Fuel Tax Form Templates

Documents:

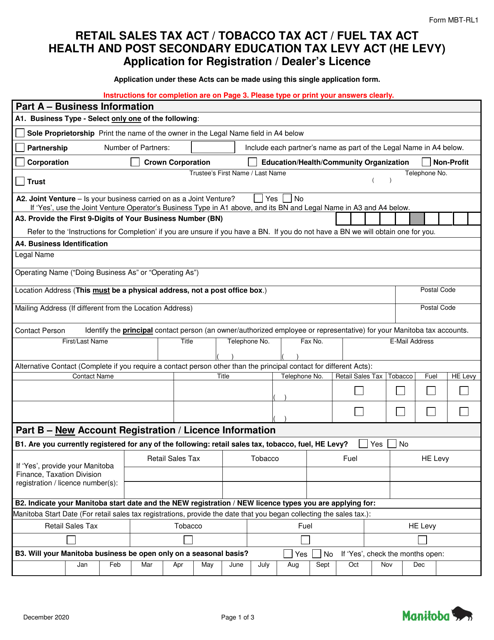

319

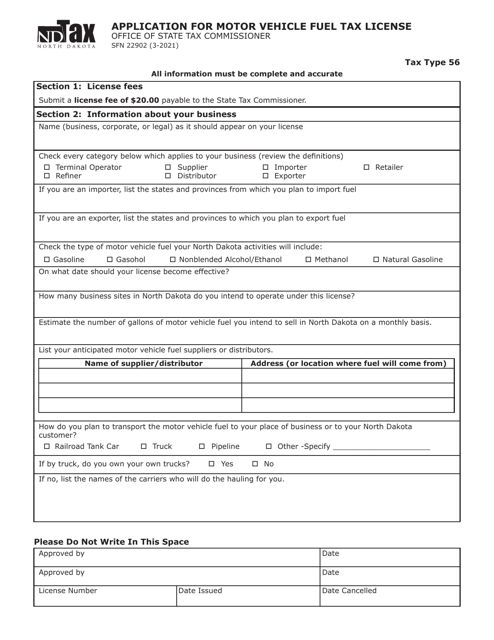

This form is used for applying for a motor vehicle fuel tax license in North Dakota. It is necessary for individuals or businesses that deal with motor vehicle fuel and need to be licensed to operate in the state.

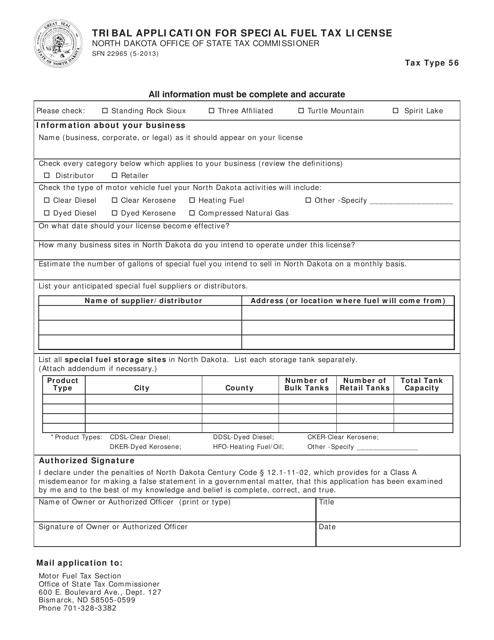

This form is used for applying for a special fuel tax license in North Dakota for tribal entities.

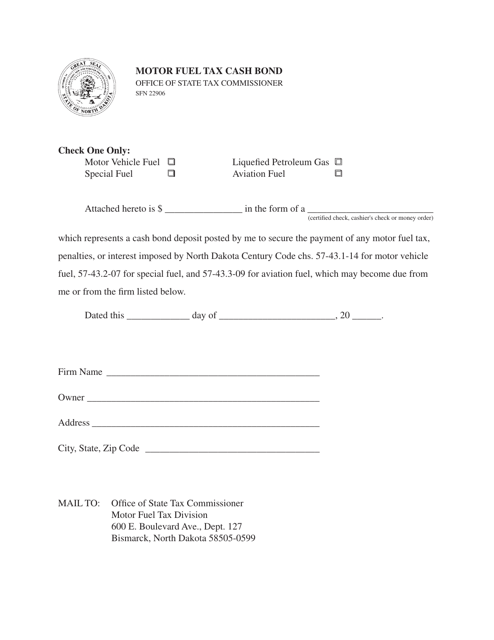

This form is used for submitting a cash bond for motor fuel tax in North Dakota. It is required for businesses in the state that need to post a bond as a guarantee for paying their motor fuel tax obligations.

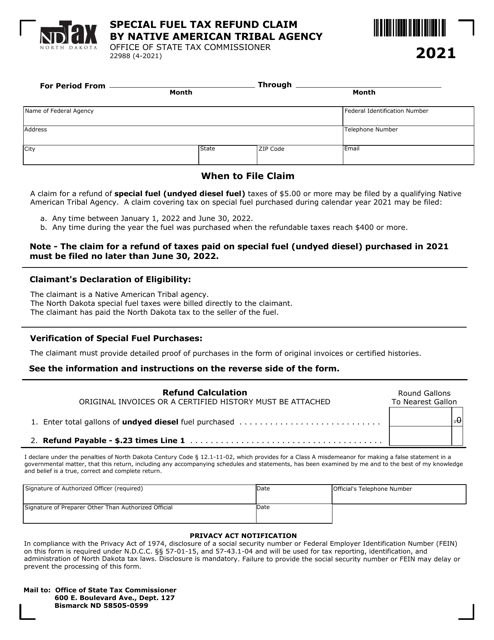

This form is used by Native American tribal agencies in North Dakota to claim a refund on special fuel taxes.

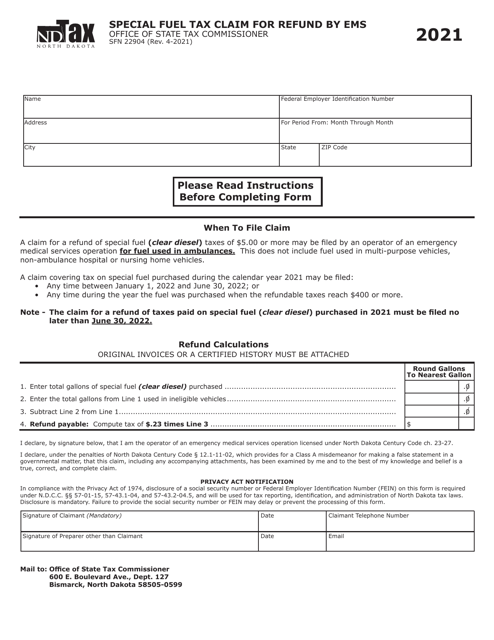

This form is used for claiming a refund of special fuel tax paid by EMS (Emergency Medical Services) in North Dakota.

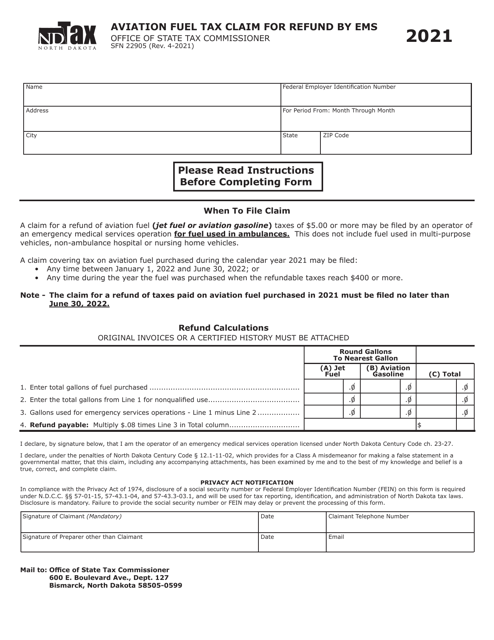

This form is used for claiming a refund on aviation fuel tax paid by an Emergency Medical Service (EMS) in North Dakota.

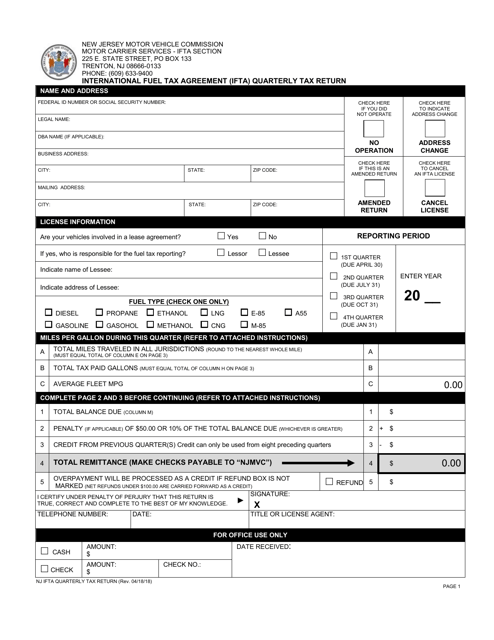

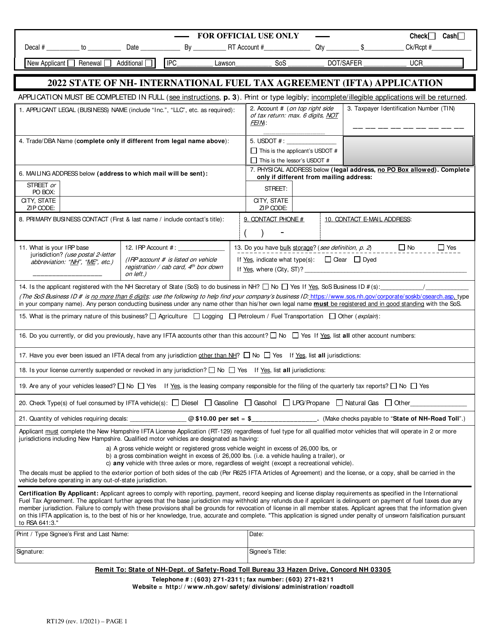

This document is used for submitting the quarterly tax return for the International Fuel Tax Agreement (IFTA) in the state of New Jersey.

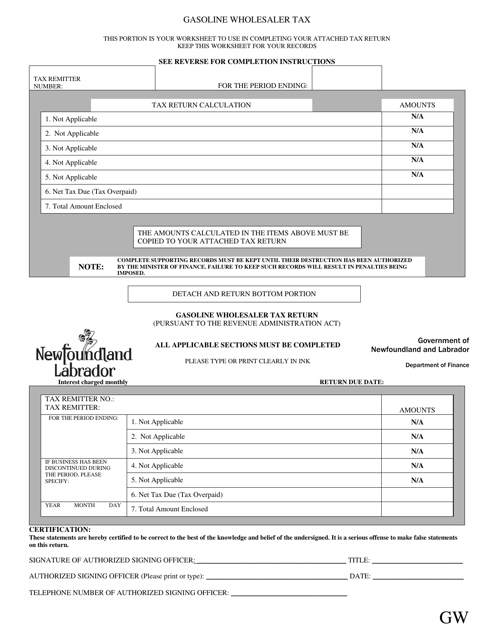

This document is used for reporting the gasoline and carbon wholesaler tax in Newfoundland and Labrador, Canada.

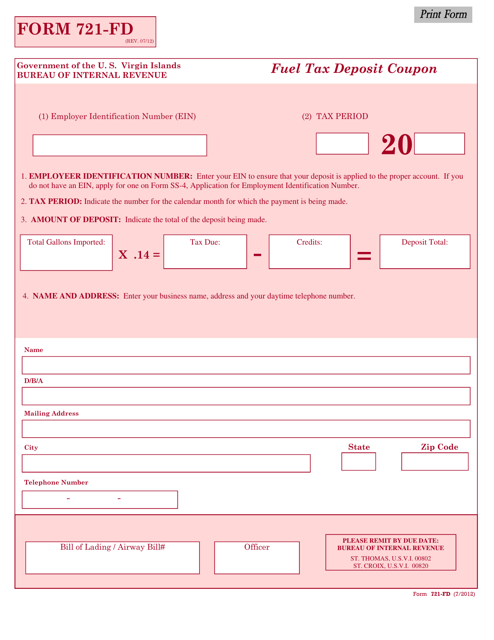

This form is used for making fuel tax deposits in the Virgin Islands.

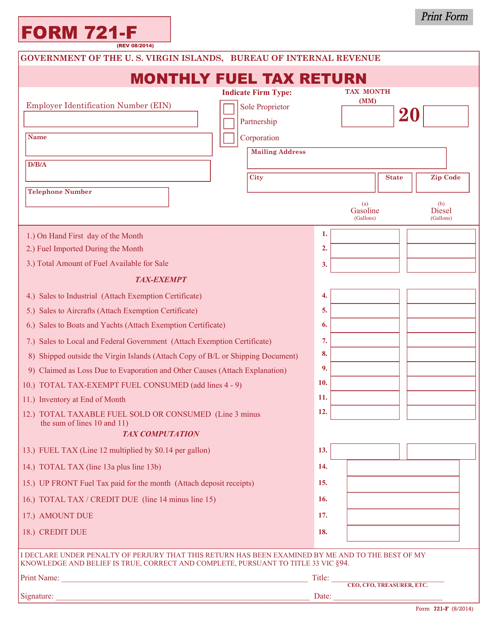

This form is used for filing the monthly fuel tax return in the Virgin Islands.

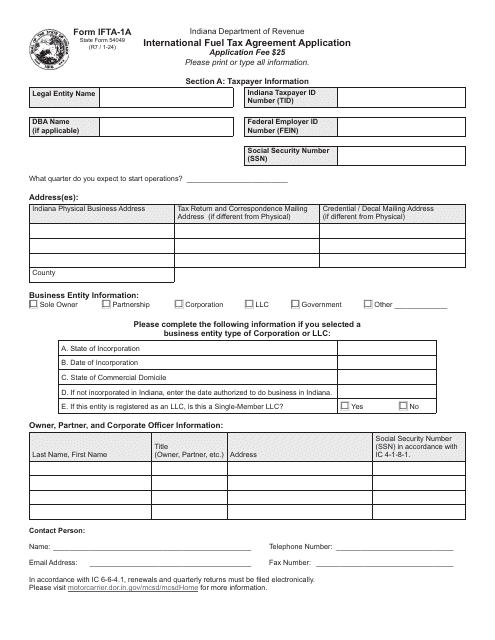

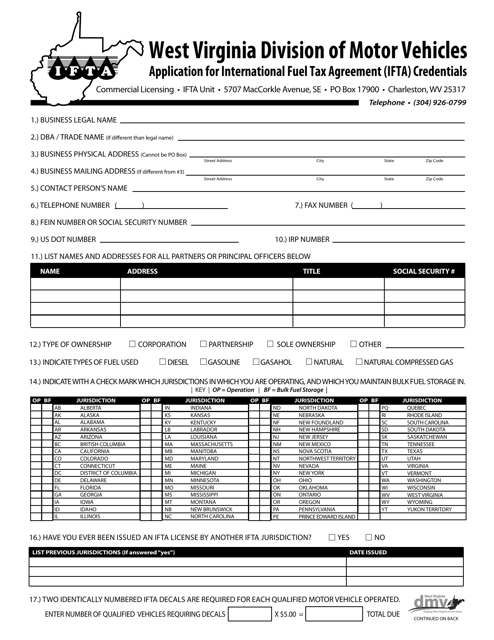

This Form is used for applying for International Fuel Tax Agreement (IFTA) credentials in West Virginia. IFTA allows for the simplified reporting and payment of fuel taxes by interstate motor carriers.

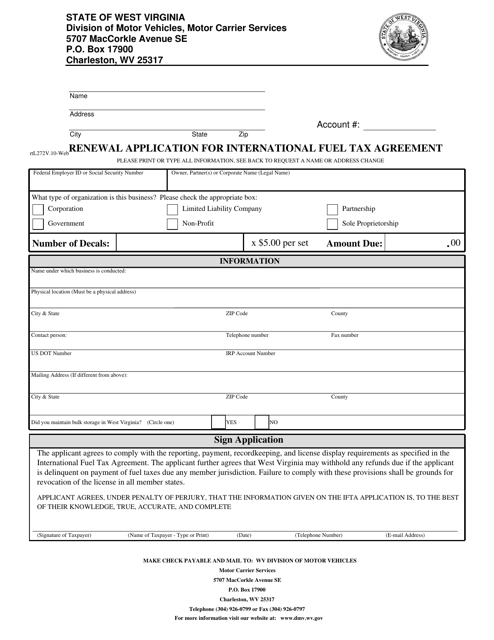

This form is used for renewing the International Fuel Tax Agreement in the state of West Virginia.

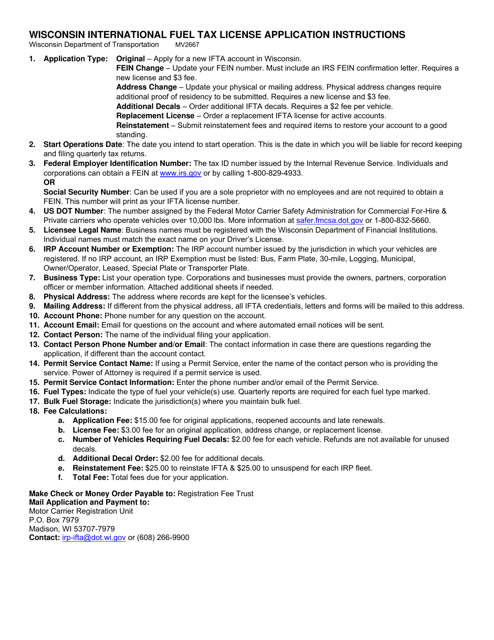

This form is used for applying for an international fuel tax license in Wisconsin.

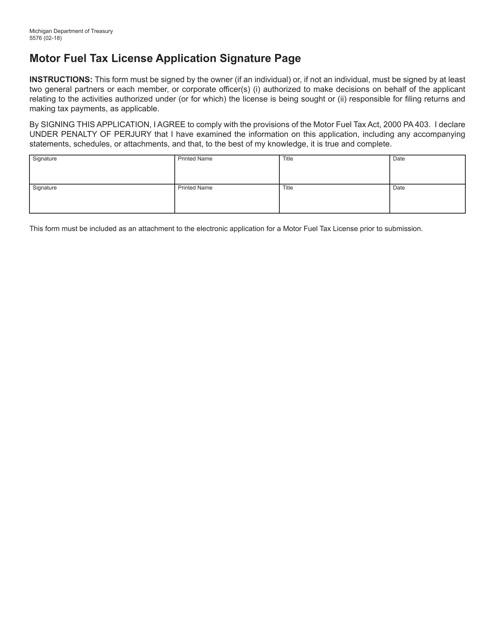

This Form is used for the Motor Fuel Tax License Application Signature Page in the state of Michigan.