Fuel Tax Form Templates

Documents:

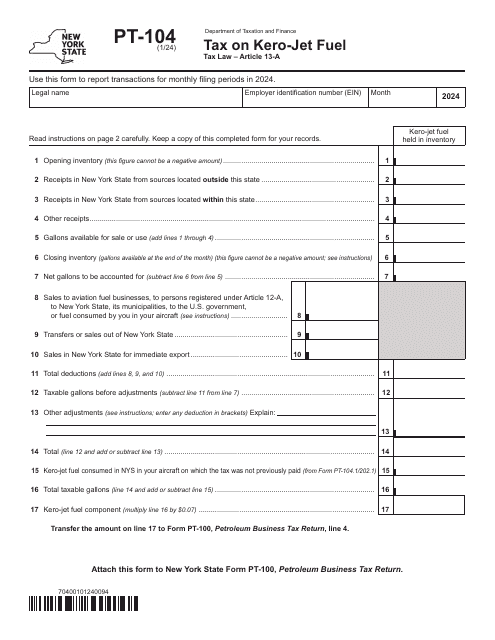

319

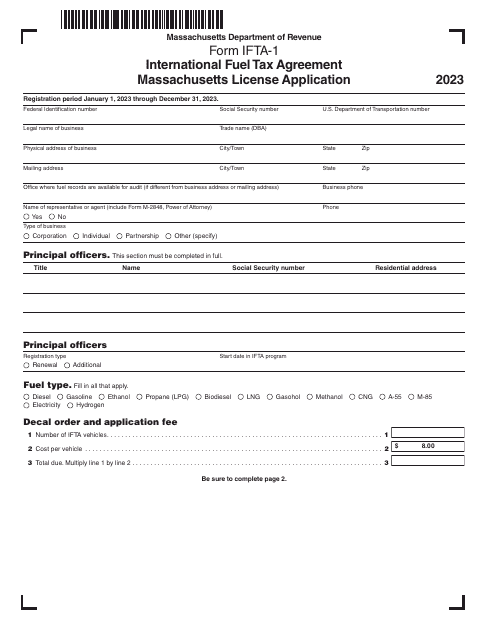

Form IFTA-1 International Fuel Tax Agreement Massachusetts License Application - Massachusetts, 2023

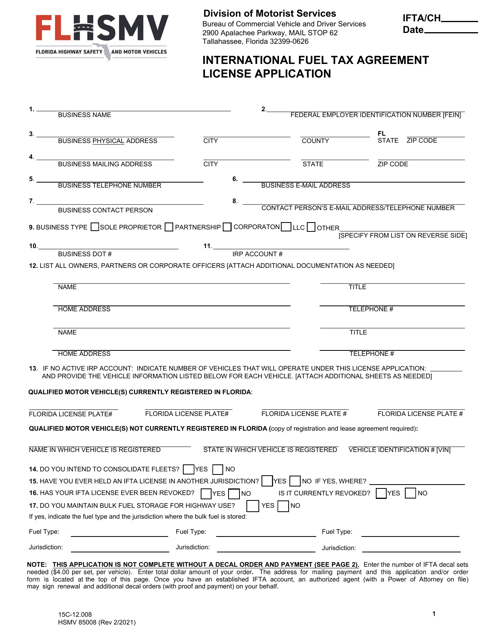

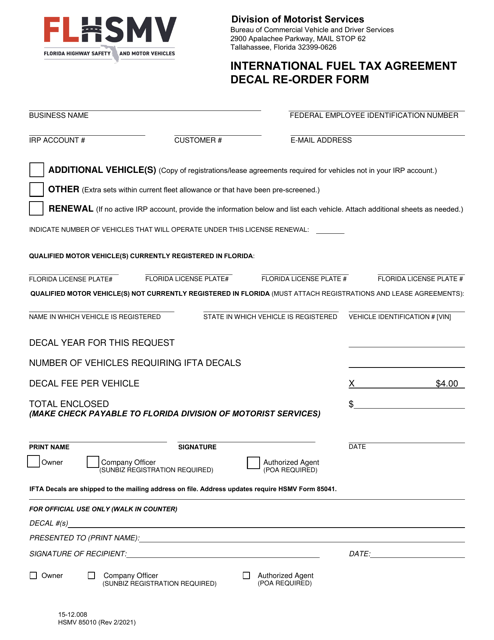

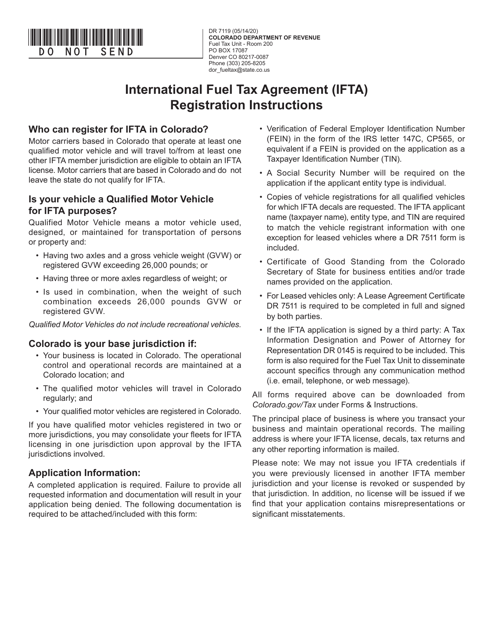

This form is used for re-ordering International Fuel Tax Agreement decals in the state of Florida. It is necessary for motor carriers to display these decals on their vehicles when operating in multiple jurisdictions.

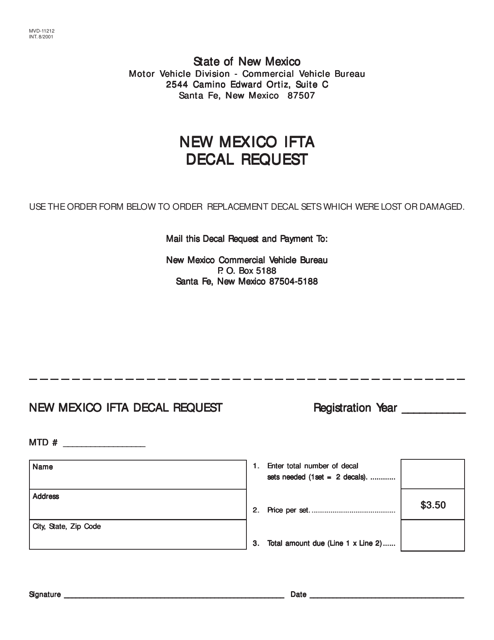

This form is used for requesting an IFTA decal in New Mexico.

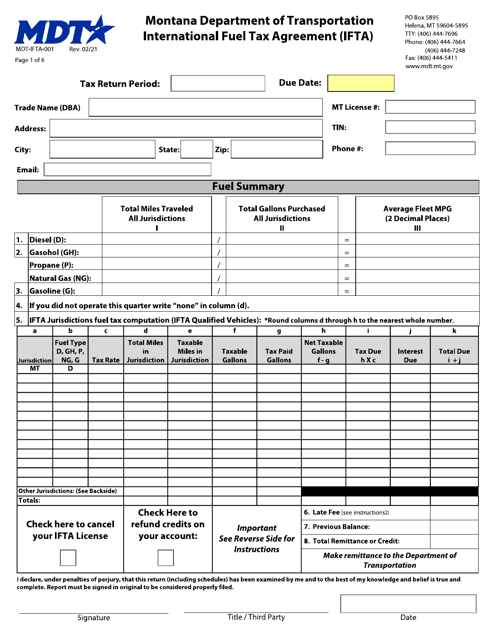

This form is used for filing the International Fuel Tax Agreement (IFTA) tax return in Montana for reporting fuel taxes paid by motor carriers operating in multiple jurisdictions.

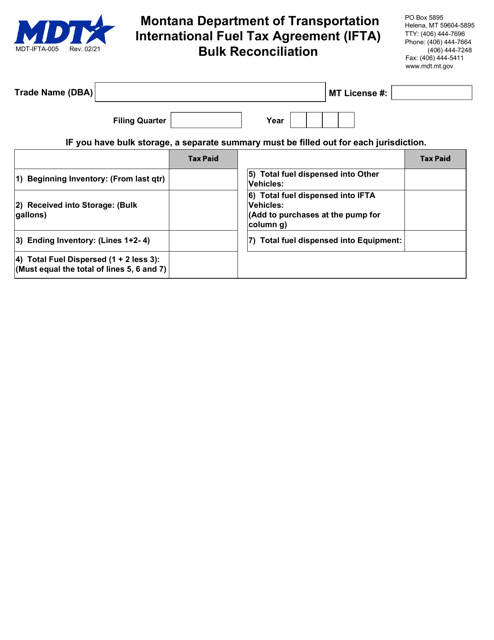

This Form is used for submitting a bulk reconciliation request under the International Fuel Tax Agreement (IFTA) for the state of Montana.

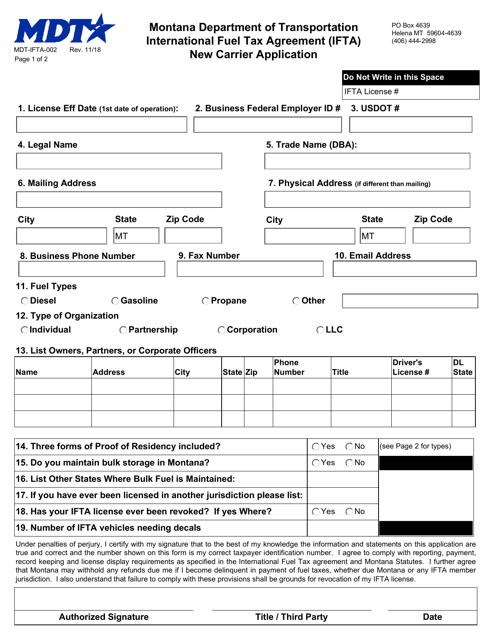

This form is used for new carriers in Montana to apply for the International Fuel Tax Agreement (IFTA), which allows them to report and pay fuel taxes in multiple states or provinces.

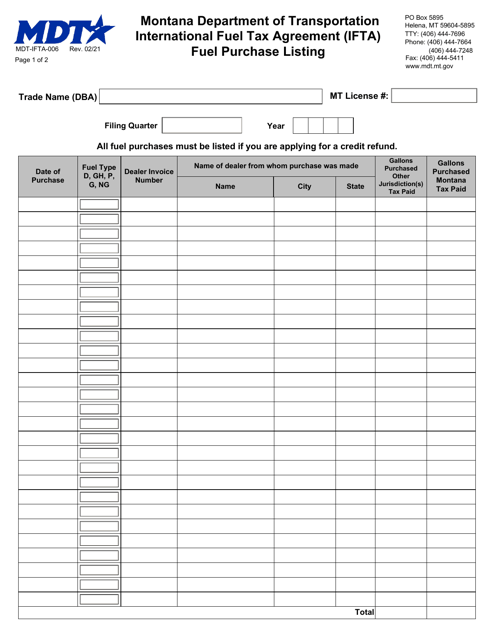

This Form is used for reporting fuel purchases made under the International Fuel Tax Agreement (IFTA) in the state of Montana.

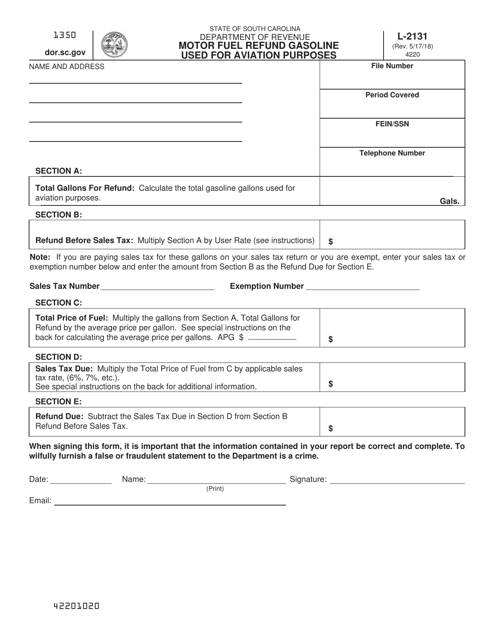

This form is used for claiming a refund for gasoline used for aviation purposes in South Carolina.

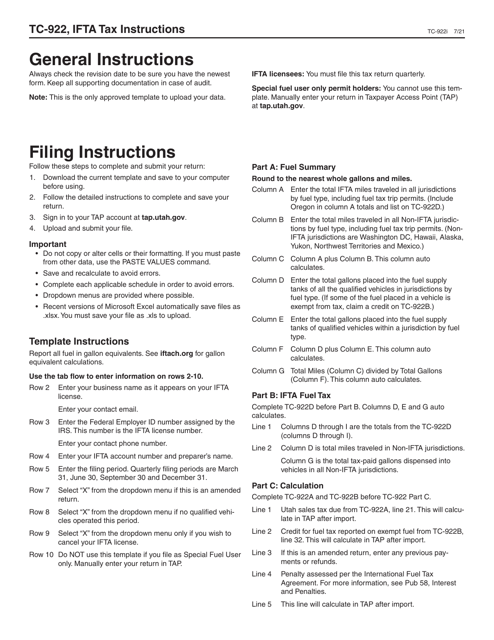

This Form is used for filing IFTA tax returns in the state of Utah. It provides instructions on how to accurately complete and submit the form.

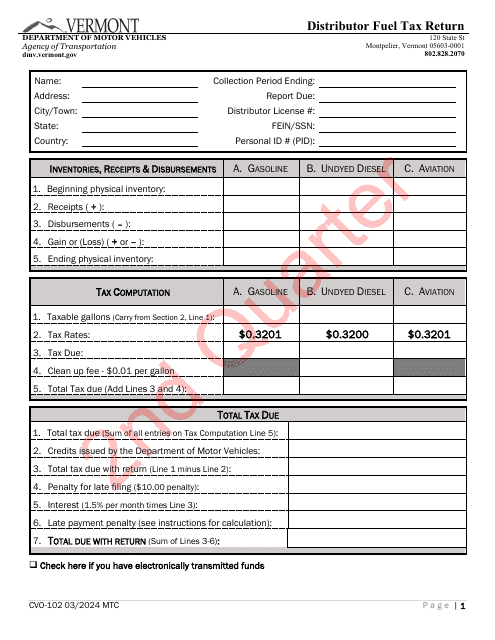

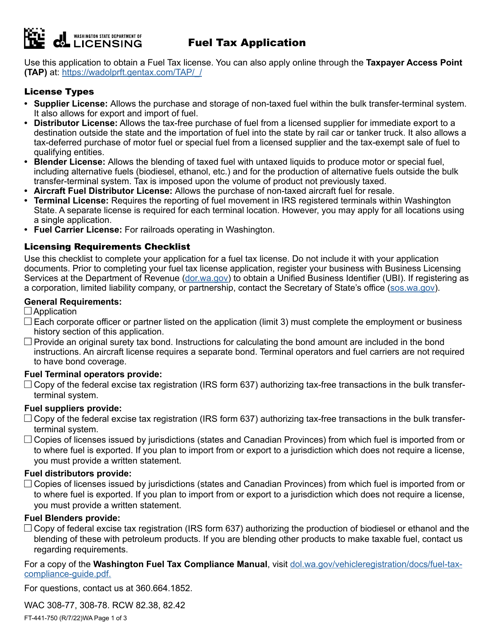

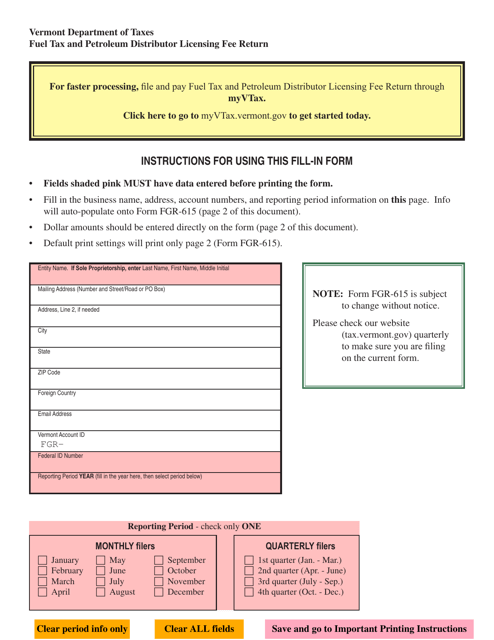

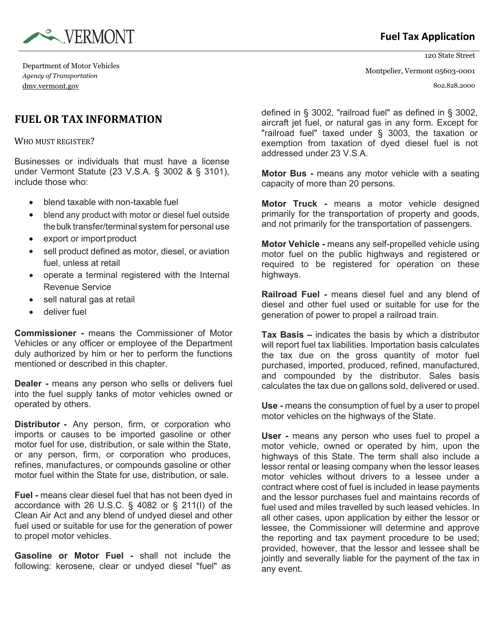

This Form is used for applying for fuel tax in the state of Vermont. It is necessary for individuals or businesses engaged in the sale or distribution of motor fuel to file this application in order to comply with Vermont's fuel tax laws.

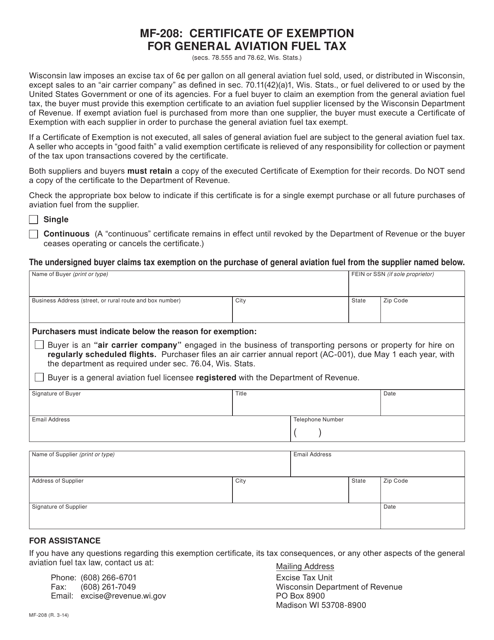

This Form is used for applying for a certificate of exemption from the general aviation fuel tax in Wisconsin. It is used by individuals or organizations involved in general aviation operations to claim a tax exemption on fuel purchases.

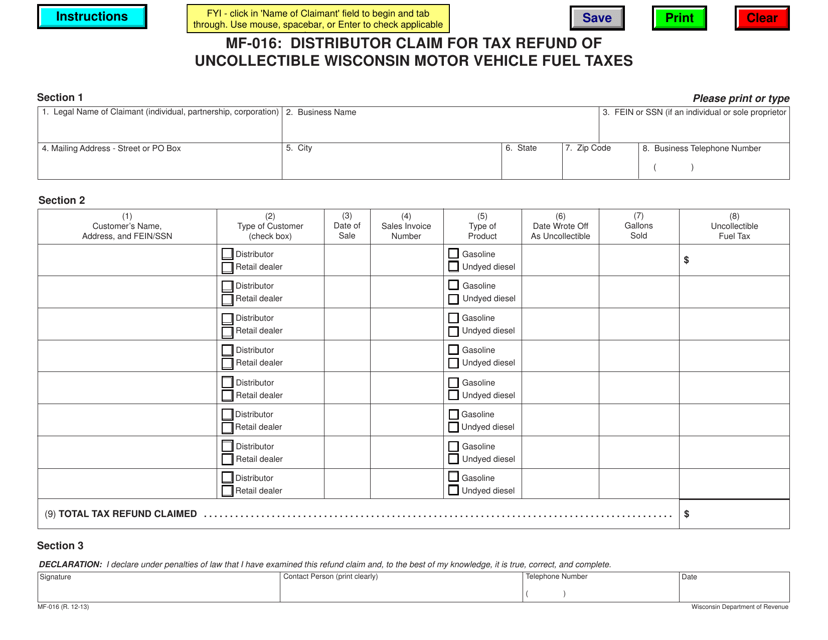

This form is used for distributors in Wisconsin to claim a tax refund for uncollectible motor vehicle fuel taxes.

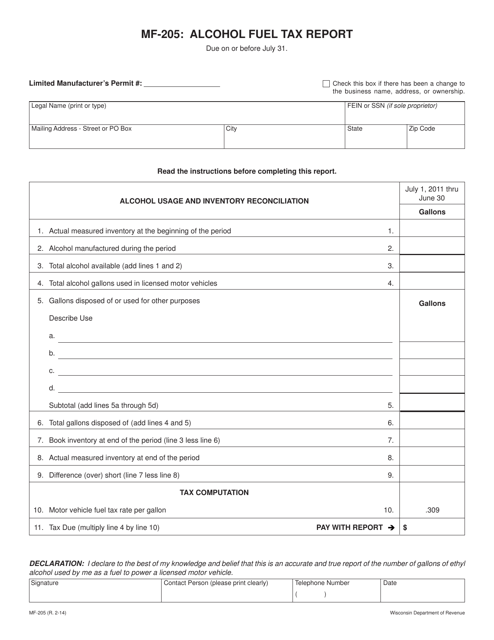

This Form is used for reporting alcohol fuel tax in Wisconsin.