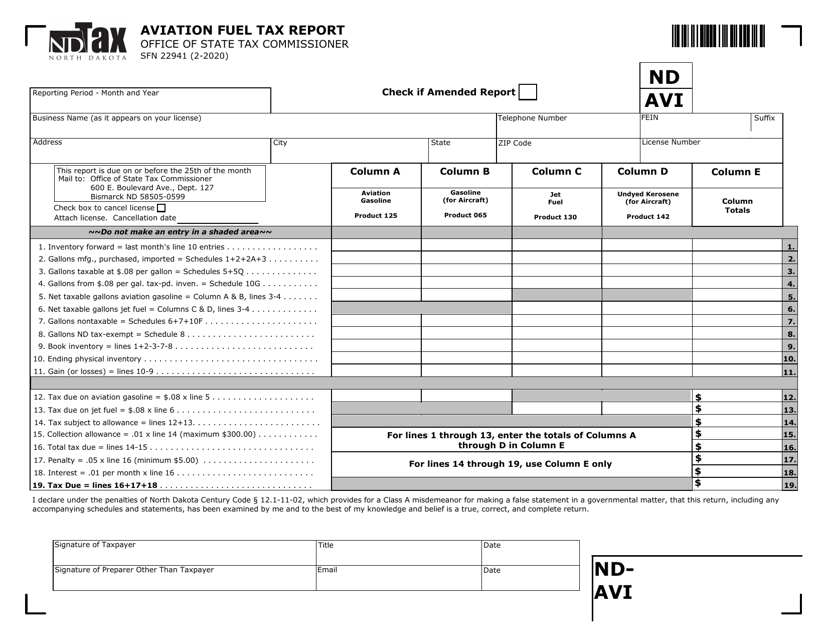

This form is used for reporting aviation fuel tax in North Dakota.

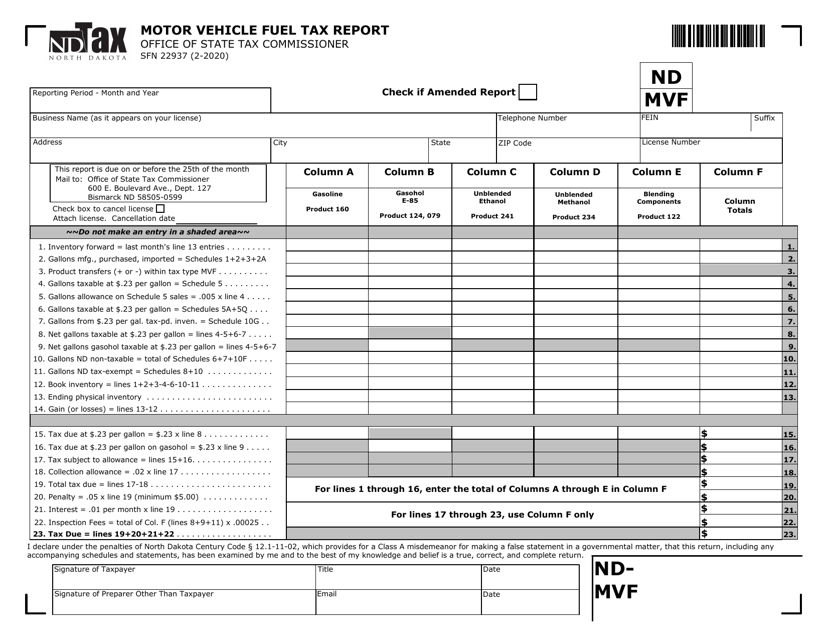

This Form is used for reporting motor vehicle fuel tax in North Dakota.

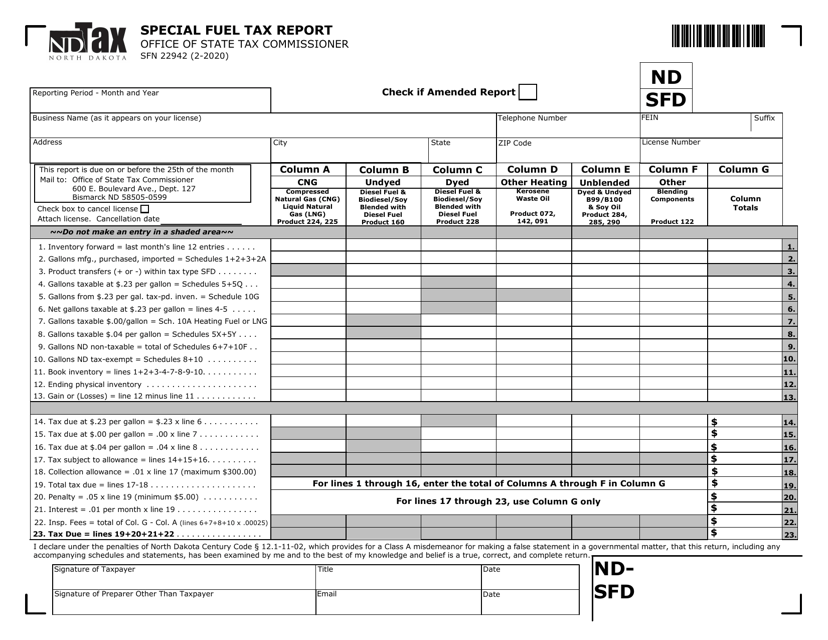

This form is used for reporting special fuel tax in North Dakota.

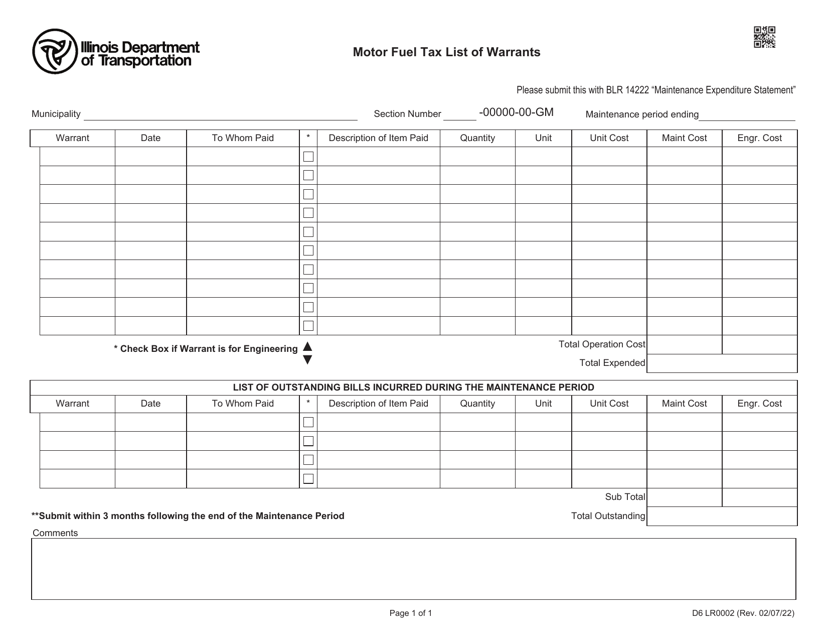

This form is used for listing warrants related to motor fuel tax in the state of Illinois.

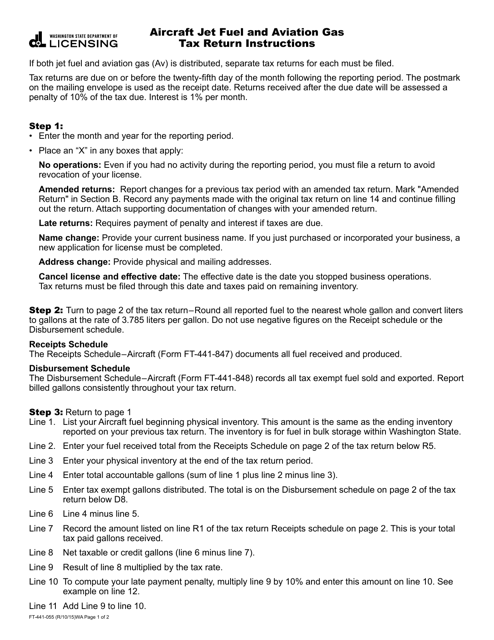

This Form is used for reporting and paying aviation gasoline taxes in the state of Washington. It provides instructions on how to accurately complete and submit the tax return.

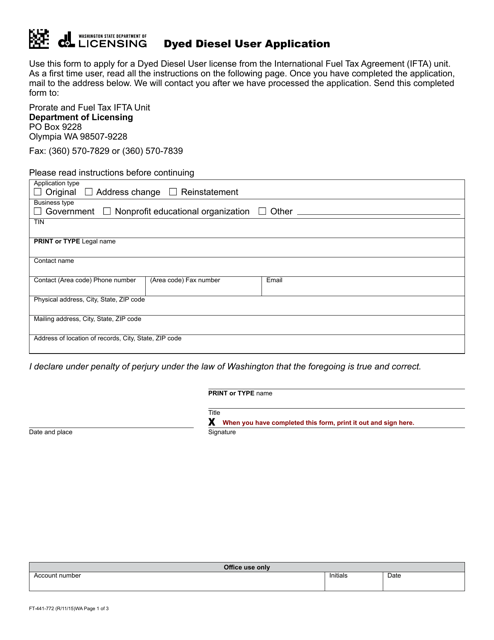

This form is used for applying as a user of dyed diesel in Washington state.

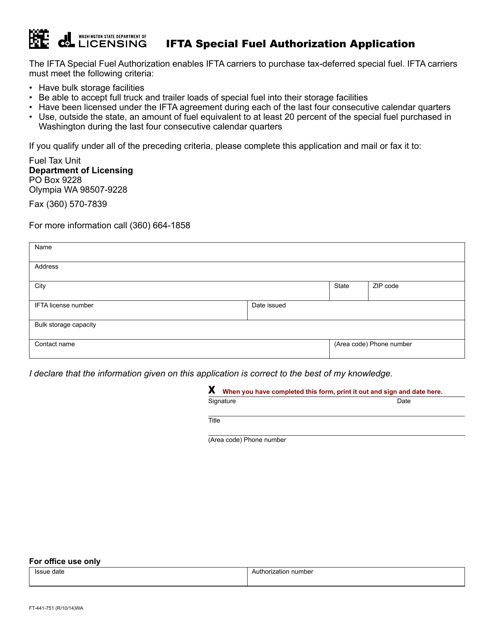

This form is used for applying for special fuel authorization for the IFTA (International Fuel Tax Agreement) in the state of Washington.

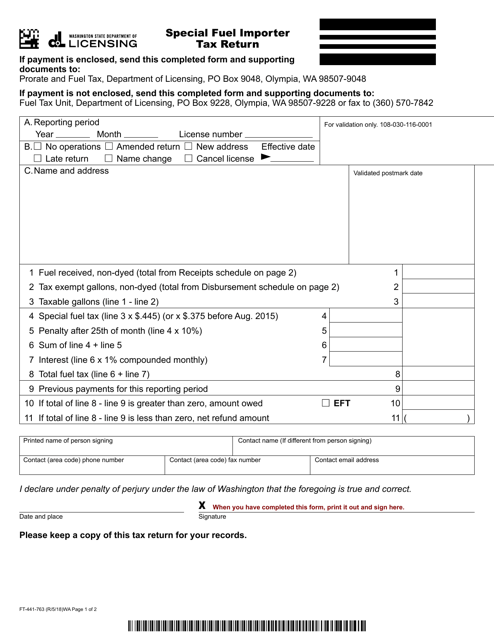

This form is used for filing the Special Fuel Importer Tax Return in the state of Washington.

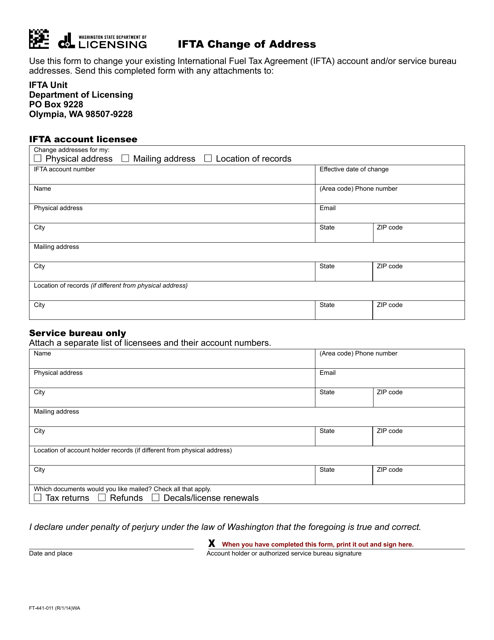

This form is used for changing the address associated with an IFTA account in Washington state.

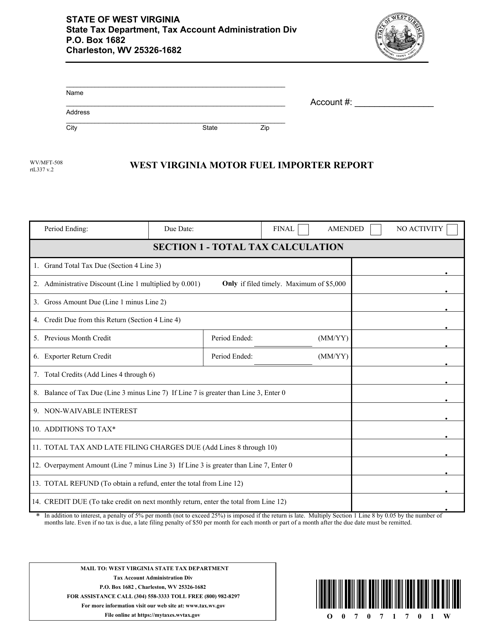

This form is used for reporting motor fuel imports in West Virginia.

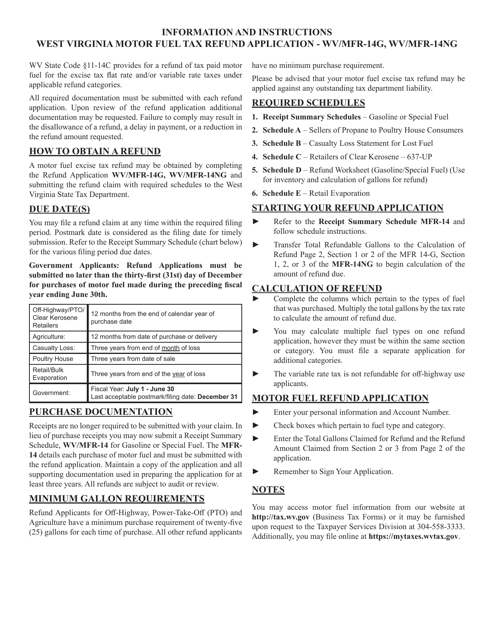

This document is used for applying for a motor fuel tax refund in West Virginia. It provides instructions on how to complete Form WV/MFR-14G or WV/MFR-14NG.

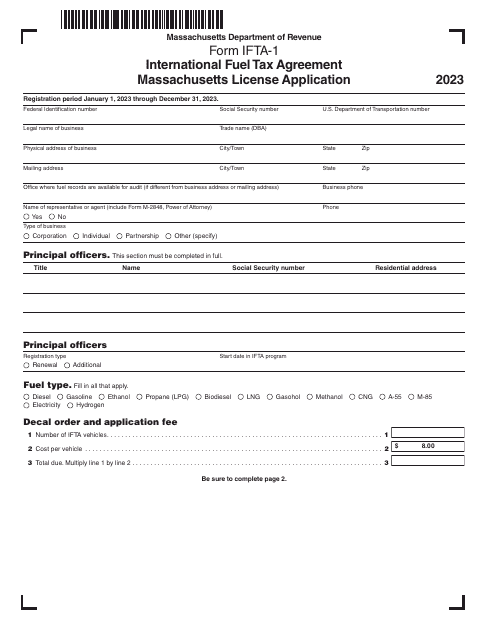

Form IFTA-1 International Fuel Tax Agreement Massachusetts License Application - Massachusetts, 2023

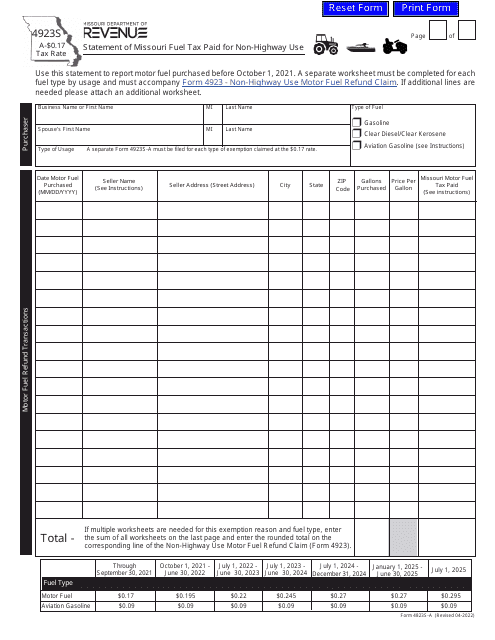

This Form is used for reporting the amount of Missouri fuel tax paid for non-highway use. The tax rate is $0.17.

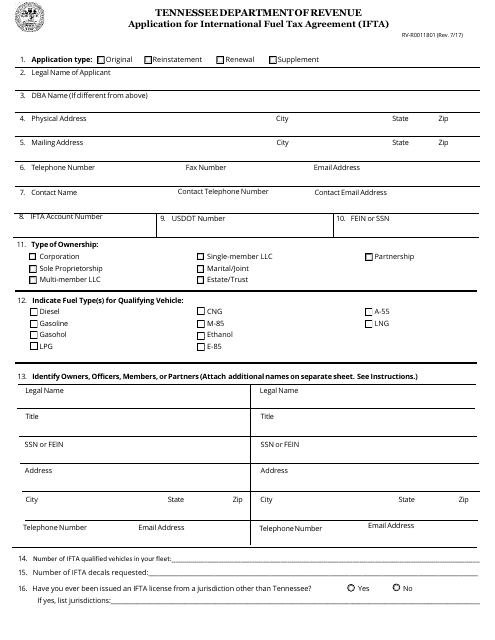

This form is used for applying for the International Fuel Tax Agreement (IFTA) in the state of Tennessee. IFTA is an agreement among the 48 contiguous United States and 10 Canadian provinces that simplifies the reporting and payment of fuel taxes by motor carriers operating in multiple jurisdictions.

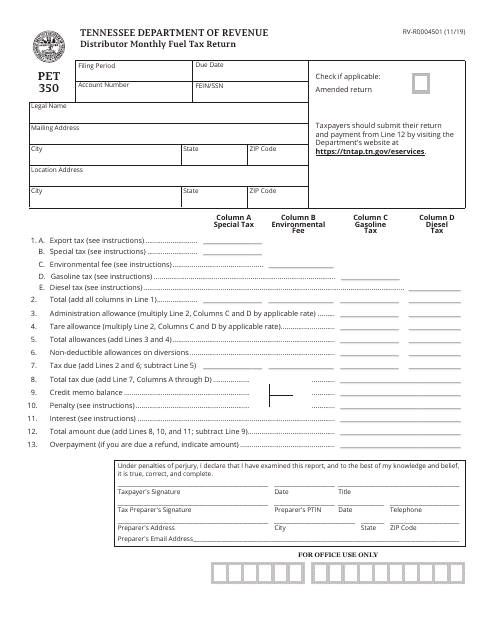

This form is used for the Distributor Monthly Fuel Tax Return in Tennessee.